Have you ever wondered how to get a clearer picture of a company’s true operational performance without all the extra financial noise? That’s where EBIDA comes in. EBIDA, or Earnings Before Interest, Depreciation, and Amortization, is a financial metric that helps you focus on what really matters—how much money a business is making from its core activities.

By stripping out interest payments, depreciation, and amortization, EBIDA gives you a cleaner view of profitability, especially when comparing companies with different capital structures or asset bases. Whether you’re analyzing financial statements, making investment decisions, or simply trying to understand a company’s earnings potential, EBIDA is a useful tool to help you cut through the clutter and focus on what’s important.

What is EBIDA?

EBIDA stands for Earnings Before Interest, Depreciation, and Amortization. It is a financial metric used to measure a company’s profitability from core operations, without the impact of interest expenses, taxes, depreciation, and amortization. Essentially, EBIDA provides a clearer picture of how well a company is generating earnings through its primary business activities, leaving out financial and accounting factors that might obscure the true operational performance.

Unlike metrics that include these non-operational expenses, EBIDA focuses on the earnings produced by day-to-day activities, making it an ideal metric for evaluating operational efficiency. While EBIT (Earnings Before Interest and Taxes) looks at profitability without interest or tax considerations, EBIDA goes a step further by adding back depreciation and amortization—non-cash expenses that reflect the gradual reduction in value of a company’s assets.

This focus on operational earnings makes EBIDA a highly useful metric for comparing companies in similar industries, especially when capital investment varies significantly between businesses. By eliminating non-cash charges, EBIDA allows for a more accurate comparison of core profitability across companies, regardless of their asset bases or financial structures.

Importance of EBIDA in Financial Analysis

EBIDA plays a critical role in financial analysis by offering a more accurate and comprehensive view of a company’s operational performance. It helps investors, analysts, and decision-makers assess profitability without the influence of financial structure or non-cash accounting practices.

- Isolates operational performance: By excluding interest, depreciation, and amortization, EBIDA provides a clearer picture of how efficiently a company is generating earnings from its core business activities. This helps business leaders assess if operations are running smoothly and if the company is poised for growth.

- Helpful for cash flow analysis: Since depreciation and amortization are non-cash expenses, EBIDA offers a more accurate representation of a company’s ability to generate cash from its operations. It serves as a useful proxy for cash flow, especially in industries with significant capital investment.

- Industry comparability: EBIDA enables more accurate comparisons across companies in industries with differing asset structures. By excluding the effects of depreciation and amortization, it allows for a more apples-to-apples comparison of operational efficiency, regardless of a company’s investment in physical or intangible assets.

- Strategic decision-making: Business leaders can use EBIDA to inform decisions about capital investments, acquisitions, or debt financing. It offers insight into a company’s operational profitability and cash generation capacity, which are crucial when determining how much debt a company can afford to take on or how much it can reinvest in its business.

- Evaluating long-term sustainability: EBIDA is particularly useful for assessing a company’s ability to sustain operations over the long term. Since it focuses on operational earnings, it helps decision-makers determine whether the company can continue to generate sufficient profits from its core business activities, even in the face of market fluctuations or changing economic conditions.

Key Differences Between EBIDA and EBITDA

EBIDA and similar metrics, such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), are often used interchangeably, but there are important distinctions between them. Understanding these differences is essential when choosing the right metric for a specific analysis.

EBIDA and EBITDA both measure a company’s earnings before certain expenses, but the key difference lies in the treatment of depreciation and amortization. EBIDA removes both interest expenses and non-cash charges like depreciation and amortization, while EBITDA removes only interest, taxes, depreciation, and amortization. This subtle distinction can have a significant impact on the interpretation of a company’s operational profitability.

- EBIDA focuses more on cash flow: Since EBIDA removes both interest and non-cash expenses, it offers a clearer view of the company’s ability to generate cash from its core operations. EBITDA, on the other hand, focuses on earnings before the impact of interest and taxes, but still includes depreciation and amortization. For capital-intensive businesses where depreciation plays a large role, EBIDA provides a cleaner picture of actual cash generation.

- EBITDA includes interest expenses: One key difference between EBIDA and EBITDA is that EBITDA accounts for interest expenses, while EBIDA does not. This can make EBITDA more relevant for evaluating profitability in companies with less significant interest costs. However, for companies with significant debt or high capital expenditures, EBIDA may offer a better understanding of core operational profitability, as it isolates the effects of financing and accounting practices.

- More applicable in capital-intensive industries: EBIDA tends to be more useful in industries where depreciation and amortization are significant and reflect long-term capital investment, such as manufacturing, utilities, and energy. EBITDA, on the other hand, is better suited for sectors where depreciation and amortization are less significant, such as technology or service-based industries.

