- What is Investment Management?

- What is Investment Management Software?

- Key Investment Management Software Features

- Top Investment Management Software and Tools

- How to Choose the Best Investment Management Software?

- How to Implement Investment Management Software?

- Investment Management Software Best Practices

- Conclusion

Are you looking to optimize your investment strategy and make smarter financial decisions? In today’s fast-paced and complex investment landscape, having the right tools at your disposal can make all the difference. Whether you’re a seasoned investor or just starting out, finding the best investment management software and tools is essential for maximizing returns, managing risk, and achieving your financial goals. With a wide range of options available, navigating the world of investment software can seem daunting.

That’s why we’ve created this guide to help you understand the key features, benefits, and considerations when choosing investment management software. From portfolio tracking and performance analysis to risk management and integration capabilities, we’ll cover everything you need to know to find the perfect solution for your investment needs. So let’s dive in and explore the top investment management software and tools that can help you take your investment strategy to the next level.

What is Investment Management?

Investment management encompasses the professional management of various securities and assets to meet specific investment goals for investors. It involves making informed decisions about asset allocation, portfolio diversification, risk management, and investment selection to optimize returns while mitigating risks.

Importance of Investment Management

Investment management is crucial for several reasons:

- Goal Achievement: Effective investment management helps investors achieve their financial goals, whether it’s saving for retirement, funding education expenses, or building wealth over time.

- Risk Mitigation: Properly managed investment portfolios are diversified across different asset classes and sectors, reducing the overall risk of loss and volatility.

- Wealth Preservation: Investment management focuses on preserving and growing wealth over the long term, ensuring that investors can maintain their standard of living and meet future financial obligations.

- Inflation Protection: Investing in assets that outpace inflation helps protect the purchasing power of wealth and ensures that investors can maintain their desired lifestyle despite rising prices.

- Tax Efficiency: Investment management strategies aim to minimize tax liabilities through tax-efficient investment vehicles, tax-loss harvesting, and other tax optimization techniques.

- Professional Expertise: Professional investment managers have the expertise, knowledge, and resources to analyze market trends, conduct research, and make informed investment decisions on behalf of clients.

- Time Savings: Outsourcing investment management tasks to professionals allows investors to focus on other aspects of their lives, such as career, family, or leisure activities, without the burden of constant monitoring and decision-making.

What is Investment Management Software?

Investment management software refers to digital tools and platforms designed to assist investors in managing their investment portfolios more efficiently. These software solutions offer a wide range of features and functionalities, including portfolio tracking, performance analysis, risk assessment, and reporting capabilities.

Importance of Using Investment Management Tools

Investment management tools play a crucial role in helping investors make informed decisions and optimize their investment portfolios. Here are some reasons why using investment management tools is essential:

- Data Aggregation: Investment management tools allow investors to aggregate all their investment accounts and holdings in one place, providing a comprehensive view of their financial position.

- Performance Analysis: These tools offer performance analysis tools that help investors assess the performance of their investment portfolios, identify trends, and track progress towards their financial goals.

- Risk Management: Investment management tools provide risk assessment and management features that help investors identify, measure, and mitigate various types of investment risk.

- Automation: Many investment management tools offer automation features that streamline routine tasks such as data updates, portfolio rebalancing, and report generation, saving investors time and effort.

- Decision Support: These tools provide valuable insights, research, and analytics that help investors make informed investment decisions based on data-driven analysis rather than emotions or speculation.

- Compliance and Reporting: Investment management tools help investors ensure compliance with regulatory requirements and provide customizable reporting capabilities for clients, stakeholders, or regulatory authorities.

Investment management software and tools empower investors to take control of their financial futures, make informed decisions, and achieve their investment goals with greater efficiency and confidence.

Key Investment Management Software Features

When selecting investment management software, it’s essential to assess various key features to ensure it meets your specific needs and objectives. Let’s delve into each of these features in detail:

Portfolio Tracking and Management

Portfolio tracking and management are fundamental aspects of any investment management software. This feature allows you to monitor and manage your investment portfolio effectively. Here’s what to look for:

- Comprehensive Tracking: The software should provide comprehensive tracking capabilities for all types of investments, including stocks, bonds, mutual funds, ETFs, and alternative assets.

