Are you seeking efficient ways to manage your investment portfolios and optimize returns? Look no further. In today’s dynamic financial landscape, fund management software has become an indispensable tool for investment firms, asset managers, and financial institutions. From tracking investments to analyzing performance and ensuring regulatory compliance, these digital solutions streamline complex processes and empower professionals to make data-driven decisions.

In this guide, we’ll delve into the top fund management software and tools, exploring key features, benefits, and implementation best practices. Whether you’re a seasoned investor or a financial professional, this guide will equip you with the knowledge and insights needed to navigate the evolving landscape of fund management technology and maximize your investment outcomes.

What is Fund Management?

Fund management, also known as asset management or investment management, refers to the professional management of various investment funds, portfolios, or assets on behalf of investors or institutions. Fund managers are responsible for making investment decisions, allocating assets, and monitoring portfolio performance to achieve specific financial objectives and targets.

Fund management encompasses a wide range of activities, including investment analysis, portfolio construction, risk management, and performance evaluation. Fund managers employ various strategies and techniques to optimize returns while managing risk within specified constraints.

Importance of Fund Management

- Wealth Preservation: Fund management plays a crucial role in preserving and growing wealth over time by making informed investment decisions and managing risk effectively.

- Portfolio Diversification: Effective fund management allows investors to diversify their portfolios across different asset classes, sectors, and regions, reducing overall investment risk and enhancing long-term returns.

- Financial Goal Achievement: Fund managers help investors achieve their financial goals and objectives, whether it’s saving for retirement, funding education, or generating income, by designing investment strategies aligned with their specific needs and risk tolerance.

- Market Expertise: Fund managers possess specialized knowledge and expertise in financial markets, economic trends, and investment strategies, enabling them to identify opportunities and navigate market volatility to generate positive returns for investors.

- Risk Management: Fund management involves assessing and managing various types of risk, including market risk, credit risk, and liquidity risk, to protect investors’ capital and minimize potential losses.

- Professional Management: Fund management provides investors with access to professional investment management services, allowing them to benefit from the expertise, experience, and resources of skilled investment professionals.

What is Fund Management Software?

Fund management software refers to digital tools, platforms, and applications designed to streamline and automate various aspects of fund management, portfolio management, and investment operations. Fund management software enables fund managers, investment firms, and financial institutions to efficiently manage portfolios, analyze performance, mitigate risk, and ensure regulatory compliance.

Benefits of Using Fund Management Software

- Efficiency: Fund management software automates routine tasks and processes, saving time and resources while increasing operational efficiency and productivity.

- Accuracy: Advanced analytics and reporting tools provide precise insights into portfolio performance, risk exposure, and compliance status, enabling informed decision-making and strategic planning.

- Compliance: Fund management software helps ensure regulatory compliance by incorporating compliance checks, audit trails, and reporting functionalities to meet regulatory requirements and industry standards.

- Scalability: Scalable fund management software can accommodate growing portfolios, increasing transaction volumes, and evolving business needs, supporting organizational growth and expansion.

- Client Service: Fund management software enhances client service and communication by providing real-time access to portfolio information, performance reports, and investment updates, fostering transparency and trust with clients and stakeholders.

Key Features to Look for in Fund Management Software

Finding the right fund management software requires careful consideration of several key features. Let’s explore these features in detail to help you make an informed decision.

Portfolio Management Capabilities

Effective portfolio management is the cornerstone of any fund management software. Look for solutions that offer robust portfolio tracking, management, and optimization tools. Some essential capabilities to consider include:

- Portfolio Tracking: The software should provide real-time updates on portfolio holdings, transactions, and performance metrics. This allows you to monitor investments and make informed decisions promptly.

- Asset Allocation: Look for tools that enable you to optimize asset allocation strategies based on your investment objectives and risk tolerance. The software should support dynamic allocation adjustments to adapt to changing market conditions.

- Rebalancing: Automated rebalancing functionality is crucial for maintaining desired portfolio allocations over time. Choose a solution that streamlines the rebalancing process and minimizes manual intervention.

Performance Analysis and Reporting

Comprehensive performance analysis and reporting tools are essential for evaluating portfolio performance and making data-driven decisions. Consider the following features when assessing performance analysis capabilities:

- Performance Measurement: The software should offer robust performance measurement tools to assess portfolio returns against benchmarks and objectives. Look for features such as time-weighted and money-weighted return calculations.

