Premium Financial Models

-

Sale!

SaaS Financial Model Template

184,03 €Original price was: 184,03 €.125,21 €Current price is: 125,21 €.Maximize your SaaS business success with our Financial Model Template. Forecast revenue, track expenses, and make data-driven decisions. Get started now to automate your P&L, balance sheet, cash flow statement, and financial metrics calculation.Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details -

Sale!

Standard Financial Model Template

184,03 €Original price was: 184,03 €.125,21 €Current price is: 125,21 €.Streamline your financial modeling process with our customizable Standard Financial Model Template. Save time and effort with pre-built formulas, formatting, and structure. Create accurate projections and make informed decisions.Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details -

Sale!

Startup Financial Model Template

100,00 €Original price was: 100,00 €.66,39 €Current price is: 66,39 €.Empower your startup and supercharge your financial planning with a comprehensive financial projection. Create projections, track revenue & expenses, and calculate key financial metrics.Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details -

Sale!

Marketplace Financial Model Template

184,03 €Original price was: 184,03 €.125,21 €Current price is: 125,21 €.Maximize your Marketplace business's financial growth with our comprehensive Financial Model Template. Forecast your revenues and expenses, customize settings, and view key financial metrics on an interactive dashboard!Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details -

Sale!

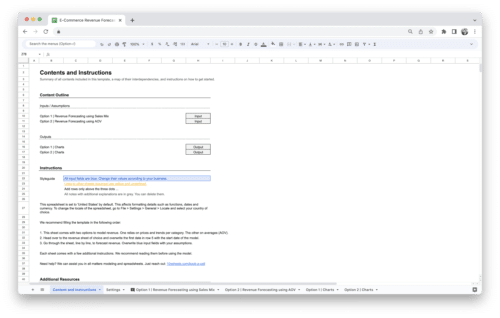

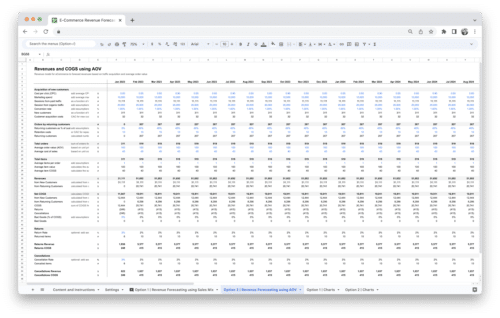

E-Commerce Financial Model Template

184,03 €Original price was: 184,03 €.125,21 €Current price is: 125,21 €.Optimize your e-commerce business's finances. Easily forecast revenues, analyze expenses, and customize to your unique needs with a dashboard, financial statements, and expense modeling!Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details

Profit and Loss Statements

-

Sale!

E-Commerce Profit and Loss Statement

100,00 €Original price was: 100,00 €.66,39 €Current price is: 66,39 €.Start modeling your business's financial performance with ease, and adapt it for any type of business to get ahead of the competition. Plus, get actuals and assumptions sheets, and a dashboard to visualize key metrics!Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details -

Sale!

SaaS Profit and Loss Statement

100,00 €Original price was: 100,00 €.66,39 €Current price is: 66,39 €.Transform your financial modeling game with our customizable P&L statement template for SaaS. Streamline your revenue and expense tracking and analyze key metrics on a user-friendly dashboard!Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details -

Sale!

Startup Profit and Loss Statement

100,00 €Original price was: 100,00 €.66,39 €Current price is: 66,39 €.Get the basics of our Standard Financial Model, with separate sheets for actuals and assumptions. Quickly adapt it to your business and add revenue and expense modeling. Then, visualize key financial metrics with an interactive dashboard!Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details -

Sale!

Marketplace Profit and Loss Statement

100,00 €Original price was: 100,00 €.66,39 €Current price is: 66,39 €.Take control of your marketplace business finances, forecast your revenues and expenses, and track your financial performance with ease. With a customizable dashboard and separate Assumptions and Actuals sheets, you can easily stay organized and make informed decisions.Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details

Revenue Forecasting Tools

-

Choose from two revenue models and visualize your metrics with easy-to-read charts. Plan your operations, make informed decisions, and take control of your e-commerce business's financial planning to stay ahead of the competition!

