Are you ready to navigate the intricate terrain of strategic finance and unlock the secrets to achieving financial success? This guide delves deep into the world of strategic finance, equipping you with the knowledge and tools needed to make informed financial decisions that drive sustainable growth and prosperity for your organization.

From understanding the core principles to mastering risk management and embracing ethical financial practices, this guide is your compass to navigate the ever-evolving landscape of strategic finance with confidence and expertise.

What is Strategic Finance?

Strategic finance is a multifaceted approach to financial management that extends beyond traditional accounting and budgeting. It encompasses a strategic perspective that aligns financial decision-making with an organization’s long-term goals and objectives. In essence, it’s about using financial data and analysis to drive strategic planning and achieve sustainable growth.

The Importance of Strategic Finance

Strategic finance plays a pivotal role in an organization’s success by providing a framework for informed financial decision-making. Here’s why it is crucial:

- Aligns Financial Goals with Strategy: It ensures that financial goals are in harmony with the broader strategic goals of the organization. This alignment helps in efficient resource allocation and prioritization.

- Risk Management: Strategic finance incorporates risk assessment and mitigation into financial planning. This helps in identifying and managing potential financial pitfalls effectively.

- Long-Term Sustainability: By focusing on long-term financial sustainability, organizations can weather economic downturns, capitalize on growth opportunities, and navigate changes in the business landscape.

- Enhances Resource Efficiency: It promotes efficient use of financial resources, optimizing costs, and maximizing returns on investments, which ultimately contributes to profitability.

- Informs Decision-Making: Strategic finance provides decision-makers with data-driven insights, enabling them to make informed choices that support the organization’s strategic direction.

In summary, strategic finance is not just about managing numbers; it’s about using financial data to shape the future of the organization and ensure its long-term viability.

Key Goals and Objectives of Strategic Finance

Strategic finance encompasses a set of key goals and objectives that guide financial decision-making:

- Maximizing Profitability: One of the primary objectives is to maximize profitability while considering risk factors and long-term sustainability.

- Optimizing Resource Allocation: Efficiently allocate financial resources to various projects and initiatives based on their strategic importance and potential returns.

- Risk Management: Identify, assess, and mitigate financial risks to protect the organization from adverse events that could impact its financial health.

- Ensuring Liquidity: Maintain adequate liquidity to meet short-term financial obligations and avoid financial distress.

- Enhancing Shareholder Value: Focus on strategies that increase shareholder value through sound financial performance and responsible financial management.

- Strategic Planning: Integrate financial planning into the overall strategic planning process to align financial goals with the organization’s mission and vision.

- Compliance and Ethical Standards: Ensure compliance with financial regulations and adhere to ethical standards in financial practices.

- Long-Term Sustainability: Aim for long-term financial sustainability by making decisions that support the organization’s growth and resilience.

These goals and objectives collectively form the foundation of strategic finance, guiding organizations toward sound financial management and strategic success.

Strategic Financial Planning

Strategic financial planning is the cornerstone of effective financial management, guiding your organization toward its long-term goals. Let’s delve deeper into the components of strategic financial planning.

Setting Financial Objectives

Setting clear and well-defined financial objectives is paramount to charting a successful financial course. These objectives serve as your guiding stars, helping you navigate through the intricate financial landscape. Your financial objectives should be SMART—Specific, Measurable, Achievable, Relevant, and Time-bound. Here’s how you can approach each element:

- Specific: Ensure that your objectives are precise and unambiguous. They should leave no room for interpretation.

- Measurable: Your objectives should be quantifiable, allowing you to track progress and assess success.

- Achievable: Set realistic goals that are within reach given your organization’s resources and capabilities.

- Relevant: Align your financial objectives with your organization’s overall mission and strategic plan.

- Time-bound: Establish clear timeframes for achieving each objective.

Remember that financial objectives can vary widely, from boosting revenue by a specific percentage to reducing operating costs within a defined timeframe.

Environmental Analysis

Before embarking on strategic financial planning, it’s essential to conduct a comprehensive environmental analysis. This step involves evaluating both internal and external factors that can impact your organization’s finances.

Internal Factors

Internal factors encompass your organization’s strengths and weaknesses. To assess these effectively, consider the following:

- Financial Health: Examine your organization’s financial statements to gauge its fiscal well-being.

- Resources: Identify the resources available to you, such as capital, assets, and human resources.

- Capabilities: Evaluate your organization’s competencies and areas of expertise.

