Are you curious about how businesses ensure they can meet their short-term financial obligations when the need arises? In the world of finance, the Quick Ratio serves as a vital tool for precisely that purpose. This guide will take you on an insightful exploration of the Quick Ratio, its components, calculation methods, significance, advantages, disadvantages, and its role in financial analysis. Delve into real-life examples and discover strategies to enhance the Quick Ratio, empowering you to make informed decisions about a company’s financial health and liquidity.

What is Quick Ratio?

Quick Ratio, also known as the Acid-Test Ratio, is a key financial indicator that assesses a company’s short-term liquidity and ability to meet its immediate financial obligations. Unlike some other liquidity ratios, the Quick Ratio focuses on the most liquid assets a company possesses, excluding inventory.

The formula for calculating the Quick Ratio is:

Quick Ratio = (Cash + Cash Equivalents + Accounts Receivable) / Current Liabilities

Here’s a breakdown of the key components:

- Cash: This includes physical cash on hand and cash equivalents, such as short-term investments that are highly liquid and easily convertible into cash.

- Cash Equivalents: Investments with a maturity date within three months or less from the date of purchase. They are readily convertible to a known amount of cash and are subject to insignificant risk of changes in value.

- Accounts Receivable: The amounts owed to the company by customers for goods or services provided on credit. These represent future cash inflows, although the timing of collection can vary.

- Current Liabilities: These are obligations the company is expected to settle within one year, including accounts payable, short-term loans, and accrued expenses.

The Quick Ratio is a conservative measure of liquidity because it excludes inventory, which may not be as quickly convertible to cash and could potentially lose value over time.

Importance of Quick Ratio

The Quick Ratio is a vital metric in financial analysis, serving several crucial purposes that contribute to a comprehensive evaluation of a company’s financial health:

- Assessing Short-Term Liquidity: The primary role of the Quick Ratio is to assess a company’s short-term liquidity. It answers the question of whether the company has enough quick assets (cash, cash equivalents, and accounts receivable) to cover its short-term liabilities without relying on inventory sales.

- Indicator of Financial Stability: A strong Quick Ratio indicates that a company is well-prepared to meet its immediate financial obligations. This not only reflects stability but also reduces the risk of financial distress or default.

- Creditor and Investor Confidence: Creditors and investors often use the Quick Ratio as a key factor in their decision-making process. Lenders are more inclined to extend credit to companies with a healthy Quick Ratio, while investors gain confidence in a company’s ability to manage financial challenges.

- Comparative Analysis: Comparing a company’s Quick Ratio to industry benchmarks or competitors’ ratios can provide valuable insights. It helps determine whether the company’s liquidity position is in line with industry norms.

- Early Warning Indicator: A declining Quick Ratio over time may signal liquidity problems and serve as an early warning of potential financial difficulties. Monitoring changes in the ratio can prompt timely corrective actions.

In summary, the Quick Ratio is a fundamental tool for assessing a company’s liquidity, financial stability, and creditworthiness. Its significance extends beyond financial analysis to influence the decisions of creditors, investors, and stakeholders, making it a metric of utmost importance in the world of finance.

Quick Ratio vs. Current Ratio

The Quick Ratio and the Current Ratio are both liquidity ratios used to assess a company’s ability to meet its short-term obligations, but they have distinct differences. Understanding how they compare is essential for a comprehensive view of a company’s financial health.

Quick Ratio

- Focus on Quick Assets: The Quick Ratio emphasizes the most liquid assets a company holds, including cash, cash equivalents, and accounts receivable. It excludes inventory because it may not be as quickly convertible to cash.

- Conservative Measure: As a conservative measure of liquidity, the Quick Ratio provides a stricter assessment of a company’s short-term financial strength.

Current Ratio

- Inclusive of All Current Assets: The Current Ratio considers all current assets, including cash, cash equivalents, accounts receivable, and inventory. It provides a broader view of liquidity.

- Less Conservative: The Current Ratio is less conservative than the Quick Ratio because it includes inventory, which may take longer to convert into cash.