- Attribution Analysis: Choose a solution that provides attribution analysis to identify the drivers of portfolio performance, such as asset allocation, security selection, and market factors. This insight helps you understand the sources of portfolio returns and make adjustments accordingly.

- Customizable Reporting: Flexible reporting capabilities are essential for generating customized reports tailored to your specific needs and preferences. Look for software that allows you to create reports with detailed performance metrics, charts, and graphs for effective communication with stakeholders.

Risk Management Tools

Effective risk management is critical for preserving capital and achieving long-term investment objectives. Look for fund management software that offers robust risk management tools, including:

- Risk Assessment: The software should provide tools for assessing and quantifying portfolio risk using metrics such as volatility, value-at-risk (VaR), and stress testing. Look for features that allow you to identify and mitigate potential risks proactively.

- Scenario Analysis: Scenario analysis tools enable you to evaluate the impact of various market scenarios on portfolio performance. Choose a solution that allows you to simulate different market conditions and assess the resilience of your portfolio under adverse circumstances.

- Compliance Monitoring: Regulatory compliance features are essential for ensuring adherence to legal and regulatory requirements. Look for software that offers automated compliance checks and alerts to help you stay compliant with relevant regulations.

Compliance and Regulatory Features

In today’s regulatory environment, compliance is a top priority for financial institutions and investment firms. When evaluating fund management software, consider the following compliance and regulatory features:

- Regulatory Compliance: Choose software that offers built-in compliance features to ensure adherence to regulatory requirements such as SEC, FINRA, and GDPR. Look for solutions that provide customizable compliance rules and alerts to help you stay compliant with evolving regulations.

- Audit Trails: Detailed audit trails are essential for tracking changes made to portfolios and maintaining regulatory transparency. Look for software that provides comprehensive audit trail functionality, allowing you to trace every transaction and decision back to its source.

- Document Management: Secure document management capabilities are crucial for storing and accessing regulatory documents and disclosures. Choose software that offers robust document management features, including version control, access controls, and document encryption, to ensure data security and compliance.

Integration and Scalability

Seamless integration and scalability are key considerations when selecting fund management software. Look for solutions that offer the following integration and scalability features:

- Data Integration: Choose software that seamlessly integrates with external data sources such as market data providers, custodian banks, and accounting systems. Look for solutions that support standardized data formats and protocols to facilitate smooth data exchange.

- Scalability: The software should be scalable to accommodate growing portfolios, increasing transaction volumes, and evolving business requirements. Look for solutions that offer flexible deployment options, including cloud-based scalability and on-premises deployment, to support your organization’s growth trajectory.

- API Access: Application Programming Interface (API) access is essential for integrating the software with other internal systems and third-party applications. Look for software that provides well-documented APIs and developer tools to facilitate seamless integration and customization.

User Interface and Accessibility

An intuitive user interface and accessibility features are critical for user adoption and productivity. Look for fund management software that offers the following user interface and accessibility features:

- User-Friendly Interface: Choose software with an intuitive and user-friendly interface that streamlines navigation and workflow management. Look for solutions that offer customizable dashboards and layouts to accommodate individual user preferences and roles.

- Mobile Accessibility: Mobile accessibility is essential for accessing portfolio data and making informed decisions on the go. Look for software that offers dedicated mobile applications or responsive web interfaces optimized for mobile devices.

- Customization Options: The software should offer customization options to tailor the user interface and workflow to your specific needs and preferences. Look for solutions that allow you to personalize dashboards, reports, and alerts to align with your unique investment processes and priorities.

Top Fund Management Software and Tools

In today’s financial landscape, the demand for efficient fund management solutions has never been higher. Here, we delve into some of the top fund management software and tools that empower investment firms, asset managers, and financial institutions to streamline portfolio management, enhance performance analysis, mitigate risks, and ensure regulatory compliance.

1. FundCount

FundCount stands out as a comprehensive fund management solution trusted by investment professionals and family offices worldwide. Offering robust portfolio tracking and management capabilities, FundCount enables users to monitor investments, analyze performance, and optimize asset allocation strategies effectively. With integrated performance measurement and compliance monitoring features, FundCount provides a holistic approach to fund management, helping users stay compliant with regulatory requirements while maximizing returns.