External Factors

External factors encompass the broader economic and market conditions in which your organization operates. Pay attention to:

- Economic Trends: Analyze prevailing economic conditions, including inflation rates, interest rates, and GDP growth.

- Market Conditions: Understand market dynamics, such as supply and demand, industry trends, and competitive forces.

- Regulatory Environment: Stay abreast of regulatory changes that could impact your financial strategy.

A thorough environmental analysis provides the foundation for informed decision-making in strategic financial planning.

Risk Assessment

Risk is an inherent element of financial management. To make well-informed decisions, it’s crucial to identify, assess, and manage potential financial risks. Let’s explore key aspects of risk assessment:

- Market Risk: Market volatility can significantly affect your investments and financial performance. Tools like sensitivity analysis can help you assess the impact of market fluctuations.

- Credit Risk: Assess the creditworthiness of customers, suppliers, and partners to mitigate the risk of default.

- Operational Risk: Identify potential weaknesses in your internal processes that could lead to financial losses.

- Compliance Risk: Stay vigilant about regulatory compliance to avoid fines and legal issues.

By thoroughly assessing risks, you can develop strategies to mitigate their impact on your organization’s financial health.

Financial Forecasting

Financial forecasting is the process of predicting your organization’s future financial performance. Accurate forecasting is essential for planning and budgeting. Here are some key elements to consider:

- Sales Forecasting: Estimate future sales based on historical data, market trends, and marketing initiatives. Use tools like regression analysis for more precise predictions.

- Expense Forecasting: Project your operating expenses and capital expenditures. Consider factors like inflation and cost fluctuations.

- Cash Flow Forecasting: Forecast cash inflows and outflows to ensure liquidity. It helps you avoid cash shortages and maintain financial stability.

- Profit and Loss Forecasting: Anticipate future income and expenses to assess profitability. Employ financial modeling techniques to create comprehensive forecasts.

Incorporating these forecasting methods and tools, such as Excel spreadsheets and financial modeling software, into your strategic financial planning enables you to make data-driven decisions. Remember that accuracy is key, as your forecasts will shape your financial strategy and resource allocation.

Capital Budgeting and Investment Analysis

Effective capital budgeting and investment analysis are crucial for making informed decisions about allocating your organization’s financial resources.

Evaluating Investment Opportunities

Evaluating investment opportunities is the first step in capital budgeting. It involves scrutinizing potential projects or investments to determine their viability and potential returns. Here’s how you can approach this critical aspect of financial decision-making:

- Return on Investment (ROI): Calculate the ROI for each investment by comparing the expected gains against the initial investment cost. The formula for ROI is:ROI (%) = [(Net Profit / Investment Cost) x 100]By using this formula, you can quantify the potential return from each investment opportunity.

- Payback Period: Determine the time it will take to recover the initial investment through cash inflows. Projects with shorter payback periods are often considered more attractive.

- Risk Assessment: Evaluate the level of risk associated with each investment. Consider factors such as market volatility, economic conditions, and project-specific risks.

- Strategic Alignment: Ensure that the investment aligns with your organization’s strategic goals and long-term vision. Investments should contribute to the overall growth and sustainability of the organization.

Evaluating investment opportunities requires a combination of financial analysis, risk assessment, and strategic thinking to make well-informed decisions.

Capital Allocation Strategies

Once you’ve identified promising investment opportunities, the next step is to determine how to allocate your organization’s capital effectively. The choice of capital allocation strategies depends on various factors, including risk tolerance, financial objectives, and available resources. Key strategies to consider include:

- Weighted Average Cost of Capital (WACC): Calculate your organization’s WACC to determine the minimum return required on investments. The WACC takes into account the cost of both debt and equity capital.

- Risk-Adjusted Return: Adjust expected returns based on the level of risk associated with each investment. Investments with higher risk profiles should offer potentially higher returns.

- Portfolio Diversification: Spread investments across different asset classes or projects to reduce overall risk. Diversification can help protect your organization from the negative impact of a single investment’s underperformance.

Careful consideration of capital allocation strategies is essential to optimize the use of financial resources and achieve your organization’s financial goals.

Risk Management in Capital Budgeting

Risk management plays a pivotal role in capital budgeting, as it helps safeguard your organization’s financial health and minimizes potential losses. Here are key aspects of risk management in the context of capital budgeting:

- Scenario Analysis: Conduct scenario analysis to explore different potential outcomes under various conditions. This allows you to assess how different economic, market, or project-specific scenarios could impact your investments.