Ultimately, while both EBIDA and EBITDA are used to evaluate a company’s operating performance, EBIDA offers a more detailed look at cash flow and operational efficiency by excluding interest, depreciation, and amortization. The choice between the two metrics depends on the specific context and the financial dynamics of the company being analyzed.

The Components of EBIDA

To fully grasp the importance of EBIDA, it’s essential to understand each of its components. The metric combines earnings before interest and taxes (EBIT) with the addition of depreciation and amortization. These three factors—EBIT, interest, and depreciation/amortization—play unique roles in shaping EBIDA and provide insights into a company’s financial performance.

Earnings (EBIT)

Earnings Before Interest and Taxes (EBIT) is the starting point of the EBIDA calculation. It represents the company’s operating profit, excluding the impact of interest expenses and tax liabilities. Essentially, EBIT shows how much money the business generates from its core operations before accounting for external financial obligations and taxes.

What makes EBIT valuable is its focus solely on operational efficiency. It gives you a snapshot of a company’s ability to generate profits through its products or services, without considering how the company is financed (whether through debt or equity) or how much it owes in taxes.

For example, if a company has a large amount of debt, its interest payments could heavily influence its overall profitability. By using EBIT as the foundation of EBIDA, you get a clearer picture of a company’s inherent ability to produce earnings, independent of its financial structure or tax strategies. EBIT is critical for business owners and investors because it focuses on operational effectiveness and disregards the noise created by financing and tax strategies.

Interest: Role in Financial Evaluation

Interest represents the cost of borrowing money. Companies often use loans and debt to finance their operations and expansion. The interest paid on these debts is typically subtracted from a company’s income statement, impacting net profits. However, when evaluating a company’s operational performance, it’s useful to exclude interest because it reflects the company’s capital structure rather than its ability to generate profits through its core business activities.

In the case of EBIDA, removing interest allows for a more accurate comparison between companies with different financing strategies. Some companies may rely more on debt to finance their operations, while others may be equity-heavy. By excluding interest payments, EBIDA provides a level playing field, allowing you to focus on the business’s ability to earn money from its operations rather than how it finances itself.

For example, two companies might be equally profitable at the operational level, but one may have a heavy debt load, leading to significant interest payments that reduce its net income. The other company may have no debt, so its net income may be higher. However, when you look at EBIDA, you see that both companies are generating similar operating profits, which helps investors and analysts make better decisions about their future prospects.

Depreciation and Amortization: Impact on Financial Statements

Depreciation and amortization are accounting methods used to allocate the cost of tangible and intangible assets over time. Depreciation applies to physical assets like machinery, buildings, and equipment, while amortization refers to the gradual write-off of intangible assets such as patents, trademarks, or goodwill. Both depreciation and amortization are non-cash expenses, meaning that they don’t involve an actual outlay of cash.

These expenses impact the company’s income statement and reduce its reported profits. However, since they don’t affect cash flow, they can distort the view of a company’s true operating performance. This is where EBIDA comes in. By adding back depreciation and amortization, EBIDA offers a clearer picture of how much money a company is actually generating from its core business, without the effect of accounting practices meant to reflect long-term asset wear and tear.

For example, a company that invests heavily in equipment may report a significant depreciation expense, which could reduce its profitability on paper. But this expense doesn’t represent an outflow of cash—it’s simply an accounting entry. By excluding depreciation and amortization, EBIDA removes this non-cash expense and provides a more accurate view of how well the company is performing operationally.

Together, depreciation and amortization provide an understanding of a company’s investment in assets and the aging of those assets. However, when you’re assessing operational performance or trying to compare companies in the same industry, removing these non-cash factors can offer a much clearer picture of a company’s ability to generate revenue from its core activities.

The Significance of EBIDA in Business Valuation

EBIDA is a powerful financial metric that helps provide a clear picture of a company’s operational profitability. By focusing on earnings before interest, depreciation, and amortization, it allows analysts, investors, and business owners to assess the performance of a company without the distortions caused by financing decisions, tax strategies, or non-cash accounting entries. This makes EBIDA particularly useful when evaluating a company’s core operations, which are often the most critical for long-term growth and success.

One of the primary advantages of EBIDA is that it isolates the company’s earnings generated purely from its day-to-day business activities. This makes it an excellent tool for evaluating profitability across different companies or industries, as it removes variables that may be specific to a company’s financial structure or accounting policies. As such, EBIDA becomes a fundamental metric for valuation, as it paints a clear picture of how well a company can generate earnings through its operations, regardless of its debt levels or asset write-offs.