- Real-time Updates: Ensure the software offers real-time updates on portfolio performance, asset allocation, and individual security positions.

- Transaction Recording: Look for tools that allow you to record and track transactions, including buys, sells, dividends, and corporate actions.

- Customization Options: Choose software that offers customization options for organizing and categorizing your investments based on your preferences and investment strategy.

Performance Analysis and Reporting

Performance analysis and reporting tools are critical for evaluating the success of your investment strategies and making informed decisions. Here’s what to consider:

- Performance Metrics: The software should provide a range of performance metrics, including return on investment (ROI), annualized returns, volatility, Sharpe ratio, and benchmark comparisons.

- Visualization Tools: Look for tools that offer intuitive visualization features such as charts, graphs, and performance heatmaps to help you analyze and interpret data effectively.

- Customizable Reports: Ensure the software allows you to generate customizable reports tailored to your specific needs, whether for personal use, client reporting, or compliance purposes.

- Historical Analysis: Choose software that offers historical performance analysis tools, allowing you to assess performance trends over time and identify areas for improvement.

Risk Management

Effective risk management is essential for preserving capital and achieving long-term investment objectives. Here’s what to look for in risk management features:

- Risk Assessment Tools: The software should offer robust risk assessment tools to identify and quantify various types of risk, including market risk, credit risk, liquidity risk, and geopolitical risk.

- Stress Testing: Look for tools that allow you to conduct stress tests on your portfolio to simulate the impact of adverse market conditions or economic scenarios.

- Asset Allocation Optimization: Choose software that offers asset allocation optimization tools based on your risk tolerance, investment horizon, and financial goals.

Integration Capabilities

Integration capabilities allow your investment management software to seamlessly connect with other financial tools and platforms, streamlining workflows and improving efficiency.

- Brokerage Integration: Ensure the software integrates with major brokerage platforms, allowing for direct access to account information and trade execution.

- Financial Planning Integration: Look for integration with financial planning software to facilitate holistic wealth management solutions, including retirement planning, tax optimization, and goal setting.

- Third-party Data Integration: Choose software that supports integration with third-party data providers, offering access to additional market data, research, and analytics.

User Interface and Ease of Use

The user interface and overall user experience play a significant role in the adoption and effectiveness of investment management software.

- Intuitive Design: Opt for software with a clean, intuitive user interface that makes it easy to navigate and access key features.

- Customization Options: Look for software that offers customization options for the interface, layouts, and settings to suit your preferences and workflow.

- Mobile Accessibility: Ensure the software is accessible via mobile devices, either through a responsive web interface or dedicated mobile app, allowing you to manage your investments on the go.

Investment management software with robust features in these areas can significantly enhance your ability to monitor, analyze, and manage your investment portfolio effectively. Take the time to evaluate your specific needs and objectives to find the software that best aligns with your requirements.

Top Investment Management Software and Tools

Choosing the right investment management software and tools is crucial for optimizing your investment strategy and achieving your financial goals. Here, we explore some of the top options available in the market, each offering unique features and capabilities to cater to various investment needs:

1. Personal Capital

Personal Capital stands out as a comprehensive financial management platform that offers a wide array of tools for tracking investments, analyzing performance, and planning for retirement. With automatic account aggregation, users can effortlessly consolidate all their financial accounts in one place, gaining a holistic view of their financial health.

The platform’s robust portfolio analysis tools provide insights into asset allocation, risk exposure, and investment fees, empowering users to make informed decisions about their investment portfolios. Additionally, Personal Capital’s retirement planning tools help users set realistic retirement goals and track their progress over time, ensuring they stay on track to achieve their long-term financial objectives.