Choosing Between the Ratios

Which ratio to use depends on the specific analysis and context. The Quick Ratio is often favored when a conservative assessment of liquidity is required, and inventory may not be easily convertible to cash. The Current Ratio, on the other hand, offers a broader perspective and is useful for evaluating overall liquidity.

In summary, while both ratios assess liquidity, the choice between the Quick Ratio and the Current Ratio depends on the specific analysis and the information required for making informed financial decisions. Each ratio has its strengths and limitations, and using them in conjunction can provide a more comprehensive understanding of a company’s liquidity position.

Components of Quick Ratio

Understanding the components of the Quick Ratio is crucial to grasp how this financial metric works and what it reveals about a company’s liquidity.

Current Assets

Current assets are the first key component of the Quick Ratio. These are assets that a company expects to convert into cash or consume within one year. They are the lifeblood of short-term liquidity. Current assets typically include:

- Cash: This is the most liquid asset. It includes physical cash and cash equivalents, such as short-term investments that are easily convertible into cash within a few months.

- Accounts Receivable: These are amounts owed to the company by customers for goods or services provided on credit. Accounts receivable represent future cash inflows, but the timing of collection is uncertain.

- Other Liquid Assets: Depending on the company, current assets may also include items like marketable securities or prepaid expenses.

Understanding the composition of a company’s current assets helps in evaluating how quickly these assets can be converted into cash to meet short-term obligations.

Current Liabilities

The second key component of the Quick Ratio is current liabilities. Current liabilities are obligations that a company is expected to settle within one year. They include:

- Accounts Payable: These are outstanding bills and invoices that the company owes to suppliers or vendors. They represent short-term debts that need to be paid off in the near future.

- Short-term Loans and Debt: Any loans or debt with maturities within the next year are considered current liabilities. This includes lines of credit, bank loans, and other short-term borrowings.

- Accrued Liabilities: This category includes expenses that the company has incurred but has not yet paid. Examples include salaries and wages payable, rent, and utilities.

By examining a company’s current liabilities, you can gauge the magnitude of its short-term financial obligations. The Quick Ratio assesses whether current assets, excluding inventory, are sufficient to cover these liabilities, providing a conservative measure of liquidity.

How to Calculate Quick Ratio?

Let’s dive into the nitty-gritty of how to calculate the Quick Ratio and what it means for a company’s financial health.

Quick Ratio Formula

The Quick Ratio is a simple formula that provides insight into a company’s liquidity position. It is calculated as follows:

Quick Ratio = (Cash + Cash Equivalents + Accounts Receivable) / Current Liabilities

Now, let’s walk through a numerical example to illustrate how this formula works in practice:

Suppose you’re analyzing Company XYZ, and you have the following financial information for them:

- Cash: $50,000

- Cash Equivalents: $20,000

- Accounts Receivable: $30,000

- Current Liabilities: $45,000

Plug these values into the formula:

Quick Ratio = ($50,000 + $20,000 + $30,000) / $45,000 = $100,000 / $45,000 = 2.22

In this example, Company XYZ has a Quick Ratio of 2.22, which means they have $2.22 in quick assets for every $1 of current liabilities. This indicates a strong liquidity position because their quick assets significantly exceed their short-term obligations.

Interpretation of Quick Ratio

Now that you know how to calculate the Quick Ratio, let’s explore how to interpret this ratio:

- Quick Ratio > 1: If the Quick Ratio is greater than 1, it indicates that the company has enough quick assets to cover its current liabilities. This is a positive sign, suggesting that the company is likely to meet its short-term financial obligations without relying heavily on inventory.

- Quick Ratio = 1: When the Quick Ratio equals 1, it means that the company’s quick assets are just enough to cover its current liabilities. While this isn’t necessarily a red flag, it does suggest a more precarious liquidity position, as there is little margin for error.

- Quick Ratio < 1: If the Quick Ratio is less than 1, it implies that the company’s quick assets are insufficient to cover its current liabilities. This can be a cause for concern, indicating potential difficulties in meeting short-term financial obligations without relying on inventory sales.

