Expenses refer to the money spent on goods, services, or activities. They are the costs incurred by individuals or businesses in their day-to-day operations. Expenses can be categorized into various types, such as fixed expenses, variable expenses, and discretionary expenses, based on their nature and frequency. Understanding the different types of expenses is crucial for effective financial management, budgeting, and tax planning.

What are Expenses?

Expenses are the costs incurred by individuals or businesses in their daily activities. They can be defined as the outflow of cash or other assets to acquire goods, services, or activities that contribute to the functioning of an individual or business. Expenses can be incurred on a regular basis, such as monthly bills, or on a one-time basis, such as a major repair or purchase. In accounting, expenses are recorded as an outflow of cash or a reduction in assets on the balance sheet and are deducted from revenue to calculate profit.

Types of Expenses

Fixed Expenses

Fixed expenses are those expenses that remain constant over time and are not affected by changes in the level of business activity. Some common examples of fixed expenses include rent, insurance premiums, salaries, and property taxes. Fixed expenses are usually predictable and can be budgeted for in advance. They are considered essential expenses that must be paid regardless of the level of revenue generated.

Variable Expenses

Variable expenses are those expenses that fluctuate based on changes in the level of business activity. These expenses are usually linked to the production or sale of goods and services. Some examples of variable expenses include raw materials, labor costs, shipping fees, and marketing expenses. Variable expenses are less predictable and can vary significantly from month to month.

Discretionary Expenses

Discretionary expenses are those expenses that are not essential for the operation of the business but are incurred to enhance the quality of life or promote growth. Some common examples of discretionary expenses include entertainment, travel, and education expenses. Discretionary expenses are not fixed and can be controlled or reduced to improve cash flow.

Examples of Expenses

Personal Expenses

- Housing Expenses – Rent or mortgage payments, property taxes, homeowner’s insurance, utilities, and maintenance costs.

- Transportation Expenses – Car payments, gas, insurance, registration, and maintenance costs.

- Food and Grocery Expenses – Groceries, dining out, and snack purchases.

- Healthcare Expenses – Insurance premiums, co-pays, prescriptions, and medical bills.

- Entertainment Expenses – Movies, concerts, sports events, and hobbies.

Business Expenses

- Cost of Goods Sold – Raw materials, labor costs, and manufacturing overhead.

- Operating Expenses – Rent, utilities, insurance, office supplies, and salaries.

- Marketing Expenses – Advertising, public relations, promotions, and sponsorships.

- Travel Expenses – Transportation, lodging, meals, and entertainment.

- Professional Fees – Legal, accounting, consulting, and other professional services.

How to Calculate Expenses?

Expenses can be calculated by subtracting the cost of goods sold and other operating expenses from the revenue generated. The formula for calculating expenses is as follows:

Expenses = Cost of Goods Sold + Operating Expenses + Other Expenses

For example, if a business generated $100,000 in revenue, had $50,000 in cost of goods sold, and $30,000 in operating expenses, the calculation for expenses would be:

Expenses = $50,000 + $30,000 = $80,000

Therefore, the business incurred $80,000 in expenses to generate $100,000 in revenue.

Importance of Expense Management

Effective expense management is crucial for individuals and businesses to maintain financial stability and growth. Some key benefits of expense management include:

- Improved Cash Flow: By managing expenses effectively, individuals and businesses can control their cash outflow, reduce unnecessary spending, and improve cash flow.

- Better Budgeting: Understanding the different types of expenses and their nature can help individuals and businesses create realistic budgets and avoid overspending.

- Tax Planning: Proper expense management can help individuals and businesses take advantage of tax deductions and credits, reduce taxable income, and minimize tax liability.

- Financial Stability: By managing expenses effectively, individuals and businesses can maintain financial stability and avoid financial distress.

Conclusion

Expenses refer to the money spent on goods, services, or activities. They can be categorized into various types, such as fixed expenses, variable expenses, and discretionary expenses. Effective expense management is crucial for individuals and businesses to maintain financial stability and growth, and it can be achieved through better budgeting, tax planning, and improved cash flow. By understanding the different types of expenses and their nature, individuals and businesses can make informed financial decisions and improve their overall financial health.