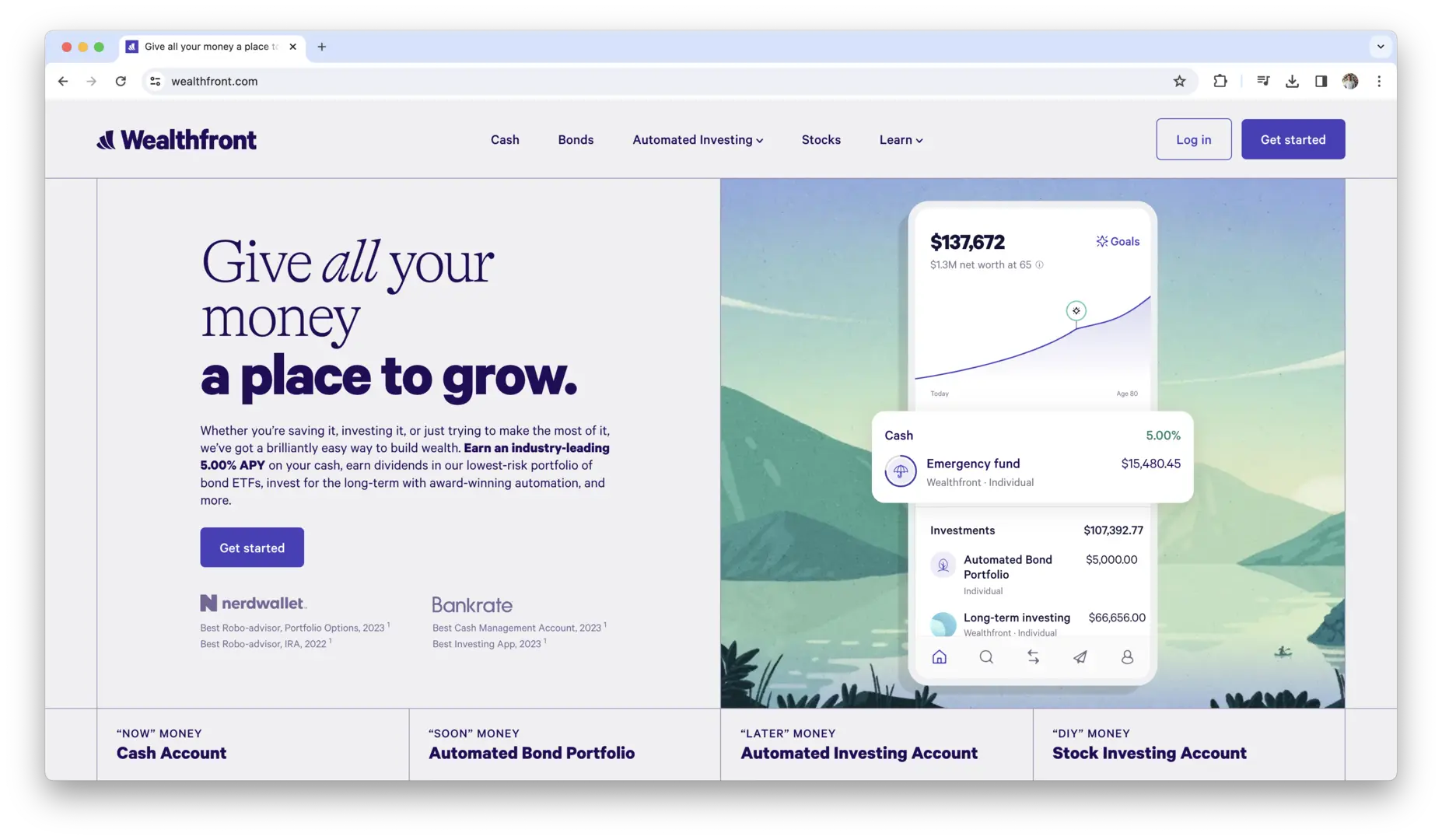

2. Wealthfront

Wealthfront is a popular robo-advisor platform renowned for its algorithmic approach to investment management. Catering to investors seeking a hands-off approach, Wealthfront offers automated portfolio management based on predetermined criteria and risk tolerance levels. The platform’s tax-loss harvesting and direct indexing features optimize tax efficiency, helping users minimize tax liabilities and maximize after-tax returns.

With a focus on low-cost, diversified investment strategies, Wealthfront provides users with a hassle-free way to grow their wealth over time, making it an excellent choice for individuals looking to invest for the long term without the need for active portfolio management.

