Operating expenses are the costs incurred by a company in the process of running its business operations. These expenses are essential to keep the business running, and they include items such as rent, utilities, payroll, insurance, taxes, and other costs necessary to produce and sell a company’s goods or services. In this glossary entry, we will define operating expenses, provide examples of common operating expenses, and discuss how to calculate them.

What are Operating Expenses?

Operating expenses are the costs incurred by a company in the regular course of its business operations. These expenses are typically recurring and necessary for the business to continue operating. Operating expenses can be broken down into two categories: fixed and variable.

- Fixed operating expenses are expenses that do not change regardless of the level of business activity. Examples of fixed operating expenses include rent, property taxes, insurance, and salaries for fixed employees.

- Variable operating expenses are expenses that fluctuate based on the level of business activity. Examples of variable operating expenses include costs of goods sold, sales commissions, and utilities. The more a company produces or sells, the higher the variable operating expenses will be.

Examples of Operating Expenses

There are many types of operating expenses that a company may incur in the regular course of its business operations. Some common examples of operating expenses include:

- Salaries and wages: This includes the compensation paid to employees for their work, including benefits, payroll taxes, and other related expenses.

- Rent: This includes the cost of leasing or renting space for business operations.

- Utilities: This includes expenses related to electricity, gas, water, and other utilities required to operate the business.

- Insurance: This includes various types of insurance coverage, such as liability insurance, property insurance, and workers’ compensation insurance.

- Taxes: This includes all taxes levied on the business, including income tax, sales tax, property tax, and payroll tax.

- Depreciation and amortization: This includes the systematic allocation of the cost of long-term assets over their useful lives.

- Office supplies: This includes expenses related to office supplies, such as paper, ink, pens, and other materials used in the regular course of business.

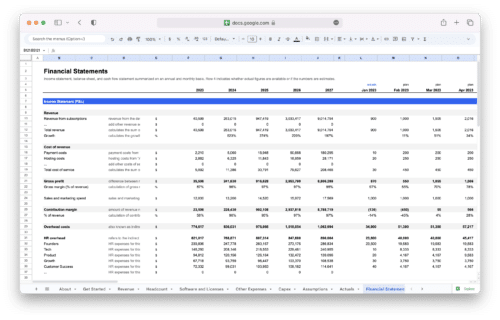

How to Calculate Operating Expenses?

Operating expenses are typically calculated on an annual basis. To calculate operating expenses, you need to add up all the expenses incurred during the year. The formula for calculating operating expenses is:

Operating expenses = cost of goods sold + operating expenses – depreciation and amortization

Here’s an example of how to calculate operating expenses:

Suppose a company had the following expenses for the year:

- Cost of goods sold = $200,000

- Operating expenses = $50,000

- Depreciation and amortization = $10,000

To calculate operating expenses, we would use the following formula:

Operating expenses = $200,000 + $50,000 – $10,000 = $240,000

This means that the company incurred $240,000 in operating expenses for the year.

Conclusion

Operating expenses are an essential part of running a business. They include all the costs incurred in the regular course of business operations, including fixed and variable expenses. Examples of operating expenses include salaries and wages, rent, utilities, insurance, taxes, depreciation and amortization, and office supplies. To calculate operating expenses, you need to add up all the expenses incurred during the year and subtract depreciation and amortization. By understanding operating expenses, companies can better manage their finances and make informed decisions to improve profitability.

