Startup Financial Model Template

100,00 € Original price was: 100,00 €.66,39 €Current price is: 66,39 €.

34% Off

Value added tax is not collected, as small businesses according to §19 (1) UStG.

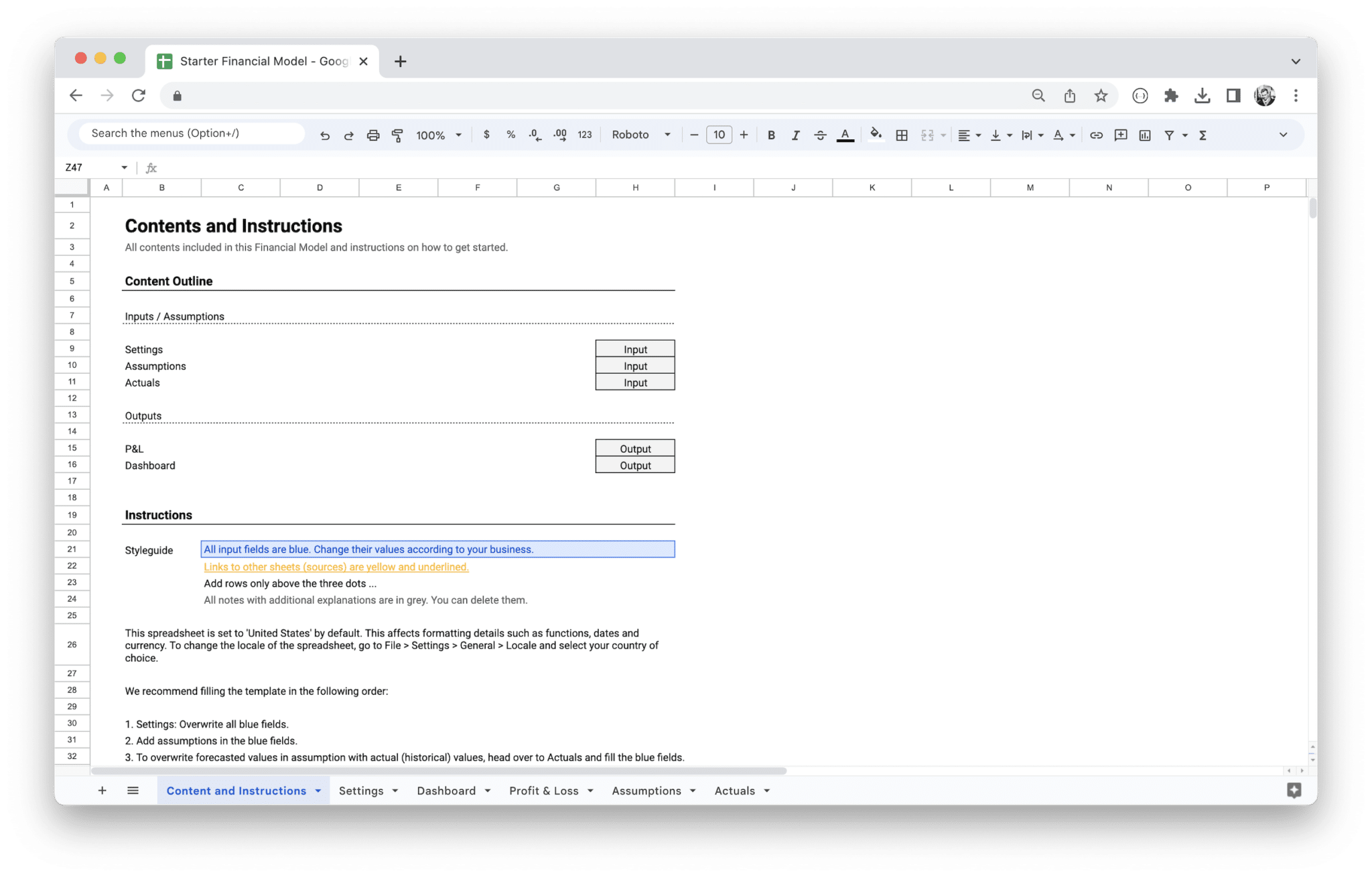

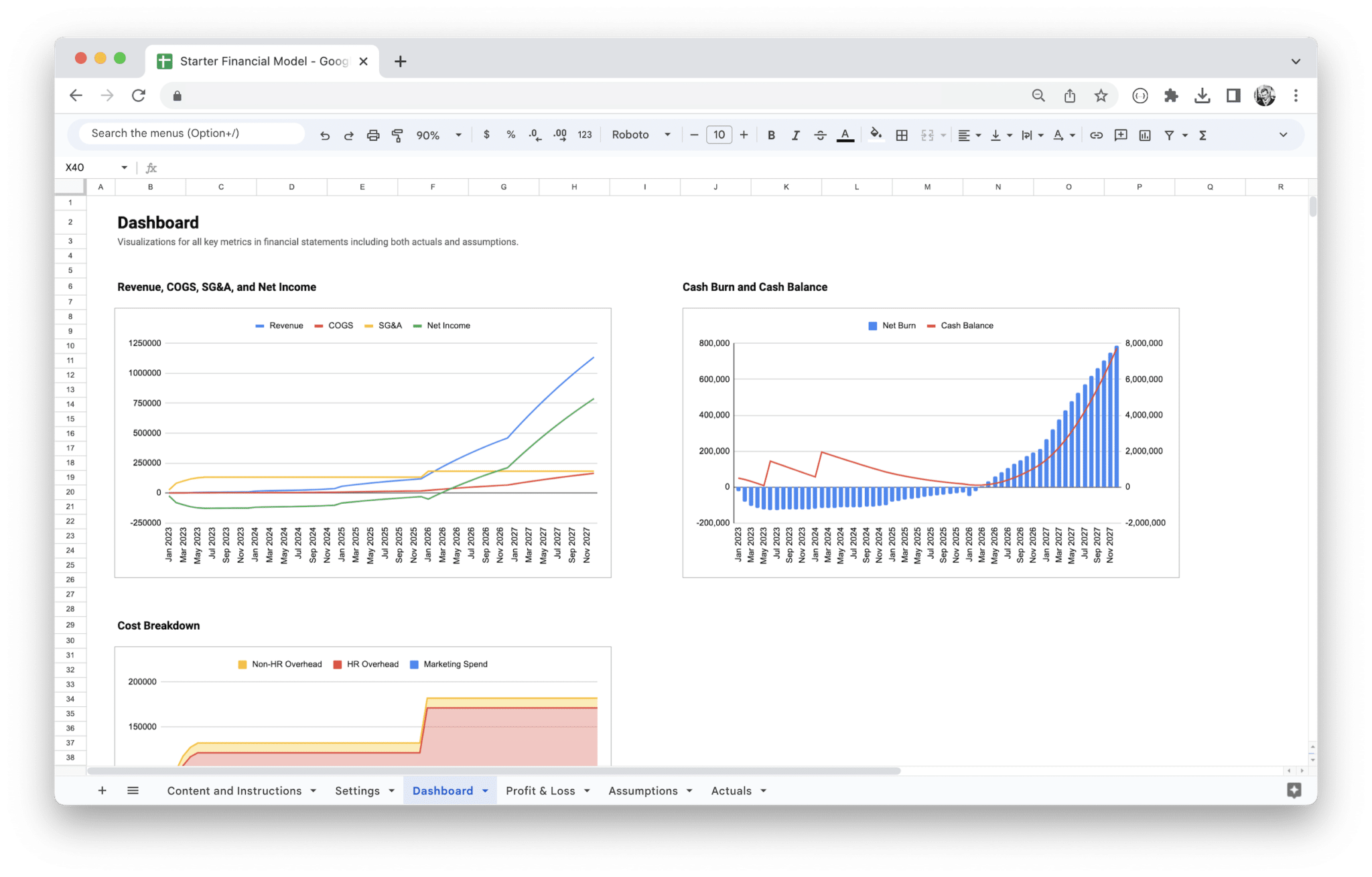

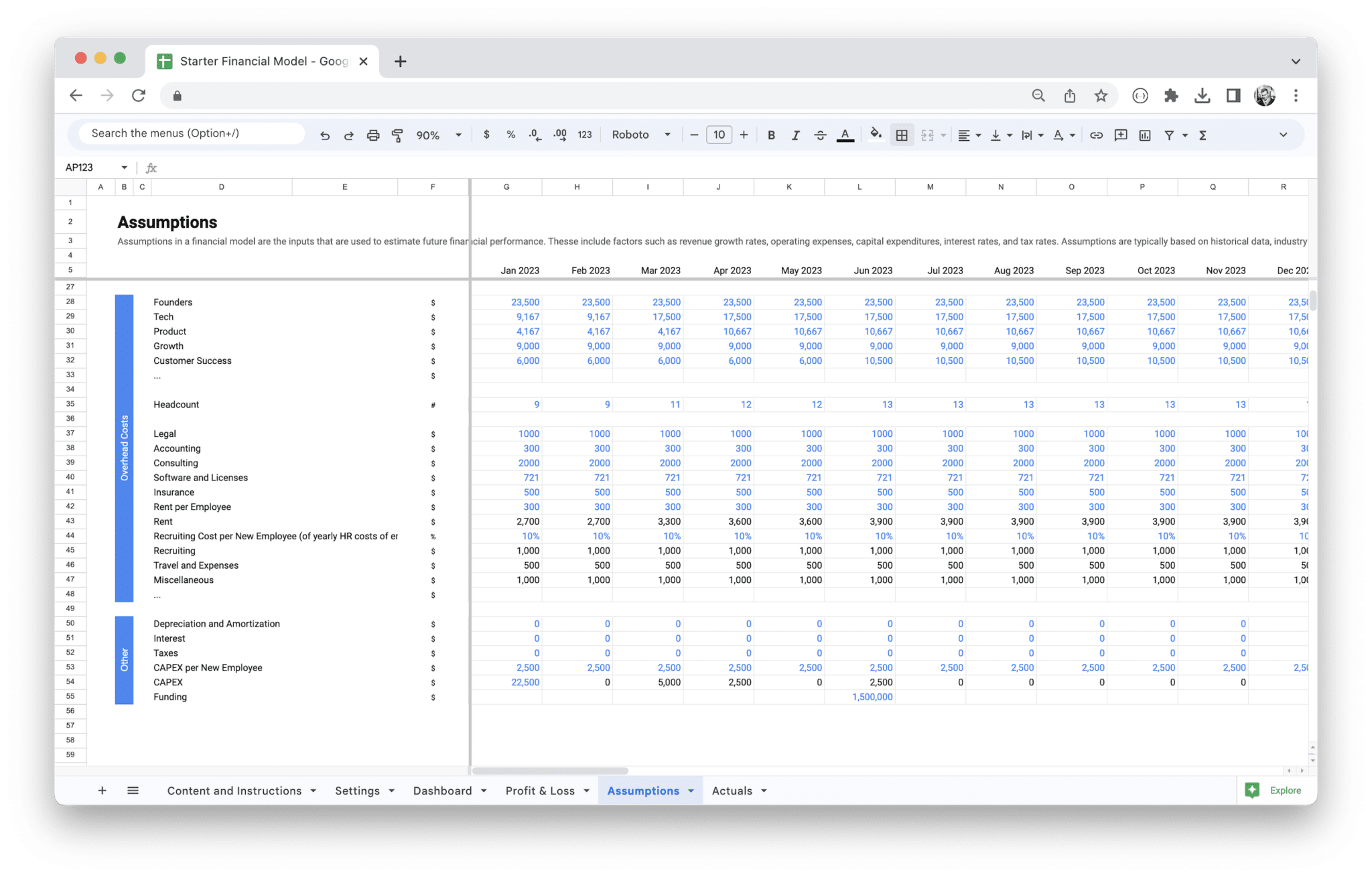

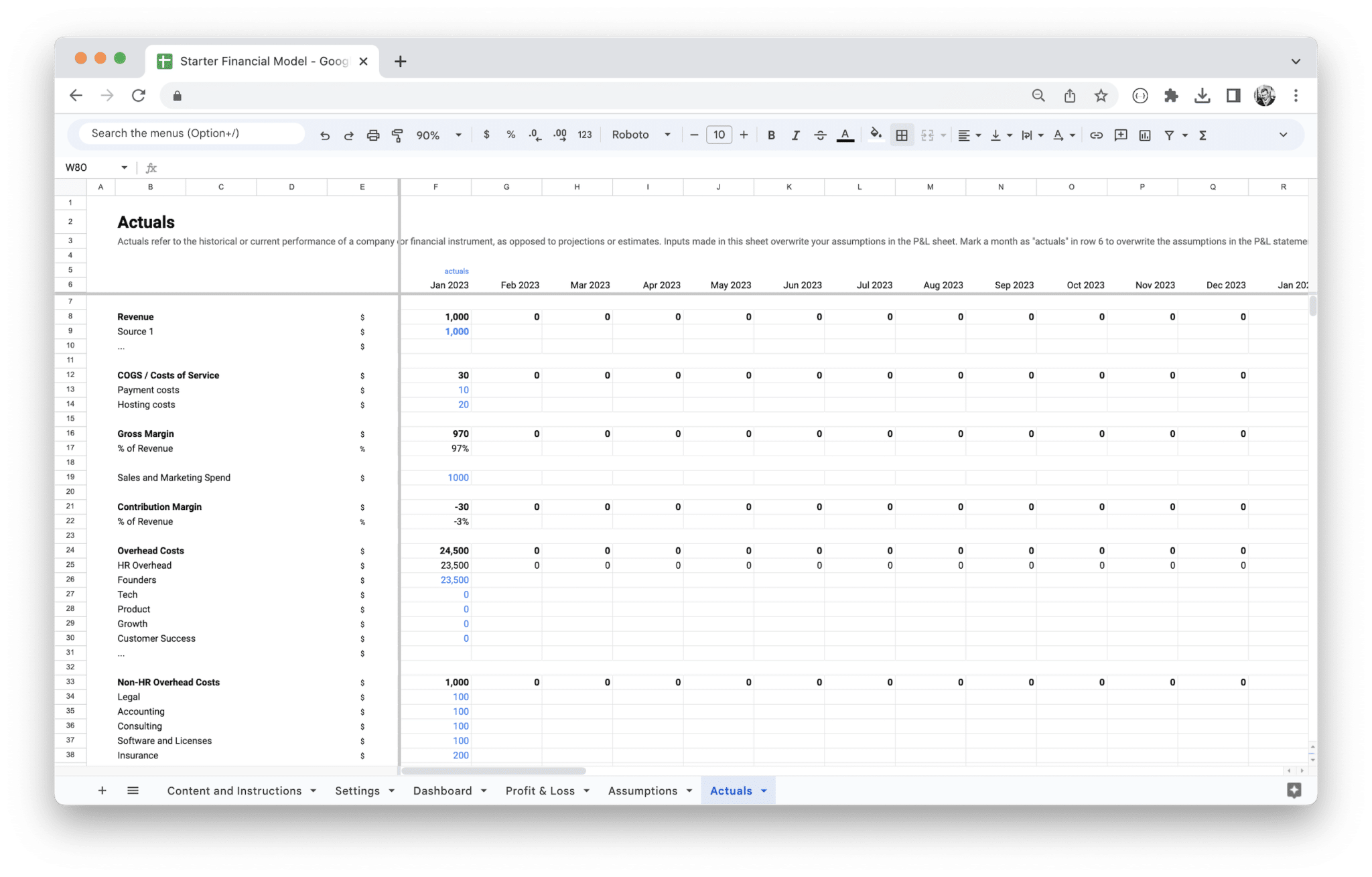

Empower your startup and supercharge your financial planning with a comprehensive financial projection. Create projections, track revenue & expenses, and calculate key financial metrics.

Description

Starting a business is challenging, and one of the biggest hurdles for entrepreneurs is managing their finances. Without clear financial projections, it’s easy to miss opportunities, underestimate costs, or be unprepared for cash flow challenges. Navigating these uncertainties can hinder growth and make it harder to attract investors. That’s where a reliable financial model becomes essential.

