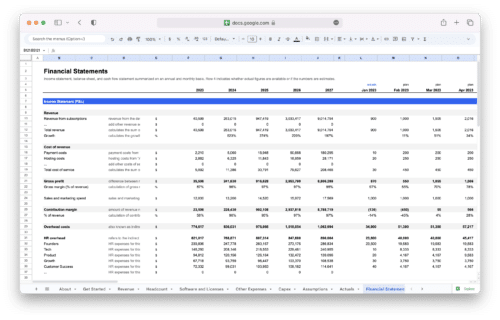

What is P&L?

Profit and Loss (P&L) is a financial statement that provides an overview of a company’s revenue, costs, and expenses over a specific period. The P&L statement is also known as an income statement or statement of operations. It is an essential financial statement that helps investors and stakeholders assess a company’s profitability and financial health and understand how much money it made or lost during the period.

Components of a P&L Statement

The P&L statement has three primary components: revenue, cost of goods sold, and expenses. Let’s explore these components in more detail.

- Revenue: Revenue refers to the money a company earns from its business operations. It includes all the money the company receives from selling goods or services to its customers. Revenue is the first item on the P&L statement because it is the starting point for calculating the company’s profitability.

- Cost of Goods Sold: Cost of goods sold (COGS) refers to the direct costs associated with producing and delivering a company’s products or services. It includes the cost of raw materials, labor, and other expenses related to the production process. COGS is subtracted from revenue to calculate the gross profit of the company.

- Expenses: Expenses refer to the costs incurred by the company in running its business operations. It includes expenses such as rent, salaries, advertising, and other administrative costs. Expenses are subtracted from the gross profit to calculate the company’s net profit.

How to Calculate P&L?

Calculating the P&L statement involves subtracting the COGS and expenses from the revenue. The formula for calculating P&L is:

P&L = Revenue – COGS – Expenses

Let’s take an example to understand this formula better. Suppose a company has revenue of $1,000, COGS of $500, and expenses of $300. To calculate the P&L, we can use the formula:

P&L = $1,000 – $500 – $300 = $200

Therefore, the P&L of the company for the given period is $200.

Importance of P&L

The P&L statement is essential for several reasons. Some of the significant benefits of using P&L are:

- Assessing Financial Health: Help investors and stakeholders assess the financial health of the company. It provides insights into how much money the company made or lost during a particular period. A positive P&L indicates the company is profitable, while a negative P&L indicates the company is losing money.

- Identifying Areas for Improvement: Help companies identify areas for improvement. By analyzing the revenue, COGS, and expenses, the company can determine where they are spending too much or not generating enough revenue. This information can be used to make changes to the company’s operations to increase profitability.

- Making Informed Decisions: Provide companies with valuable insights that can be used to make informed decisions. For example, if a company’s P&L shows that it is losing money, it may decide to cut costs or increase revenue to improve profitability.

Limitations of Profit and Loss

While P&L statements are essential for understanding a company’s financial health, there are some limitations to this financial statement. Some of the limitations of P&L are:

- Limited Timeframe: P&L statements only provide information about a company’s financial performance over a specific period. It does not provide information about the company’s long-term financial health.

- Excludes Non-Financial Factors: P&L statements only provide financial information and exclude non-financial factors such as customer satisfaction, brand reputation, and employee morale, which can also impact a company’s financial health.

- Subjectivity: P&L statements are subject to the interpretation of the company’s management. There may be differences in the way different companies calculate their P&L statements.

Profit and Loss Applications

P&L statements are used in different industries, but the components of P&L can vary depending on the industry. For example, in the manufacturing industry, COGS may include the cost of raw materials, labor, and equipment, while in the service industry, it may include the cost of labor and other expenses related to service delivery.

Conclusion

In conclusion, the P&L statement is a vital financial statement that provides information about a company’s profitability over a specific period. The P&L statement includes revenue, COGS, and expenses, and it is calculated by subtracting COGS and expenses from revenue.

P&L statements are essential for assessing a company’s financial health, identifying areas for improvement, and making informed decisions. However, there are limitations to P&L statements, such as the limited timeframe and subjectivity. Nonetheless, P&L statements remain an essential tool for evaluating a company’s financial performance in different industries.

