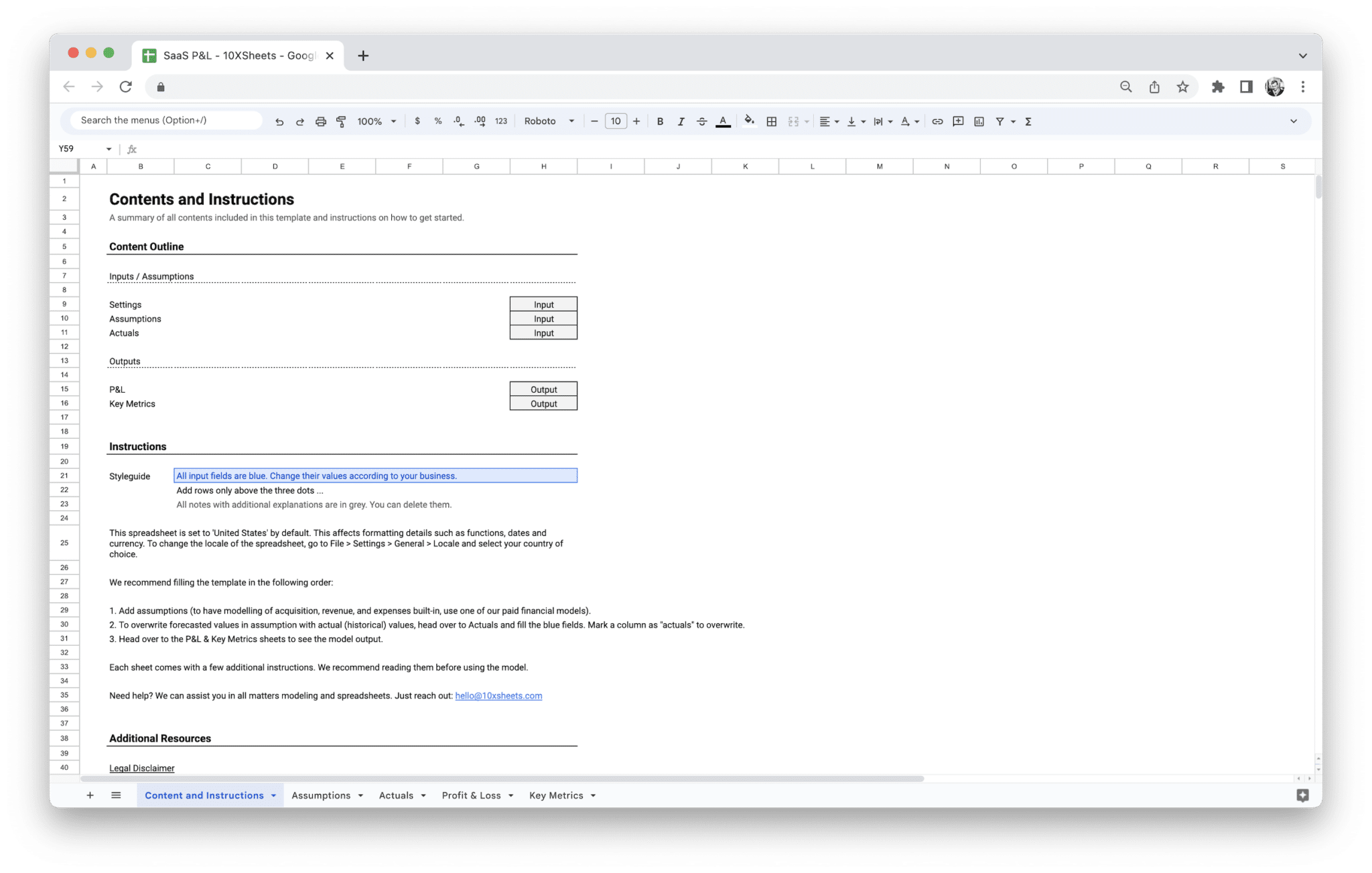

SaaS Profit and Loss Statement

100,00 € Original price was: 100,00 €.66,39 €Current price is: 66,39 €.

34% Off

Value added tax is not collected, as small businesses according to §19 (1) UStG.

