Ever wondered how businesses track and manage the various expenses they incur while keeping their operations running smoothly? Understanding Period Costs is key to unraveling this mystery. From paying employee salaries to covering utility bills and marketing expenses, Period Costs encompass a wide range of expenditures necessary for day-to-day business operations.

In this guide, we’ll delve deep into the world of Period Costs, exploring their definition, types, significance in financial analysis, methods of allocation, and strategies for effective management. Whether you’re a business owner, manager, or investor, grasping the concept of Period Costs is essential for making informed decisions, optimizing resources, and ultimately achieving financial success.

What are Period Costs?

Period Costs refer to expenses incurred by a business during a specific accounting period, such as a month, quarter, or year. These costs are not directly associated with the production of goods or services but are necessary to support ongoing business operations. Period Costs are expensed on the income statement in the period they are incurred and typically include administrative expenses, selling expenses, marketing expenses, and depreciation.

Importance of Period Costs in Financial Analysis

Understanding the importance of Period Costs is essential for accurate financial analysis and decision-making within a business. Here are several reasons why Period Costs are significant:

- Profitability Analysis: Period Costs directly impact a company’s profitability by reducing net income on the income statement. Analyzing Period Costs helps assess the efficiency of cost management efforts and evaluate overall profitability.

- Cash Flow Management: Monitoring Period Costs helps businesses manage cash flow effectively by predicting and planning for future expenses. By understanding the timing and magnitude of Period Costs, businesses can ensure they have sufficient liquidity to cover their obligations.

- Investor and Stakeholder Perspective: Investors and stakeholders rely on financial statements to assess a company’s financial health and performance. Understanding Period Costs allows stakeholders to evaluate a company’s operating expenses, profitability margins, and sustainability over time.

- Cost Control and Efficiency: Analyzing Period Costs helps businesses identify cost-saving opportunities, streamline processes, and improve operational efficiency. By controlling Period Costs, businesses can enhance their competitiveness and profitability in the marketplace.

- Strategic Decision-Making: Period Costs provide valuable insights into a company’s cost structure and resource allocation. By understanding the composition and drivers of Period Costs, businesses can make informed decisions about pricing strategies, product mix, investment priorities, and resource allocation.

Recognizing the importance of Period Costs in financial analysis allows businesses to make informed decisions, optimize performance, and achieve long-term success and sustainability.

Types of Period Costs

Understanding the different types of Period Costs is essential for managing your business’s finances effectively. Let’s explore the various categories in more detail:

Fixed Period Costs

Fixed Period Costs are those expenses that remain constant over a specific period, irrespective of the level of production or sales volume. These costs are often associated with maintaining the infrastructure and operations of the business. Here are some examples:

- Rent: The cost of leasing office space or facilities remains the same each month, regardless of how much product is produced or sold.

- Salaries and Benefits: Certain salaries, such as those of administrative staff or management, are fixed and do not vary based on production levels.

- Insurance Premiums: Insurance costs for general liability, property insurance, or workers’ compensation are typically fixed expenses paid periodically.

- Software Subscriptions: Monthly or annual software subscriptions often have fixed costs that remain constant regardless of usage.

Managing fixed period costs involves careful budgeting and planning to ensure that the business can cover these expenses even during periods of low revenue or economic downturns.

Variable Period Costs

Variable Period Costs fluctuate in direct proportion to changes in production or sales volume. These costs tend to increase as production levels rise and decrease as production levels fall. Here are some examples:

- Raw Materials: The cost of raw materials used in production varies depending on the quantity of goods produced.

- Direct Labor: Wages paid to production workers or hourly employees directly involved in the manufacturing process fluctuate based on the number of hours worked.

- Sales Commissions: Commission-based compensation for sales staff is directly tied to the volume of sales generated.

- Shipping and Freight Costs: Costs associated with shipping products to customers vary based on the quantity and destination of shipments.

