Are you looking for a reliable way to send money across borders quickly, securely, and affordably? In today’s interconnected world, the need for efficient remittance and money transfer software has never been greater. Whether you’re an individual sending money to family members abroad or a business conducting international transactions, choosing the right software solution can make all the difference. With a plethora of options available, navigating the landscape of remittance software can be overwhelming.

That’s why we’ve put together this guide to help you navigate the world of remittance and money transfer software with confidence. From understanding the basics of remittance to evaluating top software solutions and implementing best practices, this guide covers everything you need to know to make informed decisions and streamline your money transfer processes. Whether you’re seeking competitive exchange rates, fast delivery options, or robust security features, we’ve got you covered.

What is Remittance and Money Transfer Software?

Remittance and money transfer software are digital solutions designed to facilitate the transfer of funds between individuals, businesses, and financial institutions across borders. These software platforms streamline the process of sending and receiving money internationally, offering users convenience, speed, and security.

Functionality of Remittance Software

Remittance software typically offers a range of functionalities to meet the diverse needs of users:

- Transaction Initiation: Users can initiate money transfers through various channels, including web portals, mobile applications, and agent locations.

- Currency Conversion: Remittance software supports the conversion of currencies, allowing users to send money in their preferred currency, which is then converted to the recipient’s local currency.

- Transaction Tracking: Users can track the status of their transactions in real-time, providing visibility into the progress of funds from initiation to delivery.

- Compliance and Security: Remittance software incorporates security features such as encryption, authentication, and compliance with regulatory standards to protect user data and transactions.

Importance of Choosing the Best Money Transfer Software for Remittance Needs

Selecting the right remittance software is crucial for individuals and businesses alike due to the following reasons:

- Cost-Effectiveness: Choosing a software provider with competitive fees and exchange rates can result in cost savings on each transaction, especially for high-volume users or businesses conducting frequent transfers.

- Speed and Efficiency: The best remittance software solutions offer real-time transfer capabilities, enabling funds to be delivered to recipients instantly. This speed and efficiency are essential for time-sensitive transactions.

- Security and Compliance: Opting for reputable remittance software providers ensures that user data and transactions are protected with robust security measures and compliance with regulatory standards such as AML and KYC.

- Global Reach: Selecting software with a broad network of partner banks and financial institutions expands the reach of your remittance transactions, allowing you to send money to a wide range of countries and regions.

- Convenience and Accessibility: User-friendly interfaces and intuitive features make it easy for individuals and businesses to initiate and track remittance transactions from anywhere, at any time, using their preferred device.

By prioritizing these factors and choosing the best remittance software for your needs, you can streamline your money transfer processes, reduce costs, and ensure the security and efficiency of your transactions.

Understanding Remittance Software

Remittance software serves as a pivotal tool in the realm of international finance, facilitating the seamless transfer of funds across borders. Let’s delve deeper into what remittance software entails and its significance in the global financial landscape.

What is Remittance?

Remittance refers to the process of sending money from one geographical location to another, typically across international borders. It’s a fundamental aspect of global commerce, enabling individuals, businesses, and even governments to transfer funds for various purposes, including personal remittances, business transactions, and foreign aid.

Remittance software encompasses a range of digital platforms and technologies designed to streamline and optimize the remittance process. From mobile applications to web-based platforms, these solutions offer users a convenient and efficient means of initiating, tracking, and managing cross-border transactions.

Role of Remittance Software in Facilitating Money Transfers

Remittance software plays a crucial role in modernizing and revolutionizing the way money transfers are conducted on a global scale. Its primary functions extend beyond mere transaction processing to encompass security, compliance, and accessibility.

At its core, remittance software acts as a digital intermediary, connecting senders and recipients across disparate geographic locations. By leveraging secure networks and robust encryption protocols, these platforms ensure the confidentiality and integrity of financial transactions, mitigating the risk of fraud and unauthorized access.

Moreover, remittance software serves as a compliance gateway, enabling users to adhere to stringent regulatory requirements imposed by governing bodies worldwide. From anti-money laundering (AML) measures to know-your-customer (KYC) verification, these platforms employ sophisticated algorithms and protocols to verify the identities of both senders and recipients, thereby reducing the likelihood of illicit financial activities.

Remittance Software Key Features and Functionalities

Remittance software encompasses a diverse array of features and functionalities designed to streamline the money transfer process and enhance user experience. Some of the key features commonly found in remittance software include:

- Secure Transaction Encryption: Remittance software employs state-of-the-art encryption algorithms to safeguard sensitive financial data and ensure secure transmission of funds.

- Compliance and Regulatory Oversight: These platforms integrate robust compliance measures to ensure adherence to regulatory frameworks, including AML, KYC, and other relevant regulations.

- Real-Time Transfer Capabilities: Many remittance software solutions offer real-time transfer capabilities, allowing users to send and receive funds instantly, thereby minimizing transactional delays.

- Multi-Currency Support: Given the global nature of remittance transactions, most software solutions support a wide range of currencies, enabling users to conduct transactions in their preferred currency.

- User-Friendly Interface: Intuitive user interfaces and streamlined workflows are hallmark features of remittance software, making it easy for users to initiate and track transactions with minimal effort.

- Transaction Tracking and Reporting: Remittance software typically provides users with real-time tracking and reporting capabilities, allowing them to monitor the status of their transactions and generate detailed reports for accounting and reconciliation purposes.