Use of EBIDA in Evaluating Company Performance

EBIDA plays a crucial role in evaluating a company’s performance, especially in industries that require heavy capital investment. Since it excludes the impact of depreciation, amortization, and interest payments, EBIDA offers an unfiltered view of how effectively a company is running its core operations. This makes it an ideal metric for determining whether a business is generating sufficient profits to cover its costs and drive growth, without considering external financial factors that might obscure the truth.

For instance, companies in sectors like manufacturing, telecommunications, or energy often have substantial capital expenditures related to machinery, infrastructure, or technology. These expenses can lead to significant depreciation and amortization costs, which reduce net income. However, these companies still generate strong operational earnings. EBIDA allows investors and analysts to look beyond these accounting adjustments, providing a cleaner and more accurate measure of operational profitability.

In practice, EBIDA is commonly used to assess a company’s ability to generate cash flow from its core business activities. Since it excludes non-operational factors like interest payments and non-cash accounting entries, EBIDA can be more useful for understanding whether a company can sustain operations, pay down debt, and reinvest in growth opportunities.

How Investors and Analysts Interpret EBIDA

Investors and analysts use EBIDA as a tool to gauge the profitability of a company’s core business without the influence of its capital structure or accounting decisions. It’s particularly helpful for comparing companies that might operate with different financing strategies. By removing interest costs, analysts can assess how well a company is performing operationally, regardless of whether it is financed with debt or equity.

For example, two companies in the same industry might have similar EBIT figures, but one might have a large debt load and significant interest payments, while the other operates with minimal debt. If you were to look solely at net income, you might think the first company is less profitable. However, by using EBIDA, you can see that both companies are generating similar earnings from their operations, which provides a clearer basis for comparison.

EBIDA also helps investors evaluate a company’s potential to generate cash flow, which is an important factor in determining its ability to meet financial obligations, fund new projects, or return capital to shareholders. Since the metric removes the impact of non-cash expenses, it can help investors assess a company’s true capacity to generate revenue and fund future growth, especially in industries with significant capital expenditures.

Comparisons Across Industries

One of the main reasons EBIDA is so useful is its ability to facilitate comparisons across industries. Different industries have varying capital structures, tax obligations, and capital expenditure needs, which can significantly affect their financial results. By excluding the effects of interest, depreciation, and amortization, EBIDA neutralizes these factors, enabling a more direct comparison of operational performance.

For example, industries like technology or software, which often have minimal capital expenditures, may show a much higher EBIDA relative to industries like manufacturing or energy, where large investments in physical assets lead to higher depreciation and amortization. In the case of technology companies, the absence of substantial depreciation and amortization means that EBIDA will more closely align with cash flow, providing a clearer picture of profitability.

In capital-intensive industries, EBIDA gives you a more realistic understanding of a company’s ability to generate profits from its operations, without the noise introduced by depreciation and interest expenses. It’s important to note, however, that while EBIDA is a great tool for comparing companies in similar industries, it’s not always the most useful metric for comparing businesses in vastly different sectors. The nature of a company’s assets, investments, and financing can vary greatly depending on the industry, so EBIDA should be interpreted in the context of the specific sector in which a company operates.

Ultimately, EBIDA is an essential tool for understanding how efficiently a company is operating, and it’s particularly valuable for comparing businesses in sectors with high capital investment. It gives investors and analysts the ability to make more informed decisions, based on the actual performance of a company’s core business rather than external financial factors.

EBIDA vs EBITDA: Which Is More Relevant?

EBIDA and EBITDA are both financial metrics that aim to measure a company’s operational profitability, but there are subtle differences between the two that can make one more useful than the other depending on the situation. Understanding when to use each metric is essential for getting an accurate picture of a company’s financial health. While both metrics focus on earnings before interest, taxes, depreciation, and amortization, EBIDA goes one step further by excluding depreciation and amortization, offering a clearer view of operational earnings for certain industries and situations.

Knowing when to choose EBIDA over EBITDA—or vice versa—depends on the nature of the company you’re analyzing and what you want to measure. In this section, we’ll look at when EBIDA is more relevant than EBITDA and the pros and cons of using EBIDA for financial analysis.

When to Use EBIDA Instead of EBITDA?

EBIDA is particularly useful when you want a more straightforward measure of a company’s profitability, especially in industries where capital expenditures and depreciation play a major role. For businesses with heavy investments in fixed assets, such as manufacturing, transportation, or infrastructure, EBIDA can offer a more accurate representation of operational earnings. By excluding both depreciation and amortization, EBIDA eliminates the noise caused by these non-cash expenses, allowing you to focus on the core profitability generated by the company’s operations.

