Are you looking for the best project portfolio management software to streamline your project management process and maximize your team’s productivity? Managing multiple projects simultaneously can be overwhelming, with numerous tasks, deadlines, and resources to juggle. That’s where project portfolio management software comes in handy. These specialized tools offer a centralized platform for planning, tracking, and prioritizing projects, allowing you to align your project portfolio with your organization’s strategic objectives and make data-driven decisions.

Whether you’re a small business or a large enterprise, finding the right project portfolio management software can help you stay organized, optimize resource allocation, and deliver successful projects on time and within budget. In this comprehensive guide, we’ll explore the top project portfolio management software solutions available on the market, key features to consider, tips for choosing the right software for your needs, and strategies for maximizing the benefits of project portfolio management software.

What is Portfolio Management?

Portfolio management refers to the process of managing a collection of investments, known as a portfolio, with the goal of achieving specific financial objectives. It involves strategically allocating assets, monitoring performance, and making adjustments to optimize risk and return. Portfolio management encompasses a range of activities, including asset selection, asset allocation, risk management, and performance evaluation.

Importance of Portfolio Management

Effective portfolio management plays a crucial role in achieving long-term financial success and meeting investment goals. Here are some key reasons why portfolio management is essential:

- Diversification: By spreading investments across different asset classes, industries, and geographic regions, portfolio management helps reduce risk and minimize the impact of market fluctuations on investment returns.

- Risk Management: Portfolio management involves assessing and managing various types of risks, including market risk, credit risk, and liquidity risk. By implementing risk management strategies, investors can protect their portfolios from potential losses and preserve capital.

- Goal Alignment: Portfolio management allows investors to align their investment strategy with their financial goals and objectives. Whether the goal is retirement planning, wealth accumulation, or income generation, portfolio management helps tailor the investment approach to meet specific needs.

- Performance Optimization: Through ongoing monitoring and analysis, portfolio management aims to optimize investment performance and maximize returns. By evaluating portfolio composition, asset allocation, and investment decisions, investors can identify opportunities for improvement and capitalize on market trends.

- Adaptability: Portfolio management enables investors to adapt to changing market conditions, economic trends, and personal circumstances. By regularly reviewing and adjusting portfolios, investors can respond to new opportunities and challenges while staying aligned with their long-term objectives.

What is Portfolio Management Software?

Portfolio management software is a specialized tool designed to help investors manage their investment portfolios more effectively and efficiently. It provides a centralized platform for tracking investments, analyzing performance, and making informed decisions. Portfolio management software offers a range of features and functionalities tailored to the needs of investors, including investment tracking, performance analysis, risk management, and reporting.

Role of Software in Portfolio Management

Portfolio management software plays a vital role in streamlining the investment process and enhancing decision-making capabilities. Here are some key ways in which software contributes to portfolio management:

- Automation: Portfolio management software automates routine tasks such as data entry, transaction processing, and portfolio rebalancing, saving time and reducing manual errors.

- Data Analysis: By providing tools for performance analysis, risk assessment, and scenario modeling, portfolio management software helps investors analyze portfolio data more effectively and gain valuable insights into investment performance and risk exposure.

- Decision Support: Portfolio management software offers decision support tools such as asset allocation models, investment screeners, and optimization algorithms, helping investors make informed decisions aligned with their investment goals and risk tolerance.

- Reporting and Communication: Portfolio management software generates customizable reports, charts, and graphs that summarize portfolio performance, asset allocation, and investment activity. These reports facilitate communication with clients, advisors, and other stakeholders.

- Integration: Portfolio management software integrates with other financial tools and platforms, such as brokerage accounts, financial planning software, and accounting systems, enabling seamless data transfer and workflow integration.

By leveraging portfolio management software, investors can streamline their investment process, improve decision-making, and achieve better outcomes in managing their investment portfolios.

Portfolio Management Software Key Features

When selecting portfolio management software, it’s crucial to consider a range of features that will best suit your investment needs. Here’s a closer look at some key features to prioritize:

Investment Tracking

Investment tracking is the backbone of any portfolio management software. It allows you to monitor the performance of your investments in real-time, providing insights into how your portfolio is performing against market benchmarks and your own financial goals. Look for software that offers comprehensive tracking capabilities across various asset classes, including stocks, bonds, mutual funds, ETFs, and alternative investments. Additionally, consider features such as transaction history tracking, dividend and interest tracking, and support for multiple currencies if you have international investments.

