Have you ever wondered what makes a great invoice and why it’s so important for your business? Invoices are more than just a request for payment—they’re a key part of keeping your business organized, compliant, and on track financially.

Whether you’re a freelancer, small business owner, or managing a larger enterprise, understanding how to create, manage, and utilize invoices effectively is essential for smooth operations. From setting clear payment terms to keeping your cash flow steady, invoices play a vital role in ensuring your business runs efficiently and your clients are happy.

What is an Invoice?

An invoice is a formal request for payment issued by a seller to a buyer for goods or services provided. It outlines the terms of the transaction, including the items or services purchased, the cost, applicable taxes, and payment terms. Invoices act as a legally binding document that records the details of the transaction and ensures both parties are clear about what is owed and when payment is expected.

Purpose of an Invoice

An invoice serves several critical purposes in the business world:

- Clearly documents the details of a transaction, including what was sold, how much was sold, and at what price.

- Establishes a payment expectation and provides the buyer with the necessary details to fulfill payment.

- Serves as a legal document that can be used in case of disputes or audits.

- Helps businesses track revenue and manage accounts receivable.

- Provides necessary information for tax purposes, including the amount of sales tax or VAT charged.

Importance of Invoices in Business Transactions

Invoices are crucial for the smooth operation of any business and play a key role in ensuring financial accuracy and legal compliance:

- Facilitate clear communication between buyer and seller about the terms of the transaction, helping prevent misunderstandings.

- Help businesses manage cash flow by providing a formal record of what is owed and by when.

- Serve as an essential tool for tax reporting, helping businesses calculate and remit the correct amount of taxes.

- Protect both buyers and sellers by providing documentation that can be used in case of disputes or for legal purposes.

- Enable businesses to maintain organized records of their sales and purchases, which is essential for accurate accounting and reporting.

Types of Invoices

Different types of invoices are used based on the nature of the transaction or the relationship between the buyer and seller. Each serves a specific purpose:

- Standard Invoice: Used for one-time transactions with a clear list of goods or services provided, typically issued after a product or service has been delivered.

- Recurring Invoice: Sent at regular intervals, such as monthly or annually, for ongoing services or subscriptions, such as utilities or SaaS products.

- Proforma Invoice: A preliminary or pre-sale document that outlines the details of a potential transaction, often used for quotes or to confirm the buyer’s intent to purchase.

- Credit Invoice: Issued when the buyer is entitled to a refund, discount, or adjustment, often used in cases of returned goods or billing errors.

- Debit Invoice: Sent when additional charges need to be applied to a previous invoice, such as for additional products or services that were not originally included.

- Electronic Invoice (E-Invoice): A digital version of an invoice, usually sent through email or invoicing software, offering faster processing, better organization, and often automated payment tracking.

Components of an Invoice

Creating an invoice is not just about asking for payment; it’s about making sure that both parties are clear on the details of the transaction. A well-structured invoice ensures that your client knows exactly what they owe, why they owe it, and how they can make the payment. Here are the critical elements that make up a complete and professional invoice.

Seller and Buyer Information

Your invoice should clearly display the information of both the seller (you) and the buyer. This includes not only the business name but also contact details, such as addresses, phone numbers, and email addresses. This is vital because, if there’s ever a dispute or a need for clarification, both parties need to be easily identifiable. Additionally, providing clear contact information ensures that the buyer can easily reach out if they need to discuss the invoice.

When it comes to the buyer’s details, always make sure you have the correct billing address and company name, especially for larger clients who may have different billing departments or multiple locations. This avoids any mix-ups when your client processes the payment, ensuring it’s correctly assigned to the right account.

Invoice Number and Date

An invoice number is essential for tracking your invoices and maintaining order in your financial records. Each invoice you issue should have a unique number that’s easy to track and refer back to. This helps you and your client stay organized and ensures there’s no confusion between invoices, especially when you’re managing multiple clients or transactions.

The invoice date is another crucial component. This indicates when the goods or services were provided, and it’s used to calculate the due date based on the payment terms. Including a date on your invoices also allows you to track how long it takes to receive payment, which can help you analyze your cash flow and adjust your payment terms accordingly.

Itemized List of Goods or Services Provided

One of the most important parts of an invoice is the itemized list of the goods or services you’ve provided. This section should break down exactly what the client is paying for, showing each product or service along with the quantity, unit price, and the total for each item.

For example, if you’re providing a service, you might list each phase of a project, like “Initial Consultation,” “Design Phase,” and “Final Delivery,” with the corresponding price for each. If you’re selling physical products, list each product with a brief description, quantity, price per unit, and total cost.

By including an itemized list, you help your client understand the value of what they’re receiving, which can increase the likelihood of timely payment and reduce the chances of disputes. It also provides a clear record of what was delivered, should any questions arise later.

Payment Terms and Conditions

Your payment terms are the rules you set for the buyer regarding when and how the payment should be made. This could include things like due dates, early payment discounts, late fees, and acceptable payment methods.