If you’re analyzing a company with a significant amount of capital investment, EBIDA provides a cleaner view of how much the business is actually earning from its core operations. In such cases, depreciation and amortization might skew the numbers, especially when the company is in the early stages of asset investment, leading to higher depreciation costs. Since depreciation and amortization are accounting practices rather than actual cash expenditures, EBIDA allows investors and analysts to assess the company’s performance without the impact of these non-cash charges.

Moreover, if you’re comparing businesses in the same industry that have different financing structures or asset bases, EBIDA is helpful because it removes the effects of depreciation and amortization. This makes it easier to evaluate the operational efficiency of each business without the distortions caused by varying levels of capital investment.

In contrast, if you’re looking at a company in an industry with lower capital expenditures, like technology or software, where depreciation and amortization are less significant, EBITDA might be more relevant. For such industries, where the focus is more on revenue generation and less on heavy investments in physical assets, EBITDA would give you a clearer picture of operational profitability.

Pros and Cons of Using EBIDA in Financial Analysis

Using EBIDA in financial analysis has both advantages and limitations. Understanding these pros and cons can help you determine whether it’s the right metric for your specific needs.

EBIDA Pros

- Focus on Core Operations: Since EBIDA excludes interest, depreciation, and amortization, it allows for a more accurate assessment of a company’s operating performance. You get a direct view of how well the business is generating profits from its day-to-day activities, without the influence of financing decisions or non-cash expenses.

- Clearer Comparison Across Companies: When comparing companies with significant differences in capital investment, EBIDA removes the impact of depreciation and amortization. This enables a more meaningful comparison of operational performance, especially when companies in the same industry have different asset bases or financing structures.

- Simpler Picture for Capital-Intensive Businesses: For businesses in capital-intensive industries, such as manufacturing or utilities, EBIDA provides a clearer view of profitability. Depreciation and amortization are significant expenses in these sectors, and excluding them can offer a more direct picture of operational earnings, especially for businesses making large upfront investments in assets.

- More Useful for Cash Flow Assessment: EBIDA is often used to assess a company’s ability to generate cash flow from its operations. Since depreciation and amortization don’t represent actual cash outflows, removing them gives a more accurate sense of how much cash the company is generating for reinvestment, debt servicing, and other needs.

EBIDA Cons

- Potential for Oversimplification: By excluding depreciation and amortization, EBIDA can provide an overly simplified view of a company’s profitability. For businesses with significant capital investments, these non-cash expenses are an important reflection of the company’s asset usage and long-term sustainability. Ignoring these factors entirely could lead to an incomplete assessment of a company’s financial health.

- Less Useful for Valuing Companies with Low Capital Investment: If a company operates in an industry where capital expenditures are low, such as technology or services, EBIDA might not add much value. In these cases, depreciation and amortization are less relevant, and EBITDA would likely provide a more accurate representation of profitability, as it includes these expenses without overstating their significance.

- Not Always a Complete Picture of Profitability: EBIDA doesn’t account for interest expenses, which are a significant cost for companies with high levels of debt. If a company has large interest payments, relying solely on EBIDA might paint an overly optimistic picture of its profitability, as it doesn’t reflect the financial burden of servicing debt. Investors and analysts might need to consider other metrics, like EBIT or net income, to get a more comprehensive view of profitability.

- Not Ideal for Non-Cash-Intensive Industries: In industries where the capital investment is minimal, such as software or consulting, EBIDA might not offer much insight. For these industries, the focus is more on revenue generation and operational efficiency, making EBITDA a more relevant metric. Since depreciation and amortization are less of a factor in these sectors, excluding them can lead to redundant calculations.

In conclusion, EBIDA is a highly valuable metric, but its relevance depends on the type of company and the specific analysis you’re conducting. It’s ideal for capital-intensive industries where you want to assess core operational profitability without the effects of asset depreciation and amortization. However, in sectors where these expenses are less significant, EBIDA may not add much value and could even provide an incomplete picture of a company’s financial health. By carefully considering the context and purpose of your analysis, you can determine whether EBIDA or EBITDA is the better choice.

How to Calculate EBIDA?

Calculating EBIDA (Earnings Before Interest, Depreciation, and Amortization) is a straightforward process that requires a few key pieces of financial data. The metric builds upon EBIT (Earnings Before Interest and Taxes) and adds back depreciation and amortization expenses to arrive at a more accurate picture of a company’s operational profitability. Here’s a step-by-step guide to calculating EBIDA, along with adjustments to consider for a more accurate calculation.

EBIDA Calculation

The process of calculating EBIDA involves gathering the necessary financial data from the company’s income statement and performing a few simple calculations.

Start with EBIT, which represents the company’s profit before interest and taxes. This is usually found directly on the income statement or can be calculated by subtracting operating expenses (excluding interest and taxes) from total revenues.