Performance Analysis and Reporting

Effective performance analysis and reporting tools are essential for gaining insights into the historical performance of your investment portfolios. Look for software that offers robust reporting features, including customizable reports, performance attribution analysis, and portfolio benchmarking against relevant market indices. Advanced charting and graphing capabilities can also help visualize performance trends over time, making it easier to identify areas for improvement and track progress towards your financial goals.

Risk Management Tools

Risk management is a critical aspect of portfolio management, helping investors mitigate potential losses and achieve a balanced risk-return profile. Look for software that offers advanced risk management tools, such as portfolio risk assessment, volatility analysis, and scenario modeling. Some software may also offer risk-adjusted performance metrics, such as Sharpe ratio or beta, which can help you assess the risk-adjusted returns of your portfolio relative to the overall market.

Asset Allocation and Diversification

Asset allocation and diversification are fundamental principles of investment management, aimed at spreading risk across different asset classes and investment strategies. Look for software that offers intuitive asset allocation tools, allowing you to set target allocations for various asset classes and rebalance your portfolio accordingly. Additionally, consider features such as portfolio optimization algorithms, which can help you construct portfolios that maximize returns for a given level of risk.

Tax Management

Tax management is an important consideration for investors, as taxes can significantly impact investment returns over time. Look for software that offers robust tax management features, such as tax-loss harvesting, which involves strategically selling investments at a loss to offset capital gains and reduce tax liabilities. Additionally, consider features such as tax optimization tools, which can help you minimize taxes on investment income through strategies such as asset location and tax-efficient fund selection.

Integration and Compatibility

Integration with third-party platforms and compatibility with various devices are essential considerations for seamless user experience. Look for software that integrates with your existing financial accounts, brokerage platforms, and accounting software, allowing you to sync data automatically and streamline your workflow. Additionally, consider compatibility with mobile devices and tablets, ensuring you can access your portfolio information on the go and make informed decisions anytime, anywhere.

User Interface and Accessibility

An intuitive user interface and accessible design are critical for user adoption and satisfaction. Look for software that offers a clean and user-friendly interface, with intuitive navigation and customizable dashboards. Additionally, consider features such as multi-platform compatibility and responsive customer support, ensuring you can access help and assistance whenever you need it.

By prioritizing these key features and considerations, you can select portfolio management software that best meets your investment needs and helps you achieve your financial goals effectively.

Top Portfolio Management Software and Tools

Choosing the right portfolio management software or tool is essential for effectively managing your investments and achieving your financial goals. Here, we’ll explore some of the top options available in the market and delve into their features and benefits:

1. eFront

eFront (a part of BlackRock) is a leading portfolio management software platform designed for institutional investors, asset managers, and private equity firms. It offers advanced portfolio analytics, performance attribution, and risk management tools to optimize investment decisions and drive superior returns. With its intuitive interface and seamless integration capabilities, eFront delivers a powerful solution for investment professionals.

2. Morningstar Direct

Morningstar Direct is a popular asset management software used by investment professionals and financial institutions worldwide. It offers comprehensive tools for investment research, portfolio analysis, and risk assessment, allowing users to make data-driven investment decisions. With its extensive database of investment data and intuitive visualization tools, Morningstar Direct is a valuable resource for investors seeking actionable insights and competitive advantages.