For instance, you might set Net 30 as your payment term, meaning the invoice is due within 30 days of the date issued. If you offer an early payment discount (such as 5% off the total for payment within 10 days), make sure to clearly state this. Likewise, if you charge a late fee for payments made past the due date, specify the fee amount or percentage so the buyer is aware of the consequences for not paying on time.

Clearly defined payment terms ensure there are no surprises and help set expectations from the beginning. When both parties are aware of the terms, it can avoid confusion and potential disputes down the line.

Total Amount Due, Taxes, and Discounts

At the end of the itemized list, you need to clearly show the total amount due. This includes the sum of all goods and services provided, plus any taxes, and any applicable discounts.

If taxes apply, make sure to specify the tax rate (such as VAT) and calculate the amount separately. For example, if you’re selling a product for $100 and the tax rate is 10%, you’d add $10 to the total, giving your client a final total of $110. Similarly, if you offer any discounts, such as a seasonal sale or an early payment discount, subtract that amount from the subtotal.

The key here is clarity: make sure the client understands exactly how the total was calculated. This reduces the chance of disputes and makes it easier for both parties to verify that the amounts are correct.

Payment Methods and Instructions

You should also provide clear payment instructions on your invoice. This includes specifying the methods of payment you accept (such as credit cards, bank transfers, or online payment systems like PayPal). If you prefer one payment method over others, be sure to mention this.

For instance, if you’re accepting payments by wire transfer, include the necessary bank details, such as your IBAN and SWIFT code. If you accept PayPal, include your account details. If your business deals internationally, it’s essential to provide details for international payments, such as currency and any relevant charges.

Including these instructions makes it easy for your client to pay promptly without any confusion. It also ensures they’re paying in the way you prefer, saving time and reducing the likelihood of payment delays.

How to Create an Invoice?

Creating an invoice is one of the most important tasks you’ll do as a business owner, freelancer, or entrepreneur. Whether you choose to manually create your invoices or leverage invoicing software, the process needs to be efficient and professional. Let’s break down the key steps in creating an invoice, the pros and cons of manual versus software-generated invoices, and how to make sure your invoice fits your business’s needs.

Manual versus Software-Generated Invoices

When it comes to creating invoices, you have two main options: doing it manually or using invoicing software. Each approach has its own benefits and challenges, so the best option will depend on your business’s needs and the volume of invoices you’re processing.

Manual Invoices

Creating invoices manually might seem like a straightforward option, especially if you’re just starting out or have a small number of clients. Typically, this involves using a word processor (like Microsoft Word or Google Docs) or a spreadsheet (such as Excel or Google Sheets) to create your invoices. While it’s easy to do, there are a few challenges:

- Time-consuming: Each invoice needs to be created from scratch, and every time you need to update details or send a reminder, you have to repeat the process.

- Risk of errors: Manually calculating totals, taxes, and discounts can result in mistakes, which can lead to payment delays or disputes.

- Limited scalability: As your business grows, manually creating invoices becomes inefficient and harder to track, especially if you need to issue multiple invoices regularly.

Software-Generated Invoices

Invoicing software provides a more streamlined solution, especially if you need to send invoices regularly or manage a large number of clients. These tools are designed to automate much of the invoicing process, offering several advantages:

- Automation: Invoicing software can automatically generate invoices, apply taxes and discounts, and even send payment reminders. This frees up your time and ensures that your invoices are accurate.

- Customization: Many invoicing tools allow you to personalize your invoices with your branding, logos, and preferred formats.

- Integrated record-keeping: Software often integrates with accounting tools, making it easier to track payments, reconcile accounts, and analyze cash flow.

- Scalability: As your business grows, software-generated invoices allow you to efficiently manage a larger volume of transactions without sacrificing accuracy or efficiency.

Ultimately, if you’re just starting out or only deal with a few clients, manually creating invoices might work fine. However, as your business scales, investing in invoicing software can save time, reduce errors, and improve efficiency.

How to Design a Professional Invoice

A professional-looking invoice helps reinforce your brand and increases the likelihood that your client will take the invoice seriously and pay promptly. Whether you’re creating invoices manually or using software, here’s how you can design an invoice that leaves a lasting, professional impression.

- Use your branding: Ensure your business name, logo, and contact information are prominent at the top of the invoice. This establishes your identity and makes the invoice look polished and official. Stick to your brand colors and fonts for consistency.

- Create a clean layout: The design of your invoice should be simple and easy to read. Use clear headings, bold fonts for important details, and plenty of white space to avoid clutter. Organize the information logically, with clear distinctions between sections (e.g., seller and buyer information, itemized list, payment details).

- Make it organized: Keep the structure neat with proper alignment and formatting. For example, list itemized products or services in a table format with rows for quantity, description, unit price, and total amount. This makes the invoice easier to read and understand.

- Include important legal details: Your invoice is not just a payment request; it’s also a legal document. Make sure to include all necessary legal information, such as payment terms, tax information (like VAT or sales tax), and any regulatory requirements your business needs to adhere to.

- Number and date it correctly: Your invoice should have a unique invoice number for tracking, as well as a clear issue date to help both you and your client keep track of when the payment is due.