Once you have EBIT, add back the depreciation and amortization expenses, which are typically listed as separate line items in the income statement or in the cash flow statement. Depreciation reflects the wear and tear of physical assets, while amortization pertains to the gradual expense recognition of intangible assets.

The formula for EBIDA looks like this:

EBIDA = EBIT + Depreciation + Amortization

This is the core calculation, but there are several adjustments you might need to consider depending on the financial complexity of the company or the specifics of the industry.

Adjustments to Consider When Calculating EBIDA

While the basic calculation of EBIDA is relatively simple, there are some important adjustments and nuances that you should be aware of when performing the calculation.

First, ensure that you’re using the correct figures for EBIT, depreciation, and amortization. In some cases, companies may report these values differently, or they might be embedded in other financial categories. For instance, operating income may be reported in a way that includes some non-operational income or expenses. It’s important to extract the pure operational earnings to avoid inflating the EBIT figure.

Next, if you’re analyzing a company that has significant one-time charges or non-recurring expenses, you may want to adjust for these items. While EBIDA focuses on operational profitability, any extraordinary or non-recurring expenses (such as restructuring charges or asset impairments) can distort the figure. To get a more accurate picture of recurring operations, you might exclude these one-time items from EBIT before adding back depreciation and amortization.

Another consideration is how the company handles its depreciation and amortization policies. Companies with aggressive depreciation schedules may report higher depreciation expenses, which can lower their EBIT. If you’re comparing companies with different accounting policies, it might make sense to adjust the depreciation figure to ensure consistency across your analysis.

Additionally, for companies operating in multiple regions or industries, currency fluctuations and international accounting practices might introduce some variance in depreciation and amortization values. You should make adjustments for these factors if you are conducting an analysis across companies in different regions to ensure comparability.

Examples of EBIDA Calculation in Real Business Scenarios

Let’s go through a few real business scenarios to see how EBIDA is calculated and applied.

Scenario 1: Capital-Intensive Industry

Imagine a manufacturing company with the following financial data:

- EBIT: $10,000,000

- Depreciation: $2,500,000

- Amortization: $1,000,000

Using the EBIDA formula, you would calculate the company’s operational profitability as follows:

EBIDA = $10,000,000 + $2,500,000 + $1,000,000 = $13,500,000

In this scenario, the company’s core operations generated $13.5 million in earnings, which is a more accurate reflection of its operational profitability than EBIT alone. The depreciation and amortization are added back to account for non-cash expenses that don’t directly affect cash flow.

Scenario 2: Technology Company with Minimal Capital Investment

Now let’s consider a technology company with lower capital expenditures, such as a software business. The financial data for the company is:

- EBIT: $5,000,000

- Depreciation: $200,000

- Amortization: $300,000

The EBIDA calculation would be:

EBIDA = $5,000,000 + $200,000 + $300,000 = $5,500,000

In this case, the EBIDA is only slightly higher than EBIT, reflecting the fact that depreciation and amortization are less significant expenses for a company in the software sector. Despite this, EBIDA still gives a clearer picture of the company’s operational earnings, especially if the company’s EBIT includes other non-operational factors like income from investments.

Scenario 3: Adjusting for One-Time Expenses

Suppose a retail company has the following data:

- EBIT: $8,000,000

- Depreciation: $1,500,000

- Amortization: $500,000

- One-time restructuring charge: $1,000,000

In this case, you would adjust the EBIT figure to exclude the one-time restructuring charge before calculating EBIDA, as this charge isn’t part of the company’s regular operations. Adjusted EBIT would be:

Adjusted EBIT = $8,000,000 – $1,000,000 = $7,000,000

Now, you can calculate the EBIDA:

EBIDA = $7,000,000 + $1,500,000 + $500,000 = $9,000,000

By excluding the restructuring charge, the adjusted EBIDA of $9,000,000 provides a better reflection of the company’s ongoing operational profitability, without the distortion from one-time charges.

These examples illustrate how EBIDA is calculated in real-world scenarios and highlight the adjustments that may be necessary to ensure an accurate representation of a company’s financial health. By understanding the factors involved in the calculation, you can confidently use EBIDA as a valuable tool in your financial analysis and decision-making.

Examples of EBIDA in Action

To better understand how EBIDA works in practice, let’s look at a few real-world scenarios where this metric can be applied. These examples illustrate how EBIDA helps assess operational performance and profitability in different industries and financial situations.

Example 1: Manufacturing Company with Heavy Capital Investments

Consider a manufacturing company that relies heavily on machinery and equipment for production. Here’s a simplified set of financial data:

- EBIT: $15,000,000

- Depreciation: $3,000,000

- Amortization: $500,000

In this case, the company has substantial depreciation costs due to its investment in physical assets. By adding back depreciation and amortization, we can see a more accurate picture of the company’s cash-generating capacity from its core operations, which may be obscured by these non-cash charges.