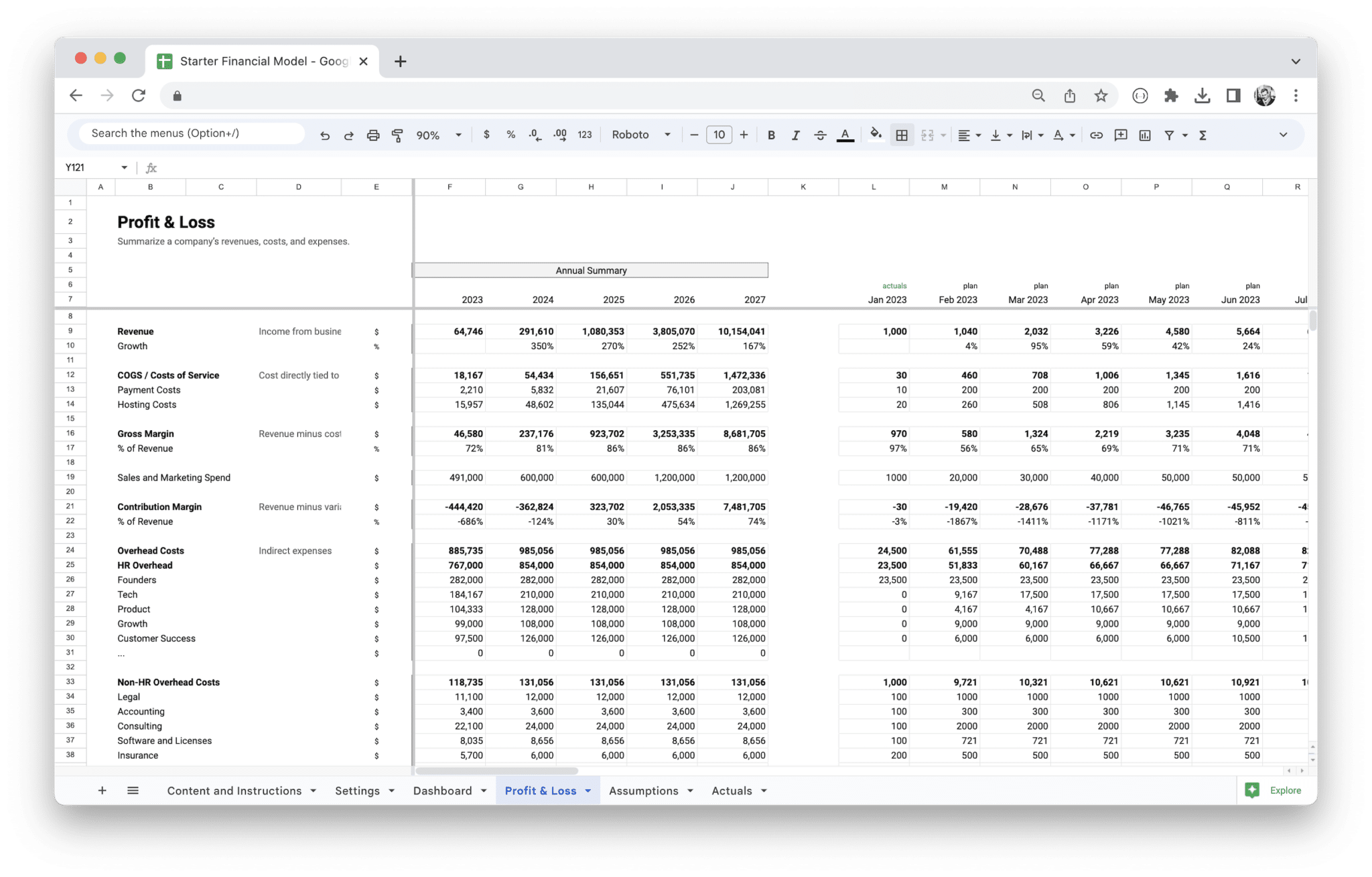

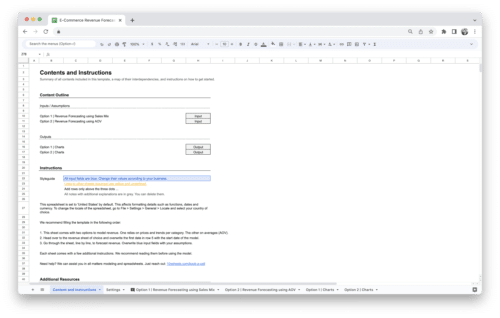

Our Startup Financial Model Template is designed to take the guesswork out of planning your startup’s financial future. With this template, you can easily map out revenue projections, track expenses, and monitor cash flow in a structured, easy-to-use format. It’s customizable to suit your unique business needs, whether you’re a SaaS company, a product-based startup, or offering services. This template will help you visualize your financial landscape, identify potential risks, and make informed decisions that drive growth. By using this tool, you gain clarity, control, and confidence in your startup’s financial strategy.

When launching a startup, one of the first things you’ll need to do is plan for how your business will grow and become profitable. Financial modeling is an essential tool in this planning process. It’s a way to project your business’s future financial performance based on key assumptions and variables. Startup financial modeling allows you to visualize potential revenue, track costs, and understand your cash flow, helping you make informed decisions and attract investors.

In this section, we’ll explore what financial modeling is, why it’s crucial for your startup, and how using a financial model template can simplify the process.

What is Startup Financial Modeling?

At its core, startup financial modeling is the process of creating a structured representation of a startup’s future financial performance. It involves building a set of detailed financial projections that estimate your startup’s revenue, expenses, cash flow, and other key metrics over a specific time frame, typically for 3 to 5 years. These projections are based on a series of assumptions about your business model, market conditions, and operational strategies.

Startup financial modeling combines a mix of historical data (if available), industry benchmarks, and estimated projections to create a realistic view of how your business might perform. The model can include various financial statements like a profit and loss statement, balance sheet, and cash flow statement.

Financial models help you forecast future growth, plan for potential challenges, and strategize for success. They provide a comprehensive overview of how different factors—such as revenue growth, customer acquisition, operational costs, and market conditions—will impact your business financially.

What is a Startup Financial Model?

A startup financial model is a structured tool that outlines the expected financial outcomes of a startup. It’s like a map that shows the paths your business can take based on various assumptions, allowing you to understand your revenue streams, cost structures, and potential profitability.

A typical startup financial model includes:

- Revenue projections: How much money you expect to make, broken down by product or service.

- Expenses: Both fixed and variable costs that your business will incur.

- Profit and loss statements: A summary of your income, costs, and profitability.

- Cash flow statements: A breakdown of how money flows into and out of your business.

- Balance sheet: A snapshot of your business’s assets, liabilities, and equity at a given point in time.

The model also helps you define key financial metrics such as gross margin, customer acquisition costs (CAC), customer lifetime value (LTV), and break-even points. These metrics help you track your startup’s performance and understand what levers you need to pull to reach profitability.

In essence, a financial model is a decision-making tool that helps entrepreneurs and investors assess the viability of the business and plan for the future. It also serves as a communication tool to share your startup’s financial projections with stakeholders such as potential investors, partners, or team members.

The Importance of Financial Models for Startups

Financial models are critical for startups because they provide a roadmap for the business’s future. They help you navigate the uncertainties of entrepreneurship and offer a clear picture of your startup’s financial health.

- Guides strategic decision-making: Financial models help founders understand how changes in pricing, customer acquisition strategies, and cost structures will affect profitability. This enables more informed decision-making as your startup grows.

- Attracts investors: Investors want to see that your startup has a clear path to profitability and that you understand the financial dynamics of your business. A solid financial model shows them that you’ve thought through your business plan and have realistic projections for future growth.

- Helps secure funding: Whether you’re raising seed capital or preparing for a larger round of funding, your financial model plays a critical role in showing potential investors that your startup is worth investing in.

- Identifies potential risks and challenges: By modeling different scenarios, you can identify potential risks to your business’s financial health and take action to mitigate them before they become issues.

- Tracks progress: A financial model helps you track your startup’s financial performance over time. By regularly updating your model with real data, you can see if you’re meeting your projections or if adjustments are needed.

How a Startup Financial Model Template Can Simplify Planning

While building a financial model from scratch can be complex, using a financial model template can significantly simplify the process. Templates are pre-structured models that you can adapt to your startup’s needs, saving you time while ensuring that you don’t miss critical components in your financial planning.

- Saves time and effort: Templates offer a structured framework that already includes the key financial statements and metrics, which means you don’t have to start from scratch. You can focus on customizing the assumptions and inputs that are specific to your business, instead of building everything from the ground up.

- Ensures consistency: Using a template ensures that you include all the necessary components in your model, which means you won’t overlook any key financial data. This also helps maintain consistency across different sections of your model.

- Provides a foundation for customization: While a template gives you a starting point, it’s flexible enough to allow for adjustments based on your specific business needs. You can tweak revenue streams, expenses, and assumptions to reflect your business’s unique situation.

- Helps with scenario planning: Many templates come with built-in scenario planning features, allowing you to model different outcomes based on changes in key assumptions. This makes it easier to anticipate how different variables—like changes in pricing or customer acquisition rates—might impact your bottom line.

Using a financial model template streamlines the process, making it easier to plan and project your business’s financial future with confidence.

Benefits of Using a Financial Model Early in Your Startup Journey

Starting your financial modeling process early on, even if your startup is in its infancy, has several key advantages. The earlier you start, the better prepared you will be to handle the challenges that lie ahead.

- Helps set clear goals: By establishing a financial model early, you can define measurable milestones for growth and profitability. It helps you understand what you need to achieve to succeed and ensures that you stay focused on reaching those goals.

- Improves decision-making: Having a financial model in place enables you to make data-driven decisions. Whether it’s deciding how much to invest in marketing, hiring your first employee, or scaling your operations, you can rely on your model to guide your choices.

