Marketplace Financial Model Template

184,03 € Original price was: 184,03 €.125,21 €Current price is: 125,21 €.

32% Off

Value added tax is not collected, as small businesses according to §19 (1) UStG.

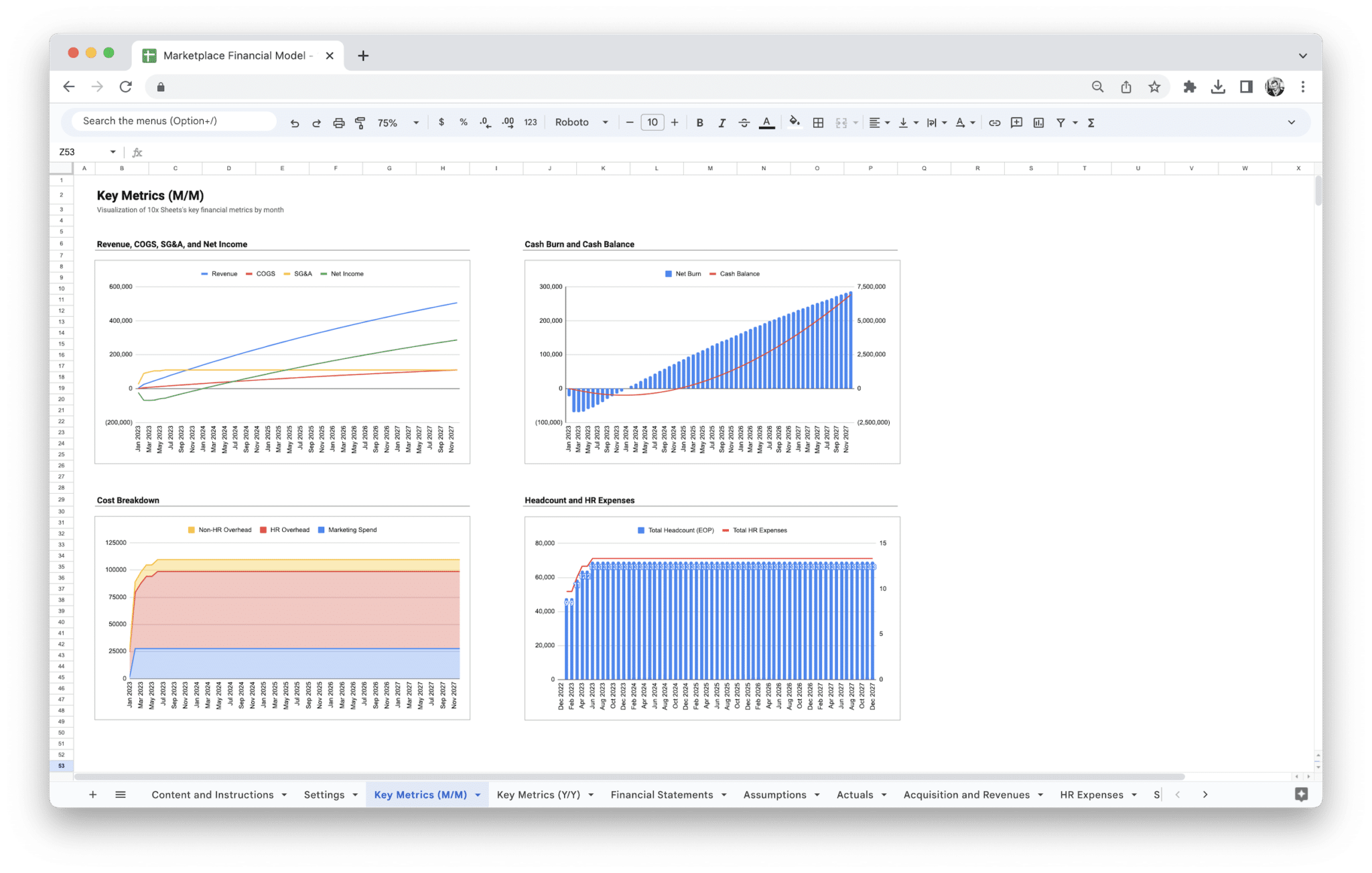

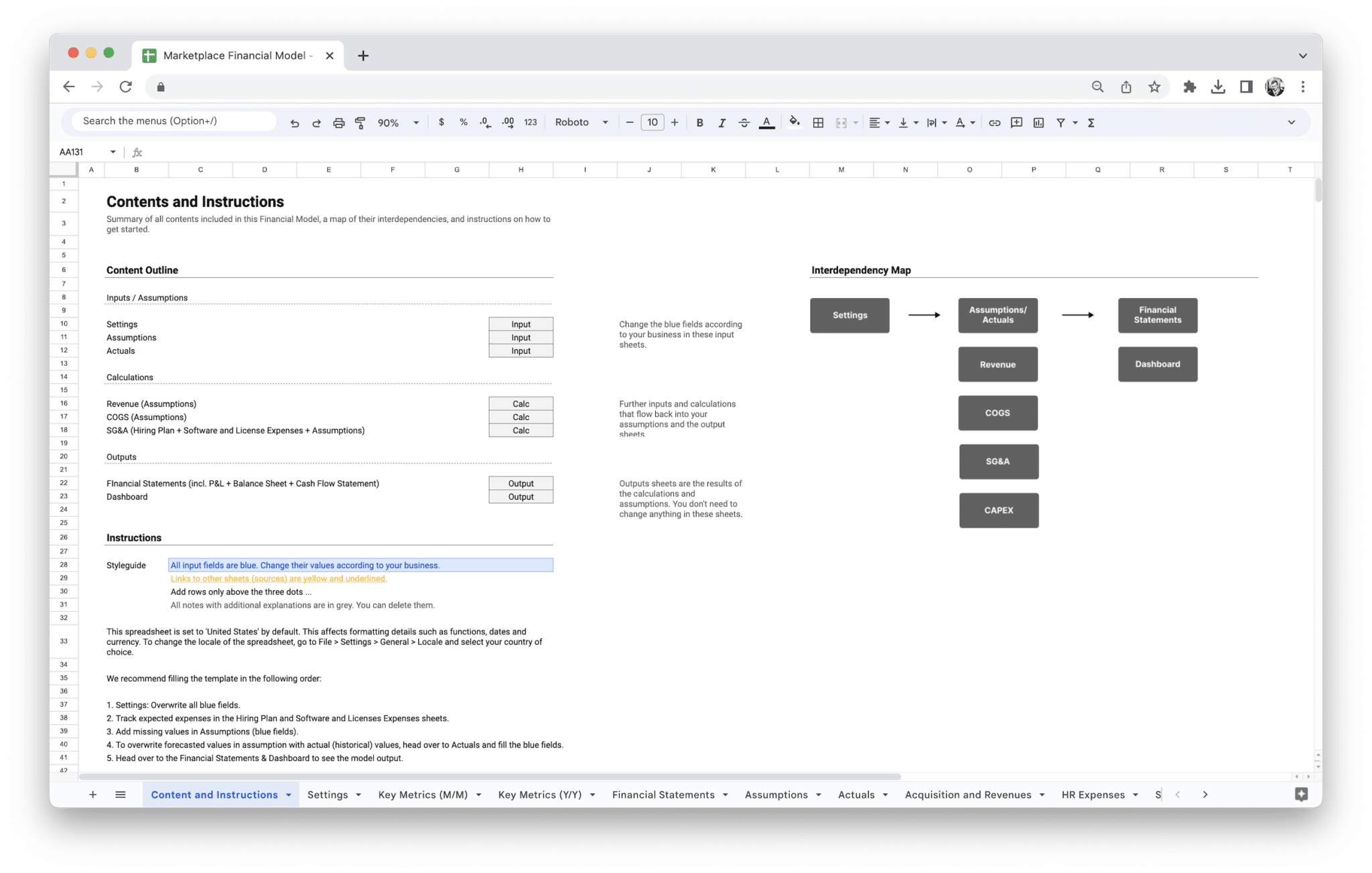

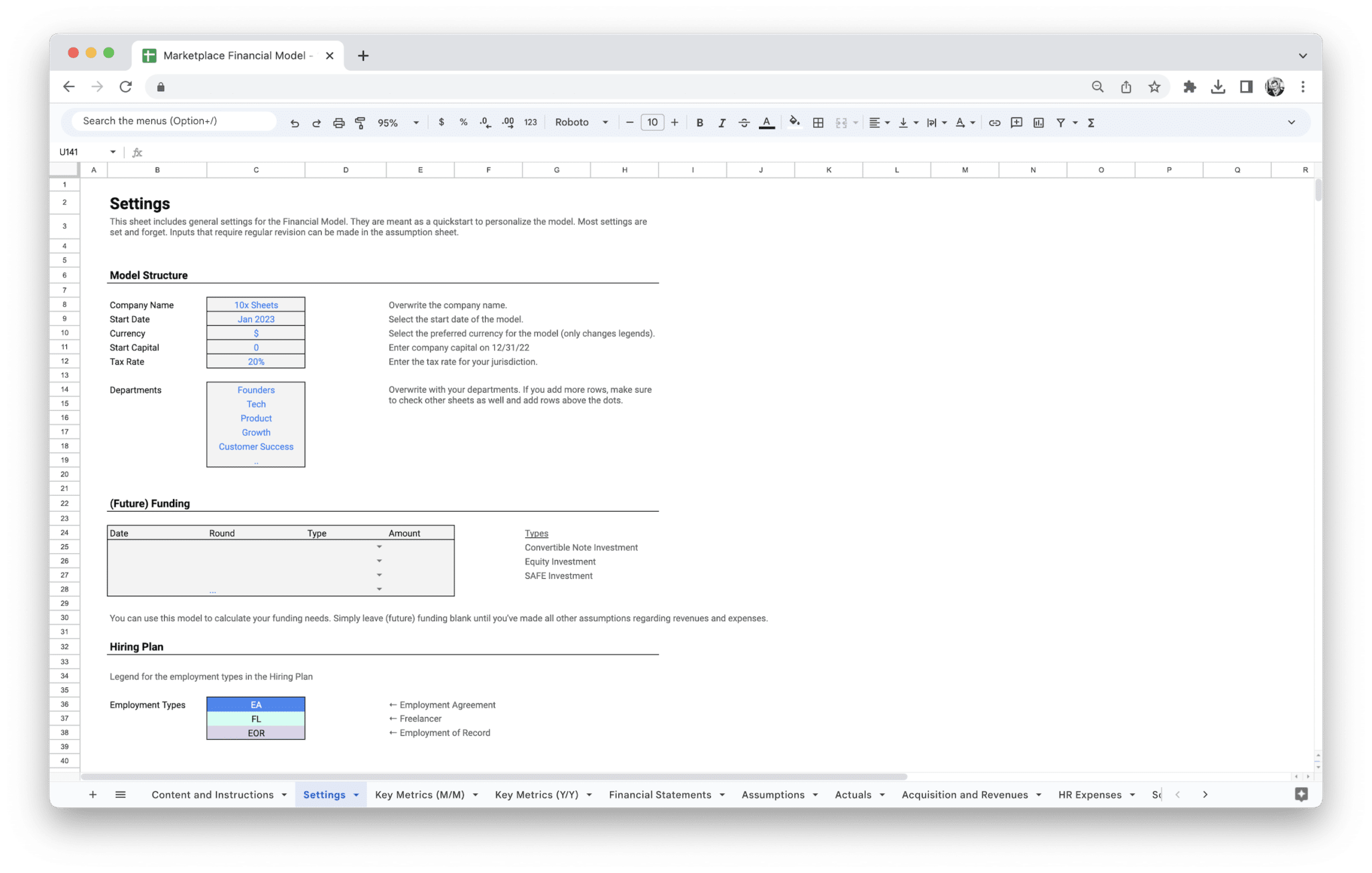

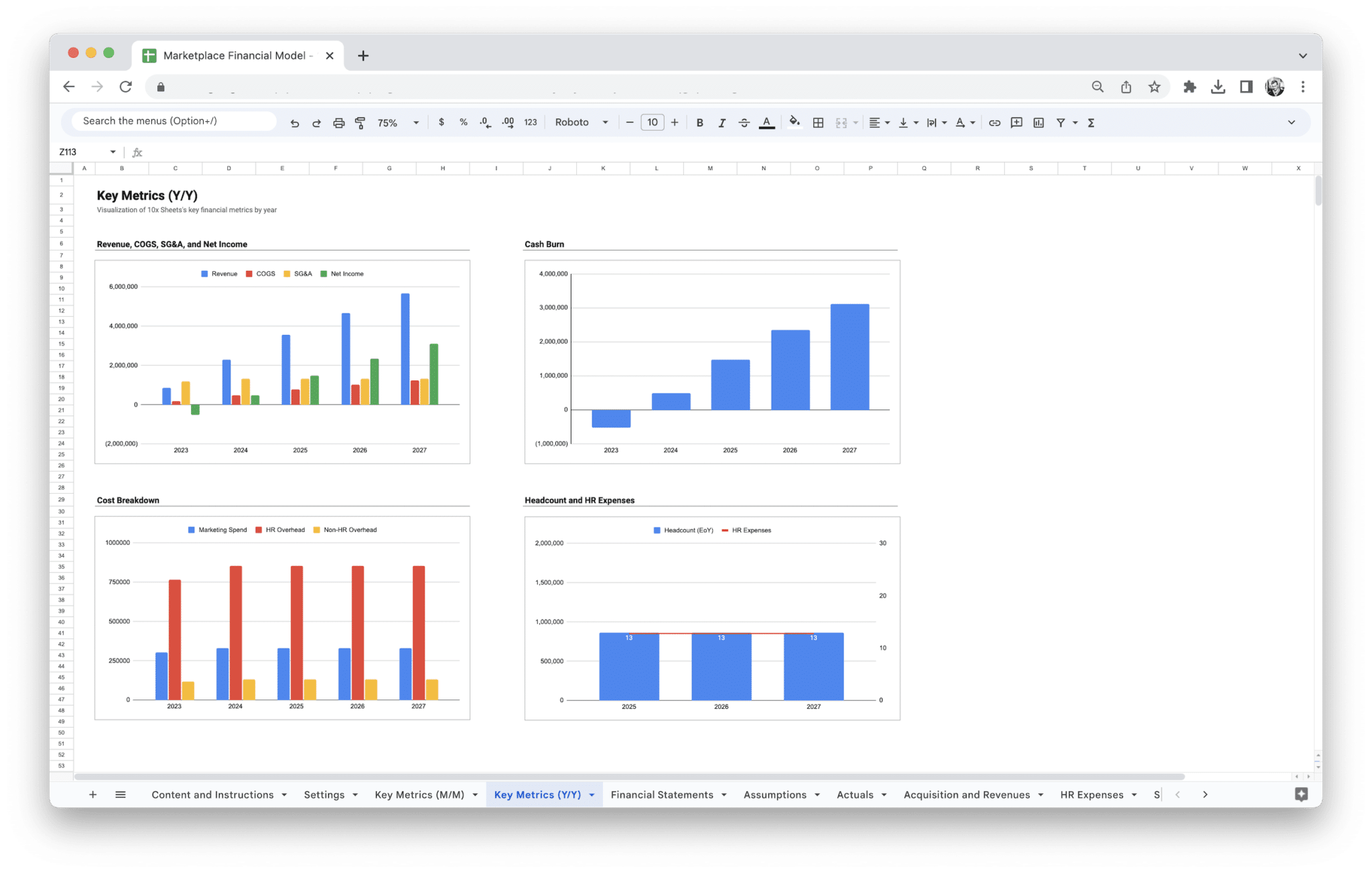

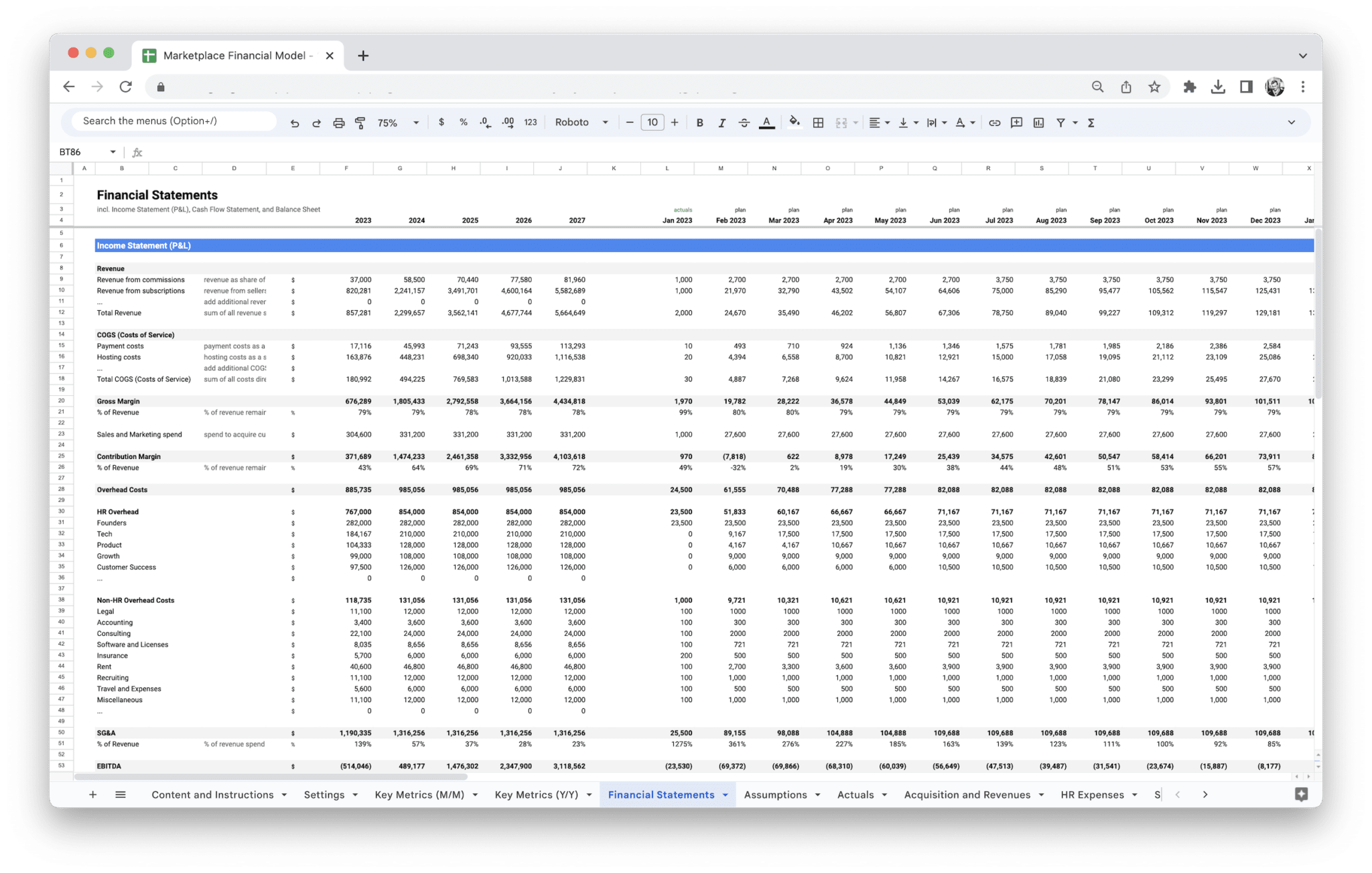

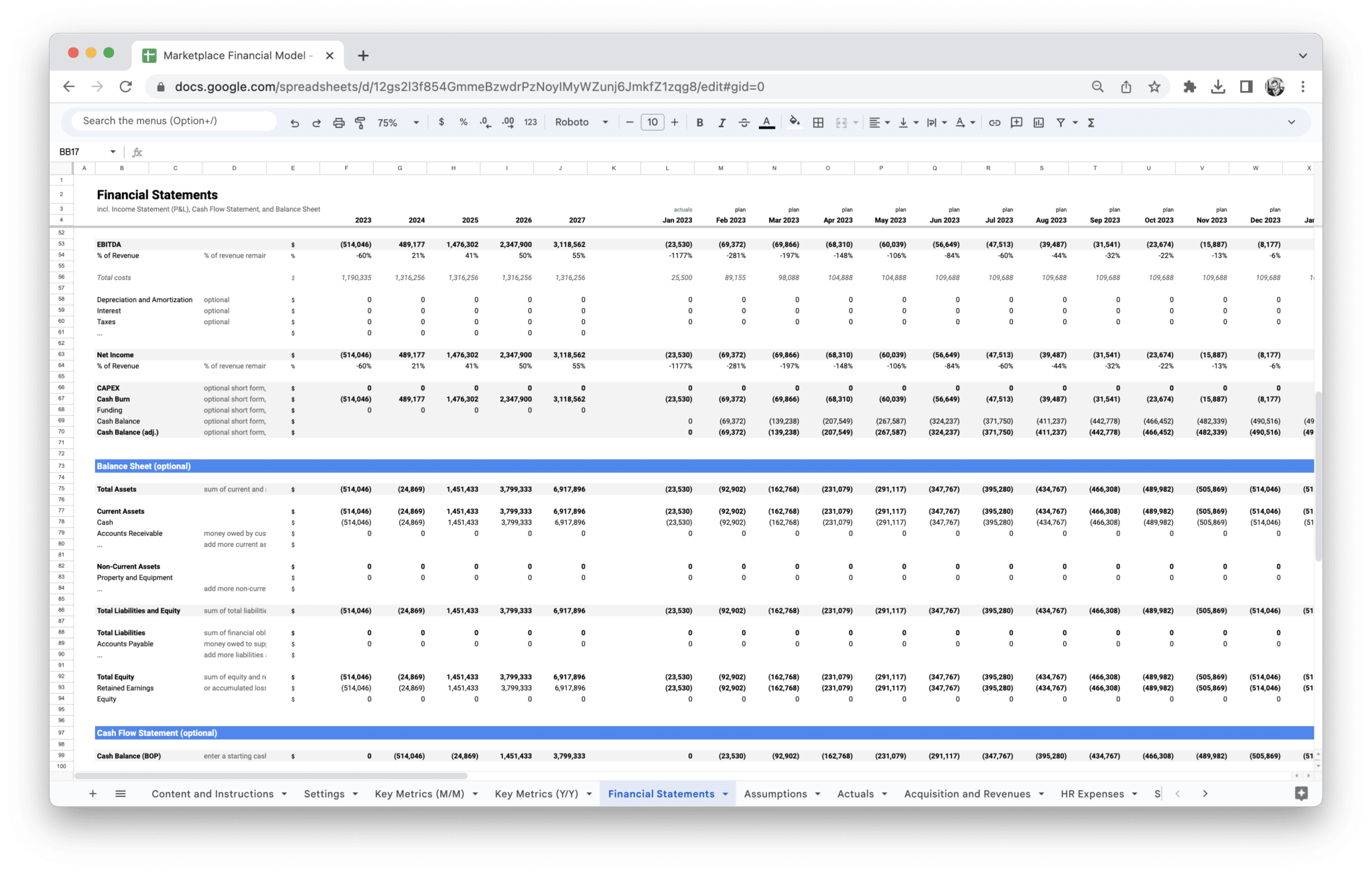

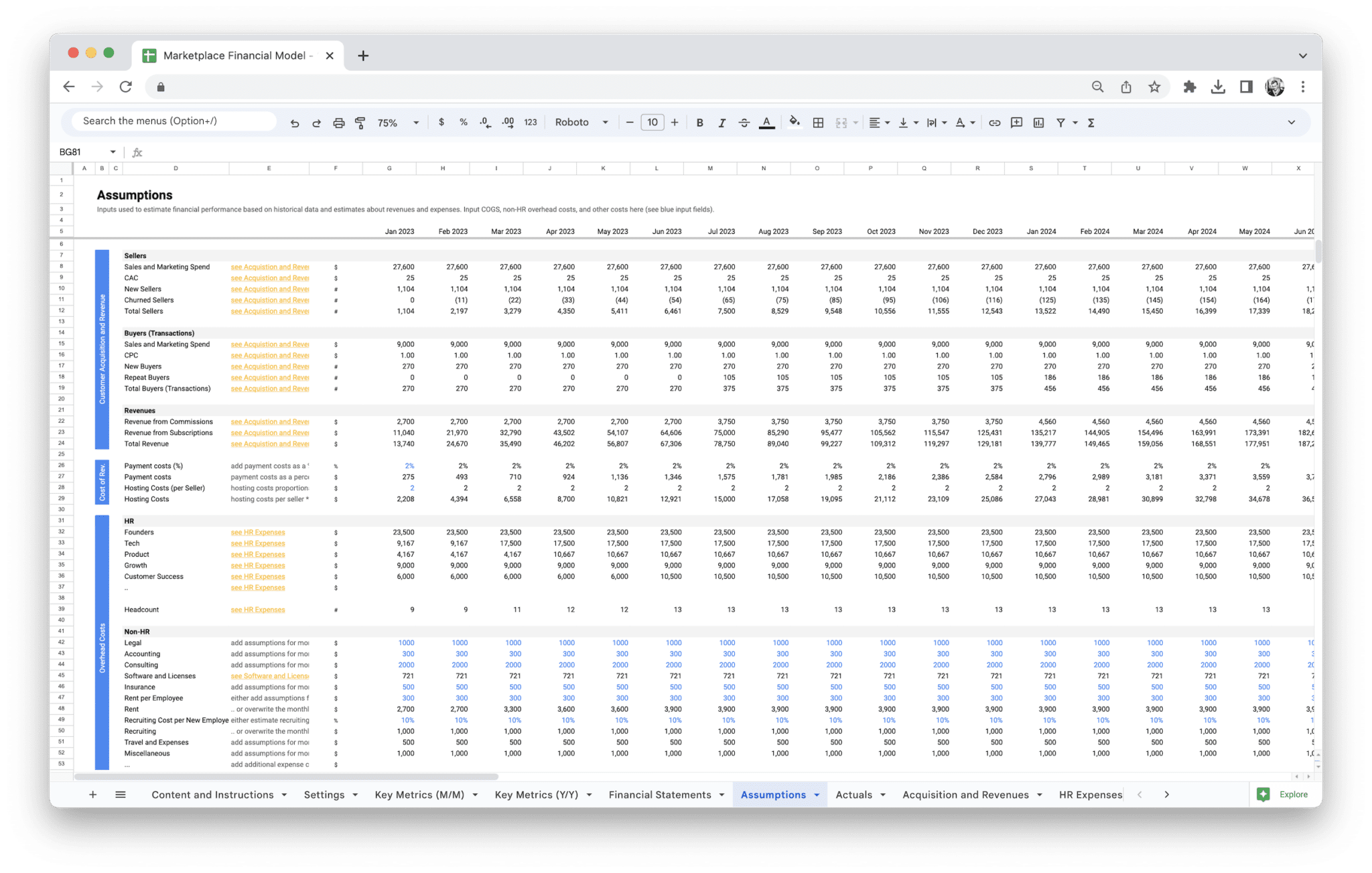

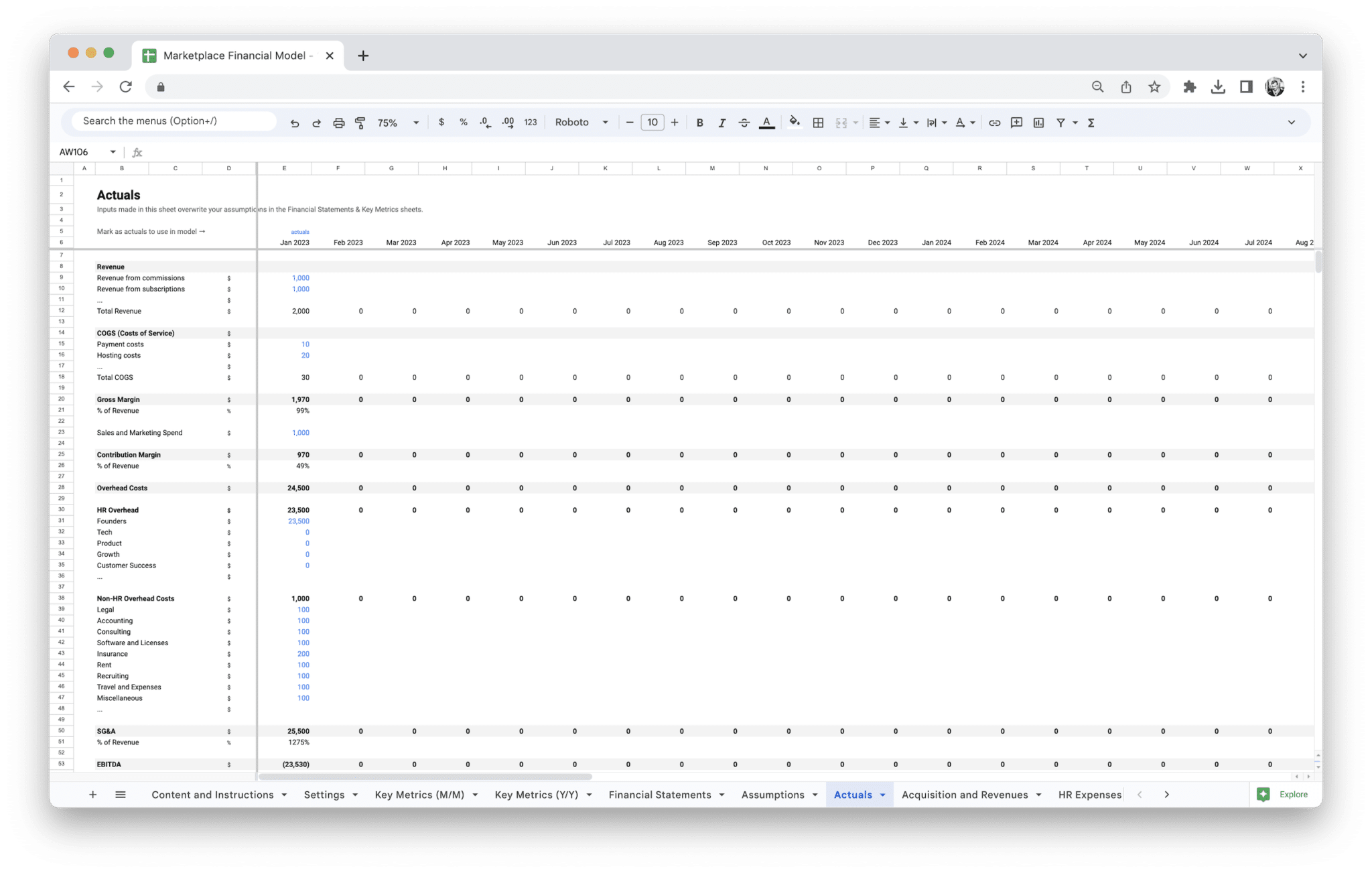

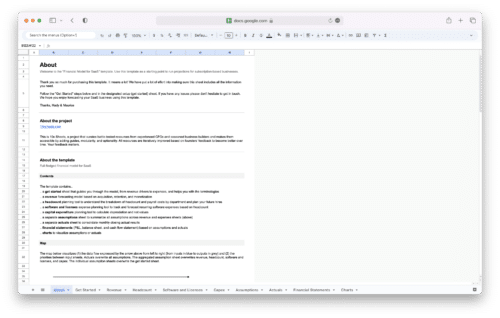

Maximize your Marketplace business’s financial growth with our comprehensive Financial Model Template. Forecast your revenues and expenses, customize settings, and view key financial metrics on an interactive dashboard!

Description

Managing the financials of a marketplace can be overwhelming. With multiple revenue streams, varying costs, and the need for constant scalability, it’s easy to feel lost in the