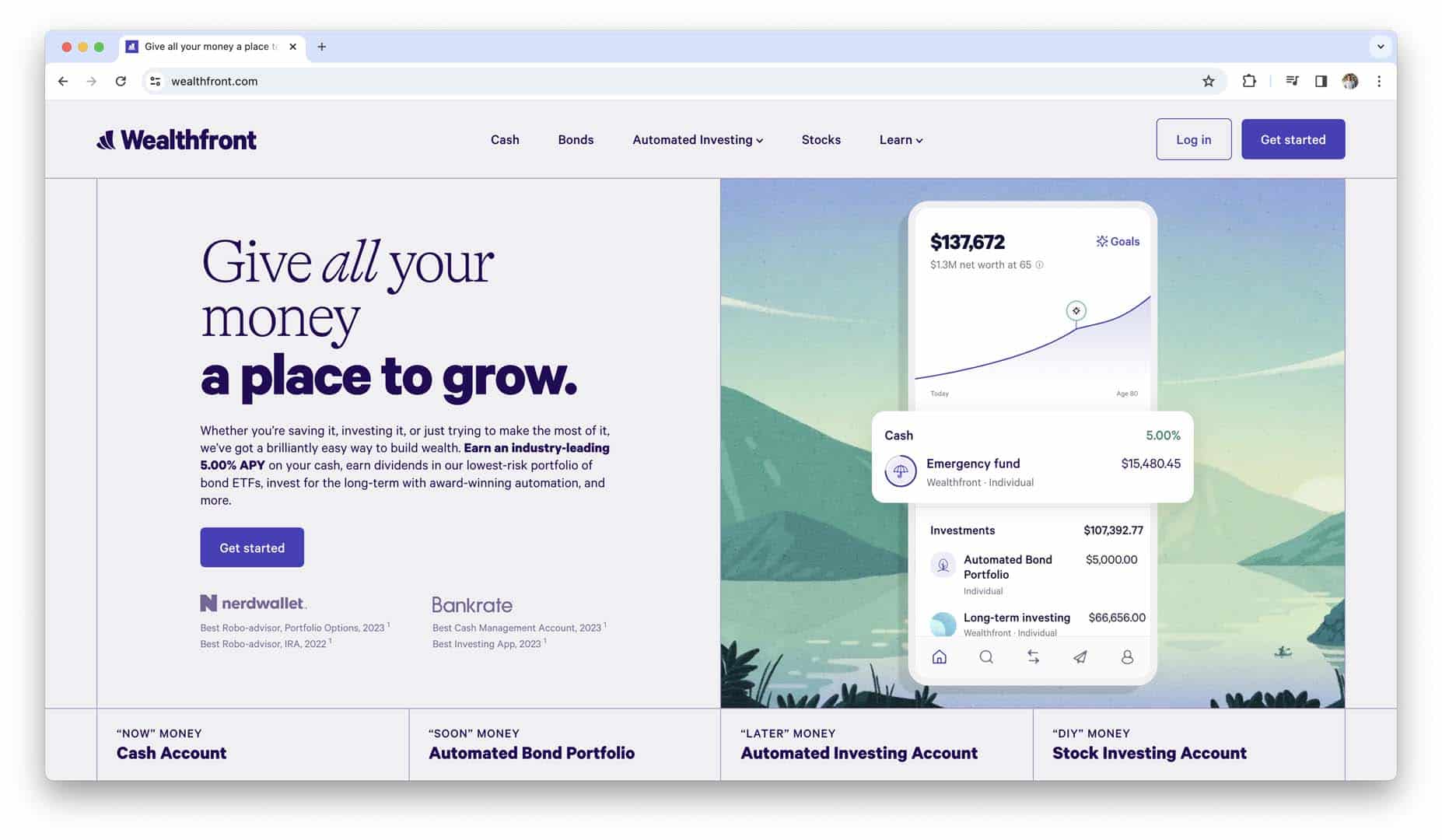

3. Wealthfront

Wealthfront is a robo-advisor platform that offers automated portfolio management services to individual investors. It uses algorithms and technology to build and manage diversified investment portfolios tailored to each user’s risk tolerance and financial goals. With its low fees and hassle-free investment approach, Wealthfront is an attractive option for investors looking for a hands-off approach to portfolio management.

4. Bloomberg Terminal

Bloomberg Terminal is a professional-grade portfolio management software widely used by financial professionals, including traders, analysts, and portfolio managers. It provides access to real-time market data, news, and analytics, allowing users to make informed investment decisions and execute trades efficiently. With its comprehensive suite of tools and customizable workspace, Bloomberg Terminal is a go-to solution for institutional investors and hedge funds.

5. Aladdin

Aladdin by BlackRock is a powerful portfolio management platform designed for institutional investors, asset managers, and financial institutions. It offers advanced risk management, portfolio optimization, and performance attribution tools to help users manage complex investment portfolios effectively. With its sophisticated analytics and scalable infrastructure, Aladdin is trusted by some of the world’s largest investment firms to drive investment success.

6. YCharts

YCharts is a financial research platform that offers portfolio management tools for individual investors, financial advisors, and institutional clients. It provides access to comprehensive market data, stock screening, and portfolio analytics, enabling users to make informed investment decisions and track portfolio performance. With its intuitive interface and customizable reports, YCharts is a valuable resource for investors seeking actionable insights and investment ideas.

