Are you looking to streamline your mergers and acquisitions process, but unsure where to start? In today’s dynamic business landscape, the right tools can make all the difference in driving successful M&A transactions. From due diligence and deal management to integration and compliance, leveraging top M&A software can significantly enhance efficiency, collaboration, and decision-making throughout the deal lifecycle. Whether you’re a seasoned dealmaker or new to the M&A game, navigating the vast array of software options can be daunting.

Overview of Mergers and Acquisitions (M&A)

Before delving into the significance of M&A software, it’s crucial to understand the fundamentals of mergers and acquisitions (M&A). M&A refers to the consolidation of companies or assets through various transactions, such as mergers, acquisitions, divestitures, and joint ventures. These transactions are undertaken for strategic reasons, including expanding market presence, gaining access to new technologies or markets, achieving economies of scale, diversifying product portfolios, or driving operational synergies.

M&A transactions can take various forms, including:

- Mergers: When two or more companies combine to form a single entity, often with the goal of achieving greater scale, market dominance, or strategic alignment.

- Acquisitions: When one company (the acquirer) purchases another company (the target) by acquiring its assets, equity, or controlling interest, typically to gain access to valuable resources, capabilities, or market share.

- Divestitures: When a company sells off a portion of its business or assets to another party, often to raise capital, streamline operations, or refocus on core business activities.

- Joint Ventures: When two or more companies collaborate to undertake a specific business venture or project, sharing risks, resources, and rewards.

M&A transactions are complex and multifaceted processes that involve various stakeholders, including executives, shareholders, board members, employees, regulators, and external advisors. Successful M&A execution requires careful planning, due diligence, negotiation, execution, and post-merger integration to achieve desired outcomes and create sustainable value for all parties involved.

Importance of M&A Software

M&A software plays a pivotal role in facilitating and optimizing the entire M&A lifecycle, from deal sourcing and due diligence to integration and post-merger management. Here are some key reasons why M&A software is indispensable in today’s business landscape:

- Efficiency and Productivity: M&A software streamlines and automates manual processes, reducing administrative burden, minimizing errors, and accelerating deal timelines. By providing centralized access to critical information, documents, and workflows, M&A software enables deal teams to collaborate more effectively and make informed decisions faster.

- Data Management and Analysis: M&A transactions involve vast amounts of data from various sources, including financial statements, legal documents, market research, and operational metrics. M&A software offers robust data management and analysis capabilities, allowing dealmakers to organize, analyze, and visualize data efficiently, identify insights, and mitigate risks.

- Collaboration and Communication: M&A software facilitates seamless communication and collaboration among deal team members, both internally and externally. Through features such as virtual data rooms, messaging, document sharing, and task management, M&A software enables stakeholders to communicate, coordinate, and track progress throughout the deal lifecycle, regardless of geographical locations or time zones.

- Risk Management and Compliance: M&A transactions are fraught with risks, including financial, legal, regulatory, operational, and reputational risks. M&A software helps mitigate these risks by providing tools for conducting thorough due diligence, assessing risk factors, ensuring regulatory compliance, and implementing robust controls and governance mechanisms.

- Strategic Decision-Making: M&A software empowers decision-makers with actionable insights and analytics to support strategic decision-making throughout the deal lifecycle. By leveraging advanced reporting, forecasting, and scenario analysis capabilities, M&A software enables executives to evaluate deal opportunities, assess potential synergies, and optimize deal structures to maximize value creation and minimize risks.

In summary, M&A software is essential for driving efficiency, effectiveness, and success in M&A transactions by enabling dealmakers to manage complexities, mitigate risks, foster collaboration, and make data-driven decisions throughout the deal lifecycle. As the pace of M&A activity continues to accelerate globally, the role of M&A software will become increasingly indispensable for organizations seeking to gain a competitive edge and capitalize on strategic growth opportunities.

Understanding M&A Software

Now, let’s dive into what M&A software really is, exploring its definition, scope, key features, and the different types available in the market.

What is M&A Software?

M&A software, also known as merger and acquisition software, encompasses a range of digital tools and platforms designed to streamline and optimize the various stages of the M&A process. From initial due diligence to post-merger integration, these software solutions play a crucial role in facilitating collaboration, data management, analysis, and decision-making throughout the deal lifecycle.