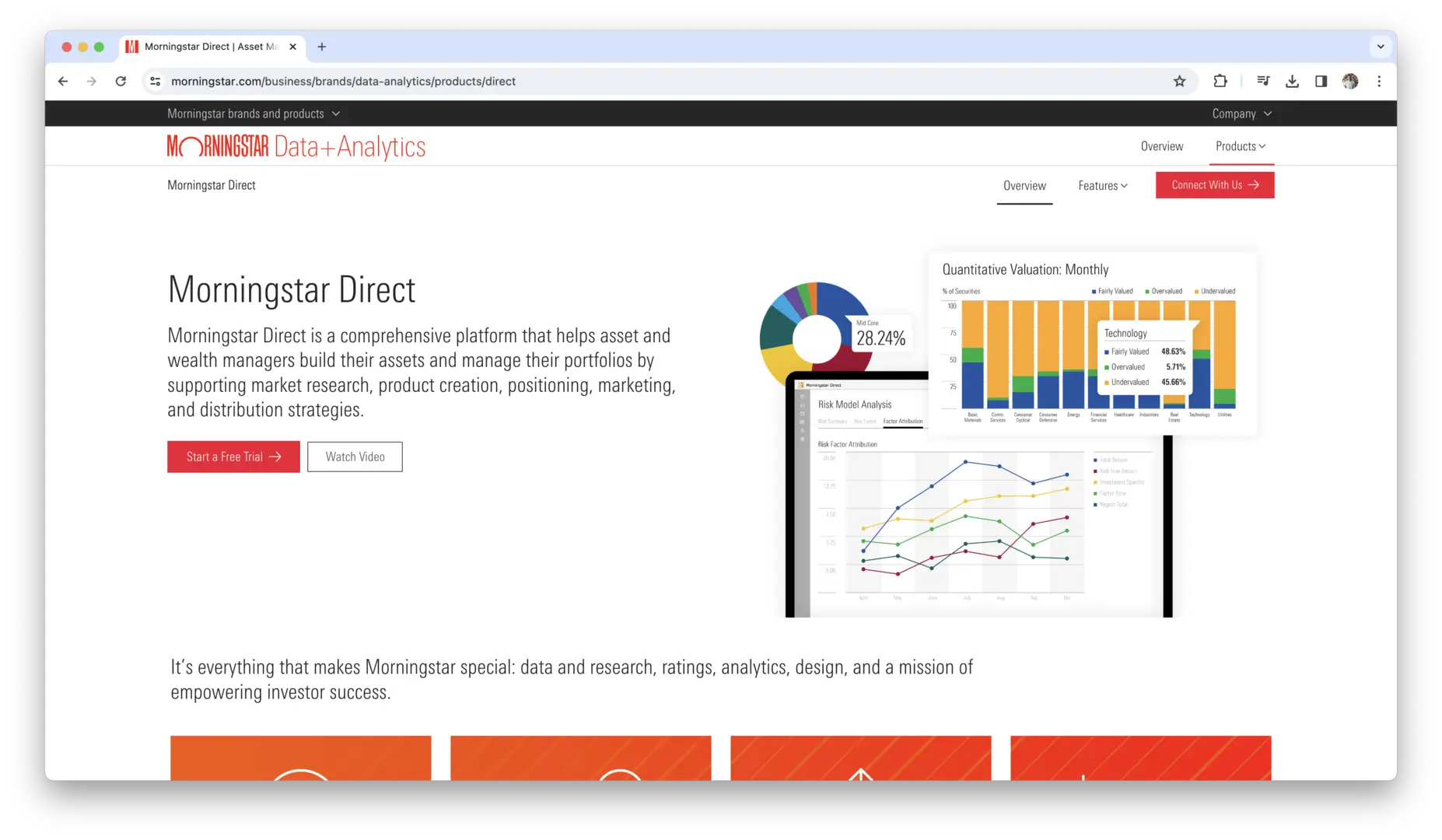

3. Morningstar Direct

Morningstar Direct is a powerful institutional investment analysis platform designed for professional investors and financial institutions. Offering advanced portfolio analytics, investment research, and risk management tools, Morningstar Direct provides users with the insights and data they need to make informed investment decisions and manage complex portfolios effectively.

The platform’s extensive database of investment data, including fund performance, holdings, and expenses, allows users to conduct in-depth research and analysis, enabling them to identify investment opportunities and mitigate risks effectively. Moreover, Morningstar Direct’s customizable reporting capabilities enable users to communicate investment insights and strategies with clients, stakeholders, and regulatory authorities seamlessly.