7. Charles River IMS

Charles River Investment Management System (IMS) is an integrated portfolio management platform designed for asset managers, investment advisors, and institutional investors. It offers end-to-end functionality for portfolio construction, trading, compliance, and performance measurement, helping users streamline their investment process and drive operational efficiency. With its flexible architecture and extensive asset coverage, Charles River IMS is a trusted solution for investment professionals worldwide.

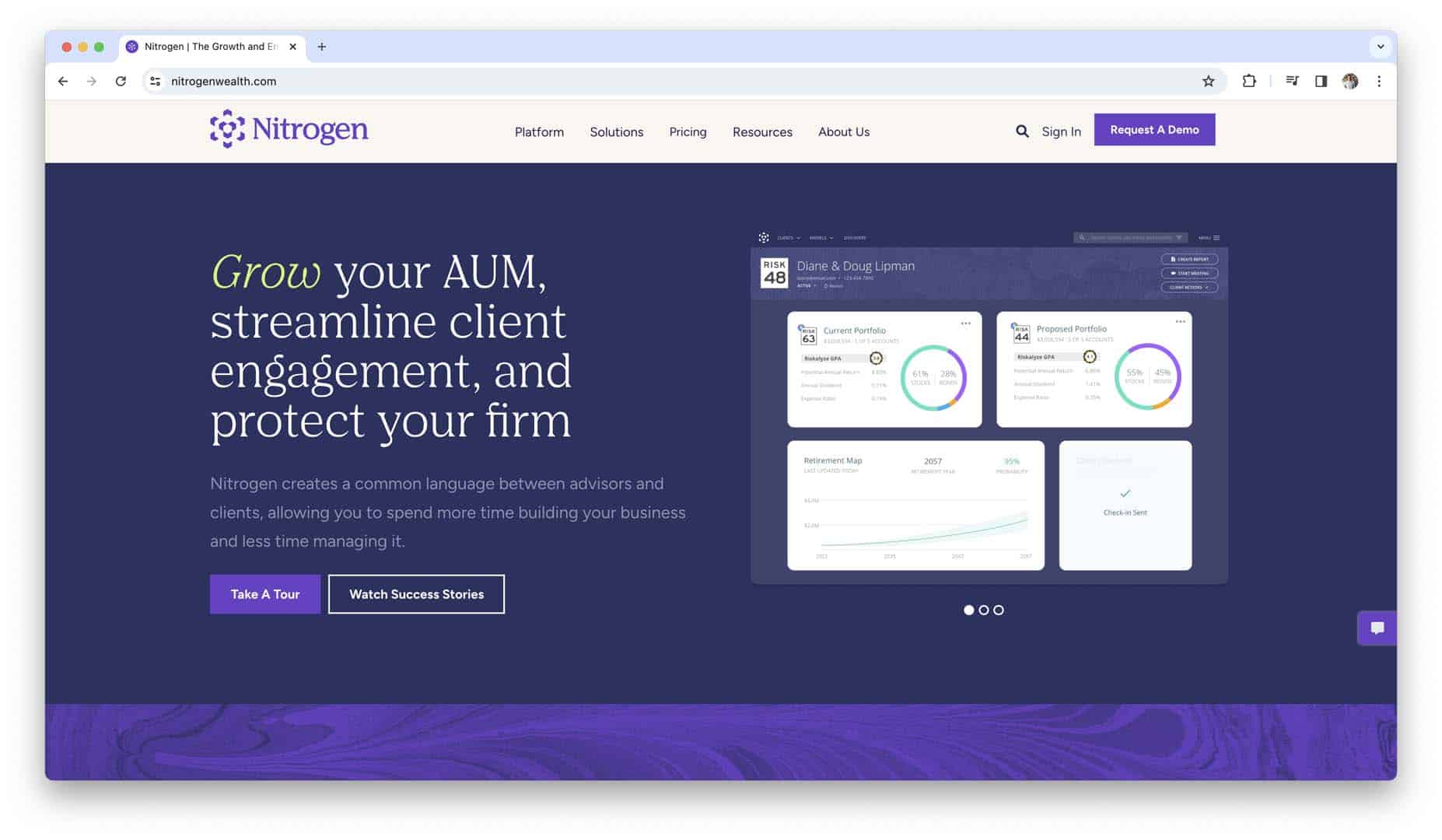

8. Nitrogen (Riskalyze)

Nitrogen (previously Riskalyze) is a risk assessment and portfolio management platform aimed at financial advisors and wealth managers. It uses proprietary algorithms to quantify investors’ risk tolerance and assess the risk profile of their investment portfolios. With its risk-centric approach to portfolio management, Nitrogen helps advisors construct suitable investment portfolios aligned with their clients’ risk preferences and financial goals.