Variable period costs can be more challenging to predict and manage than fixed costs since they are directly tied to production levels. Effective inventory management and production planning can help mitigate the impact of variable costs on profitability.

Mixed Period Costs

Mixed Period Costs contain elements of both fixed and variable costs. These costs may have a fixed component that remains constant over time and a variable component that fluctuates based on activity levels. Mixed period costs are sometimes referred to as semi-variable costs. Examples include:

- Utilities: While some utility costs, such as basic service charges, remain fixed regardless of usage, the overall utility bill may increase or decrease based on consumption.

- Maintenance and Repairs: Routine maintenance costs may be fixed, while repair expenses vary depending on the frequency and extent of equipment breakdowns.

- Advertising and Marketing: While certain advertising expenses, such as retainer fees for marketing agencies, may be fixed, additional advertising spending may vary based on promotional campaigns and initiatives.

Managing mixed period costs requires a nuanced approach, balancing the fixed and variable components to ensure cost-effectiveness and efficiency. Analyzing historical data and trends can help businesses anticipate fluctuations in mixed costs and make informed decisions to control expenses.

Period Costs vs. Product Costs

Understanding the distinction between Period Costs and Product Costs is crucial for accurate financial reporting and decision-making within your business. Let’s delve deeper into each category:

What are Product Costs?

Product Costs, also known as inventoriable costs, are expenses directly associated with the production of goods or services. These costs are capitalized and recorded as assets on the balance sheet until the products are sold, at which point they are expensed as Cost of Goods Sold (COGS) on the income statement. Product Costs typically include:

- Direct Materials: The cost of raw materials or components used in manufacturing a product.

- Direct Labor: Wages paid to workers directly involved in the manufacturing process, such as assembly line workers or machine operators.

- Manufacturing Overhead: Indirect costs incurred during the production process, such as factory rent, utilities, and equipment depreciation.

Product Costs are essential for calculating the cost of goods sold and determining the gross profit margin of a business.

Key Differences between Period Costs and Product Costs

While both Period Costs and Product Costs are necessary for running a business, they differ in several key aspects:

- Timing of Expense Recognition: Period Costs are expensed in the period they are incurred, regardless of when the associated revenue is generated. In contrast, Product Costs are capitalized and expensed only when the products are sold.

- Relation to Production: Product Costs are directly tied to the production process and vary with changes in production levels. Period Costs, on the other hand, are not directly linked to production and may remain unchanged despite fluctuations in output.

- Treatment in Financial Statements: Product Costs are recorded as assets on the balance sheet and expensed as Cost of Goods Sold (COGS) on the income statement when the products are sold. Period Costs, however, are expensed on the income statement in the period they are incurred, reducing net income directly.

Understanding these differences is essential for accurate financial reporting and analysis. By properly classifying costs as either Period Costs or Product Costs, businesses can assess their profitability, make informed pricing decisions, and allocate resources effectively.

Period Costs Examples

To gain a deeper understanding of Period Costs, let’s explore some common examples that businesses encounter:

Administrative Expenses

Administrative Expenses encompass the costs associated with running the day-to-day operations of a business. These expenses are essential for maintaining the organization’s infrastructure and supporting its administrative functions. Examples of administrative expenses include:

- Salaries and Wages: Compensation paid to administrative staff, including executives, office managers, receptionists, and other support personnel.

- Office Supplies: Costs associated with purchasing office supplies such as paper, ink cartridges, pens, and stationery.

- Utilities: Expenses related to utilities such as electricity, water, and internet services for office spaces.

- Rent and Lease Payments: The cost of leasing office space or renting facilities for business operations.

- Insurance Premiums: Insurance costs for general liability, property insurance, workers’ compensation, and other types of coverage.

- Professional Fees: Fees paid to legal, accounting, and consulting firms for professional services.

Managing administrative expenses effectively involves optimizing processes, reducing waste, and ensuring that resources are allocated efficiently to support the organization’s goals and objectives.