Description

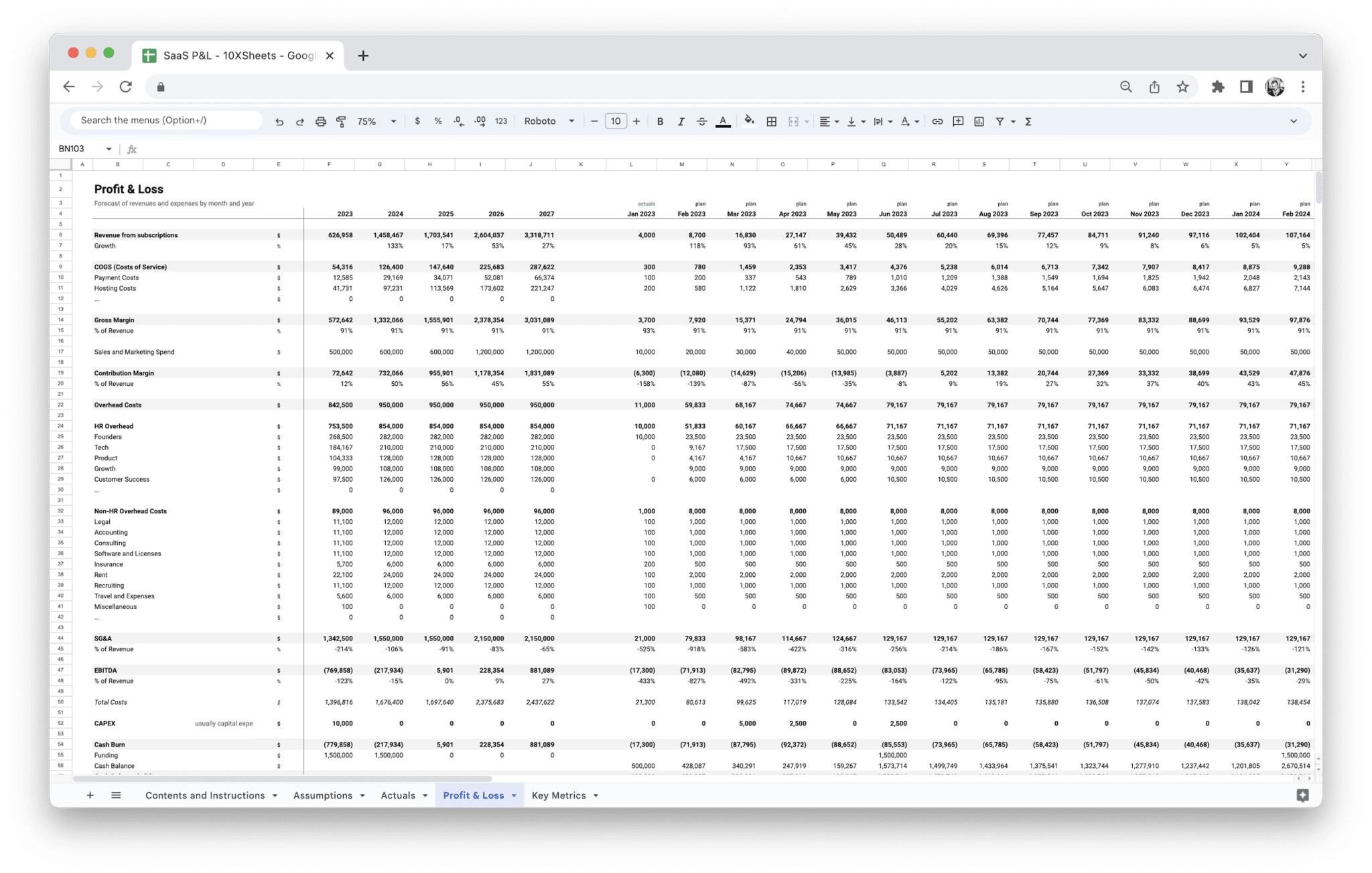

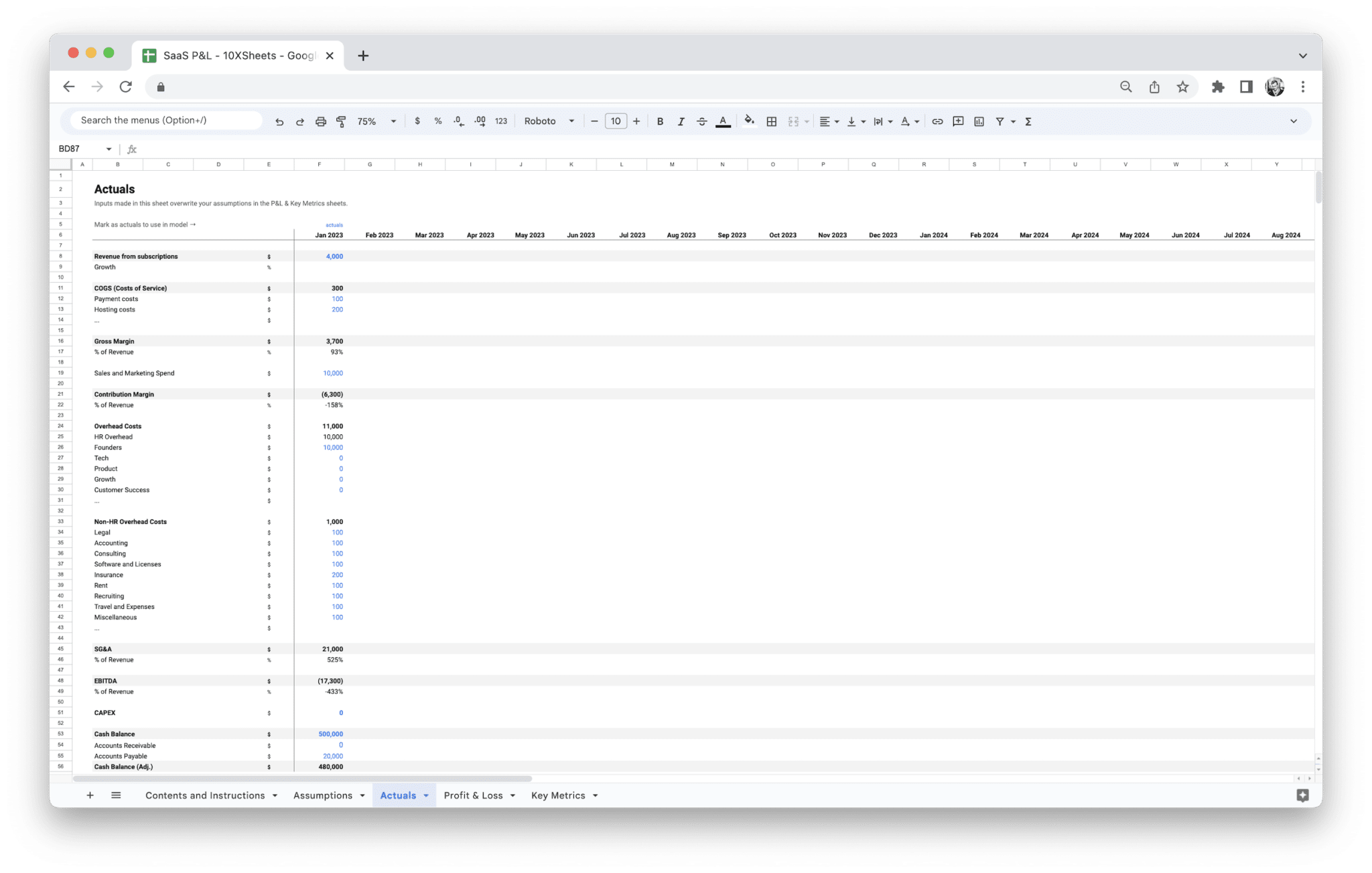

Managing finances for a SaaS business can quickly become overwhelming. As your customer base grows, tracking revenue, expenses, and profitability becomes more complex. Without a clear, organized way to manage your financial data, it’s easy to lose sight of important metrics like customer acquisition costs, gross margin, and operating income. This can lead to missed opportunities, inefficiencies, and poor decision-making that can affect your growth and long-term sustainability.