9. Investor’s Business Daily (IBD)

Investor’s Business Daily (IBD) offers a suite of portfolio management tools tailored for individual investors and traders. It provides access to proprietary stock research, market analysis, and portfolio tracking features to help users make informed investment decisions. With its extensive educational resources and technical analysis tools, IBD is a valuable resource for investors seeking to improve their trading strategies and portfolio performance.

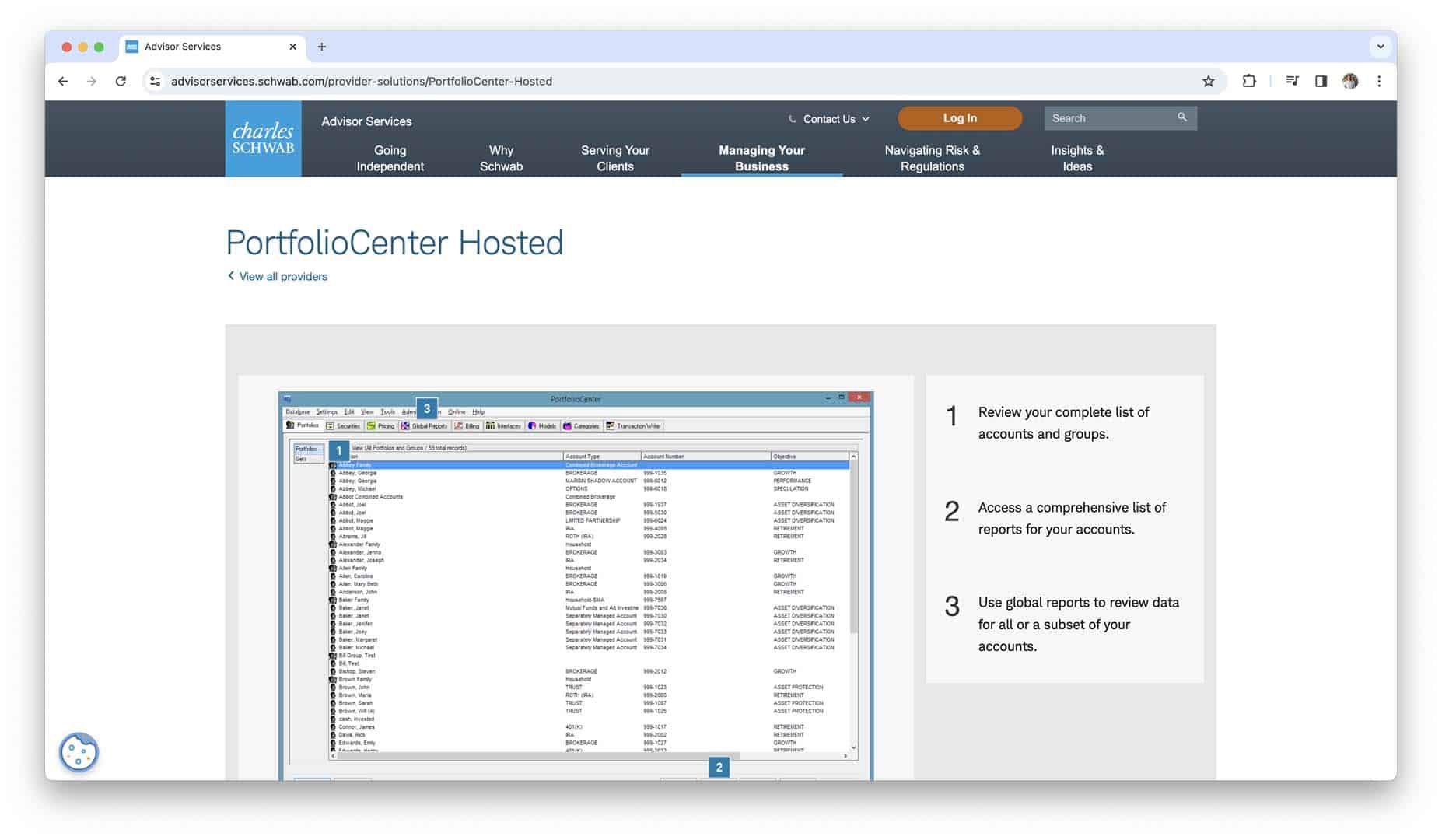

10. PortfolioCenter

PortfolioCenter by Schwab Advisor Services is a portfolio management and reporting software designed for independent financial advisors and wealth management firms. It offers comprehensive features for portfolio accounting, performance reporting, and client billing, streamlining back-office operations and enhancing client service. With its integration with Schwab Advisor Services and other custodians, PortfolioCenter provides a seamless solution for advisors managing client portfolios.