If you use invoicing software, many platforms offer pre-designed templates that you can customize, so you don’t have to worry about designing from scratch. These templates are professional, responsive, and meet most invoicing requirements.

Customizing Invoices for Different Business Needs

Every business is unique, and your invoices should reflect that. Depending on your industry, client relationships, or the complexity of the products or services you provide, you may need to customize your invoices to fit your specific needs. Here’s how you can make sure your invoices are tailored to your business:

- Service-based businesses: If you offer services, break down each phase of the project or the type of service provided. For instance, if you’re a consultant, your invoice might list services like “initial consultation,” “research,” “strategy development,” etc., each with its own rate. This helps the client understand exactly what they’re paying for.

- Product-based businesses: If you sell physical products, list each item with its name, description, and quantity. It’s important to include product codes, SKU numbers, or other identifiers if your products are more complex or varied. You can also provide additional details like the delivery method or tracking numbers.

- Project-based or retainer contracts: If you work on long-term projects or under a retainer agreement, include project milestones, payment schedules, and progress reports. This ensures that both you and your client are aligned on the work completed and payments due at each stage.

- International transactions: When dealing with international clients, you may need to adjust your invoices to reflect the currency used, country-specific tax rates (e.g., VAT), and any additional charges related to international shipping or fees. Always check the invoicing laws of the client’s country to ensure compliance.

- Subscription or recurring payments: If you run a subscription-based business, your invoices should clearly state the billing period, the recurring fee, and the payment terms. Include a note that outlines the payment cycle (e.g., monthly, yearly) to avoid confusion.

- Discounts and special pricing: If you’re offering discounts, provide a clear breakdown showing the original price, discount percentage, and the final price after applying the discount. If you have special pricing for long-term clients, make sure those terms are clearly communicated.

Customization not only makes your invoices look more professional but also helps your clients better understand what they’re paying for, reducing potential confusion or disputes. Tailoring your invoices to suit the specific needs of your business is essential for maintaining good client relationships and managing your finances effectively.

Invoice Template

Having a clear, professional invoice template can make your billing process more efficient and ensure consistency across all your transactions. A well-structured invoice template not only simplifies the process for you but also makes it easy for your clients to understand the charges and terms. Below is a detailed invoice template that can be customized to fit any business need. It covers all the essential components while maintaining a clean, professional layout.

Invoice Template Example

Invoice Number: [Enter unique invoice number] Date Issued: [Enter date] Due Date: [Enter due date]

Seller Details:[Your Business Name] [Your Business Address] [City, State, ZIP Code] Phone: [Your Phone Number] Email: [Your Email Address] Website: [Your Website]

Buyer Details:[Client’s Business Name] [Client’s Business Address] [City, State, ZIP Code] Phone: [Client’s Phone Number] Email: [Client’s Email Address]

Description of Goods/Services:

| Item Number | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| [001] | [Service/Product Description] | [Qty] | [$ Price] | [$ Total] |

| [002] | [Service/Product Description] | [Qty] | [$ Price] | [$ Total] |

| Subtotal | [$ Total] | |||

| Sales Tax (X%) | [$ Amount] | |||

| Total Amount Due | [$ Total] |

Payment Terms:

- Payment due within [X] days from the invoice date.

- Please make the payment via [preferred payment method, e.g., bank transfer, PayPal, credit card].

- A late fee of [X%] will be applied if payment is not received by the due date.

Notes:

[Additional information or instructions can be added here, such as payment instructions, return policies, or any other relevant details.]This template covers all the essential information needed for clear communication between you and your client, ensuring there are no ambiguities regarding what is owed. It includes:

- Seller and Buyer Information: Clearly lists the details of both parties involved in the transaction, ensuring they are easily identifiable.

- Invoice Number and Dates: Helps with tracking the invoice and establishes a timeline for when payment is due.

- Itemized List of Goods or Services: Breaks down the products or services provided, along with quantities, unit prices, and the total cost for each item. This clarity helps the client understand what they’re paying for.

- Taxes and Total Amount Due: Ensures all taxes are included, and the final amount to be paid is clearly listed. If you’re using any discounts, you can also add that information here.

- Payment Terms: Specifies when payment is due, what payment methods are accepted, and the consequences of late payments. This section ensures your client is aware of the expectations and penalties associated with overdue payments.

- Notes: An optional section that allows you to include additional details that may be relevant to the transaction, such as a thank you message, specific payment instructions, or a refund policy.

How to Use This Invoice Template?

- Customization: Modify the template with your business details, such as your business name, address, and contact information. You should also input the client’s details, including their name, business name, and contact information.

- Descriptions: Add descriptions for the goods or services provided. Be specific about the items sold to avoid confusion. Include any relevant details about the delivery method, product specifications, or service expectations.

- Unit Price and Quantity: Clearly indicate the price for each unit and the quantity of each item. Multiply them to calculate the total for each line item.

- Taxes: Apply the appropriate sales tax based on your location or your client’s location. Be sure to specify the tax rate and calculate the total tax amount.