By leveraging these advanced features and functionalities, remittance software empowers users to conduct cross-border transactions with confidence and efficiency, thereby facilitating economic growth and financial inclusion on a global scale.

How to Choose the Best Remittance Software?

Selecting the right remittance software for your needs requires careful consideration of various factors to ensure optimal performance, security, and cost-effectiveness. Let’s explore the key considerations you should keep in mind when evaluating different options.

Security and Compliance

Security and compliance are paramount when it comes to remittance software, as it involves the transfer of sensitive financial information across borders. Here’s what to look for:

- Encryption Standards: Ensure that the software employs robust encryption protocols such as AES-256 to protect data both in transit and at rest.

- Regulatory Compliance: Verify that the software complies with relevant regulations such as GDPR, PCI DSS, and international anti-money laundering (AML) and know-your-customer (KYC) requirements.

- Data Protection Measures: Evaluate the software’s data protection measures, including access controls, data encryption, and regular security audits.

Transaction Fees and Exchange Rates

The cost of sending money internationally can vary significantly depending on transaction fees and exchange rates. Consider the following factors:

- Transparent Fee Structures: Look for software providers that offer transparent fee structures with no hidden charges, allowing you to accurately calculate the total cost of each transaction.

- Competitive Exchange Rates: Compare exchange rates offered by different providers to ensure that you get the best value for your money. Keep in mind that even small differences in exchange rates can have a significant impact on the overall cost of remittances.

- Fee Negotiation: Some remittance software providers may offer discounts or preferential rates for high-volume users or businesses. Explore options for fee negotiation to minimize costs.

Transfer Speed and Reliability

The speed and reliability of money transfers are crucial considerations, especially for time-sensitive transactions. Here’s what to look for:

- Real-Time Transfer Options: If speed is a priority, choose software that offers real-time transfer capabilities, allowing funds to be delivered to recipients instantly.

- Track Record for Reliability: Research the reputation of remittance providers to ensure that they have a track record for reliability and timely delivery of funds. Look for user reviews and testimonials to gauge customer satisfaction.

- Redundancy and Failover Mechanisms: Check whether the software has built-in redundancy and failover mechanisms to ensure uninterrupted service in the event of system failures or outages.

Global Reach and Access

The availability of currencies and countries supported by the remittance software is essential for reaching recipients worldwide. Consider the following factors:

- Supported Currencies and Countries: Choose a software provider that supports a wide range of currencies and countries, allowing you to send money to virtually any destination.

- Network of Partner Institutions: Evaluate the software’s network of partner banks and financial institutions to ensure broad coverage and accessibility. A larger network means more options for sending and receiving funds globally.

- Accessibility and Convenience: Assess the accessibility and convenience of the software’s user interface, including support for multiple languages and intuitive navigation, to cater to users from diverse backgrounds and regions.

By carefully evaluating these factors, you can identify the remittance software that best aligns with your specific needs and requirements, ensuring a seamless and cost-effective money transfer experience.

Top Remittance and Money Transfer Software Solutions

Choosing the right remittance and money transfer software is crucial for ensuring seamless, secure, and cost-effective international transactions. Here, we’ll delve into some of the top software solutions available in the market, each offering unique features and functionalities to meet the diverse needs of users:

1. Wise (formerly TransferWise)

Wise is a renowned remittance platform known for its transparent pricing and competitive exchange rates. With Wise, users can send money internationally at lower fees compared to traditional banks, making it a popular choice for individuals and businesses alike.

Key Features:

- Transparent Fee Structure: Wise offers clear and upfront pricing, with no hidden fees or markups.

- Real-Time Exchange Rates: Users benefit from real-time exchange rates, ensuring transparency and accuracy in currency conversion.

- Multi-Currency Account: Wise provides users with multi-currency accounts, allowing them to hold and manage funds in multiple currencies.

- Fast Transfers: Funds sent through Wise often arrive within minutes, making it ideal for time-sensitive transactions.

- Integration with Banking Apps: Wise integrates seamlessly with banking apps, providing users with easy access to their accounts and transactions.

2. PayPal

PayPal is a globally recognized payment platform that offers remittance services for individuals and businesses. With PayPal, users can send money to over 200 countries and regions worldwide, leveraging its extensive network and user-friendly interface.

Key Features:

- Wide Global Reach: PayPal’s extensive network enables users to send money to virtually any destination worldwide.

- Buyer and Seller Protection: PayPal offers buyer and seller protection policies, providing peace of mind for online transactions.

- Mobile App: The PayPal mobile app allows users to send money on the go, making it convenient for users with busy lifestyles.

- Secure Transactions: PayPal prioritizes security, employing advanced encryption and fraud detection measures to protect user data and transactions.

3. Remitly

Remitly is a popular remittance service focused on providing fast and affordable money transfers to various countries worldwide. It offers competitive exchange rates and low fees, making it an attractive option for individuals sending money to family and friends abroad.

Key Features:

- Express and Economy Options: Remitly offers two delivery options – Express and Economy – allowing users to choose between speed and affordability.

- Cash Pickup and Bank Deposit: Recipients can receive funds through cash pickup at designated locations or direct bank deposits, providing flexibility and convenience.

- Mobile Wallet Transfers: Remitly supports transfers to mobile wallets in select countries, catering to recipients who prefer digital payment methods.

- 24/7 Customer Support: Remitly provides round-the-clock customer support to assist users with any inquiries or issues they may encounter.