The scope of M&A software extends across multiple facets of the M&A process, including:

- Due Diligence: Facilitating the gathering, organization, and analysis of crucial information about target companies, such as financial statements, legal documents, operational metrics, and market insights.

- Deal Management: Providing a centralized platform for tracking and managing the progress of M&A deals, including task assignment, document sharing, communication, and collaboration among deal team members.

- Valuation: Offering tools and capabilities for conducting comprehensive financial analysis and valuation of target companies, assessing factors such as earnings potential, asset value, market comparables, and synergy potential.

- Integration Management: Supporting the planning, execution, and monitoring of the integration process following a successful M&A transaction, including integration planning, data migration, business process alignment, and cultural integration.

- Regulatory Compliance: Ensuring adherence to legal and regulatory requirements governing M&A transactions, including antitrust regulations, securities laws, tax regulations, and data privacy laws.

- Reporting and Analytics: Providing robust reporting and analytics capabilities to generate insights into M&A performance, deal pipeline, financial metrics, risk factors, and post-merger outcomes.

Key Features and Functionalities

M&A software typically offers a wide range of features and functionalities tailored to the specific needs of M&A professionals and dealmakers. Some key features include:

- Document Management: Centralized repository for storing, organizing, and accessing critical documents and files related to M&A deals, with version control, access controls, and audit trails.

- Workflow Automation: Streamlining repetitive tasks and processes involved in M&A transactions, such as document review, approvals, compliance checks, and reporting.

- Collaboration Tools: Facilitating communication, collaboration, and information sharing among deal team members, both internally and externally, through chat, messaging, file sharing, and virtual data rooms.

- Financial Modeling: Providing tools for creating and analyzing financial models, including discounted cash flow (DCF) analysis, merger consequences analysis, sensitivity analysis, and scenario planning.

- Integration APIs: Supporting integration with other enterprise systems and applications, such as CRM, ERP, accounting software, and project management tools, to ensure seamless data flow and interoperability.

- Security and Compliance: Implementing robust security measures to protect sensitive M&A data from unauthorized access, breaches, and cyber threats, including encryption, access controls, multi-factor authentication, and compliance with industry standards and regulations.

Types of M&A Software

M&A software solutions can be categorized into several types based on their primary functionality and use cases. Some common types of M&A software include:

- Due Diligence Software: Specifically designed to streamline the due diligence process by organizing and analyzing relevant documents, conducting risk assessments, and facilitating collaboration among stakeholders.

- Deal Management Software: Focuses on managing the overall M&A deal lifecycle, from deal sourcing and screening to negotiation, execution, and post-merger integration, providing tools for tracking tasks, milestones, and communications.

- Valuation Software: Equipped with features for conducting financial analysis and valuation of target companies, including valuation methodologies, financial modeling templates, industry comparables, and scenario analysis tools.

- Integration Management Software: Helps organizations plan, coordinate, and execute the integration of acquired companies into their existing operations, including IT systems integration, organizational alignment, and cultural integration.

- Regulatory Compliance Software: Ensures compliance with legal and regulatory requirements throughout the M&A process, including anti-trust regulations, securities laws, data protection regulations, and industry-specific compliance standards.

- Reporting and Analytics Software: Provides advanced reporting and analytics capabilities to track M&A performance metrics, identify trends and patterns, and generate insights for decision-making and strategic planning.

Top M&A Software and Platforms

In today’s competitive business landscape, there is a myriad of M&A software and platforms available, each offering unique features and functionalities tailored to streamline the M&A process. Here, we highlight some of the top M&A software and platforms that are widely recognized for their effectiveness and versatility:

1. Intralinks

SS&C Intralinks is a leading provider of secure collaboration and content management solutions designed specifically for M&A transactions. Its Virtual Data Room (VDR) platform offers robust security features, intuitive user interface, and advanced analytics capabilities, making it a preferred choice for dealmakers worldwide.

Key Features:

- Secure document sharing and storage

- Advanced permission controls and audit trails

- Real-time collaboration and communication tools

- Customizable workflows and templates

- Comprehensive reporting and analytics

2. Datasite

Merrill Datasite is a cloud-based due diligence platform trusted by thousands of organizations for managing complex M&A transactions. With its intuitive interface, advanced AI-powered features, and global support infrastructure, Merrill Datasite enables seamless collaboration and deal execution from anywhere in the world.