- Payment Terms: Be clear about your payment terms. This includes when payment is due, acceptable payment methods, and any penalties for late payments. Offering multiple payment options can make it easier for your clients to pay on time.

- Final Review: Before sending the invoice, double-check all the details for accuracy, including the itemized list, totals, tax, and payment terms. Mistakes can cause delays in payment or disputes, so it’s essential to ensure everything is correct.

This invoice template is flexible and can be adapted to various types of businesses, whether you provide services or sell products. By using a template like this, you ensure that every invoice you send is professional, clear, and easy for your clients to understand, which in turn increases the chances of timely payment. You can also store this template digitally, making it easy to generate new invoices quickly and keep track of your finances.

Invoice Examples

Understanding how to structure an invoice and what it should look like is essential for creating professional and effective documents. Below are some examples of different types of invoices you might encounter, showcasing how each one is used in real-life business transactions.

Standard Invoice Example

A standard invoice is used for one-time transactions, typically for a sale of goods or services. Here’s an example of what a standard invoice might look like:

Example:

Invoice Number: 00123

Date Issued: March 15, 2024

Due Date: March 30, 2024

Seller Details:

ABC Marketing Solutions

123 Business St.

Cityville, CA 90001

Email: contact@abcmarketing.com

Buyer Details:

XYZ Corporation

456 Client Ave.

Townsville, CA 80002

Email: billing@xyzcorp.com

Description of Goods/Services:

- Marketing Consultation (5 hours) – $500

- Social Media Management Setup – $300

Subtotal: $800

Sales Tax (10%): $80

Total Amount Due: $880

Payment Terms:

Payment is due within 15 days of the invoice date. Late fees of 2% will apply after the due date.

This invoice is clear, concise, and includes all the necessary information: the services provided, the prices, and the payment terms. The buyer can easily understand what they’re paying for, and the seller has a record of the transaction.

Recurring Invoice Example

A recurring invoice is typically used for services provided on a regular basis, like subscriptions or monthly retainers. Here’s an example of a recurring invoice for a software subscription:

Example:

Invoice Number: 00456

Date Issued: March 1, 2024

Due Date: March 1, 2024 (for the upcoming month)

Seller Details:

Software Solutions Inc.

789 Tech Blvd.

Innovation City, TX 70001

Email: billing@softwaresolutions.com

Buyer Details:

Tech Enterprises

321 Corporate Dr.

Business Park, TX 60001

Email: finance@techenterprises.com

Description of Services:

- Monthly Software Subscription (1 user license) – $50

Subtotal: $50

Sales Tax (8%): $4

Total Amount Due: $54

Payment Terms:

This is a recurring monthly charge for software services. Payment is due on the 1st of each month.

Recurring invoices are often automated using invoicing software, so this invoice can be generated and sent automatically at the same time every month. It’s clear and to the point, making it easy for both parties to track ongoing payments.

Proforma Invoice Example

A proforma invoice is issued as a preliminary bill of sale, often used for quotes or pre-order transactions. Here’s an example of a proforma invoice:

Example:

Invoice Number: 00789

Date Issued: March 5, 2024

Seller Details:

Premium Electronics

123 Tech Ave.

Gadget City, NY 50001

Email: sales@premiumelectronics.com

Buyer Details:

Home Electronics Co.

456 Retail St.

Commerce City, NY 40001

Email: purchasing@homeelectronicsco.com

Description of Goods:

- 50 55-inch 4K LED TVs – $500 each

- 30 Bluetooth Speakers – $100 each

Subtotal: $25,000

Sales Tax (5%): $1,250

Total Estimate: $26,250

Payment Terms:

This is a proforma invoice. No payment is due until the order is confirmed. Final invoice will be issued upon shipment.

A proforma invoice is often used when a buyer is still considering the purchase or when a final agreement hasn’t yet been reached. This example outlines the goods, their costs, and gives the buyer a detailed quote before the final transaction takes place.

Credit Invoice Example

A credit invoice is issued when a refund, return, or adjustment needs to be made. Here’s an example of a credit invoice:

Example:

Invoice Number: 00321

Date Issued: March 10, 2024

Due Date: Immediate

Seller Details:

Stylish Furnishings

200 Furniture Rd.

Home City, CA 30001

Email: returns@stylishfurnishings.com

Buyer Details:

Modern Living Inc.

321 Modern Ave.

Uptown, CA 40001

Email: returns@modernlivinginc.com

Description of Goods Returned:

- 2 Velvet Sofas (model #102) – $1,200 each

Subtotal: $2,400

Sales Tax (8%): $192

Total Credit Issued: $2,592

Payment Terms:

This credit invoice is issued for the returned sofas. A refund of $2,592 will be processed within 5 business days.

A credit invoice is typically used when the buyer has returned an item or there’s been a mistake in the original transaction. This document adjusts the buyer’s account, ensuring the proper credit is applied.

