E-Commerce Financial Model Template

184,03 € Original price was: 184,03 €.125,21 €Current price is: 125,21 €.

32% Off

Value added tax is not collected, as small businesses according to §19 (1) UStG.

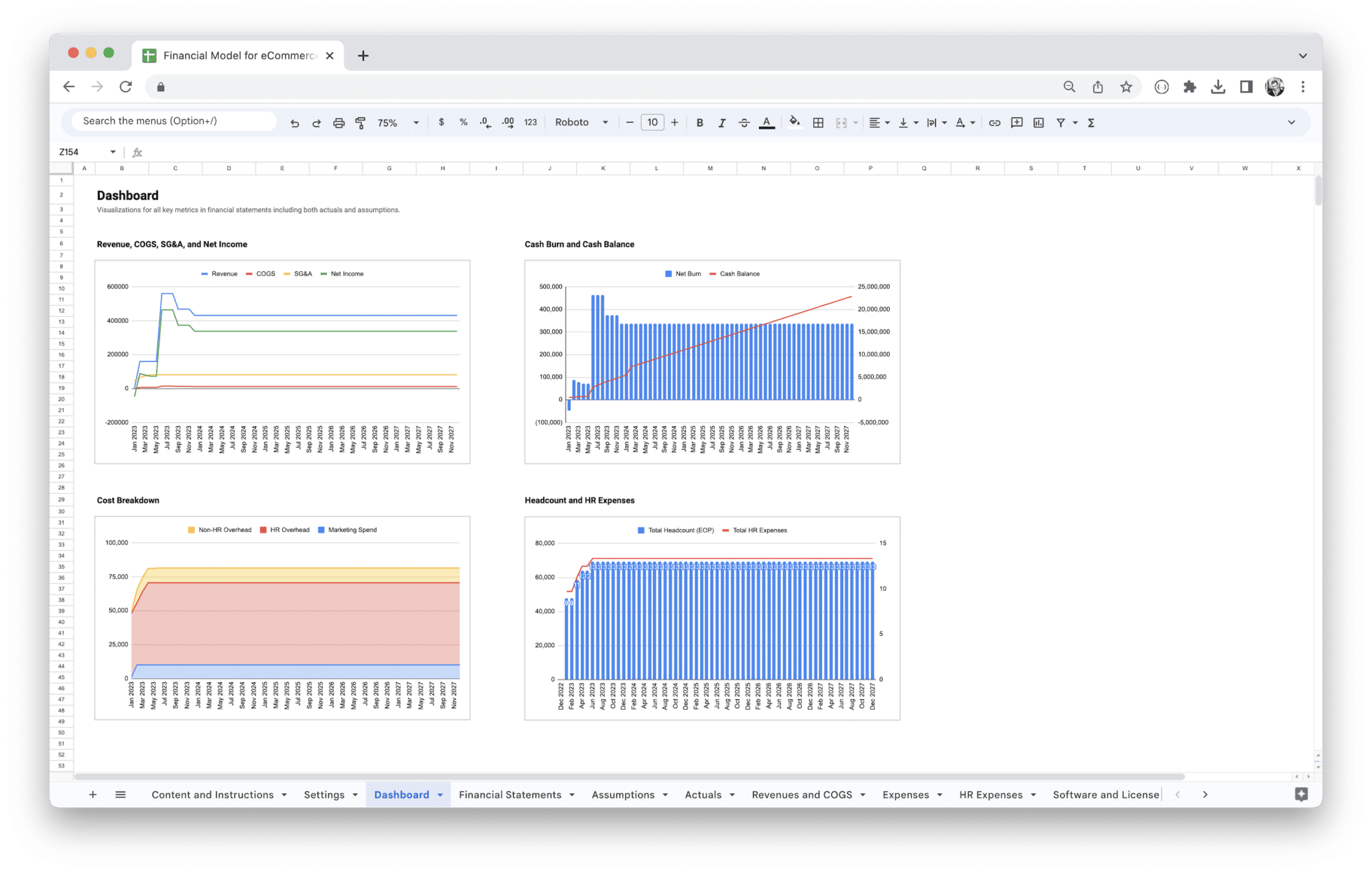

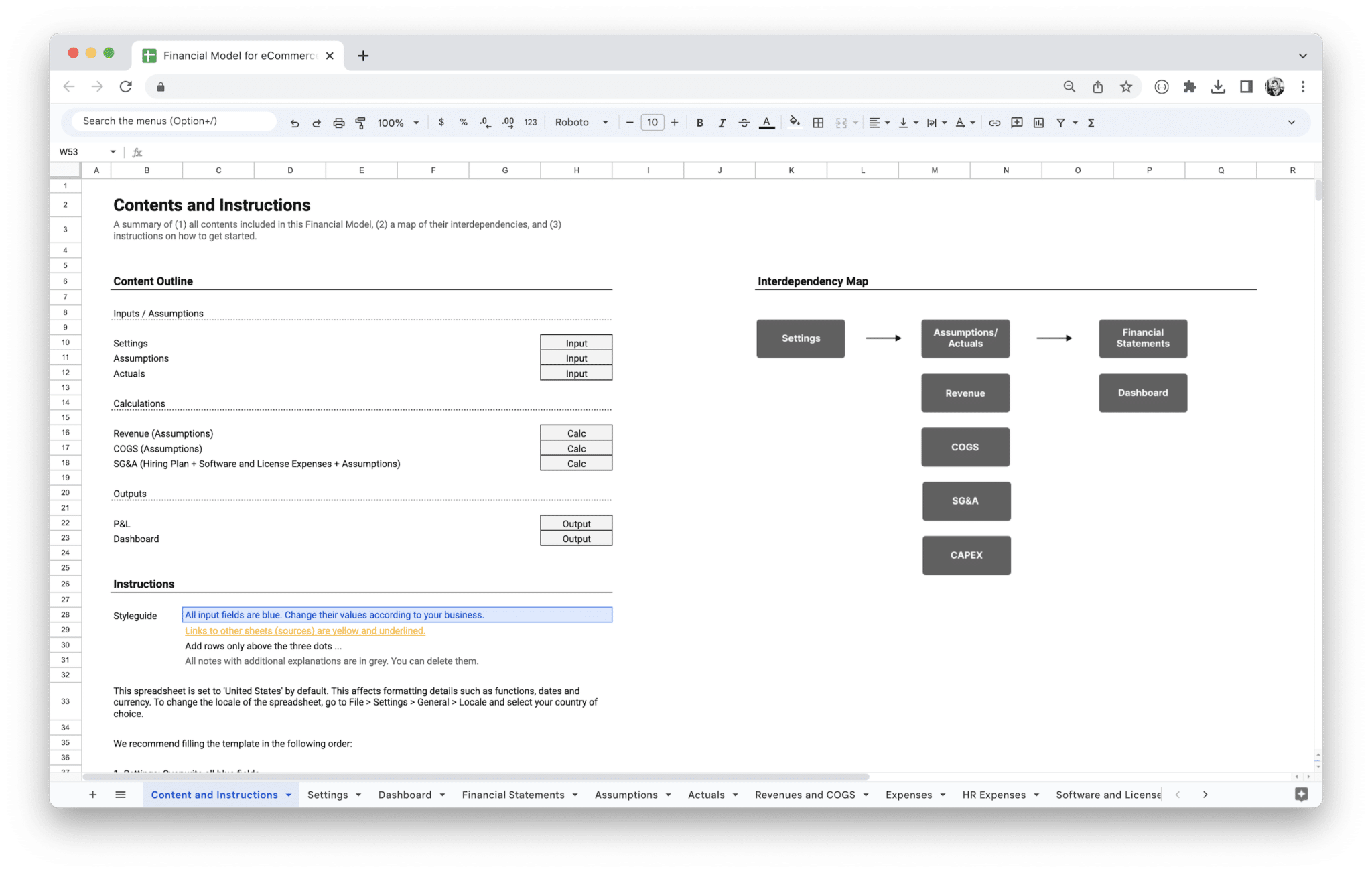

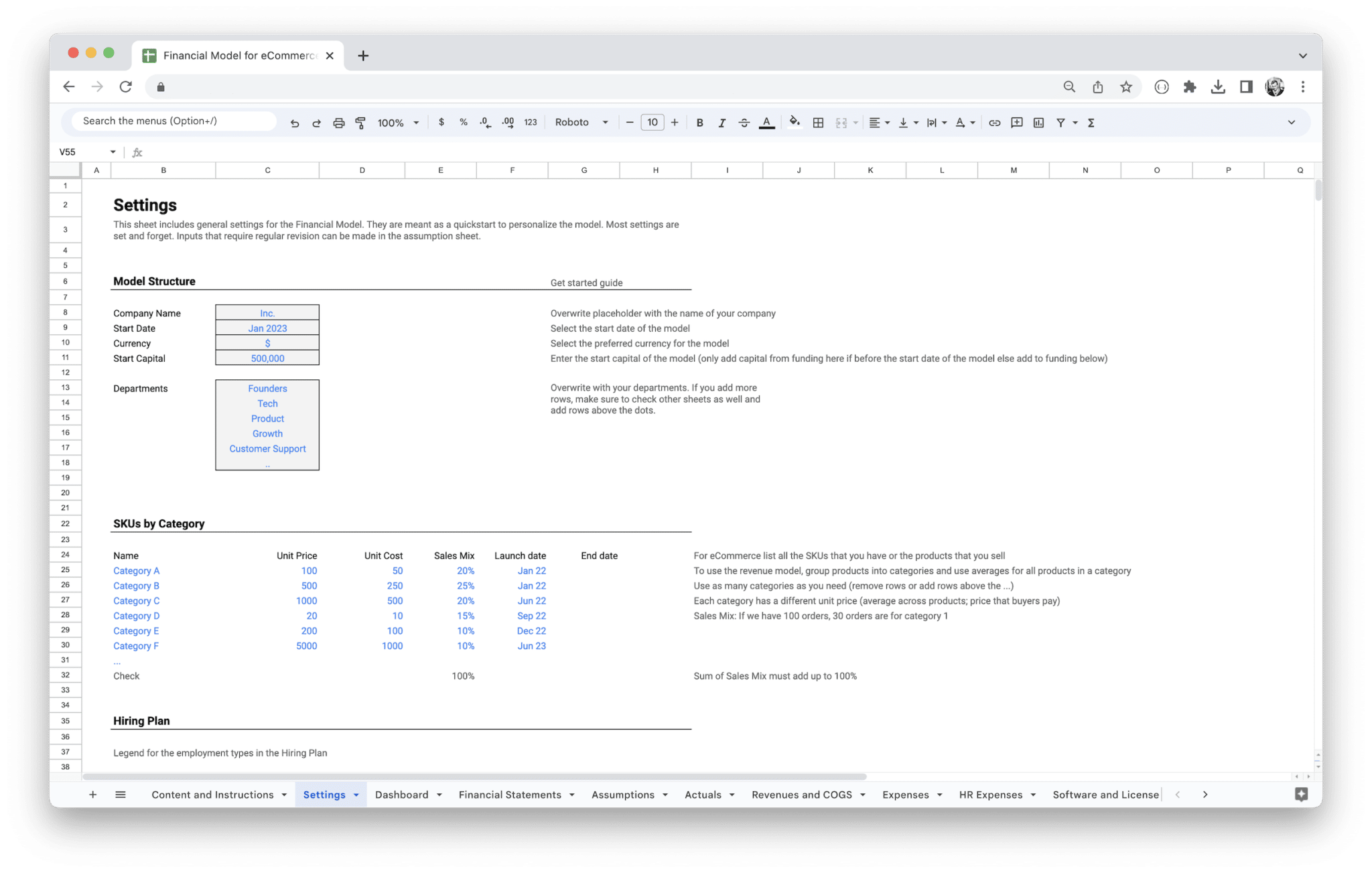

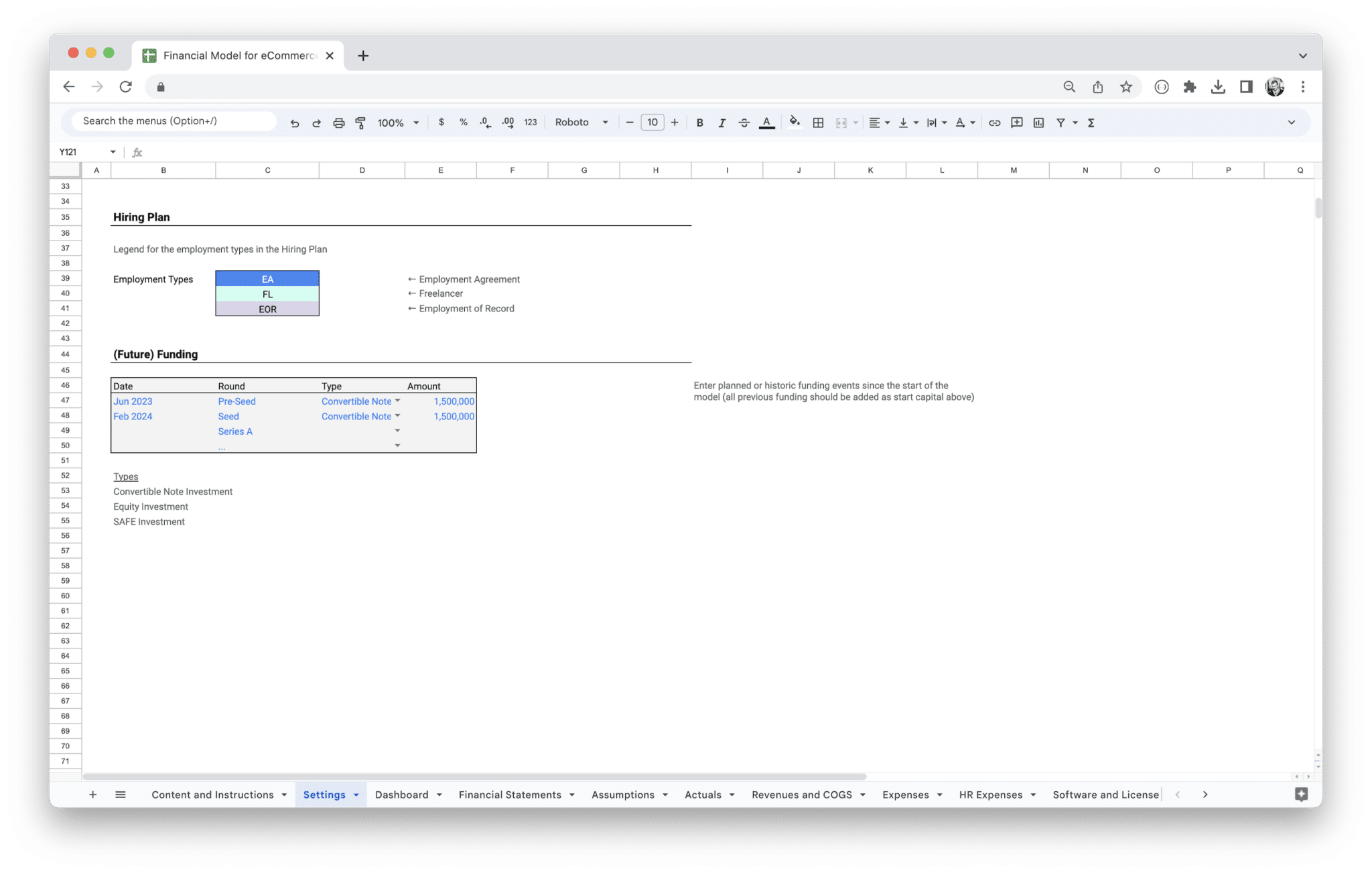

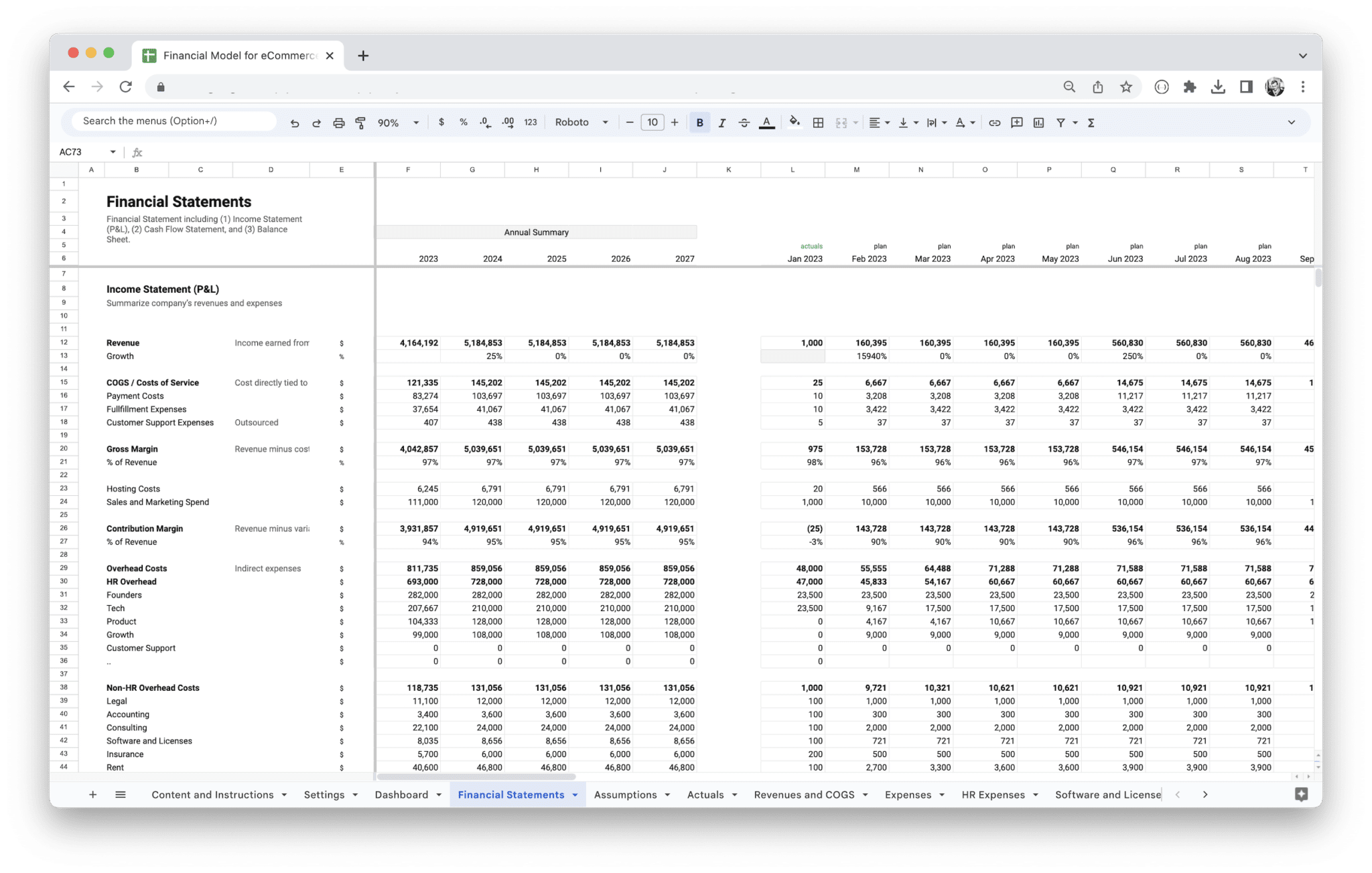

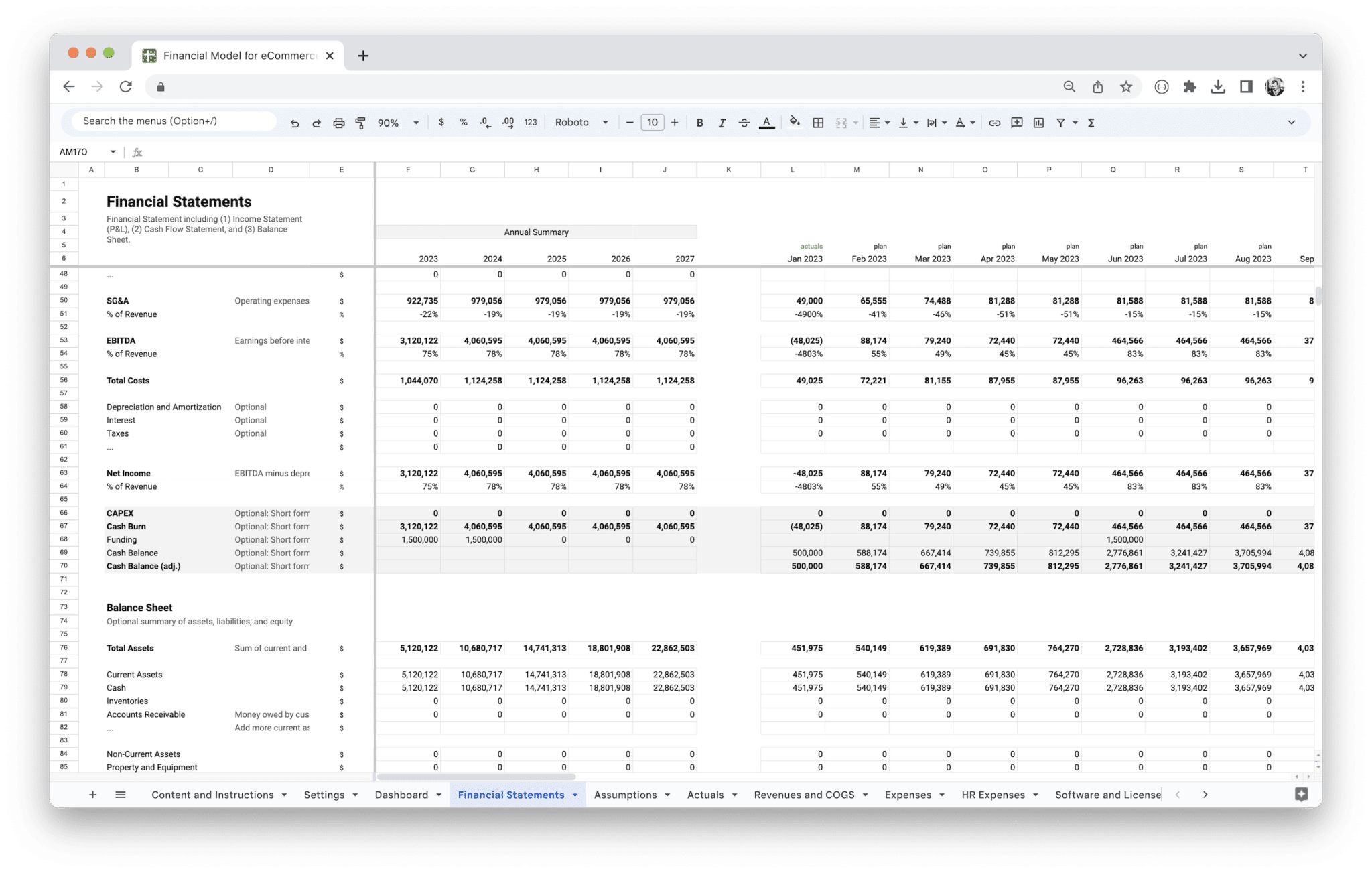

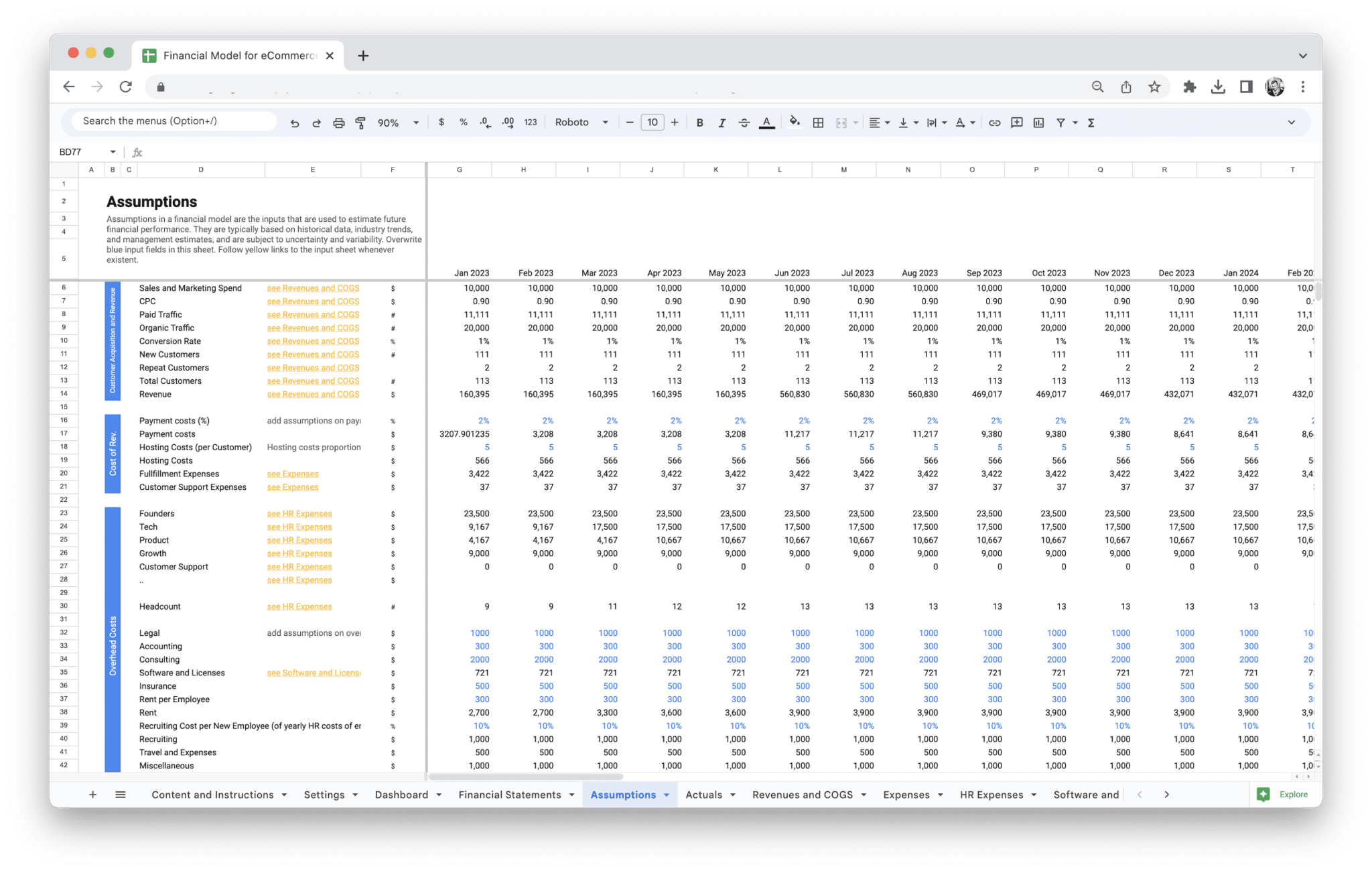

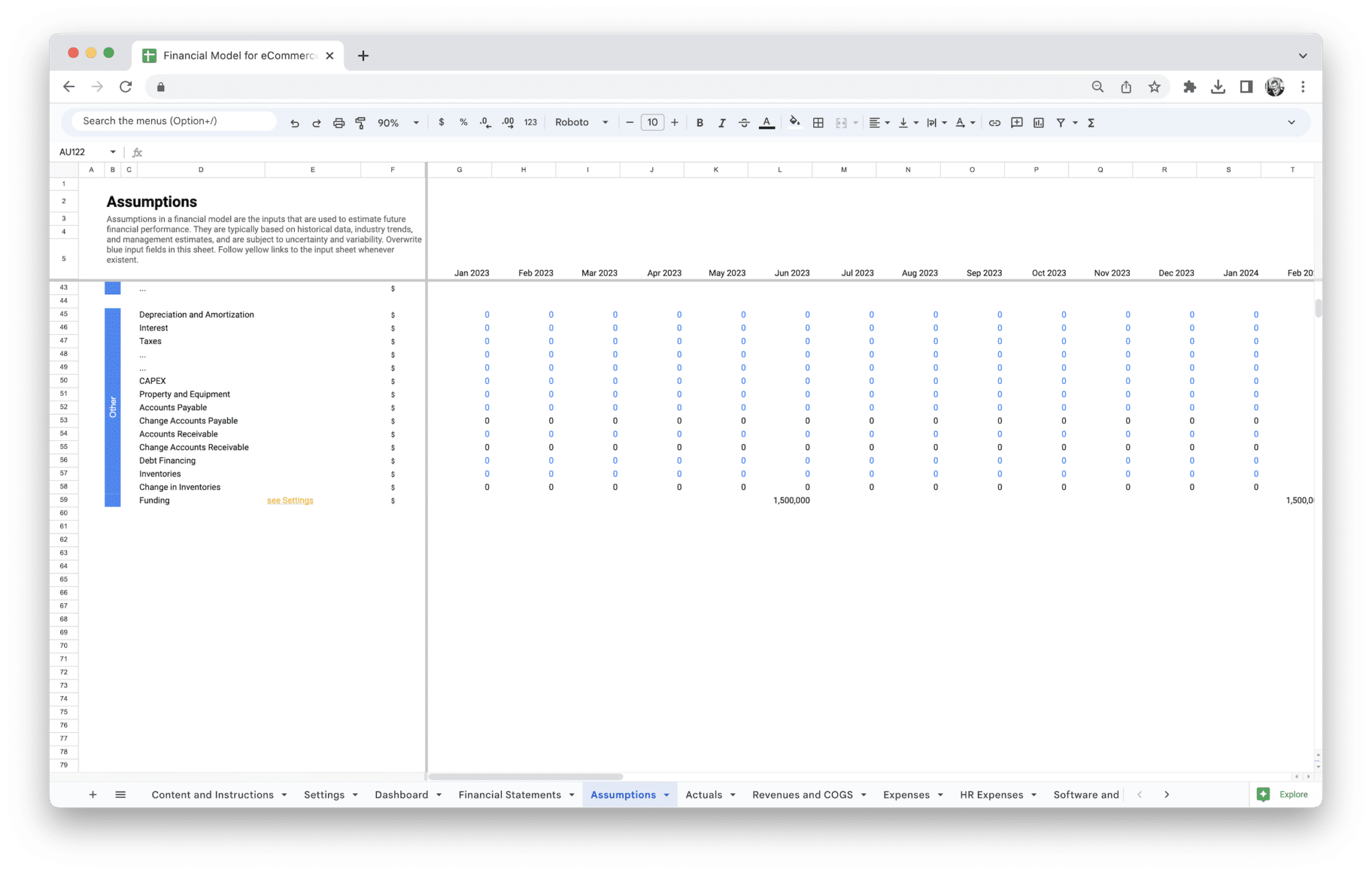

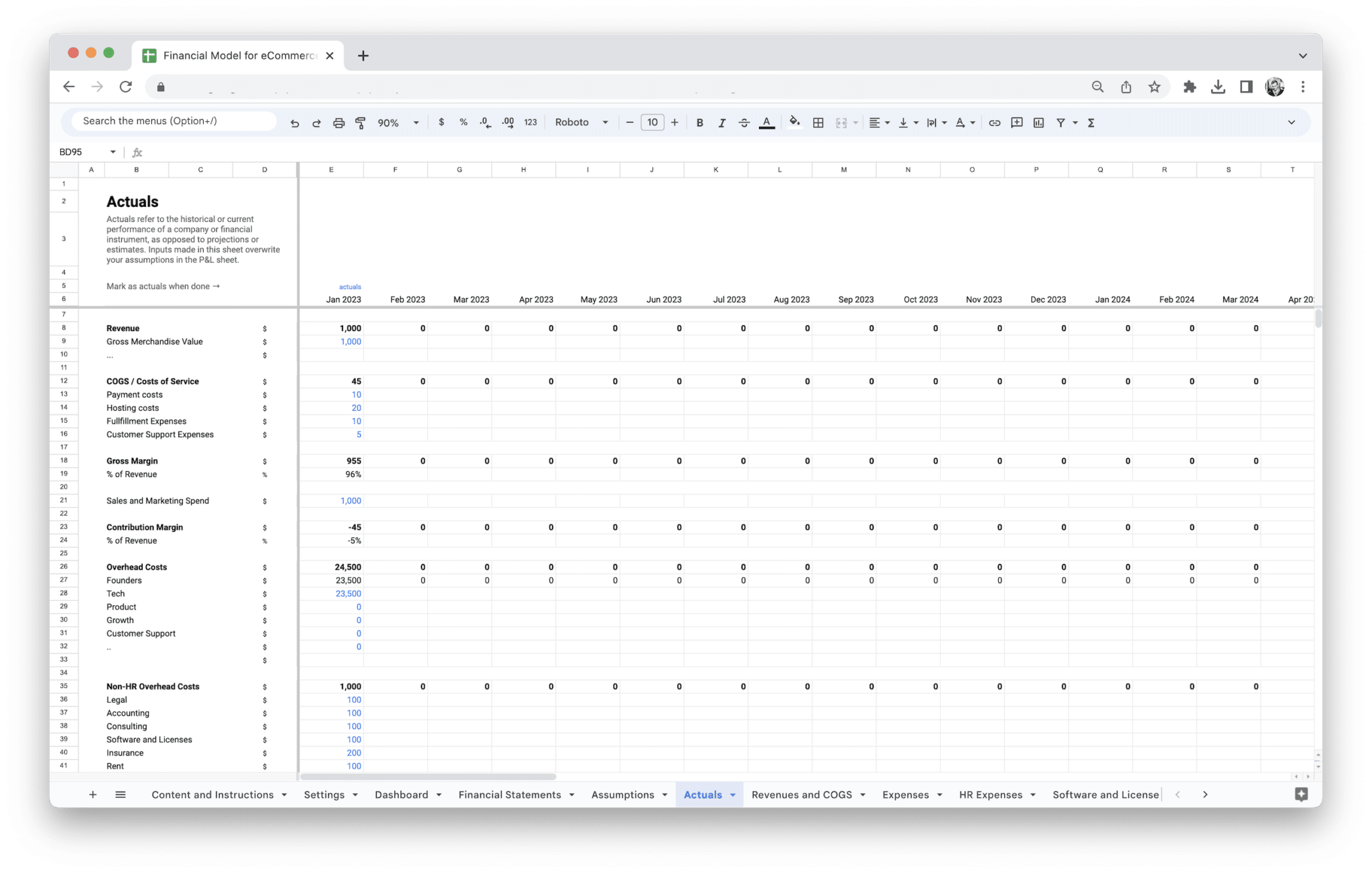

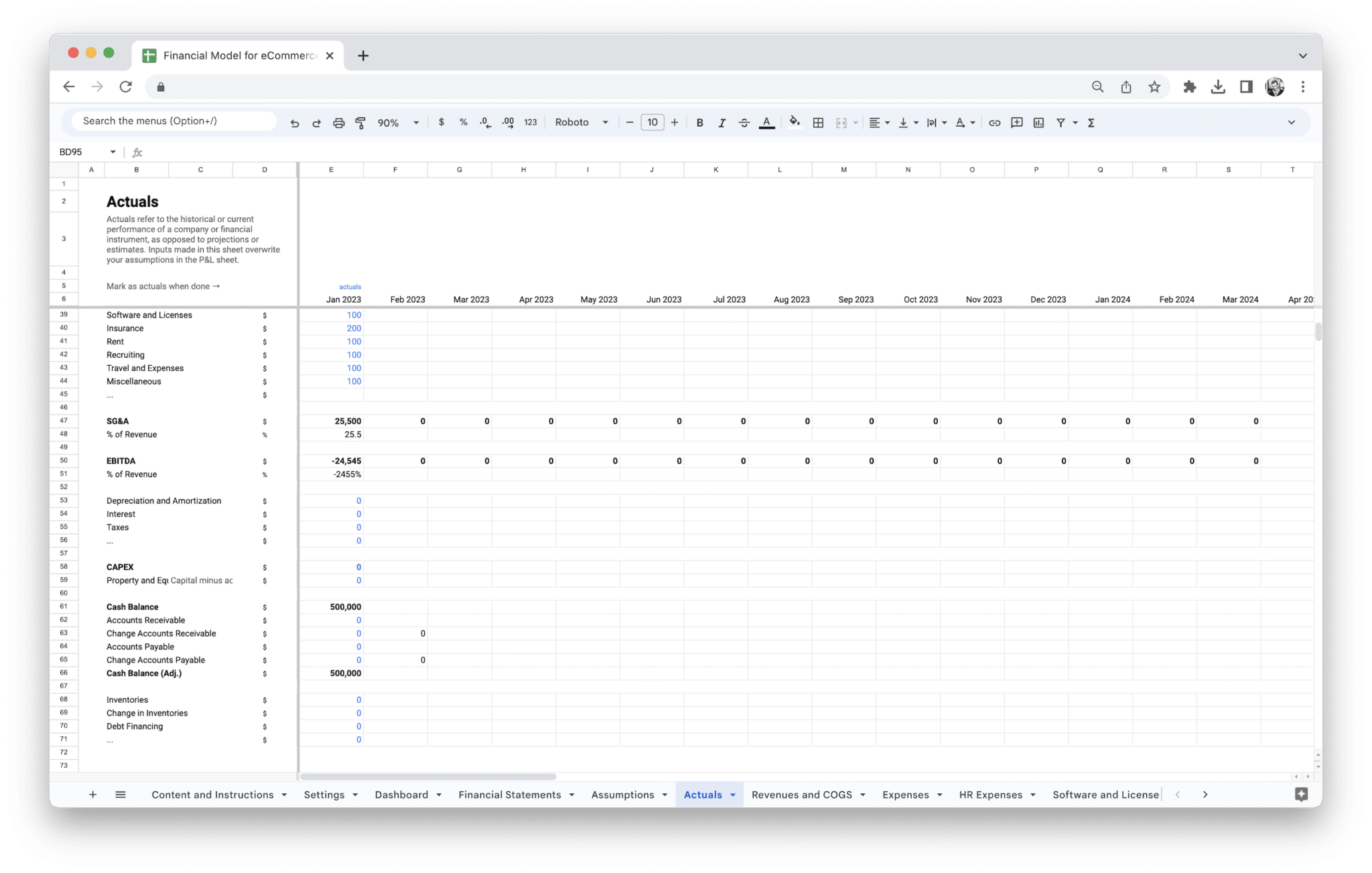

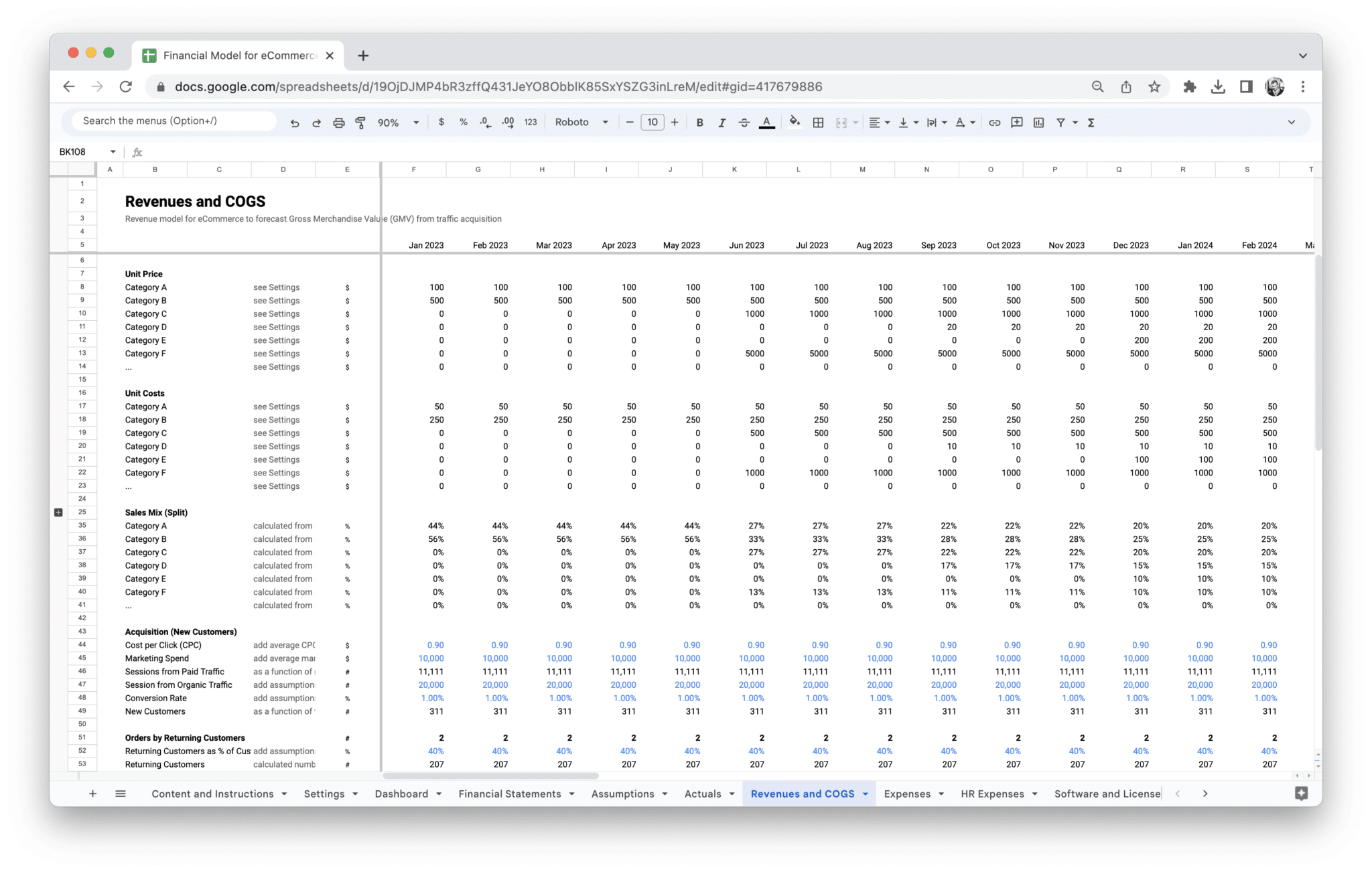

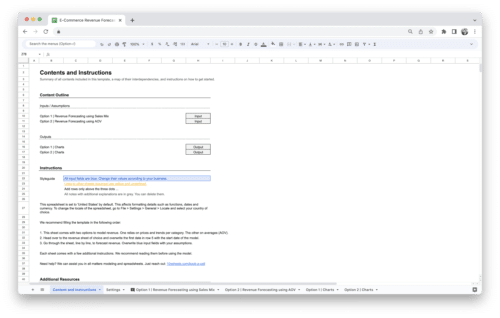

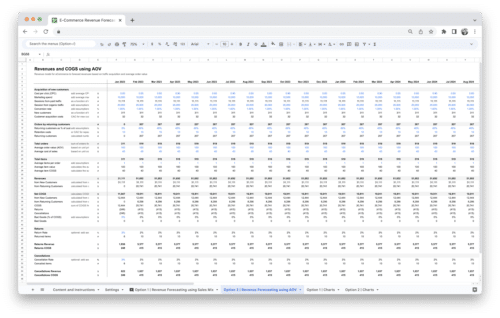

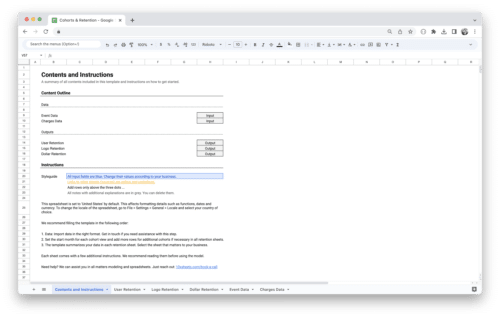

Optimize your e-commerce business’s finances. Easily forecast revenues, analyze expenses, and customize to your unique needs with a dashboard, financial statements, and expense modeling!

Description

Running an e-commerce business comes with a unique set of challenges, and managing finances is one of the toughest. Without a clear understanding of your revenue, costs, and cash flow, it’s easy to lose track of your financial health. As you scale, it becomes even more difficult to predict future growth, manage resources effectively, and make informed decisions. Without the right tools, you could be missing out on opportunities or even running into avoidable financial pitfalls.

This is where the E-Commerce Financial Model Template comes in. Designed specifically for e-commerce businesses, this template gives you a clear framework to track all your key financial metrics, including revenue, expenses, cash flow, and profits. It allows you to forecast sales growth, optimize your marketing spend, and plan for future investments with confidence. By using this template, you can gain a deeper understanding of your business’s financial position and make smarter, data-driven decisions that support growth and profitability. Whether you’re just starting out or already scaling, this template will help you take control of your financial future.