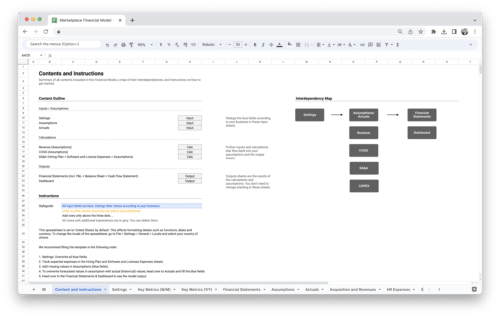

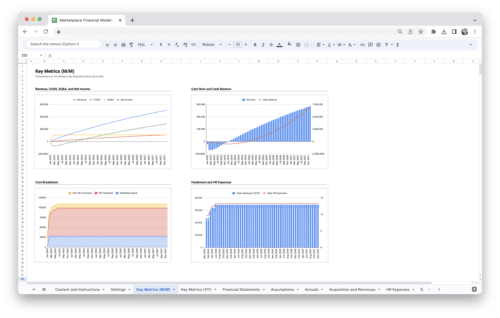

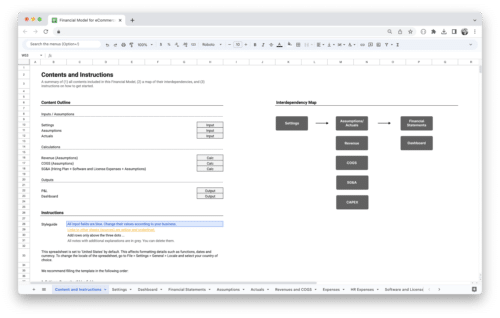

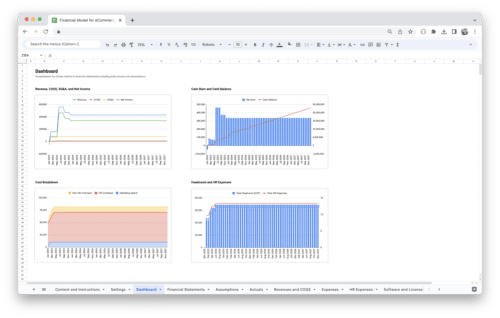

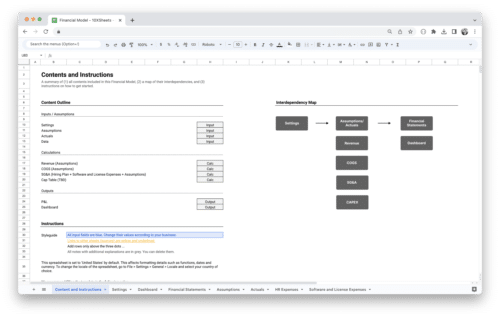

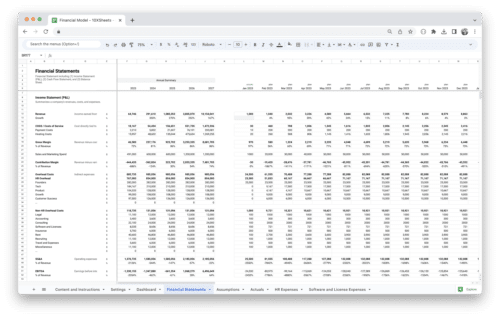

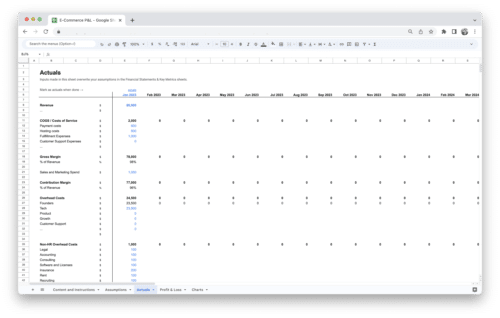

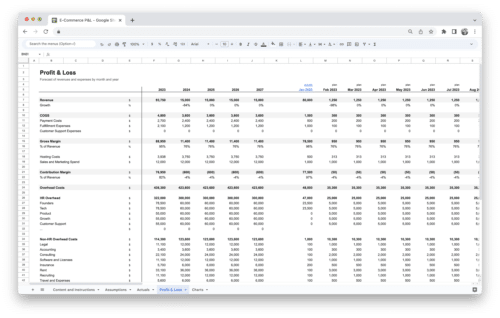

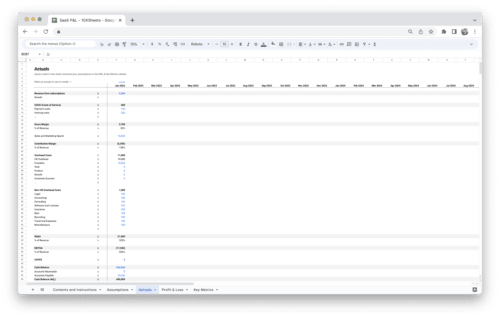

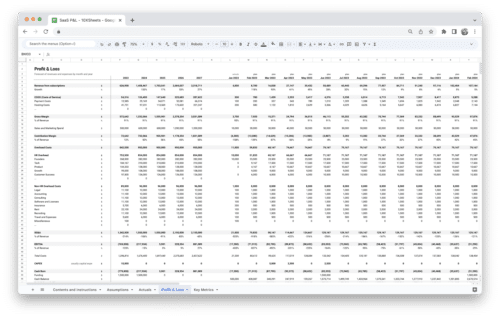

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.