2. APX

Advent Portfolio Exchange (APX) is a leading portfolio management solution tailored for asset managers, hedge funds, and institutional investors. Renowned for its portfolio rebalancing and compliance capabilities, APX empowers users to automate portfolio rebalancing, monitor compliance with regulatory constraints, and generate customizable reports to meet client and regulatory demands. With integrated performance analysis and attribution tools, APX provides valuable insights into portfolio performance drivers, enabling users to make informed investment decisions.

3. SimCorp

SimCorp Dimension stands out as an integrated investment management solution designed for asset managers, pension funds, and insurance companies. Offering multi-asset class support and real-time performance measurement capabilities, SimCorp enables users to manage complex investment portfolios with ease. With built-in regulatory compliance features and advanced risk management tools, SimCorp helps users navigate regulatory requirements and manage investment risks effectively. Additionally, its user-friendly interface and customizable workflow options enhance user experience and productivity, making it a top choice for fund managers worldwide.

4. Bloomberg AIM

Bloomberg Asset and Investment Manager (AIM) is a comprehensive asset and investment management solution trusted by institutional investors worldwide. Offering advanced portfolio analytics, trade order management, and compliance monitoring capabilities, Bloomberg AIM enables users to manage complex investment portfolios with ease. With integrated risk management features and real-time market data access, Bloomberg AIM provides users with valuable insights to make informed investment decisions and optimize returns.

5. Aladdin

Aladdin by BlackRock is a leading investment management platform utilized by asset managers, pension funds, and insurance companies globally. Renowned for its risk analytics, portfolio construction, and operational efficiency tools, BlackRock Aladdin empowers users to manage investment portfolios effectively while minimizing risks. With integrated ESG (Environmental, Social, Governance) analysis and reporting capabilities, BlackRock Aladdin helps users align investment decisions with sustainability objectives and regulatory requirements.

6. Charles River IMS

Charles River IMS (Investment Management System) is a comprehensive investment management platform designed for asset managers, wealth managers, and institutional investors. Offering integrated order and execution management, portfolio analytics, and compliance monitoring features, Charles River IMS enables users to streamline investment processes and optimize trading strategies. With real-time market data integration and advanced performance attribution tools, Charles River IMS provides users with actionable insights to drive investment performance and client satisfaction.

7. SS&C Advent Geneva

SS&C Advent Geneva is a leading investment management platform trusted by investment firms, hedge funds, and fund administrators worldwide. Offering advanced accounting, reporting, and performance measurement capabilities, SS&C Advent Geneva enables users to manage complex investment portfolios with accuracy and efficiency. With integrated compliance monitoring and regulatory reporting features, SS&C Advent Geneva helps users stay compliant with global regulatory requirements while minimizing operational risks.