- Sensitivity Analysis: Perform sensitivity analysis to identify the sensitivity of investment returns to changes in critical variables such as interest rates, inflation, or market demand. Sensitivity analysis helps you understand the potential impact of uncertainties.

- Hedging Techniques: Consider using hedging techniques, such as options or derivatives, to mitigate the risks associated with specific investments. These financial instruments can provide protection against adverse market movements.

By incorporating robust risk management practices into your capital budgeting process, you can make informed decisions that not only maximize potential returns but also protect your organization from financial setbacks.

Financial Decision-Making

Financial decision-making is a pivotal aspect of strategic finance that influences your organization’s capital structure and profitability. Let’s delve into the essential components of financial decision-making in greater detail.

Funding Strategies

Funding strategies encompass the choices you make when it comes to sourcing capital for your organization’s operations, investments, and growth initiatives. Selecting the right funding sources is crucial to ensure financial sustainability and achieve your objectives. Here are key considerations:

- Debt Financing: This involves borrowing funds through loans, bonds, or other credit instruments. Debt financing provides access to capital but involves interest payments and the obligation to repay principal.

- Equity Financing: Equity financing involves raising capital by selling shares or ownership stakes in your organization. While it doesn’t create debt obligations, it may result in dilution of ownership.

- Internal Financing: Utilize internal sources of funding, such as retained earnings and profits generated by the organization. Internal financing can offer independence from external lenders or investors.

- Grants and Subsidies: Explore opportunities for grants and subsidies, especially if your organization is a non-profit or involved in projects with social or environmental impact.

Selecting the most appropriate funding strategies depends on factors like risk tolerance, cost of capital, and the organization’s growth objectives. It’s essential to strike a balance between debt and equity to optimize your financial structure.

Cost of Capital

Understanding your organization’s cost of capital is fundamental to financial decision-making. The cost of capital represents the return expected by investors in exchange for providing capital to your organization. This rate serves as a benchmark for evaluating investment opportunities. Here’s how to calculate it:

Cost of Capital (%) = (Weighted Average Cost of Debt x Proportion of Debt) + (Cost of Equity x Proportion of Equity)

- Weighted Average Cost of Debt (WACC): This represents the cost of debt capital and is calculated based on interest rates and debt-related expenses. It considers the organization’s existing debt obligations.

- Cost of Equity: The cost of equity is the return expected by shareholders for investing in your organization’s equity. It considers factors like the risk-free rate, market risk premium, and beta coefficient.

Accurate determination of your organization’s cost of capital is vital for assessing the feasibility of projects and evaluating whether they can generate returns above this cost.

Debt vs. Equity Financing

Choosing between debt and equity financing is a significant financial decision that can impact your organization’s financial structure, risk profile, and ownership dynamics. Consider the following factors:

- Risk Tolerance: Assess your organization’s risk tolerance. Debt financing involves interest payments and financial obligations, while equity financing dilutes ownership but carries no repayment obligations.

- Interest Expense: Debt financing involves interest payments, which can impact cash flow and profitability. Equity financing does not have such interest expenses.

- Control and Ownership: Evaluate the impact of financing choices on ownership and decision-making. Debt financing typically preserves ownership but requires repayment, while equity financing may impact control.

- Tax Considerations: Explore the tax implications of debt and equity financing, as they can vary based on jurisdiction and financial structure.

The decision between debt and equity financing should align with your organization’s financial goals, risk appetite, and growth strategy. Striking the right balance can optimize your capital structure.

Dividend Policy

Dividend policy dictates how your organization distributes profits to shareholders. It’s a crucial element of financial decision-making, as it impacts both the organization and its investors. Here are key aspects to consider:

- Growth Objectives: Evaluate your organization’s growth objectives. Retained earnings can fuel growth, while paying dividends may attract income-seeking investors.

- Tax Implications: Assess the tax consequences of dividends for both the organization and shareholders. Different jurisdictions have varying tax treatments for dividends.

- Investor Expectations: Align your dividend policy with investor expectations and market conditions. Consistency and transparency in dividend payments are often valued by shareholders.

- Retained Earnings: Understand the implications of retaining earnings within the organization. Retained earnings can be reinvested for expansion or used to pay off debt.

Your dividend policy should strike a balance between rewarding shareholders, supporting growth, and maintaining financial stability. It’s essential to communicate this policy clearly to shareholders and stakeholders to manage expectations effectively.

Strategic Finance Metrics and KPIs

In the world of strategic finance, measuring and assessing financial performance is paramount. To make informed decisions, you need to rely on financial metrics and key performance indicators (KPIs).