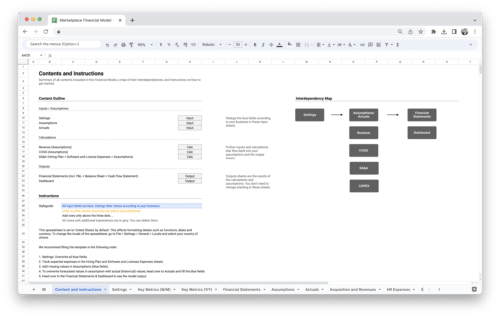

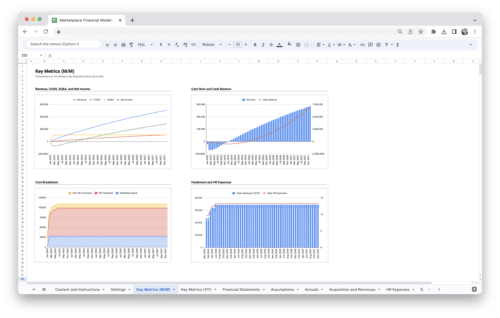

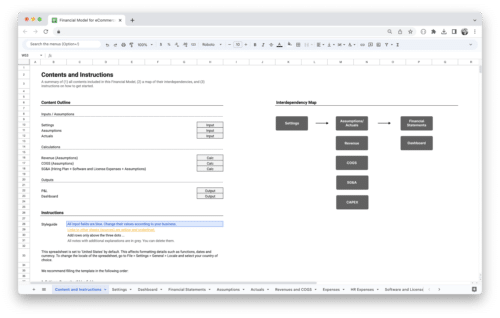

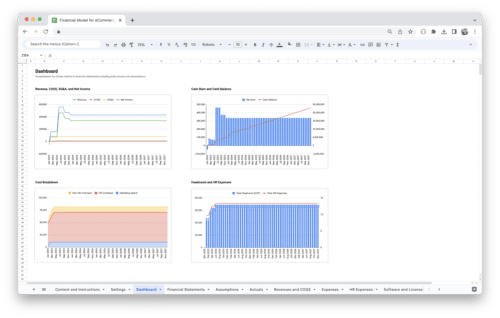

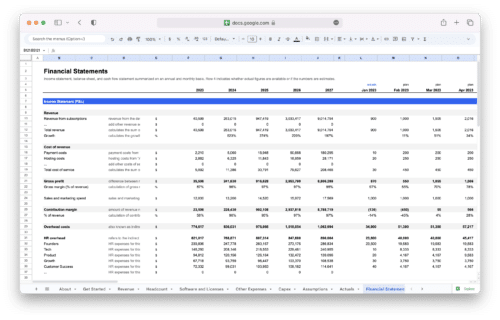

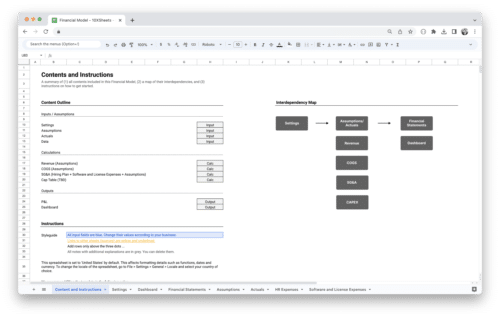

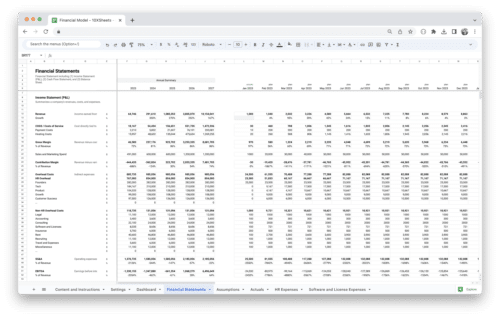

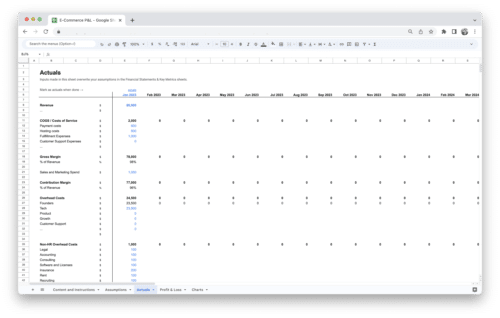

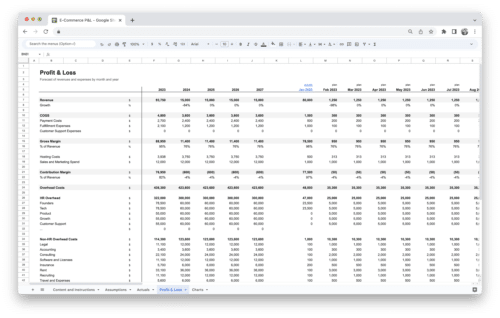

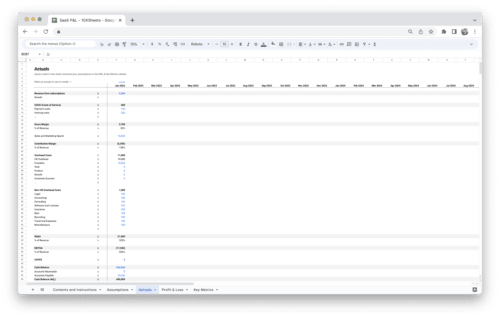

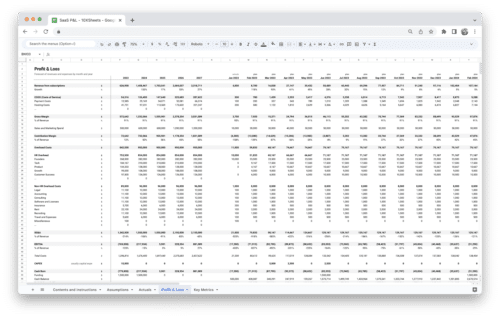

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.