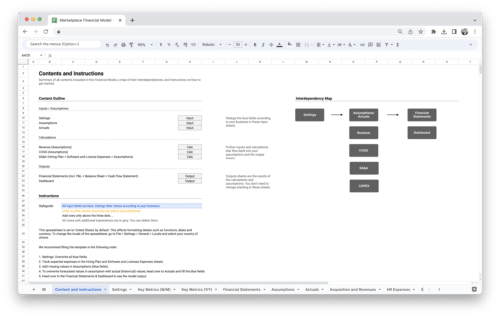

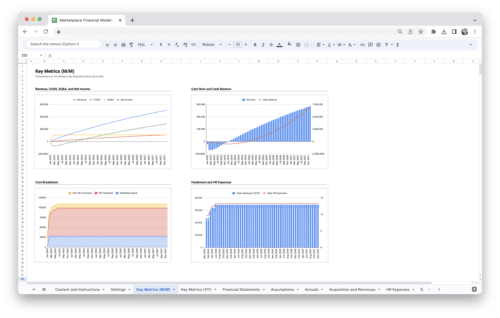

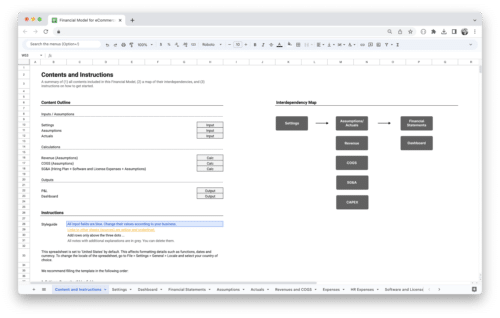

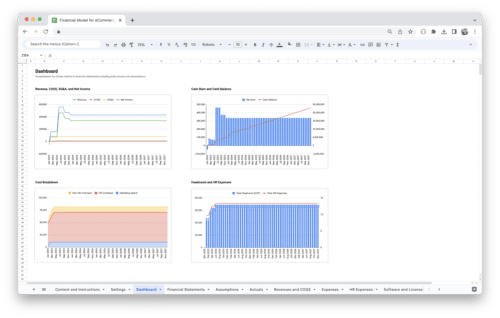

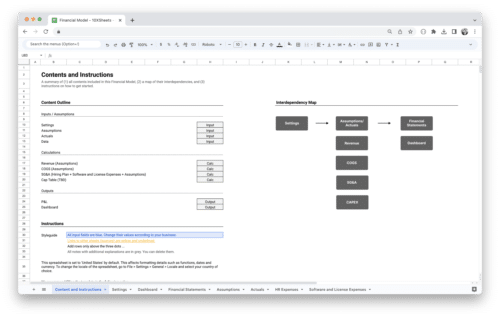

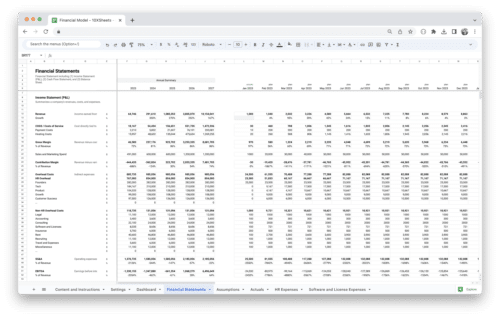

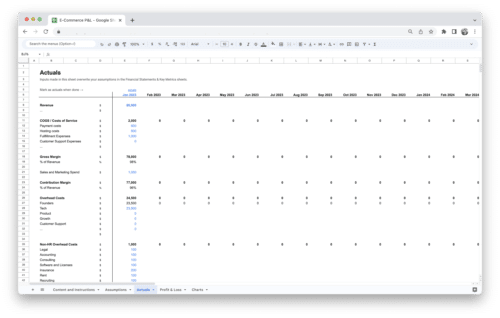

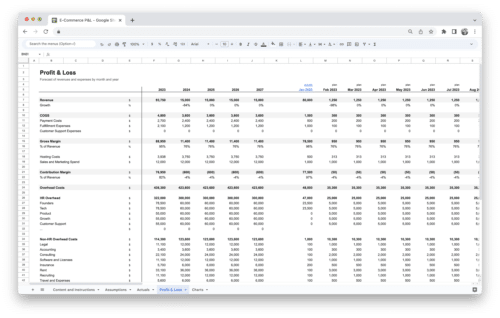

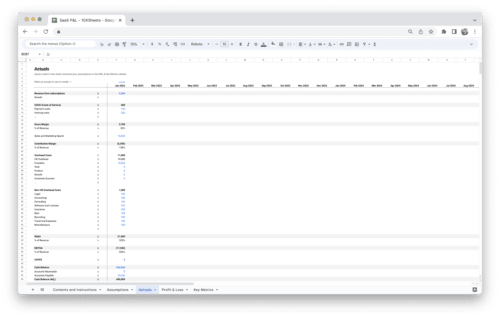

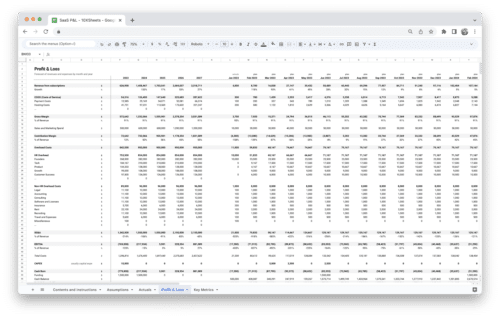

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.