Key Financial Ratios

Key financial ratios provide invaluable insights into your organization’s financial position and performance. These ratios help you gauge profitability, liquidity, efficiency, and solvency. Here are some essential financial ratios:

Monitoring these financial ratios provides a comprehensive picture of your organization’s financial health and helps identify areas that require attention.

Balanced Scorecard Approach

The Balanced Scorecard approach offers a holistic perspective on your organization’s performance by considering financial and non-financial metrics. It encourages a balanced view across four key perspectives:

- Financial Perspective: This perspective includes traditional financial measures like revenue growth, profitability, and return on investment. It answers questions related to financial sustainability and shareholder value.

- Customer Perspective: Focus on customer satisfaction, retention, and acquisition. By understanding customer needs and perceptions, you can drive growth and profitability.

- Internal Process Perspective: Examine internal processes, efficiency, and effectiveness. Identify areas where operational improvements can enhance overall performance.

- Learning and Growth Perspective: Assess employee skills, development, and innovation capabilities. A motivated and skilled workforce contributes to better performance in other areas.

The Balanced Scorecard approach helps align strategic objectives with performance metrics, ensuring that financial decisions are in harmony with the organization’s broader goals.

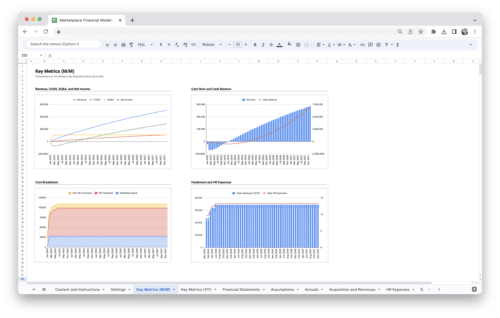

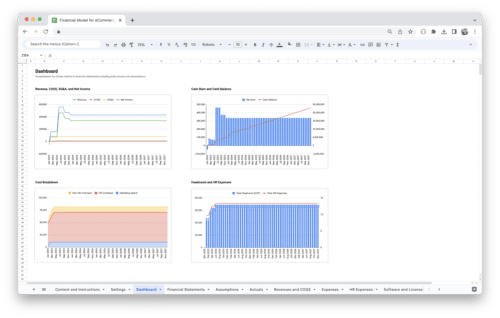

Dashboard and Reporting

Efficiently tracking financial performance and communicating it to stakeholders is crucial. Dashboards and reporting tools play a vital role in this process. Here’s how to leverage them effectively:

- Dashboard Creation: Develop dashboards that display key financial metrics and KPIs in a visually intuitive manner. Utilize data visualization techniques like charts and graphs to make information easily digestible.

- Real-Time Monitoring: Implement systems that provide real-time updates on financial data. This allows you to react promptly to changes and make agile decisions.

- Customization: Tailor your dashboards and reports to suit the needs of different stakeholders, whether it’s executives, investors, or department heads. Customize the presentation to convey relevant insights effectively.

- Periodic Reporting: Establish a regular reporting cadence, such as monthly or quarterly, to keep stakeholders informed about financial performance trends and achievements.

Effective dashboard and reporting practices ensure that decision-makers have access to up-to-date, relevant financial information, empowering them to make well-informed strategic finance decisions.

Strategic Financial Analysis

Strategic financial analysis is a critical component of effective financial management. It involves assessing your organization’s financial performance, competitive positioning, and strategic alignment. We’ll explore various analytical techniques and tools that can provide valuable insights.

Competitive Analysis

Competitive analysis in the context of strategic finance involves evaluating your organization’s financial performance in comparison to key competitors. This assessment helps identify strengths, weaknesses, opportunities, and threats. Here’s how to conduct a competitive analysis:

- Financial Metrics Comparison: Compare key financial metrics, such as revenue, profit margins, and return on investment, with those of your competitors. Identify areas where your organization outperforms or lags behind.

- Market Share Analysis: Examine your organization’s market share relative to competitors. Determine whether your market position is strengthening or weakening.

- Cost Structure Analysis: Analyze the cost structure of your organization and compare it to industry benchmarks. Identify opportunities to reduce costs or improve cost efficiency.

- Product and Service Offerings: Evaluate the competitiveness of your products and services in terms of pricing, quality, and features compared to competitors.

- Financial Stability Assessment: Assess the financial stability and creditworthiness of competitors. This can help you anticipate their financial strategies and reactions.

Competitive analysis provides insights that can inform your financial decision-making, helping you adapt to market dynamics and gain a competitive edge.