EBIDA calculation:

EBIDA = EBIT + Depreciation + Amortization

EBIDA = $15,000,000 + $3,000,000 + $500,000 = $18,500,000

The EBIDA of $18.5 million gives a clearer view of how the company is performing operationally, free from the effects of depreciation and amortization, which are related to the company’s large capital investments. This is especially useful when comparing it to other companies in the same industry, as it provides a more direct measure of profitability without the impact of asset depreciation.

Example 2: Tech Startup with Minimal Capital Investment

Now, let’s look at a tech startup that operates in the software industry. Unlike manufacturing companies, software businesses often have lower capital expenditures and less depreciation. Here’s the financial data for this company:

- EBIT: $10,000,000

- Depreciation: $100,000

- Amortization: $200,000

In this scenario, the depreciation and amortization are relatively small compared to the manufacturing company. Nevertheless, adding them back gives a more precise representation of the company’s cash flow from operations.

EBIDA calculation:

EBIDA = EBIT + Depreciation + Amortization

EBIDA = $10,000,000 + $100,000 + $200,000 = $10,300,000

The EBIDA of $10.3 million highlights that, despite the minimal impact of depreciation and amortization, the company is generating solid earnings from its core business. The difference between EBIT and EBIDA is relatively small because of the company’s low capital investment, but the metric still helps highlight how the company’s operational earnings translate to cash flow.

Example 3: Retail Company with One-Time Charges

Let’s consider a retail company that faced a significant restructuring expense last year. Here’s the financial data, along with an unusual one-time charge:

- EBIT: $12,000,000

- Depreciation: $1,200,000

- Amortization: $300,000

- One-time restructuring charge: $1,500,000

In this case, the one-time restructuring charge is an exceptional expense that is not part of the company’s usual operations. To get a more accurate picture of the company’s recurring operational performance, we should adjust for this charge.

Adjusted EBIT:

Adjusted EBIT = EBIT – One-time restructuring charge

Adjusted EBIT = $12,000,000 – $1,500,000 = $10,500,000

Now, we calculate EBIDA using the adjusted EBIT:

EBIDA calculation:

EBIDA = Adjusted EBIT + Depreciation + Amortization

EBIDA = $10,500,000 + $1,200,000 + $300,000 = $12,000,000

By adjusting for the one-time restructuring charge, the EBIDA of $12 million reflects the company’s true operational earnings. This helps decision-makers get a better sense of how the company’s regular business operations are performing, without the distortion from exceptional expenses.

Example 4: High-Debt Company in the Energy Sector

Let’s consider an energy company that has significant debt, leading to high interest payments. Here’s the company’s financial data:

- EBIT: $20,000,000

- Depreciation: $5,000,000

- Amortization: $1,000,000

- Interest expenses: $3,000,000

In this case, the company has substantial interest expenses due to its high debt load. Since EBIDA excludes interest expenses, it helps provide a clearer picture of the company’s operational profitability, without the impact of financing costs.

EBIDA calculation:

EBIDA = EBIT + Depreciation + Amortization

EBIDA = $20,000,000 + $5,000,000 + $1,000,000 = $26,000,000

By excluding interest expenses, EBIDA shows the company’s ability to generate earnings from its operations, which may be overshadowed by the interest costs if you looked only at net income. This is especially helpful for investors and analysts who want to assess the company’s operational efficiency, independent of how it is financed.

These examples demonstrate how EBIDA can be used to assess a company’s operational earnings by excluding non-operational factors like interest, depreciation, and amortization. Whether a company is in a capital-intensive industry, facing one-time charges, or dealing with heavy interest expenses, EBIDA offers a useful way to evaluate its core profitability and compare it with other companies in the same or different sectors.

How EBIDA Affects Business Decisions

EBIDA is a key metric that influences various business decisions by providing a clear picture of a company’s operational profitability. By isolating earnings from interest expenses and non-cash charges like depreciation and amortization, EBIDA offers valuable insights into a company’s ability to generate profit through its core business activities. Decision-makers use EBIDA in a variety of ways, from assessing financial health to shaping long-term strategy.

- Evaluating financial sustainability: EBIDA helps business leaders assess whether the company can generate enough operational profit to sustain its operations and reinvest in growth. It serves as a barometer for cash generation capacity, important for managing working capital and funding expansion.

- Guiding investment decisions: Investors and analysts rely on EBIDA to determine whether a business can meet its financial obligations without being skewed by tax strategies or non-cash expenses. It’s a more direct reflection of the company’s operational efficiency and a useful measure for comparing companies across industries.