In general, a higher Quick Ratio is preferable, as it signifies a stronger liquidity position. However, it’s essential to consider industry norms and the specific circumstances of the company when interpreting this ratio. Some industries naturally have lower Quick Ratios due to the nature of their business operations, while others should have higher ratios to ensure financial stability.

What is a Good Quick Ratio?

Understanding what constitutes a good Quick Ratio is vital for evaluating a company’s financial health accurately. The ideal Quick Ratio varies across industries and depends on the specific circumstances of a company. Here’s a closer look at how to determine whether a Quick Ratio is considered “good” or not:

Industry Norms

Different industries have varying liquidity requirements and working capital needs. Some industries naturally operate with lower Quick Ratios because of the nature of their business, while others require higher ratios to ensure financial stability. Therefore, it’s crucial to benchmark a company’s Quick Ratio against industry standards.

Rule of Thumb

As a general rule of thumb, a Quick Ratio above 1.0 is often considered acceptable. This indicates that the company has enough quick assets to cover its current liabilities without relying on the sale of inventory. However, what’s considered a good ratio can vary widely.

Company-Specific Factors

Beyond industry benchmarks, it’s essential to consider company-specific factors. These factors can include the company’s historical Quick Ratio trends, its access to external financing, the stability of its customer base, and the nature of its operations. A company may have a Quick Ratio slightly below 1.0 but still be in a healthy financial position if it has a reliable history of meeting short-term obligations.

In summary, a “good” Quick Ratio is context-dependent. It should align with industry norms, but it’s equally important to consider company-specific circumstances and trends over time when evaluating whether a Quick Ratio is indicative of financial strength.

Significance of Quick Ratio

Now, let’s delve deeper into the significance of the Quick Ratio and why it holds a special place in financial analysis.

What is Liquidity?

Liquidity is a fundamental concept in finance, and the Quick Ratio is a key tool for assessing it. Liquidity refers to the ease with which assets can be converted into cash without significantly affecting their market value. Understanding a company’s liquidity is crucial because it directly impacts its ability to navigate short-term financial challenges.

The Quick Ratio is particularly valuable because it provides a conservative measure of liquidity. By excluding inventory, which may take time to sell or could depreciate in value, the Quick Ratio focuses on the assets most readily convertible to cash. This gives you a clearer picture of how well a company can handle immediate financial hurdles without relying on the sale of goods.

In essence, the Quick Ratio helps you answer the question: “Does the company have enough cash and assets that can be quickly converted into cash to meet its short-term obligations?” This is vital for assessing whether a company can keep its operations running smoothly, pay its bills, and continue to invest in growth.

Quick Ratio vs. Current Ratio

Another crucial aspect of understanding the Quick Ratio’s significance is comparing it with another common liquidity metric: the Current Ratio. While both ratios assess a company’s ability to cover its short-term liabilities, they do so using different approaches.

- Quick Ratio: As we’ve seen, this ratio focuses on the most liquid assets, excluding inventory. It’s often considered a more conservative measure of liquidity because it offers a stricter assessment of a company’s short-term financial strength.

- Current Ratio: This ratio includes all current assets, including inventory. It provides a broader view of liquidity and may yield a higher ratio than the Quick Ratio. While it’s less conservative, it can indicate a company’s ability to meet short-term obligations, even if it involves selling inventory.

Comparing these two ratios can offer valuable insights into a company’s financial dynamics. Here’s what you can glean from the comparison:

- High Quick Ratio, Low Current Ratio: If the Quick Ratio is significantly higher than the Current Ratio, it suggests that inventory represents a substantial portion of current assets. This could be a sign of slow inventory turnover or potential risks related to inventory management.

- Quick Ratio ≈ Current Ratio: When the Quick Ratio and Current Ratio are roughly equal, it indicates that inventory is not a dominant part of the company’s current assets. This suggests a more balanced mix of assets in terms of liquidity.

- Low Quick Ratio, Low Current Ratio: If both ratios are low, it indicates that a company’s liquidity is challenged, and it may struggle to meet short-term obligations. This could be a warning sign for investors and creditors.

In summary, the significance of the Quick Ratio lies in its ability to offer a conservative assessment of liquidity and in its utility when compared to the Current Ratio. These two metrics together provide a comprehensive view of a company’s short-term financial health.