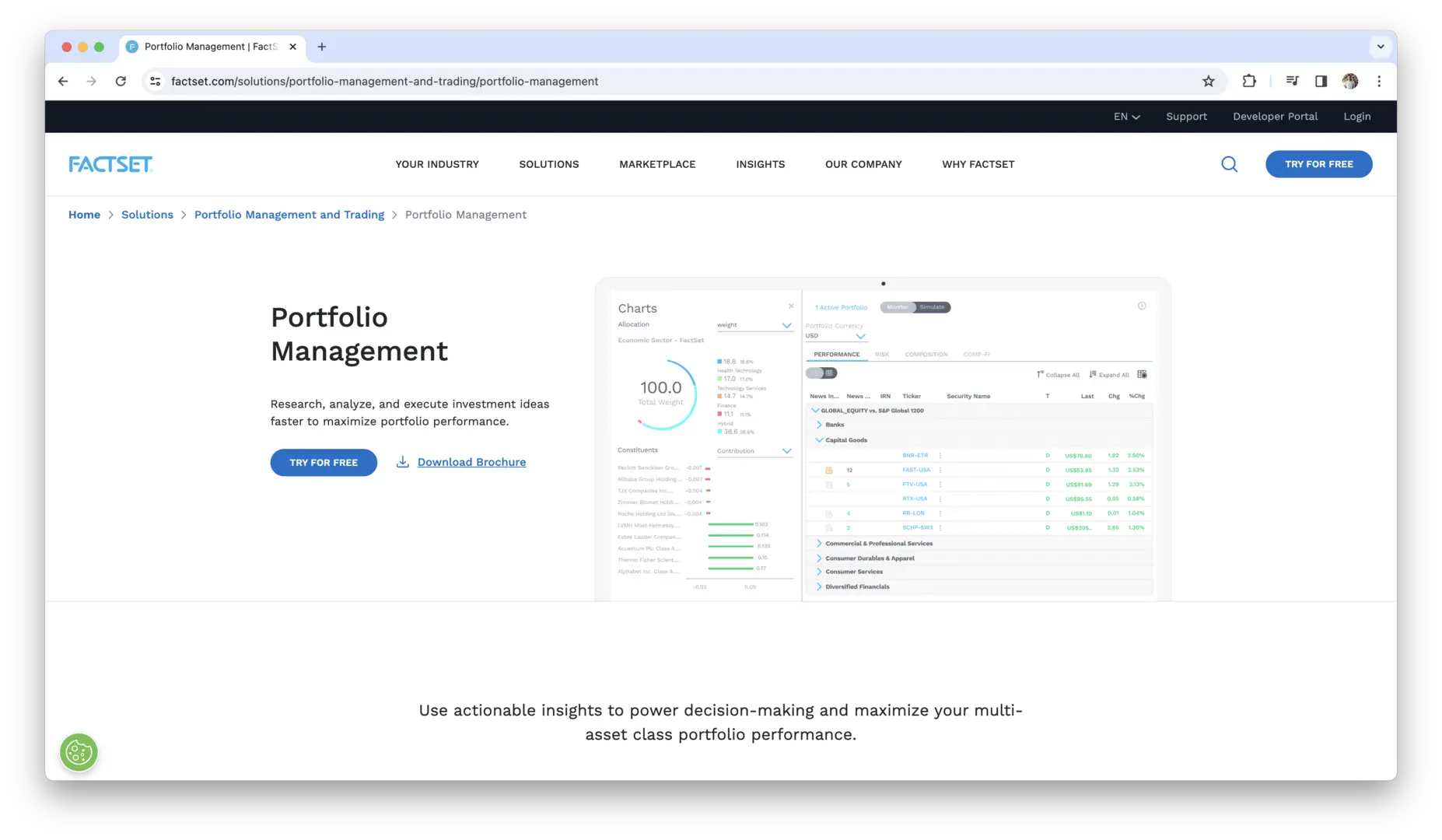

8. FactSet Portfolio Management

FactSet Portfolio Management is a comprehensive portfolio analytics and risk management solution utilized by investment professionals and asset managers globally. Offering advanced performance attribution, risk modeling, and scenario analysis tools, FactSet Portfolio Management empowers users to make informed investment decisions and optimize portfolio performance. With integrated ESG (Environmental, Social, Governance) integration and reporting capabilities, FactSet Portfolio Management helps users incorporate sustainability considerations into investment strategies and decision-making processes.

9. Eagle Investment Systems

Eagle Investment Systems offers a comprehensive suite of investment management solutions tailored for institutional investors, asset managers, and wealth managers. With features such as portfolio accounting, data management, and performance measurement, Eagle Investment Systems provides users with a holistic approach to fund management. Its scalable architecture and flexible deployment options make it an ideal choice for organizations of all sizes seeking to optimize their investment operations.

10. SEI Wealth Platform

The SEI Wealth Platform is a cloud-based investment management solution designed to streamline wealth management processes for financial advisors, banks, and wealth management firms. Offering integrated account aggregation, financial planning, and client reporting capabilities, the SEI Wealth Platform enables users to deliver personalized investment solutions and enhance client relationships. Its intuitive interface and automated workflows empower advisors to focus on client needs while leveraging technology to drive efficiency and growth.

11. Morningstar Direct

Morningstar Direct is a powerful investment analysis platform utilized by investment professionals, asset allocators, and fund managers worldwide. With features such as fund screening, performance attribution, and risk analytics, Morningstar Direct provides users with valuable insights into investment opportunities and portfolio performance. Its extensive database of investment data and research enables users to conduct thorough due diligence and make informed investment decisions based on comprehensive analysis and evaluation.