E-commerce financial models are essential tools that help business owners plan, analyze, and forecast their company’s financial performance. These models combine both historical and projected data to provide insights into different aspects of the business, such as revenue, costs, and profits. By understanding e-commerce financial modeling, you can make smarter decisions, avoid costly mistakes, and drive growth effectively.

Creating a financial model allows you to track the financial health of your business and ensures you’re making informed decisions based on solid data. As the e-commerce industry grows rapidly and becomes more competitive, having a reliable financial model becomes increasingly important for maintaining sustainability and scalability.

Overview of E-Commerce Financial Modeling

Financial modeling in e-commerce typically involves creating a detailed representation of your business’s revenues, costs, cash flows, and other financial metrics. At the core of it, a financial model for an e-commerce business is designed to simulate the financial performance of your online store based on various assumptions, historical data, and projections. These models not only track the past performance of the business but also predict future performance, helping business owners and investors evaluate the potential success of different strategies or investments.

The model encompasses multiple financial statements, such as income statements, cash flow projections, and balance sheets, alongside key performance indicators (KPIs). It can incorporate various metrics such as sales growth, customer acquisition cost, average order value, customer lifetime value, and many others, allowing you to make informed decisions about everything from pricing strategies to marketing campaigns.

In an e-commerce context, the financial model should include considerations for product pricing, shipping and fulfillment costs, marketing budgets, returns and refunds, and seasonality, which are all critical aspects that differ from traditional brick-and-mortar businesses. By focusing on these elements, e-commerce financial models provide a much more comprehensive and granular view of your business performance and potential.

What is an E-Commerce Financial Model?

An e-commerce financial model is a strategic tool that allows you to evaluate, forecast, and make data-driven decisions about your business’s financial health. It incorporates various components, including revenue projections, costs, operational expenses, and metrics to calculate profitability.

The model is based on assumptions and data about key business drivers such as sales growth rates, average order value, customer acquisition costs, marketing expenses, inventory management, and many others. By using these inputs, the model can help you predict cash flow, profitability, and other important financial outcomes.

Financial models can vary in complexity, from simple spreadsheets to more intricate models involving detailed revenue forecasts, customer segmentation, and risk assessments. Regardless of complexity, the model serves as a decision-making tool for business owners to make smarter choices about scaling, pricing, marketing, and investments.

For example, an e-commerce financial model may allow you to forecast your total revenue based on projected traffic and conversion rates. It may also help determine your break-even point by factoring in costs such as product acquisition, fulfillment, and advertising spend.

Importance of Using a Financial Model for E-Commerce Businesses

Utilizing a financial model for your e-commerce business is more than just a way to track performance—it’s an essential tool for growth, risk management, and long-term sustainability. Here are a few reasons why having a financial model is crucial:

- Facilitates data-driven decision-making: It enables business owners to make decisions based on data and projections rather than guesswork.

