- What is Cash Flow Management Software?

- Key Features to Look for in Cash Flow Management Tools

- Types of Cash Flow Management Software

- Top Cash Flow Management Software and Tools

- Benefits of Implementing Cash Flow Management Software

- Challenges in Choosing Cash Flow Management Tools

- How to Maximize the Use of Cash Flow Management Software?

- Conclusion

Are you struggling to keep track of your business’s cash flow? Whether you’re a small business owner or running a larger enterprise, managing cash flow can be a challenge. Keeping an eye on the money coming in and going out is crucial to ensure you can pay bills, invest in growth, and avoid financial issues. Cash flow management software makes this easier by automating the tracking, forecasting, and reporting of your finances. It provides real-time insights into your financial health, helps you plan for future expenses, and ensures you have the liquidity needed to keep your business running smoothly.

With so many options available, it can be tough to figure out which one is right for you. This guide breaks down the top cash flow management tools, highlighting their features, benefits, and who they’re best suited for, so you can find the right solution to keep your finances in check.

What is Cash Flow Management Software?

Cash flow management software is a tool designed to help businesses track, forecast, and manage the inflow and outflow of cash. It simplifies the complex task of monitoring financial transactions by automating key processes and providing real-time insights into the company’s liquidity. This software not only tracks the cash that comes in from sales and other income sources, but it also helps monitor outgoing payments, such as bills, payroll, and loans.

At its core, cash flow management software helps businesses avoid cash shortages by offering a clear picture of their cash position at any given time. It also supports financial decision-making, planning, and forecasting, making it an essential tool for business owners and financial managers. With various features like invoicing, expense tracking, reporting, and forecasting, cash flow management software ensures that companies can operate smoothly, even in fluctuating financial conditions.

Importance of Cash Flow Management for Businesses

Cash flow is the lifeblood of any business. Without effective cash flow management, even the most profitable businesses can run into financial difficulties. Managing cash flow properly ensures that a business has enough funds to meet its obligations while also being able to reinvest in growth opportunities. Here’s why cash flow management is so important:

- Ensures timely payments: Proper cash flow management allows businesses to pay suppliers, employees, and creditors on time, preventing late fees and damaged relationships.

- Helps avoid financial shortfalls: By tracking inflows and outflows, businesses can anticipate periods of cash scarcity and take action before it becomes a problem.

- Supports business growth: Having a clear understanding of cash flow enables businesses to make smart decisions about reinvestment, expansion, or scaling operations without jeopardizing financial stability.

- Improves financial planning: Monitoring cash flow helps businesses forecast future cash needs, allowing them to plan for seasonal fluctuations or large one-time expenses.

- Prevents overextension: A well-managed cash flow system helps businesses avoid taking on more expenses than they can afford, reducing the risk of financial strain.

- Promotes financial health: Consistent and effective cash flow management provides a snapshot of a company’s financial health, helping owners and managers make data-driven decisions for long-term sustainability.

Benefits of Using Cash Flow Management Software

Cash flow management software offers several key benefits that help businesses maintain financial stability and grow efficiently. By automating financial tracking, offering real-time insights, and simplifying forecasting, these tools ensure that businesses can stay ahead of cash flow issues and focus on their core operations. Here are some of the top benefits:

- Real-time tracking of cash flow: Provides up-to-the-minute updates on your cash position, allowing for quick, informed decisions.

- Improved accuracy: Automates data entry and calculations, reducing the chances of human error and ensuring your financial records are always accurate.

- Easier forecasting: Helps predict future cash needs, so you can plan for upcoming expenses and avoid cash shortages during slow periods.

- Streamlined invoicing and payment tracking: Automates invoicing, payment reminders, and reconciliation, saving you time and reducing the risk of missed payments.

- Better budgeting and financial planning: Makes it easier to create and maintain budgets by tracking actual income and expenses against projected figures.

- Enhanced reporting capabilities: Generates comprehensive financial reports that provide detailed insights into your business’s cash flow and financial health, supporting better decision-making.

- Time and cost savings: Automates repetitive tasks, freeing up time to focus on growing your business and reducing the need for manual intervention.

- Improved liquidity management: Helps businesses monitor and manage their liquidity effectively, ensuring there are always sufficient funds to meet obligations without unnecessary borrowing.

Key Features to Look for in Cash Flow Management Tools

When choosing cash flow management software, it’s essential to consider the features that will most effectively meet your business’s needs. The right tool can save you time, reduce human error, and provide you with the insights you need to make informed financial decisions. Here are the key features to look for in a cash flow management solution.

Real-Time Financial Tracking

One of the most valuable features of cash flow management software is the ability to track your financials in real-time. With this feature, you no longer have to wait for end-of-month reports or manually enter data to get an accurate picture of your business’s financial health. Real-time tracking means that as soon as a transaction happens—whether it’s a sale, payment, or expense—it’s reflected immediately in your software. This gives you the most up-to-date view of your cash flow, allowing you to make swift decisions and avoid surprises.

For example, if a large client pays an invoice, you can immediately see how this impacts your cash reserves. Likewise, if there’s an unexpected expense, the software will show you how this affects your overall cash position, giving you a clear view of what’s available. This constant flow of real-time data ensures that you’re always in control of your cash situation.

Integration with Accounting Software

The ability to integrate with your existing accounting software is crucial when selecting a cash flow management tool. This ensures that the data flows seamlessly between your systems, reducing the need for manual entry and minimizing the risk of errors. Integration saves you time by automating the transfer of financial information from your accounting system into the cash flow management tool, making it easier to track both your income and expenses.

Popular accounting platforms like QuickBooks, Xero, and FreshBooks offer integration with many cash flow tools. This integration not only saves time but also ensures consistency in your financial records. For example, if you issue invoices through QuickBooks, the payment data can automatically flow into your cash flow tool, giving you an updated cash position without any additional work.

Forecasting and Budgeting Capabilities

Forecasting and budgeting features are integral for businesses that want to plan ahead and avoid cash flow issues. Cash flow forecasting involves predicting future inflows and outflows based on historical data, helping you anticipate periods of high or low cash availability. With accurate forecasting, you can avoid running out of cash or experiencing liquidity issues during slower months.

Budgeting capabilities allow you to set financial goals and track progress against them. By setting budgets for different categories of expenses (such as marketing, payroll, and utilities), you can ensure that you’re staying on track and not overspending. The best cash flow management software can offer both short-term and long-term forecasting to help you make smarter, more strategic decisions about your finances.

For example, if you’re launching a new marketing campaign, you can forecast how much revenue it will generate and how it will impact your cash flow. Similarly, if you’re expecting a slow season, the tool can help you plan for it by adjusting your spending in advance.

User-Friendly Interfaces

A tool may offer fantastic features, but if the interface isn’t user-friendly, you’ll struggle to make the most of it. Look for software that is intuitive and easy to navigate, especially if you’re not well-versed in accounting or finance. A clean, organized dashboard that clearly displays your financial status is key to helping you understand your cash flow at a glance.

User-friendly interfaces also improve team collaboration. If your entire team is able to understand and interact with the software without much training, it can lead to smoother workflows. Features like drag-and-drop reports, customizable dashboards, and easy-to-read visualizations (like graphs and charts) can all make a big difference in how quickly you can get the information you need.