- Strategic planning: When setting future goals, business leaders use EBIDA to evaluate if the company’s core operations are generating sufficient revenue to meet both short-term and long-term objectives. It helps inform decisions about entering new markets or making acquisitions.

- Determining debt capacity: Companies looking to take on more debt or refinance existing debt can use EBIDA as an indicator of their ability to generate enough earnings to service that debt. Lenders often look at EBIDA to evaluate whether the business can afford additional financial leverage.

- Improving operational efficiency: By looking at EBIDA, management can pinpoint areas where costs may be reduced or processes improved to enhance operational profitability. Since EBIDA focuses on core operations, it gives a more accurate view of where efficiencies can be gained.

EBIDA Limitations and Criticisms

While EBIDA is a valuable metric for evaluating operational performance, it’s not without its limitations. There are several criticisms of relying solely on EBIDA, and understanding these drawbacks is essential when using it as part of a comprehensive financial analysis.

- Excludes important financial expenses: By excluding interest, EBIDA doesn’t account for the impact of debt. This is especially problematic for companies with significant debt loads, as it overlooks how much of the company’s earnings are used to pay for interest on that debt, potentially leading to an inflated view of profitability.

- Ignores long-term capital investment: Depreciation and amortization are critical reflections of how much a company has invested in its physical and intangible assets. By excluding these, EBIDA doesn’t provide a full picture of the company’s investment in long-term assets and may overlook the need for reinvestment.

- Overlooks tax implications: Since EBIDA removes the impact of taxes, it doesn’t provide a full understanding of a company’s overall financial health, particularly its ability to meet tax obligations. A business may be profitable in operational terms but still face significant tax burdens that aren’t reflected in EBIDA.

- Not universally applicable: While EBIDA is useful in capital-intensive industries, it may not be as relevant for companies with low capital expenditures, such as those in technology or services. In these cases, depreciation and amortization may not significantly affect earnings, and other metrics like EBITDA or net income may be more appropriate.

- Potential for misleading comparisons: Since EBIDA excludes both interest and non-cash expenses, it may lead to misleading comparisons between companies with vastly different capital structures. A company with a large debt burden or high capital expenditure might appear more profitable than it actually is when using EBIDA, skewing comparisons with other companies.

Conclusion

EBIDA is an incredibly useful tool for assessing a company’s core operational profitability. By excluding non-cash expenses like depreciation and amortization, as well as interest payments, EBIDA gives you a clearer view of how efficiently a business is running its day-to-day operations. This makes it especially valuable for industries with heavy capital investments or varying financing structures, as it removes the noise created by those factors and focuses purely on operational performance. For investors, analysts, and business leaders, understanding and using EBIDA can help make more informed decisions about the health and potential of a business.

However, it’s important to keep in mind that while EBIDA offers valuable insights, it’s not without its limitations. By excluding both interest and non-cash expenses, EBIDA might overlook key factors like debt obligations or the need for reinvestment in assets. That’s why it’s essential to consider EBIDA alongside other metrics, like EBITDA or net income, to get a fuller picture of a company’s financial situation. Ultimately, EBIDA is a great tool for evaluating operational efficiency, but it’s most effective when used in combination with other financial metrics to ensure a well-rounded analysis.