details. Without a clear financial plan, it becomes difficult to track growth, optimize spending, or forecast future performance. This lack of clarity can lead to missed opportunities, poor decision-making, and even financial instability.

Our Marketplace Financial Model Template is designed to solve these challenges by providing a clear, structured framework for managing your marketplace’s finances. It allows you to easily project revenue, track costs, and monitor key performance metrics such as customer acquisition costs, profitability, and growth rate. With this template, you can confidently plan for both short-term and long-term financial goals, ensuring your marketplace scales smoothly and efficiently. Whether you’re attracting investors, managing day-to-day operations, or making strategic decisions, this template simplifies complex financial planning and puts the data you need right at your fingertips.

A Marketplace Financial Model Template is a powerful tool designed to help businesses in the marketplace sector plan, analyze, and manage their financial performance. It provides a structured framework that incorporates various revenue models, costs, and financial assumptions that are specific to marketplace businesses. Whether you’re a founder launching a new platform or an investor assessing a marketplace’s potential, this template helps ensure you’re working with accurate, organized, and comprehensive financial data. It’s essentially a blueprint for how to manage your finances in a dynamic, scalable business environment.

Core Components

A Marketplace Financial Model Template includes several essential components that are integral to understanding the financial health of a marketplace business. These components help break down the complex relationships between revenue, costs, and growth. The key components typically include:

- Revenue Streams: Detailed projections based on commission-based fees, subscription models, freemium models, or a combination of these.