Factors Affecting Quick Ratio

The Quick Ratio is a powerful tool for evaluating a company’s short-term liquidity, but it’s influenced by various factors within a company’s operations. We’ll explore two significant factors that can affect the Quick Ratio: Inventory Management and Accounts Receivable Management.

Inventory Management

Effective inventory management plays a critical role in determining a company’s Quick Ratio. Inventory represents a substantial portion of current assets for many businesses, and how efficiently it’s managed can significantly impact the ratio. Here’s how inventory management affects the Quick Ratio:

- Slow Inventory Turnover: If a company struggles to sell its inventory quickly, a substantial portion of its current assets may be tied up in unsold goods. This can result in a lower Quick Ratio, as inventory is not considered a quick asset. To improve the Quick Ratio, a company might need to enhance its inventory turnover by adjusting its production, marketing, or sales strategies.

- Obsolescence and Depreciation: Inventory items can become obsolete or lose value over time. This poses a risk to the Quick Ratio because it may overstate a company’s true liquidity. To address this, businesses must regularly assess their inventory for items that need to be written down or sold at a discount.

- Seasonal Variations: Some businesses experience seasonal fluctuations in demand, impacting their inventory levels. During peak seasons, a company may need to hold more inventory, which can temporarily lower the Quick Ratio. To manage this effectively, companies must anticipate seasonal needs and adjust their strategies accordingly.

Accounts Receivable Management

The management of accounts receivable, or the amounts owed to a company by customers, is another critical factor influencing the Quick Ratio. Efficient management can boost liquidity, while inefficiencies can hinder it. Here’s how accounts receivable management impacts the Quick Ratio:

- Timely Collections: Prompt collections of accounts receivable can improve a company’s cash position and, consequently, its Quick Ratio. Companies should have robust credit policies, send out invoices promptly, and follow up on overdue payments to ensure timely collections.

- Aging Receivables: As accounts receivable age, they become less likely to be collected in full. To maintain a healthy Quick Ratio, companies need to regularly assess the aging of their receivables and take appropriate actions to collect outstanding amounts.

- Credit Policies: The extension of credit to customers should be carefully managed. Offering credit terms that are too generous can lead to a higher level of accounts receivable and potentially lower the Quick Ratio. Striking a balance between attracting customers and managing credit risk is essential.

In summary, both inventory management and accounts receivable management play pivotal roles in shaping a company’s Quick Ratio. Businesses must find the right balance between these factors to maintain a healthy liquidity position and ensure they can meet their short-term financial obligations.

Advantages and Disadvantages of Quick Ratio

As with any financial metric, the Quick Ratio has its set of advantages and disadvantages. Understanding both sides of the coin is essential for making informed financial decisions and effectively using this ratio for analysis.

Quick Ratio Advantages

- Conservative Measure of Liquidity: The Quick Ratio is a conservative indicator of a company’s short-term liquidity. By excluding inventory, which may not be easily convertible into cash, it provides a stricter assessment of a company’s ability to meet immediate financial obligations. This conservatism can be valuable for risk-averse investors and creditors.

- Quick Assessment: The Quick Ratio is easy to calculate and provides a rapid assessment of a company’s liquidity position. This makes it a useful tool for quickly evaluating a company’s financial health, especially when time is limited.

- Focus on Key Assets: By emphasizing cash, cash equivalents, and accounts receivable, the Quick Ratio highlights the assets that are most likely to be turned into cash within a short period. This focused approach offers insights into a company’s ability to handle short-term financial challenges effectively.

- Useful for Comparisons: The Quick Ratio allows for straightforward comparisons between companies within the same industry or sector. It helps assess which companies have stronger short-term liquidity positions, making it a valuable tool for benchmarking.

Quick Ratio Disadvantages

- Exclusion of Inventory: While excluding inventory can be an advantage, it’s also a limitation. In some industries, inventory represents a significant portion of current assets, and its exclusion can result in a lower Quick Ratio. This may not accurately reflect the true liquidity of the company, especially if the inventory can be quickly converted into cash.