Key Features:

- AI-driven document indexing and analysis

- Compliance with industry-leading security standards

- Built-in Q&A functionality for streamlined communication

- Customizable dashboards and reporting tools

- Integration with third-party applications and systems

3. Ansarada

Ansarada is an award-winning M&A platform known for its innovative features, user-friendly interface, and commitment to data security. Its AI-powered insights, automated workflows, and intuitive deal management tools empower dealmakers to make smarter decisions, accelerate deal cycles, and drive successful outcomes.

Key Features:

- Intelligent deal scoring and risk assessment

- Dynamic content indexing and search capabilities

- Secure bidder access and permission controls

- Real-time activity tracking and reporting

- Integration with leading CRM and ERP systems

4. DealRoom

DealRoom is a next-generation M&A software platform designed to streamline deal management, collaboration, and integration processes. Its intuitive interface, customizable workflows, and real-time communication tools enable deal teams to work more efficiently, reduce deal friction, and maximize value creation.

Key Features:

- Agile project management and task tracking

- Automated document indexing and version control

- Secure data rooms with granular access controls

- Interactive deal dashboards and progress reports

- Seamless integration with popular productivity tools and software

5. Firmex

Firmex is a trusted provider of virtual data room solutions for M&A, due diligence, and secure document sharing. With its robust security features, user-friendly interface, and comprehensive audit trails, Firmex helps organizations streamline their deal processes, mitigate risks, and achieve successful outcomes.

Key Features:

- Bank-grade security encryption and compliance certifications

- Granular permission controls and activity tracking

- Built-in Q&A functionality for efficient communication

- Mobile-friendly interface for on-the-go deal management

- Advanced reporting and analytics capabilities

These are just a few examples of the top M&A software and platforms available in the market today. When evaluating M&A software options, consider factors such as your company’s specific needs and requirements, budget constraints, scalability, integration capabilities, security features, and user experience to choose the solution that best aligns with your goals and objectives.

6. DFIN Venue Data Room

Donnelley Financial Solutions’ (DFIN) Venue is a comprehensive M&A software platform that offers end-to-end solutions for dealmakers. With its robust suite of features, including secure data rooms, collaboration tools, and analytics capabilities, Venue empowers organizations to streamline their M&A processes, drive efficiency, and maximize deal value.

Key Features:

- Secure document sharing and storage with advanced encryption

- Dynamic watermarking and rights management for enhanced security

- Real-time collaboration features, including chat, annotations, and Q&A

- Customizable workflows and task management tools for seamless deal execution

- Integrated analytics and reporting dashboards for actionable insights

7. Intapp

Intapp (previously DealCloud) is a leading M&A software platform designed specifically for financial services firms, private equity groups, and investment banks. Its robust suite of features, including deal sourcing, relationship management, and pipeline tracking, enables organizations to manage their M&A activities more effectively and drive growth.

Key Features:

- Deal sourcing and origination tools for identifying investment opportunities

- Relationship management features for tracking and engaging with deal prospects

- Pipeline tracking and management capabilities for monitoring deal progress

- Customizable reporting and analytics dashboards for performance monitoring

- Integration with third-party data providers and financial platforms for data enrichment

8. SmartRoom

SmartRoom is a secure virtual data room solution trusted by organizations worldwide for managing M&A transactions, due diligence, and secure document sharing. With its advanced security features, intuitive interface, and robust collaboration tools, SmartRoom helps organizations streamline their deal processes and achieve successful outcomes.

Key Features:

- Bank-grade security encryption and multi-factor authentication for data protection

- Customizable user permissions and access controls for granular security management

- Real-time activity tracking and reporting for auditability and compliance

- Mobile-friendly interface for access on smartphones and tablets

- Dedicated customer support and training resources for user adoption and success