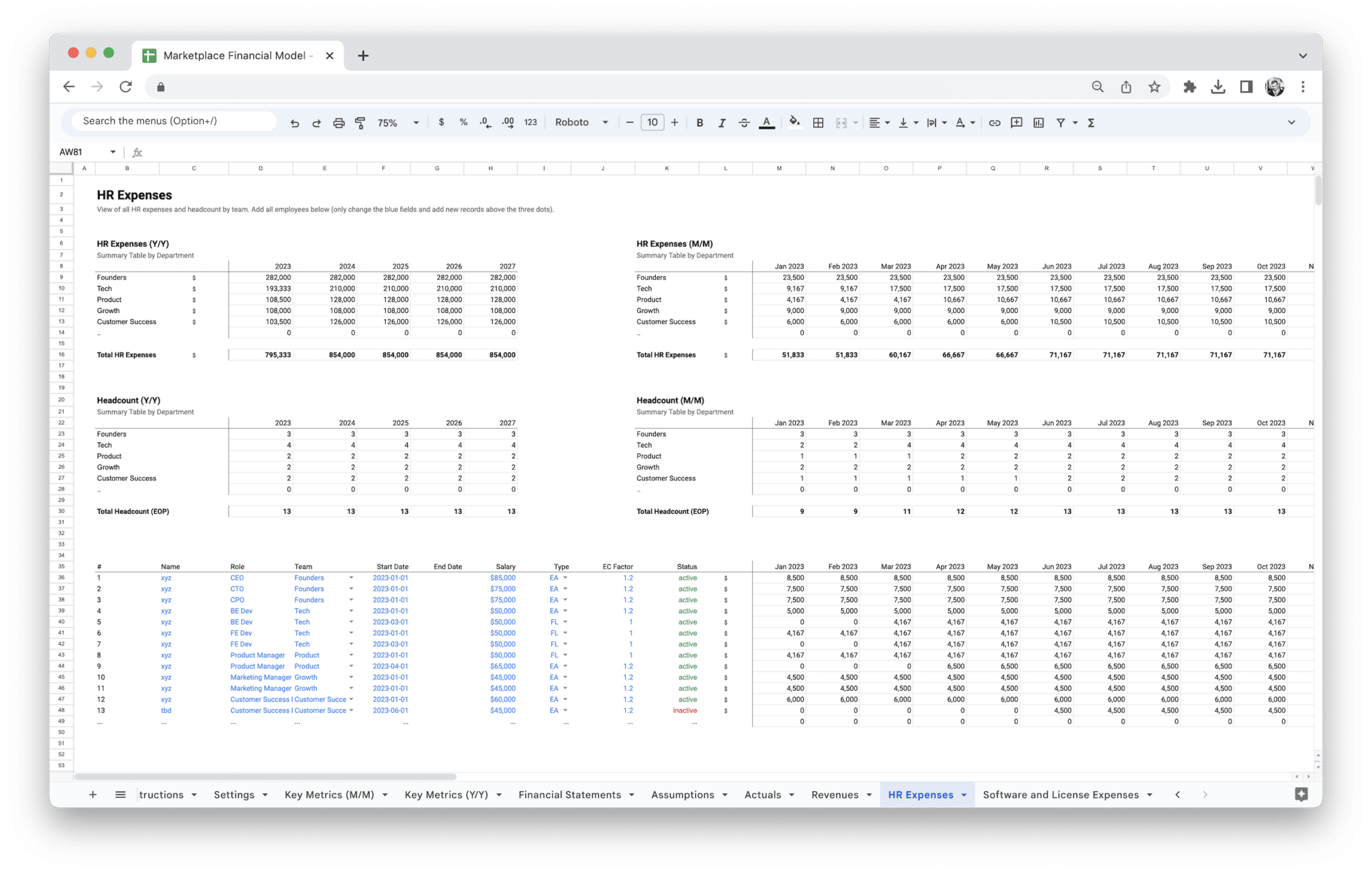

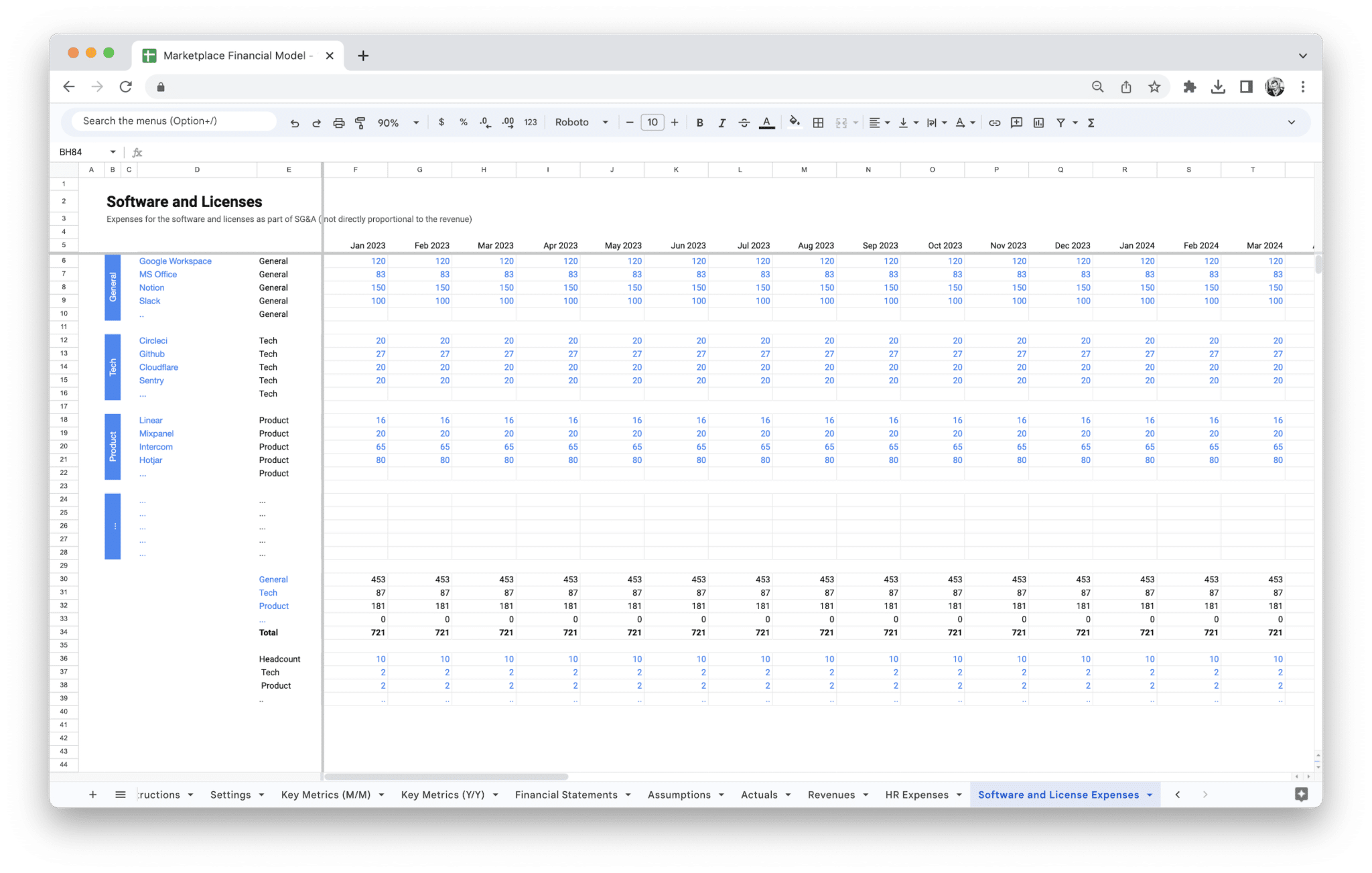

- Cost Structure: Breakdown of fixed and variable costs, including operational costs, platform maintenance, marketing, and customer support.

- User Growth and Acquisition Metrics: Projections for how many new users will join, how quickly they will be acquired, and at what cost (Customer Acquisition Cost).

- Cash Flow Projections: Tracking expected cash inflows and outflows to ensure liquidity and financial stability.

- Profitability Metrics: Gross margin, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), and net profit, which reflect how well the business is performing financially.

- Scalability Projections: Forecasts for how revenue and expenses will grow over time as the marketplace expands.

- Key Performance Indicators (KPIs): Metrics that allow the business to track its performance, such as Lifetime Value (LTV), churn rate, and customer acquisition cost.

These core components are interconnected, and together, they create a robust financial model that can help you understand how different factors impact your marketplace’s financial performance.

How it Differs from Traditional Business Financial Models

Marketplace financial models are different from traditional business models because they need to account for unique elements that affect their operations. Unlike businesses that sell products directly or offer services in a more linear way, marketplace businesses operate on two-sided platforms that connect buyers and sellers (or service providers and consumers). This creates more complexity in tracking and forecasting financials. Some of the key differences include:

- Dual Revenue Streams: Many marketplaces generate income from both sides of the platform (e.g., buyers and sellers, or service providers and consumers). Traditional businesses often rely on one revenue stream.

- Network Effects: Marketplaces benefit from network effects, where the value of the platform increases as more users join. This complicates traditional revenue and growth projections but is crucial for forecasting the success of the business.

- Scalability Assumptions: A traditional business model might scale by increasing inventory or adding staff, while a marketplace scales primarily through user acquisition and maintaining a balance between supply and demand.

- High User Acquisition Costs: For marketplaces, the cost of attracting both buyers and sellers can be significant, especially in the early stages of business. This is in contrast to traditional businesses that might only focus on one type of customer.

These factors create a unique set of financial challenges that a traditional business model doesn’t face. A Marketplace Financial Model Template addresses these specificities and provides an easier way to manage and forecast them.

The Importance of a Financial Model for Marketplace Businesses

Having a solid financial model is crucial for any business, but it is particularly important for marketplaces due to the dynamic nature of their operations and the need for ongoing scalability. Here’s why a Marketplace Financial Model Template is essential for your business:

- Clarifies Financial Assumptions: It helps you set clear expectations for how your revenue will grow, how much it will cost to acquire users, and what margins you need to maintain to be profitable.

- Provides a Roadmap for Growth: As you scale, a financial model acts as a map, guiding your business towards sustainable growth by helping you forecast where the business is headed financially.

- Attracts Investment: Investors want to see that you have a clear financial plan and projections. A well-organized model makes your business more attractive to potential investors.

- Improves Decision-Making: With a financial model, you have concrete data to guide business decisions—from pricing strategies to operational investments and marketing spend.

- Helps Manage Cash Flow: Cash flow forecasting ensures you won’t run out of money during periods of growth or when unexpected expenses arise, making it a vital tool for financial planning.

Understanding the financial landscape of your marketplace, including when and how you’ll reach profitability, is a critical step in achieving long-term success. A financial model keeps you grounded and focused on what needs to be achieved.