12. State Street Alpha

State Street Alpha is an integrated investment management platform designed for institutional investors, asset managers, and hedge funds. Offering advanced portfolio management, risk analytics, and middle-office operations capabilities, State Street Alpha enables users to streamline investment processes and optimize operational efficiency. Its scalable architecture and modular design allow users to customize the platform to meet their specific needs and preferences, making it a versatile solution for organizations seeking to modernize their investment operations.

13. InvestCloud

InvestCloud is a leading provider of digital solutions for wealth management, asset management, and financial advisory firms. With features such as client engagement portals, portfolio analytics, and compliance monitoring tools, InvestCloud empowers users to deliver personalized, data-driven investment experiences to clients. Its modular architecture and cloud-based deployment options enable rapid implementation and scalability, allowing organizations to adapt to changing business needs and market conditions quickly.

These fund management software solutions empower users to streamline operations, enhance decision-making, and achieve better investment outcomes in today’s competitive financial landscape. With their comprehensive features, scalability, and robust support services, these tools are indispensable assets for any organization seeking to excel in fund management.

How to Select the Best Fund Management Software for Your Needs?

Choosing the right fund management software is a critical decision that can significantly impact your organization’s efficiency and performance. In this section, we’ll explore key considerations to help you select the software solution that best fits your needs and objectives.

Assessing Your Requirements

Before you start evaluating fund management software options, it’s essential to assess your organization’s specific requirements and objectives.

- Investment Strategy: Determine your investment strategy, asset classes, and risk tolerance. Different software solutions may specialize in specific asset classes or investment strategies, so it’s essential to choose one that aligns with your approach.

- Regulatory Requirements: Consider regulatory requirements relevant to your jurisdiction and industry. Ensure that the software you choose provides robust compliance features to help you stay compliant with relevant regulations.

- Reporting Needs: Evaluate your reporting needs, including client reporting, regulatory reporting, and internal reporting. Look for software that offers customizable reporting capabilities to meet your specific requirements.

- Workflow Preferences: Consider your workflow preferences and operational processes. Choose software that streamlines your workflow and integrates seamlessly with your existing systems and processes.

Budget Considerations

Budget considerations are another critical factor when selecting fund management software.

- Total Cost of Ownership: Evaluate the total cost of ownership, including upfront costs, ongoing maintenance fees, and any additional expenses such as customization or integration costs.

- Scalability: Consider the scalability of the software and how pricing may change as your organization grows. Look for solutions that offer flexible pricing models that can accommodate your growth trajectory.

- ROI Potential: Assess the potential return on investment (ROI) of the software. Consider how the software can help you improve operational efficiency, reduce manual effort, and enhance investment performance to justify the cost.

Scalability and Future Growth

Scalability is crucial when selecting fund management software, especially if you anticipate future growth or expansion.

- Portfolio Size: Evaluate whether the software can effectively scale to accommodate your current portfolio size and future growth projections. Look for solutions that can handle large volumes of data and transactions without sacrificing performance.

- Transaction Volume: Consider your organization’s transaction volume and how it may change over time. Choose software that can handle increasing transaction volumes without experiencing slowdowns or performance issues.

- User Growth: Assess whether the software can support additional users and concurrent access as your organization grows. Look for solutions that offer scalable user licensing options to accommodate growing user bases.

Integration with Existing Systems

Integration with existing systems is essential for seamless data exchange and workflow integration.

- Data Sources: Evaluate the software’s ability to integrate with external data sources such as market data providers, custodian banks, and accounting systems. Choose software that supports standardized data formats and protocols to facilitate smooth data exchange.

- Third-Party Applications: Consider whether the software can integrate with third-party applications commonly used in your organization, such as CRM systems, accounting software, or risk management tools. Look for solutions that offer robust API access and pre-built integrations with popular third-party applications.

- Workflow Integration: Assess how the software integrates with your existing workflow and operational processes. Choose software that seamlessly integrates with your existing systems and processes to minimize disruption and maximize efficiency.

Vendor Reputation and Support

The reputation and support capabilities of the software vendor are crucial considerations when selecting fund management software.

- Vendor Stability: Evaluate the stability and reputation of the software vendor. Choose a vendor with a proven track record of success and financial stability to minimize the risk of vendor-related issues.