- Attracts investors and partners: Investors and potential business partners want to see that you have a well-thought-out plan for managing and growing your business. A financial model demonstrates that you have a strategy in place and gives them confidence that you understand your business’s financial potential.

- Identifies cash flow needs: Cash flow management is one of the most crucial aspects of running a successful startup. By building your financial model early, you can anticipate cash flow issues and ensure that you have enough liquidity to cover your operating expenses, even before you start generating substantial revenue.

- Ensures scalability: As your startup grows, you’ll need to manage increased revenue, operational expenses, and potential new markets. A financial model helps you plan for scalable growth, ensuring that your business can handle expansion without running into financial trouble.

Starting your financial modeling journey early equips you with the knowledge and tools to make informed decisions and position your startup for long-term success. It’s an investment in your future that can pay off significantly as your business evolves.

When building a financial model for your startup, there are a few key components you’ll need to include in order to paint a comprehensive picture of your business’s financial future. Each part plays a critical role in helping you understand your business’s potential, forecast growth, and make smarter decisions. Let’s break down the essential parts of a startup financial model and see how they fit together.

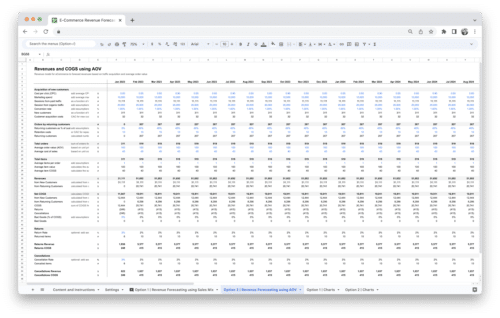

Revenue Projections: Forecasting Sales and Income Streams

Revenue projections are at the core of your financial model. They allow you to estimate how much money your business will generate over a specific period, usually monthly or yearly. Having accurate revenue projections is crucial for both your internal planning and for attracting investors. They’ll want to see how you anticipate making money and how sustainable your business model is.

A good revenue forecast isn’t about guessing the future, but rather about creating educated assumptions based on market research, historical data (if available), and realistic growth expectations. To forecast your revenue, you need to consider the following:

- Target Market Size: Your revenue projections should be based on the size of your target market and your expected share of that market. Consider factors like total addressable market (TAM), serviceable available market (SAM), and serviceable obtainable market (SOM). Each of these will give you a sense of how much you can realistically capture.

- Product Pricing and Sales Models: How you price your product and the way you structure your sales model will greatly impact your projections. If you’re offering a subscription-based service, your projections might lean heavily on the number of customers you can acquire and retain. If you’re in retail, you’ll focus more on volume and price per unit.

- Sales Channels: Are you selling through an online store, physical locations, or B2B sales teams? The method in which you acquire customers and make sales will affect the timing and volume of your revenue. Make sure to account for any potential bottlenecks in the sales process, such as lead generation cycles or seasonal fluctuations in demand.

- Sales Cycle: Be realistic about how long it takes to convert a lead into a paying customer. Startups often make the mistake of projecting immediate, rapid growth, which doesn’t always reflect the reality of sales cycles, particularly in B2B or higher-ticket products.

You’ll also want to segment your revenue projections by different sources. For example, if you have multiple revenue streams, you may break them down into categories like product sales, subscription fees, or consulting fees.

The key here is to be as specific as possible. Instead of general numbers like “$500,000 in revenue next year,” break it down into more granular predictions that show how you expect to reach that figure, such as the number of customers per month, average transaction value, and so on. Investors are keen on understanding how your business will scale, and your revenue projections should tell that story.

Expense Structure: Fixed vs. Variable Costs

A major part of your financial model will be forecasting the costs your business will incur. The key distinction here is between fixed costs and variable costs. Understanding the difference will allow you to create more accurate forecasts and gain better insights into your startup’s financial health.

- Fixed Costs: These are costs that do not change with the volume of sales or production. Regardless of whether your business is booming or struggling, fixed costs remain constant. Examples include rent, salaries of permanent staff, insurance, and certain software subscriptions. These are typically easier to predict since they don’t fluctuate frequently.

- Variable Costs: In contrast, variable costs fluctuate based on the amount of sales or business activity. If you’re a manufacturer, for instance, the cost of materials or labor will vary depending on how much product you produce. If you sell a service, costs related to delivering that service—such as freelance contractor payments or customer support hours—might change based on the volume of clients you serve. Variable costs can also include marketing spend that increases as sales ramp up.

As you build your financial model, make sure to map out both your fixed and variable costs in a way that makes sense for your business. It’s also important to track these costs over time and look for patterns. Are your variable costs increasing disproportionately compared to sales? Are there any opportunities to reduce fixed costs, such as renegotiating contracts or switching to remote work to save on office space?

Your expenses will directly impact your profit margins, so understanding this structure will help you manage costs and keep your business on track.