Choose from two revenue models and visualize your metrics with easy-to-read charts. Plan your operations, make informed decisions, and take control of your e-commerce business's financial planning to stay ahead of the competition!Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details -

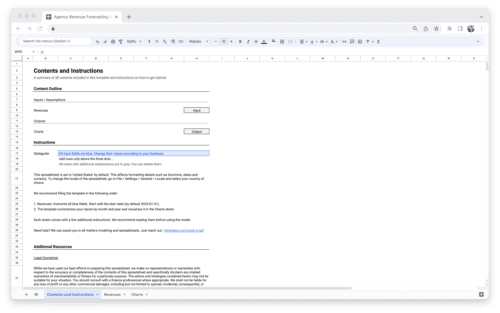

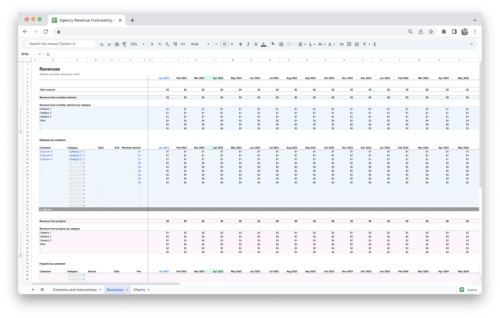

Agency Revenue Forecasting Tool

41,18 €Transform your agency's financial planning. Predict monthly retainer and project revenues with customizable revenue inputs. Visualize key revenue metrics with built-in charts for a more profitable future!Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details -

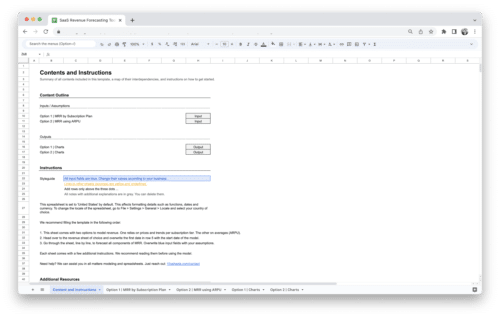

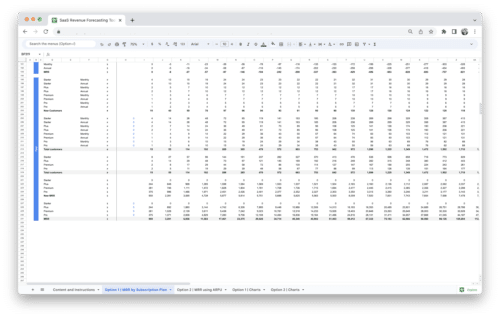

SaaS Revenue Forecasting Tool

41,18 €Maximize your SaaS business revenue. Choose from two revenue models, visualize metrics with charts, and make informed business decisions for your future success!Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details -

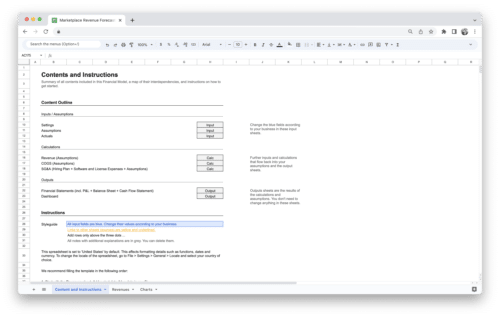

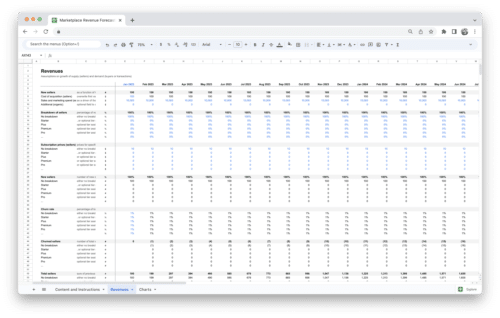

Take control of your Marketplace business with the powerful Revenue Forecasting Tool. Accurately forecast future revenues and visualize key metrics with customizable charts to make informed decisions for your business!