Selling Expenses

Selling Expenses include costs associated with promoting and selling products or services to customers. These expenses are incurred to generate sales revenue and drive business growth. Examples of selling expenses include:

- Sales Commissions: Commission-based compensation paid to sales representatives or agents for securing sales and generating revenue.

- Advertising and Marketing: Costs associated with advertising campaigns, marketing initiatives, and promotional activities to attract customers and increase brand awareness.

- Sales Materials: Expenses related to producing sales collateral, brochures, catalogs, and product samples for distribution to potential customers.

- Trade Shows and Events: Costs associated with participating in trade shows, industry conferences, and promotional events to showcase products and services.

- Travel and Entertainment: Expenses incurred for business travel, client meetings, and entertaining customers to cultivate relationships and close sales.

Effective management of selling expenses involves targeting the right audience, optimizing marketing channels, and measuring the return on investment (ROI) of sales and marketing initiatives.

Marketing Expenses

Marketing Expenses refer to the costs associated with promoting products or services and communicating their value proposition to target audiences. Marketing expenses are essential for creating brand awareness, generating leads, and driving customer engagement. Examples of marketing expenses include:

- Digital Marketing: Costs associated with online marketing channels such as search engine optimization (SEO), pay-per-click (PPC) advertising, social media marketing, email marketing, and content marketing.

- Print Advertising: Expenses related to placing advertisements in newspapers, magazines, trade publications, and direct mail campaigns.

- Public Relations (PR): Costs associated with PR efforts, including press releases, media relations, events, and sponsorships to enhance the company’s reputation and manage public perception.

- Branding and Design: Expenses for branding activities, logo design, packaging design, and brand identity development to create a consistent and memorable brand image.

- Market Research: Costs incurred for market research, consumer surveys, focus groups, and competitive analysis to understand customer needs and preferences.

Effective management of marketing expenses involves aligning marketing strategies with business objectives, measuring campaign performance, and optimizing marketing spend to achieve the desired outcomes.

Depreciation

Depreciation represents the systematic allocation of the cost of tangible assets over their useful lives. Although depreciation is a non-cash expense, it is considered a Period Cost because it is incurred over time rather than directly tied to the production of goods or services. Examples of assets subject to depreciation include:

- Property, Plant, and Equipment (PP&E): Tangible assets such as buildings, machinery, equipment, vehicles, and furniture used in the business operations.

- Intangible Assets: Non-physical assets such as patents, trademarks, copyrights, and software licenses with finite useful lives.

Depreciation expense is calculated using various methods such as straight-line depreciation, declining balance depreciation, and units of production depreciation. The choice of depreciation method depends on factors such as asset usage patterns, expected future cash flows, and accounting policies.

Managing depreciation expenses involves accurately calculating depreciation for each asset, recording depreciation expense in the accounting records, and complying with accounting standards and regulatory requirements. Additionally, businesses must periodically assess the carrying value of assets for impairment and adjust depreciation estimates as needed to reflect changes in asset values or useful lives.

Importance of Period Costs in Financial Statements

Understanding the significance of Period Costs in financial statements is essential for evaluating a company’s performance and making informed decisions. Let’s explore how Period Costs impact both the income statement and the balance sheet, as well as their significance for decision-making:

Impact on Income Statement

Period Costs directly affect the company’s profitability by reducing net income on the income statement. These expenses are deducted from revenues to calculate operating income, reflecting the costs incurred to support the business’s ongoing operations. By recognizing Period Costs in the income statement, stakeholders can assess the company’s ability to generate profits from its core activities and evaluate its operating efficiency over time.

Period Costs are typically classified as selling, general, and administrative expenses (SG&A) on the income statement. Examples include salaries and wages, rent, utilities, marketing expenses, and depreciation. Analyzing trends in Period Costs allows stakeholders to identify cost-saving opportunities, assess cost management effectiveness, and evaluate overall financial performance.