- Helps plan for scalability: Financial models allow e-commerce businesses to predict the resources needed to scale up, whether through increased marketing efforts, hiring more staff, or expanding product lines.

- Aids in investor relations: Investors look for transparency and reliability in the financial projections of a business. A well-built model provides a clear picture of the business’s financial future and growth potential.

- Identifies risks early: With a financial model, you can simulate various scenarios, allowing you to identify risks before they affect your business and adjust strategies accordingly.

- Improves cash flow management: Cash flow is often a significant challenge for growing e-commerce businesses. By modeling your business’s future cash flow, you can identify potential shortfalls and plan accordingly to maintain healthy liquidity.

- Enhances profitability: By modeling different aspects of your e-commerce business, such as product pricing, customer acquisition costs, and marketing expenses, you can maximize profitability by optimizing these variables.

A financial model gives you a more accurate understanding of your business’s current and future financial health, which enables you to make well-informed decisions that align with your business goals.

Key Benefits for Business Owners and Investors

For both e-commerce business owners and investors, having a financial model is invaluable. It offers transparency, insight, and foresight, allowing both parties to make decisions that align with the business’s objectives. Here are some key benefits:

- Helps identify profitable opportunities: A financial model helps you identify where your business is thriving and where you can capitalize on profitable opportunities.

- Improves financial forecasting: Business owners can better predict future sales, expenses, and cash flows, leading to smarter budgeting and more accurate forecasts.

- Reduces financial risk: By assessing different scenarios and stress-testing the model, you can mitigate risks and prepare for unexpected changes in the market or business environment.

- Attracts investment: Investors appreciate a solid financial model because it demonstrates the company’s potential for success. It helps them evaluate the risk and return of their investment.

- Supports better business planning: It helps business owners map out strategic goals and align them with financial reality, whether it’s expanding the product range, increasing marketing spend, or expanding to new markets.

- Improves operational efficiency: With insights from the model, businesses can identify inefficiencies in areas like inventory management, fulfillment, or marketing spend, leading to improved cost management and increased profitability.

For investors, the model helps assess the business’s financial health and future potential, which is crucial when deciding whether to invest or how much funding to allocate.

The Role of Data and Metrics in the Model

Data and metrics are at the core of any e-commerce financial model. The accuracy and effectiveness of your model depend on how well you can collect, analyze, and incorporate data to drive financial assumptions and projections. Without relevant and reliable data, the model becomes a guessing game rather than a strategic tool.

Key metrics that should be integrated into your financial model include:

- Sales Growth Rate: Understanding how fast your business is growing is critical for future revenue projections. Historical sales data is key for forecasting.

- Customer Acquisition Cost (CAC): This metric helps you understand how much you are spending to acquire a new customer, and it is crucial for determining profitability.

- Average Order Value (AOV): AOV measures how much a customer spends on average per order and helps you predict revenue based on traffic and conversion rates.

- Conversion Rate: This tells you what percentage of visitors are making a purchase, helping you estimate the effectiveness of your website or marketing campaigns.

- Customer Lifetime Value (CLTV): CLTV measures the total value a customer will bring over the entire duration of their relationship with your business, allowing you to understand long-term profitability.

By integrating these and other relevant metrics, you create a more comprehensive and accurate financial model. The more precise your data, the more realistic your projections will be, allowing you to plan with confidence. Whether you’re forecasting sales, expenses, or profits, using solid data and well-defined metrics enables you to create a model that reflects the true potential of your business and guides better decision-making.

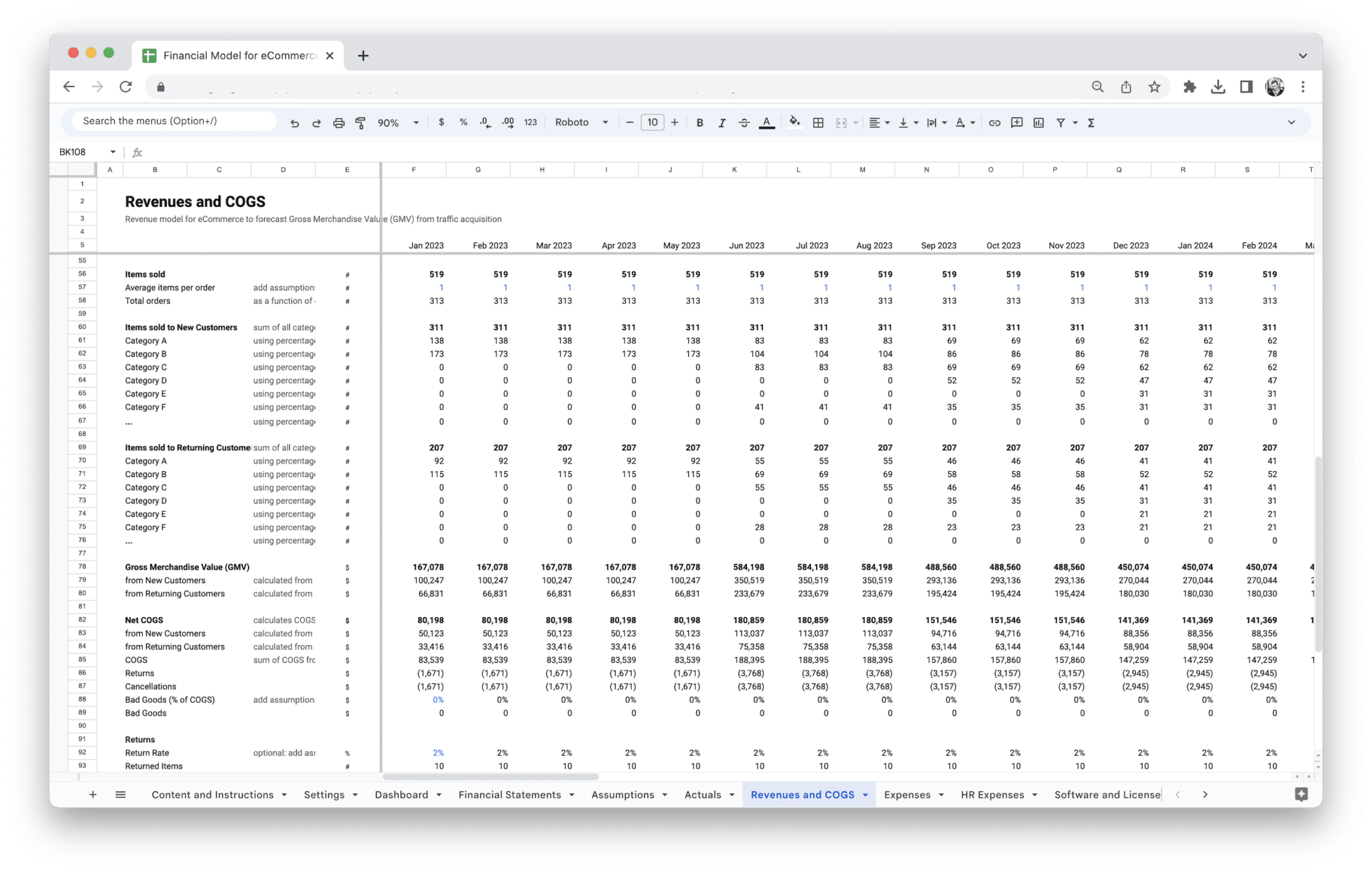

An e-commerce financial model consists of various components that provide a complete picture of your business’s financial health. These components track how money flows into your business, how it’s spent, and how to gauge profitability. Understanding these elements and how they interconnect will allow you to manage finances efficiently and make informed decisions that drive growth.

Revenue Streams (Sales, Subscriptions, etc.)

Revenue is the lifeblood of your e-commerce business. It’s essential to accurately capture and forecast every source of income in your financial model. E-commerce businesses can have multiple revenue streams, each of which needs to be tracked separately for a holistic view of financial performance.

The most straightforward revenue stream is sales revenue, which includes the money you earn from selling products or services. However, it’s important to track different types of sales revenue:

- One-time Sales: These are sales where the customer buys a product outright with no expectation of future purchases. For example, buying a pair of shoes or a piece of furniture.

- Recurring Revenue: If you have a subscription model, you’ll want to account for recurring revenue, such as monthly or yearly payments for access to your products or services.

- Affiliate Revenue: If you earn money from affiliate marketing (selling other companies’ products), this should also be included. You typically earn a commission for every product sold through your referral link.

- Ad Revenue: Some e-commerce businesses also earn revenue through placing ads on their website or app, especially if they have high traffic.

The model should help you project not just current revenue but future revenue too. This will enable you to set realistic goals and track progress. For example, forecasting how sales might grow as you expand your customer base or introduce new products is a crucial part of your financial planning.

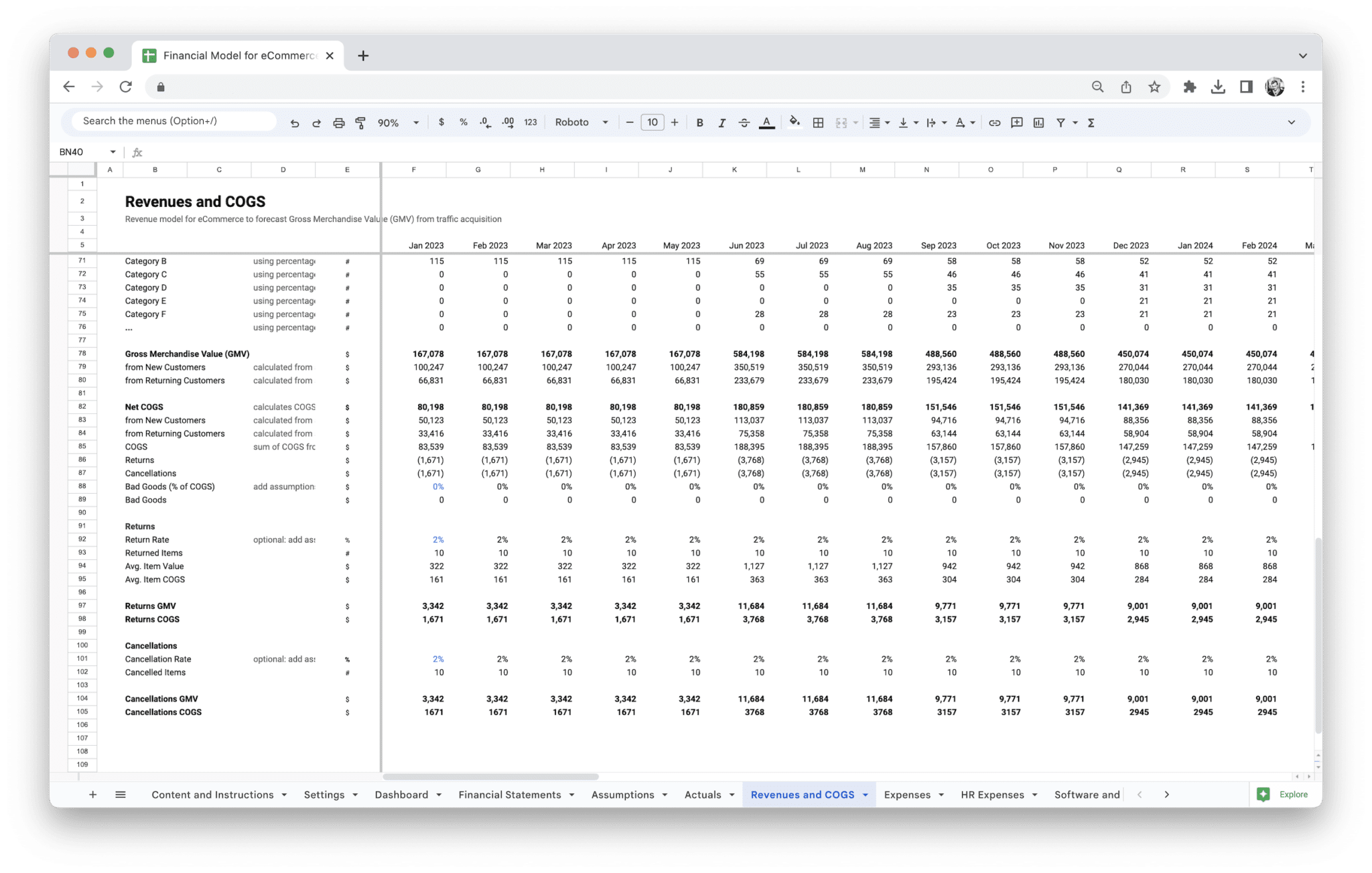

Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) refers to the direct costs of producing or acquiring the products you sell. Unlike operating expenses, which cover broader business costs like salaries or rent, COGS specifically deals with the production or purchase of the goods that generate revenue.

Accurate COGS calculations are critical because they impact your gross profit margin and directly influence pricing decisions. Inaccurately estimating COGS can lead to pricing that doesn’t cover expenses or erodes profit margins. Here are the key elements included in COGS:

- Product Costs: This includes the wholesale cost of the products you sell or the cost of raw materials if you’re manufacturing your own products.

- Shipping and Freight Costs: The cost of transporting products from suppliers to your warehouse, or from your warehouse to customers, should be accounted for as part of COGS.

- Manufacturing Costs: For businesses that produce their own goods, all production costs, including labor and factory overhead, are included here.

- Packaging Costs: Whether you’re buying pre-packaged goods or designing custom packaging for your products, packaging is a crucial part of the cost of selling.

Accurately tracking COGS not only helps with setting prices but also gives you a clearer picture of your profitability. A simple example is comparing COGS to sales revenue to see how much money you’re actually making per product after expenses.