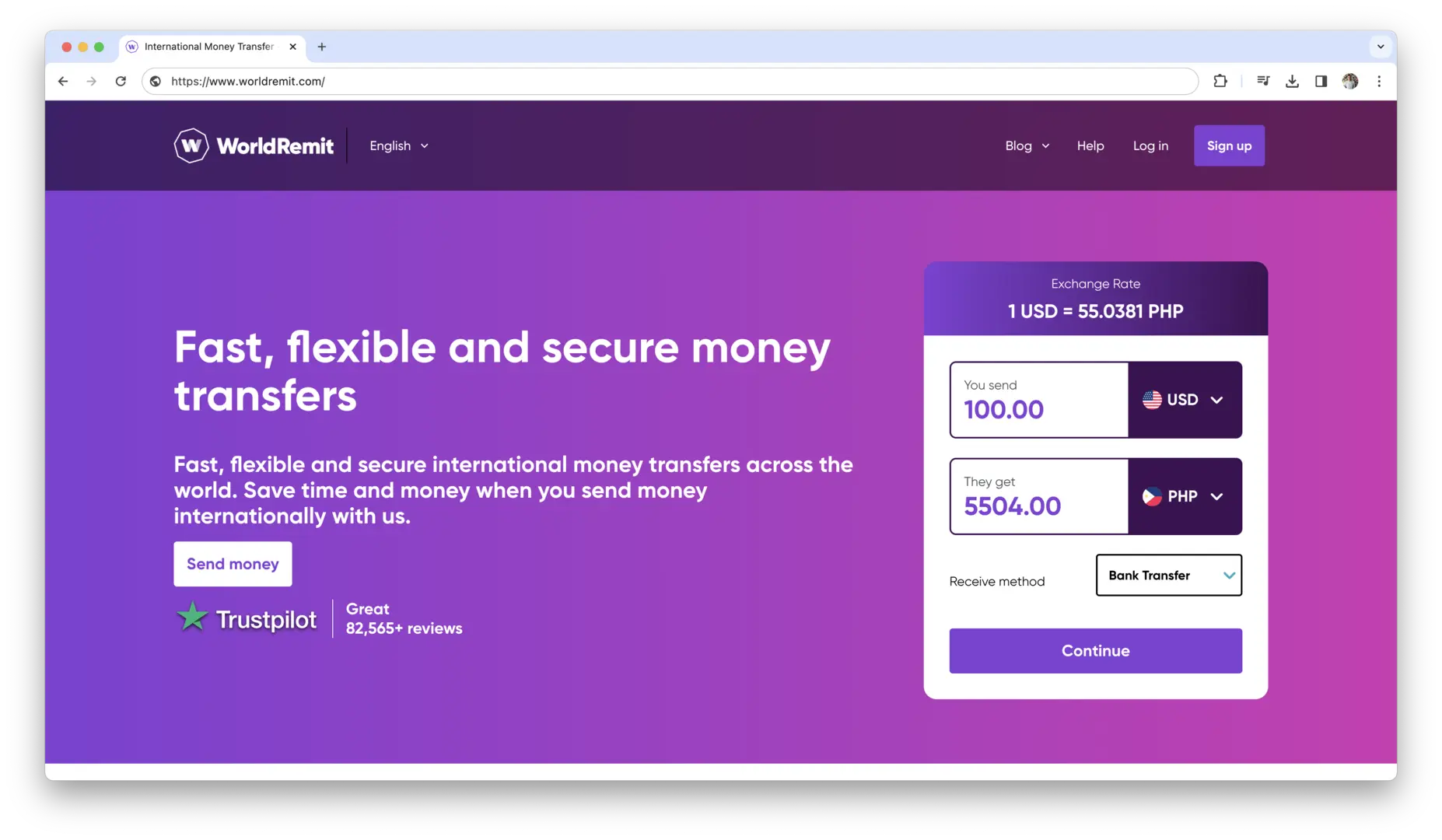

4. WorldRemit

WorldRemit is a leading digital money transfer service that enables users to send money to over 130 countries worldwide. It offers a wide range of delivery options, including bank deposits, cash pickup, and mobile money transfers, making it a versatile choice for international remittances.

Key Features:

- Variety of Delivery Options: WorldRemit provides multiple delivery options to suit the preferences of recipients, including bank deposits, cash pickups, and mobile money transfers.

- Instant Transfers: Some delivery options offered by WorldRemit allow for instant transfers, ensuring that funds are available to recipients promptly.

- Competitive Exchange Rates: WorldRemit offers competitive exchange rates and transparent fees, providing value for users sending money internationally.

- Easy-to-Use Platform: The WorldRemit platform is user-friendly, with intuitive navigation and straightforward transaction processes.

5. Xoom (by PayPal)

Xoom, a subsidiary of PayPal, is a fast and secure way to send money, pay bills, and reload phones from the United States to over 130 countries and territories worldwide. With Xoom, users can send money for cash pickup, direct bank deposits, or home delivery, making it a convenient choice for international remittances.

Key Features:

- Speedy Transfers: Xoom offers fast and reliable money transfers, with many transactions completed within minutes.

- Multiple Delivery Options: Users can choose from various delivery options, including cash pickup, bank deposits, and home delivery, to suit the preferences of recipients.

- Tracking and Notifications: Xoom provides users with real-time tracking and notifications, allowing them to monitor the status of their transfers from initiation to delivery.