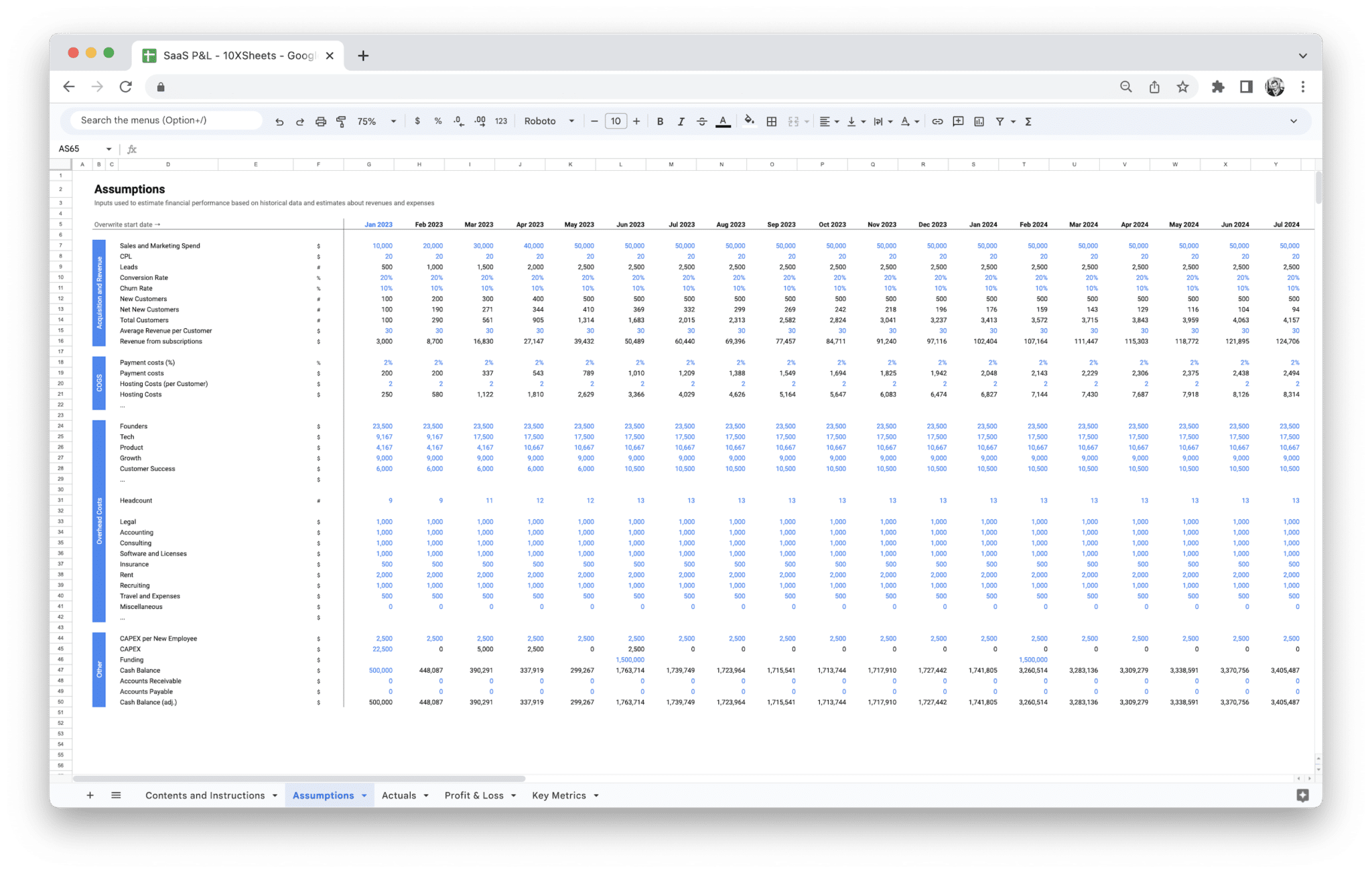

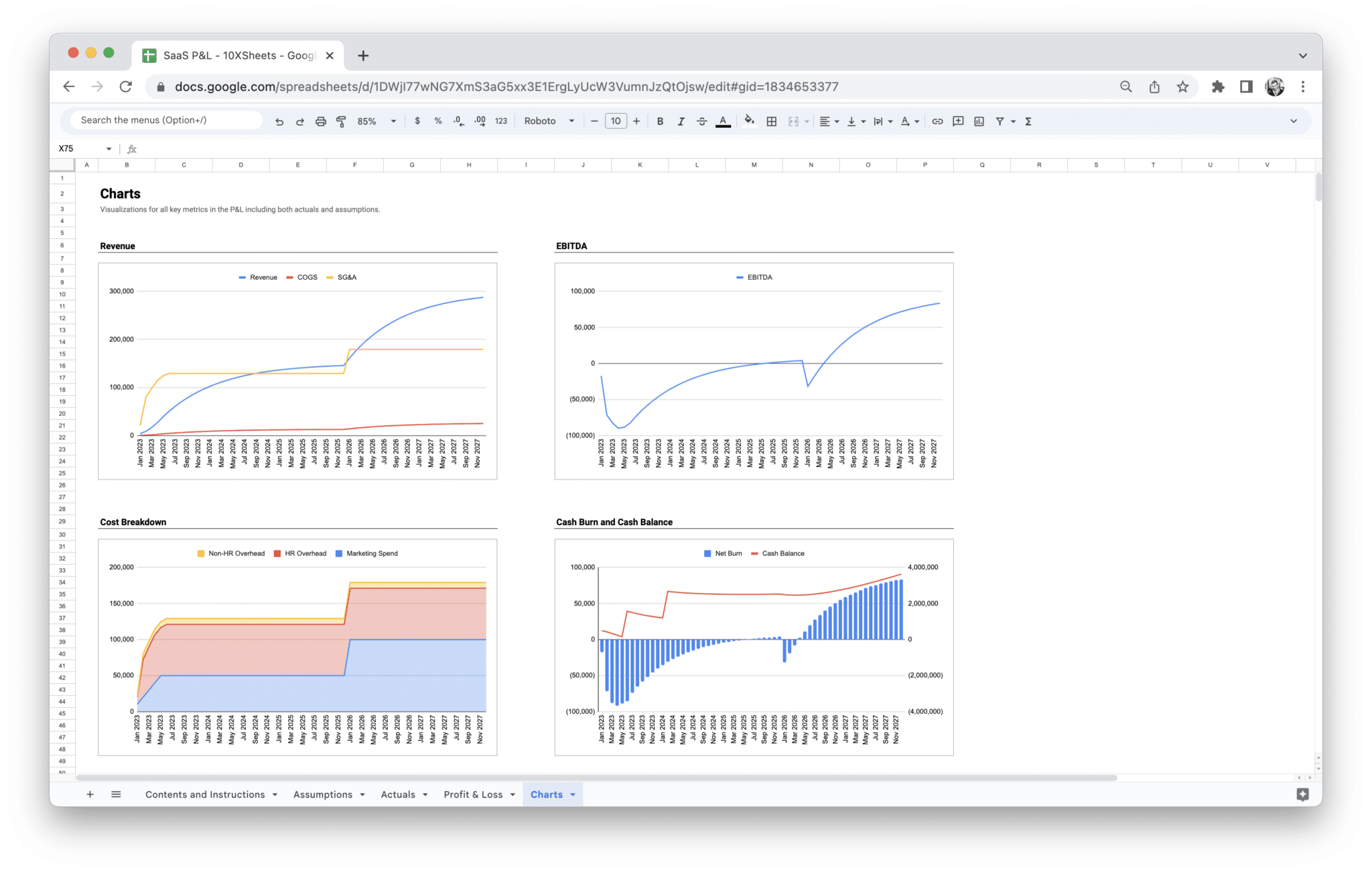

Our SaaS P&L Statement Template solves these challenges by providing a simple, customizable framework to track your business’s financial performance. Designed specifically for SaaS businesses, this template allows you to clearly categorize and monitor revenue streams, direct costs, and operating expenses. It gives you a comprehensive view of your profits and losses, helping you identify trends, optimize your pricing model, and make data-driven decisions. With this template, you can easily track key metrics like monthly recurring revenue (MRR), customer acquisition cost (CAC), and lifetime value (LTV), enabling you to plan for growth, improve cash flow, and ultimately drive profitability.