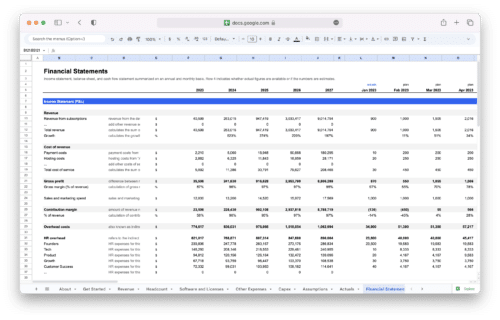

Overview of the Financial Metrics Commonly Used in Marketplace Models

To effectively analyze and track the financial health of your marketplace, certain financial metrics are critical. These metrics help you understand your revenue streams, assess your costs, and make informed decisions. Some of the most commonly used metrics in a marketplace financial model include:

- Gross Margin: The percentage of revenue left after subtracting the cost of goods or services sold. It’s essential for understanding profitability.

- Customer Acquisition Cost (CAC): The total cost of acquiring a new customer, including marketing and advertising expenses. This is crucial for understanding how much it costs to grow your user base.

- Lifetime Value (LTV): The total amount of revenue a single customer is expected to generate over their entire relationship with your platform. This helps determine how much you can afford to spend on acquisition.

- Churn Rate: The percentage of users who stop using the platform over a given period. High churn rates can signal user dissatisfaction, while low churn suggests strong user retention.

- Net Profit Margin: This metric calculates the percentage of revenue that remains after all expenses have been deducted. It’s an indicator of the overall profitability of the marketplace.

- EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization—used to measure operational efficiency and the profitability of the core business.

- Revenue Per User (RPU): How much revenue, on average, each user brings to the marketplace. This is particularly important for understanding the financial viability of different user segments.

- Conversion Rate: The percentage of visitors or users who take a desired action (e.g., making a purchase, subscribing to a service). This helps measure the effectiveness of your platform in driving revenue.

These metrics will help you track performance, make informed decisions, and identify areas for improvement within your marketplace model.

The Role of a Marketplace Financial Model Template in Streamlining Financial Planning

A Marketplace Financial Model Template is a critical tool that streamlines the financial planning process by providing a structured, easy-to-use framework for tracking and projecting various financial aspects of your business. The template is designed to simplify complex financial projections and calculations, enabling entrepreneurs, operators, and investors to quickly get a snapshot of a marketplace’s financial status. This template serves as the foundation for creating forecasts, making adjustments, and assessing financial health without starting from scratch each time.

The role of the template goes beyond just creating initial projections. It helps you regularly update and refine your model as you gather more data, ensuring that your financial planning remains relevant and adaptable. By organizing all the necessary components in a single place, the template allows you to focus on strategic decision-making instead of worrying about maintaining accuracy or missing critical assumptions.

Key Benefits for Entrepreneurs, Investors, and Operators in the Marketplace Sector

Marketplace businesses come with unique challenges, especially as they scale. A well-structured financial model can be a game-changer in navigating these complexities. Below are the key benefits that the Marketplace Financial Model Template offers to entrepreneurs, investors, and operators:

For Entrepreneurs

- Provides a clear financial picture, helping you identify potential problems early on.

- Makes it easier to secure investment by showcasing a professional, organized financial strategy.

- Offers a roadmap for scaling operations while maintaining profitability.

- Simplifies decision-making by providing a framework to test different assumptions and projections.

For Investors

- Offers transparency into the business’s financial assumptions and projections.

- Helps assess the scalability and long-term potential of the marketplace.

- Allows investors to quickly evaluate key financial metrics, reducing the time needed for due diligence.

- Provides insight into how well the business is likely to manage its growth, costs, and cash flow.