4. Betterment

Betterment is an online investment platform that caters to both novice and experienced investors, offering robo-advising and self-directed investing options. With features like goal-based investing, tax-efficient portfolio management, and automatic rebalancing, Betterment simplifies the investment process, making it accessible to a wide range of users.

The platform’s intuitive interface and personalized investment recommendations help users set and achieve their financial goals with ease and confidence. Whether users prefer a hands-off approach to investing or want more control over their investment decisions, Betterment provides a flexible solution that adapts to their needs and preferences.

5. YCharts

YCharts is a comprehensive financial research platform that offers users access to a vast array of investment data, tools, and analytics. From stock screening and charting to fundamental analysis and economic indicators, YCharts equips investors with the insights and information they need to make informed investment decisions.

The platform’s customizable dashboards and interactive charts enable users to visualize market trends and track the performance of their investments effectively. Moreover, YCharts’ extensive database of financial data, including historical pricing, corporate financials, and economic data, empowers users to conduct thorough research and analysis, gaining a deeper understanding of the markets and investment opportunities.

6. Quicken

Quicken is a popular personal finance management software that offers investment tracking and portfolio management features. With tools for tracking investments, monitoring performance, and generating reports, Quicken helps individuals stay organized and make informed investment decisions. The platform’s integration with financial institutions allows users to automatically download and categorize transactions, saving time and effort.

Moreover, Quicken’s portfolio analysis tools enable users to evaluate asset allocation, performance, and investment fees, helping them optimize their investment portfolios for better returns. Whether users are managing their investments individually or with a financial advisor, Quicken provides the tools and insights they need to achieve their financial goals with confidence.

7. Bloomberg Terminal

Bloomberg Terminal is a professional-grade financial data and analytics platform widely used by traders, analysts, and financial professionals worldwide. Offering real-time market data, news, research, and analysis tools, Bloomberg Terminal provides users with unparalleled insights and capabilities for managing investments and making trading decisions.

The platform’s extensive coverage of global financial markets, asset classes, and economic indicators enables users to stay informed about market trends and developments, helping them identify investment opportunities and mitigate risks effectively. Moreover, Bloomberg Terminal’s customizable interface and advanced charting tools allow users to analyze market data and trends with precision, gaining a deeper understanding of the markets and making more informed investment decisions.

8. Tiller Money

Tiller Money is a financial management tool that integrates with spreadsheets to help users track their finances and investments in one place. With automatic transaction updates and customizable templates, Tiller Money simplifies budgeting, expense tracking, and investment monitoring. Users can create personalized financial dashboards and reports to gain insights into their investment performance and make informed decisions about their portfolios.

9. eMoney Advisor

eMoney Advisor is a comprehensive financial planning platform designed for financial advisors and wealth management firms. Offering features such as financial goal planning, cash flow analysis, and estate planning tools, eMoney Advisor enables advisors to deliver personalized financial plans and recommendations to their clients. The platform’s interactive client portal allows users to collaborate with clients, share documents, and track progress towards financial goals in real-time.

10. SigFig

SigFig is an investment management platform that offers robo-advising services and portfolio tracking tools. With automated portfolio management, tax optimization, and personalized investment recommendations, SigFig helps users build and manage diversified investment portfolios tailored to their financial goals and risk tolerance. The platform’s intuitive interface and goal-based investing approach make it easy for users to stay on track towards achieving their long-term investment objectives.

11. M1 Finance

M1 Finance is an online brokerage platform that offers automated investing, customizable portfolios, and fractional share trading. With features like dynamic rebalancing, tax-efficient investing, and flexible portfolio construction options, M1 empowers users to build and manage diversified investment portfolios with ease. The platform’s intuitive mobile app and user-friendly interface make it accessible to investors of all experience levels, from beginners to seasoned professionals.