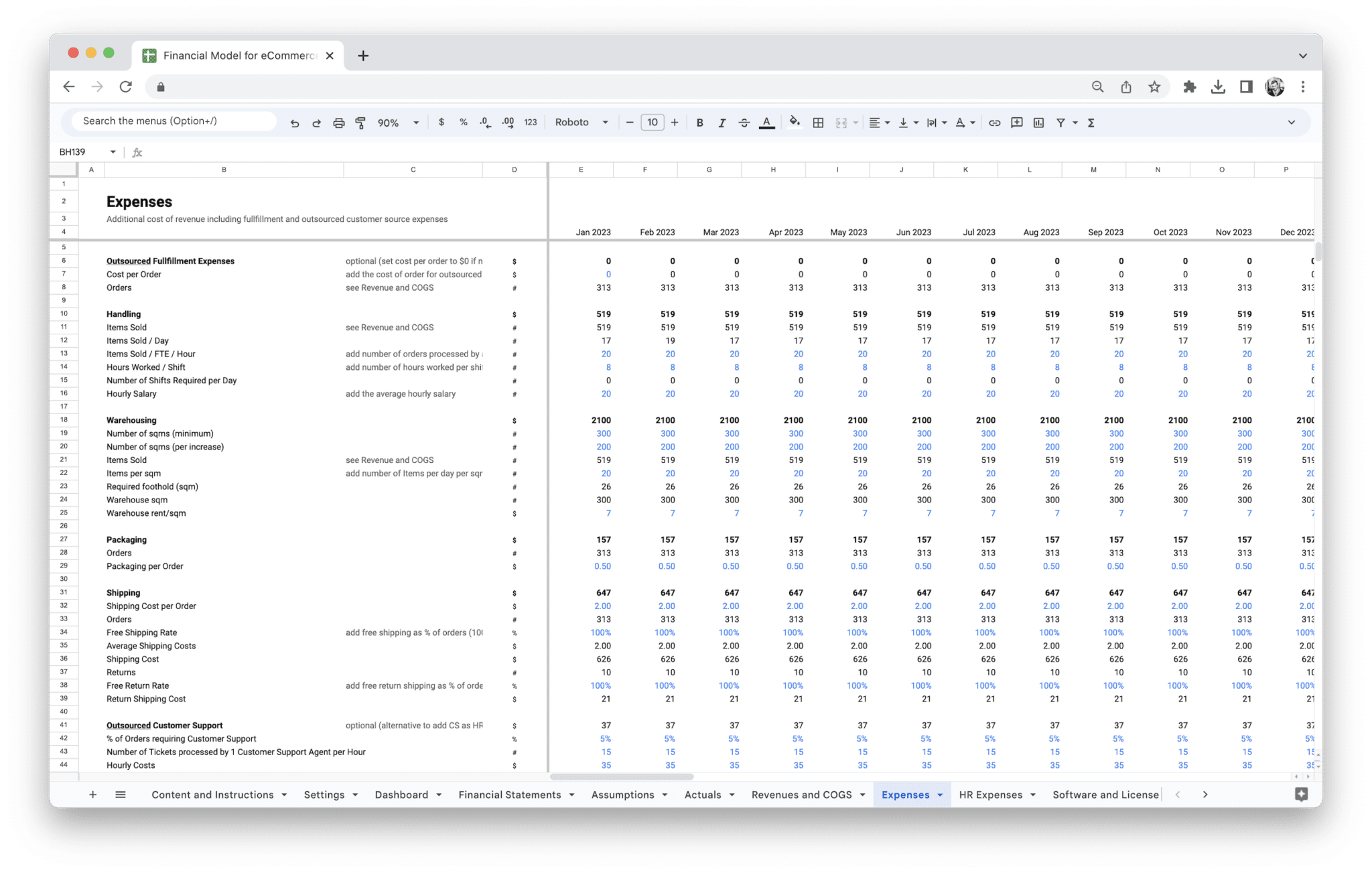

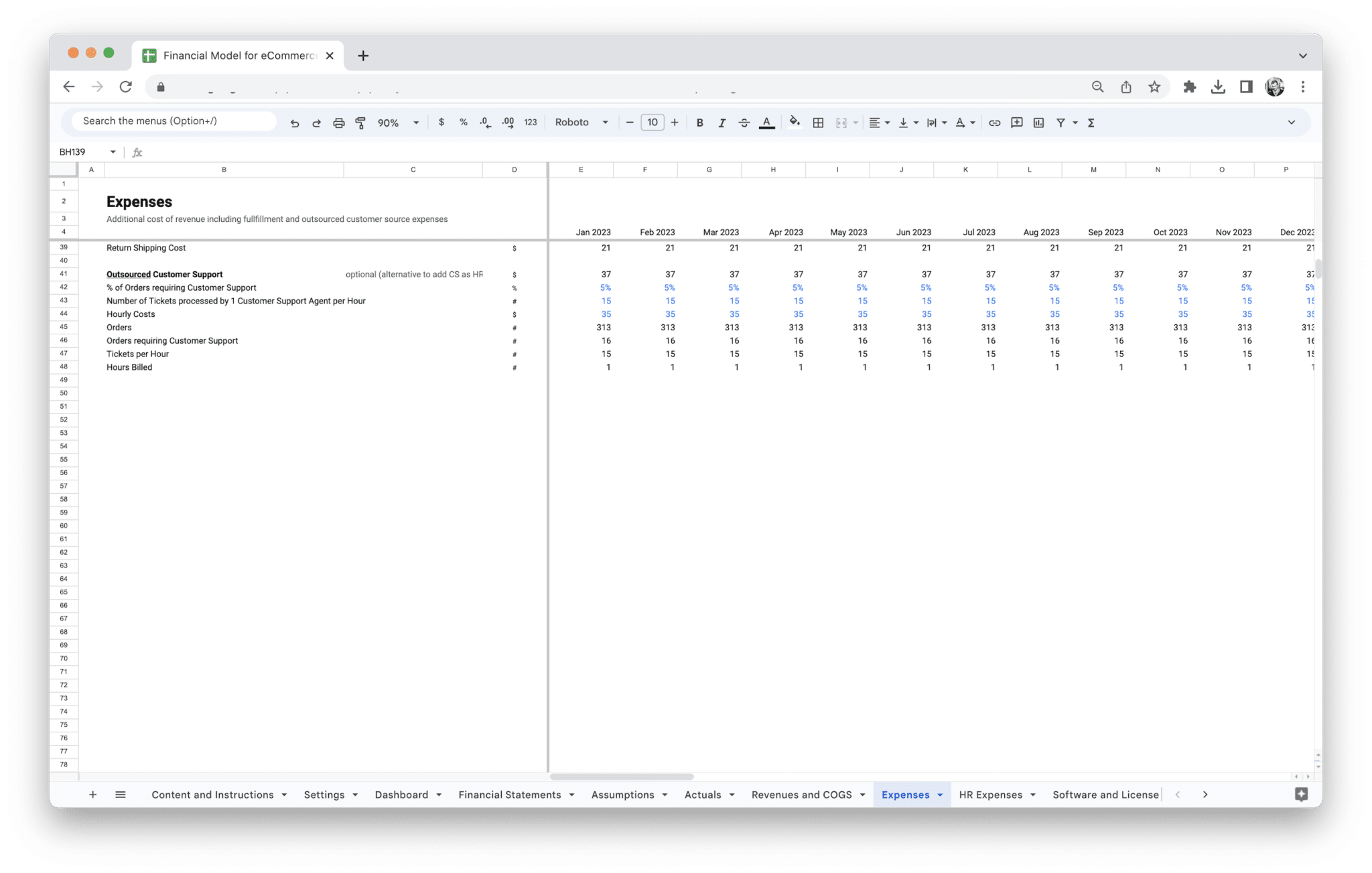

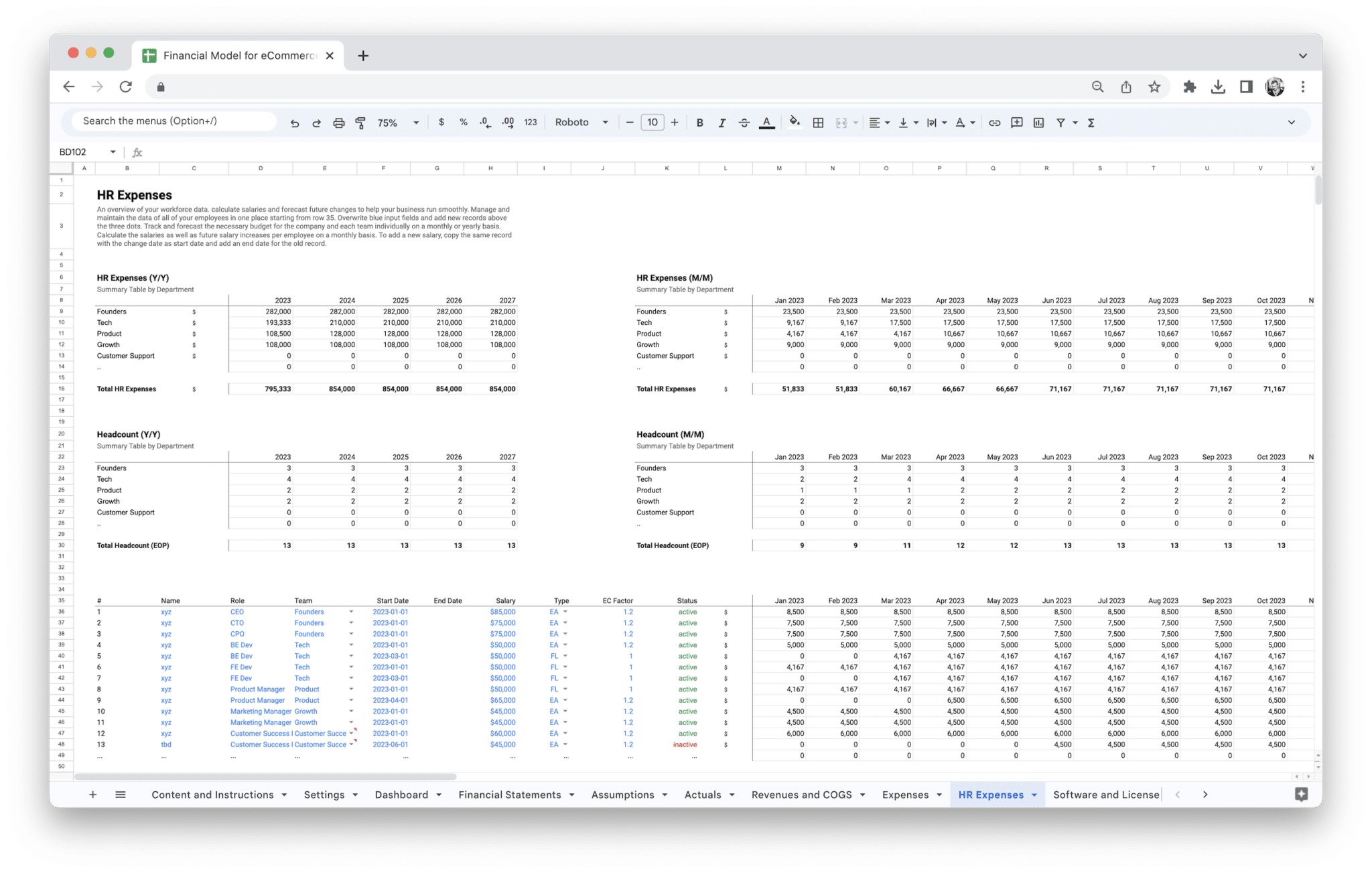

Operating Expenses (Marketing, Salaries, etc.)

Operating expenses are the ongoing costs you incur to run your business on a day-to-day basis. These expenses are not directly tied to producing the product but are necessary to support your business’s operations. Operating expenses can vary greatly depending on the size and nature of your business, but they typically include:

- Marketing and Advertising: This is one of the largest expense categories for e-commerce businesses. It includes online advertising (Google Ads, Facebook Ads, Instagram promotions), influencer marketing, content creation, and other promotional activities aimed at attracting and retaining customers.

- Employee Salaries and Wages: Paying your staff is a critical part of your operating expenses. This includes not just base salaries, but also benefits, bonuses, and other compensation-related costs.

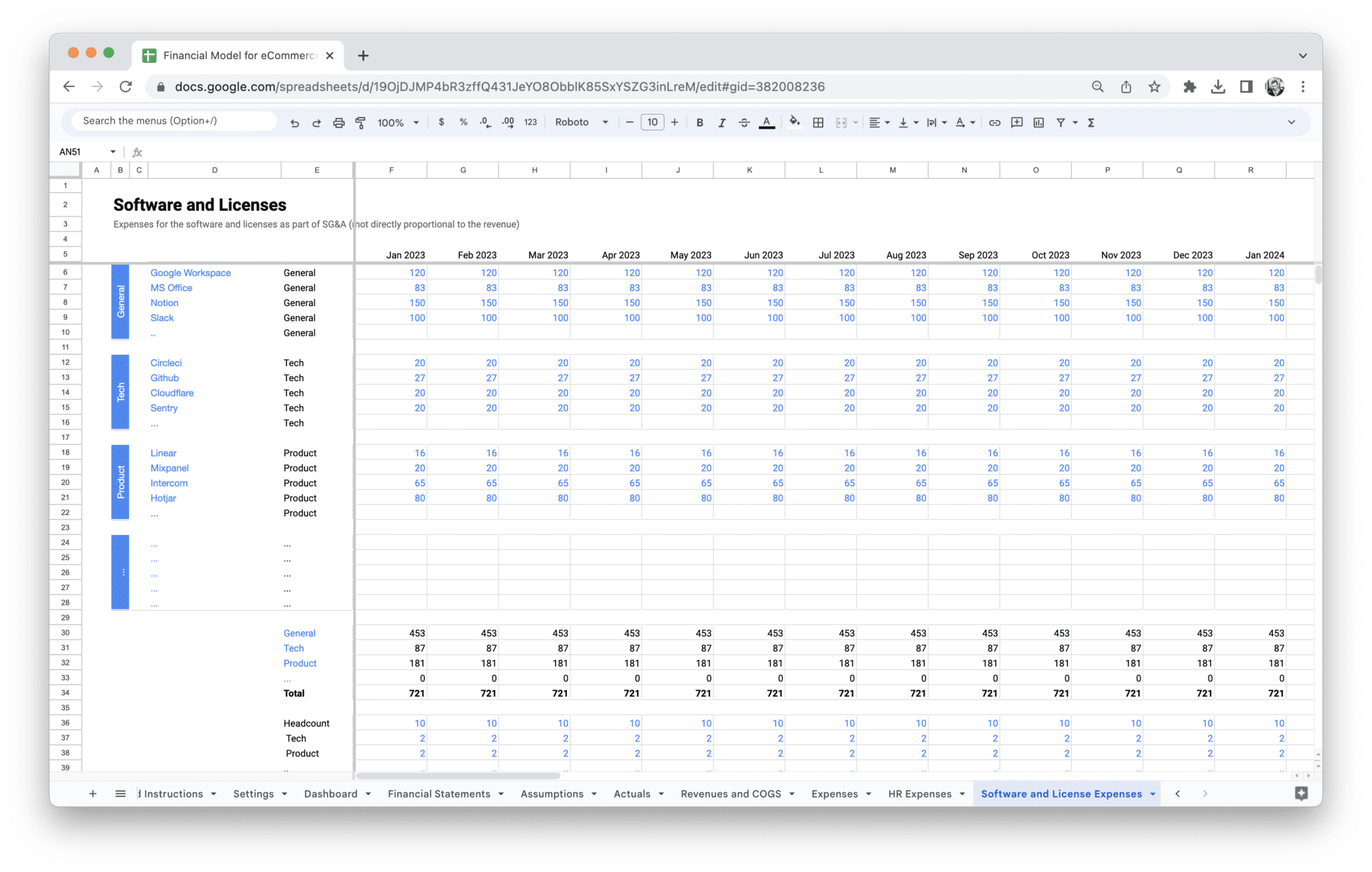

- Software and Tools: Most e-commerce businesses rely on a suite of software tools for everything from inventory management to customer relationship management (CRM) and email marketing. These subscription fees are part of your operating expenses.

- Rent and Utilities: If you operate from a physical location (such as a warehouse, office, or retail store), rent and utilities (electricity, internet, etc.) are included here.

- Customer Service Costs: Any expenses associated with providing customer support, including salaries for support staff or tools to manage customer queries, are considered operating expenses.

- Legal and Accounting Fees: Costs related to legal services or hiring accountants to handle taxes and financial reporting also fall into this category.

By tracking operating expenses, you can identify areas where you may be overspending and explore opportunities to streamline operations or reduce costs without sacrificing quality or service. Regularly reviewing operating expenses helps ensure your margins remain healthy and allows you to make adjustments as needed.