Electronic Invoice Example

An electronic invoice (e-invoice) is a digital version of an invoice sent electronically via email or invoicing software. Here’s an example:

Example:

Invoice Number: 01011

Date Issued: March 20, 2024

Due Date: March 30, 2024

Seller Details:

Digital Marketing Pros

999 Web St.

Silicon Valley, CA 90002

Email: contact@digitalmarketingpros.com

Buyer Details:

Creative Solutions LLC

1000 Design Blvd.

San Francisco, CA 94000

Email: accounts@creativesolutionsllc.com

Description of Services:

- Website Development – $3,000

- Social Media Advertising Campaign – $2,500

Subtotal: $5,500

Sales Tax (9%): $495

Total Amount Due: $5,995

Payment Terms:

Payment is due within 10 days of receipt. A late fee of 3% will be applied for payments received after the due date.

This e-invoice is sent directly via email or an invoicing platform. It includes all the relevant details, and since it’s digital, the buyer can access it easily and make payments quickly through an online gateway.

These examples highlight different types of invoices used across various business scenarios. Each type of invoice serves a specific purpose, making it easier to communicate terms and track payments effectively. By adapting these templates to your own business needs, you can ensure that your invoicing process is streamlined and professional.

How Invoices Facilitate Business Operations

Invoices play a crucial role in the day-to-day operations of any business. They’re not just a tool for requesting payment; they also provide essential insights into your financial health, help you stay compliant with tax regulations, and enable better cash flow management. Understanding how invoices contribute to these areas is key to running a smooth and efficient business.

Record-Keeping and Financial Tracking

Invoices are the cornerstone of financial tracking for any business. They serve as official records of transactions, providing you with detailed information about each sale or purchase. Having organized and accurate invoices means you can easily track your revenue, monitor outstanding payments, and reconcile accounts at the end of each period.

By maintaining a record of every invoice issued, you can ensure that all your income is documented, which is essential when preparing financial reports, like profit and loss statements or balance sheets. For instance, if your business is growing rapidly, keeping accurate invoices will help you see the financial trends, including how much revenue is coming in and when.

Invoices also make it easy to track accounts receivable. When a client’s payment is overdue, you can quickly look up the relevant invoice and follow up with a reminder. On the flip side, for businesses that purchase goods or services, invoices serve as a record of accounts payable, helping to ensure that you pay your suppliers on time.

Beyond basic tracking, invoices also help with audit preparedness. If your business is ever audited, having a well-organized system of invoices will make it easy to prove your income and expenses, ensuring that you’re in compliance with accounting standards.

Tax Reporting and Compliance

When it comes to tax reporting, invoices are a vital tool for staying compliant with local, state, and federal tax regulations. Invoices document the taxes you charge, whether they are sales tax, VAT (Value-Added Tax), or other applicable taxes depending on your location or the locations of your clients.

Invoices provide the details needed for tax filings by showing the amount of tax collected and ensuring that you remit the correct amounts to the tax authorities. For example, if your business is based in the EU, you’re likely required to charge VAT on most goods and services. By keeping a record of the VAT charged on every invoice, you can easily calculate your total tax liability at the end of each reporting period.

For businesses with international clients, invoices help ensure that you meet global tax requirements, such as understanding the tax rates in different countries or applying the correct international tax codes. In addition, invoices can reflect specific tax exemptions or adjustments, such as for non-profit organizations or businesses in tax-exempt zones.

Invoices also play a crucial role in deducting expenses on your tax return. For instance, if your business is VAT-registered, you can often reclaim VAT on business expenses listed on your supplier invoices. Similarly, keeping detailed invoices for business expenses helps you maximize any potential deductions during tax season, which can reduce your taxable income.

By tracking and organizing your invoices, you ensure that your business remains compliant with tax regulations and avoids penalties for incorrect filings. Keeping up with invoices throughout the year is much easier than scrambling to sort them at the last minute during tax season.

Streamlining Cash Flow Management

One of the most significant ways invoices facilitate business operations is by streamlining cash flow management. Cash flow is the lifeblood of any business, and invoicing plays a pivotal role in ensuring that the money coming in aligns with your business’s needs.

Invoices provide a clear, formal request for payment from your clients, setting expectations for when payment is due. By specifying payment terms—whether it’s Net 30, Net 60, or any other arrangement—you create a predictable schedule for incoming funds. This allows you to plan for upcoming expenses, such as payroll, rent, or inventory purchases, without worrying about cash shortages.

Effective invoice management also helps avoid delays in payments, which can disrupt your business’s cash flow. When you send invoices promptly and follow up on overdue payments, you minimize the risk of late payments, ensuring that your business has enough cash on hand to continue operating smoothly. For example, if your business operates on a just-in-time inventory system, timely payments from clients ensure that you can replenish stock without delay.

In addition, many businesses use invoicing software to automate the invoicing process, which accelerates cash flow even further. With automation, invoices can be sent out immediately after services are rendered or goods are delivered, reducing the chances of human error and delays in invoicing. Some software even offers features like automatic payment reminders for overdue invoices, which can help maintain steady cash flow without requiring manual intervention.