For Operators

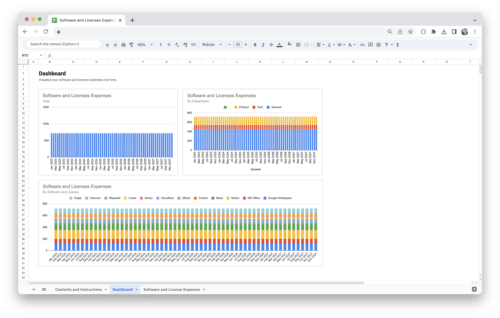

- Facilitates efficient management of day-to-day operations by highlighting key financial metrics.

- Helps track user acquisition, retention, and revenue growth to optimize operational strategies.

- Assists in planning budgets, managing costs, and forecasting cash flow.

- Enables effective long-term strategic planning by showing potential financial scenarios.

By providing these benefits, a Marketplace Financial Model Template becomes an invaluable tool for entrepreneurs, investors, and operators, ensuring that the business is financially sound and well-positioned for sustainable growth.

When it comes to building a marketplace, understanding the financial aspects that drive its success is crucial. A marketplace financial model includes various key components that can help you track performance, optimize profitability, and plan for growth. Here are the essential elements you need to focus on when designing your model.

Revenue Streams: Commission-Based, Subscription, or Freemium Models

One of the first things you’ll need to define in your financial model is how your marketplace will generate revenue. The revenue structure you choose impacts not only the pricing strategy but also how you forecast future income and scale your platform. Let’s dive into some of the most popular models used by successful marketplaces.

Commission-Based Model

The commission-based model is the most common for marketplaces. In this model, you take a cut of every transaction that happens on your platform. Think of platforms like Uber, Airbnb, or eBay, where the marketplace charges a percentage of each deal between buyers and sellers or service providers. This model works well because it scales directly with the volume of transactions—more users and activity equals more revenue.

However, the challenge with this model is ensuring that the commission percentage is set correctly. Too high, and you may deter users from transacting on your platform; too low, and you might struggle to cover your costs. A smart marketplace will use data to continuously optimize this percentage to find the sweet spot.

Subscription Model

The subscription model provides a steady, recurring revenue stream, which can be advantageous for both your business and your users. Marketplaces like LinkedIn or Etsy use a subscription model where users or sellers pay a monthly or annual fee to access premium features.

For example, Etsy offers a subscription model for its sellers who want access to additional tools, such as advanced analytics and advertising options. This model gives your marketplace a predictable revenue stream, which is particularly useful when planning long-term strategies. However, keep in mind that your users must see enough value in the subscription to make it worth their while, so your marketplace must deliver consistent and compelling features.

Freemium Model

The freemium model combines free access to basic services with paid access to premium features. Dropbox is a classic example of a business that grew rapidly using the freemium model. Free users can store a limited amount of data, while paying users get more storage and additional features.

Freemium models are attractive because they lower the barrier to entry for users, allowing you to build a large base quickly. However, the challenge is converting free users into paying customers. For a freemium model to be successful, your premium features must offer clear value that justifies the cost.

Cost Structure: Platform Maintenance, Marketing, Customer Support, etc.

The next critical piece of the marketplace financial model is the cost structure. Understanding where your money is going helps you keep the business running smoothly and ensures that your marketplace is sustainable in the long run.

Platform Maintenance

Running a marketplace isn’t just about building the platform; you need to continually maintain and improve it. Platform maintenance includes regular software updates, bug fixes, infrastructure costs (like cloud hosting), and new feature development. A robust, secure platform is crucial to maintaining user trust and ensuring a seamless experience, which means you can’t afford to skimp on this area. Regular investment in platform development and maintenance will keep your marketplace competitive.

Marketing & Customer Acquisition

Marketing is another significant cost area for any marketplace. Whether you’re using social media ads, content marketing, or influencer partnerships, bringing users onto the platform costs money. For example, digital ad campaigns might cost thousands of dollars per month, depending on the size and scope of your target audience.

The challenge with marketplace businesses is that you often need to market to both buyers and sellers. This can create a “chicken and egg” problem, where you need users to attract other users, but you don’t have users yet. This is where marketing costs can skyrocket, especially in the early stages of your business. Over time, however, as the platform grows and more users are onboarded, you should be able to rely on organic growth and network effects.

Customer Support

Customer support is another essential part of your cost structure. Whether it’s handling disputes, managing refunds, or answering basic user queries, customer support helps ensure a positive experience for your users. This means staffing a support team, implementing tools like chatbots, and maintaining a ticketing system. In many marketplaces, customer support costs are directly proportional to the number of users and the complexity of issues that arise. Investing in proactive customer service strategies can help reduce long-term support costs.

User Acquisition and Growth Metrics

Understanding user acquisition and growth is at the core of any successful marketplace. You need to constantly measure how effectively you’re bringing new users onto your platform and how well you’re retaining them.

User Acquisition Cost (CAC)

The cost of acquiring a customer is one of the first metrics you need to track. This includes all the marketing and sales expenses you incur to bring new users to your platform, divided by the number of customers you acquire. For example, if you spend $10,000 on marketing in a month and acquire 500 new users, your CAC would be $20. Keeping track of this number helps you determine how sustainable your business model is and whether your marketing efforts are paying off. A high CAC may signal that you need to adjust your marketing strategy, while a low CAC suggests that your platform is effectively gaining traction.

Churn Rate

Churn rate measures how many customers you lose over a specific period, and it’s a crucial indicator of user retention. A high churn rate means that users are signing up but leaving your platform quickly. This could be due to a number of factors, such as a poor user experience, lack of features, or better competition. The goal is to keep churn rate low by continuously improving the platform and addressing user feedback.

Growth Rate

Your marketplace’s growth rate measures how quickly your user base is expanding. This is a key indicator of market demand and overall business health. A high growth rate is usually a result of successful marketing, network effects, or viral word-of-mouth, and it signals that the platform is gaining traction. However, growing too quickly without the infrastructure or support to handle the increase in users can lead to poor user experiences and increased operational costs.

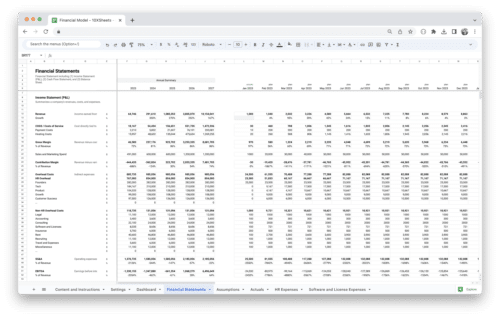

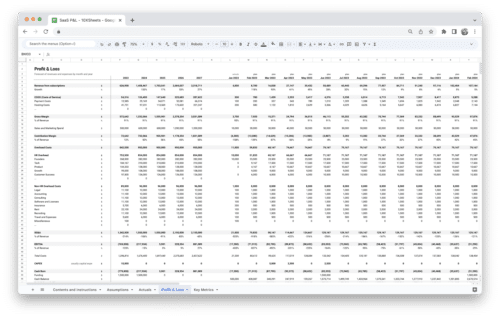

Profitability Metrics: Gross Margins, EBITDA, and Net Profit

As you track your revenue and expenses, you need to measure how profitable your marketplace is. Profitability metrics allow you to assess how much you’re earning after covering your costs, helping you make strategic decisions about where to invest next.

Gross Margin

Gross margin is the difference between your revenue and the direct costs associated with producing the goods or services sold on your platform, such as transaction fees or payment processing costs. A healthy gross margin indicates that your platform is making a reasonable profit from its core activities before accounting for overhead costs. For a marketplace, high gross margins are often seen in commission-based models, especially if the platform is low-cost to maintain.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

EBITDA is a measure of operating performance that looks at a company’s profitability without the impact of financial and accounting decisions. For marketplace businesses, EBITDA is useful because it strips out costs like interest payments and taxes that don’t directly relate to core operations. A strong EBITDA margin indicates that the business is operating efficiently and has a solid foundation for future growth.

Net Profit

Net profit is the final measure of profitability, reflecting the amount of money you have left after all expenses are paid. This is the bottom line, and it’s what you will ultimately need to grow the business, reinvest, or distribute to stakeholders. For marketplace businesses, achieving net profit can take time due to high initial acquisition costs, but once you have a strong user base, net profit becomes a critical measure of business sustainability.