- Customer References: Seek references from existing customers to gauge their satisfaction with the software and vendor support. Ask about the vendor’s responsiveness, support capabilities, and overall customer experience.

- Support Services: Assess the vendor’s support services and resources, including technical support, training, and documentation. Choose a vendor that offers comprehensive support services to ensure a smooth implementation and ongoing operation of the software.

By carefully considering these factors and conducting thorough due diligence, you can select the fund management software that best meets your organization’s needs and objectives, setting the stage for long-term success and growth.

How to Implement Fund Management Software?

Successfully implementing and integrating fund management software requires careful planning and execution. In this section, we’ll guide you through the various stages of the implementation and integration process to ensure a smooth transition and optimal utilization of the software.

Planning Phase

The planning phase is crucial for laying the foundation for a successful implementation. During this phase, you’ll define project objectives, establish timelines, allocate resources, and identify key stakeholders.

- Project Objectives: Clearly define the objectives and goals of the implementation project. Identify the specific outcomes you hope to achieve, such as improved efficiency, enhanced reporting capabilities, or better risk management.

- Timeline and Milestones: Establish a realistic timeline for the implementation project, taking into account factors such as data migration, testing, training, and user adoption. Break down the project into manageable milestones to track progress and ensure accountability.

- Resource Allocation: Allocate resources, including personnel, budget, and technology infrastructure, to support the implementation project. Ensure that you have the necessary expertise and support from internal teams or external consultants.

- Stakeholder Engagement: Identify key stakeholders, including end-users, management, IT personnel, and external partners. Engage stakeholders early in the planning process to gather input, address concerns, and gain buy-in for the project.

Data Migration

Data migration is a critical aspect of the implementation process, involving the transfer of existing data from legacy systems to the new fund management software.

- Data Assessment: Conduct a comprehensive assessment of existing data sources, formats, and quality to identify potential challenges and opportunities for improvement.

- Data Mapping: Create a data mapping plan to define how data will be transformed, mapped, and loaded into the new system. Ensure that data mapping aligns with the data model and structure of the fund management software.

- Data Cleansing: Cleanse and standardize data to ensure accuracy, consistency, and integrity. Identify and rectify any data quality issues or discrepancies before migrating data to the new system.

- Testing: Conduct thorough testing of data migration processes to validate data accuracy, completeness, and integrity. Develop test scripts and scenarios to verify that migrated data behaves as expected and meets business requirements.

Training and Onboarding

Effective training and onboarding are essential for ensuring user adoption and maximizing the benefits of the fund management software.

- User Training: Provide comprehensive training programs tailored to different user roles and responsibilities. Offer a combination of in-person training sessions, online tutorials, documentation, and self-paced learning resources to accommodate diverse learning preferences.

- Hands-on Practice: Encourage users to engage in hands-on practice and experimentation with the software to build confidence and proficiency. Offer sandbox environments or test accounts where users can explore features and functionalities in a risk-free setting.

- Role-based Training: Customize training programs to align with specific user roles and workflows. Focus on teaching users how to perform their job tasks efficiently using the fund management software, emphasizing relevant features and functionalities.

- Ongoing Support: Provide ongoing support and assistance to users as they transition to the new system. Establish channels for users to ask questions, seek help, and report issues, such as help desks, user forums, or dedicated support personnel.

Testing and Quality Assurance

Testing and quality assurance are critical to ensure the reliability, performance, and functionality of the fund management software.

- Test Planning: Develop a comprehensive test plan outlining testing objectives, scope, approach, and resources. Identify test scenarios, use cases, and acceptance criteria to guide testing activities.

- Functional Testing: Conduct functional testing to verify that the software meets specified requirements and performs as expected. Test various features, workflows, and scenarios to identify and address any defects or discrepancies.

- Integration Testing: Perform integration testing to validate the interoperability and compatibility of the fund management software with other systems and applications. Test data exchange, interfaces, and integration points to ensure seamless communication and data flow.

- Performance Testing: Evaluate the performance and scalability of the software under different load conditions and usage scenarios. Measure response times, throughput, and resource utilization to identify performance bottlenecks and optimize system performance.

Go-Live and Post-Implementation Support

The go-live phase marks the transition to the new fund management software, followed by ongoing post-implementation support and maintenance.