Managing your invoices well also enables you to forecast cash flow more accurately. By looking at past invoices, you can see trends in when clients typically pay, which gives you insights into future income and helps you anticipate any potential gaps in cash flow. This is especially useful for businesses with seasonal fluctuations, where understanding the timing of cash inflows can help you manage expenses during lean periods.

Invoicing not only ensures that you get paid but also enables you to plan, budget, and grow your business with confidence. By optimizing your invoicing process and maintaining clear records, you’re setting the foundation for long-term financial stability.

Invoicing Tools and Software

Invoicing can be a time-consuming process, but the right tools can streamline the task and make it much more efficient. Whether you’re a freelancer, a small business owner, or managing a larger enterprise, having the right invoicing tools is essential to ensuring your payment processes are smooth, timely, and accurate. Let’s explore some of the best tools available for invoicing and how they can benefit your business.

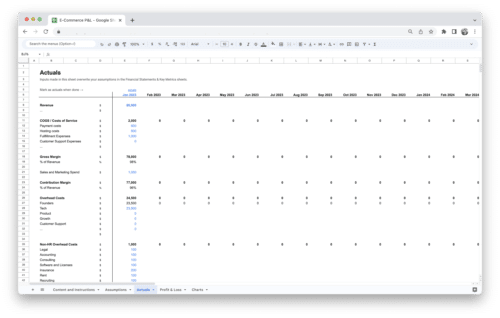

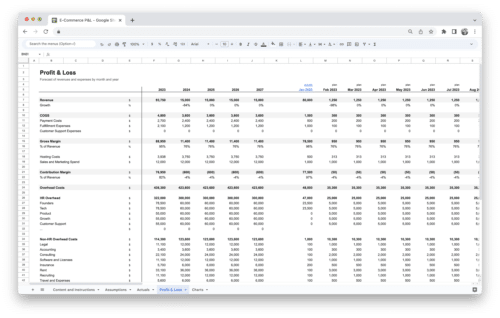

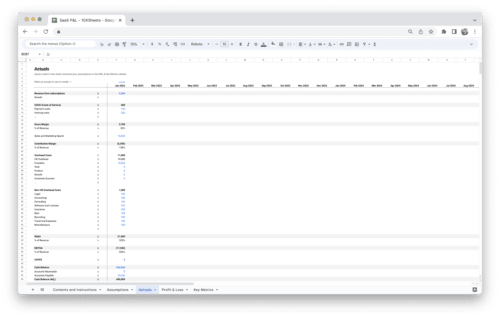

Leveraging Pre-Built Spreadsheet Templates

For those just starting or working with a small volume of invoices, spreadsheet templates are a simple yet effective option. These pre-built templates can save you time by eliminating the need to create invoices from scratch. Many spreadsheet tools like Microsoft Excel or Google Sheets offer free templates that are easy to customize with your business’s details.

Using spreadsheets to create invoices offers several advantages:

- Cost-effective: Templates are free and don’t require additional subscriptions or software purchases.

- Customizable: You can easily adjust the design, layout, and data to fit your specific business needs.

- Control: You have complete control over how your invoices look and function. You can add custom formulas to automatically calculate totals, taxes, and discounts.

However, there are limitations. While spreadsheets are flexible, they can become cumbersome if you’re dealing with a large number of invoices or require more advanced features like recurring billing, automation, or integration with other systems. Managing spreadsheets manually also increases the risk of errors.

Invoicing Software and Platforms for Businesses of All Sizes

For businesses that are scaling up or require more advanced features, invoicing software is an excellent option. There are various invoicing tools available that cater to businesses of all sizes, from freelancers to large corporations. These platforms automate much of the invoicing process, saving you time and reducing human error. Popular invoicing platforms include:

- QuickBooks: An all-in-one accounting software that includes robust invoicing features. It allows you to create, send, and track invoices, manage payments, and even sync with your bank accounts for automatic reconciliation.

- FreshBooks: A cloud-based accounting solution tailored to small businesses. It offers easy-to-use invoicing tools that allow you to create professional invoices, track time, and manage expenses.

- Xero: A cloud-based software that allows businesses to generate invoices, send reminders, and track payments. Xero’s integrations with accounting tools make it easy to manage your finances in one place.

- Zoho Invoice: A cost-effective option for small businesses, Zoho Invoice allows you to create and customize invoices, track time, and even set up recurring billing.

These tools typically offer a range of features that improve the efficiency of your invoicing process:

- Professional invoice templates: Most invoicing software comes with a variety of templates, making it easy to create branded invoices.

- Automatic tax calculations: Invoicing platforms often include built-in tax rates, so you don’t have to worry about calculating sales tax or VAT manually.

- Payment reminders: Many tools can automatically send payment reminders to clients, helping you get paid faster and reducing the chances of missed payments.

- Multi-currency support: If you have international clients, invoicing software typically supports multiple currencies, so you can easily bill clients in their local currency.

Invoicing software simplifies the process and is particularly beneficial for businesses with higher invoicing volumes or complex invoicing needs.