Running a SaaS business comes with its unique set of challenges, but one of the most important aspects of success lies in managing your finances effectively. Financial statements, particularly the Profit and Loss (P&L) statement, serve as the compass that guides your business through these challenges. For SaaS companies, where revenue models, costs, and growth trajectories are often unique, a P&L statement becomes even more crucial. This financial document provides an accurate snapshot of the company’s performance, revealing insights into how well the business is functioning, where it’s spending, and how it can improve.

What is a Profit and Loss (P&L) Statement?

A Profit and Loss (P&L) statement, also known as an income statement, is a financial document that shows a company’s revenues, costs, and expenses over a specific period of time. It essentially tells you how much money your business made or lost during that period. For SaaS businesses, the P&L statement is especially important because it highlights the performance of recurring revenue streams, tracks the cost of delivering your service, and offers a clear view of profitability.

The P&L statement is divided into three main parts:

- Revenue: The income generated from your customers, including subscription fees, one-time charges, and other revenue streams.

- Cost of Goods Sold (COGS): The direct costs incurred to provide the service, such as cloud hosting fees, third-party licenses, and customer support costs.

- Operating Expenses: These are indirect costs like sales and marketing, research and development, and administrative expenses.

By subtracting the costs and expenses from the revenue, the P&L statement helps you determine the company’s gross profit and net income—key metrics that reflect your business’s overall health.

The Importance of Financial Statements for SaaS Businesses

Financial statements, especially the P&L, are essential tools for any SaaS company, whether you’re a startup or an established business. They provide transparency, guide strategy, and help you manage resources effectively. Here’s why financial statements are so critical:

- They help you track revenue and costs to determine profitability, ensuring that your SaaS business is financially sustainable.

- They provide investors and stakeholders with the insight they need to evaluate the business’s financial performance, helping build trust and attract investment.

- They give a clear view of your company’s cash flow, enabling better forecasting and planning for growth and operational needs.

- They allow you to measure key financial metrics like gross margin, net income, and EBITDA, which provide insight into the efficiency of your operations.

- They help you identify trends, both positive and negative, in your financial data so you can make timely adjustments to your business strategy.

- They guide the allocation of resources, helping you decide where to invest more (such as in marketing or product development) and where to cut back (such as in overhead costs).

How a P&L Statement Supports Decision-Making for SaaS Companies

A well-structured P&L statement is a decision-making tool, not just a reflection of past performance. For a SaaS company, it offers insights that go beyond just profitability—it reveals opportunities for optimization, areas for improvement, and the financial risks associated with business decisions. Here’s how a P&L statement supports decision-making:

- It helps you evaluate the profitability of different customer segments or revenue models, allowing you to make more informed decisions about pricing and resource allocation.

- It enables you to track customer acquisition costs (CAC) relative to lifetime value (LTV), guiding marketing and sales strategies to ensure sustainable customer growth.

- It provides a clear picture of your gross margin, helping you identify inefficiencies in service delivery, such as high hosting or customer support costs, so you can optimize your infrastructure.

- It helps you assess the impact of your operating expenses, so you can make adjustments to marketing spend, R&D budgets, or staffing costs to improve operational efficiency.

- It assists in cash flow management by revealing trends in revenue and expenses, helping you prepare for seasonal fluctuations or periods of rapid growth.

- It gives you the financial data you need to plan for expansion—whether it’s scaling your product, entering new markets, or hiring additional staff.

- It highlights areas where cost-cutting might be necessary, such as reducing churn or renegotiating vendor contracts to improve margins without sacrificing product quality.

- It helps guide long-term strategic planning by providing a comprehensive overview of your financial standing, allowing you to make decisions that align with both short-term and long-term goals.

The Profit and Loss (P&L) statement is a snapshot of your company’s financial health. For a SaaS business, this document is crucial to understanding how your revenue, costs, and expenses come together to determine your profitability. Each component of the P&L is interconnected, and knowing what goes into these areas helps you make better strategic decisions for growth.

Revenue Streams

Revenue is the cornerstone of your P&L. For a SaaS business, it’s usually tied to subscription-based models, but there are also a variety of other ways SaaS companies generate income. Understanding your revenue streams will give you insights into your company’s financial growth and help with forecasting.

Subscription Revenue

Subscription revenue is the most significant source of income for most SaaS businesses. This revenue comes from customers who pay on a recurring basis—usually monthly or annually—to use your software. The predictability of subscription revenue makes SaaS businesses particularly attractive to investors and provides a stable cash flow.

Depending on the pricing model, subscription revenue can be broken down into different tiers based on customer usage. Some SaaS companies offer different pricing packages—such as basic, professional, and enterprise plans—with each tier offering varying levels of features. It’s important to track how each tier performs and consider how changes in pricing or features might affect the overall revenue.

Subscription revenue is often compounded by annual plans that offer significant upfront payments, which can make a noticeable impact on cash flow.

One-Time Fees

While subscription models dominate, SaaS businesses can also generate revenue from one-time fees. These fees might include:

- Onboarding Fees: A charge for setting up the software or providing initial training.

- Setup Fees: For companies requiring custom configurations or integrations.

- Consulting or Professional Services: Some SaaS businesses offer consulting, integration, or bespoke development services for clients, which can be billed as one-time charges.

While one-time fees aren’t a regular income stream like subscriptions, they can contribute to your P&L and should be carefully tracked. These fees can help smooth out seasonal dips in recurring revenue, but they’re less predictable than ongoing subscriptions.

Other Revenue Sources

Beyond subscriptions and one-time fees, SaaS businesses might also generate income through other channels:

- Affiliate Revenue: If your platform includes affiliate links to third-party products or services, you might earn commissions on those referrals.

- Add-On Features or Upgrades: Many SaaS platforms offer basic features for a subscription fee but charge extra for premium services, additional storage, or advanced integrations.

- Partner Programs: If you have partnerships with other companies, revenue could also come from revenue-sharing agreements, co-branded services, or partner reselling of your software.

Tracking all revenue streams in your P&L will give you a clearer picture of how your business makes money and where your growth opportunities lie.

Cost of Goods Sold (COGS) for SaaS Companies

COGS refers to the direct costs involved in delivering your service to customers. These are costs that can be directly attributed to the creation and maintenance of your SaaS product. Unlike operating expenses, which are more general, COGS can be traced directly to specific customer activities. For SaaS businesses, these costs generally relate to the infrastructure, technology, and support needed to run your software platform.