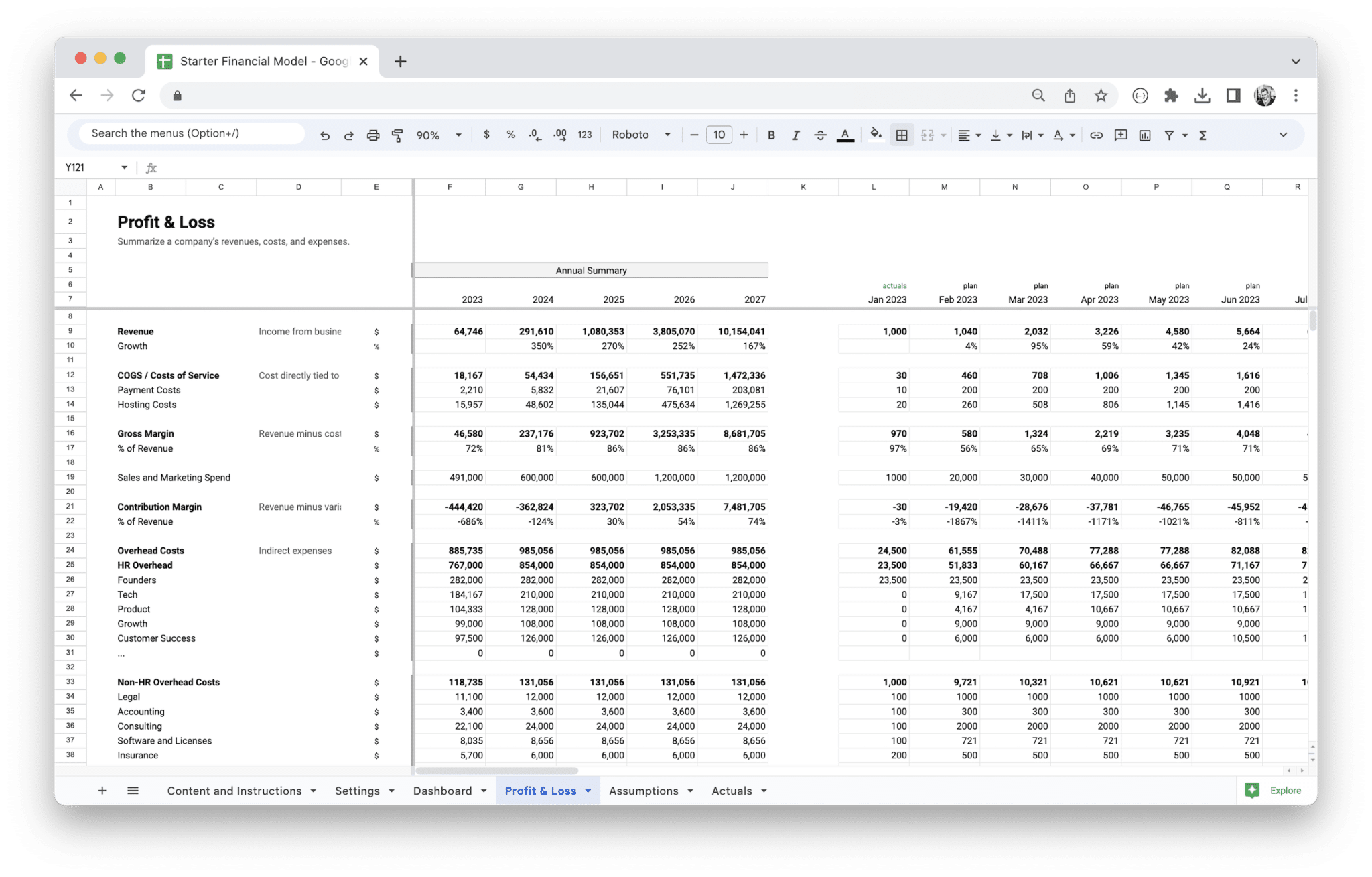

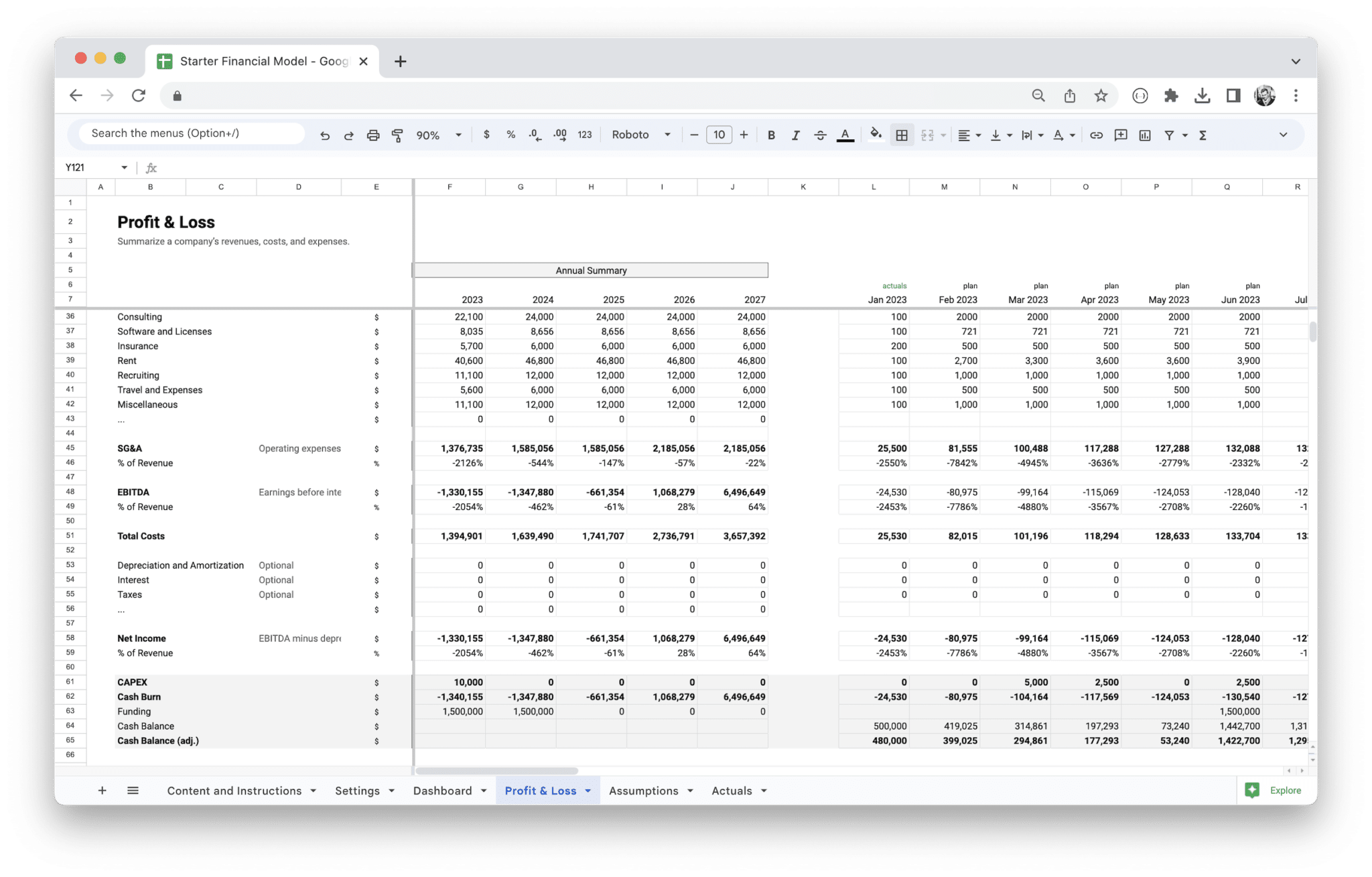

Profit and Loss Statement (P&L): An Overview

The Profit and Loss (P&L) statement is one of the most important financial documents for any startup. It shows whether your business is making a profit or a loss over a given period, typically monthly or quarterly. Investors often look at the P&L as a key indicator of how well the business is performing, so it’s important to ensure that your projections are realistic and based on solid assumptions.

At its core, the P&L is a summary of three key elements:

- Revenue: This is the total amount of money your business earns from all sources. Revenue is typically broken down by product lines or services so you can track which areas are performing the best.

- Expenses: This section outlines your costs, which we already discussed in the previous section. Here, you’ll list both fixed and variable costs in detail, and you can break them down further into categories like operating expenses, marketing costs, and research and development.

- Profit: Finally, the P&L shows your business’s profitability, calculated as revenue minus expenses. This will give you your gross profit, operating profit, and net profit. Gross profit is the amount left after you subtract the direct costs associated with making or delivering your product or service (like production or materials). Operating profit takes into account your general operational expenses, while net profit shows how much is left after all costs (including taxes, interest, and other one-time expenses).

Your goal should be to make sure that your P&L not only looks healthy in the short term but also demonstrates a path toward sustained profitability. Investors want to see how your business will go from break-even to profitable and beyond.

Cash Flow Statement: Understanding Inflows and Outflows

The cash flow statement tracks how money moves in and out of your business. While the P&L tells you whether you’re profitable, the cash flow statement gives you a more detailed view of your liquidity—whether you have enough cash to cover your expenses. Positive cash flow means you have the liquidity to reinvest in your business or pay off debts, while negative cash flow can lead to trouble if you’re unable to pay your bills.

A good cash flow statement breaks down the three main activities that affect your cash flow:

- Operating Activities: This includes all the cash that comes from your core business activities, such as customer payments, product sales, and service income. It also includes cash payments to suppliers, employees, and other operational expenses. Keeping your cash flow positive in this area is key to staying solvent.

- Investing Activities: Cash that goes toward buying or selling long-term assets, such as property, equipment, or investments. If you’re in the growth phase, this might also include the purchase of new software or R&D spending. While this section may show negative cash flow at times, it reflects your business’s investment in future growth.

- Financing Activities: Cash that comes from or goes to investors, lenders, or other sources of funding. This includes loans, equity financing, or dividend payments. While you generally want to limit dependence on external financing, this section can provide insight into your business’s funding needs.

By monitoring your cash flow regularly, you can ensure that you won’t run into situations where you’re profitable on paper but don’t have enough cash to pay your bills.

Balance Sheet: Evaluating Your Financial Health

The balance sheet provides a snapshot of your startup’s financial position at any given moment in time. It’s divided into three main sections: assets, liabilities, and equity. The balance sheet follows the basic accounting equation: Assets = Liabilities + Equity. This simple formula tells you if your business is financially healthy by comparing what it owns against what it owes.

- Assets: This section includes everything your business owns that has value. These can be either current assets (such as cash, accounts receivable, or inventory) or long-term assets (like real estate or equipment). The more assets you have, the more financially stable your business is likely to be, as they can be used to pay off liabilities.

- Liabilities: This is what your business owes, such as loans, credit lines, or accounts payable. Liabilities are broken down into current liabilities (due within a year) and long-term liabilities (due after more than a year). If your liabilities exceed your assets, it could indicate financial trouble.

- Equity: This is the difference between your assets and liabilities and represents the owner’s share in the business. It’s an important indicator of your company’s financial health. The more equity you have, the less reliant you are on external financing, which can make you more attractive to investors.

Your balance sheet helps you understand whether your startup is on solid ground financially. If liabilities are creeping up without corresponding growth in assets or equity, it could signal potential risks. Monitoring this balance will allow you to take corrective actions before it becomes an issue.

These key components work together to form a complete financial picture of your startup. By carefully projecting and tracking your revenue, costs, profits, cash flow, and financial position, you’ll be in a much better place to make strategic decisions and grow your business sustainably.

When it comes to building a financial model for your startup, there isn’t a one-size-fits-all approach. Different stages of business development require different types of models, and the level of complexity will evolve as your business grows. Let’s take a closer look at the three primary types of financial models you’ll encounter as a startup: the basic model, the scalable model, and the investor-ready model.

The Basic Financial Model: A Simplified Approach for New Ventures

The basic financial model is ideal for early-stage startups, particularly those that are still in the idea or seed stage. At this point, your business is likely experimenting with its product or service, testing the market, and trying to figure out how to make it all work. Your financial model doesn’t need to be overly complex, but it should give you a clear, foundational understanding of your revenue streams, cost structure, and profitability potential.

This simplified model focuses on the essentials: a clear understanding of your revenue, expenses, and profitability. You’re essentially creating a roadmap for how your business will generate income and manage costs. While a basic financial model is relatively straightforward, it provides enough structure to help guide early-stage decision-making and identify any potential red flags early on.