Benefits of Adopting Electronic Invoicing

Electronic invoicing (e-invoicing) has become increasingly popular due to its convenience and efficiency. Instead of generating paper invoices or relying on traditional methods like mail or fax, electronic invoicing allows you to create, send, and store invoices online. The benefits of adopting e-invoicing are numerous:

- Faster payments: Electronic invoices are delivered instantly via email or directly through invoicing platforms, allowing for quicker payments. The faster the client receives the invoice, the faster they can process it.

- Environmental benefits: E-invoicing reduces the need for paper and physical mail, which is not only good for the environment but also helps lower your business’s operational costs.

- Cost savings: By eliminating postage, printing, and physical filing costs, businesses save money. E-invoicing systems often have lower overheads compared to traditional paper invoicing.

- Improved accuracy: Electronic invoices are less likely to contain errors since they can be generated automatically from your business systems. This reduces the chances of miscalculations or missed details that could delay payments.

- Streamlined record-keeping: With electronic invoicing, you can easily store and retrieve invoices, making record-keeping much simpler. Most e-invoicing platforms also offer features like automated backups and cloud storage, ensuring your records are safe and accessible.

Adopting e-invoicing helps businesses stay ahead in an increasingly digital world while improving efficiency, reducing costs, and ensuring quicker payment processing.

Integrating Invoicing Systems with Accounting Tools

For businesses that want to optimize their invoicing and financial management, integrating invoicing systems with accounting tools is a game-changer. Integrating these two systems ensures that your invoices, payments, and financial records are automatically synced, reducing the risk of errors and saving you time.

The integration of invoicing with accounting software offers several key benefits:

- Automatic syncing: Payments made against invoices are automatically recorded in your accounting system, ensuring that your accounts are always up to date.

- Real-time reporting: Integration enables real-time access to your financial data, making it easier to track cash flow, monitor outstanding invoices, and generate reports for taxes or financial planning.

- Less manual data entry: When you generate invoices through an integrated system, you don’t need to manually enter the payment details into your accounting software. This minimizes the chances of human error and streamlines the workflow.

- Centralized management: With integrated invoicing and accounting systems, you have all your financial data in one place, making it easier to manage, analyze, and report on your business finances.

- Time-saving automation: Many integrations come with automated workflows that generate and send invoices, apply payments, and update accounting records in real-time. This frees you up to focus on other aspects of your business, like growth and customer relationships.

Popular tools like QuickBooks, Xero, and Zoho Books offer built-in invoicing features, while platforms like Stripe and PayPal can be integrated into your accounting software to ensure all transactions are captured seamlessly.

By integrating invoicing systems with accounting tools, businesses can streamline their financial processes, enhance accuracy, and save time, allowing for better management of both client billing and internal financials.

Invoice Management Best Practices

Efficient invoice management is crucial for ensuring smooth cash flow and maintaining professional relationships with clients. By implementing best practices, you can avoid common invoicing mistakes, reduce the risk of errors, and ensure that payments are received on time. Here are some key invoice management tips to keep your business running smoothly:

- Always send invoices promptly after completing a job or delivering goods to avoid delays in payment.

- Double-check your invoices for accuracy, including client details, product/service descriptions, tax calculations, and payment terms.

- Use professional templates that reflect your brand identity and make the invoice look polished and organized.

- Keep track of every invoice issued, including dates and payment status, using an invoicing tool or accounting software to monitor outstanding balances.

- Set clear payment terms that include due dates, acceptable payment methods, and any penalties for late payments.

- Automate recurring invoices to save time and ensure clients are billed on a consistent schedule.

- Follow up on overdue invoices with polite but firm reminders to encourage prompt payment.

- Maintain a clean, organized record of all invoices for easy reference and tax purposes, using cloud storage or an invoicing platform to store data securely.

Handling Invoice Disputes and Late Payments

Despite your best efforts, invoice disputes and late payments are an unfortunate part of doing business. Knowing how to handle these situations effectively can help maintain positive client relationships while ensuring you get paid. Here are some strategies for managing disputes and overdue invoices:

- Address any discrepancies promptly by reviewing the invoice with your client and clarifying any misunderstandings or errors.

- Maintain a calm, professional tone in your communications, whether via email, phone, or written correspondence, to preserve the business relationship.

- Keep detailed records of all communications regarding disputes, including emails, phone calls, and any agreed-upon resolutions, in case the issue escalates.

- Consider offering flexible payment terms or alternative payment arrangements if your client is facing temporary financial difficulties, but ensure it is documented in writing.

- Charge late fees if outlined in your payment terms, and apply them consistently to discourage future delays in payments.

- If a dispute continues unresolved, consider involving a third-party mediator or legal professional to help resolve the matter fairly.

- When payments are significantly overdue, take action by sending formal reminders or even engaging a collections agency as a last resort.

Conclusion

Mastering the art of invoicing is a key part of running a successful business. From creating clear and professional invoices to managing disputes and late payments, every step in the invoicing process helps you stay organized, ensure timely payments, and maintain good relationships with your clients. By using the right tools and following best practices, you can reduce errors, save time, and make sure that your cash flow stays healthy. The more you refine your invoicing process, the easier it will be to keep your business running smoothly, without unnecessary stress or confusion.