Take control of your Marketplace business with the powerful Revenue Forecasting Tool. Accurately forecast future revenues and visualize key metrics with customizable charts to make informed decisions for your business!Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details

Business Modules

-

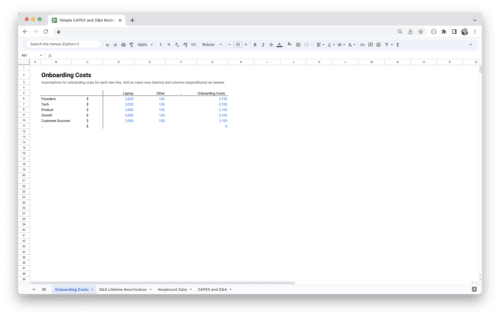

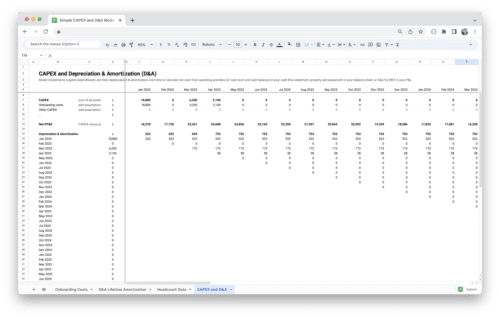

Forecast capital expenditures & boost financial planning with this dynamic model. Calculate depreciation and net PP&E easily using headcount data. Optimize your CapEx planning now!

Forecast capital expenditures & boost financial planning with this dynamic model. Calculate depreciation and net PP&E easily using headcount data. Optimize your CapEx planning now!Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details -

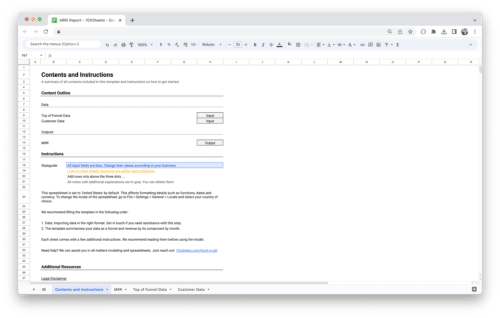

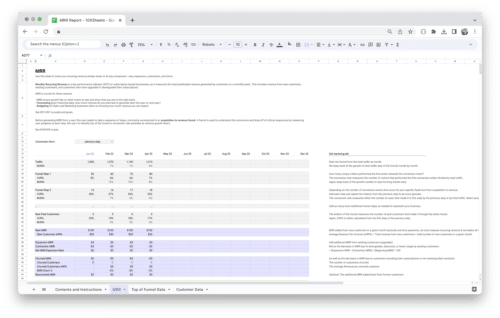

MRR Dashboard Template

0,00 €Take control of your business's growth with the MRR Reporting Template. Forecast your monthly recurring revenue, track your revenue streams, and make data-driven decisions. Integrate your payment provider and unlock powerful insights today!Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details -

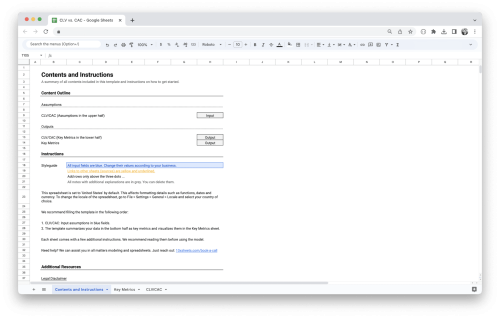

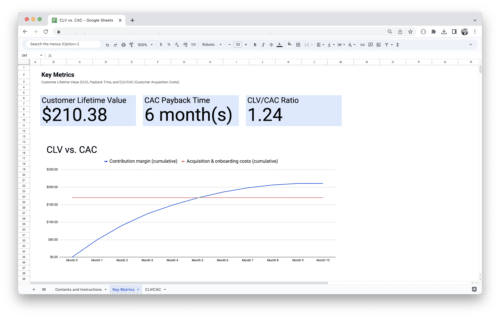

Boost your SaaS or subscription business profitability. Easily calculate customer lifetime value and acquisition costs to make data-driven decisions for marketing and sales strategies and optimize your ROI.