Effect on Balance Sheet

While Period Costs are expensed on the income statement in the period they are incurred, they do not directly impact the balance sheet. Unlike Product Costs, which are capitalized as assets until the products are sold, Period Costs are not associated with the creation of inventory and are expensed immediately. As a result, Period Costs do not affect the company’s assets, liabilities, or equity on the balance sheet.

However, managing Period Costs effectively indirectly impacts the balance sheet by influencing cash flow, liquidity, and profitability. By controlling Period Costs and optimizing spending, businesses can improve their bottom line profitability, increase cash reserves, and enhance overall financial stability. For example, reducing administrative expenses can lead to higher net income and retained earnings, strengthening the company’s financial position.

Significance for Decision Making

Period Costs play a crucial role in decision-making processes, guiding strategic initiatives and resource allocation within the organization. Understanding the composition and drivers of Period Costs enables management to make informed decisions to improve operational efficiency, reduce expenses, and enhance profitability. Here’s why Period Costs are significant for decision-making:

- Cost Control: Monitoring and managing Period Costs help businesses identify inefficiencies, streamline processes, and control expenses to achieve cost reduction objectives.

- Budgeting and Forecasting: Accurately forecasting Period Costs allows businesses to develop realistic budgets, allocate resources effectively, and evaluate financial performance against targets.

- Performance Evaluation: Analyzing Period Costs enables management to evaluate the performance of different departments, business units, or product lines and identify areas for improvement.

- Investment Decisions: Considering Period Costs in investment decisions helps businesses assess the potential return on investment (ROI) and allocate capital to projects or initiatives that generate the highest value.

By leveraging Period Cost data in decision-making processes, businesses can enhance operational efficiency, mitigate risks, and achieve sustainable growth and profitability in the long term.

How to Allocate Period Costs?

Allocating Period Costs is a crucial aspect of cost accounting that allows businesses to assign expenses to specific cost objects, such as products, services, or departments. Let’s explore the various methods of allocating Period Costs in more detail:

Direct Allocation

Direct Allocation involves assigning Period Costs directly to the specific cost object based on a clear cause-and-effect relationship. This method is straightforward and suitable for costs that can be easily traced to a single cost object. Examples of costs that can be directly allocated include:

- Direct Labor: Wages paid to employees who work exclusively on a particular project or product.

- Direct Materials: The cost of raw materials used in manufacturing a specific product.

- Sales Commissions: Commission expenses directly related to a particular sales transaction.

Direct allocation provides a simple and transparent way to assign costs to cost objects, making it easier to trace expenses and calculate the true cost of producing goods or services. However, not all Period Costs can be directly allocated, especially those that benefit multiple cost objects simultaneously.

Indirect Allocation

Indirect Allocation, also known as overhead allocation, involves distributing Period Costs to cost objects based on predetermined allocation bases. These allocation bases may include factors such as labor hours, machine hours, square footage, or production volume. Indirect costs are shared among multiple cost objects and cannot be easily traced to a specific product or service. Examples of indirect costs include:

- Factory Rent: The cost of renting a factory space that benefits multiple production lines or departments.

- Utilities: Expenses for electricity, water, and heating that are used by various departments within the organization.

- Administrative Salaries: Salaries of administrative staff who support multiple departments or functions.

Indirect allocation requires careful consideration of allocation bases to ensure that costs are allocated fairly and accurately. Common methods of indirect allocation include the use of predetermined overhead rates or activity-based costing (ABC) systems.

Activity-Based Costing (ABC)

Activity-Based Costing (ABC) is a sophisticated method of allocating Period Costs that identifies and assigns costs to specific activities or processes within an organization. ABC recognizes that not all activities consume resources at the same rate and seeks to allocate costs based on the actual drivers of those activities. ABC involves the following steps:

- Identifying Activities: Identify the key activities or processes involved in producing goods or delivering services.