- Secure Transactions: Xoom prioritizes the security of user data and transactions, employing advanced encryption and fraud prevention measures to safeguard against unauthorized access and fraudulent activities.

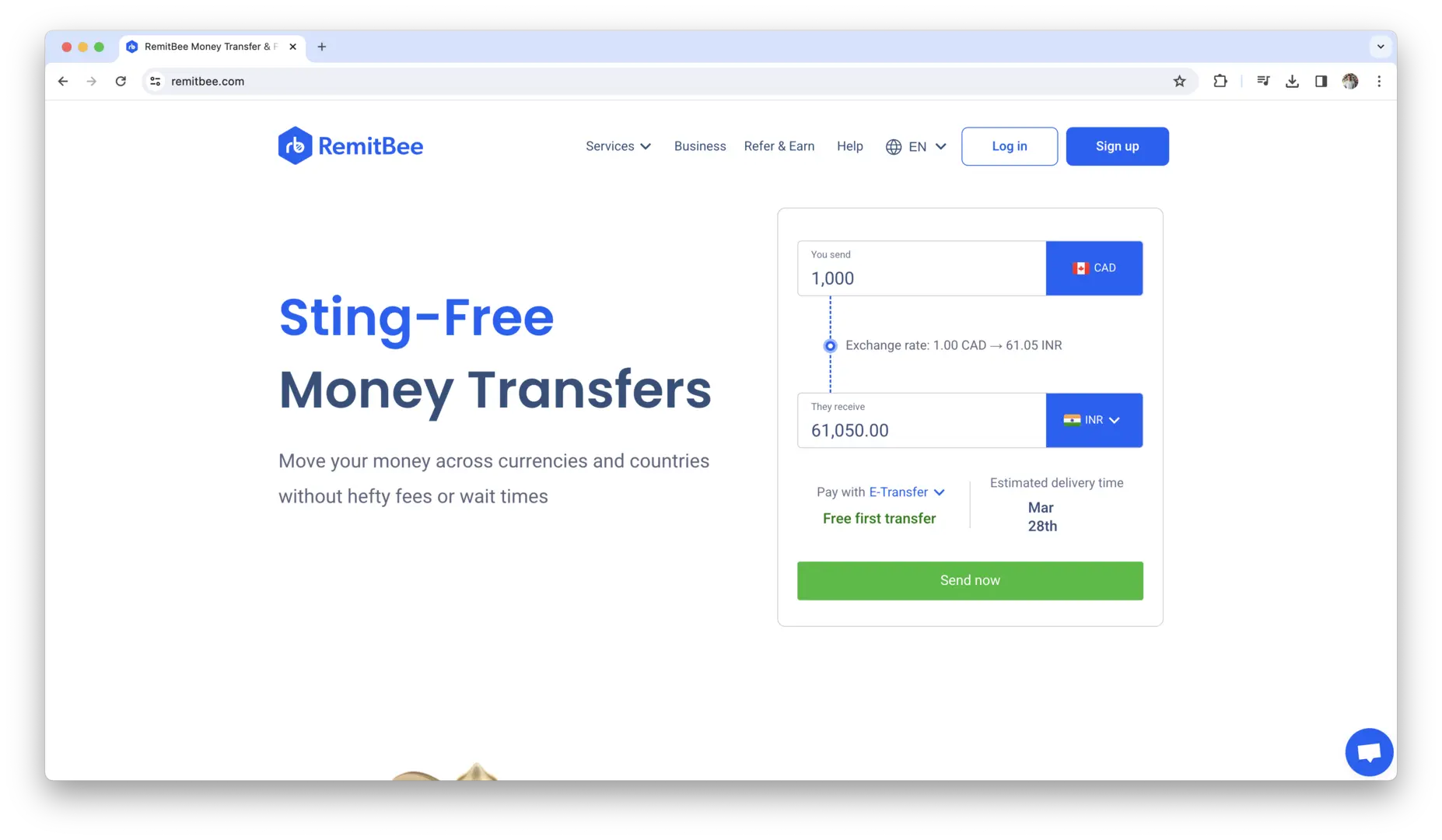

6. Remitbee

Remitbee is a Canada-based remittance platform that focuses on providing fast, secure, and affordable money transfer services. It offers competitive exchange rates and low fees, making it an attractive option for individuals sending money internationally.

Key Features:

- Competitive Exchange Rates: Remitbee offers competitive exchange rates, ensuring that users get the most value for their money.

- Flexible Delivery Options: Users can choose from various delivery options, including bank deposits, cash pickups, and mobile money transfers, to suit the preferences of recipients.

- Instant Transfers: Remitbee provides instant transfers to select countries, allowing recipients to receive funds promptly.

- Referral Program: Remitbee offers a referral program where users can earn rewards for referring friends and family to the platform.

- Dedicated Customer Support: Remitbee provides dedicated customer support to assist users with any inquiries or issues they may encounter during the transfer process.