Industry Benchmarking

Industry benchmarking involves measuring your organization’s financial performance against industry standards and best practices. It helps you understand where your organization stands in relation to industry peers and identify areas for improvement. Here’s how to leverage industry benchmarking effectively:

- Select Relevant Benchmarks: Choose industry benchmarks that align with your organization’s sector, size, and business model. Benchmarks may include industry averages, top performers, or specific peer groups.

- Financial Ratio Benchmarking: Compare your organization’s financial ratios (e.g., liquidity, profitability, solvency) with industry benchmarks. Deviations from industry norms may signal areas for attention.

- Operational Benchmarking: Assess your operational efficiency by comparing factors like production costs, inventory turnover, or employee productivity to industry standards.

- Market Performance Comparison: Evaluate how your organization’s stock price or market capitalization compares to industry peers. Market performance can reflect investor sentiment and industry prospects.

- Identify Improvement Opportunities: Benchmarking can reveal areas where your organization falls short of industry standards. Use these insights to set performance improvement goals.

By regularly conducting industry benchmarking, you can adapt your financial strategies and operational practices to remain competitive and better align with industry trends.

SWOT Analysis for Finance

A SWOT analysis is a versatile tool that can be applied to financial decision-making. It involves assessing your organization’s strengths, weaknesses, opportunities, and threats in the financial context. Here’s how to perform a SWOT analysis for finance:

- Strengths: Identify internal financial strengths, such as strong cash reserves, low debt levels, or efficient cost management. Highlight areas where your organization excels financially.

- Weaknesses: Examine financial weaknesses, such as high debt ratios, low liquidity, or unstable cash flow. Recognize areas that need improvement or risk mitigation.

- Opportunities: Explore financial opportunities, such as potential investment avenues, cost-saving initiatives, or market expansion possibilities. Look for financial prospects that align with your organization’s goals.

- Threats: Recognize financial threats, such as economic downturns, rising interest rates, or competitive challenges. Develop strategies to mitigate these financial risks.

SWOT analysis for finance enables you to create a comprehensive financial strategy that leverages strengths, addresses weaknesses, capitalizes on opportunities, and mitigates threats. It’s a valuable tool for strategic financial planning and decision-making.

Financial Risk Management

Effective financial risk management is crucial for safeguarding your organization’s financial stability and ensuring its ability to achieve its strategic objectives. We will explore various aspects of financial risk management, including the types of financial risks, strategies for mitigating these risks, and hedging techniques.

Types of Financial Risks

Financial risks are potential events or circumstances that can negatively impact your organization’s financial health and performance. Understanding the types of financial risks is the first step in managing them effectively. Here are the primary types of financial risks:

- Market Risk: Market risk encompasses the risk of financial losses due to fluctuations in market prices, such as stocks, bonds, commodities, and currencies. Subtypes of market risk include:

- Price Risk: The risk of asset value changes.

- Interest Rate Risk: The risk that interest rate changes will affect asset values.

- Currency Risk: The risk of adverse exchange rate movements impacting international transactions.

- Credit Risk: Credit risk refers to the potential losses resulting from counterparties failing to meet their financial obligations. It includes:

- Default Risk: The risk that borrowers will fail to repay loans or bonds.

- Counterparty Risk: The risk that trading partners or financial institutions may default on contracts.

- Liquidity Risk: Liquidity risk arises when an organization cannot meet its short-term financial obligations, leading to financial distress. It includes the risk of not having enough cash to cover operational expenses or debt payments.

- Operational Risk: Operational risk stems from internal processes, systems, or human errors that result in financial losses. It includes risks related to technology failures, fraud, compliance, and process inefficiencies.

- Compliance Risk: Compliance risk arises from non-adherence to laws, regulations, or industry standards, leading to legal penalties, fines, or reputation damage.

Understanding these financial risks is essential for developing a comprehensive risk management strategy tailored to your organization’s specific needs.

Risk Mitigation Strategies

Once you’ve identified financial risks, it’s crucial to implement effective risk mitigation strategies to minimize their potential impact. These strategies aim to reduce the likelihood or severity of adverse financial events. Common risk mitigation strategies include:

- Diversification: Diversify your investments across different asset classes, regions, or industries to spread risk. This can help reduce the impact of market and sector-specific risks.

- Risk Avoidance: In some cases, it may be prudent to avoid certain financial risks altogether. For example, avoiding investments in highly speculative assets can mitigate market risk.