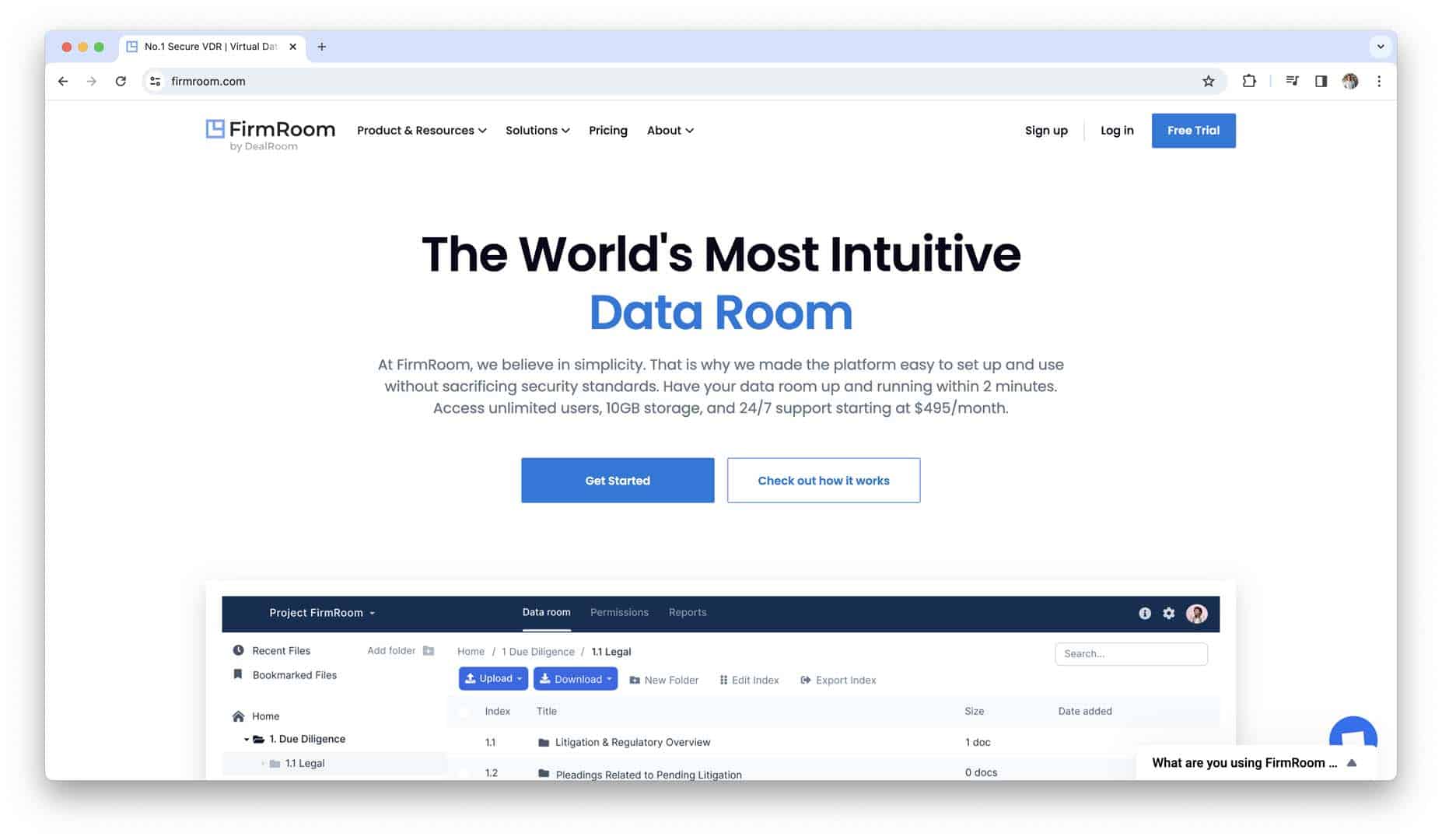

9. FirmRoom

FirmRoom is a user-friendly virtual data room solution designed to simplify the M&A process for dealmakers and advisors. With its intuitive interface, robust security features, and comprehensive document management capabilities, FirmRoom helps organizations streamline their deal workflows and collaborate more effectively with stakeholders.

Key Features:

- Secure document sharing and storage with encryption and access controls

- Drag-and-drop interface for easy uploading and organizing of documents

- Real-time notifications and alerts for deal activity and updates

- Customizable branding options to reflect your organization’s identity

- Integration with popular productivity tools and software for seamless workflow management

How to Choose an M&A Software?

Selecting the right M&A software is a critical decision that can significantly impact the success of your M&A initiatives. We’ll explore the key factors you should consider when evaluating different M&A software solutions to ensure they align with your company’s needs and requirements.