Here’s what you typically include in a basic financial model:

- Revenue projections: At this stage, you will be estimating your sales based on your best assumptions about the market and pricing. Keep it simple and don’t overcomplicate your projections. Factor in things like expected customer acquisition and how many units or services you plan to sell. Even if these numbers are rough, they’ll help you gauge if your idea has the potential for success.

- Fixed and variable costs: You’ll want to identify your key expenses, particularly fixed costs (like rent or software subscriptions) and variable costs (such as raw materials or marketing spend). Understanding these will give you a clear view of what it takes to keep the business running.

- Basic P&L: Your basic profit and loss (P&L) statement will include an outline of your projected revenue, expenses, and the net profit (or loss) you expect. While it won’t be as detailed as it could be for a later-stage company, it’s essential to understand whether your business will be able to cover its costs.

- Simple cash flow projections: Cash flow management is critical for startups, as you may not yet have consistent revenue. A simple cash flow statement will allow you to track your liquidity, helping you understand when you’ll need to raise funds or adjust your spending.

The simplicity of this model means that you can quickly adapt and make changes as your business evolves. It’s a useful tool for understanding the basic financial dynamics of your startup and will give you the insights you need to operate at an early stage without overwhelming you with unnecessary complexity.

The Scalable Financial Model: Preparing for Growth and Expansion

As your startup gains traction, your financial needs become more sophisticated. The scalable financial model is designed to account for growth, allowing you to plan for future expansion and navigate the complexities that come with a larger business. In this stage, you’ve likely moved beyond the basics and are beginning to see a clearer path forward in terms of market fit and revenue generation.

A scalable model isn’t just about forecasting growth—it’s about planning for multiple scenarios and understanding how your business will scale as it matures. This model is built to handle more granular details, such as customer acquisition costs (CAC), lifetime value (LTV), and how your operational costs will evolve as you scale.

Key elements of a scalable financial model include:

- Revenue forecasting with growth assumptions: A scalable model needs to account for different growth rates in revenue. At this point, you’re no longer just guessing at what might happen—you’ll have some historical data (perhaps from customer acquisition or pilot programs) that can help you project future growth. Your assumptions will include how quickly your customer base will grow and what factors could influence that growth, such as seasonality or market saturation.

- Customer acquisition and retention costs: As you grow, your customer acquisition strategies will become more complex, so it’s essential to factor in how much it will cost to acquire new customers and how much revenue each customer will generate over their lifetime. This helps you understand whether your marketing and sales expenses are sustainable as you scale.

- Cash flow modeling for expansion: In this phase, you need to understand how your cash flow will change as your revenue and costs increase. Consider how your working capital needs will shift and what timing adjustments might be required as your business starts paying suppliers or vendors on longer terms.

- Operational scaling: As your startup expands, you’ll need to account for increased operational costs. For example, you might need to hire more employees, invest in technology or infrastructure, or expand your marketing efforts. A scalable model should consider these added costs and the effects they will have on your profitability.

- Scenario planning: Unlike the basic model, the scalable model often includes scenario planning to account for various growth outcomes. For example, what happens if your sales increase at a slower rate than expected? Or what if a competitor enters the market and cuts into your customer base? Understanding how different growth scenarios could affect your bottom line helps you plan ahead and minimize surprises.

The scalable financial model is all about understanding your business’s growth potential and planning for the increased complexity that comes with scaling. It’s more dynamic than the basic model and incorporates a lot more data and assumptions, helping you steer the business in the right direction.

The Investor-Ready Financial Model: Attracting Capital and Funding

When your startup reaches the point where you’re ready to raise funds from investors, the investor-ready financial model is the one you’ll need to rely on. This model is the most complex of the three, and it’s designed to provide potential investors with a clear, detailed picture of your financial health, growth prospects, and overall business strategy.

Investors are looking for startups with a solid growth trajectory, a clear path to profitability, and a compelling reason to invest their capital. A robust investor-ready financial model not only showcases your past financial performance (if applicable) but also demonstrates your future potential, risk management strategies, and the expected return on investment (ROI).

Key components of an investor-ready financial model include:

- Detailed P&L statement: Investors will want to see a detailed profit and loss statement that covers multiple years, often 3-5 years into the future. This will provide insight into your projected revenue, costs, gross profit margins, operating expenses, and net profit. It should be more comprehensive than the P&L in earlier models, with a focus on profitability milestones.

- Advanced revenue projections: Investors expect to see detailed, realistic revenue projections, backed by solid assumptions and market research. This is where you’ll break down the different revenue streams and how they’ll evolve over time. You’ll also include how you plan to acquire and retain customers and how those strategies will contribute to revenue growth.

- Financial ratios and metrics: Investors love data, and financial ratios are a key part of that. Common ratios include gross margin, net profit margin, return on equity (ROE), return on investment (ROI), and debt-to-equity ratio. These metrics help investors gauge the health and viability of your business, and how you compare to competitors in your industry.

- Funding requirements and capital structure: You’ll need to clearly outline how much capital you’re seeking, how it will be used, and the terms of the funding (e.g., equity ownership, debt, or convertible notes). Investors will also want to know how the capital will help you achieve your business milestones and the expected timeline for profitability.

- Risk analysis and mitigation strategies: Any investor knows that startups are inherently risky, so it’s important to demonstrate that you understand the risks your business faces and have strategies in place to mitigate those risks. Whether it’s competition, regulatory changes, or market shifts, showing that you have a plan in place to deal with potential issues builds trust with investors.

- Exit strategy: Investors are looking for a return on their investment, so you need to show them how they will get that return. Whether it’s through a public offering, acquisition, or another method, outlining your exit strategy will help investors see the potential for a profitable exit down the line.

The investor-ready financial model is your pitch in numbers. It needs to be accurate, clear, and professionally presented to impress potential investors. This model is the final step in your financial modeling journey, and it’s what you’ll use to secure the capital you need to take your business to the next level.

Each of these financial models serves a different purpose, depending on the stage of your startup. The basic model is a great starting point for new businesses, the scalable model helps prepare for growth, and the investor-ready model is essential when you’re seeking funding. As your business evolves, so too will your financial model, and understanding when to shift from one model to the next will help you stay on top of your finances and ultimately achieve long-term success.

Creating a financial model from scratch can feel like a daunting task, but it’s one of the most valuable exercises you can undertake for your startup. A well-built financial model gives you a clear understanding of your business’s financial health, helps you identify potential challenges early on, and gives you the roadmap to scale successfully. When you’re starting from scratch, it’s important to lay a solid foundation. That means defining assumptions, estimating market size, understanding your customer metrics, and forecasting your expenses.

Let’s dive deeper into the steps that make up this crucial process.