- Risk Reduction: Implement measures to reduce the magnitude of potential losses. For instance, maintaining a well-capitalized balance sheet can mitigate liquidity risk.

- Risk Transfer: Transfer financial risks to third parties through insurance, hedging contracts, or other financial instruments. This approach can help mitigate credit risk and certain market risks.

- Scenario Analysis: Conduct scenario analysis to evaluate the potential outcomes of different financial risk scenarios. This helps you proactively plan for adverse events.

Hedging Techniques

Hedging is a specific risk management strategy that involves using financial instruments to offset potential losses from adverse price movements or fluctuations in financial markets. Hedging techniques are often employed to protect against market risk, currency risk, and interest rate risk. Some common hedging techniques include:

- Forward Contracts: These contracts allow organizations to lock in future exchange rates or commodity prices, reducing exposure to currency and price fluctuations.

- Options Contracts: Options provide the right, but not the obligation, to buy or sell an asset at a specified price. They can be used to hedge against adverse market movements.

- Futures Contracts: Similar to forward contracts, futures contracts are standardized agreements to buy or sell assets at a predetermined price and date.

- Swaps: Interest rate swaps and currency swaps can help organizations manage interest rate and currency risks by exchanging cash flows with a counterparty.

- Derivative Instruments: Utilize various derivative instruments, such as swaps, options, and futures, to create customized hedging strategies tailored to specific risk exposures.

Effective financial risk management involves a combination of risk identification, mitigation, and hedging strategies to protect your organization’s financial well-being and support strategic goals. The choice of strategy should align with your risk tolerance, objectives, and the nature of the risks involved.

Examples of Strategic Finance in Action

To gain a deeper understanding of strategic finance, let’s explore some real-world examples that showcase its principles and calculations.

1. Capital Budgeting

Imagine you’re the CFO of a manufacturing company, and you need to decide whether to invest in a new production facility. The initial investment is $5 million, and the projected cash flows over the next five years are as follows:

- Year 1: $1.5 million

- Year 2: $2 million

- Year 3: $2.5 million

- Year 4: $2.2 million

- Year 5: $2.8 million

To determine the viability of this investment, you calculate the Net Present Value (NPV) and the Internal Rate of Return (IRR).

NPV Calculation:

The NPV formula is:

NPV = Σ [CFt / (1 + r)^t] - Initial Investment

Where:

CFt = Cash flow in year tr = Discount rate (your cost of capital)t = Time period

Let’s assume a discount rate of 10%:

NPV = [$1.5M / (1 + 0.10)^1] + [$2M / (1 + 0.10)^2] + [$2.5M / (1 + 0.10)^3] + [$2.2M / (1 + 0.10)^4] + [$2.8M / (1 + 0.10)^5] - $5M

NPV = [$1.36M + $1.65M + $1.89M + $1.61M + $1.93M] – $5M

NPV = $8.44M – $5M

NPV = $3.44M

A positive NPV of $3.44 million indicates that the investment is financially attractive.

IRR Calculation:

The IRR is the discount rate at which the NPV equals zero. Using Excel or financial calculators, you find that the IRR is approximately 18.2%.

With an IRR higher than the cost of capital (10%), the project appears financially sound.

2. Risk Management

Suppose you are managing the finances of an international company exposed to currency risk due to foreign operations. Your company imports goods from Europe, and you’re concerned about exchange rate fluctuations impacting costs. You decide to hedge your currency risk by using a forward contract.

- Current exchange rate: 1 USD = 0.85 EUR

- Expected payment for imports in 3 months: 1,000,000 EUR

You enter into a forward contract to buy 1,000,000 EUR in 3 months at the current rate of 0.85 USD/EUR.

Hedging Calculation:

Three months later, the exchange rate has changed to 1 USD = 0.80 EUR. You use your forward contract to buy 1,000,000 EUR at the contracted rate of 0.85 USD/EUR, saving on the unfavorable exchange rate.

- Cost without hedging: 1,000,000 EUR * 1.25 USD/EUR = $1,250,000

- Cost with hedging: 1,000,000 EUR * 0.85 USD/EUR = $850,000

By using a forward contract to hedge your currency risk, you saved $400,000 in this transaction.

These examples illustrate how strategic finance involves complex calculations and informed decisions to enhance profitability, mitigate risk, and promote long-term financial sustainability.

Long-Term Financial Sustainability

Ensuring long-term financial sustainability is a fundamental goal for any organization. It involves practices that go beyond short-term gains to support your organization’s financial well-being for years to come. In this section, we will explore sustainable finance practices, ethical and social responsibility in finance, and the integration of Environmental, Social, and Governance (ESG) factors into financial decision-making.