Company Needs Assessment

Before diving into the selection process, it’s essential to conduct a thorough assessment of your company’s specific M&A needs and objectives. This assessment should take into account factors such as:

- Deal Volume and Complexity: Evaluate the typical volume and complexity of your M&A transactions to determine the scalability and robustness of the software solution needed.

- Industry and Regulatory Considerations: Consider any industry-specific regulations or compliance requirements that may impact your choice of M&A software, such as data privacy regulations, industry standards, or regulatory reporting requirements.

- Organizational Structure and Culture: Assess your company’s organizational structure, culture, and existing workflows to ensure that the chosen M&A software can integrate seamlessly with your existing systems and processes.

- User Requirements and Preferences: Gather input from key stakeholders and end-users to understand their preferences, pain points, and must-have features when it comes to M&A software.

Scalability and Customization

As your company grows and your M&A activities evolve, it’s essential to choose a software solution that can scale and adapt to your changing needs. Consider the following factors related to scalability and customization:

- Scalability: Ensure that the M&A software can accommodate a growing number of users, transactions, and data volumes without compromising performance or reliability.

- Flexibility and Customization: Look for software solutions that offer a high degree of customization to tailor the platform to your company’s unique workflows, processes, and reporting requirements.

- Modularity: Consider whether the software offers a modular architecture that allows you to add or remove features as needed, enabling you to scale up or down based on your requirements.

Integration Capabilities

Effective integration with existing systems and tools is crucial for maximizing the value of your M&A software investment and ensuring seamless collaboration across departments and functions. Evaluate the software’s integration capabilities in the following areas:

- APIs and Connectors: Check whether the M&A software provides robust APIs and connectors that facilitate integration with other enterprise systems, such as CRM, ERP, accounting, and project management software.

- Data Compatibility: Ensure that the software can handle a wide range of data formats and sources, including structured and unstructured data, to support data integration and analysis from diverse sources.

- Workflow Integration: Look for features that enable seamless integration of M&A workflows with existing business processes and systems, minimizing disruption and ensuring continuity of operations.

Security and Compliance

Security and compliance are paramount considerations when dealing with sensitive M&A data, including financial information, intellectual property, and confidential documents. When evaluating M&A software, pay close attention to the following security and compliance features:

- Data Encryption: Verify that the software offers robust encryption mechanisms to protect data both in transit and at rest, ensuring that sensitive information remains secure from unauthorized access or breaches.

- Access Controls: Ensure that the software provides granular access controls and permission settings, allowing you to restrict access to sensitive data based on user roles, responsibilities, and privileges.

- Compliance Frameworks: Check whether the software complies with relevant industry standards and regulations, such as SOC 2, GDPR, HIPAA, or ISO 27001, to ensure that your M&A activities remain compliant with legal and regulatory requirements.

- Auditing and Monitoring: Look for features that enable comprehensive auditing and monitoring of user activities within the software platform, including user logins, file access, and changes to permissions or configurations.

User-Friendliness and Training Requirements

The usability and intuitiveness of the M&A software can significantly impact user adoption and productivity. Consider the following factors related to user-friendliness and training requirements:

- User Interface: Evaluate the software’s user interface (UI) and user experience (UX) design to ensure that it is intuitive, visually appealing, and easy to navigate for users with varying levels of technical expertise.

- Training and Onboarding: Assess the availability and quality of training and onboarding resources provided by the software vendor, including documentation, tutorials, training sessions, and customer support options.

- Feedback Mechanisms: Look for features that allow users to provide feedback and suggestions for improving the software’s usability, functionality, and overall user experience.

Cost and ROI Analysis

Finally, consider the total cost of ownership (TCO) of the M&A software, including upfront costs, ongoing subscription fees, implementation expenses, and potential return on investment (ROI). Conduct a thorough cost and ROI analysis by considering the following factors:

- Total Cost of Ownership: Calculate the total cost of purchasing, implementing, and maintaining the M&A software over its expected lifespan, including software licensing fees, implementation costs, training expenses, and ongoing support and maintenance fees.

- ROI Potential: Estimate the potential return on investment (ROI) of the M&A software by identifying key benefits and cost savings associated with improved efficiency, reduced cycle times, increased deal volume, enhanced collaboration, and better decision-making.