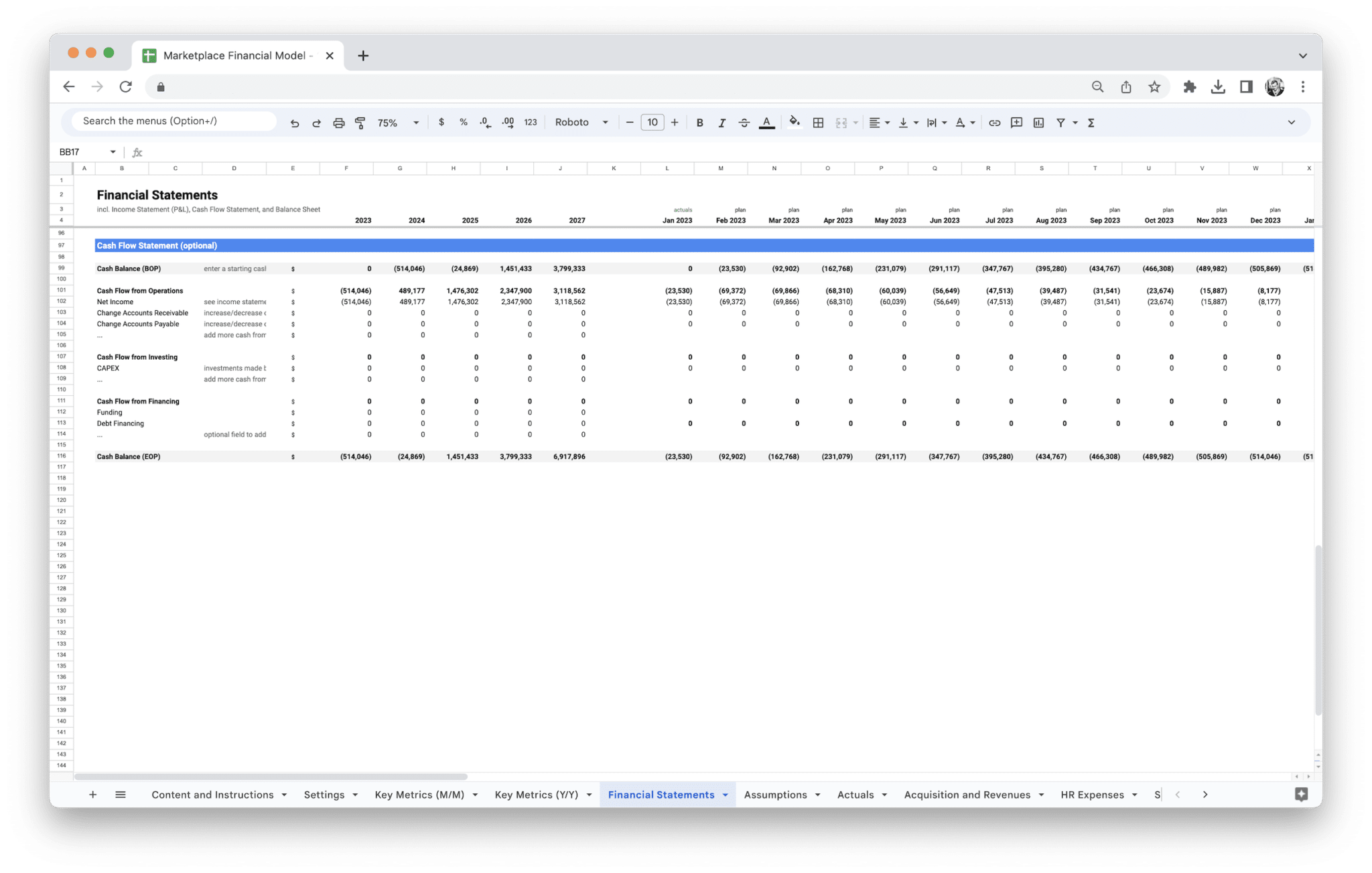

Cash Flow Forecasting and Working Capital Management

Cash flow is the lifeblood of your marketplace business, and being able to forecast and manage it is critical to long-term success.

Cash Flow Forecasting

Cash flow forecasting is the process of predicting when money will come in and go out of your business. It’s essential for ensuring that you have enough funds to cover your costs at all times. For marketplaces, where revenue may fluctuate based on seasonality or market conditions, cash flow forecasting helps you anticipate lean periods and plan accordingly. A positive cash flow means that your business can grow without needing to rely on external funding, while a negative cash flow may indicate operational inefficiencies.

Working Capital Management

Working capital refers to the money you need to run your day-to-day operations, such as paying for platform maintenance, employee salaries, and marketing costs. Effective working capital management ensures that you can maintain liquidity without tying up too much capital in assets. For marketplaces, managing working capital involves balancing cash flow with payment processing schedules, user payouts, and other operational needs. If not managed carefully, poor working capital can lead to cash shortages, limiting your ability to scale effectively.

By understanding and optimizing these key elements of your marketplace financial model, you’ll be able to track your business’s health, manage risks, and make data-driven decisions that will drive long-term growth. The key is to regularly review and adjust your model based on real-world performance, ensuring your marketplace remains financially viable and ready for the challenges ahead.

Building a marketplace financial model is an essential step toward understanding the financial landscape of your platform. Whether you’re starting from scratch or refining an existing model, this process provides the foundation for forecasting, making data-driven decisions, and attracting investors. Let’s explore how to build your financial model, step by step, ensuring you set up a comprehensive tool that accurately represents your business’s financial dynamics.

How to Create a Financial Model?

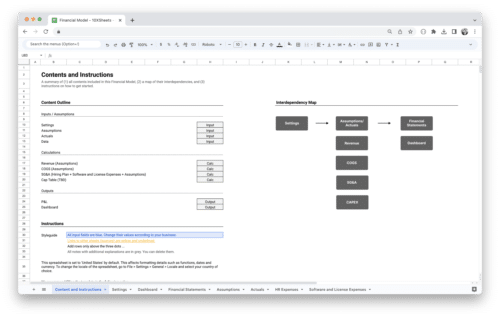

Creating a marketplace financial model is more than just plugging numbers into spreadsheets; it’s about building a tool that reflects your business reality while providing insights into future performance. Here’s a simple process you can follow to set up your model:

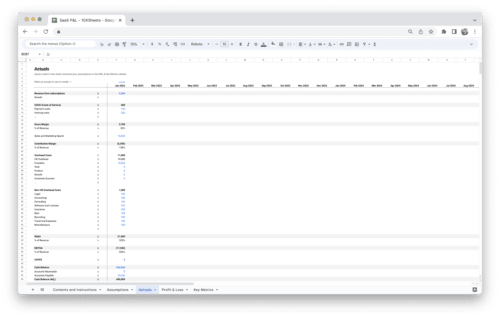

- Set Up Your Spreadsheet Framework

Start by organizing your financial model in a way that reflects the different sections you’ll need to track. Create tabs for key categories like revenue, expenses, user growth, cash flow, and profitability metrics. Each tab should include data inputs, formulas for automatic calculations, and outputs that show how different variables affect your financial performance. - Start with Revenue Projections

Begin by forecasting how much revenue your marketplace will generate. For a commission-based model, you’ll need to estimate the average transaction value, the volume of transactions, and your commission rate. If you use a subscription model, you’ll forecast the number of subscribers, subscription fees, and conversion rates from free to paid users. This step is critical for understanding how your business will scale as more users engage with your platform. - Estimate Your Costs

The next step is to forecast the costs associated with running your marketplace. These include direct costs like transaction fees and payment processing, as well as overhead costs like platform maintenance, marketing, and customer support. Understanding your cost structure will allow you to calculate your break-even point and how much revenue you need to cover your expenses. - Create Your Cash Flow Projections

Cash flow is the heartbeat of your business, and it’s important to map out when money will come in and go out. You should project monthly cash inflows from revenue and monthly outflows from operating expenses. Additionally, be sure to include any capital expenditures or investment in growth that will impact cash flow. This will help you anticipate liquidity issues and plan for long-term financial health. - Define Key Metrics for Tracking Performance

A well-rounded financial model includes key performance indicators (KPIs) to track the health of your marketplace. Metrics like Gross Margin, Customer Acquisition Cost (CAC), Lifetime Value (LTV), and Churn Rate will help you understand how well your platform is doing and where improvements can be made.

By following this process, you’ll create a financial model that is structured, comprehensive, and adaptable to changes as your marketplace grows.

Setting Up Revenue and Cost Assumptions

Once the framework is in place, you need to establish your assumptions around revenue and costs. These assumptions will drive the accuracy of your financial model and serve as the basis for future predictions.

Revenue Assumptions

The first step is to predict your revenue streams. Whether you’re using a commission-based model, subscription model, or a hybrid, you need to create realistic assumptions for each revenue source.

- Transaction Volume: For commission-based models, you’ll need to estimate how many transactions will happen on your platform per month. This is where understanding your market size and penetration is key. Think about how fast your platform can grow and what external factors (such as economic shifts or competitor activities) might influence these numbers.

- Average Transaction Value: This is the amount of money your platform generates per transaction. You’ll need to consider the types of goods or services being sold and the average price users are willing to pay. If you’re launching a niche marketplace, it may take time to identify the correct price point.

- Subscription Revenue: For subscription-based models, you need to estimate the number of active subscribers each month and the price each subscriber pays. Look at competitor pricing or do market research to set a realistic fee structure.

Cost Assumptions

Next, focus on your cost structure. Accurate cost assumptions are crucial for ensuring that your model reflects the true cost of doing business.

- Fixed Costs: These are the costs that don’t change regardless of how many transactions or users you have. Examples include software development, platform maintenance, and salaries for core staff. These should be consistent and predictable.

- Variable Costs: These costs fluctuate based on how many users you have or how many transactions occur. For instance, payment processing fees, customer support, and marketing spend may vary depending on your user base. You need to predict how these costs scale as your marketplace grows.

- Customer Acquisition Cost (CAC): Calculate how much you need to spend to acquire one customer, whether through paid marketing campaigns, referral programs, or partnerships. A high CAC might signal the need for a more cost-effective growth strategy.

Integrating User Acquisition and Retention Data

User acquisition and retention are pivotal to your marketplace’s success, and your financial model needs to reflect how both of these elements influence your bottom line.

User Acquisition

The key to growing your marketplace lies in acquiring new users efficiently. For each new user, you’ll need to know how much it costs to bring them onboard and how many users you plan to acquire each month.

- Marketing Spend: Based on your budget and the channels you plan to use (e.g., digital ads, content marketing, social media), you’ll need to estimate how many users you can acquire from each marketing initiative.

- Conversion Rate: This is the percentage of visitors to your platform who actually sign up or make a purchase. Conversion rates can vary depending on the user experience, product-market fit, and incentives. Higher conversion rates lead to lower CAC and are critical for scaling efficiently.

- User Growth Rate: The growth rate is how fast you expect your platform to scale. You should model this growth over time, starting slow in the beginning and accelerating as your platform gains traction and network effects come into play.

User Retention

Once users are onboarded, keeping them is just as important. Retention affects your long-term profitability because retaining users is cheaper than constantly acquiring new ones. For marketplaces, user retention is influenced by platform value, customer support, product offerings, and community engagement.