Hosting and Infrastructure Costs

As a SaaS business, you rely on cloud hosting services to deliver your product. The costs of using cloud infrastructure—whether it’s Amazon Web Services (AWS), Google Cloud, or Microsoft Azure—are a critical component of COGS. Hosting fees include:

- Cloud Storage: The cost of storing your customer data, files, and other resources.

- Computational Power: Charges for servers used to process customer data and run your software.

- Bandwidth Usage: The cost associated with transferring data over the internet.

These costs scale with the number of users on your platform, meaning that as your business grows, so will your hosting fees. Tracking these costs closely helps you optimize infrastructure spending and determine pricing strategies that can absorb growing costs.

Software Licensing

Many SaaS platforms rely on third-party software to power certain features. For instance, you might integrate with other platforms or use external APIs to offer functionality like payment processing or email marketing. If you pay for licenses or subscription-based access to such services, those costs should be categorized under COGS.

This could include:

- Payment Gateway Fees: Fees associated with processing payments through platforms like Stripe or PayPal.

- API Costs: Any third-party services or tools that charge based on API usage.

These software-related expenses are crucial to delivering your service and should be accounted for to get an accurate understanding of your direct costs.

Customer Support

The cost of customer support—such as hiring a support team, paying for ticketing systems, and maintaining a knowledge base—should also be factored into COGS. Although it’s often considered an indirect cost, support is a vital part of delivering your SaaS product effectively, ensuring customer satisfaction, and retaining clients.

In larger SaaS businesses, this may also include costs associated with success management or technical account management roles that help customers get the most out of the service.

Payment Processing Fees

Every transaction you process comes with fees attached. Payment processing services like Stripe, Square, or PayPal charge a percentage of each transaction. These fees are often a fixed percentage per transaction plus a small flat fee, and they can add up quickly, especially for high-volume SaaS businesses. Even though these fees aren’t huge individually, they can significantly impact your margins if not closely monitored.

Operating Expenses

Operating expenses are the day-to-day costs involved in running your SaaS business. Unlike COGS, operating expenses aren’t tied directly to the delivery of your service but are necessary for running and growing your company. For SaaS businesses, these expenses usually fall into categories like marketing, sales, research and development (R&D), and general administrative costs.

Marketing and Advertising

SaaS businesses often rely heavily on digital marketing strategies such as pay-per-click advertising, content marketing, search engine optimization (SEO), and social media marketing. These costs can add up quickly, especially if you’re running a large-scale ad campaign or working with influencers. Marketing expenses also include:

- Email Marketing Tools: The software used to run email campaigns.

- Content Creation: Outsourcing content writing, video production, and other marketing assets.

- Event Sponsorships: If you’re attending or sponsoring industry events or conferences, these costs should be factored in.

Tracking marketing and advertising costs is important to ensure you’re getting a strong return on investment (ROI) for every dollar spent. Over time, you’ll be able to determine the customer acquisition cost (CAC) for each channel and optimize your marketing strategies accordingly.

Sales Expenses

Sales expenses encompass the cost of acquiring customers. These expenses could include:

- Salaries and Commissions: For your sales team, including account executives, sales representatives, and sales managers.

- Sales Tools: CRM software, lead generation tools, and any other sales-related services.

- Travel and Expenses: If your sales team meets clients in person or attends trade shows, these expenses are part of the overall sales cost.

A strong sales team is essential for any SaaS business, and their compensation and tool costs need to be tracked carefully to ensure that the expense is justified by customer acquisition and retention.

Research and Development (R&D)

For a SaaS business to remain competitive, continuous investment in product development is essential. R&D expenses can include:

- Salaries for Developers and Engineers: These are usually one of the largest expenses for SaaS companies.

- Beta Testing and User Research: The costs associated with collecting feedback, conducting usability tests, and refining your platform.

- Technology Upgrades: The cost of updating or enhancing your product’s features to keep it relevant in the market.

In a fast-paced tech environment, R&D is crucial for long-term sustainability. However, it can significantly affect short-term profits. As a result, tracking R&D expenditures carefully is vital for balancing innovation with financial health.

General and Administrative Expenses

These are the costs of running the business itself, including:

- Office Rent and Utilities: Even if your team works remotely, you may still have a physical office or related expenses.

- Insurance: Health, liability, and other insurance premiums.

- Employee Benefits: This can include healthcare, paid time off, retirement plans, and other employee-related costs.

While these expenses may seem broad, they play an essential role in keeping your business functioning. Tracking and managing these costs ensures that you’re spending effectively and can make data-driven decisions to scale your business.

Gross Profit and Operating Income

Once you’ve accounted for your revenue and subtracted your COGS, the result is gross profit. Gross profit reflects the amount of money you’re making after covering the direct costs of delivering your product or service. This number is crucial because it shows how efficiently you’re producing and delivering your product. A high gross profit margin means that your SaaS business is generating significant revenue relative to the cost of service delivery.

Operating income goes a step further and subtracts operating expenses (like marketing, R&D, and sales expenses) from gross profit. Operating income gives you a more accurate picture of your business’s profitability from day-to-day operations. It’s often used to assess whether a business is growing efficiently or if it’s spending too much on expansion.

The final step in the P&L is net income, which accounts for taxes, interest, depreciation, and any other one-time income or expenses that affect the business. Net income is the bottom line—it tells you whether you’re profitable overall or running at a loss.

By closely monitoring your gross profit and operating income, you can identify areas of inefficiency, adjust your pricing model, or find ways to cut costs without sacrificing growth.

As you dive into managing your SaaS Profit and Loss (P&L) statement, it’s essential to track several key metrics that will provide insight into the financial health and performance of your business. These metrics are not only indicators of profitability but also help you understand the scalability and efficiency of your SaaS business model. By closely monitoring these metrics, you can make data-driven decisions and adjust your strategies accordingly. Here are some of the most critical metrics to focus on when evaluating your P&L.

Gross Margin: What It Means for SaaS

Gross margin is one of the most telling metrics for a SaaS business, and understanding it is crucial to gauging your overall business health. Essentially, your gross margin shows how much money you retain after covering the direct costs of delivering your service—known as the cost of goods sold (COGS). The higher your gross margin, the more money you have available to reinvest in your business for growth, marketing, and product development.

For SaaS companies, gross margin tends to be quite high compared to traditional businesses. This is because, once you’ve built your software, your direct costs (like cloud hosting and support) can be relatively low, especially as your customer base grows. A typical SaaS business can achieve gross margins of 70% to 90%, but this can vary depending on your pricing model, customer acquisition costs, and infrastructure needs.

Why Gross Margin Matters for SaaS

A high gross margin indicates that your company is efficient at generating revenue while managing the costs of providing your service. This leaves more room for you to invest in sales and marketing, product development, and customer success, all of which are key to long-term growth.

