What are Actuals in Finance?

Actuals are the real, factual financial results of a company’s operations or performance during a specific period. They are different from estimates or forecasts, which are predictions of what a company’s financial performance could be. Actuals are essential for companies to understand their current financial standing, make informed decisions, and adjust their strategies accordingly.

Here are some of the key importance of actuals:

- Provides accurate and reliable financial information: Actuals offer an accurate picture of a company’s financial performance, which helps stakeholders make informed decisions based on reliable data.

- Helps with budgeting and forecasting: Actuals are used to compare with budgeted or forecasted numbers, which helps companies adjust their budgets and forecasts for future periods.

- Enables performance evaluation: Actuals help evaluate a company’s performance against its goals and objectives, allowing management to identify areas for improvement or potential risks.

- Aids in compliance with accounting standards: Actuals are required by accounting standards, such as GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards), to provide accurate and transparent financial reporting.

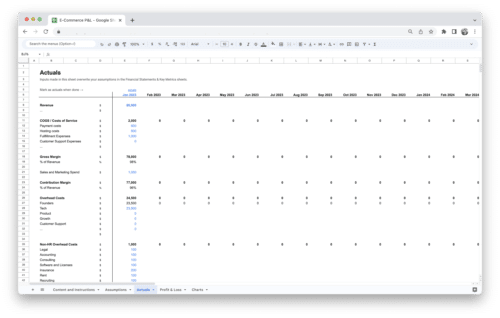

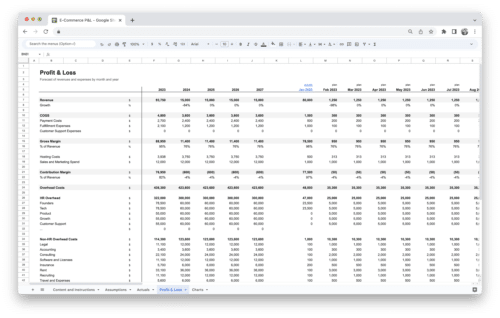

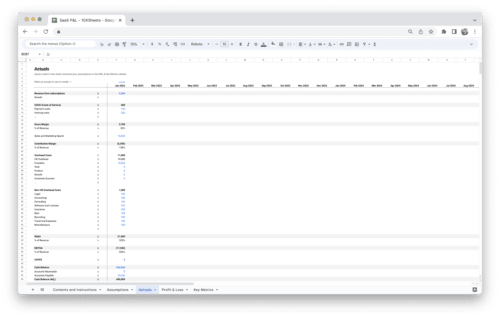

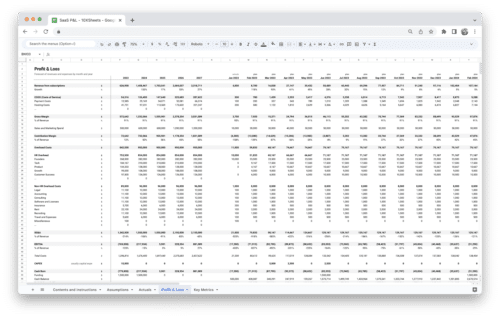

Actuals in Financial Reporting

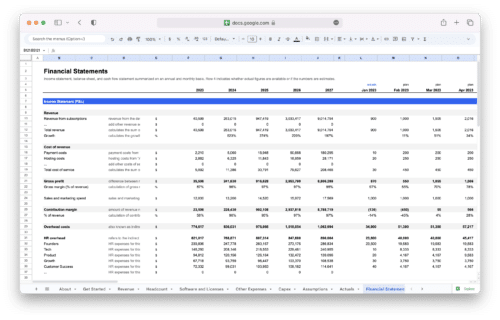

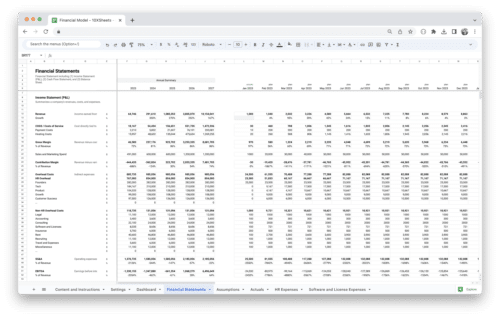

In financial reporting, actuals are typically presented in financial statements, such as income statements, balance sheets, and cash flow statements. These statements show the actual financial performance of a company for a given period, typically a quarter or a year. Actuals are presented alongside budgeted or forecasted numbers, allowing stakeholders to compare the actual results with the expected results.

Common financial statements that use actuals include:

- Income Statement: Actuals are used to show the actual revenue, expenses, and net income or loss for the period, compared to the budgeted or forecasted numbers.

- Balance Sheet: Actuals are used to show the actual values of the assets, liabilities, and equity at the end of the period, compared to the budgeted or forecasted numbers.

- Cash Flow Statement: Actuals are used to show the actual cash inflows and outflows for the period, compared to the budgeted or forecasted numbers.

How to Calculate Actuals?