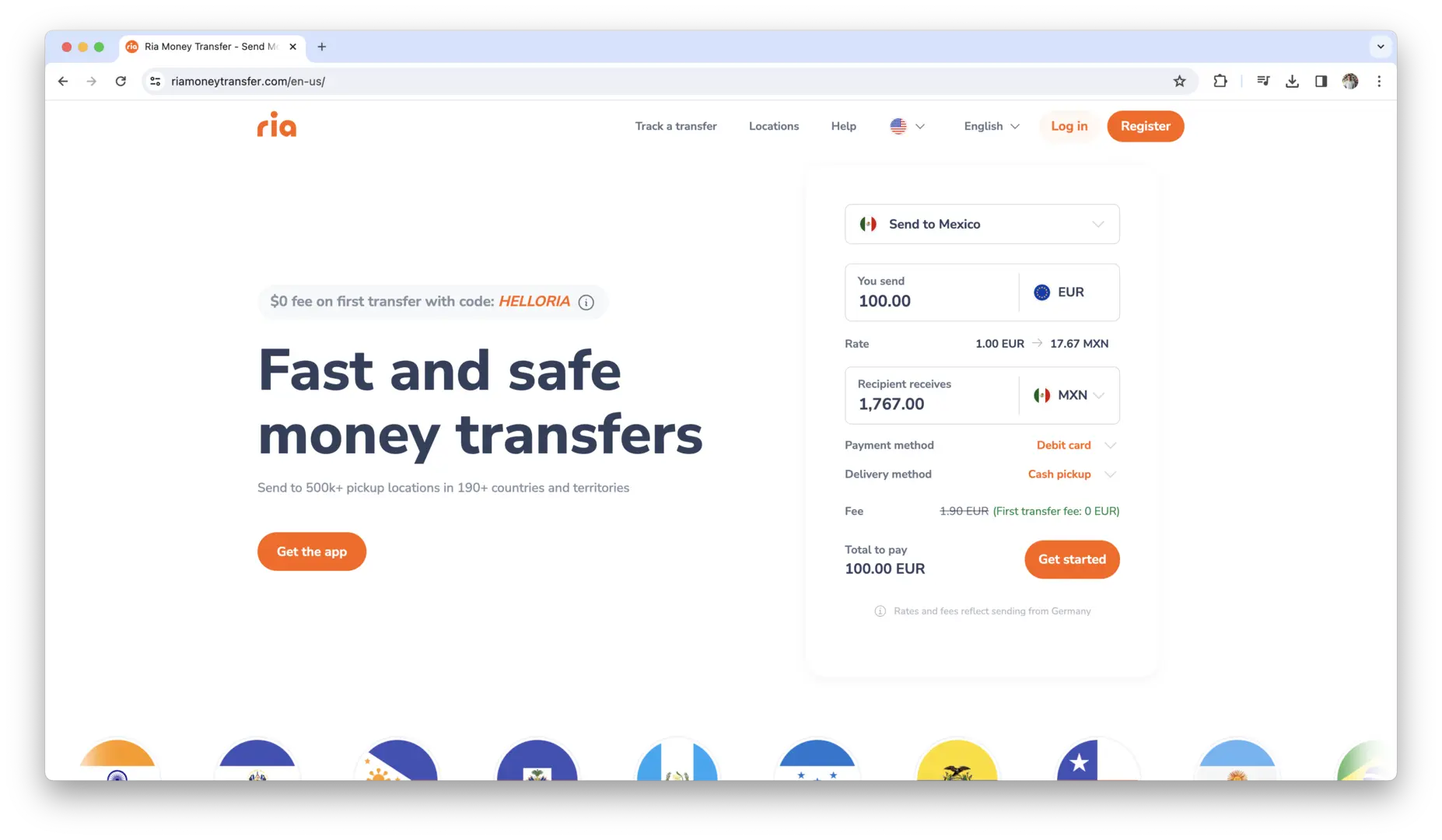

7. Ria Money Transfer

Ria Money Transfer is a global remittance service that offers fast, reliable, and affordable money transfer solutions. With over 437,000 locations in 160 countries, Ria provides extensive coverage and accessibility for users worldwide.

Key Features:

- Extensive Network: Ria Money Transfer boasts a vast network of agent locations, making it easy for users to send and receive money in-person.

- Competitive Pricing: Ria offers competitive pricing with low fees and competitive exchange rates, ensuring cost-effectiveness for users.

- Multiple Delivery Options: Users can choose from various delivery options, including bank deposits, cash pickups, and home deliveries, to suit the preferences of recipients.

- Loyalty Program: Ria offers a loyalty program where users can earn points for every transaction, which can be redeemed for discounts and rewards.

- Global Support: Ria provides multilingual customer support to assist users in different languages and time zones, ensuring a seamless experience for users worldwide.