Sustainable Finance Practices

Sustainable finance practices encompass strategies that not only drive financial success but also contribute to environmental and social well-being. Here are some key sustainable finance practices:

- Responsible Investing: Consider environmental, social, and governance (ESG) factors when making investment decisions. Invest in companies and projects that align with your organization’s values and promote sustainability.

- Green Finance: Explore opportunities to invest in green projects and environmentally friendly initiatives. This may include renewable energy, sustainable agriculture, or green infrastructure projects.

- Social Impact Investments: Allocate capital to initiatives that have a positive social impact, such as affordable housing, education, or healthcare projects. Socially responsible investments can generate financial returns while benefiting communities.

- Supply Chain Sustainability: Ensure that your supply chain practices align with sustainability principles. Work with suppliers and partners who share your commitment to responsible and ethical practices.

- Sustainability Reporting: Develop transparent sustainability reports that communicate your organization’s environmental and social performance. This fosters trust among stakeholders and can attract socially responsible investors.

By integrating sustainable finance practices into your long-term financial strategy, you can enhance your organization’s reputation, reduce risk, and create lasting value for both your organization and society at large.

Ethical and Social Responsibility in Finance

Ethical and social responsibility in finance extends beyond profitability to encompass ethical decision-making and social impact. Here’s how you can integrate these principles into your financial practices:

- Ethical Investment: Screen investments to ensure they align with ethical values and principles. Avoid investments in industries or companies that engage in activities contrary to your organization’s ethical stance.

- Fair Labor Practices: Ensure that your organization adheres to fair labor practices, including fair wages, safe working conditions, and equal opportunities for all employees.

- Community Engagement: Actively engage with local communities where your organization operates. Support community development projects, charitable initiatives, and social causes that resonate with your organization’s mission.

- Corporate Social Responsibility (CSR): Develop and implement CSR programs that focus on environmental sustainability, community engagement, and philanthropy. CSR efforts can enhance your organization’s reputation and foster goodwill.

- Ethical Governance: Maintain strong ethical governance practices, emphasizing transparency, accountability, and responsible decision-making at all levels of the organization.

By prioritizing ethical and social responsibility in finance, you not only contribute positively to society but also enhance your organization’s long-term reputation and sustainability.

Environmental, Social, and Governance (ESG) Factors

ESG factors have gained prominence in financial decision-making. These factors encompass environmental, social, and governance considerations that can impact an organization’s financial performance and risk profile. Here’s how ESG factors are relevant:

- Environmental (E): Evaluate the environmental impact of your organization’s operations, including carbon emissions, resource consumption, and sustainability efforts. Addressing environmental concerns can reduce operational risks and attract environmentally conscious investors.

- Social (S): Assess your organization’s social impact, including employee relations, diversity and inclusion, and community engagement. Strong social practices can enhance your organization’s reputation and attract socially responsible investors.

- Governance (G): Focus on governance practices that ensure transparency, accountability, and ethical decision-making. Effective governance reduces the risk of financial scandals and regulatory issues.

- ESG Integration: Integrate ESG factors into your investment decisions, risk assessments, and strategic planning. Consider how these factors can affect financial performance and make informed choices accordingly.

By considering ESG factors in your financial decision-making process, you not only support long-term sustainability but also align your organization with global trends and investor expectations for responsible and ethical financial practices.

Conclusion

Strategic finance is the compass that guides organizations towards financial success. By aligning financial goals with strategic vision, effectively managing risks, and embracing ethical practices, you can chart a course for long-term sustainability. Remember, strategic finance is not just about numbers; it’s about shaping a brighter financial future for your organization and achieving lasting prosperity.

As you embark on your journey in the world of strategic finance, always keep in mind that informed financial decisions have the power to steer your organization towards growth and resilience. By maximizing profitability, optimizing resource allocation, and ensuring compliance with ethical standards, you can navigate the complexities of finance with confidence and set your organization on a path to financial prosperity.