Boost your SaaS or subscription business profitability. Easily calculate customer lifetime value and acquisition costs to make data-driven decisions for marketing and sales strategies and optimize your ROI.Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details -

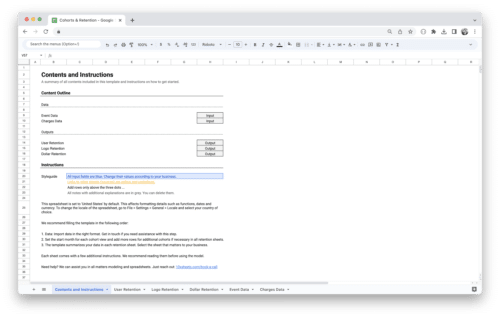

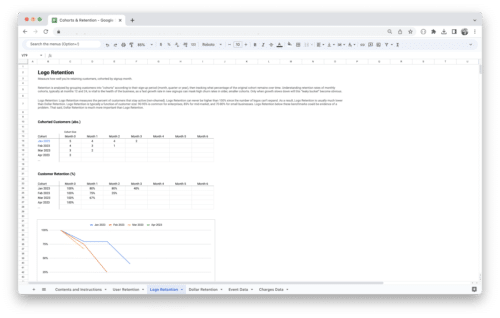

Cohort Analysis Template

0,00 €Boost your subscription-based business with our Cohorts, Churn, and Retention Analysis Template. Calculate customer cohort retention and revenue, and track user retention for better insights and to gain a competitive edge!Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details -

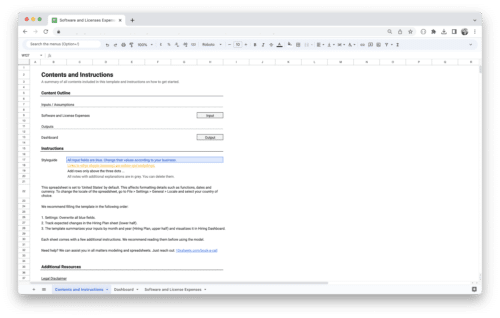

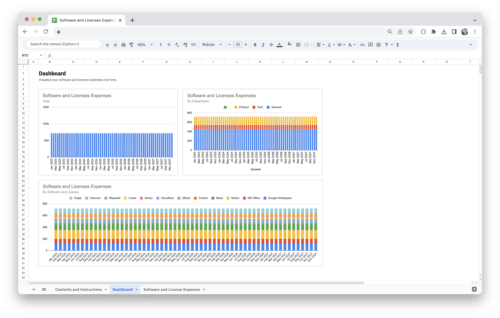

Optimize your financial forecasting. Forecast software and license expenses based on headcount for the next 5 years with customizable settings, pre-built revenue models, and comprehensive financial statements to take control of your finances.

Optimize your financial forecasting. Forecast software and license expenses based on headcount for the next 5 years with customizable settings, pre-built revenue models, and comprehensive financial statements to take control of your finances.Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details -

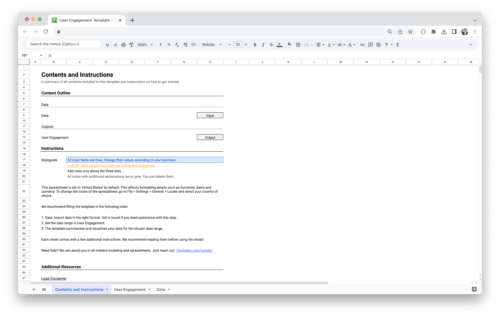

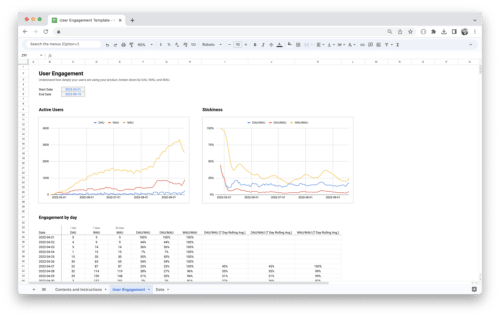

Maximize your SaaS or subscription-based business. Keep track of user activity with daily, weekly, and monthly active user metrics based on event data to gain insights and improve user engagement!

Maximize your SaaS or subscription-based business. Keep track of user activity with daily, weekly, and monthly active user metrics based on event data to gain insights and improve user engagement!Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details -

Workforce Planning Tool

8,40 €Optimize your workforce management with this powerful workforce planning tool. Forecast demand and identify skills gaps to align your workforce with business objectives, streamline processes, and boost productivity.Value added tax is not collected, as small businesses according to §19 (1) UStG.

Add to Cart Details