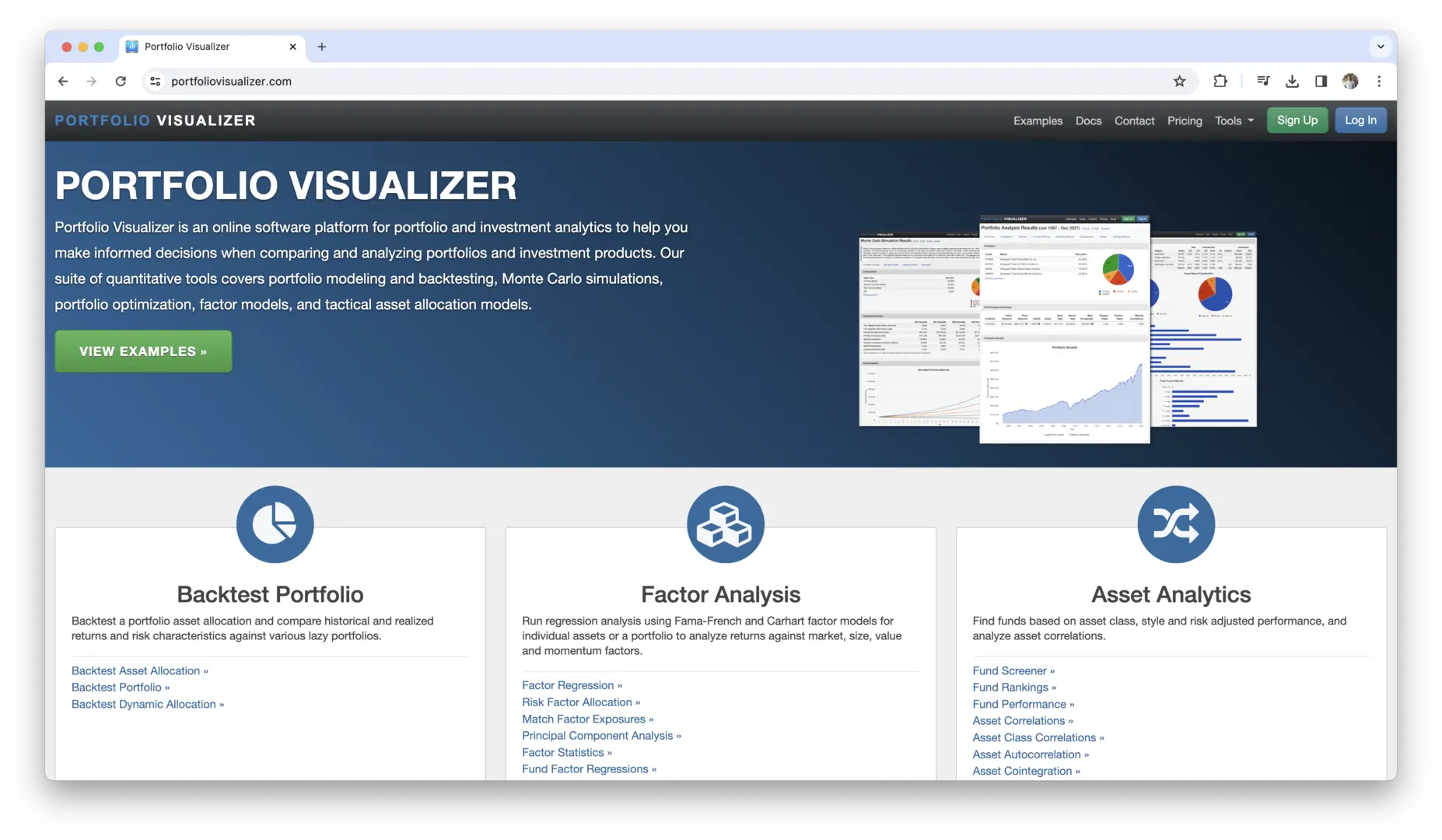

12. Portfolio Visualizer

Portfolio Visualizer is a free online investment analysis tool that allows users to backtest investment strategies, analyze portfolio performance, and conduct asset allocation studies. With features like Monte Carlo simulation, efficient frontier analysis, and correlation matrices, Portfolio Visualizer provides users with valuable insights into their investment portfolios and helps them optimize asset allocation for better risk-adjusted returns. The platform’s customizable charts and graphs enable users to visualize investment data and trends effectively, facilitating informed decision-making.

13. Fundrise

Fundrise is an online real estate investment platform that offers access to diversified real estate portfolios through REITs (Real Estate Investment Trusts) and eREITs (electronic Real Estate Investment Trusts). With features like automated portfolio management, dividend reinvestment, and tax-efficient investing, Fundrise allows users to invest in real estate with low minimums and without the hassles of property management. The platform’s transparent fee structure and easy-to-use interface make it a popular choice for individuals looking to diversify their investment portfolios with real estate assets.