Multi-Currency and Multi-Account Support

If your business operates globally or has multiple revenue streams, choosing a cash flow management tool that supports multi-currency and multi-account capabilities is crucial. Multi-currency support is particularly important for businesses that deal with clients or suppliers overseas. It ensures that all transactions, regardless of currency, are accurately recorded and accounted for, helping you get a true picture of your financial situation.

Multi-account support is similarly important if you manage different business accounts. Whether it’s a separate account for operations, payroll, or marketing expenses, the software should allow you to track and consolidate these accounts into a unified cash flow report. This way, you can easily compare cash flow across various departments and make more accurate financial projections.

Reporting and Analytics Features

Reporting is a core component of cash flow management software. The best tools offer a variety of reports that give you insights into your financial health. These can include profit and loss statements, cash flow statements, balance sheets, and more. Additionally, robust analytics capabilities allow you to dig deeper into the numbers to identify trends and patterns.

With reporting features, you can generate detailed reports that show your business’s financial performance over different periods. Analytics tools allow you to visualize key metrics, such as how quickly you’re receiving payments or which areas of your business have the highest expenses. For example, if you see that your marketing costs are eating into your profits, you can adjust your strategy to allocate resources more efficiently.

Moreover, some tools allow you to create customized reports based on specific business needs. Whether you’re preparing for a meeting with investors or reviewing your finances for tax season, having the flexibility to generate personalized reports can save you time and make your financial data more accessible.

Types of Cash Flow Management Software

When choosing the right cash flow management software for your business, it’s important to understand the different types available. The ideal solution for your business will depend on factors like size, industry, and the complexity of your financial needs. The main types of software fall into three categories: cloud-based vs. on-premise solutions, industry-specific tools, and solutions tailored for either enterprise-level or small businesses. Each of these options comes with its own advantages and considerations.

Cloud-Based vs. On-Premise Solutions

The debate between cloud-based and on-premise solutions often comes down to convenience, cost, and control. Let’s break down what each option offers.

Cloud-Based Solutions are hosted online, meaning you can access your software from any device with an internet connection. These tools are typically subscription-based, with vendors offering different pricing tiers based on features and the size of your business. Cloud-based tools are ideal for companies that need mobility and flexibility, as you can check your cash flow data on the go—whether you’re at the office, traveling, or working remotely.

One of the biggest advantages of cloud-based solutions is their scalability. As your business grows, it’s easy to upgrade your plan or add additional users without worrying about infrastructure changes. Cloud-based software is also automatically updated, meaning you always have the latest features and security patches without having to manually manage upgrades.

However, cloud-based solutions rely on a stable internet connection. If your connection is unreliable or you experience frequent outages, this could disrupt your access to critical financial data. Additionally, cloud tools often involve ongoing monthly or annual subscription fees, which can add up over time.

On the other hand, On-Premise Solutions are installed and maintained on your own servers or local hardware. This option gives you full control over your data, offering a sense of security and privacy that some businesses prefer. If you operate in a regulated industry, such as finance or healthcare, on-premise solutions might be necessary to meet compliance standards for data security and privacy.

On-premise tools do not require a constant internet connection, so they can be used offline, which may be an advantage in certain situations. However, these tools tend to come with higher upfront costs due to the need for hardware and installation. Maintenance, updates, and security are also your responsibility, which can add to the total cost of ownership. In addition, scaling your system might require investing in new hardware or IT resources, making it less flexible than cloud-based solutions.

Industry-Specific Tools

Not all businesses have the same financial management needs. For this reason, there are cash flow management tools designed specifically for certain industries. These tools are often tailored to address the unique financial workflows, compliance needs, and reporting standards specific to an industry, making them more effective for certain use cases.

For instance, E-commerce Businesses often need tools that integrate with online payment gateways, track inventory purchases, and manage shipping costs. A solution like Shopify’s Cash Flow Management Tool would be ideal for such businesses as it helps track revenue from various sales channels while accounting for returns, refunds, and shipping expenses.

Freelancers and Solopreneurs also have unique needs when it comes to cash flow management. They need software that allows them to easily track income from multiple clients, manage irregular payments, and create invoices on the go. For this, a tool like FreshBooks would work well, as it’s designed with freelancers in mind, offering simple expense tracking, time tracking, and invoicing tools.

Similarly, businesses in Construction or Real Estate may need cash flow management tools that help track project-specific expenses, such as subcontractor payments, material purchases, and ongoing operational costs. These industries often require tools that can handle project-based budgeting and offer detailed reporting for every job or property. Buildertrend and CoConstruct are examples of specialized tools that serve these markets.

While industry-specific tools can offer great advantages, they may lack the versatility needed to scale across different business functions. Therefore, it’s essential to evaluate whether a specialized tool will meet all your needs or if you would benefit from a more general, all-in-one solution.

Enterprise-Level vs. Small Business Solutions

The size of your business plays a significant role in determining the type of cash flow management software you should choose. Larger enterprises have complex financial needs and require tools that can handle high volumes of transactions, support multiple departments, and integrate with various enterprise resource planning (ERP) systems. Small businesses, on the other hand, typically need something that is easy to use, affordable, and can scale as they grow.

For Enterprise-Level Businesses, cash flow management solutions need to offer robust features such as multi-currency support, advanced forecasting, complex reporting, and team collaboration capabilities. These solutions should also integrate seamlessly with other enterprise systems, such as human resources, procurement, and sales management tools. Enterprise-level solutions often come with a significant price tag and require dedicated teams for implementation and ongoing management. A tool like NetSuite is an example of an enterprise-level solution that offers extensive customization, multi-entity support, and advanced financial analytics.

Small Businesses, in contrast, typically need a simpler, more affordable solution that offers essential features without the complexity of an enterprise-level system. Small business owners need tools that allow them to track income and expenses, forecast cash flow, and generate basic financial reports—all within an intuitive, easy-to-use interface. Software like Wave or Zoho Books is ideal for smaller businesses, offering core cash flow management capabilities at an affordable price, with scalability as the business grows.

The primary difference between enterprise-level and small business solutions is the complexity and scale of operations. While enterprise tools are built to handle the needs of large organizations with diverse financial systems and large teams, small business tools prioritize simplicity, ease of use, and affordability, with a focus on enabling the owner or a small team to manage finances with minimal effort.

In summary, when selecting a cash flow management solution, consider the size and needs of your business. For larger enterprises, choose a tool that supports scalability, complex workflows, and integration with other business systems. For small businesses, prioritize ease of use, affordability, and the ability to grow with your business over time. Whether you’re in e-commerce, construction, or any other industry, it’s important to choose a tool that aligns with your business’s unique needs and future goals.

Top Cash Flow Management Software and Tools

There are many cash flow management tools available on the market today, each offering a range of features and capabilities designed to help businesses track their finances, predict future cash flow, and make better financial decisions. The right tool for your business depends on factors such as company size, industry, and specific needs, such as integration with accounting software or the ability to scale as your business grows. Below are some of the top cash flow management tools that businesses of all sizes can use to streamline their financial processes.