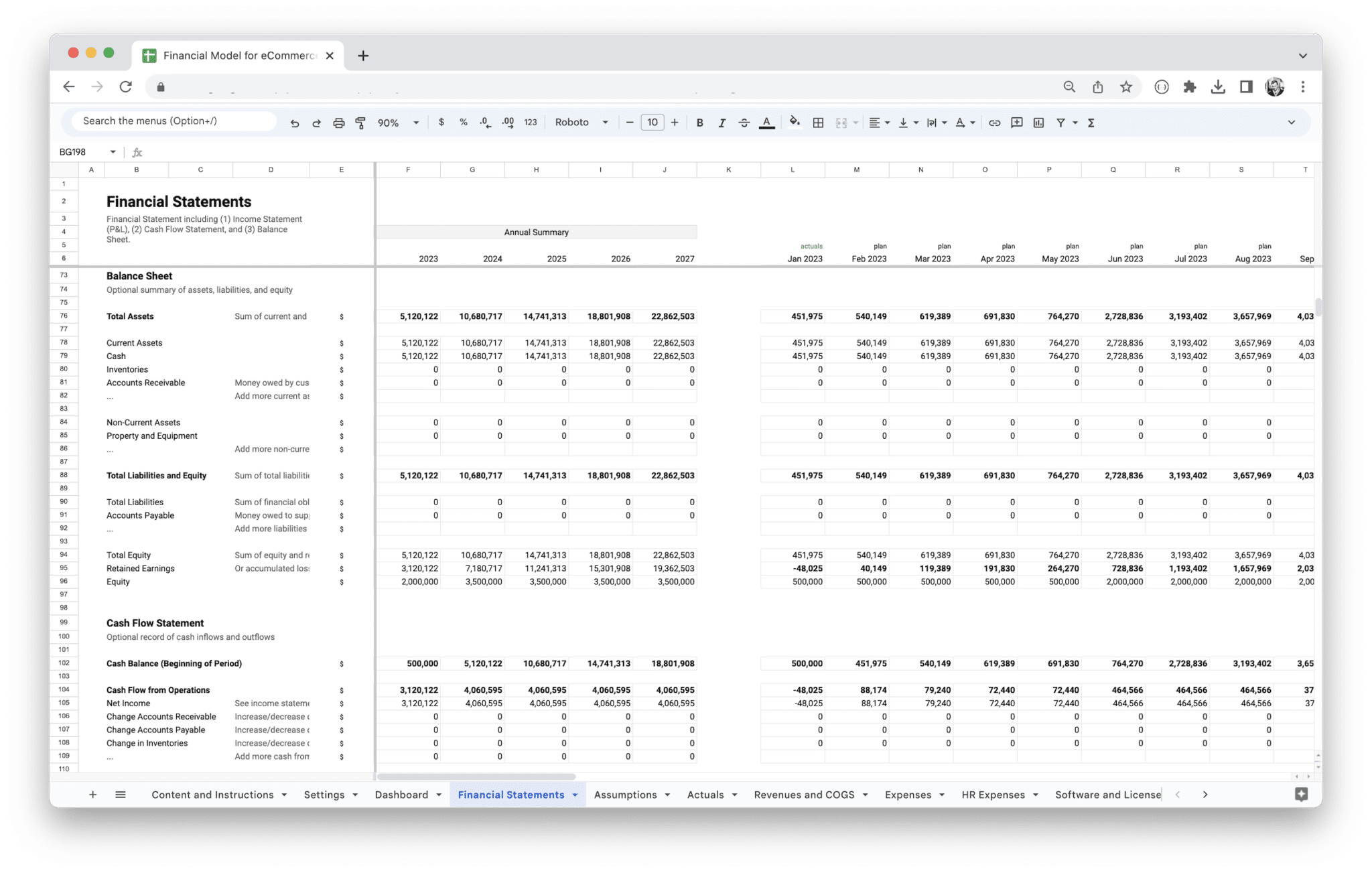

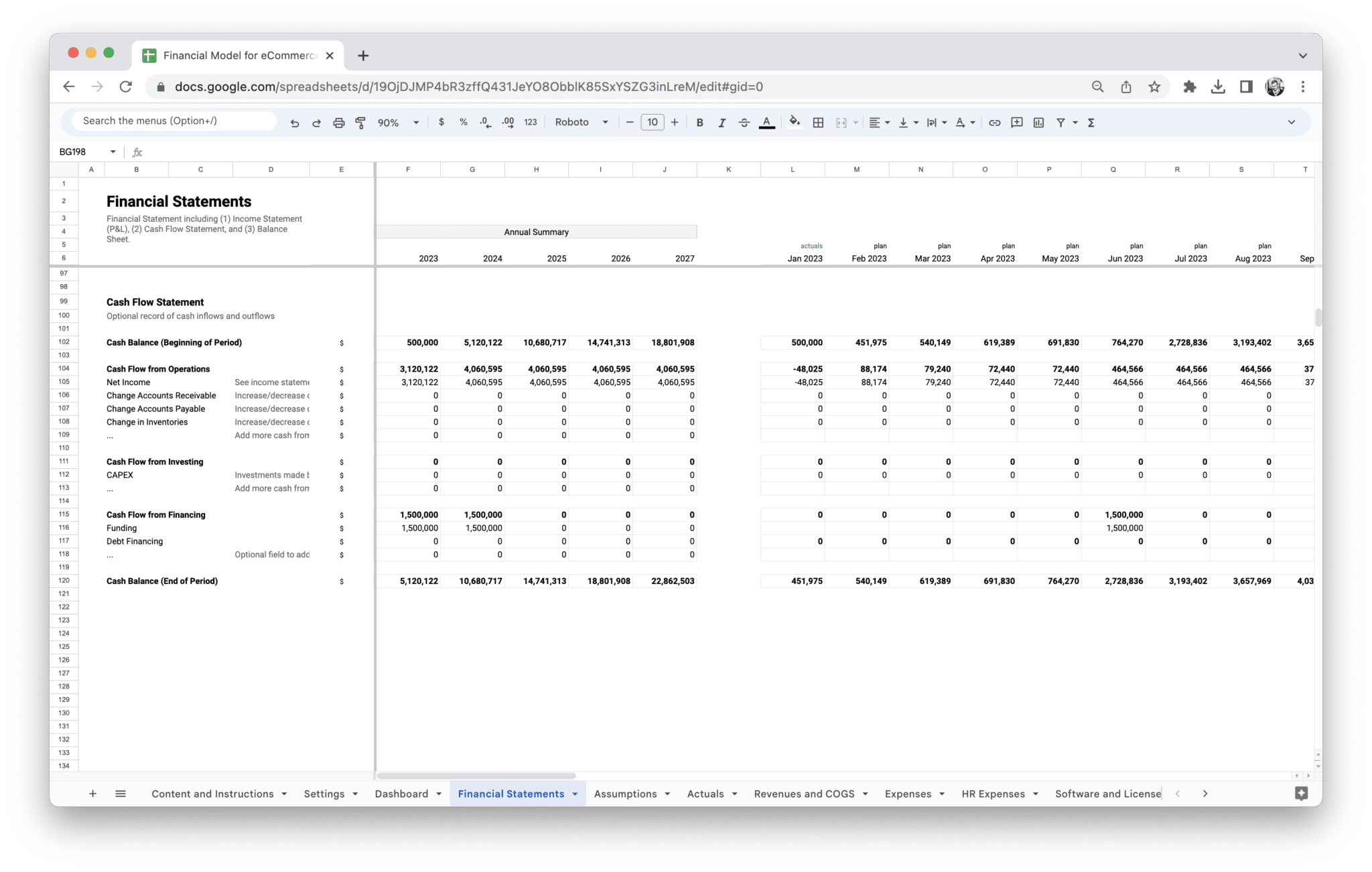

Cash Flow Projections

Cash flow projections are one of the most critical elements of any financial model. Cash flow refers to the movement of money into and out of your business over a set period. Unlike profit, which accounts for income minus expenses, cash flow focuses on the actual cash available in your bank account to meet immediate business needs.

Understanding your cash flow is essential for several reasons:

- Liquidity Management: Positive cash flow ensures you have enough cash to pay employees, suppliers, and other operational expenses without needing to rely on credit or loans.

- Planning for Growth: Accurate cash flow projections allow you to plan for expansion, marketing campaigns, inventory purchases, or other investments that require a steady stream of cash.

- Debt Management: For businesses that have taken out loans or lines of credit, cash flow helps you determine how easily you can meet your repayment obligations.

Cash flow projections should take into account seasonal fluctuations, especially for e-commerce businesses where demand can vary throughout the year. A business might experience higher cash inflows during peak shopping periods (e.g., the holiday season) and lower inflows during off-peak months. You need to plan for these fluctuations to ensure there’s always enough liquidity to cover operational needs.

Profit & Loss Statement

The Profit & Loss (P&L) statement, also known as an income statement, is a summary of your revenue, costs, and expenses during a specific period. It provides a clear picture of whether your business is profitable or operating at a loss.

The P&L statement is essential because it gives insight into:

- Revenue vs. Expenses: You’ll see at a glance whether your business is generating more income than it’s spending.

- Gross Profit: By subtracting COGS from total revenue, you get your gross profit. This figure gives you an idea of how efficient your operations are in terms of product pricing and production costs.

- Operating Profit: After deducting operating expenses from gross profit, you get the operating profit. This tells you how well your business is performing without considering taxes and interest payments.

- Net Profit: The final line on your P&L statement shows the net profit or loss after all expenses have been subtracted from revenue. This is your ultimate measure of profitability.

Having a detailed P&L statement allows you to assess the overall financial health of your business, spot trends, and identify areas for improvement.

Balance Sheet

The balance sheet provides a snapshot of your business’s financial position at a given moment in time. It lists your business’s assets, liabilities, and equity, which together show your company’s net worth.

A balance sheet is divided into two parts:

- Assets: These are things your business owns and can use to generate income, such as cash, inventory, equipment, and property.

- Liabilities: These are what your business owes, including loans, credit lines, unpaid bills, and any other financial obligations.

- Equity: This represents the residual value of the business after subtracting liabilities from assets. It’s the ownership value in your business.

The balance sheet is particularly useful when evaluating the overall financial health of your e-commerce business. It helps you assess your liquidity (how easily you can access cash), solvency (how able you are to meet long-term obligations), and leverage (how much debt your business carries compared to its equity).

Together, these components—revenue streams, COGS, operating expenses, cash flow projections, the P&L statement, and the balance sheet—form the backbone of your e-commerce financial model. By keeping a close eye on each of these areas, you can ensure your business is financially healthy, prepared for growth, and able to make informed decisions.

To make informed decisions about your e-commerce business, you need more than just financial statements and projections. You need to focus on key metrics that provide actionable insights into how well your business is performing and where improvements can be made. These metrics not only help you measure growth but also guide strategic decisions about pricing, marketing, customer acquisition, and retention. Here are the most important metrics to track in your e-commerce financial model.

Average Order Value (AOV)

Average Order Value (AOV) is one of the most important metrics for e-commerce businesses. It gives you an idea of how much revenue you are generating on average per order. This metric is key because it directly impacts your overall sales and profitability. Higher AOV means you are making more revenue with the same number of customers, which can be more cost-effective than trying to acquire new customers to increase revenue.

How to Calculate AOV?

To calculate your AOV, divide your total revenue by the number of orders you received in a specific time period, such as a month or quarter. The formula looks like this:

AOV = Total Revenue / Number of Orders

For example, if your business generates $10,000 in revenue from 200 orders in a month, your AOV would be:

AOV = $10,000 / 200 = $50

This means, on average, each customer spends $50 per order.

Why AOV Matters?

A higher AOV can dramatically improve profitability without needing to increase customer acquisition costs. By increasing AOV, you can achieve more with less. If you increase your AOV by just 10%, you could see a significant increase in your overall revenue without needing to spend more on marketing or increase your customer base.

Some strategies to increase AOV include:

- Upselling and Cross-Selling: Suggesting related products or higher-end items at checkout.

- Bundling: Offering product bundles at a slightly discounted rate.

- Minimum Purchase Discounts: Offering free shipping or discounts on purchases over a certain amount.

Tracking AOV helps you understand how well your business is doing in terms of maximizing each transaction, which can be a crucial driver of profitability.

Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is the metric that tells you how much you need to spend to acquire a single customer. This includes all the costs associated with your marketing and sales efforts, such as ad spend, content marketing, and sales team compensation. Understanding your CAC is essential for evaluating the efficiency of your marketing efforts and ensuring that your customer acquisition strategies are sustainable.

How to Calculate CAC?

To calculate CAC, you need to add up all of your marketing and sales expenses for a given period and then divide that number by the total number of new customers acquired during that period. Here’s the formula:

CAC = Total Marketing and Sales Expenses / Number of New Customers Acquired

For example, if you spent $5,000 on marketing and sales in a month and acquired 100 new customers, your CAC would be:

CAC = $5,000 / 100 = $50

This means you spent $50 to acquire each new customer.

Why CAC Matters?

Tracking CAC is crucial because it tells you whether your marketing efforts are cost-effective. If your CAC is too high relative to your customer’s lifetime value, you may be spending too much to acquire new customers, which could lead to unsustainable business practices. Ideally, you want your CAC to be low enough so that you can generate long-term profits from each customer.

Lowering CAC can be achieved through strategies such as:

- Optimizing Marketing Channels: Focus on the marketing channels that provide the highest return on investment (ROI), such as SEO or organic social media.

- Improving Conversion Rates: If more of your visitors are converting into customers, you can reduce CAC by improving your site’s user experience.

- Referrals and Word of Mouth: Encouraging existing customers to refer others can reduce CAC by relying on free or low-cost marketing channels.

Tracking this metric helps ensure that your customer acquisition strategy is not only effective but also scalable as your business grows.

Customer Lifetime Value (CLTV)

Customer Lifetime Value (CLTV) is a prediction of the total revenue you expect to generate from a customer over the entire duration of their relationship with your business. CLTV is one of the most important metrics for understanding the long-term profitability of your customers and whether your business is sustainable. When CLTV is greater than CAC, you know your business is in a good financial position, as you are generating more revenue from each customer than it costs to acquire them.

How to Calculate CLTV?

To calculate CLTV, you need three key pieces of information:

- Average Order Value (AOV): How much a customer spends per order.

- Purchase Frequency: How often a customer makes a purchase in a given time period (typically monthly or annually).

- Customer Lifespan: The average duration of time a customer continues buying from your store.

The formula for CLTV is:

CLTV = AOV x Purchase Frequency x Customer Lifespan

For example, if your AOV is $50, the average customer makes a purchase every three months (4 times a year), and they remain a customer for 3 years, your CLTV would be:

CLTV = $50 x 4 x 3 = $600

This means, on average, each customer will generate $600 in revenue over the span of their relationship with your business.

Why CLTV Matters?

CLTV gives you insight into the long-term value of your customers and helps you determine how much you should spend on acquiring new customers (i.e., your CAC). If your CLTV is high, it means that you have a solid base of loyal customers who will continue generating revenue over time. In contrast, if your CLTV is low, you may need to focus on improving customer retention and increasing repeat purchases.

By tracking CLTV, you can better understand customer retention patterns, evaluate the effectiveness of loyalty programs, and create more personalized marketing strategies that encourage repeat business.

Conversion Rate

Conversion rate is the percentage of visitors to your website who take a desired action, such as making a purchase, signing up for a newsletter, or completing a contact form. In e-commerce, the primary conversion rate to track is the percentage of visitors who convert into paying customers. Improving conversion rates can have a significant impact on your overall revenue without having to increase traffic to your website.

How to Calculate Conversion Rate?

To calculate your conversion rate, divide the number of conversions (i.e., sales) by the total number of visitors to your site, and then multiply that number by 100 to get a percentage. The formula looks like this:

Conversion Rate = (Number of Conversions / Number of Visitors) x 100

For example, if your website had 5,000 visitors in a month and 100 of them made a purchase, your conversion rate would be:

Conversion Rate = (100 / 5,000) x 100 = 2%

This means 2% of your website visitors made a purchase.

Why Conversion Rate Matters?

Conversion rate is a powerful indicator of how effective your website is at turning visitors into customers. If your conversion rate is low, it could be a sign that your website is not effectively guiding visitors through the sales funnel. Potential reasons for low conversion rates include:

- Poor User Experience: Slow loading times, confusing navigation, or unoptimized checkout processes can cause visitors to leave before making a purchase.

- Unattractive Product Pages: Lack of high-quality images, insufficient product information, or unclear pricing can deter customers.

- Lack of Trust Signals: If your website lacks security badges, reviews, or testimonials, customers may be hesitant to purchase.

Improving conversion rate can involve testing different strategies, such as simplifying the checkout process, using persuasive copy, adding product reviews, or offering limited-time discounts.

Return on Investment (ROI)

Return on Investment (ROI) is the metric that measures the profitability of an investment, relative to its cost. For e-commerce businesses, ROI helps assess the effectiveness of various investments, from marketing campaigns to technology upgrades and new product development. A high ROI means that the returns from an investment are greater than the cost, making it a worthwhile expense.

How to Calculate ROI?