Conversely, a low gross margin could suggest inefficiencies in your operations. For example, if your hosting costs are disproportionately high relative to your revenue, or if your customer support team is too large, these factors may negatively impact your gross margin. Regularly reviewing this metric is essential for identifying areas where you can improve your cost structure.

EBITDA: Why It’s Important for SaaS Startups

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is another crucial metric that provides insight into your company’s financial health, especially when evaluating the profitability of your core business operations. Unlike net income, which is influenced by non-operating factors such as taxes and depreciation, EBITDA focuses purely on the income generated from your day-to-day business activities.

For SaaS startups, EBITDA is an important metric because it helps investors and business owners assess the profitability of their operations without the distortion of financial variables like interest rates or tax laws. Essentially, EBITDA tells you how well your business is performing based on its operations before non-cash expenses (like depreciation) or external costs (like interest on loans or tax obligations) are considered.

Why EBITDA Matters for SaaS Startups

When you’re a SaaS startup, especially in the early stages, you might not yet be profitable after factoring in all your expenses, taxes, or interest payments. However, EBITDA gives you a clearer view of how your business is performing operationally, without these financial distractions. Investors and potential acquirers also pay close attention to EBITDA because it reflects the underlying profitability of your business and its ability to scale.

For example, if your startup is in growth mode, you might be heavily investing in marketing and R&D to build your customer base and improve your product. As a result, your expenses could be high, and your net income could be negative. However, a strong EBITDA can indicate that your core business operations are profitable and that you’re on the right track, even if you haven’t reached profitability yet.

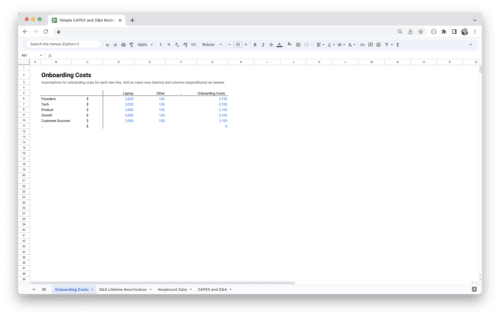

Customer Acquisition Costs (CAC) and Lifetime Value (LTV)

Understanding Customer Acquisition Costs (CAC) and Lifetime Value (LTV) is critical for any SaaS business. These two metrics help you assess the efficiency of your sales and marketing efforts and provide insights into the long-term value of each customer relationship.

Customer Acquisition Cost (CAC)

CAC is the total cost of acquiring a new customer, including everything from marketing expenses to sales team salaries and commissions. To calculate CAC, you would typically divide the total costs of sales and marketing by the number of new customers acquired during a given period. These costs include:

- Marketing campaigns (digital ads, content marketing, social media)

- Sales team compensation (salary, bonuses, commissions)

- Software tools used for lead generation and customer relationship management (CRM tools, email automation software)

Tracking CAC is important because it helps you understand the efficiency of your customer acquisition efforts. If your CAC is too high, you may be overspending on sales and marketing, or it may indicate that your sales process is inefficient.

Lifetime Value (LTV)

LTV is the total amount of revenue you can expect from a customer over the entire duration of their relationship with your business. It’s an essential metric because it helps you understand the long-term value of each customer, allowing you to gauge whether your CAC is sustainable.

To calculate LTV, you’ll typically multiply your average revenue per customer (ARPC) by the average customer lifespan. This gives you the total revenue you expect from a customer, which can then be compared to CAC to assess profitability. If your LTV is significantly higher than CAC, this indicates that your business is healthy and that your customers are valuable over time.

Why CAC and LTV Matter for SaaS Businesses

The relationship between CAC and LTV is one of the most important indicators of your SaaS business’s sustainability. If your LTV is far greater than your CAC, you have a profitable business model because each customer you acquire brings in more revenue than it costs to acquire them.

For example, if you spend $100 to acquire a customer, but the customer generates $500 in revenue over their lifetime, that’s a healthy ratio. However, if your CAC is higher than your LTV, it means you’re spending too much on customer acquisition relative to the value those customers provide. This imbalance could lead to unsustainable business practices and prevent you from scaling efficiently.

SaaS companies should aim for an LTV that’s at least three times greater than their CAC. If the ratio is lower, it may be time to revisit your customer acquisition strategy, optimize your sales funnel, or look for ways to increase customer retention.

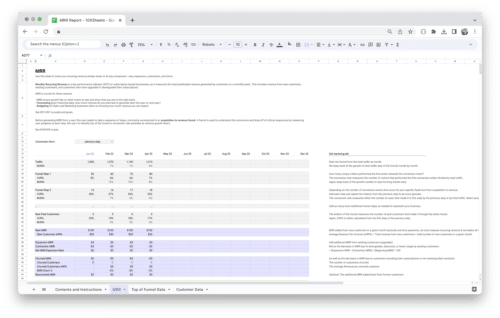

Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR)

For SaaS businesses, recurring revenue is the foundation of the business model. Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) are the key metrics that indicate the predictable, subscription-based revenue stream of your business. Both metrics help you understand the financial stability of your business and are essential for forecasting future cash flow.

Monthly Recurring Revenue (MRR)

MRR is the predictable revenue you can expect to receive on a monthly basis from your customers who have signed up for subscriptions. It’s particularly important for SaaS businesses because it gives you a clear picture of how much income you can count on each month.

To calculate MRR, you simply add up the subscription revenue from all of your paying customers. For example, if you have 100 customers paying $100 per month, your MRR is $10,000. MRR is crucial for:

- Forecasting: It helps you predict cash flow and make more accurate financial forecasts.

- Identifying Growth Trends: By tracking MRR over time, you can see how your business is growing and whether you’re hitting your targets.

- Churn Analysis: MRR helps you track churn (the rate at which customers cancel their subscriptions). A decline in MRR might indicate a high churn rate, which you should address immediately.

Annual Recurring Revenue (ARR)

ARR is simply the annualized version of MRR. It’s calculated by multiplying your monthly recurring revenue by 12, providing you with a year’s worth of predictable revenue. ARR is particularly useful for long-term planning and for SaaS businesses with a significant number of annual subscriptions.

For example, if you have an MRR of $10,000, your ARR would be $120,000. ARR helps you:

- Long-Term Planning: Unlike MRR, which is more short-term, ARR provides a bigger picture of your business’s revenue potential and growth.

- Investment Insights: Investors often look at ARR as a key indicator of financial health because it shows the long-term revenue potential of your business.

- Revenue Stability: With more customers committing to annual plans, ARR offers a more stable and predictable revenue stream compared to monthly plans.

Why MRR and ARR Matter for SaaS Businesses

Both MRR and ARR provide valuable insights into your business’s revenue health. They help you assess the stability and predictability of your income, which is crucial for SaaS businesses that rely on subscription models.