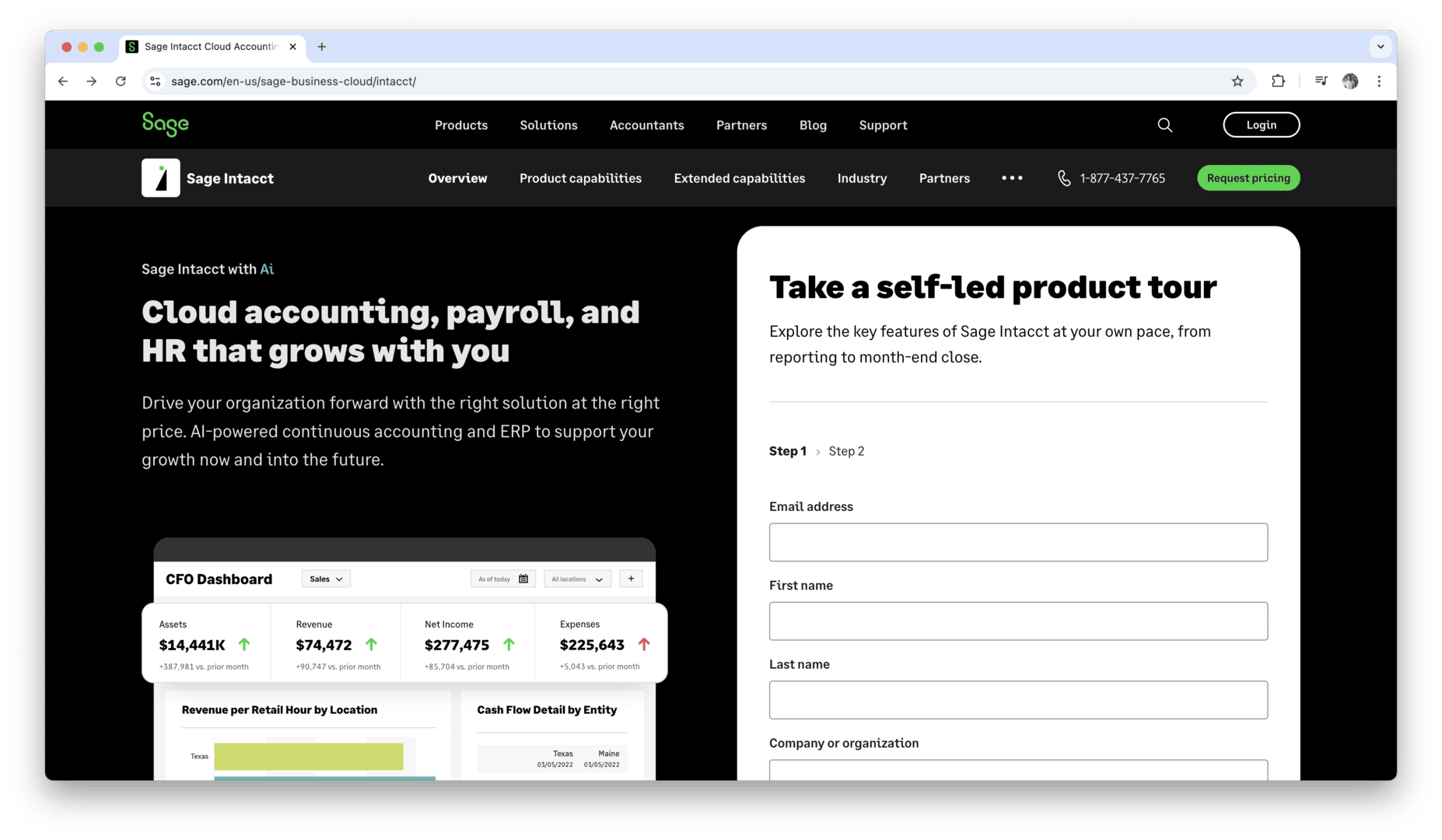

Sage Intacct

Sage Intacct is a cloud-based financial management tool that provides advanced capabilities for managing cash flow, billing, and financial reporting. As an enterprise-level solution, it’s designed to support larger organizations with complex financial needs.

Sage Intacct excels in cash flow management through its real-time data updates and forecasting tools. Businesses can track accounts payable and receivable, automate workflows, and generate cash flow reports that help make timely decisions. The software integrates with other business systems, such as payroll, inventory management, and CRM, allowing for a comprehensive financial overview. Sage Intacct’s advanced financial analytics also helps businesses understand where they can improve their cash flow processes and optimize working capital.