- Assigning Costs to Activities: Determine the costs associated with each activity, including both direct and indirect costs.

- Determining Cost Drivers: Identify the factors that drive the consumption of resources for each activity, such as machine hours, setup time, or number of orders.

- Allocating Costs to Cost Objects: Allocate costs to cost objects based on their consumption of the activity’s resources using appropriate cost drivers.

ABC provides a more accurate understanding of cost behavior and cost drivers, enabling businesses to make more informed decisions about pricing, product mix, and process improvement. By aligning costs with activities that drive value, ABC helps businesses optimize their operations and improve profitability.

Choosing the appropriate method of allocating Period Costs depends on factors such as the nature of the business, the complexity of operations, and the availability of data. By implementing effective cost allocation methods, businesses can gain insights into their cost structure, enhance decision-making capabilities, and ultimately drive sustainable growth and profitability.

How to Manage Period Costs Effectively?

Effectively managing Period Costs is crucial for maintaining profitability and sustainability in business operations. Let’s explore some key strategies and techniques for managing Period Costs effectively:

Cost Reduction Strategies

Cost reduction strategies aim to minimize expenses without compromising the quality of products or services. Implementing cost reduction measures requires a comprehensive approach that identifies opportunities for streamlining processes, optimizing resources, and eliminating waste. Here are some effective cost reduction strategies:

- Negotiating Supplier Contracts: Negotiate with suppliers and vendors to secure favorable terms, discounts, or volume pricing agreements.

- Implementing Lean Practices: Adopt lean manufacturing principles to streamline workflows, reduce lead times, and eliminate non-value-added activities.

- Outsourcing Non-Core Functions: Consider outsourcing non-core functions or services to third-party providers to reduce overhead costs and focus internal resources on core business activities.

- Implementing Technology Solutions: Invest in technology solutions such as automation, software applications, and data analytics tools to improve efficiency and reduce labor costs.

- Energy Efficiency Measures: Implement energy-saving initiatives and sustainable practices to reduce utility expenses and minimize environmental impact.

By identifying and implementing cost reduction strategies, businesses can lower their operating expenses, improve profit margins, and enhance competitiveness in the marketplace.

Budgeting and Forecasting Techniques

Budgeting and forecasting play a critical role in managing Period Costs by providing a roadmap for allocating resources and controlling expenses. Effective budgeting and forecasting techniques enable businesses to plan ahead, set financial goals, and monitor performance against targets. Here are some key techniques for budgeting and forecasting Period Costs:

- Zero-Based Budgeting (ZBB): Zero-based budgeting requires departments to justify all expenses from scratch, rather than using historical budgets as a baseline. This approach encourages cost-consciousness and helps identify opportunities for cost savings.

- Rolling Forecasts: Rolling forecasts involve continuously updating and revising financial projections based on actual performance and changing market conditions. This dynamic approach allows businesses to adapt quickly to unforeseen events and make timely adjustments to resource allocation.

- Variance Analysis: Conduct variance analysis to compare actual Period Costs against budgeted amounts and identify significant deviations. Analyzing variances helps pinpoint areas of overspending or inefficiency that require corrective action.

- Flexible Budgeting: Develop flexible budgets that adjust for changes in activity levels or production volumes. Flexible budgets allow for better cost control and resource allocation in dynamic business environments.

- Scenario Planning: Perform scenario analysis to assess the potential impact of various economic scenarios or market conditions on Period Costs. Scenario planning helps businesses anticipate risks and develop contingency plans to mitigate adverse effects.

By leveraging budgeting and forecasting techniques, businesses can improve financial planning, optimize resource allocation, and enhance decision-making capabilities.