11. Orion

Orion Advisor Solutions is a comprehensive portfolio management platform aimed at financial advisors and registered investment advisors (RIAs). It offers a suite of tools for portfolio construction, rebalancing, and performance reporting, as well as access to a range of investment strategies and models. With its scalable technology and customizable solutions, Orion empowers advisors to deliver personalized investment strategies and solutions to their clients.

12. Envestnet | Tamarac

Envestnet | Tamarac is a portfolio management and client reporting software designed for registered investment advisors (RIAs) and wealth management firms. It offers integrated tools for portfolio accounting, performance reporting, and client communication, enabling advisors to streamline their operations and deliver exceptional client service. With its robust features and scalable architecture, Envestnet | Tamarac is a trusted solution for advisors looking to grow their businesses and enhance client satisfaction.

13. Wealthscape

Fidelity Wealthscape is a comprehensive wealth management platform that offers portfolio management tools for financial advisors and registered investment advisors (RIAs). It provides access to a wide range of investment products, research, and analytics, as well as integrated tools for portfolio construction and client reporting. With its user-friendly interface and customizable features, Wealthscape helps advisors manage client portfolios efficiently and deliver personalized investment solutions.

These are just a few examples of the top portfolio management software and tools available in the market. When choosing a solution for your investment needs, consider factors such as features, pricing, user experience, and integration capabilities to find the best fit for your requirements.

How to Choose the Right Portfolio Management Software?

Selecting the right portfolio management software is a crucial decision that can have a significant impact on your investment success. Here are some key steps to help you make an informed choice:

Assess Your Requirements

Before diving into the myriad options available, take some time to assess your specific requirements and preferences. Consider factors such as the size and complexity of your investment portfolio, your investment goals and objectives, and the level of detail and customization you require in a portfolio management tool. Some points to consider include:

- Scope of Investments: Determine the types of assets you’ll be managing, such as stocks, bonds, mutual funds, real estate, or alternative investments.

- Features Needed: Identify the specific features and functionalities that are essential for your investment strategy, such as performance analysis, risk management, tax optimization, or integration with other financial tools.

- User Experience Preferences: Consider your preferences regarding user interface design, ease of navigation, and customization options. Some investors may prefer a simple and intuitive interface, while others may prioritize advanced analytics and customization capabilities.

Consider Budgetary Constraints

Budgetary considerations are another crucial factor in choosing portfolio management software. While some solutions may offer comprehensive features and robust capabilities, they may come with a higher price tag. Evaluate your budget and weigh the cost of the software against its potential benefits and value proposition. Keep in mind that the cheapest option may not always be the best choice if it lacks essential features or fails to meet your needs effectively.

- Subscription Costs: Consider the pricing structure of the software, including monthly or annual subscription fees, as well as any additional costs for premium features or upgrades.

- Scalability: Assess whether the software offers scalable pricing options that can accommodate your needs as your investment portfolio grows over time.

- Value for Money: Evaluate the overall value proposition of the software, considering factors such as the breadth of features, quality of customer support, and potential return on investment.

Evaluate User-Friendliness

User-friendliness is a critical aspect of portfolio management software, as it directly impacts your ability to navigate the platform, access key information, and make informed decisions. Look for software that offers an intuitive user interface, clear navigation pathways, and customizable dashboards that allow you to organize and prioritize information according to your preferences. Consider the following:

- Ease of Use: Test the software’s interface and features to assess how intuitive and user-friendly it is for your specific needs.

- Customization Options: Evaluate the degree of customization available within the software, such as the ability to personalize dashboards, reports, and alerts to suit your preferences.

- Training and Support: Consider the availability of training resources, tutorials, and customer support options to help you get up to speed with the software quickly and address any issues or questions that may arise.