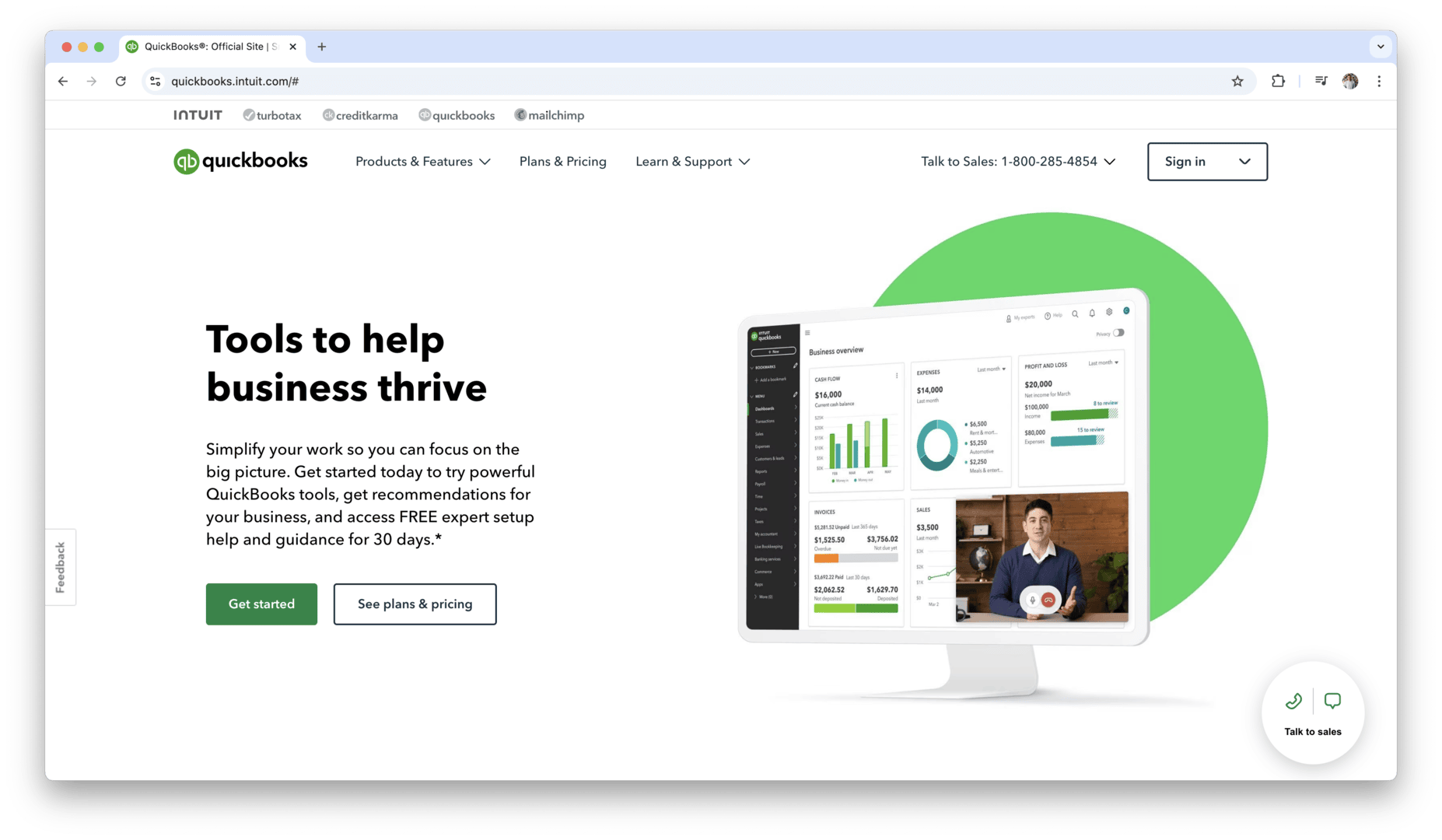

QuickBooks Online

QuickBooks Online is one of the most well-known accounting and cash flow management platforms on the market. It offers a robust set of tools for small to mid-sized businesses, including real-time tracking of income and expenses, automatic invoicing, and expense categorization. QuickBooks Online also integrates seamlessly with a wide variety of other software tools, such as PayPal, Square, and Shopify, making it a versatile option for many types of businesses.

With features like cash flow forecasting and budgeting, QuickBooks provides clear insights into future income and expenses, allowing business owners to plan ahead. The tool also offers extensive reporting options, which can be customized to suit your needs, making it easy to generate cash flow statements, profit and loss reports, and balance sheets.

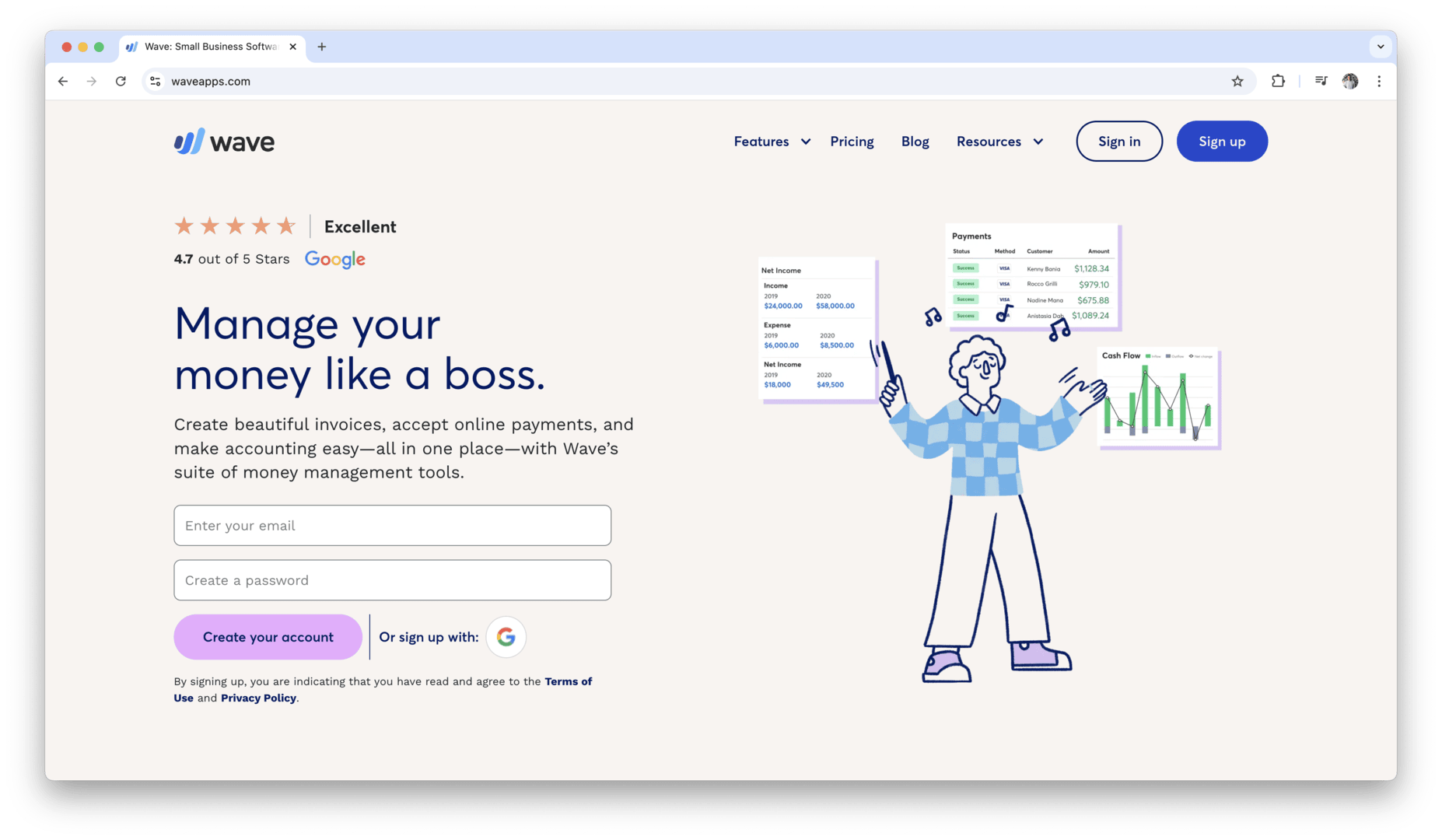

Wave

Wave is a free accounting software tool that provides cash flow management features for small businesses, freelancers, and entrepreneurs. It offers basic financial tracking capabilities, such as income and expense tracking, invoicing, and receipt scanning. Wave’s simplicity and ease of use make it an attractive option for businesses with basic financial management needs.

While Wave doesn’t provide as many advanced features as some other tools, its no-cost pricing model makes it a valuable choice for businesses just starting out or those with tight budgets. For businesses that need only the essentials for cash flow management, Wave provides an accessible and cost-effective solution.