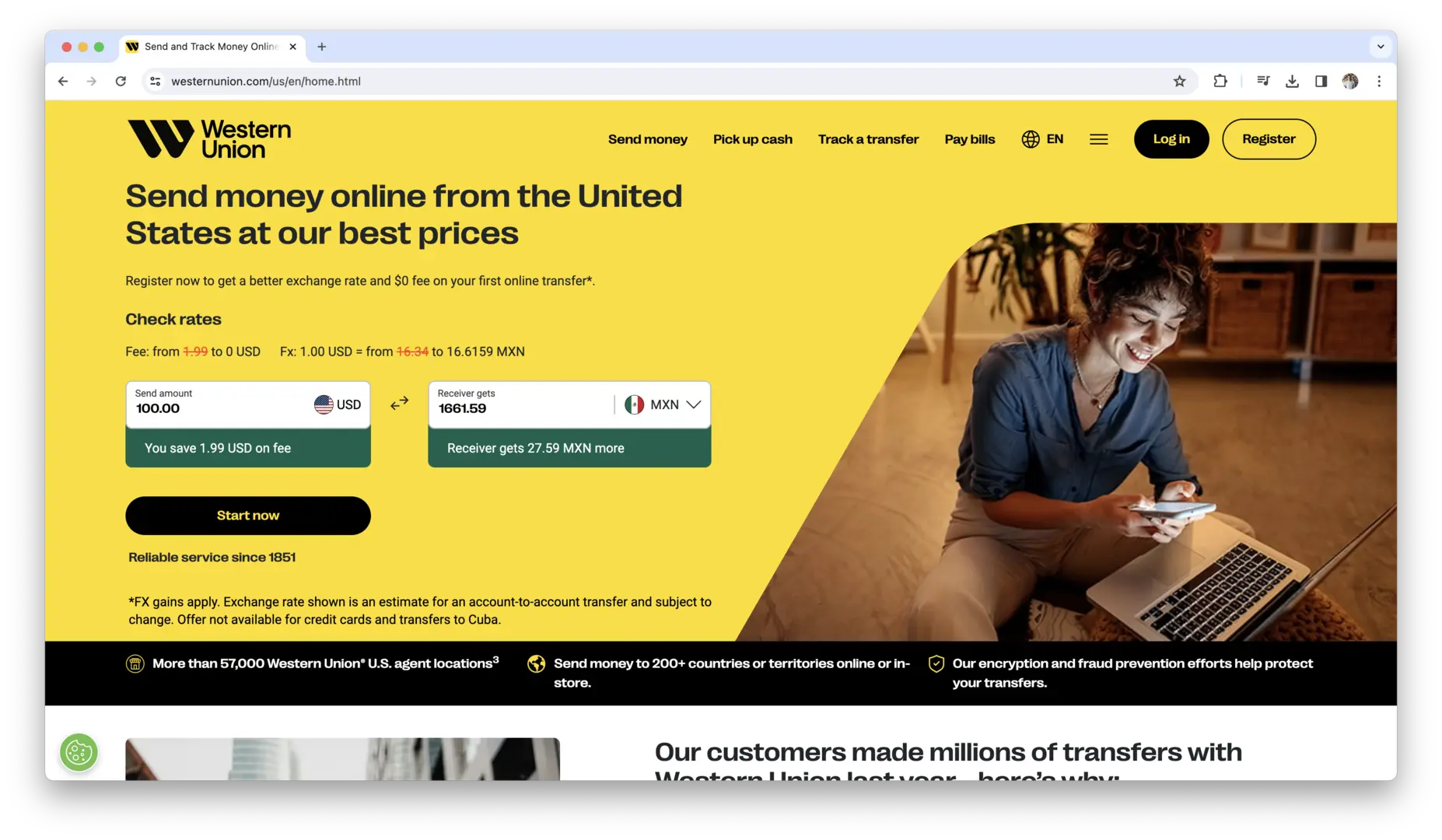

8. Western Union

Western Union is one of the oldest and most well-established remittance services globally, offering a wide range of money transfer solutions for individuals and businesses. With over 500,000 agent locations in over 200 countries and territories, Western Union provides extensive coverage and accessibility for users worldwide.

Key Features:

- Extensive Global Network: Western Union boasts an extensive network of agent locations, making it easy for users to send and receive money in-person.

- Fast and Reliable Transfers: Western Union offers fast and reliable money transfer services, with many transactions completed within minutes.

- Multiple Delivery Options: Users can choose from various delivery options, including bank deposits, cash pickups, and mobile money transfers, to suit the preferences of recipients.

- Online and Mobile Platforms: Western Union provides user-friendly online and mobile platforms, allowing users to initiate and track transfers from anywhere, at any time.

- Brand Trust and Reputation: With over 170 years of experience in the industry, Western Union is widely trusted and recognized for its reliability and security.

9. MoneyGram

MoneyGram is a leading remittance service provider offering fast, reliable, and convenient money transfer solutions. With a global network spanning over 200 countries and territories, MoneyGram provides extensive coverage and accessibility for users worldwide.

Key Features:

- Wide Global Reach: MoneyGram offers a wide global reach, with thousands of agent locations and partnerships worldwide, making it easy for users to send and receive money in-person.

- Fast and Convenient Transfers: MoneyGram provides fast and convenient money transfer services, with many transactions completed within minutes.

- Diverse Delivery Options: Users can choose from various delivery options, including bank deposits, cash pickups, and mobile money transfers, to suit the preferences of recipients.

- Online and Mobile Platforms: MoneyGram offers user-friendly online and mobile platforms, allowing users to initiate and track transfers conveniently from their devices.

- 24/7 Customer Support: MoneyGram provides round-the-clock customer support to assist users with any inquiries or issues they may encounter during the transfer process.

These top remittance and money transfer software solutions offer a range of features and benefits to cater to the diverse needs of users, whether individuals sending money to family members abroad or businesses conducting international transactions. By choosing a reputable and reliable software provider, users can enjoy peace of mind knowing that their funds are transferred securely, efficiently, and cost-effectively.

How to Evaluate Remittance Software for Your Needs?

Choosing the right remittance software requires a systematic approach that takes into account your specific requirements and preferences. Let’s explore the steps involved in evaluating remittance software to find the best fit for your needs.

Assessing Your Remittance Requirements

Before you begin your search for remittance software, it’s essential to assess your specific remittance requirements. Consider the following factors:

- Transaction Volume: Determine the average volume and frequency of your remittance transactions. Are you a high-volume sender, or do you send occasional transfers?