Seek Recommendations and Reviews

Gathering feedback from other users and industry experts can provide valuable insights into the strengths and weaknesses of different portfolio management software solutions. Seek recommendations from trusted sources, such as financial advisors, fellow investors, or online communities and forums. Additionally, read reviews and testimonials from current users to get a sense of their experiences with the software. Some points to consider include:

- User Reviews: Look for reviews and testimonials from users who have similar investment objectives and preferences to yours, paying attention to both positive and negative feedback.

- Industry Recognition: Consider whether the software has received any awards or accolades from industry publications or organizations, which can serve as a validation of its quality and effectiveness.

- Professional Recommendations: Consult with financial professionals or experts in the field to get their recommendations and insights into the best portfolio management software for your needs.

Trial Period and Customer Support

Before committing to a specific portfolio management software, take advantage of any free trials or demo periods offered by the provider. This allows you to test drive the software, explore its features and capabilities, and determine whether it meets your expectations. Additionally, evaluate the quality and responsiveness of customer support provided by the software provider, as timely assistance and support are essential for addressing any technical issues or questions that may arise. Consider the following:

- Trial Period: Take advantage of any free trials or demo periods offered by the software provider to evaluate the software firsthand and assess its suitability for your needs.

- Customer Support Channels: Evaluate the availability and responsiveness of customer support channels, such as phone, email, live chat, or online help resources.

- Training and Onboarding: Inquire about the availability of training resources, onboarding assistance, and ongoing support options to ensure a smooth transition to using the software.

By following these steps and considerations, you can effectively evaluate and choose the right portfolio management software that aligns with your investment objectives, preferences, and budgetary constraints.

How to Maximize the Benefits of Portfolio Management Software?

Optimizing your use of portfolio management software can greatly enhance your investment experience and outcomes. Here are some valuable tips to help you maximize the benefits of your chosen software:

- Stay Organized with Regular Updates: Keep your investment portfolios up-to-date by regularly entering transactions and updating asset values. This ensures that your portfolio data is accurate and reflects your current financial position.

- Utilize Advanced Features for Analysis: Explore the full range of analytical tools and features offered by your portfolio management software. Use features such as performance attribution analysis, scenario modeling, and risk assessment to gain deeper insights into your investment performance and make informed decisions.

- Customize Reports for Your Needs: Tailor your reports and dashboards to focus on the key metrics and indicators that matter most to you. Customize charts, graphs, and tables to visualize your portfolio performance in a way that is meaningful and actionable.

- Stay Informed About Updates and New Features: Keep abreast of software updates and new features released by your portfolio management provider. Take advantage of new functionalities and enhancements to optimize your investment strategy and workflow.

- Implement Tax Optimization Strategies: Leverage tax management features offered by your portfolio management software to optimize your tax efficiency. Explore strategies such as tax-loss harvesting, asset location, and tax-efficient fund selection to minimize tax liabilities and maximize after-tax returns.

- Automate Routine Tasks: Streamline your investment process by automating routine tasks and workflows. Set up alerts and notifications for important events such as portfolio rebalancing opportunities, dividend payments, or tax deadlines.

- Stay Disciplined with Your Investment Strategy: Use your portfolio management software to stay disciplined and stick to your investment strategy. Set clear goals and objectives, and use the software to track your progress and monitor your performance against benchmarks.

- Seek Continuous Improvement: Continuously evaluate and refine your investment approach based on insights gained from your portfolio management software. Identify areas for improvement and adjustment, and use the software to test and implement changes to your strategy over time.

By following these tips and incorporating them into your investment routine, you can unlock the full potential of your portfolio management software and achieve greater success in managing your investment portfolios.

Conclusion

Selecting the right project portfolio management software is crucial for streamlining your project management process and achieving success in your organization’s initiatives. By leveraging the features and capabilities offered by these tools, you can effectively plan, track, and prioritize your projects, ensuring alignment with your strategic objectives and maximizing your team’s productivity. Whether you’re a small team or a large enterprise, investing in the right project portfolio management software can make a significant difference in your ability to deliver projects on time, within budget, and with the desired outcomes.

Furthermore, as technology continues to evolve and businesses face increasing demands for efficiency and agility, project portfolio management software will play an even more essential role in driving organizational success. By staying informed about the latest advancements in project management technology and continuously refining your approach to portfolio management, you can stay ahead of the competition and achieve your business goals more effectively. Remember to assess your requirements, compare different software solutions, and prioritize user-friendly interfaces and robust features to ensure you select the best project portfolio management software for your needs.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.