- Deployment Planning: Develop a deployment plan outlining tasks, responsibilities, and timelines for the go-live transition. Coordinate with stakeholders, IT teams, and vendors to ensure a smooth deployment process with minimal disruption to operations.

- User Support: Provide dedicated support and assistance to users during the go-live period to address any issues, questions, or concerns that arise. Establish help desks, support hotlines, or user forums to facilitate communication and resolution of issues.

- Monitoring and Feedback: Monitor system performance and user feedback during the initial post-implementation period to identify any issues or areas for improvement. Gather feedback from users and stakeholders to inform ongoing enhancements and optimizations.

- Maintenance and Upgrades: Implement regular maintenance procedures and software upgrades to ensure the continued reliability, security, and performance of the fund management software. Stay informed about software updates, patches, and new releases to take advantage of new features and enhancements.

By following these best practices for implementation and integration, you can maximize the success of your fund management software deployment and achieve your desired business outcomes.

Fund Management Software Best Practices

To maximize the efficiency of your fund management software and achieve optimal results, consider implementing the following best practices:

- Regular Updates and Maintenance: Stay up-to-date with software updates, patches, and bug fixes provided by the vendor. Regularly schedule maintenance activities to ensure the software remains secure, stable, and fully functional.

- Training and Skill Development: Invest in ongoing training and skill development for users to enhance their proficiency with the software. Offer training programs, workshops, and online resources to keep users informed about new features and best practices.

- Utilizing Advanced Features: Explore and leverage advanced features and functionalities offered by the software to streamline operations and gain deeper insights into portfolio management, performance analysis, and risk assessment.

- Monitoring and Evaluation: Implement monitoring tools and performance metrics to track system usage, performance, and user satisfaction. Regularly evaluate key performance indicators (KPIs) to identify areas for improvement and optimization.

- Feedback and Continuous Improvement: Encourage user feedback and engagement to gather insights into user needs, preferences, and pain points. Use feedback to drive continuous improvement initiatives and enhance the software’s usability and functionality.

- Customization and Configuration: Take advantage of customization and configuration options to tailor the software to your organization’s unique requirements and workflows. Customize dashboards, reports, and workflows to align with specific user roles and preferences.

- Data Quality Management: Implement data quality management practices to ensure the accuracy, completeness, and integrity of data within the software. Regularly cleanse, validate, and reconcile data to maintain data quality standards and minimize errors.

- Collaboration and Communication: Foster collaboration and communication among users and stakeholders to facilitate knowledge sharing, decision-making, and problem-solving. Encourage cross-functional teams to collaborate on projects and initiatives using the software.

- Security and Compliance: Prioritize security and compliance measures to protect sensitive data and ensure regulatory compliance. Implement access controls, encryption, and audit trails to safeguard data and mitigate security risks.

- Integration with External Systems: Explore opportunities for integrating the fund management software with external systems and applications to enhance interoperability and streamline data exchange. Integrate with market data providers, custodian banks, and accounting systems to automate data retrieval and processing.

By implementing these best practices, you can optimize the efficiency, effectiveness, and value of your fund management software, driving better outcomes and performance for your organization.

Conclusion

Embracing fund management software and tools can revolutionize the way you manage investment portfolios, enhance efficiency, and drive better outcomes. By leveraging advanced features such as portfolio tracking, performance analysis, and compliance monitoring, you can gain valuable insights, mitigate risks, and optimize returns. Additionally, investing in ongoing training and skill development for users, staying updated with software updates and industry trends, and fostering a culture of continuous improvement will ensure that you stay ahead in the competitive landscape of fund management. Remember, the right fund management software is not just a tool; it’s a strategic investment that empowers you to achieve your financial goals and thrive in today’s dynamic market environment.

In today’s fast-paced financial world, the importance of leveraging top fund management software cannot be overstated. From wealth preservation to market expertise and client service, these digital solutions offer a myriad of benefits that drive efficiency, compliance, and growth. As you embark on your journey towards implementing and integrating fund management software, remember to prioritize scalability, integration with existing systems, and user adoption. By following best practices, staying proactive, and continuously refining your processes, you can harness the full potential of fund management software and stay ahead of the curve in an ever-evolving industry.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.