- Variability Across Industries: Different industries have varying levels of reliance on inventory and different norms for what constitutes “quick assets.” This means that what is considered a good Quick Ratio in one industry may not hold true in another. Comparing Quick Ratios across industries can be challenging.

- Lack of Context: The Quick Ratio alone may not provide a complete picture of a company’s financial health. It doesn’t consider factors such as the timing of cash flows, debt maturity, or the nature of the company’s operations. Therefore, it should be used in conjunction with other financial metrics and qualitative analysis for a comprehensive assessment.

- Dynamic Nature: Liquidity can change rapidly. A company with a healthy Quick Ratio one month may face liquidity challenges the next. This means that the Quick Ratio should be considered alongside trends in liquidity over time, not just as a static snapshot.

In summary, the Quick Ratio is a valuable tool for assessing short-term liquidity, but it should be used judiciously and in conjunction with other financial metrics to gain a complete understanding of a company’s financial health. Its advantages lie in its conservative nature, ease of use, and focus on key assets, while its disadvantages stem from its exclusion of inventory, industry-specific variations, lack of context, and the dynamic nature of liquidity

Quick Ratio Importance in Financial Analysis

The Quick Ratio holds immense importance in financial analysis, offering valuable insights into a company’s short-term financial health. Let’s explore how it serves as a critical tool in assessing short-term solvency and evaluating creditworthiness.

Assessing Short-term Solvency

Short-term solvency is the ability of a company to meet its immediate financial obligations without disrupting its normal operations. This aspect of financial analysis is essential because it addresses the company’s ability to stay afloat in the short term, even when unexpected financial challenges arise.

The Quick Ratio is a key indicator for assessing short-term solvency because it focuses on a company’s most liquid assets. By excluding inventory, which may not be quickly convertible to cash, it provides a conservative measure of whether a company can pay its short-term debts, bills, and expenses without relying on inventory sales.

When analyzing short-term solvency using the Quick Ratio, consider the following:

- Thresholds and Benchmarks: Different industries and sectors may have varying acceptable levels of liquidity. It’s crucial to compare a company’s Quick Ratio to industry standards to determine if it meets the threshold for short-term solvency.

- Trends Over Time: Monitoring changes in a company’s Quick Ratio over time is essential. Consistent declines may signal deteriorating short-term solvency, while improvements indicate better financial health.

- Operational Continuity: Assess whether a company’s Quick Ratio allows it to maintain its day-to-day operations smoothly. Inadequate liquidity can lead to disruptions in paying suppliers, employees, or other essential expenses.

Creditworthiness Evaluation

Lenders, creditors, and investors frequently rely on the Quick Ratio to evaluate a company’s creditworthiness. Creditors, in particular, use this metric to determine whether a company is likely to repay its debts on time. Here’s how the Quick Ratio contributes to creditworthiness evaluation:

- Lending Decisions: When a company seeks financing, whether through loans or lines of credit, lenders often scrutinize its Quick Ratio. A higher Quick Ratio indicates a more liquid financial position, which makes the company a more attractive borrower. Lenders are more likely to extend credit to companies that can readily cover their short-term obligations.

- Bond Ratings: Credit rating agencies use liquidity ratios like the Quick Ratio to assign bond ratings. A strong Quick Ratio can result in a higher credit rating, which translates to lower borrowing costs for the company. Conversely, a weak Quick Ratio may lead to lower credit ratings and higher borrowing costs.

- Investor Confidence: Investors also consider the Quick Ratio when evaluating a company’s stock. A strong liquidity position can instill confidence in investors, as it suggests the company is better equipped to weather financial storms and continue its operations.

In conclusion, the Quick Ratio plays a pivotal role in financial analysis by aiding in the assessment of short-term solvency and the evaluation of creditworthiness. It offers a conservative measure of liquidity, making it a valuable tool for creditors, investors, and financial analysts seeking to make informed decisions about a company’s financial health and stability.

How to Improve Quick Ratio?

Improving the Quick Ratio is a goal for many companies, as it signifies enhanced short-term liquidity and financial resilience. Here, we’ll explore various strategies that businesses can employ to increase their Quick Ratio. These strategies are divided into two key categories: boosting quick assets and managing current liabilities.