- Target Regions: Identify the countries and regions where you most frequently send money. Ensure that the remittance software you choose supports transactions to these destinations.

- Transaction Speed: Assess whether you require real-time transfer capabilities or if standard processing times are sufficient for your needs.

- Security and Compliance: Consider your risk tolerance and regulatory obligations. Do you prioritize robust security features and compliance with international regulations such as AML and KYC?

- Budget: Determine your budget for remittance software, including transaction fees, exchange rates, and any additional costs associated with the software.

By clarifying your remittance requirements upfront, you can narrow down your options and focus on solutions that align with your specific needs.

Conducting Thorough Research on Available Options

Once you’ve identified your remittance requirements, conduct thorough research on available software options. Consider the following sources of information:

- Online Reviews and Testimonials: Read reviews and testimonials from other users to gain insights into their experiences with different remittance software solutions. Look for patterns in feedback regarding security, reliability, customer support, and overall user experience.

- Industry Publications and Reports: Consult industry publications and reports for expert insights and analysis of leading remittance software providers. These sources often provide in-depth reviews and comparisons of features, pricing, and performance.

- Peer Recommendations: Reach out to peers, colleagues, or industry contacts who have experience with remittance software. Ask for recommendations based on their firsthand experiences and insights.

Gathering information from multiple sources will give you a comprehensive understanding of the available options and help you make an informed decision.

Comparing Features and Pricing

Once you’ve compiled a list of potential remittance software providers, compare their features and pricing to identify the best fit for your needs. Consider the following factors:

- Key Features: Evaluate each software provider’s key features and functionalities, such as security measures, compliance capabilities, transfer speed, and customer support.

- Pricing Structure: Compare the pricing structures of different providers, including transaction fees, exchange rates, and any additional charges. Pay attention to hidden fees or surcharges that may impact the total cost of using the software.

- Scalability: Assess whether the software can accommodate your future growth and scalability needs. Consider whether the provider offers flexible pricing plans or customizable solutions tailored to your business requirements.

By conducting a thorough comparison of features and pricing, you can identify the remittance software that offers the best value for your investment.

Trial and Testing Period Considerations

Before committing to a remittance software provider, consider participating in a trial or testing period to evaluate the software’s performance and suitability for your needs. During this period, pay attention to the following factors:

- Ease of Use: Assess the user interface and overall usability of the software. Is it intuitive and easy to navigate, or does it require extensive training?

- Transaction Processing: Test the software’s transaction processing capabilities, including speed, reliability, and accuracy. Evaluate whether it meets your expectations for timeliness and efficiency.

- Customer Support: Interact with the provider’s customer support team to gauge their responsiveness, knowledge, and willingness to assist with any issues or inquiries.

- Compatibility and Integration: Determine whether the software integrates seamlessly with your existing systems and workflows. Test any integration features or APIs to ensure compatibility and functionality.

By conducting thorough testing and evaluation during the trial period, you can make an informed decision about whether the software meets your requirements and expectations.

Seeking Recommendations and Reviews from Trusted Sources

Finally, seek recommendations and reviews from trusted sources to validate your decision and gain additional insights into the performance of remittance software providers. Consider the following sources:

- Industry Experts: Consult industry experts and thought leaders for their recommendations and insights into the best remittance software solutions available.

- Professional Networks: Reach out to peers, colleagues, and professional networks for recommendations based on their firsthand experiences and insights.

- Online Communities and Forums: Participate in online communities and forums dedicated to finance, banking, and international money transfer to seek advice and recommendations from other users.

By leveraging recommendations and reviews from trusted sources, you can validate your decision and gain confidence in your choice of remittance software provider.

How to Implement Remittance and Money Transfer Software?

Once you’ve selected the right remittance software for your needs, the next step is to implement and integrate it into your existing infrastructure. Let’s explore the key considerations and best practices for a successful implementation process.

Installation and Setup Process

The installation and setup process for remittance software can vary depending on the provider and the complexity of the software. Here’s a general overview of what to expect:

- Installation: Begin by downloading the software from the provider’s website or app store. Follow the instructions provided to install the software on your computer or mobile device.

- Configuration: Once installed, you’ll need to configure the software settings according to your preferences and requirements. This may include setting up user accounts, defining transaction limits, and configuring security settings.

- Data Migration: If you’re migrating from an existing remittance system or software solution, you’ll need to transfer your data to the new software. Ensure that the migration process is conducted securely and accurately to avoid data loss or corruption.

During the installation and setup process, it’s essential to follow the provider’s instructions carefully and seek assistance from their support team if needed.

Integration with Existing Systems (if Applicable)

If you’re integrating the remittance software with your existing systems or workflows, careful planning and coordination are required to ensure a seamless integration process. Consider the following steps:

- Assessment: Begin by assessing your existing systems and identifying any potential integration points or dependencies. Determine how the remittance software will interface with other systems, such as accounting software or CRM platforms.

- Compatibility Testing: Before proceeding with the integration, conduct compatibility testing to ensure that the remittance software is compatible with your existing systems and infrastructure. Address any compatibility issues or conflicts that arise during testing.

- API Integration: If the remittance software offers APIs or integration capabilities, leverage these tools to streamline the integration process. Work closely with your IT team or development partners to develop and implement custom integrations as needed.

- Data Synchronization: Establish processes for synchronizing data between the remittance software and your existing systems to ensure consistency and accuracy. This may involve setting up automated data synchronization routines or manual data imports and exports.