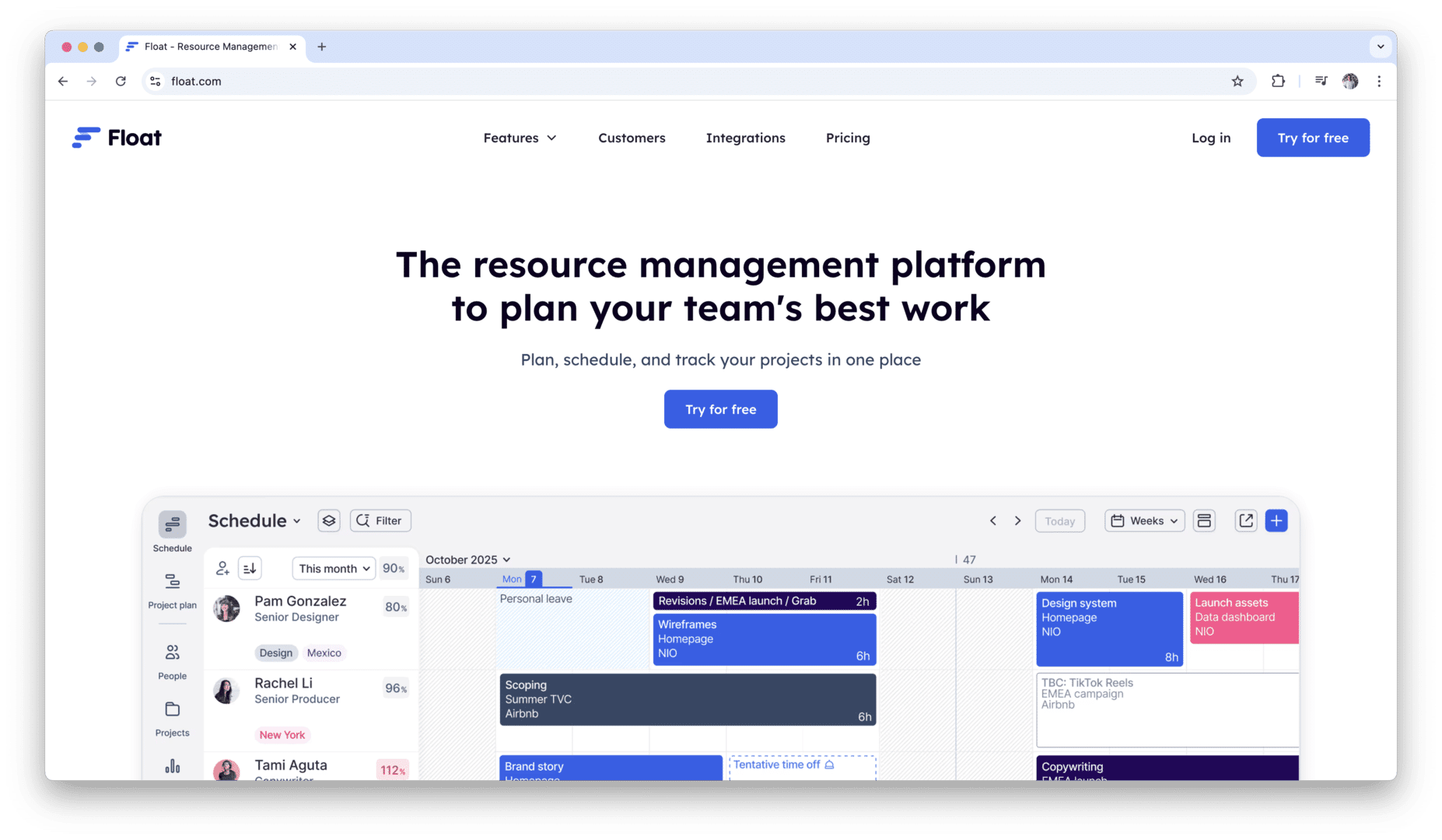

Float

Float is a dedicated cash flow forecasting tool that integrates with accounting software like Xero, QuickBooks, and FreeAgent. It’s designed for businesses that need to gain a clearer understanding of their cash flow dynamics over time. Float’s key strength lies in its ability to provide detailed cash flow projections, offering real-time updates based on your financial data.

With Float, you can see exactly when cash is expected to come in and when it will go out, allowing you to make informed decisions. The software also provides scenario planning, allowing you to create different cash flow models based on potential changes in revenue or expenses, making it especially useful for businesses navigating unpredictable financial environments.

Float’s visual interface makes it easy to track your cash flow at a glance, and it offers the ability to drill down into the details of your cash flow, providing business owners with a deeper understanding of how money is moving through their operations.

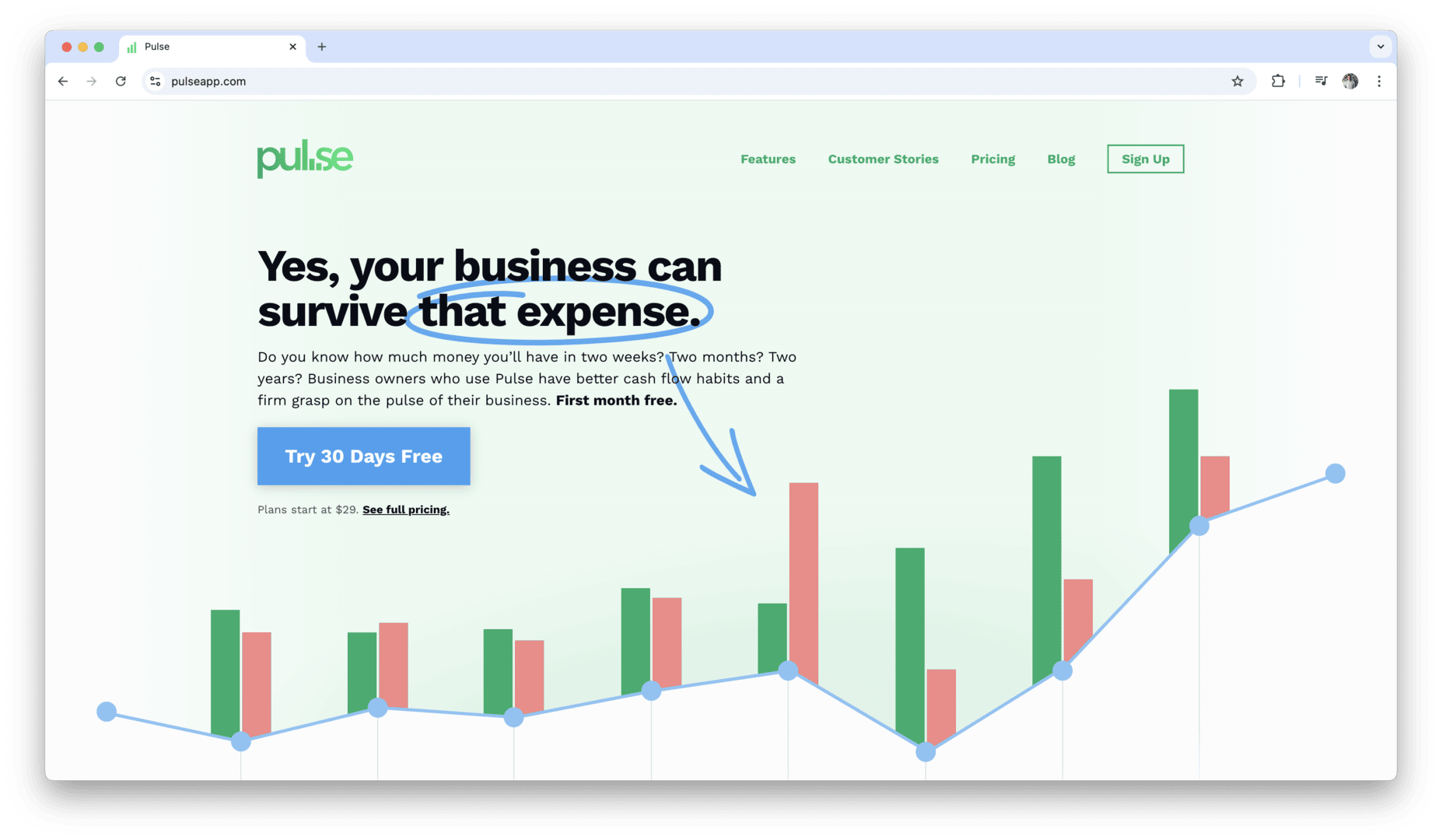

Pulse

Pulse is a cash flow management tool that’s especially designed for small to medium-sized businesses. It provides a user-friendly interface with easy-to-understand reports, helping business owners track income and expenses while gaining insights into their financial health. One of Pulse’s standout features is its ability to give business owners a real-time overview of their cash flow, with visualizations that make it simple to track the movement of money in and out of the business.