To calculate ROI, subtract the initial cost of the investment from the return it generated, then divide that number by the initial cost of the investment. Finally, multiply by 100 to get a percentage. Here’s the formula:

ROI = [(Return – Investment Cost) / Investment Cost] x 100

For example, if you spent $1,000 on a Facebook ad campaign and generated $5,000 in sales from that campaign, your ROI would be:

ROI = [($5,000 – $1,000) / $1,000] x 100 = 400%

This means you earned 4 times the amount you spent on the campaign.

Why ROI Matters?

Tracking ROI allows you to determine which marketing and operational investments are delivering value. By focusing on investments with a high ROI, you can allocate your budget more effectively and make decisions that directly contribute to growth.

For example, if a particular advertising channel provides a 500% ROI and another provides only 50%, you can allocate more budget to the high-performing channel, maximizing profitability.

Tracking these key metrics—AOV, CAC, CLTV, conversion rate, and ROI—will give you deep insights into your e-commerce business’s financial performance. Each metric serves a different purpose, but together, they provide a comprehensive picture of your business’s profitability, growth potential, and efficiency. By regularly monitoring and optimizing these metrics, you’ll be able to make data-driven decisions that lead to sustained business success.

Creating a solid e-commerce financial model can seem like a daunting task, but it’s a crucial step in understanding and managing your business’s financial health. Whether you’re a small business owner or an established e-commerce brand, having a clear, structured model will help you make data-driven decisions, manage cash flow, and plan for future growth. The good news is that building your own e-commerce financial model isn’t as complex as it seems. With the right approach, you can create a useful model that supports your business goals.

How to Create the Financial Model?

Building an e-commerce financial model is a process that involves several steps, each crucial for laying a strong foundation. The goal is to create a model that reflects your business’s operations, expenses, revenues, and projections.

1. Define Your Assumptions

The first step in building your e-commerce financial model is to clearly define your business assumptions. These assumptions act as the foundation for all your calculations. To set realistic assumptions, you need to understand both the macroeconomic environment and your specific business context. Some of the key assumptions you should consider include:

- Sales Growth Rate: Estimate how much you expect your sales to grow over a defined period (usually monthly or annually). If you’re just starting, this can be based on similar businesses or early-stage data.

- Conversion Rate: This is the percentage of website visitors who make a purchase. The average e-commerce conversion rate varies widely, but setting a realistic figure based on industry benchmarks is crucial for accurate forecasting.

- Customer Retention: If you have returning customers, estimate how often they will make repeat purchases. A strong retention rate leads to higher lifetime value and can impact long-term revenue projections.

- Average Order Value (AOV): This is the average amount a customer spends when they place an order. You’ll use this figure to estimate revenue based on the number of orders or transactions.

- Operating Expenses: Estimate the costs for marketing, technology, payroll, and other operational activities.

2. Gather Financial Data

To make your model as accurate as possible, you need to gather all relevant data. Start by collecting historical sales data, if available, and any other data points that are relevant to your business operations. Key information might include:

- Revenue from past months or years

- The cost of goods sold (COGS)

- Operating expenses such as salaries, software subscriptions, and advertising costs

- Tax rates or other statutory costs that could impact profitability

If you’re a new business without historical data, you’ll need to base your projections on industry averages, competitor insights, and any available market research. Don’t worry if your data isn’t perfect—it’s better to have an educated guess than to proceed without a model at all.

3. Set Up Your Financial Statements

Your financial model will consist of several key financial statements. The most important are the income statement (Profit & Loss), the balance sheet, and the cash flow statement. Each of these should be laid out in your model in a clear, structured way.

- Income Statement: This will show your revenue, costs, and expenses over a specific period. It will help you determine your net profit or loss and offer insight into your overall profitability.

- Balance Sheet: This statement reflects your company’s assets, liabilities, and equity. It provides a snapshot of your financial position and helps you understand whether your business is in a strong position to handle short-term and long-term obligations.

- Cash Flow Statement: The cash flow statement tracks the movement of money in and out of your business. It ensures that you have enough cash on hand to cover expenses, pay employees, and fund growth.

Using these three statements in tandem helps you understand different aspects of your business. The income statement shows profitability, the balance sheet provides a snapshot of your financial health, and the cash flow statement helps you understand liquidity.

4. Develop Your Revenue Model

Your revenue model is at the heart of your financial model. To estimate how much revenue your business will generate, break down your revenue into different streams. Common revenue streams for e-commerce businesses include:

- Direct Sales: Revenue generated from the sale of products on your website.

- Subscriptions or Memberships: If you run a subscription-based business model, include estimates of how much recurring revenue you expect.

- Affiliate Revenue: If you’re earning money through affiliate links or partnerships, factor this into your revenue model.

- Ad Revenue: Some e-commerce businesses earn money by displaying ads on their platform or website.

Once you’ve identified all your revenue streams, estimate how each one will contribute to your overall revenue. This involves forecasting how much each stream will grow over time, based on your sales growth assumptions and any data you’ve gathered.

5. Estimate Costs and Expenses

Understanding your costs is critical for determining profitability. There are two types of costs you need to account for: fixed costs and variable costs.

- Fixed Costs are expenses that stay the same regardless of your sales volume. These could include salaries, office rent, software subscriptions, and insurance.

- Variable Costs change depending on the level of sales or production. For example, the more products you sell, the higher your shipping costs, product manufacturing, or packaging costs will be.

Make sure to include both types of costs in your model, as this will give you a comprehensive understanding of your business expenses. Additionally, you should factor in taxes and any other regulatory costs that may apply to your business.

6. Project Cash Flow

Cash flow projections help ensure that your business can meet its financial obligations and plan for future expenses. Start by estimating how much money will come in (from sales, subscriptions, or other revenue streams) and how much will go out (for operational costs, taxes, and loan payments).

Look at factors such as:

- Timing of Payments: When do you expect to receive payment from customers (e.g., immediately after a purchase or on a recurring monthly basis)?

- Expenses Timing: When will you need to pay your suppliers, employees, or contractors?

Being able to anticipate when cash will flow in and out of your business will help you avoid liquidity problems and prepare for potential shortfalls.

7. Run Different Scenarios

Once you’ve completed your basic financial model, it’s time to test it with different scenarios. These can include:

- Best-case scenario: What happens if sales exceed expectations, customer retention is higher than predicted, or costs are lower than expected?

- Worst-case scenario: What happens if sales fall flat, costs increase, or market conditions worsen?

- Moderate scenario: This scenario reflects a more balanced, realistic view of how your business will perform.

Running multiple scenarios helps you understand the potential risks and rewards of your business and allows you to make adjustments as necessary.

Basic Formulas and Calculations

Financial models rely heavily on formulas to turn assumptions and data into actionable insights. Let’s break down some of the essential formulas that are commonly used in e-commerce financial models.

Revenue Formulas

- Total Revenue: This is simply the total amount of money you earn from sales or subscriptions.

Formula:Total Revenue = Number of Units Sold x Price Per Unit - Average Order Value (AOV): AOV helps you understand how much a typical customer spends per transaction.

Formula:AOV = Total Revenue / Number of Orders - Customer Lifetime Value (CLTV): CLTV estimates how much revenue a customer will generate over their entire relationship with your business.

Formula:CLTV = Average Order Value x Purchase Frequency x Customer Lifespan

Profitability Formulas

- Gross Profit: Gross profit is the money left after you subtract the cost of producing your goods from your revenue.

Formula:Gross Profit = Total Revenue - Cost of Goods Sold - Net Profit: Net profit shows what’s left after you subtract all your operating expenses from gross profit.

Formula:Net Profit = Gross Profit - Operating Expenses - Operating Profit: Operating profit helps you understand how much money you’re making from core operations (excluding taxes and interest).

Formula:Operating Profit = Gross Profit - Operating Expenses

Cost Formulas

- Cost of Goods Sold (COGS): COGS includes all the direct costs related to producing and selling your products.

Formula:COGS = Opening Inventory + Purchases During the Period - Closing Inventory - Customer Acquisition Cost (CAC): CAC tells you how much you need to spend on marketing and sales to acquire one customer.

Formula:CAC = Total Marketing Spend / Number of New Customers Acquired

Cash Flow Formulas

- Net Cash Flow: This is the overall cash movement in and out of your business.

Formula:Net Cash Flow = Cash Inflows - Cash Outflows

These formulas are the building blocks of your e-commerce financial model. They allow you to turn raw data into meaningful insights that will guide decision-making and help you forecast future financial performance with accuracy.

By following this process and using these formulas, you’ll be able to build a financial model that serves as a valuable tool for managing your e-commerce business and guiding your growth.

Once you’ve built and customized your e-commerce financial model, the next step is to leverage it for strategic decision-making. A financial model isn’t just a static document; it’s a dynamic tool that helps you make informed choices about your operations, growth strategies, and long-term vision. To get the most value from your financial model, it’s essential to use it actively and consistently in decision-making across different aspects of your business.

- Strategic Planning and Goal Setting: Your financial model should serve as the foundation for setting realistic business goals. By analyzing your projections for revenue, costs, and profit, you can set achievable targets for growth and profitability. Use the model to define clear, measurable goals and track progress against them over time.

- Budgeting and Resource Allocation: One of the primary uses of your financial model is for budgeting. It helps you determine where to allocate resources efficiently, whether it’s investing in marketing, hiring new staff, or purchasing inventory. The model provides a clear picture of your cash flow and profit margins, ensuring that you make data-driven decisions about where to spend and how much to invest in each area.

- Pricing Decisions: Pricing is a critical aspect of e-commerce business success. Your financial model can guide your pricing strategy by showing the relationship between price points, customer demand, and profitability. Use the model to test different pricing scenarios and understand how small changes in pricing can affect your bottom line. This is particularly important if you’re considering offering discounts, bundling products, or adjusting your pricing to remain competitive.

- Managing Cash Flow: Effective cash flow management is crucial for sustaining your business in the long term. Use your financial model to monitor cash inflows and outflows. By forecasting future cash flow, you can anticipate any liquidity issues and make adjustments to avoid running into cash shortages. You can also use the model to decide when to invest in growth opportunities or when to tighten spending.

- Identifying Operational Improvements: Your financial model can help you spot inefficiencies in your operations. For instance, if your gross margins are shrinking, it might be an indication that production costs or supply chain expenses need to be re-examined. Use the insights from your model to identify areas where you can streamline operations, cut costs, or optimize resources to improve profitability.

- Evaluating Investment Opportunities: When you consider new investments—whether it’s new product lines, marketing strategies, or geographic expansion—your financial model should be used to assess the potential return on investment (ROI). It allows you to project how an investment will affect your revenue, costs, and profitability over time, helping you make informed decisions about where to invest for the greatest impact.

- Risk Management: Every business faces risks, and e-commerce is no exception. Whether it’s market volatility, changing consumer trends, or unexpected operational disruptions, your financial model can help you manage risk by running sensitivity analyses. By modeling different scenarios, you can understand the potential impact of various risks and develop strategies to mitigate them.

- Investor and Stakeholder Communication: If you’re seeking funding or need to communicate your business’s financial health to investors or stakeholders, your financial model provides the key data they need to make decisions. It offers a comprehensive look at your business’s financial position, future projections, and growth potential, helping to build trust and transparency.

- Performance Tracking and Adjustments: Use your financial model to track actual performance against your forecasts. This allows you to identify any variances and make necessary adjustments to stay on course. For example, if actual revenue is falling short of projections, you can adjust your marketing spend, rethink pricing strategies, or focus on improving conversion rates to meet your goals.

Your financial model should be a living, breathing document that evolves alongside your business. By using it to guide decisions, evaluate opportunities, and manage risks, you’ll be able to make smarter, more informed choices that drive long-term success for your e-commerce business.

When creating an e-commerce financial model, one size doesn’t fit all. Different industries, business sizes, and market conditions require unique approaches to forecasting, budgeting, and overall financial planning. By customizing your model to reflect the specific nuances of your business, you can gain deeper insights and make more informed decisions. Customization is key to ensuring that your financial model accurately represents your operations, growth potential, and risks, providing a solid foundation for scaling your e-commerce business.

Tailoring the Financial Model for Specific Industries

Every e-commerce business operates in a different environment, and the financial model needs to reflect the specific challenges and opportunities within your industry. Whether you are in fashion, electronics, health and wellness, or another niche, understanding the unique drivers of your industry is essential for accurate forecasting and budgeting.

Fashion and Apparel

For fashion and apparel e-commerce businesses, one of the most important factors to include in your financial model is inventory turnover. The fashion industry is known for its seasonality and rapidly changing trends, which means your model needs to incorporate frequent restocking, markdowns, and potential unsold inventory. Key variables to adjust for in a fashion-focused financial model include:

- Seasonal Demand: Fashion businesses experience peaks and valleys in demand throughout the year. For example, the holiday season might generate high sales, but post-holiday returns and discounts could create fluctuations in cash flow. Your financial model should account for higher sales in key months and reduced sales during off-peak times.

- Return Rates: In fashion, return rates can be significant, especially for items like clothing and accessories. On average, e-commerce fashion businesses see return rates anywhere from 20-30%. Your model should reflect these returns and their impact on revenue.

- Trend Sensitivity: Fashion relies heavily on trends, and staying ahead of the market can be a competitive advantage. However, unsold inventory from outdated collections can significantly reduce profit margins. Forecasting and planning for unsold inventory or discounting strategies is essential to managing profitability.

Electronics and Tech

Electronics and tech e-commerce businesses typically operate in a fast-paced, innovation-driven environment. A key customization in financial modeling for this industry would involve managing product lifecycle and technology obsolescence. For example:

- Product Launch Cycles: Tech products often have short life cycles, and new models or upgrades are released frequently. Your model should reflect the cost of development, manufacturing, and marketing of new products, as well as the potential for revenue generation over time. It’s important to forecast revenue spikes when new products are released.

- R&D Expenses: Tech businesses often spend a significant portion of their budget on research and development (R&D). Your financial model needs to account for these investments, as they are necessary to stay competitive, but they can delay profitability in the short term.

- Depreciation: Unlike other industries, electronics experience rapid depreciation. When developing your financial model, you’ll need to factor in how the depreciation of tech products impacts both inventory costs and pricing strategies.

Health & Wellness

For health and wellness businesses, especially those selling supplements or fitness products, the focus may shift to customer retention and regulatory compliance. Key considerations in a financial model for this industry include:

- Subscription Models: Many health and wellness brands operate on a subscription basis, such as monthly shipments of supplements or vitamins. Your model should incorporate the recurring revenue from subscriptions and the potential churn rate for these customers.

- Compliance Costs: Health-related products are heavily regulated, and the cost of compliance with FDA or other local regulations can be significant. Your financial model should account for ongoing compliance testing and certification expenses.

- Customer Loyalty: In a market driven by customer trust, repeat business is essential. Modeling for customer lifetime value (CLTV) is especially important, as repeat customers can significantly increase profitability. Factor in marketing costs to maintain customer loyalty, such as loyalty programs or special offers.

By customizing your financial model to reflect the specific characteristics and dynamics of your industry, you ensure that it accurately captures the nuances that drive financial performance. This helps you make better decisions regarding pricing, inventory, marketing, and resource allocation.

Adjusting for Different Business Sizes

Another key factor when building a financial model for e-commerce is adjusting it based on the size of your business. Whether you’re a small startup, a growing medium-sized business, or an established large enterprise, the scale of your operations will influence how you structure your financial model.

Startups

Startups often face different financial challenges compared to larger businesses, primarily because of limited resources and higher uncertainty. For a startup, it’s crucial to focus on:

- Cash Flow Management: Startups typically operate with tight cash flow, and your financial model should reflect this by ensuring that your model includes accurate cash flow projections. This will help you understand when to expect funding needs and avoid running out of cash.

- Customer Acquisition Costs (CAC): Early-stage e-commerce businesses often spend more on customer acquisition, especially if they are investing in building brand awareness or marketing campaigns. Your model should allow you to track CAC and adjust spending accordingly to achieve a sustainable ratio between CAC and Customer Lifetime Value (CLTV).