14. Stash

Stash is an investment app that offers fractional share investing, personalized investment recommendations, and educational content to help users build wealth over time. With features like goal-based investing, automatic saving, and cash back rewards, Stash makes investing accessible and affordable for users of all income levels. The platform’s easy-to-use interface and gamified investing experience encourage users to develop healthy financial habits and achieve their financial goals with confidence.

15. Stock Rover

Stock Rover is an investment research platform that provides users with comprehensive stock screening, portfolio analysis, and research tools. With features like customizable screeners, in-depth financial data, and charting capabilities, Stock Rover empowers users to identify investment opportunities, evaluate company fundamentals, and track portfolio performance effectively. The platform’s intuitive interface and powerful analytical tools make it a valuable resource for investors seeking to make informed decisions and optimize their investment portfolios for long-term success.

These top investment management software and tools offer a range of features and functionalities to suit different investment styles, preferences, and objectives. Whether you’re a novice investor looking to get started or a seasoned professional managing complex portfolios, there’s a solution out there to help you optimize your investment strategy and achieve your financial goals.

How to Choose the Best Investment Management Software?

Selecting the right investment management software is a critical decision that requires careful consideration of various factors to ensure it aligns with your unique needs and preferences. Let’s explore these factors in detail:

Budget

Your budget plays a significant role in determining the investment management software that is feasible for you.

- Upfront Costs vs. Ongoing Expenses: Some software may have a one-time upfront cost, while others operate on a subscription basis with recurring fees. Evaluate your budget to determine which payment structure is more suitable for you.

- Scalability of Pricing: Consider how pricing scales with the size of your investment portfolio or the number of users. Ensure that the software remains affordable as your needs grow.

- Value for Money: Assess the features and functionality offered by the software in relation to its cost. Look for software that provides the best value for your budget.

Scalability

Scalability is essential, especially if you anticipate your investment portfolio growing over time.

- Portfolio Size: Ensure that the software can accommodate a growing portfolio without sacrificing performance or functionality. Scalable software should be able to handle increasing volumes of data and transactions efficiently.

- User Base: If you’re choosing software for a team or organization, consider whether it can scale to support multiple users with varying levels of access and permissions.

- Additional Features: Evaluate whether the software offers additional features or modules that can be added as your needs evolve, allowing you to scale your investment management capabilities seamlessly.

Customization Options

Every investor has unique preferences and requirements when it comes to managing their investments. Look for software that offers ample customization options to tailor the experience to your specific needs:

- Dashboard Customization: Choose software that allows you to customize the dashboard layout, widgets, and data visualization options according to your preferences.

- Report Customization: Ensure that the software enables you to create custom reports with the metrics, charts, and data points that are most relevant to you or your clients.

- Alerts and Notifications: Look for customization options for setting up alerts and notifications based on specific criteria, such as portfolio performance thresholds or market events.

Customer Support

Reliable customer support is crucial, especially when dealing with complex software or encountering technical issues.

- Availability: Determine the availability of customer support channels, including phone, email, live chat, and knowledge base resources. Choose software that offers support during your business hours or trading hours.

- Response Time: Assess the average response time for customer support inquiries and the efficiency of issue resolution. Look for software providers with a reputation for prompt and helpful customer support.

- Training and Resources: Evaluate the availability of training materials, tutorials, and documentation to help you get started with the software and maximize its features effectively.

Security and Compliance

Security and compliance are paramount when dealing with sensitive financial data and personal information. Ensure that the investment management software adheres to industry best practices and regulatory requirements:

- Data Encryption: Look for software that employs robust encryption protocols to protect data transmission and storage from unauthorized access or cyber threats.

- Compliance Features: Ensure that the software offers features and tools to facilitate compliance with relevant regulations, such as GDPR, SEC, or FINRA requirements.

- Audit Trails: Choose software that maintains detailed audit trails and activity logs to track user actions and changes to sensitive data, providing transparency and accountability.

Considering these factors in your evaluation process will help you make an informed decision and choose investment management software that meets your needs while staying within your budget and ensuring scalability, customization, customer support, and security.

How to Implement Investment Management Software?