Strategies for Increasing Quick Assets

Enhancing the Quick Ratio often begins with a focus on increasing quick assets, which are the assets that can be readily converted into cash. Here are some strategies to achieve this:

- Optimize Cash Management: Ensure that your company has an efficient cash management system in place. This includes monitoring cash flows, reducing idle cash balances, and investing surplus cash in short-term, highly liquid investments.

- Accelerate Accounts Receivable Collections: Implement effective accounts receivable management practices to speed up the collection of outstanding customer payments. This may involve offering discounts for early payment, sending timely invoices, and actively following up on overdue accounts.

- Diversify Revenue Streams: Explore ways to diversify your revenue streams beyond your core products or services. This can lead to increased cash inflows from various sources, bolstering your quick assets.

- Reduce Non-Essential Assets: Review your balance sheet for non-essential assets that could be sold or leased, freeing up cash. This could include surplus equipment or property that is not critical to your operations.

- Negotiate Better Terms with Suppliers: Negotiate with suppliers to extend payment terms, allowing you to hold onto cash for a longer period. Be cautious not to strain supplier relationships, but reasonable negotiations can improve your liquidity.

- Strategic Cost Control: Examine your operating costs and identify areas where you can reduce expenses without compromising core operations. Cost-saving initiatives can help conserve cash.

Managing Current Liabilities

Managing current liabilities effectively is equally crucial in improving the Quick Ratio. Here are strategies for managing current liabilities:

- Refinance or Extend Debt Maturities: Consider refinancing short-term debt into longer-term debt with more manageable repayment schedules. This can reduce the immediate pressure on your liquidity.

- Negotiate Favorable Loan Terms: When securing loans or lines of credit, negotiate terms that align with your cash flow and revenue cycles. Favorable terms may include grace periods or flexible repayment options.

- Prioritize Debt Payments: Prioritize paying off high-interest debt that can strain your liquidity. Redirect available cash toward reducing outstanding debts, starting with those carrying the highest interest rates.

- Streamline Accounts Payable: Implement efficient accounts payable processes to ensure timely payments to suppliers without unnecessary delays. Take advantage of available discounts for early payment, if offered.

- Accurate Forecasting: Develop accurate cash flow forecasts to anticipate short-term funding needs and avoid surprises. This allows you to plan for upcoming liabilities and allocate resources accordingly.

- Manage Accrued Liabilities: Keep a close eye on accrued liabilities, such as unpaid salaries or accrued expenses. Timely settlement of these obligations can prevent them from becoming a burden on liquidity.

Incorporating these strategies into your financial management practices can contribute to a healthier Quick Ratio. Remember that improving liquidity is an ongoing effort, and it requires a balance between enhancing quick assets and effectively managing current liabilities to ensure the long-term financial stability of your business.

Quick Ratio Examples

To deepen our understanding of how the Quick Ratio operates in real-world scenarios, let’s explore some real-life examples and case studies from various industries. These examples illustrate how the Quick Ratio can be applied and interpreted in different business contexts.

Example 1: Retail Company

Imagine a retail company that specializes in electronics. During a holiday season, they typically experience a surge in sales and need to maintain higher inventory levels to meet customer demand. Here’s how their Quick Ratio might vary throughout the year:

- High Quick Ratio in Off-season: During non-holiday periods, the company may reduce its inventory levels and focus on promoting cash sales. This results in a higher Quick Ratio as inventory is minimized.

- Lower Quick Ratio During Holidays: In preparation for the holiday rush, the company increases its inventory significantly. This temporarily reduces the Quick Ratio, but it’s a strategic move to ensure they have enough stock to meet customer demand.

The takeaway here is that the Quick Ratio can fluctuate seasonally, and what’s considered a “healthy” ratio depends on the company’s specific business model.

Example 2: Manufacturing Company

A manufacturing company producing custom machinery faces challenges in quick asset conversion. Here’s how they manage their Quick Ratio:

- High Accounts Receivable: Due to the custom nature of their products, the company often extends credit terms to clients. This results in a substantial accounts receivable balance, which can temporarily lower the Quick Ratio.