Pulse offers a streamlined budgeting feature that can be customized to suit your needs, and it allows you to easily create and track financial goals. The software also offers detailed reporting, enabling business owners to break down their cash flow and see where their money is going, whether that’s for operating expenses, capital investment, or other needs.

Pulse’s simplicity and low learning curve make it an excellent choice for businesses that don’t require the complexity of larger enterprise-level solutions but still need robust cash flow management.

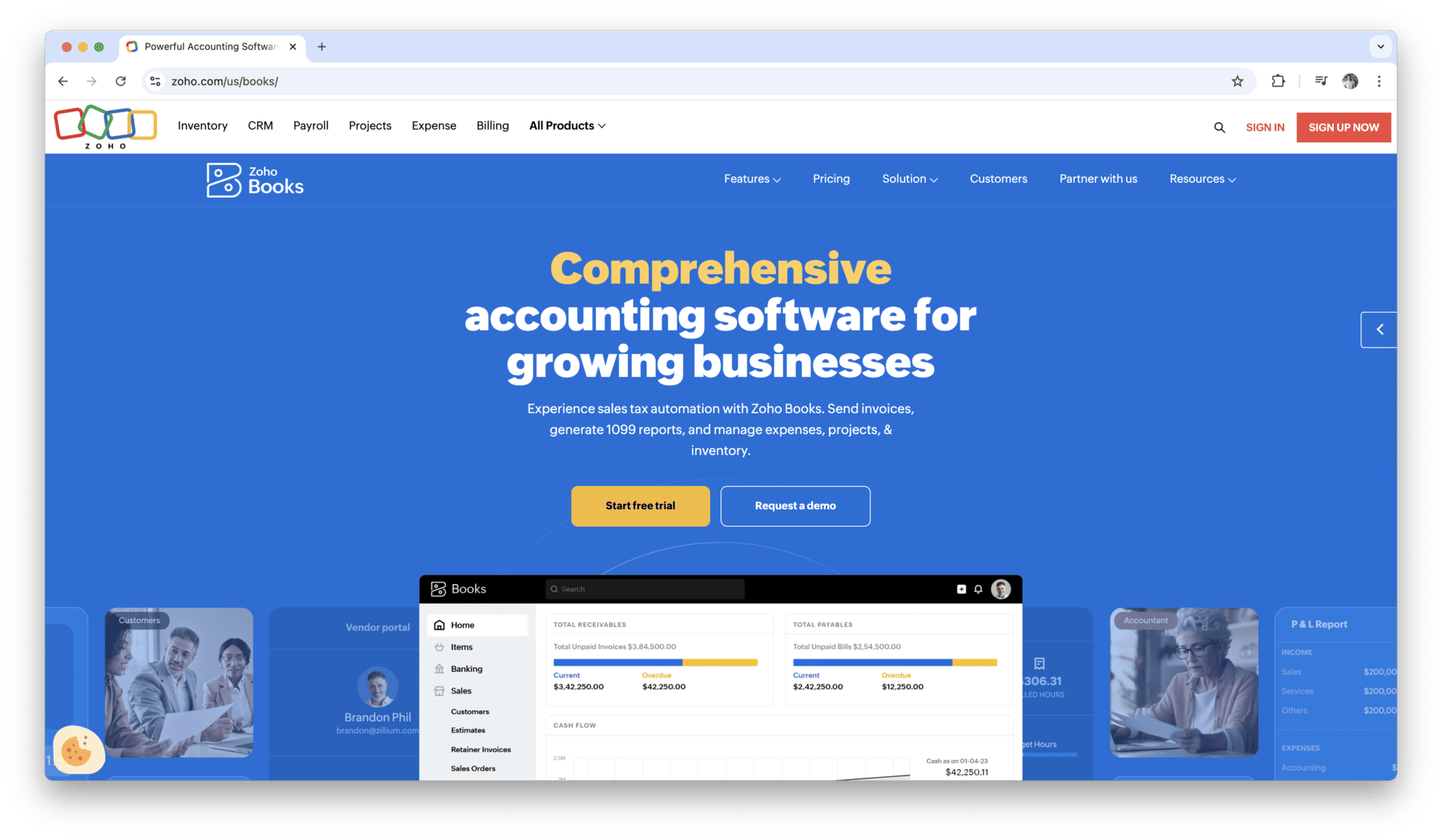

Zoho Books

Zoho Books is part of the Zoho suite of business tools and offers comprehensive accounting and cash flow management features. This tool is designed for small businesses and freelancers, allowing them to handle invoicing, expense tracking, and cash flow management all in one place. Zoho Books also includes project-based financial tracking, which is helpful for businesses that need to manage cash flow across multiple projects or departments.

One of Zoho Books’ strongest features is its ability to automate many financial processes, such as recurring invoices and payment reminders. This reduces the manual effort needed to keep cash flow operations running smoothly and ensures that no payments are missed. Zoho Books also integrates well with other tools in the Zoho suite, as well as external platforms like PayPal and Stripe, enabling seamless payments and expense tracking.