By carefully planning and executing the integration process, you can minimize disruptions and ensure that the remittance software seamlessly integrates with your existing systems and workflows.

Training Staff and Users

Effective training is crucial for ensuring that your staff and users can utilize the remittance software effectively and efficiently. Consider the following strategies for training:

- User Training: Provide comprehensive training sessions for staff and users to familiarize them with the features and functionalities of the remittance software. Tailor the training sessions to different user roles and levels of experience.

- Hands-On Workshops: Offer hands-on workshops or interactive training sessions where users can practice using the software in a simulated environment. Encourage active participation and provide opportunities for feedback and questions.

- Documentation and Resources: Create user manuals, guides, and other documentation to supplement training sessions and serve as reference materials for users. Make these resources readily accessible through the software interface or your organization’s intranet.

- Ongoing Support: Offer ongoing support and assistance to users as they become accustomed to using the remittance software. Establish channels for users to submit questions, report issues, and request assistance, and ensure that support staff are readily available to respond to inquiries.

By investing in comprehensive training and support, you can empower your staff and users to make the most of the remittance software and maximize its benefits for your organization.

Testing and Troubleshooting

Before fully deploying the remittance software, it’s essential to conduct thorough testing and troubleshooting to identify and address any issues or errors. Consider the following steps:

- Functional Testing: Test all the core functionalities of the remittance software to ensure that they work as expected. This includes initiating transactions, tracking payments, generating reports, and accessing support resources.

- Performance Testing: Assess the performance of the remittance software under various conditions, including peak usage periods and high transaction volumes. Identify any performance bottlenecks or latency issues and optimize system configurations as needed.

- User Acceptance Testing: Involve end-users in the testing process to gather feedback on usability, functionality, and overall satisfaction with the software. Address any usability issues or concerns raised by users to improve the user experience.

- Bug Fixing and Troubleshooting: Monitor the remittance software for any bugs or errors that arise during testing. Promptly address any issues identified and implement fixes or workarounds as needed. Document and track reported issues to ensure they are resolved in a timely manner.

By conducting thorough testing and troubleshooting, you can minimize the risk of disruptions and ensure a smooth transition to the new remittance software for your organization.

Best Practices for Using Remittance Software Effectively

To maximize the benefits of remittance software and streamline your money transfer processes, consider implementing the following best practices:

- Stay Updated: Regularly update your remittance software to access the latest features, security patches, and performance enhancements. Stay informed about industry trends and regulatory changes that may impact your use of the software.

- Maintain Data Accuracy: Ensure that your transaction data is accurate and up-to-date by regularly reconciling transactions, verifying recipient information, and monitoring transaction statuses. Implement processes for error detection and correction to minimize discrepancies.

- Optimize Security Measures: Strengthen the security of your remittance software by implementing multi-factor authentication, access controls, and encryption protocols. Educate users about security best practices, such as avoiding sharing login credentials and using strong, unique passwords.

- Monitor Exchange Rates: Keep an eye on exchange rates and market trends to identify favorable opportunities for currency conversion. Consider using automated tools or alerts to notify you of significant changes in exchange rates, allowing you to make informed decisions about when to initiate transactions.

- Utilize Automation Features: Take advantage of automation features offered by your remittance software to streamline repetitive tasks and improve efficiency. This may include setting up recurring payments, scheduling transfers in advance, and automating compliance checks.

- Maintain Compliance: Stay compliant with relevant regulations and industry standards governing remittance transactions, such as AML, KYC, and GDPR. Regularly review and update your compliance policies and procedures to reflect changes in regulations and mitigate the risk of non-compliance.

- Provide Training and Support: Offer ongoing training and support to users to ensure that they can effectively navigate and utilize the remittance software. Address any user questions or concerns promptly and provide resources such as user manuals, tutorials, and helpdesk support.

- Monitor Performance Metrics: Track key performance metrics related to your remittance transactions, such as transaction volume, processing times, error rates, and customer satisfaction scores. Use this data to identify areas for improvement and optimize your money transfer processes.

- Seek Feedback and Continuous Improvement: Encourage feedback from users and stakeholders about their experiences with the remittance software. Use this feedback to identify opportunities for enhancements and prioritize feature requests or bug fixes accordingly. Continuously iterate and improve your use of the software to adapt to changing business needs and market dynamics.

By following these best practices, you can leverage remittance software effectively to streamline your money transfer processes, enhance security, and drive operational efficiency in your organization.

Conclusion

Choosing the right remittance and money transfer software is essential for ensuring smooth, secure, and cost-effective international transactions. By understanding your specific needs, evaluating key factors such as security, fees, and delivery options, and implementing best practices, you can make the most out of these software solutions. Whether you’re an individual sending money to loved ones overseas or a business conducting global transactions, the right software can make the process seamless and efficient.

Remember, it’s crucial to stay informed about the latest trends and updates in the remittance industry, as well as to regularly review your chosen software’s performance and features. By staying proactive and continuously optimizing your money transfer processes, you can save time, money, and hassle while ensuring that your funds reach their destination safely and swiftly. So, whether you opt for well-known platforms like Wise or PayPal, or choose emerging solutions like Remitly or Remitbee, make sure to select the software that best fits your needs and preferences. With the right tools and knowledge at your disposal, you can make international money transfers with confidence and ease, no matter where in the world you may be.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.