If you see fluctuations in MRR or a decline in ARR, it’s a signal that something is wrong, whether it’s customer churn, ineffective pricing, or issues with your product. Regularly tracking MRR and ARR ensures that you can act quickly to address any issues, optimize revenue generation, and focus on retention and growth strategies.

Both of these metrics are critical for providing investors, stakeholders, and yourself with a clear picture of your financial trajectory. The more stable and predictable your recurring revenue is, the better equipped you’ll be to make long-term strategic decisions for your SaaS business.

When creating a Profit and Loss (P&L) statement for a SaaS business, it’s important to structure it in a way that clearly outlines your revenue, costs, and profitability. A well-organized P&L will provide valuable insights into your financial health, allowing you to make informed decisions about how to grow your business. The structure of your P&L should be simple enough to follow but detailed enough to provide a true reflection of your company’s financial performance.

Suggested Template Format

A SaaS P&L statement should follow a logical flow from top to bottom, with each section clearly separating your income from your costs, and your gross profits from your operating expenses. The structure typically follows this format:

- Revenue: This section will break down your total income, including subscription revenue, one-time fees, and any other income sources.

- Cost of Goods Sold (COGS): The direct costs of delivering your product or service to customers, such as hosting fees, software licensing, and payment processing.

- Gross Profit: Subtract COGS from revenue to determine your gross profit. This is a key metric that helps you understand how well you’re managing your direct costs.

- Operating Expenses: These are the costs associated with running your business on a daily basis, such as sales and marketing, R&D, and general administrative costs.

- Operating Income: Subtract your operating expenses from your gross profit to get your operating income. This shows your profitability from core operations.

- Net Income: After accounting for taxes, interest, and any one-time expenses or income, your net income reflects your bottom-line profitability.

Here’s how each section should look in more detail:

- Revenue: This is where you will categorize all of your income sources. For most SaaS businesses, subscription revenue is the bulk of the income, but don’t forget to include one-time fees and any other income sources, such as affiliate income or premium add-ons. Be sure to list revenue streams separately so that you can clearly track how each category is performing.

- Cost of Goods Sold (COGS): For SaaS, COGS often includes hosting fees, third-party software licenses, and customer support costs. These are the direct costs tied to delivering your service. It’s important to track COGS closely because it will affect your gross margin.

- Gross Profit: Gross profit is calculated by subtracting COGS from total revenue. This figure helps you assess how efficiently you’re delivering your service relative to the income you’re generating.

- Operating Expenses: Operating expenses include the costs necessary to run your business, but not directly tied to service delivery. This will include things like marketing expenses, salaries for your sales team, and R&D investments. It’s important to track these expenses separately from COGS so that you can see the full picture of your spending.

- Operating Income: After you’ve subtracted operating expenses from your gross profit, you’ll be left with operating income. This shows how well your business is performing based solely on its core activities, excluding any one-time items or interest-related costs.

- Net Income: Net income is your final figure, reflecting the overall profitability of your business. After accounting for taxes, interest, and other one-time income or expenses, this is the number you’ll use to gauge your financial health and success.

Detailed Breakdown of Each Section of the P&L for SaaS Businesses

A P&L statement isn’t just a series of numbers—each section tells a story about your business’s financial performance. Understanding the breakdown of each section will allow you to make more informed decisions and adjust your strategy when necessary.

Revenue Breakdown

The revenue section is the first and most important part of your P&L statement. For a SaaS business, this is where you will track your recurring revenue (typically from subscriptions) and any non-recurring revenue (from things like setup fees or one-time services). It’s important to track both to get a sense of how stable your income is and how much you’re relying on one-time charges.

In addition to subscriptions, many SaaS companies offer different pricing tiers or levels. You should break down your subscription revenue by plan, such as:

- Basic Plan

- Standard Plan

- Enterprise Plan

This segmentation will allow you to track how each plan performs and make data-driven decisions about pricing and features. For example, if you find that a particular plan is underperforming, you might adjust your marketing efforts or optimize the features offered in that tier.

Cost of Goods Sold (COGS) Breakdown

COGS represents the costs directly tied to the delivery of your service. For SaaS businesses, this typically includes:

- Cloud Hosting Fees: The cost of hosting your service, including cloud storage and computing power.

- Third-Party Licensing Fees: If you rely on third-party software or services to provide features, you’ll need to include the costs here.

- Payment Processing Fees: These are the fees charged by payment processors like Stripe, PayPal, or other similar services.

- Customer Support Costs: This includes the salary of customer support staff, the tools they use to assist customers, and any other direct support-related costs.

By tracking these costs, you can determine your gross margin—the percentage of revenue left over after subtracting COGS. A healthy gross margin is crucial for the financial success of your SaaS business because it indicates that your pricing model is effectively covering the costs of service delivery.

Operating Expenses Breakdown

Operating expenses cover all the indirect costs of running your business. These are critical for tracking the efficiency of your operations and understanding the areas where you can reduce costs or invest more heavily.

- Sales and Marketing Expenses: This includes all costs related to acquiring and retaining customers, such as advertising spend, salaries for salespeople, and CRM tools. As a SaaS business, customer acquisition can be a significant ongoing cost, and marketing expenses often take up a large portion of your budget.

- Research and Development (R&D): As technology evolves, your SaaS platform must stay current. This section includes salaries for your development team, the cost of beta testing, and any tools or software used in the development process. SaaS businesses often spend a significant amount on R&D to maintain their competitive edge.

- General and Administrative (G&A) Expenses: These are the costs associated with the general running of your business—things like office rent, utilities, insurance, and executive salaries. G&A costs can be variable, but it’s essential to keep track of them to avoid unnecessary overheads.

Operating expenses should be evaluated regularly to see if your business is scaling efficiently. For example, if your marketing expenses are increasing but your revenue isn’t, it may be time to reallocate resources or reconsider your marketing strategies.

Operating Income

Operating income is calculated by subtracting operating expenses from your gross profit. This is a critical number to track because it reflects your business’s profitability from its core operations. A positive operating income means your business is generating more revenue than it spends on operations, which is a good sign of a sustainable and healthy SaaS model.

On the other hand, a negative operating income could indicate that your business is spending too much on non-essential expenses or that your pricing structure isn’t generating enough revenue to cover operating costs.

Net Income

Net income is the final result of your P&L statement and shows your overall profitability. After factoring in taxes, interest, and other one-time or non-operating income and expenses, net income gives you the final number for how much your business has earned or lost over a specific period.

For SaaS companies, tracking net income is critical for understanding the long-term sustainability of your business. Negative net income isn’t necessarily a red flag in the early stages, especially for businesses that are investing heavily in growth. However, consistently negative net income over time could indicate deeper financial issues that need to be addressed.