- Efficient Inventory Management: The company is diligent in managing its inventory. They maintain only essential inventory levels to avoid tying up excessive cash, which helps keep their Quick Ratio at an acceptable level.

- Effective Cash Management: The manufacturing company prioritizes cash management, investing surplus funds in short-term, easily liquidated instruments. This ensures they have adequate cash on hand to cover short-term obligations.

This case highlights how companies in different sectors may use the Quick Ratio differently to manage their unique challenges.

Example 3: Tech Startup

A tech startup in the software-as-a-service (SaaS) industry has a different approach to the Quick Ratio:

- Limited Inventory: As a SaaS company, their business model doesn’t involve holding physical inventory. Instead, their assets mainly consist of cash, accounts receivable, and intellectual property.

- Focus on Efficient Receivables: The startup places significant emphasis on efficient accounts receivable management. They offer subscription-based services and ensure timely customer payments, which keeps their Quick Ratio high.

- Cash Reserves: Understanding the importance of liquidity, the startup maintains a healthy cash reserve to cover unexpected expenses and ensure they can meet their short-term obligations comfortably.

This case illustrates how companies in technology and service industries may have higher Quick Ratios, as their assets are predominantly in the form of cash and accounts receivable.

These examples demonstrate that the Quick Ratio’s interpretation varies across industries and is influenced by a company’s business model, seasonality, and financial management strategies. When analyzing a company’s financial health, it’s crucial to consider these contextual factors and trends over time to make informed decisions.

Conclusion

The Quick Ratio is a crucial metric that provides valuable insights into a company’s ability to meet short-term financial obligations. By focusing on quick assets and excluding inventory, it offers a conservative assessment of liquidity, helping investors, creditors, and analysts gauge a company’s financial health.

Whether you’re a seasoned financial professional or just starting to explore the world of finance, understanding the Quick Ratio and its components is essential. It allows you to make informed decisions, assess short-term solvency, evaluate creditworthiness, and gain a deeper insight into a company’s financial stability. By applying the knowledge and strategies outlined in this guide, you’ll be well-equipped to navigate the intricate landscape of financial analysis and make sound financial judgments.