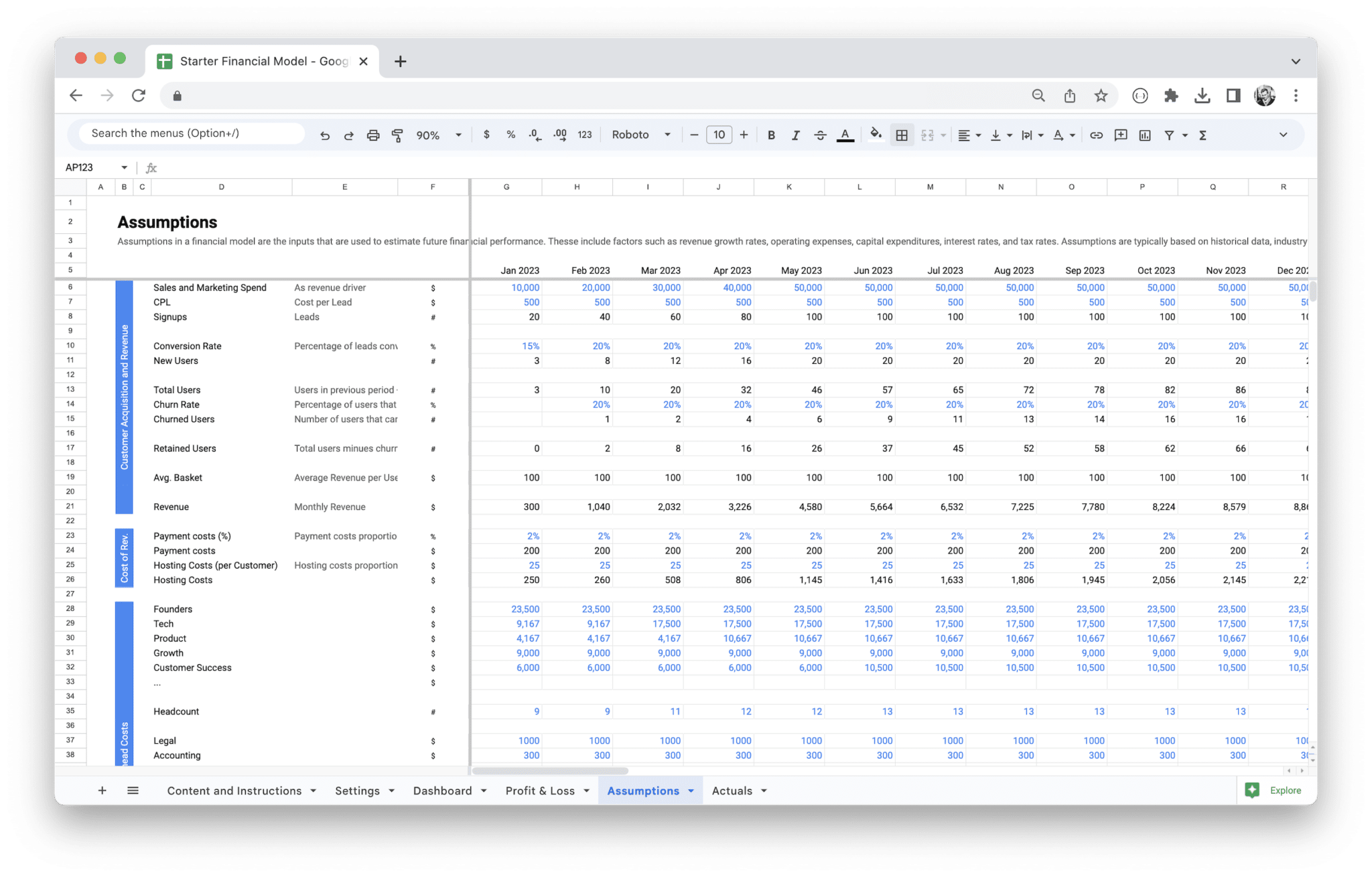

1. Define Your Startup’s Key Assumptions

The heart of your financial model lies in the assumptions you make. Assumptions are essentially educated guesses about how things will play out in your business. While you won’t be able to predict everything with absolute certainty, clear and realistic assumptions form the foundation for all your financial projections.

Start by thinking through the key drivers of your business. What factors will influence your revenue? What will determine your costs? These drivers will shape your assumptions and impact your financial model. Here are some critical assumptions you’ll want to consider:

- Market growth rates: How quickly is your industry growing? What is the adoption rate for your product or service? Understanding the broader market trend helps you estimate how your business might perform. For example, if you’re in the SaaS industry, market growth might be driven by digital transformation trends. If you’re launching a physical product, consumer behavior trends could influence growth projections.

- Pricing strategy: Your assumptions around pricing are key. Will your product be priced competitively, or will it be premium? Will you offer discounts or promotions? Pricing will affect your revenue projections, so base your assumptions on market research or competitor pricing models to determine a starting point.

- Sales channels: Think about how you plan to sell your product—online, offline, B2B, B2C, or a mix. Each channel comes with its own costs, sales cycle, and customer engagement methods. Your assumptions about how much revenue each channel will generate will drive your revenue projections.

- Sales and marketing efficiency: How effective will your sales and marketing efforts be? If you’re estimating a customer acquisition cost (CAC), consider how much you plan to spend on marketing and sales and how many customers you expect to acquire from that investment.

- Customer behavior: Make assumptions about customer retention, repeat purchases, churn rates, and lifetime value (LTV). For example, if you’re in a subscription business, how long do customers typically stay? These assumptions will help you estimate the future revenue that will come from existing customers.

While assumptions can never be 100% accurate, they should always be based on available data or reasonable projections. The more informed your assumptions are, the more reliable your financial model will be.

2. Estimate Market Size and Potential Revenue Streams

Understanding the market size and your potential revenue streams is a critical step when building a financial model. You need to figure out how big your opportunity is and how much you can realistically capture in that market.

Start by calculating the Total Addressable Market (TAM)—this is the total demand for your product or service within a specific market. For example, if you’re offering a business software tool for small businesses, your TAM would be the number of small businesses in the region you’re targeting. From there, you narrow it down to your Serviceable Available Market (SAM), which is the segment of the market you can target with your product or service. For instance, this could be small businesses that use digital tools, excluding those who rely on traditional methods.

Once you have an understanding of your target market, it’s time to estimate your Serviceable Obtainable Market (SOM). This is the portion of the market you realistically expect to capture in the near term. SOM takes into account factors like competition, your marketing budget, your product’s value proposition, and your ability to scale.

Market research is your best tool for estimating these numbers. Use industry reports, surveys, competitor analysis, and customer interviews to get a clearer picture of how large the market is and how much you can realistically capture. If you’re just starting, it’s okay to make rough estimates, but as you gain more data over time, refine these numbers for greater accuracy.

In terms of revenue streams, consider all the ways your business can make money. Will you have a one-time purchase model, a subscription-based model, or a freemium model? Understanding all possible revenue streams will allow you to forecast a variety of potential outcomes. For instance:

- Product sales: If you’re selling a physical product, you need to estimate the volume of products you’ll sell each month, the price per unit, and the expected profit margins.

- Subscriptions: If your startup is SaaS-based, you’ll need to project how many customers you’ll acquire each month and the average subscription fee per customer. Factor in churn rates (how many customers cancel) and any upselling or cross-selling opportunities.

- Ad revenue or affiliate marketing: If your business will rely on ads or affiliate revenue, estimate how much you can earn based on traffic or the number of users engaging with your content.

The key is to estimate all the ways your business will generate revenue and project how those streams will grow over time. Understanding your market and revenue potential early on can help you make more informed decisions as you scale.

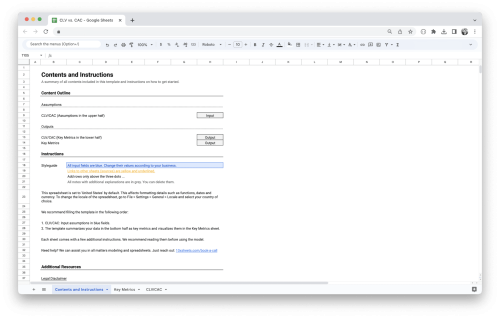

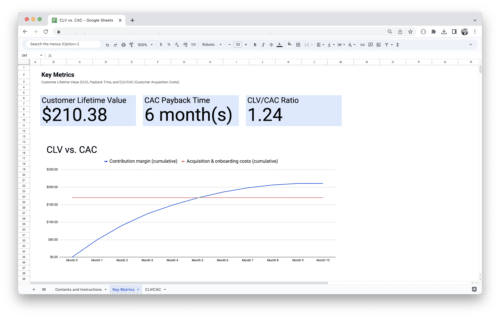

3. Understand Customer Acquisition Costs and Lifetime Value

Customer acquisition cost (CAC) and lifetime value (LTV) are two of the most important metrics you’ll need to focus on. These metrics help you understand how much you’re spending to acquire a customer and how much revenue you can expect from that customer over the course of your relationship.

- Customer Acquisition Cost (CAC): This metric represents how much it costs your business to acquire a single customer. To calculate CAC, add up all the costs associated with acquiring customers—such as marketing expenses, advertising spend, and sales team salaries—then divide that total by the number of customers you acquired in the same period.

For example, if you spent $10,000 on marketing and sales and acquired 100 customers, your CAC is $100 per customer. The lower your CAC, the more efficient your business is at acquiring customers.

- Lifetime Value (LTV): This metric represents the total amount of revenue you expect to earn from a customer over the entire time they stay with your business. It’s important to understand because it helps you determine whether your CAC is sustainable. If it costs you $100 to acquire a customer, but you only make $50 from that customer over their lifetime, your business model is not sustainable.

To calculate LTV, consider the following factors:

- Average Revenue per User (ARPU): How much does the average customer spend with you over a specific period (monthly or annually)?

- Churn Rate: How long do customers stay with you? If your churn rate is high, LTV will be lower because customers don’t stay long enough to generate significant revenue.

- Customer Segmentation: Different types of customers might generate different levels of revenue. Segment your customers based on behaviors, spending patterns, and longevity.

Your goal should be to have an LTV that’s higher than your CAC. Ideally, you want your LTV to be 3x higher than your CAC, which will make your customer acquisition efforts sustainable and profitable in the long run.

4. Project Operational and Capital Expenses

Accurately projecting your startup’s expenses is essential for understanding whether your business can generate sustainable profits. Expenses can be broken down into two main categories: operational expenses and capital expenses.

- Operational Expenses: These are the day-to-day costs that keep your business running. They include salaries, office rent, software subscriptions, marketing expenses, utilities, and any other recurring costs associated with maintaining your operations. While operational expenses tend to be more predictable, they can also grow as your business scales.