How to Tailor a P&L Statement for Your Specific SaaS Model

While the general structure of a SaaS P&L statement remains relatively consistent, you’ll need to tailor it to fit your specific business model. SaaS businesses come in many shapes and sizes—some operate on a freemium model, others on a subscription-based model, and some offer usage-based pricing.

Freemium Model

In a freemium model, you offer a free version of your software with the option for users to upgrade to a premium, paid version. This model means that your revenue from subscriptions may not be as predictable, as you’ll have a mix of paying and non-paying users.

For this model, your P&L will likely include a breakdown of:

- Conversion Rate: The percentage of free users who upgrade to paid plans. This is crucial for tracking your freemium-to-paid conversion efficiency.

- User Acquisition Cost: Since the majority of your customers are free users, your customer acquisition costs could be higher, and it’s essential to monitor how much you spend to convert free users into paying ones.

Subscription Model

If your SaaS business operates on a subscription model, you’ll need to focus on recurring revenue and churn rate. Your P&L should reflect monthly or annual recurring revenue (MRR or ARR), and it’s essential to monitor how your customer retention strategies are performing.

For a subscription-based SaaS business, you’ll also want to closely track:

- Customer Lifetime Value (LTV): The total revenue you expect to generate from a customer over their lifetime with your company. LTV should always be higher than your customer acquisition cost (CAC).

- Churn Rate: The rate at which customers cancel their subscriptions. This is a crucial metric for SaaS businesses because high churn can be a signal that your product or customer experience needs improvement.

Usage-Based Pricing Model

In a usage-based pricing model, customers pay based on how much they use your software. This model often works well for SaaS products that offer variable or scalable features, like cloud storage, API usage, or video streaming services.

For this type of model, your P&L will need to focus more heavily on:

- Variable Costs: Since usage-based pricing is tied to consumption, your costs will fluctuate as customers use more or less of the service. It’s important to track these costs closely to ensure that your pricing structure adequately covers them.

- Revenue Per User: You should measure how much each customer is paying over time based on their usage patterns. This helps ensure that your pricing aligns with customer behavior and that you’re generating enough revenue to cover your variable costs.

By tailoring your P&L to reflect your specific business model, you can gain deeper insights into your company’s financial performance and make smarter decisions about pricing, customer acquisition, and long-term growth.

Managing a SaaS Profit and Loss (P&L) statement effectively requires more than just filling in numbers. It’s about creating a tool that reflects the financial health of your business, helps you make data-driven decisions, and serves as a guide for both short-term adjustments and long-term growth. A well-managed P&L statement is one of the most powerful tools in your financial toolkit, and by following best practices, you can ensure it provides you with the most accurate and actionable insights possible. Here are key practices to keep in mind:

- Regularly update and reconcile your P&L to ensure it accurately reflects your latest financial data.

- Track both recurring and non-recurring revenue separately to assess the stability of your income stream.

- Monitor gross margin closely, and look for ways to reduce COGS (cost of goods sold) as your customer base grows.

- Incorporate a detailed breakdown of operating expenses, and track both fixed and variable costs to identify potential areas for cost savings.

- Use your P&L as a tool for forecasting by comparing current performance to historical trends, allowing you to predict cash flow more accurately.

- Ensure that your P&L aligns with your business goals by continuously reviewing key metrics like MRR, LTV, and CAC.

- Adjust pricing, product features, and customer acquisition strategies based on the insights provided by your P&L.

- Be proactive in managing your churn rate by identifying any correlations between customer retention and financial performance.

- Regularly review your operating income to ensure you’re maintaining profitability, and understand how much of your growth is driven by operational efficiency versus outside investments.

- Use your P&L as a communication tool to provide transparency to stakeholders, investors, and team members about the company’s financial health and strategy.

By following these practices, you can ensure that your SaaS P&L statement becomes a valuable asset that helps you keep your business on track, scale effectively, and make strategic decisions that will drive long-term success.

Creating and maintaining an accurate and insightful P&L statement for a SaaS business is challenging, especially as your business grows and your financial landscape becomes more complex. While it’s important to take advantage of the power of a P&L, there are common mistakes that can undermine its usefulness. Recognizing and avoiding these pitfalls will allow you to better manage your business’s finances and make more informed decisions. Here are key mistakes to watch out for:

- Failing to regularly update your P&L can lead to outdated or inaccurate financial data, making it difficult to make informed decisions.

- Overestimating revenue, especially when relying too heavily on projections for new customer acquisitions or one-time fees, can create an unrealistic picture of your business’s performance.

- Underestimating churn rates can lead to inflated revenue forecasts and missed opportunities to improve customer retention strategies.

- Not accurately categorizing expenses can result in a distorted view of your financial health, especially if operating expenses are lumped in with COGS or not properly tracked.

- Neglecting to factor in long-term investments, like product development or infrastructure improvements, can result in a skewed view of profitability, especially in fast-growing businesses.

- Focusing only on net income without understanding underlying metrics like gross margin and operating income can lead to oversimplified conclusions about your business’s financial health.

- Ignoring key performance indicators (KPIs) like CAC and LTV can result in missed opportunities to optimize your customer acquisition strategy or assess the sustainability of your business model.

- Failing to segment revenue streams—especially in SaaS businesses with different pricing tiers or revenue sources—can make it difficult to track the performance of each segment and identify areas for improvement.

- Not adjusting your P&L based on industry benchmarks or market conditions can lead to misguided financial decisions and poor strategic planning.

- Overlooking the importance of cash flow management can lead to financial trouble, even if your P&L looks positive on paper. Be sure to consider both revenue and expenses on a cash basis.

Avoiding these pitfalls will ensure that your P&L remains an effective tool for managing your finances, enabling you to track your progress, adjust your strategy, and make informed decisions that contribute to long-term growth and success.

Make a one-time payment and

enjoy your template forever.

No extra costs, no strings attached,

more savings for you.

Keep your templates up-to-date

with free access to regular updates.

Related products

-

Sale!

SaaS Financial Model Template

184,03 €Original price was: 184,03 €.125,21 €Current price is: 125,21 €.Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to cart Details -

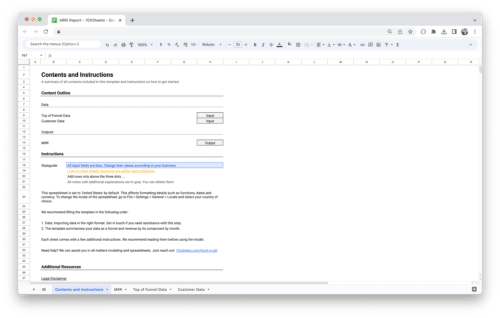

MRR Dashboard Template

0,00 €Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to cart Details -

Sale!

Startup Financial Model Template

100,00 €Original price was: 100,00 €.66,39 €Current price is: 66,39 €.Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to cart Details -

Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to cart Details