- Churn Rate: This is the rate at which users leave your platform. A high churn rate could signal dissatisfaction, a lack of engagement, or poor product fit. Understanding and addressing churn is critical for improving retention rates.

- Lifetime Value (LTV): LTV is a metric that predicts how much revenue you will earn from a user during their lifetime on your platform. High LTV suggests that users are returning and spending money over time, which can significantly increase your profitability.

How to Project Long-Term Growth and Scalability

Projecting long-term growth and scalability is one of the most challenging—but also rewarding—aspects of building a marketplace financial model. Your financial model should not only account for the early stages of business but also plan for future scaling.

Revenue Growth

As your user base expands, your revenue will likely increase, but the rate at which it grows might change. Early on, growth can be exponential as you tap into new users and build awareness. Over time, you may find that your growth rate slows down as your market becomes saturated. To project long-term revenue growth, you’ll need to understand market trends, competitive dynamics, and the potential for market expansion.

- Expansion into New Markets: A key driver of long-term growth could be geographical expansion or launching new services. For example, expanding to new countries or adding new product categories could substantially increase your revenue potential.

- Revenue Diversification: As your marketplace grows, you may explore new revenue streams, such as offering additional services or creating partnerships. Diversification can buffer your business against market fluctuations and increase long-term sustainability.

Scaling Costs

Growth doesn’t just mean increasing revenue; it also means managing the costs associated with that growth. As your marketplace scales, some costs, like platform maintenance and customer support, will grow in proportion to the increase in users and transactions. However, many of your fixed costs may not scale as quickly, allowing for economies of scale. This means that over time, as your platform grows, your profit margins should improve.

Tips for Adjusting Assumptions Based on Market Conditions

Your financial model is based on assumptions about the future, but market conditions can change quickly. To make sure your model remains accurate, here are a few tips for adjusting your assumptions:

- Stay Updated on Market Trends: Regularly review market conditions to see if any shifts in demand, competition, or regulation might affect your assumptions. For example, a competitor might launch a new feature that changes user behavior, or economic downturns might increase your CAC.

- Be Flexible with Projections: Your model should allow for flexibility. Use scenarios to model different outcomes—such as best-case, worst-case, and expected-case scenarios. This can help you prepare for uncertainty and adjust your strategy accordingly.

- Use Real-Time Data: Incorporate real-time data into your model. As your marketplace gathers more users, actual data on user acquisition, transaction volume, and churn should be integrated to refine your forecasts.

By building a flexible, data-driven marketplace financial model, you can adjust assumptions and projections as your business grows, ensuring that your financial planning is always aligned with market conditions. This approach gives you the confidence to scale your platform while minimizing risks and maximizing profitability.

When presenting your marketplace financial model to investors, it’s crucial to communicate the financial health and growth potential of your business in a way that resonates with them. Investors want to see clear projections, strong assumptions, and a roadmap for scalability. Here’s how you can use your financial model to make a compelling case:

- Highlight Key Metrics: Focus on the metrics that matter most to investors, such as projected revenue growth, customer acquisition cost (CAC), lifetime value (LTV), and profitability metrics like gross margin and EBITDA. These numbers help investors understand the scalability and financial health of your marketplace.

- Show Market Opportunity: Use your model to demonstrate the potential for growth in your target market. Include assumptions about market size, adoption rates, and user growth. Investors are more likely to be interested in your business if they can see that there’s a large, expanding market for your product or service.

- Demonstrate Path to Profitability: Investors want to know how and when your marketplace will become profitable. Use your financial model to outline a clear path to profitability, showing how your revenue will eventually exceed your costs. Highlight key milestones, such as user acquisition goals or product expansions, that will help you achieve this.

- Run Different Scenarios: Present a range of scenarios to give investors a sense of the potential upside and downside. This includes best-case, worst-case, and base-case scenarios that account for different market conditions. Showing that you’ve thought about various possibilities demonstrates a level of preparedness and strategic thinking.

- Emphasize Scalability: Use your financial model to highlight how your marketplace will scale over time. Investors want to see how quickly your platform can grow, how you’ll manage increased demand, and how your costs will be controlled as you scale. Show that you understand the dynamics of scaling a marketplace and that you have a plan in place to manage growth effectively.

- Provide a Timeline for Milestones: Investors often look for a clear timeline of when you plan to reach certain milestones, such as achieving a certain revenue target, acquiring a specific number of users, or expanding into new markets. Your financial model should align with these milestones and demonstrate how you will reach them.

- Be Transparent with Assumptions: Transparency is key when presenting your financial model to investors. Be clear about the assumptions you’ve made, such as growth rates, CAC, and market size. Investors will appreciate your honesty and may even provide valuable feedback that can improve your model.

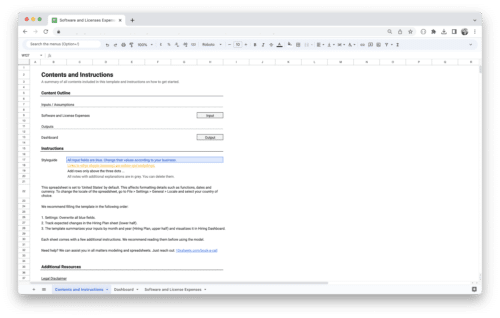

Using a template for your marketplace financial model can save you significant time and effort while ensuring that you’re covering all the necessary elements of your business’s finances. Financial modeling can be complex, especially when managing multiple revenue streams and scaling operations. Here are the key reasons why a template can help:

-

Consistency and Structure: A well-designed template ensures that your financial model follows a consistent structure, making it easier to compare data, track metrics, and adjust assumptions. Templates provide a predefined framework that saves you from reinventing the wheel each time you build a model.

-

Time-Saving: Building a financial model from scratch can be incredibly time-consuming, especially if you lack experience with complex spreadsheets or financial projections. Templates streamline the process by already having key components in place, like revenue models, cost structures, and forecasting formulas.

-

Accuracy and Reliability: Templates are often based on industry standards and best practices, meaning they come with proven formulas and calculations that are designed to minimize errors. This can be particularly valuable if you’re not a financial expert, as it reduces the chance of mistakes that could lead to incorrect assumptions.

-

Customizability: While templates provide a strong foundation, they are also customizable to your specific marketplace. You can adjust revenue assumptions, tweak cost structures, and modify key metrics to align with the specifics of your business model.

-

Focus on Strategy, Not Details: With the bulk of the financial modeling work handled by the template, you can focus on refining your business strategy. Templates take care of the time-intensive, repetitive calculations, so you can prioritize analysis, decision-making, and planning for growth.

-

Simplified Communication with Stakeholders: Whether you’re presenting to investors, partners, or your team, having a standardized template can help ensure that everyone is on the same page. It provides a clear, easy-to-understand structure that stakeholders can quickly digest and assess.

Even though templates are designed to simplify the process of building a financial model, there are still potential pitfalls that you should avoid. Missteps in the way you use or interpret the template can lead to inaccurate projections, unrealistic assumptions, and costly errors. Here are some common mistakes to watch out for:

-

Overestimating Revenue Growth: One of the most common mistakes when using a financial model template is overestimating how quickly your marketplace will grow. It’s easy to get carried away with optimistic projections, but this can lead to inflated expectations. Make sure to validate your growth assumptions with real-world data or benchmark them against similar companies in your industry.

-

Underestimating Customer Acquisition Costs (CAC): Many marketplace businesses underestimate how much it will cost to acquire users. While it’s tempting to think that growth will happen organically through word-of-mouth or viral marketing, customer acquisition often requires sustained investment in advertising, partnerships, and incentives. Be conservative in your CAC projections to avoid cash flow issues.

-

Ignoring Market Saturation: Early-stage marketplaces may experience exponential growth, but this rate usually slows down over time. It’s essential to account for market saturation and how it will affect your growth trajectory. Don’t expect growth to continue at the same pace once you’ve captured a significant portion of the target market.

-

Not Updating the Model Regularly: A financial model is a living document that should evolve as your marketplace grows and market conditions change. Failure to update assumptions based on real-world performance or market shifts can lead to outdated and irrelevant projections. Be sure to revisit your model frequently to ensure it remains accurate and reflective of your business’s trajectory.

-

Overlooking Operational Costs: When you’re focused on revenue and user acquisition, it’s easy to overlook the operational costs required to support a growing marketplace. Don’t underestimate the resources needed for customer support, platform maintenance, and scalability. These costs can creep up and impact your profitability if they’re not properly accounted for.

-

Failure to Stress-Test the Model: A common mistake is relying too heavily on the base case scenario without testing how the model would perform under various conditions. You should run scenarios that account for worst-case, best-case, and expected-case situations to understand how changes in market conditions, user behavior, or competition could affect your bottom line.

-

Not Accounting for Seasonality: Some marketplaces may experience fluctuations in revenue or activity based on seasons or external events. For instance, e-commerce platforms may see higher sales during the holiday season, while service-based marketplaces might have slower months during vacation periods. Be sure to account for seasonality in your revenue and cash flow projections.

Make a one-time payment and

enjoy your template forever.

No extra costs, no strings attached,

more savings for you.

Keep your templates up-to-date

with free access to regular updates.

Related products

-

Sale!

Standard Financial Model Template

184,03 €Original price was: 184,03 €.125,21 €Current price is: 125,21 €.Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to cart Details -

Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to cart Details -

Sale!

SaaS Profit and Loss Statement

100,00 €Original price was: 100,00 €.66,39 €Current price is: 66,39 €.Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to cart Details -

Sale!

SaaS Financial Model Template

184,03 €Original price was: 184,03 €.125,21 €Current price is: 125,21 €.Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to cart Details