- Value Proposition: Evaluate the software’s value proposition in terms of its ability to deliver tangible benefits and business outcomes that justify the investment, such as increased deal success rates, higher deal values, improved post-merger performance, and competitive advantage.

By carefully considering these factors and conducting a comprehensive evaluation of different M&A software solutions, you can select the right platform that aligns with your company’s needs, objectives, and budget constraints, ultimately enabling you to drive greater efficiency, effectiveness, and success in your M&A initiatives.

How to Implement M&A Software?

Implementing M&A software requires careful planning, execution, and ongoing support to ensure a successful transition and maximize the software’s benefits. We’ll guide you through the implementation process, from pre-planning to post-implementation support and maintenance.

Pre-Implementation Planning

Before rolling out M&A software across your organization, it’s essential to lay a solid foundation through comprehensive pre-implementation planning. This phase involves several key activities:

- Goal Setting: Define clear objectives and goals for implementing the M&A software, aligning them with your company’s overall M&A strategy and business objectives. These goals could include improving operational efficiency, reducing deal cycle times, enhancing collaboration, or ensuring regulatory compliance.

- Team Formation: Assemble a cross-functional implementation team comprising representatives from various departments, including finance, legal, IT, operations, and HR. Assign roles and responsibilities to team members, ensuring that each stakeholder has a clear understanding of their tasks and deliverables.

- Needs Assessment: Conduct a thorough needs assessment to identify specific requirements, pain points, and challenges that the M&A software is intended to address. Gather input from end-users and stakeholders to understand their workflows, preferences, and priorities, which will inform the selection and configuration of the software solution.

- Data Migration Planning: Develop a data migration plan to ensure the seamless transfer of relevant data, documents, and files from legacy systems to the new M&A software platform. Assess the quality, integrity, and completeness of existing data, identify any data cleansing or normalization requirements, and establish protocols for data mapping and migration.

Implementation Steps

Once the pre-implementation planning phase is complete, it’s time to move on to the implementation phase, which involves several sequential steps:

- Software Installation and Configuration: Work closely with the software vendor or implementation partner to install and configure the M&A software according to your company’s specifications and requirements. This may involve setting up user accounts, defining access controls and permissions, configuring workflows and templates, and integrating with other systems and tools.

- Training and Onboarding: Provide comprehensive training and onboarding sessions for end-users to familiarize them with the new M&A software and its features. Tailor training programs to different user groups based on their roles, responsibilities, and proficiency levels, offering hands-on exercises, tutorials, and support materials to reinforce learning and adoption.

- Testing and Quality Assurance: Conduct rigorous testing and quality assurance to ensure that the M&A software meets performance, usability, and functionality requirements before full deployment. Test various scenarios, workflows, and use cases to identify any bugs, errors, or inconsistencies that need to be addressed. Engage end-users in user acceptance testing (UAT) to validate the software’s effectiveness and usability in real-world scenarios.

Post-Implementation Support and Maintenance

The post-implementation phase is just as crucial as the initial implementation phase for ensuring the long-term success and sustainability of the M&A software. This phase involves ongoing support, maintenance, and optimization activities:

- User Support: Provide continuous user support and assistance to address any questions, issues, or challenges that may arise during daily operations. Establish helpdesk channels, ticketing systems, and knowledge bases to facilitate timely resolution of user inquiries and problems, ensuring minimal disruption to business activities.

- Software Updates and Upgrades: Stay up-to-date with software updates, patches, and upgrades released by the vendor to address bugs, vulnerabilities, and performance improvements. Develop a schedule for applying updates and upgrades, ensuring minimal downtime and disruption to users.

- Performance Monitoring and Optimization: Monitor the performance and usage of the M&A software on an ongoing basis, collecting feedback from end-users and stakeholders to identify areas for improvement and optimization. Conduct periodic reviews and audits of the software’s configuration, workflows, and integrations to ensure alignment with evolving business needs and industry best practices.

- Training and Continuous Learning: Offer ongoing training and professional development opportunities for end-users to deepen their knowledge and proficiency in using the M&A software effectively. Provide advanced training sessions, workshops, and certification programs to empower users to leverage the full capabilities of the software and drive continuous improvement in M&A processes and outcomes.