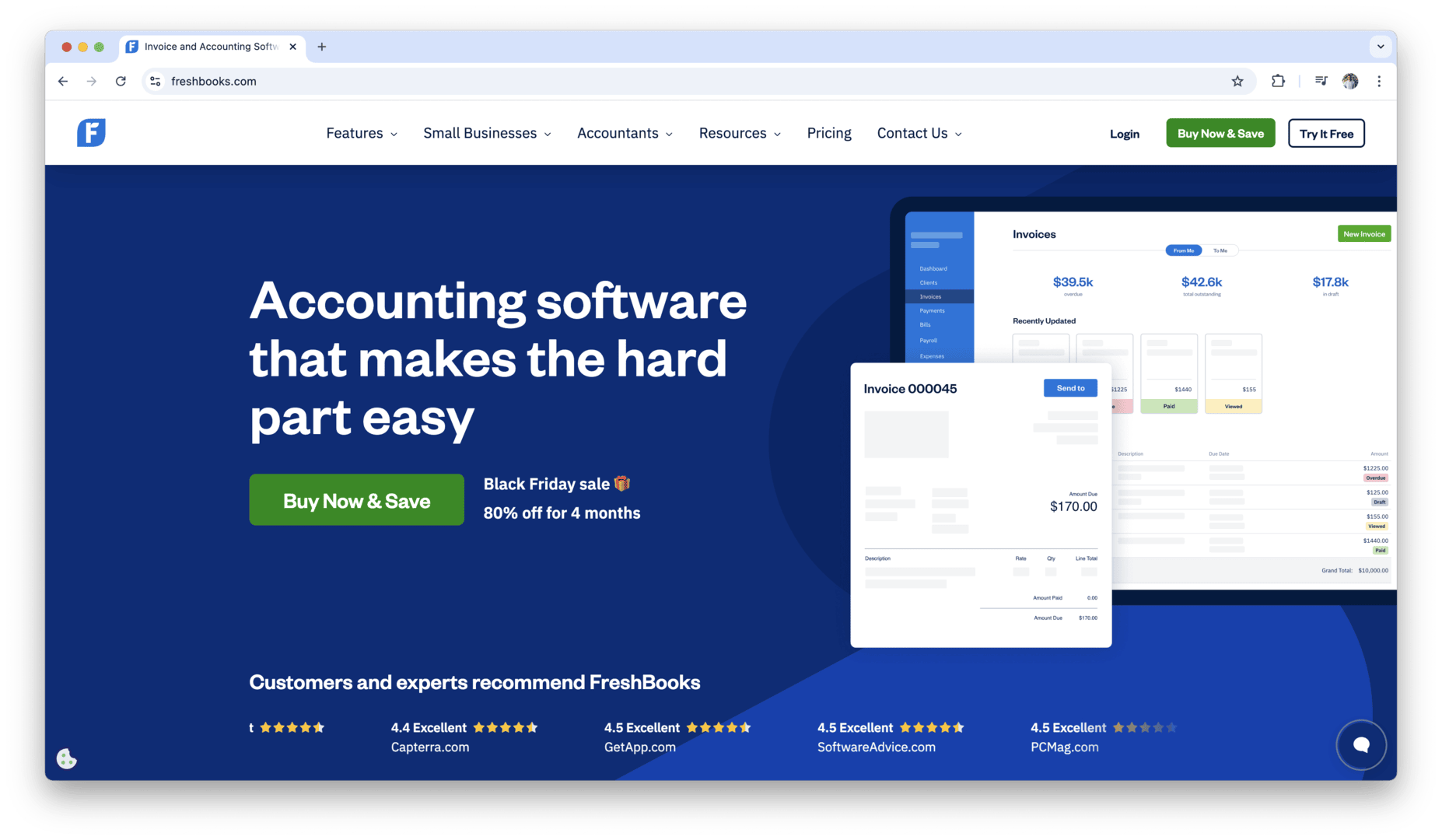

FreshBooks

FreshBooks is another popular tool that is particularly well-suited for small businesses, freelancers, and service-based industries. While it started as a tool for invoicing, it has since evolved into a comprehensive accounting platform that also offers cash flow management features. FreshBooks allows you to track both cash inflows and outflows, manage expenses, and generate detailed reports to understand your cash flow better.

The software offers automatic expense categorization, invoice tracking, and payment reminders, all of which help streamline the cash flow management process. FreshBooks’ forecasting tools help you predict cash flow based on past performance, and its simple, user-friendly interface makes it accessible even for business owners who aren’t financial experts.

NetSuite

NetSuite is an enterprise-level solution designed for large businesses with complex financial needs. It offers robust cash flow management features, including multi-currency support, detailed reporting, and advanced forecasting tools. NetSuite integrates seamlessly with other business systems, such as CRM and ERP, providing a comprehensive view of your financials across the organization.

NetSuite’s cash flow management tools are ideal for businesses that need to track cash across multiple departments or geographies, as it allows for deep integration and collaboration. The platform also offers real-time reporting, which helps large businesses maintain financial oversight and adjust their strategies accordingly. Although it’s more complex and expensive than some other tools, it’s a powerful option for enterprises with advanced financial management requirements.

Expensify

Expensify is primarily known for its expense management features but also provides excellent tools for cash flow management. It allows businesses to track spending, manage receipts, and generate detailed reports on financial activities. Expensify simplifies the process of recording expenses by using its SmartScan technology to automatically capture receipt data, eliminating the need for manual entry.

Expensify integrates with accounting software like QuickBooks and Xero, making it easy to track expenses in real-time and keep your books in order. Additionally, the tool allows for approval workflows, making it easier for businesses to manage who approves certain expenditures. For businesses looking to control and optimize their spending while maintaining cash flow, Expensify offers a simple and effective solution.

Bill.com

Bill.com is a tool that helps businesses manage accounts payable and receivable, making it easier to manage cash flow by streamlining payment processing. With BILL, businesses can send invoices, receive payments, and even automate approval workflows for bills. This automation helps companies manage their cash flow more efficiently, reducing delays and manual processes.

One of BILL’s most notable features is its integration with popular accounting platforms like QuickBooks and NetSuite, making it a seamless tool for financial management. Bill.com’s dashboard provides a clear view of upcoming payments, due dates, and cash flow, allowing businesses to plan ahead and avoid late fees or missed payments. It also offers international payment capabilities, making it ideal for businesses with global operations.

Fathom

Fathom is a financial intelligence platform designed to provide businesses with in-depth reporting and analysis for cash flow and overall financial health. Fathom’s key strength is its ability to integrate with accounting software like Xero, QuickBooks, and MYOB to deliver powerful reporting insights.

With Fathom, businesses can create customized financial reports, track cash flow performance, and forecast future financial trends. Fathom’s scenario modeling allows you to create what-if analyses based on different assumptions, helping businesses plan for future cash flow fluctuations. It’s particularly useful for businesses that want to track key performance indicators (KPIs) and gain a deeper understanding of their financial data, enabling better decision-making.

KashFlow

KashFlow is an intuitive accounting software tool for small to medium-sized businesses that helps with cash flow management, invoicing, and expense tracking. One of KashFlow’s strongest features is its ease of use, which makes it an ideal option for business owners without a financial background.

KashFlow allows businesses to generate cash flow reports, manage expenses, and track income. The software’s real-time dashboard provides visibility into cash flow, making it easy to understand the financial position of the business at any given time. Additionally, KashFlow integrates with bank accounts, allowing for automatic reconciliation and reducing the need for manual entry. The tool is especially suited for freelancers, startups, and small businesses that need a simple and effective solution for managing cash flow.

Pandle

Pandle is a UK-based accounting software designed for small businesses and freelancers. While its primary function is to manage accounting tasks like invoicing and expenses, Pandle also includes cash flow management features.

Pandle’s user-friendly interface makes it easy to track both income and expenses, with a clear overview of your financial position. The tool offers simple reporting features that give users insights into their cash flow and overall financial health. Pandle integrates with both UK bank accounts and PayPal, which simplifies the process of reconciling transactions and tracking payments. With its low-cost pricing and straightforward functionality, Pandle is a good choice for small businesses and freelancers looking for a simple tool to help manage cash flow.

Microsoft Dynamics 365 Finance

Microsoft Dynamics 365 Finance is an enterprise-level software solution that provides comprehensive financial management features, including cash flow forecasting, budgeting, and reporting. It’s part of the Microsoft Dynamics 365 suite, which integrates well with other business tools and allows for seamless data sharing across departments.

Dynamics 365 Finance helps businesses manage cash flow by providing real-time financial visibility and forecasting capabilities. The software uses AI-powered analytics to predict future cash flow trends based on historical data, enabling businesses to make proactive decisions. The ability to track expenses, manage billing, and automate workflows also enhances cash flow management for large organizations that need a robust financial system to handle complex financial operations.