Performance Evaluation and Monitoring

Performance evaluation and monitoring involve tracking and analyzing Period Costs to assess operational efficiency, identify areas for improvement, and measure progress towards strategic objectives. Effective performance evaluation techniques enable businesses to evaluate the effectiveness of cost management efforts and make data-driven decisions. Here are some key strategies for performance evaluation and monitoring:

- Key Performance Indicators (KPIs): Define and track relevant KPIs related to Period Costs, such as cost per unit produced, cost-to-income ratios, or overhead absorption rates. KPIs provide actionable insights into cost performance and help identify areas requiring attention.

- Benchmarking: Compare Period Costs against industry benchmarks or best practices to assess performance relative to peers or competitors. Benchmarking highlights areas of strength and opportunities for improvement.

- Regular Reporting and Analysis: Establish a regular reporting cadence to review Period Costs and variance analysis reports. Conduct in-depth analysis to identify root causes of variances and develop strategies for improvement.

- Continuous Improvement Initiatives: Foster a culture of continuous improvement by encouraging feedback, implementing process enhancements, and empowering employees to identify and address inefficiencies.

By implementing robust performance evaluation and monitoring processes, businesses can identify cost-saving opportunities, optimize resource utilization, and drive sustainable growth and profitability.

Conclusion

Understanding Period Costs is crucial for any business looking to navigate the complex landscape of financial management. By grasping the distinction between Period Costs and Product Costs, businesses can accurately assess their expenses and make informed decisions to improve profitability. From administrative and selling expenses to marketing costs and depreciation, every Period Cost plays a role in shaping a company’s financial health.

Effective management of Period Costs involves implementing cost reduction strategies, budgeting and forecasting techniques, and performance evaluation measures. By optimizing spending, monitoring performance, and making data-driven decisions, businesses can enhance their competitiveness, maximize profitability, and achieve long-term success.

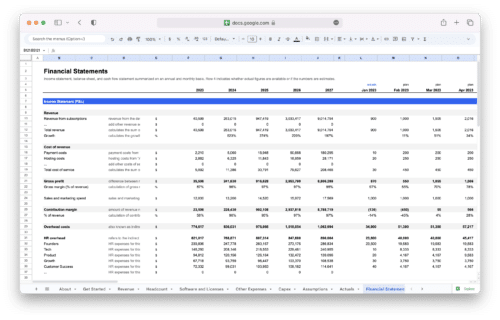

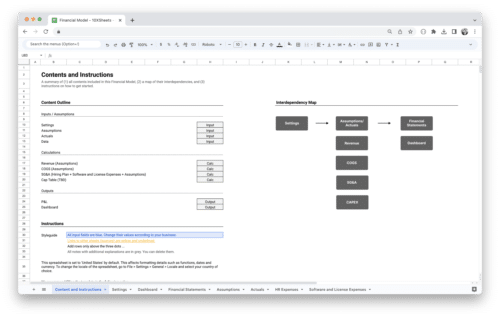

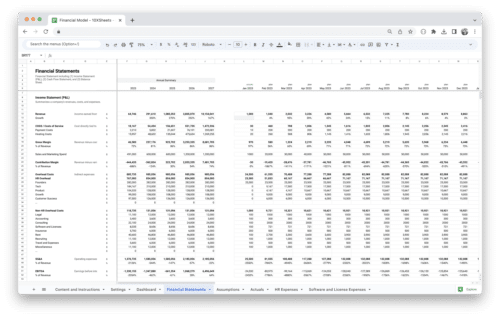

Get Started With a Prebuilt Template!