By following these implementation best practices and investing in post-implementation support and maintenance, you can ensure a smooth transition to the new M&A software platform and maximize its value proposition for your organization.

Best Practices for Maximizing M&A Software Effectiveness

To fully leverage the capabilities of M&A software and drive successful outcomes in your mergers and acquisitions, consider implementing the following best practices:

- Establish Clear Communication Channels: Foster open and transparent communication among all stakeholders involved in the M&A process, including executives, deal teams, legal counsel, finance professionals, and external advisors. Use collaborative tools and platforms within the M&A software to facilitate real-time communication, document sharing, and decision-making, ensuring alignment and coordination across all parties.

- Standardize Processes and Workflows: Develop standardized processes, templates, and workflows for key M&A activities, such as due diligence, deal management, valuation, integration planning, and post-merger integration. Define clear roles, responsibilities, and approval workflows to streamline operations, improve consistency, and reduce the risk of errors or oversights. Leverage automation features within the M&A software to automate repetitive tasks and enforce compliance with established processes.

- Ensure Data Accuracy and Integrity: Maintain accurate, up-to-date, and consistent data within the M&A software to support informed decision-making and analysis throughout the deal lifecycle. Implement data governance policies and controls to enforce data quality standards, data validation rules, and data access controls. Conduct regular data audits and reconciliation checks to identify and rectify any discrepancies or anomalies, ensuring the reliability and trustworthiness of M&A data.

- Promote Cross-Functional Collaboration: Encourage collaboration and knowledge sharing across different functional areas and departments involved in the M&A process, such as finance, legal, HR, IT, operations, and strategic planning. Facilitate cross-functional workshops, working groups, and task forces within the M&A software to foster collaboration, innovation, and synergy identification. Break down silos and promote a culture of collaboration and teamwork to maximize the collective expertise and capabilities of diverse stakeholders.

- Invest in User Training and Adoption: Provide comprehensive training and onboarding programs for end-users to ensure proficiency and adoption of the M&A software. Offer role-based training sessions, hands-on workshops, and self-paced tutorials tailored to the specific needs and skill levels of different user groups. Provide ongoing support and resources, such as user guides, FAQs, and helpdesk support, to address user questions, issues, and feedback effectively. Foster a culture of continuous learning and improvement by encouraging users to share best practices, tips, and tricks for using the M&A software more effectively.

- Measure and Monitor Key Performance Metrics: Establish key performance indicators (KPIs) and metrics to track the effectiveness, efficiency, and impact of M&A activities and initiatives. Define quantitative and qualitative metrics related to deal volume, deal cycle times, deal success rates, cost savings, revenue synergies, operational efficiencies, and post-merger integration outcomes. Use the reporting and analytics capabilities of the M&A software to generate customized dashboards, reports, and visualizations that provide insights into M&A performance and facilitate data-driven decision-making.

- Continuously Improve and Iterate: Embrace a mindset of continuous improvement and iteration to refine and optimize M&A processes, strategies, and outcomes over time. Solicit feedback from stakeholders, end-users, and external partners to identify areas for improvement and innovation within the M&A software. Leverage agile methodologies and iterative development approaches to implement incremental changes, enhancements, and updates to the software based on user feedback, changing requirements, and emerging best practices. Regularly review and refine M&A strategies, policies, and procedures to adapt to evolving market dynamics, regulatory requirements, and organizational priorities.

Conclusion

Selecting the right M&A software is a critical decision that can have a profound impact on the success of your mergers and acquisitions. By understanding your company’s specific needs, evaluating key factors such as scalability, integration capabilities, security, and user-friendliness, and following best practices for implementation and optimization, you can maximize the effectiveness of your M&A software investment. With the right tools and strategies in place, you can streamline your M&A processes, mitigate risks, foster collaboration, and drive value creation for your organization.

Remember, the M&A landscape is constantly evolving, with new technologies, regulations, and market dynamics shaping the way deals are done. Stay informed, stay adaptable, and continue to innovate to stay ahead of the curve. By leveraging the insights and resources provided in this guide, you can navigate the complexities of M&A transactions with confidence and achieve your strategic growth objectives. Whether you’re a small startup or a global corporation, the right M&A software can be a game-changer in driving successful outcomes and unlocking new opportunities for growth and success.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.