- Lean Operations: Startups tend to have fewer resources, so it’s important to keep operating expenses low. Modeling for smaller teams, limited marketing budgets, and more efficient supply chain strategies can help ensure profitability as you grow.

Startups should also be flexible with their financial model, as they will likely need to pivot their business model or product offerings based on market feedback. Your model should be easily adjustable to account for these changes.

Medium-Sized Businesses

Medium-sized e-commerce businesses usually have more resources than startups but are still in a stage where scaling efficiently is crucial. In this stage, your model should focus on:

- Scaling Strategies: How you scale your operations will have a significant impact on your financial projections. Medium-sized businesses need to focus on growing without disproportionately increasing costs. Your model should account for how increased sales volumes will affect things like inventory, shipping, and staffing.

- Operational Efficiency: As your business grows, you’ll likely experience higher complexity in operations. Streamlining processes such as fulfillment, customer service, and inventory management should be modeled, as inefficiencies can eat into margins.

- Profit Margins: With more experience in the market, medium-sized businesses should start to focus on improving profit margins through better supplier negotiations, economies of scale, or optimized marketing strategies. Your model should reflect both opportunities for increasing margins and risks related to underpricing or overstocking.

Large Enterprises

Large e-commerce enterprises have extensive resources, global operations, and potentially diverse product lines. As such, their financial model needs to account for much larger complexities:

- Multi-Channel Revenue Streams: Large enterprises often sell through multiple channels, such as their website, Amazon, or retail stores. Modeling for different sales channels helps forecast overall revenue and manage the performance of each channel separately.

- Global Operations: For businesses that operate internationally, currency fluctuations, import/export duties, and taxes must be factored into the financial model. Each market will have its own set of challenges, and the financial model should track revenue, expenses, and profitability by region.

- Advanced Analytics: Large businesses often rely on more sophisticated analytics to guide decision-making. Your financial model should incorporate data from various departments (sales, marketing, customer service) and reflect the company’s ability to invest in data-driven tools that drive efficiency.

The key for large enterprises is managing complexity without losing sight of profitability. Your financial model needs to handle a large number of variables, from multiple revenue streams to international expansion, while providing clear insights into financial health.

Incorporating Seasonality and Market Trends

Seasonality and market trends have a significant impact on e-commerce businesses, regardless of their size or industry. Understanding how these factors influence your business will help you make better financial predictions and plan for periods of high and low demand.

Seasonality

E-commerce businesses often experience seasonal fluctuations in sales, depending on the time of year. For example, retail e-commerce might see massive sales increases during the holidays, while fitness or wellness brands may see peaks around New Year’s resolutions. Modeling for seasonality involves:

- Sales Variations by Month or Quarter: Identify trends in your historical data to understand how much demand fluctuates throughout the year. This allows you to forecast more accurately during peak and off-peak periods.

- Marketing Spend Adjustments: Seasonal periods often require heavier marketing spend. Your financial model should adjust your marketing budget to account for these periods and track how they impact overall sales and profitability.

- Inventory Planning: In industries with seasonal spikes, you’ll need to manage inventory carefully. Overordering can lead to excess stock, while underordering can result in missed sales opportunities. Your model should account for these seasonal fluctuations to avoid these pitfalls.

Market Trends

Market trends can influence consumer behavior, demand, and overall market conditions. For example, shifts toward sustainable products, changes in consumer preferences (e.g., a move toward online shopping post-pandemic), or technological advancements all impact your sales and profitability.

Tracking market trends and adjusting your financial model accordingly allows you to be proactive instead of reactive. For example:

- Consumer Behavior Shifts: If your model reflects a growing interest in eco-friendly products, you can adjust revenue forecasts for a product line that aligns with that trend.

- Technological Innovations: The adoption of new technologies, such as AI-powered shopping assistants or faster checkout systems, can change the way consumers interact with your store. Modeling for these changes helps you plan for necessary investments.

- Economic Factors: Broader economic conditions, such as inflation, unemployment, or shifts in disposable income, can affect consumer spending behavior. Your model should factor in the potential impact of these macroeconomic changes on your business.

By factoring seasonality and market trends into your financial model, you can create a more accurate representation of your business’s future and make more informed decisions about staffing, inventory, marketing, and growth strategies.

Customizing your financial model to reflect the unique needs of your industry, business size, and external factors like seasonality and market trends is key to building a truly effective tool. By doing so, you’ll gain deeper insights into your operations, minimize risks, and plan for sustainable growth in an ever-changing market.

As your e-commerce business grows, the complexity of managing finances also increases. Simple financial models might work for small, early-stage companies, but as you scale, you’ll need more advanced features in your financial model. These features will help you predict growth, manage risks, and make informed decisions when dealing with outside investors or funding rounds. Advanced financial modeling can be a game-changer for managing business growth in a dynamic and competitive industry.

Forecasting Growth and Scalability

Forecasting growth is an essential part of any advanced e-commerce financial model. When you’re scaling your business, having an accurate prediction of future performance helps you allocate resources, manage cash flow, and plan for expansion. A solid growth forecast is based on data, assumptions, and a clear understanding of how your business will evolve over time.

How to Forecast Growth

To forecast growth, you’ll first need to understand the key drivers behind your revenue. For most e-commerce businesses, these drivers typically include:

- Sales Growth Rate: How much do you expect sales to increase over a specific period? This could be based on historical growth rates, market research, or specific business initiatives like launching new products or entering new markets.

- Market Trends: The e-commerce market is always changing. Identifying trends such as the rise of mobile shopping, subscription services, or niche product categories can give you insight into potential areas of growth.

- Customer Acquisition: Your ability to acquire new customers will impact growth. Forecasting how many new customers you plan to acquire and how much each will spend over time is key to projecting future revenue.

- Product Expansion: If you plan to introduce new products or services, forecasting how these will contribute to overall revenue is important. For instance, adding a new product line might attract a different type of customer and require a fresh marketing strategy.

- Geographic Expansion: If you’re planning to expand into new markets, consider the cultural, logistical, and operational challenges of those regions. Assessing how expansion will affect your revenue stream can guide your forecasting model.

Once you’ve identified these drivers, you can build assumptions about how each will behave in the future. For example, you might assume that sales will grow by 10% each quarter, driven by a combination of customer retention, marketing efforts, and the addition of new products. You’ll use these assumptions to create your revenue projections for the coming months or years.

Forecasting with Data

It’s essential to base your forecasts on data rather than gut feeling. Use historical data whenever possible—things like previous sales performance, average order value, and customer retention rates. Additionally, keep an eye on your competitors and industry reports, as they can provide valuable insights into broader market trends and expectations.

A good growth forecast doesn’t only focus on revenue. It should also include:

- Customer Growth: How many new customers will you acquire, and how does this compare to the number of churned customers?

- Profit Margins: As your sales increase, will your profit margins improve due to economies of scale, or will they shrink as competition intensifies?

- Cash Flow: Forecasting cash flow is critical for ensuring that you have enough liquidity to meet business obligations, especially as you scale.

Accurate forecasting helps you plan for challenges before they arise, allowing you to adjust strategies in real-time and avoid unpleasant surprises.

Sensitivity Analysis for Risk Management

As you scale your e-commerce business, you will face risks that could impact your profitability or growth. Sensitivity analysis is an advanced financial modeling technique that allows you to assess how different variables affect your business. It helps you understand which assumptions are the most important to your financial outcomes and how they might change under different circumstances.

How Sensitivity Analysis Works

Sensitivity analysis involves varying key assumptions in your financial model to see how they impact the results. The goal is to understand the relationship between variables and how sensitive your business is to changes in key drivers, such as sales growth, pricing, or marketing costs.

For example, let’s say you are forecasting revenue based on an assumption that sales will grow by 15% per quarter. In your sensitivity analysis, you might test what happens if sales only grow by 10% or if they increase by 20%. You could also test the impact of increasing advertising spend or changing the average order value.

The key inputs you might test include:

- Sales Growth Rate: How does a change in your sales growth rate (either higher or lower) affect your revenue and profit margins?

- Price Sensitivity: What happens if your customers become more price-sensitive, and you need to lower prices? Will this lead to a significant drop in revenue, or can you maintain margins?

- Marketing Expenses: What happens if your marketing costs increase or decrease? A higher marketing budget might lead to more customer acquisition, but how will that affect your profitability?

- Customer Retention Rates: If fewer customers return for repeat purchases, how will this affect revenue over time? This scenario is especially important for subscription-based or repeat-purchase businesses.

- Operating Expenses: How do changes in your operating costs, like rent or salaries, affect your profit margins?

Running sensitivity analysis helps you make more informed decisions by understanding the range of potential outcomes. It helps you prepare for risks, whether they are related to pricing pressures, competition, or market changes, and allows you to set contingency plans in place. For example, if the model shows that your business becomes highly sensitive to fluctuations in marketing spend, you may want to adjust your marketing strategy to stabilize revenue growth.

Applying Sensitivity Analysis to Your Business

Sensitivity analysis allows you to assess the financial impact of various risks and provides a clear picture of where you need to focus your attention. By identifying which variables have the most significant impact on your bottom line, you can develop strategies to mitigate those risks. This could involve diversifying your revenue streams, securing fixed-price contracts with suppliers, or maintaining a flexible marketing budget that can be adjusted in response to changes in customer behavior.

Incorporating Funding and Investment Rounds

As your e-commerce business grows, you may find the need to raise external funding to fuel expansion, improve cash flow, or enter new markets. Whether through venture capital, private equity, or debt financing, it’s important to integrate funding and investment rounds into your financial model. By forecasting how these funding rounds will affect your capital structure and financial position, you can ensure your business is prepared to take on outside investment and use it effectively.

How to Model Funding and Investment Rounds

When you incorporate funding into your financial model, you’ll need to account for both the amount of capital raised and the terms of the funding (e.g., equity dilution, loan repayment terms, interest rates). There are a few key aspects to consider:

- Equity Financing: If you raise funds by selling equity, you’ll need to adjust your ownership structure. This will affect how profits are distributed and the amount of control you retain over the business. You’ll also need to factor in dilution, which is the reduction of your ownership percentage as new shares are issued.

- Debt Financing: If you secure a loan, you’ll need to account for the interest payments and repayment schedule in your cash flow projections. This will impact both your short-term cash flow and long-term profitability.

- Convertible Notes or SAFEs: Some businesses raise capital using instruments like convertible notes or Simple Agreements for Future Equity (SAFEs). These are unique types of funding that convert into equity at a later date, typically during a future financing round. You’ll need to model the conversion terms and how they will impact your financial position in the future.

It’s also essential to model the impact of funding on key financial metrics, such as profit margins, cash flow, and return on investment. This allows you to see how external funding will influence your financial health and whether it will help you achieve your growth targets.

How to Use Investment Projections

Forecasting the timing and amounts of future funding rounds allows you to plan your capital needs. For example, if you know you’ll need a Series A investment to expand your business in two years, you can plan accordingly by adjusting your revenue growth projections and estimating how much funding will be required to achieve your goals.

Investment rounds also impact valuation. When raising funds, your investors will want to know the current value of your business, and your financial model is a crucial tool in determining that. The model should reflect all of your assets, liabilities, revenue projections, and growth plans to come up with a realistic valuation for your business.

Using your financial model to manage funding and investment projections ensures that you’re prepared for future growth while balancing the need for external capital with the long-term sustainability of your business.

Integrating advanced financial model features like growth forecasting, sensitivity analysis, and funding projections into your e-commerce business plan can elevate your decision-making and strategic planning. These features help you plan for the future, manage risks, and ensure that you’re ready to handle the complexities that come with scaling a successful e-commerce operation. Whether you’re looking to attract investors, manage cash flow, or adjust to market fluctuations, these advanced tools will support your journey towards sustainable business growth.

Creating a financial model for your e-commerce business is a powerful tool for decision-making and growth. However, it’s easy to make mistakes that can skew your projections and lead to poor decision-making. To ensure your model is effective, you need to be aware of some common pitfalls and how to avoid them. These mistakes can undermine your forecasting, waste resources, and cause you to miss critical opportunities.

- Overestimating Revenue Growth: One of the most frequent mistakes is being overly optimistic about revenue growth. While it’s important to be ambitious, overestimating your sales can lead to unrealistic expectations, particularly when scaling. It’s crucial to base your revenue forecasts on solid data, industry trends, and realistic assumptions rather than wishful thinking.

- Underestimating Operational Costs: Many e-commerce businesses overlook or underestimate the costs associated with running operations, especially when they’re in the growth phase. This could include marketing expenses, customer service, packaging, and logistics. Inaccurate cost projections can lead to a cash flow crunch, especially if your revenue doesn’t meet expectations.

- Ignoring Cash Flow Management: It’s tempting to focus on profitability and revenue projections, but cash flow is the lifeblood of any business. Without a clear understanding of when cash will be coming in and when expenses will need to be paid, you might face liquidity issues that hinder day-to-day operations. Make sure your model includes detailed cash flow forecasts, including seasonality and payment terms with suppliers or customers.

- Not Considering Market Conditions: Your financial model should reflect not just your business’s internal operations but also external factors, like market trends, competition, and broader economic conditions. Failing to adjust for these factors can result in overly optimistic or overly cautious predictions, both of which can derail growth.

- Overcomplicating the Model: While it’s important to capture all the relevant aspects of your business in your financial model, you can get bogged down by excessive complexity. Overly detailed models may become hard to maintain or use for decision-making. It’s important to strike a balance between complexity and usability. Focus on the key drivers that most directly impact your business and forecast based on those.

- Lack of Regular Updates: A financial model is not a one-time task—it’s a living document that needs to be updated regularly. Failing to keep your model current, especially as your business grows or market conditions change, can lead to poor decision-making. Ensure that your model reflects real-time data and adjust it based on actual performance rather than relying solely on historical assumptions.

- Not Accounting for Seasonality: If your business experiences seasonal fluctuations in sales, neglecting to account for these variations can lead to unrealistic financial projections. Whether it’s the holiday shopping season or cyclical market changes, your financial model needs to reflect the highs and lows of your revenue to avoid surprises and plan for cash flow gaps.

- Overlooking Tax Implications: Taxes are a major part of any business’s financial picture. Failing to incorporate tax obligations, both current and future, can result in significant cash flow issues. It’s important to model your tax liabilities and ensure that you’re setting aside enough to cover them, especially if you’re scaling rapidly or expanding internationally.

- Failing to Plan for Uncertainty: E-commerce businesses operate in a dynamic environment, and factors like supply chain disruptions, changes in consumer behavior, or unforeseen economic shifts can affect your performance. Your financial model should allow for flexibility, including sensitivity analysis or different “what-if” scenarios to test the impact of uncertainties and make sure your business is prepared for the unexpected.

Avoiding these common mistakes will make your financial model a more reliable tool for making informed decisions and positioning your e-commerce business for success.

Make a one-time payment and

enjoy your template forever.

No extra costs, no strings attached,

more savings for you.

Keep your templates up-to-date

with free access to regular updates.

Related products

-

Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to cart Details -

Sale!

Marketplace Profit and Loss Statement

100,00 €Original price was: 100,00 €.66,39 €Current price is: 66,39 €.Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to cart Details -

Sale!

Standard Financial Model Template

184,03 €Original price was: 184,03 €.125,21 €Current price is: 125,21 €.Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to cart Details -

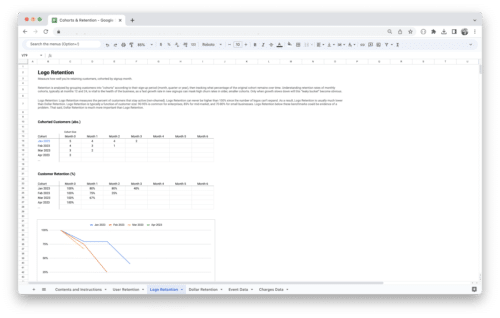

Cohort Analysis Template

0,00 €Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to cart Details