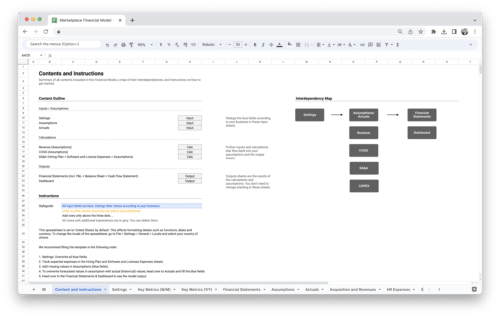

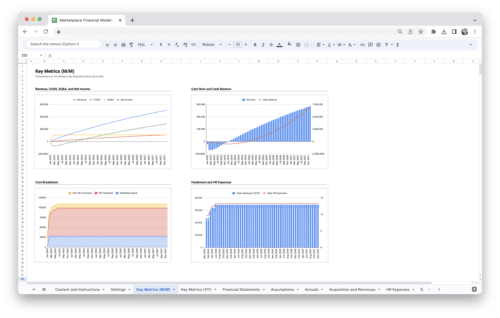

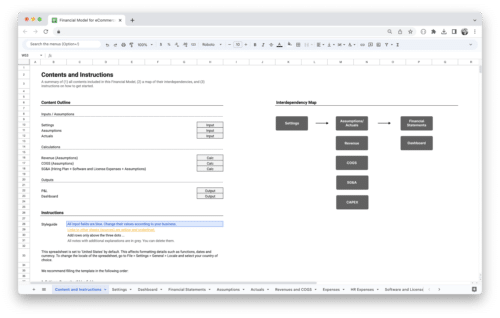

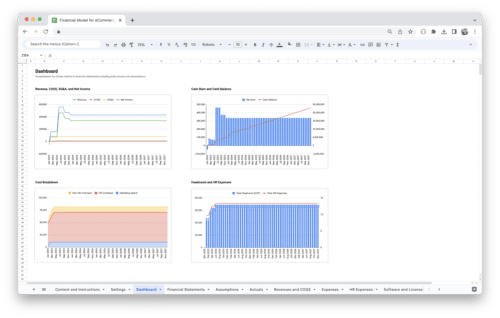

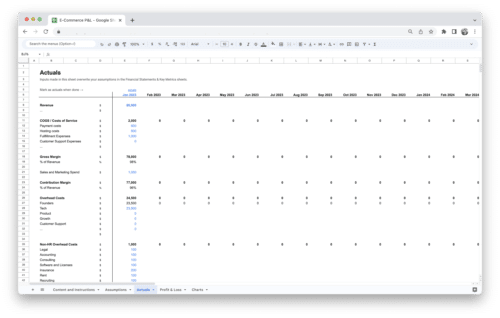

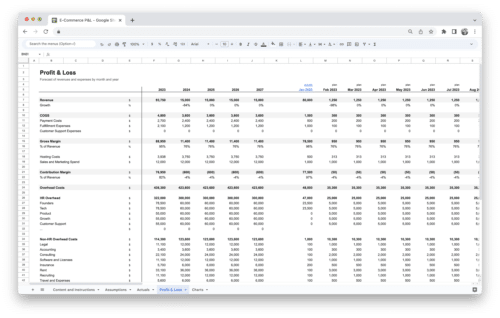

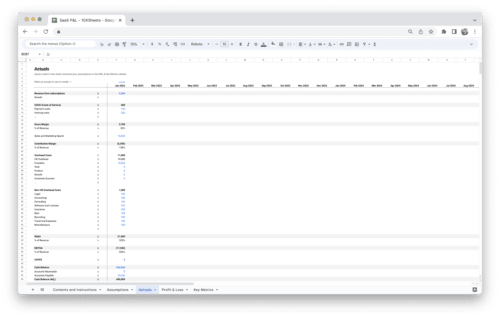

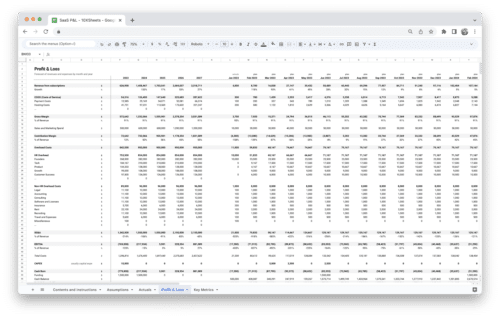

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.