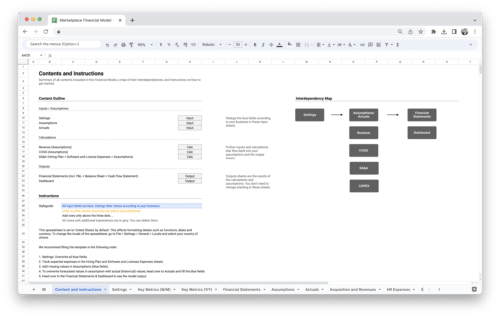

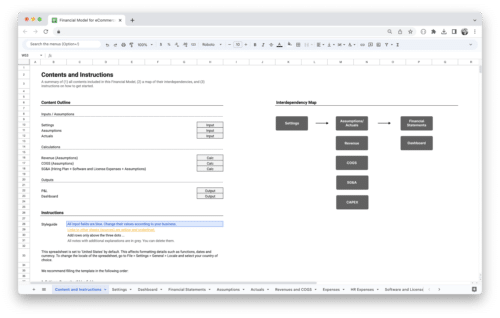

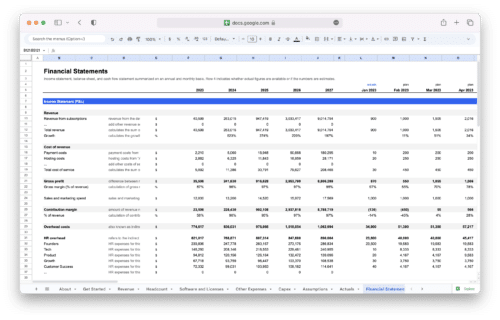

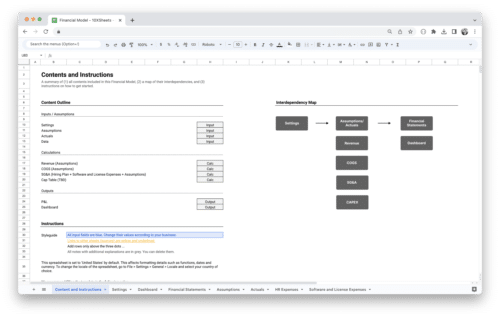

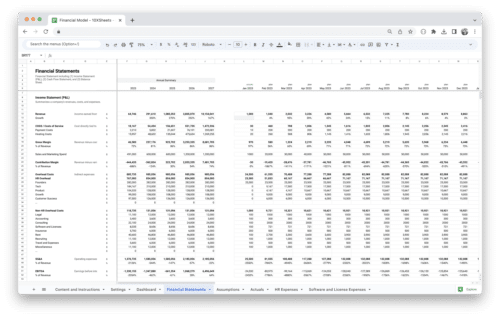

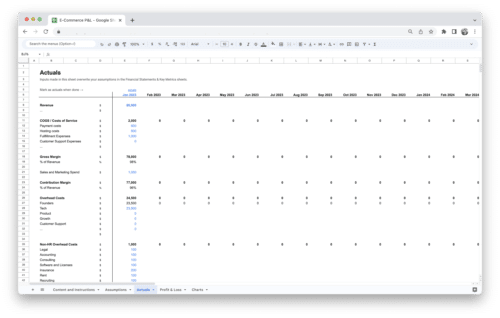

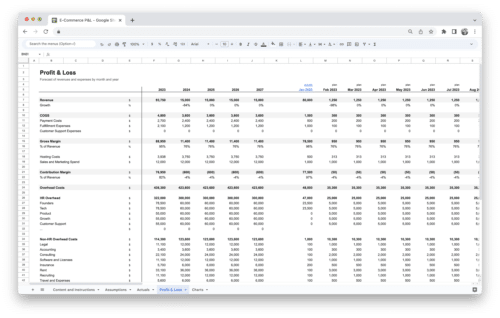

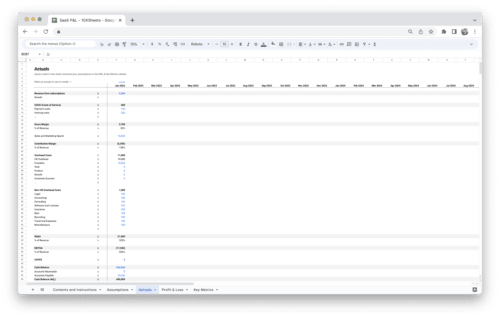

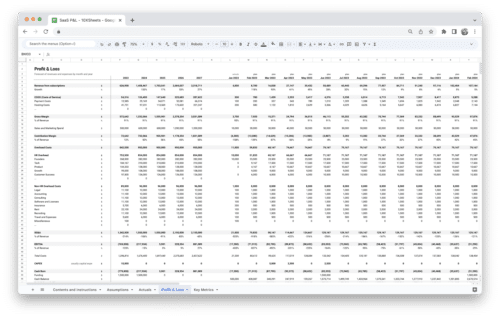

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.