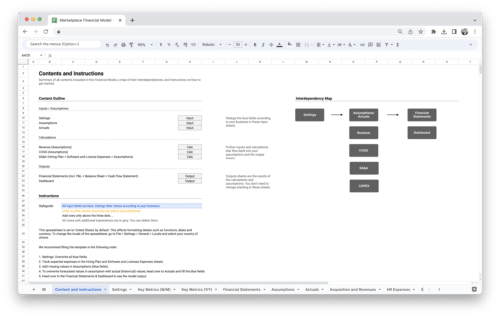

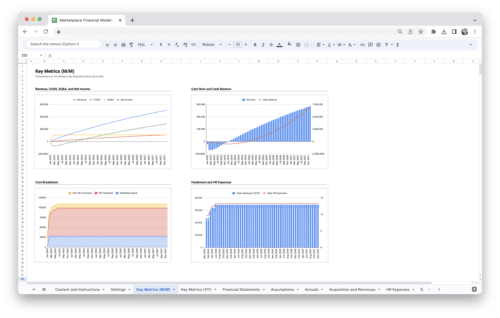

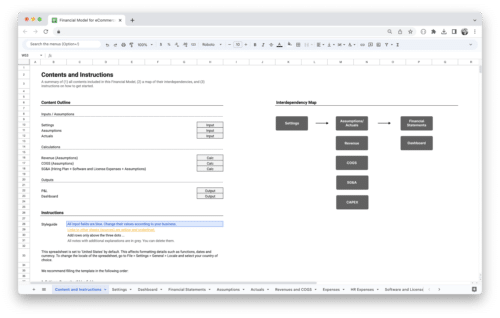

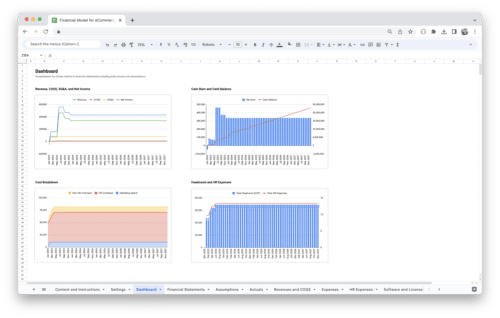

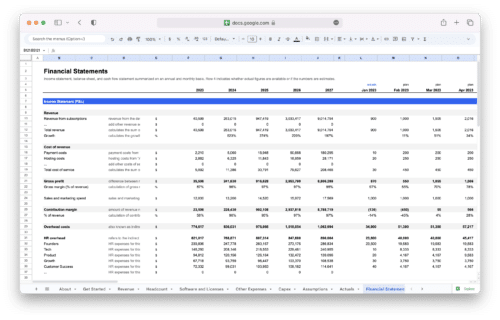

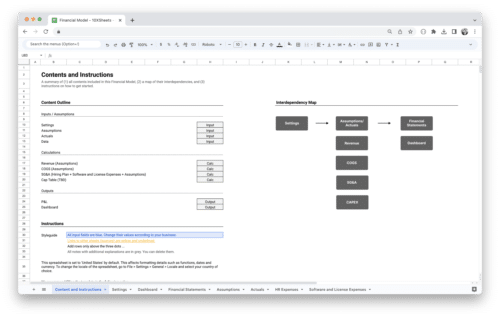

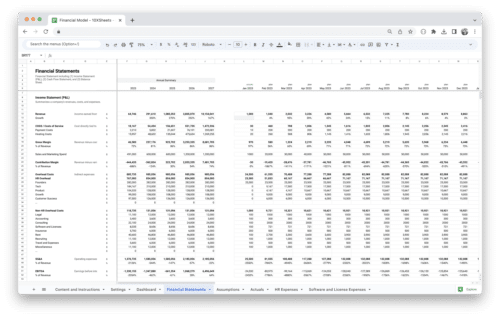

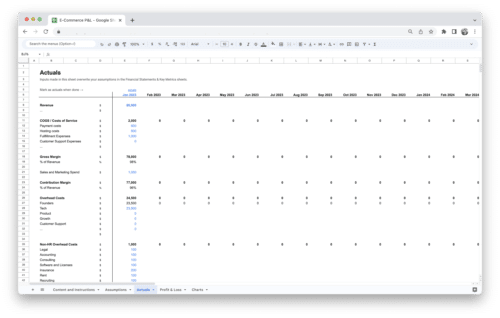

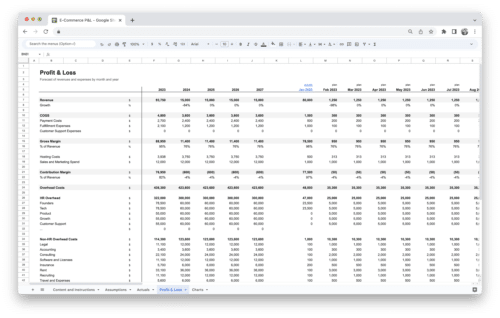

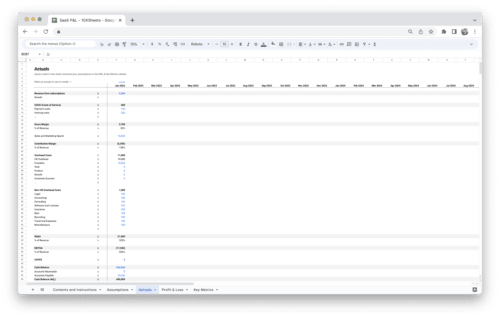

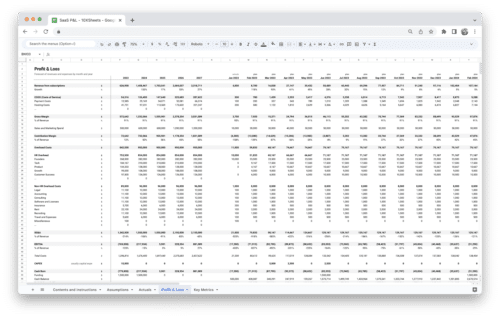

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.