Remember, invoices are not just pieces of paper or digital documents—they’re a critical part of your business’s financial system. They help you keep track of revenue, stay compliant with tax regulations, and protect you in case of disputes. Whether you use manual spreadsheets or invoicing software, the goal is the same: to make the payment process as clear, efficient, and professional as possible. By staying organized and proactive with your invoicing, you can focus on growing your business and delivering great products and services without worrying about payment delays or mistakes.

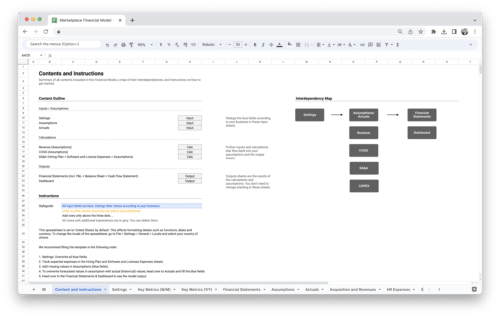

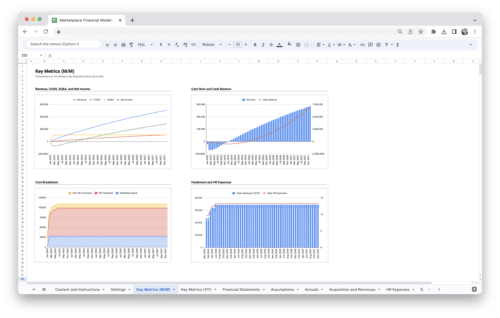

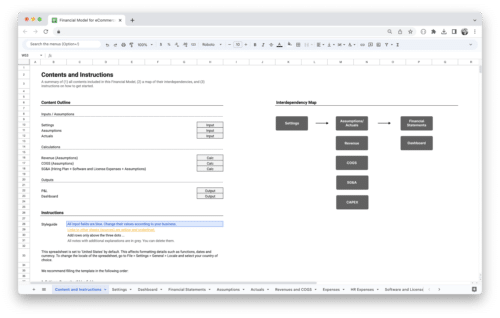

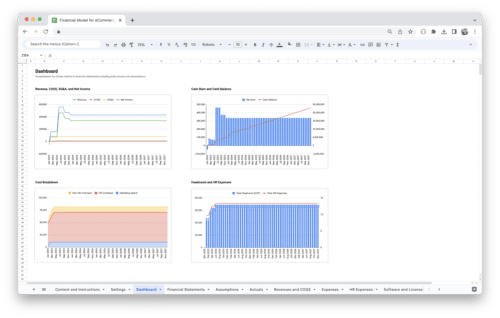

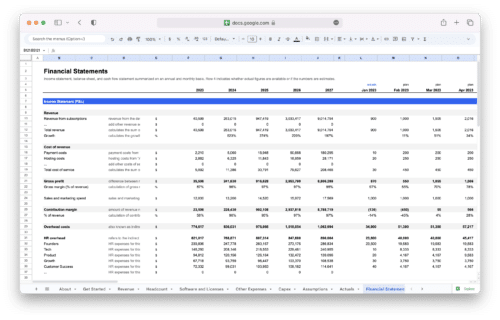

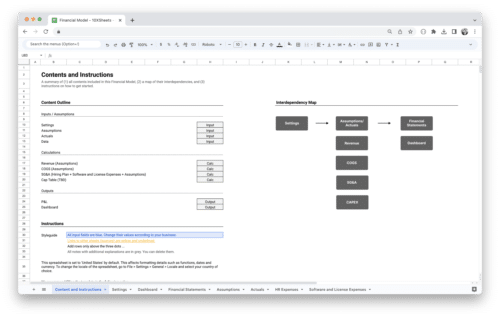

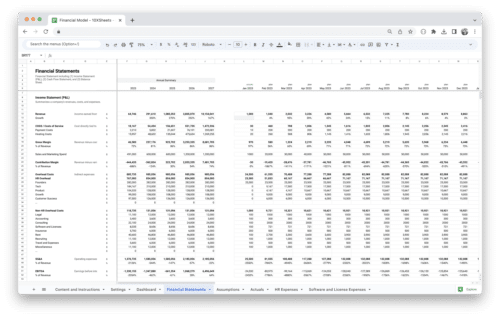

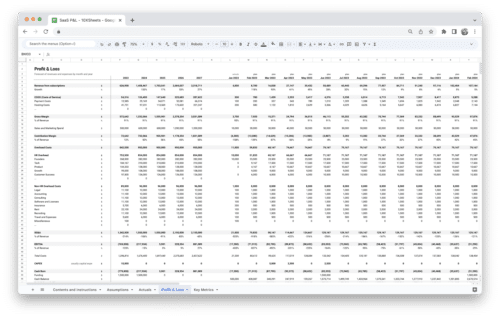

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.