Zoho Expense

Zoho Expense is an expense management tool that offers features to help businesses track their spending and manage cash flow. It’s especially useful for companies that need to monitor travel expenses, reimbursements, and other variable costs.

Zoho Expense allows businesses to record expenses in real-time, and it automates the process of categorizing expenses for easy reporting. With its real-time tracking and reporting features, businesses can monitor their cash flow more effectively. Zoho Expense also integrates with other Zoho tools, such as Zoho Books, to provide a comprehensive view of your financial position. For businesses that deal with a high volume of employee expenses, Zoho Expense simplifies the process of managing and controlling cash flow.

FreeAgent

FreeAgent is an all-in-one accounting tool designed for freelancers, contractors, and small businesses. It offers robust features for managing cash flow, including invoicing, expense tracking, and financial reporting.

FreeAgent allows businesses to automatically import transactions from their bank accounts and categorize them to keep track of income and expenses. Its cash flow management features provide users with a clear view of their financial status, with real-time updates and forecasting tools. FreeAgent’s straightforward interface makes it a good choice for small businesses and freelancers who need a simple, reliable tool to manage their cash flow and track the financial health of their business.

These are just a few examples of the many cash flow management tools available today. Each one offers unique features tailored to different business needs, from small startups to large enterprises. The right choice depends on your business size, industry, budget, and specific financial management requirements. Whether you need basic tracking tools or an all-in-one enterprise solution, there’s a cash flow management tool that can help you stay on top of your finances.

Benefits of Implementing Cash Flow Management Software

Using cash flow management software can provide a host of advantages for businesses of all sizes. By streamlining financial processes, improving decision-making, and offering deeper insights into your financial health, these tools can make a significant impact on your bottom line. Here’s a look at the key benefits you can expect when implementing cash flow management software:

- Improved cash flow visibility: With real-time tracking, you can instantly see your cash position and make informed decisions about spending, investing, and saving. This helps avoid cash shortages and ensures timely payments.

- Accurate forecasting and budgeting: By analyzing past data, forecasting tools help predict future cash inflows and outflows, giving you the ability to plan for seasonal fluctuations, large expenses, and growth.

- Increased operational efficiency: Automating time-consuming tasks like invoicing, payment reminders, and reporting frees up valuable time, allowing you to focus on growing your business.

- Better financial decision-making: With detailed financial reports and analytics, you can identify areas for improvement, assess the financial impact of business decisions, and ensure that you’re making the best choices for long-term success.

- Enhanced cash flow planning: You can proactively manage cash flow, ensuring you have the resources to cover upcoming costs, avoid shortfalls, and maintain smooth operations.

- Reduction of financial risks: Cash flow software minimizes human errors, reducing the risk of financial mismanagement and ensuring that you’re always working with accurate data.

- Seamless integration with other systems: Many cash flow tools integrate with accounting software and other business management systems, making it easier to keep everything in sync and ensuring consistency across your financial records.

- Improved team collaboration: With cloud-based tools, team members can access up-to-date financial data from anywhere, ensuring everyone is aligned and working with the latest information.

Challenges in Choosing Cash Flow Management Tools

While cash flow management software can offer a wide range of benefits, selecting the right tool for your business is not always straightforward. There are several challenges you may encounter as you evaluate different options. Understanding these challenges can help you make a more informed decision:

- Choosing the right features: Not all tools are created equal, and different businesses have different needs. You may struggle to find a solution that has all the features you need while avoiding unnecessary functionalities that might complicate things.

- Integration with existing systems: If your business already uses accounting software, project management tools, or enterprise resource planning (ERP) systems, finding a cash flow management solution that integrates smoothly with these platforms can be a challenge.

- Cost considerations: Some tools can come with a hefty price tag, especially those with advanced features. It’s essential to evaluate your budget and ensure that the software you choose provides value for the price.

- User adoption and training: Introducing new software into your business can face resistance from employees, especially if the tool is complex or requires significant training. Ensuring smooth adoption and minimizing the learning curve can be a challenge.

- Scalability: As your business grows, so will your cash flow management needs. It’s important to select a tool that can scale with your business and continue to meet your financial management requirements over time.

- Data security and privacy concerns: With financial data being sensitive and valuable, ensuring that the software you choose is secure and compliant with data protection regulations (such as GDPR) is essential.

- Customization and flexibility: Some businesses require specialized features, and finding a cash flow management tool that can be customized to your specific needs can be challenging, particularly for niche industries.

- Ongoing maintenance and support: Depending on the solution you choose, you may need ongoing technical support or maintenance. It’s crucial to assess whether the vendor provides adequate customer service and updates to ensure smooth long-term use.

How to Maximize the Use of Cash Flow Management Software?

To truly reap the rewards of cash flow management software, you need to ensure you’re using it to its full potential. There are several best practices you can follow to get the most out of your investment and keep your financial management on track:

- Set up automated workflows: Automate repetitive tasks like invoicing, payment reminders, and recurring billing to save time and reduce manual errors.

- Regularly update your data: Ensure that your software is updated with the latest income, expenses, and transactions. Regular updates provide more accurate insights and forecasts.

- Customize reports to your needs: Tailor financial reports to highlight the most important metrics for your business. This will help you stay focused on key performance indicators (KPIs) and make decisions based on relevant data.

- Integrate with other business tools: Leverage integration features to connect your cash flow software with other systems like accounting, CRM, or project management tools. This creates a unified workflow and ensures consistency across your business operations.

- Use forecasting tools for strategic planning: Regularly use forecasting features to project future cash inflows and outflows, helping you anticipate challenges, plan for growth, and ensure liquidity.

- Monitor and adjust budgets regularly: Continuously track your budget against actual performance. If you’re spending more in certain areas or seeing less revenue than expected, adjust your budget to stay on track.

- Involve key team members: Encourage team collaboration by allowing key employees to access and use the cash flow software, ensuring that everyone has up-to-date financial information and is aligned with financial goals.

- Track and review financial health periodically: Regularly review your cash flow reports and analyze trends to identify potential issues before they become bigger problems. Keeping a finger on the pulse of your financial health will allow you to make timely adjustments and avoid surprises.

- Train your team on best practices: Make sure everyone who interacts with the software is familiar with how it works and understands how to use it effectively. Proper training will reduce errors and improve the overall efficiency of the tool.

Conclusion

Choosing the right cash flow management software is essential for keeping your business on track financially. Whether you’re looking for an easy-to-use tool for a small operation or a more robust system for managing complex financial processes, there’s a solution out there to meet your needs. By understanding the key features, benefits, and challenges of each tool, you can make a more informed decision about which one aligns with your business goals. Remember that the best tool is the one that simplifies your financial management, gives you accurate real-time data, and helps you plan ahead with confidence.

Ultimately, cash flow management software helps you stay organized, make smarter financial decisions, and avoid cash shortages that could disrupt your business. With the right tool in place, you’ll be better equipped to handle your finances efficiently, forecast future cash flow, and reduce the risk of errors or missed payments. Whether you need basic tracking or advanced forecasting, investing in the right software will help you maintain a healthy financial position and set your business up for long-term success.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.