When projecting operational expenses, think about:

- Staffing costs: As your business grows, you’ll need to hire more employees, which adds to your payroll. This also includes benefits, taxes, and any bonuses.

- Marketing and sales: As you scale, your marketing budget will likely increase. This could include advertising, content creation, social media, and other sales enablement tools.

- Technology and tools: Consider the cost of any software, licenses, and tools you’ll need to run your business, especially as you scale.

- Capital Expenses: These are one-time or long-term investments required to grow your business. For example, if you need to purchase equipment, invest in property, or fund significant product development, those costs fall under capital expenses.

Capital expenses are often more difficult to predict, as they can vary depending on your growth stage. For example, as a startup, you may not need to invest heavily in infrastructure early on, but as you scale, you may need to purchase office space, hire additional staff, or invest in more sophisticated technology.

Having a solid understanding of both operational and capital expenses will help you ensure your business remains financially stable as you grow. By projecting these costs and monitoring them against your revenue, you’ll be able to make smarter decisions about how to allocate resources.

Building a financial model from scratch requires a careful balance of forecasting and assumption-setting. It may feel like a lot of work up front, but it’s worth the effort to create a roadmap for your business’s future. By defining key assumptions, estimating market size, understanding customer metrics, and projecting expenses, you’ll have a comprehensive financial model that can guide you as your business grows and evolves.

Using a financial model template can save you time and effort when creating projections for your startup, but it’s essential that you use it in the right way. A template is just the starting point—you need to customize it to reflect the specific nature of your business and the assumptions that drive your financial decisions. The effectiveness of your financial model will depend on how well you adapt the template to suit your unique circumstances. Here are some strategies to get the most out of your template:

- Tailor the template to your business: While templates offer a convenient framework, they won’t work as intended unless you customize them to reflect your industry, business model, and target market. For example, if your startup is SaaS-based, you’ll need to include recurring revenue streams, churn rates, and customer acquisition costs. If you’re selling a physical product, you’ll need to focus more on inventory, supply chain costs, and product pricing. Start with the template but adjust it to your business’s specific needs.

- Use realistic assumptions and data: Your template will rely on the assumptions you input, so ensure these assumptions are based on real, current data. Don’t simply rely on best-case scenarios or projections that feel good. Be as specific and realistic as possible, using market research, customer insights, and even competitor data to inform your numbers. The more accurate your assumptions are, the more useful your financial model will be.

- Focus on key metrics: Rather than getting bogged down in every single number, focus on the most critical metrics for your startup. These could include revenue growth, customer acquisition cost, customer lifetime value, gross margin, and cash flow. By tracking these key metrics regularly, you’ll be able to adjust your strategies as needed and keep your business on track.

- Update the model regularly: Your financial model should evolve alongside your business. As your startup progresses, revisit and update your model frequently. Whether you’re securing funding, expanding your product line, or adjusting your marketing strategy, your financial model should reflect these changes. Keeping your model updated will ensure that it remains accurate and useful as a decision-making tool.

- Use the model for decision-making: A financial model isn’t just a document for investors; it’s a tool for running your business. Use it to help guide decisions about hiring, marketing investments, or product development. If the numbers indicate that cash flow might become tight in a few months, for example, it’s a signal to adjust your spending or secure additional funding. Treat your model as a roadmap for business growth, not just a static tool.

- Run different scenarios: One of the most useful aspects of a financial model is the ability to simulate different scenarios. Don’t just look at the “best-case” projection. Create different versions of the model based on different assumptions—what if customer acquisition costs go up? What if you have a slow quarter of sales? Running these scenarios will help you prepare for the unexpected and ensure that you’re ready for whatever the market throws at you.

- Involve key stakeholders in the process: When using a financial model template, it’s helpful to involve other members of your team—whether it’s your co-founder, financial advisor, or investors—in the process. This ensures that the assumptions you’re making are realistic and that you’re considering all possible angles. Collaborating with others will also help you spot any blind spots and improve the overall accuracy and usefulness of your model.

- Use the model as a communication tool: A financial model is a great way to communicate your business’s potential to investors, partners, and other stakeholders. It’s not just about crunching numbers—it’s about telling the story of your business. Be prepared to explain the assumptions behind your numbers, how you plan to grow, and the strategies you’ll use to reach profitability. A clear, well-constructed model will help others see the potential in your startup.

By following these guidelines, you’ll be able to get the most out of your financial model template. When used effectively, it can be a powerful tool for guiding decisions, securing funding, and ultimately driving the success of your startup.

Building a financial model for your startup can be an overwhelming task, and while using a template can save time, it’s important to be mindful of the common pitfalls that can occur. Even the best templates require careful attention and customization to your specific business. Avoiding these common mistakes will ensure that your financial model remains realistic, useful, and a true reflection of your startup’s financial health.

- Overestimating revenue projections: It’s tempting to project rapid, exponential growth, but such assumptions can lead to unrealistic expectations. Being overly optimistic about how fast customers will flock to your product can distort your financial planning and lead to poor decision-making down the road. Instead, make your revenue projections based on solid market research and real-world data. While growth is crucial, a more conservative, gradual growth approach will provide a clearer roadmap for your startup’s success.

- Underestimating costs and expenses: One of the most common mistakes startups make is underestimating the true cost of running their business. When you’re projecting expenses, it’s easy to overlook or underestimate factors like marketing, software tools, employee compensation, or overhead costs. Even if you’re operating out of a small space and don’t have many employees at first, these costs can add up quickly as your business grows. It’s important to accurately account for both fixed and variable costs and overestimate, rather than underestimate, to ensure you’re prepared for surprises.

- Failing to account for cash flow fluctuations: Profitability doesn’t always equate to liquidity. Even if your business is profitable on paper, you might still struggle to pay bills, payroll, or other essential expenses if cash isn’t flowing in at the right times. Failing to model cash flow accurately, especially in the early stages of your business, can lead to cash shortages that stall your progress. Consider not just your earnings, but how quickly your customers pay, how often you have to pay suppliers, and how your cash needs fluctuate throughout the year.

- Using outdated or irrelevant data: Financial models are only as good as the data you put into them. If you’re using a template, make sure the assumptions it is based on are relevant to your industry, market conditions, and business model. Additionally, don’t rely on historical data that’s not representative of your current situation. You should regularly update your model as new data becomes available and adjust your assumptions accordingly. Failure to incorporate accurate, up-to-date information will cause your projections to be less reliable.

- Neglecting scenario planning: A key part of a good financial model is the ability to test different scenarios. For example, what happens if your sales are 20% lower than expected? Or what if you get an influx of new customers? Too often, startups build financial models that only focus on a “best-case” scenario, which can leave you unprepared for market fluctuations or unexpected downturns. Modeling different scenarios, such as best-case, worst-case, and base-case, helps you plan for uncertainty and create more resilient strategies.

- Not adjusting the model as your business evolves: A financial model is a living, breathing document. When you first build it, the numbers might reflect a set of assumptions about your business. However, as your company grows and evolves, your model should be adjusted to reflect real data and new insights. Whether it’s shifting your pricing strategy, expanding your product line, or changing your market approach, it’s important to regularly review and update your model to ensure it’s always aligned with the current state of your business.

Make a one-time payment and

enjoy your template forever.

No extra costs, no strings attached,

more savings for you.

Keep your templates up-to-date

with free access to regular updates.

Related products

-

Sale!

Startup Profit and Loss Statement

100,00 €Original price was: 100,00 €.66,39 €Current price is: 66,39 €.Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to cart Details -

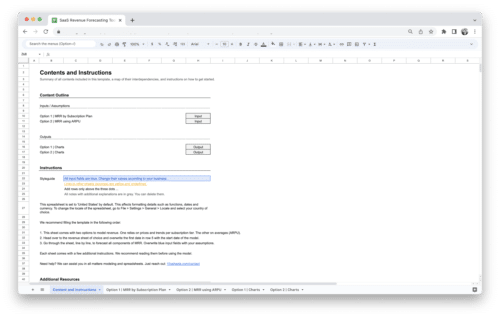

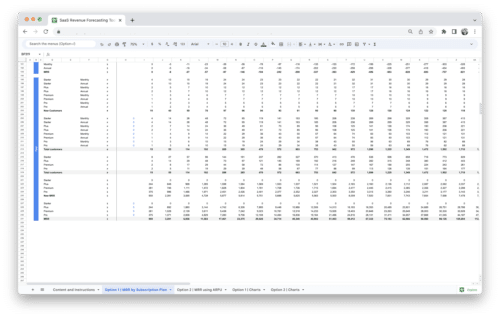

SaaS Revenue Forecasting Tool

41,18 €Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to cart Details -

Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to cart Details -

Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to cart Details