Calculating actuals involves determining the actual financial performance or results of a company for a given period. Here are the steps involved in calculating actuals:

- Gather financial data: Collect all the financial data for the period, including revenues, expenses, assets, liabilities, and equity.

- Verify data accuracy: Verify the accuracy of the data to ensure it’s reliable and free from errors or omissions.

- Calculate actuals: Use the verified financial data to calculate the actual financial performance or results for the period.

- Compare actuals with budgeted or forecasted numbers: Compare the actuals with the budgeted or forecasted numbers to identify any variances or differences.

Actuals vs. Budgets and Forecasts

Actuals are different from budgets and forecasts in that they represent the actual financial performance or results of a company for a given period, while budgets and forecasts are predictions of what a company’s financial performance could be.

Here are some differences between actuals, budgets, and forecasts:

- Actuals are based on real, factual financial data, while budgets and forecasts are based on estimates and assumptions.

- Actuals represent the past financial performance of a company, while budgets and forecasts represent future expectations.

- Actuals are used to compare with budgets and forecasts to identify any variances or differences, while budgets and forecasts are used to plan and set financial goals for the future.

Variance Analysis

Variance analysis is the process of comparing actuals with budgeted or forecasted numbers to identify any variances or differences. Variance analysis is essential because it helps companies understand why their actual financial performance differs from their expected performance. The steps involved in variance analysis are as follows:

- Identify the variances: Compare the actuals with the budgeted or forecasted numbers to identify any variances or differences.

- Analyze the variances: Analyze the variances to understand why they occurred. For example, a variance in revenue could be due to changes in sales volume, price, or customer mix.

- Take corrective actions: Take corrective actions based on the variance analysis to address any issues or opportunities identified. For example, if the variance is due to higher expenses, management may decide to cut costs or increase sales to improve profitability.

Conclusion

Actuals are an essential component of financial reporting because they provide an accurate and reliable picture of a company’s financial performance. Actuals are used to compare with budgeted or forecasted numbers, which helps companies adjust their budgets and forecasts for future periods.

Variance analysis compares actuals with budgeted or forecasted numbers to identify any variances or differences, which helps companies understand why their actual financial performance differs from their expected performance. Understanding actuals and their importance is crucial for stakeholders to make informed decisions and drive business success.

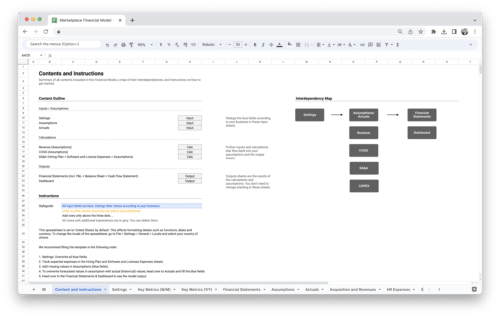

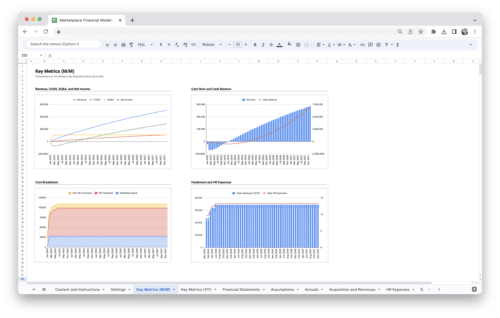

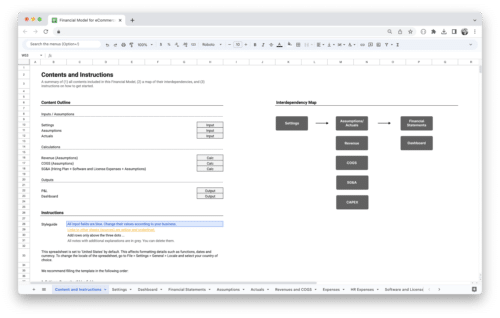

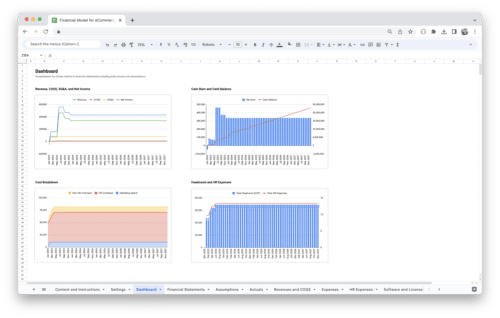

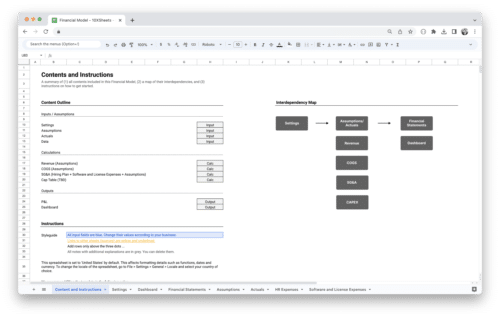

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.