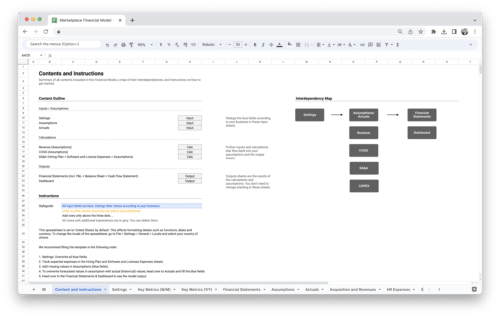

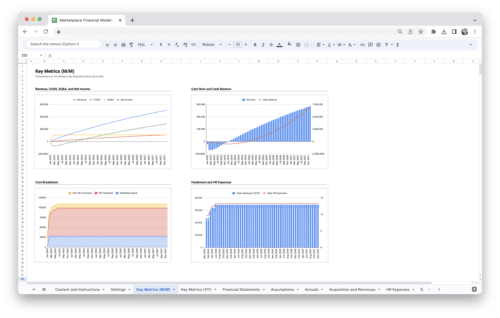

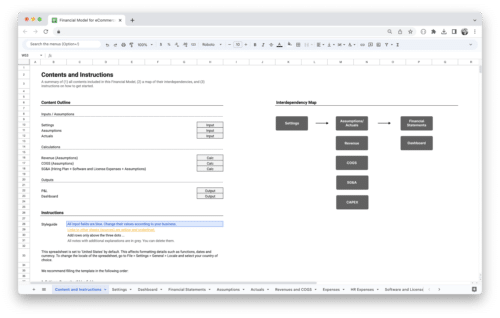

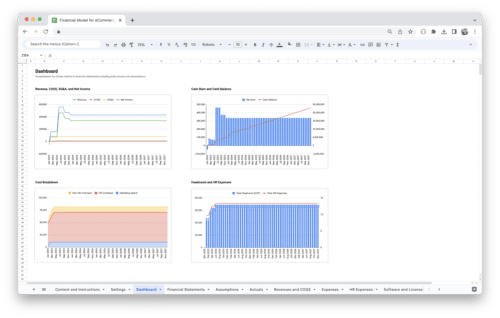

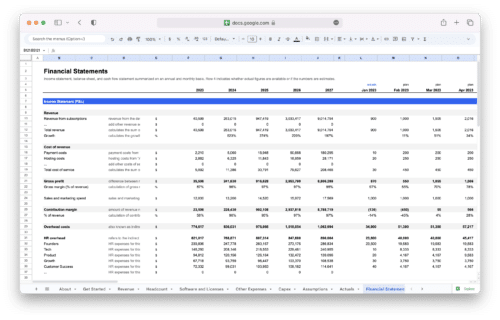

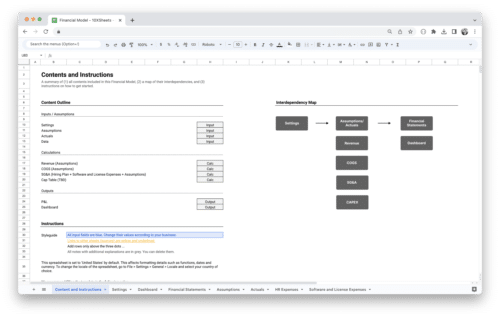

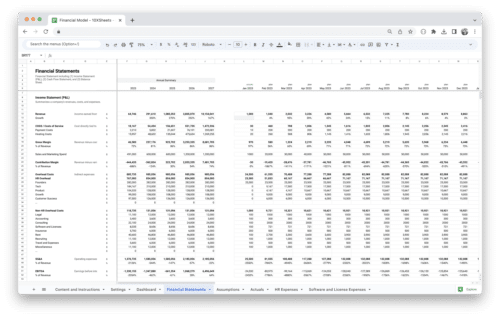

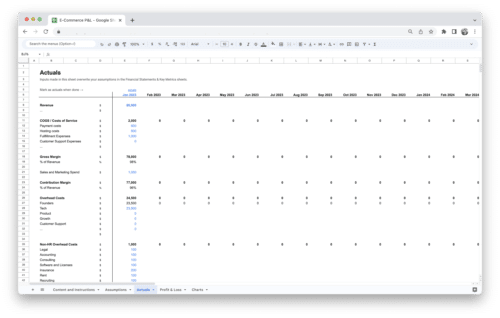

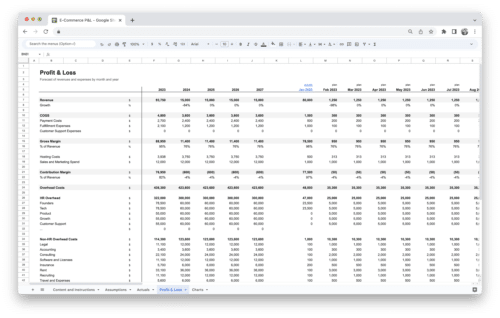

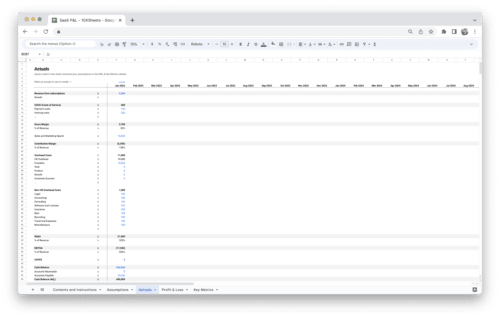

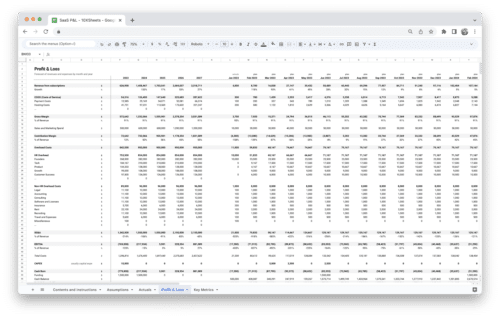

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.