Implementing and integrating investment management software into your workflow is a crucial step towards optimizing your investment processes and achieving your financial goals. Let’s explore the key aspects of implementation and integration in detail:

Steps for Implementation

Implementing investment management software involves several steps to ensure a smooth transition and effective utilization of the software’s features. Here’s a breakdown of the implementation process:

- Assessment of Needs: Begin by assessing your specific needs and objectives for implementing the software. Identify the features and functionality that are essential for your investment management tasks.

- Selection of Software: Choose the software that best aligns with your needs and preferences based on thorough research and evaluation. Consider factors such as functionality, pricing, scalability, and user experience.

- Data Migration: If you’re transitioning from existing systems or spreadsheets, plan and execute the migration of your investment data to the new software. Ensure data integrity and accuracy throughout the migration process.

- Configuration and Customization: Configure the software settings and customize the interface to suit your preferences and workflow. Set up dashboards, reports, alerts, and notifications according to your requirements.

- User Training: Provide comprehensive training to users who will be using the software, including portfolio managers, analysts, administrators, and support staff. Offer hands-on training sessions, tutorials, and documentation to familiarize users with the software’s features and functionality.

- Testing and Quality Assurance: Conduct thorough testing of the software to ensure all features are working correctly and meeting your expectations. Identify any bugs, issues, or discrepancies and work with the software provider to address them promptly.

- Deployment: Once testing is complete and any issues have been resolved, deploy the software for full production use. Monitor the software closely during the initial deployment phase to ensure stability and performance.

- Feedback and Iteration: Encourage feedback from users and stakeholders regarding their experience with the software. Use this feedback to make iterative improvements and optimizations to enhance user satisfaction and productivity.

Integration with Existing Systems

Integration with existing systems is essential for seamless data flow and workflow continuity. Here’s how to effectively integrate investment management software with your existing systems:

- Assessment of Compatibility: Evaluate the compatibility of the investment management software with your existing systems, such as accounting software, CRM systems, and data providers.

- API Integration: Check if the software offers APIs (Application Programming Interfaces) or integration capabilities that allow for seamless data exchange and interoperability with your existing systems.

- Custom Development: In some cases, custom development may be required to establish integration between the investment management software and your existing systems. Work with developers or third-party integration partners to develop custom solutions if needed.

- Data Mapping and Transformation: Ensure that data mapping and transformation processes are in place to reconcile data formats and structures between different systems. This ensures accurate and consistent data flow across the integrated systems.

- Testing and Validation: Conduct thorough testing of the integration to verify data accuracy, integrity, and reliability. Test various scenarios and data flows to identify and address any issues or discrepancies.

- Documentation and Maintenance: Maintain detailed documentation of the integration setup, including data mappings, API configurations, and troubleshooting procedures. Regularly monitor and maintain the integration to address any changes or updates to the software or existing systems.

Training and Support

Training and ongoing support are essential for ensuring user adoption and maximizing the benefits of investment management software. Here’s how to provide effective training and support to users:

- Initial Training Sessions: Offer comprehensive training sessions for users to familiarize them with the software’s features, functionality, and best practices. Provide hands-on training with real-life scenarios and examples.

- On-Demand Resources: Provide access to on-demand training resources, such as tutorials, videos, user guides, and knowledge base articles. These resources allow users to reinforce their learning and find answers to common questions independently.

- Dedicated Support Channels: Establish dedicated support channels, such as a helpdesk, email support, or live chat, to address user inquiries, issues, and technical challenges promptly.

- User Communities and Forums: Encourage users to participate in user communities, forums, and discussion groups related to the investment management software. These platforms facilitate knowledge sharing, collaboration, and peer support among users.

- Regular Updates and Communication: Keep users informed about software updates, new features, and best practices through regular communications, newsletters, and announcements. Provide training sessions or documentation for major updates to ensure users are up to date with the latest enhancements.

By following these steps for implementation and integration and providing comprehensive training and support to users, you can ensure a successful rollout of investment management software within your organization, leading to improved efficiency, productivity, and decision-making capabilities.

Investment Management Software Best Practices

Investment management software can significantly enhance your ability to monitor, analyze, and manage your investment portfolio effectively. Here are some valuable tips for maximizing the benefits of investment management software:

- Regularly Update and Review Data: Ensure that your investment data is up to date by regularly syncing your accounts and reconciling transactions. Review your portfolio performance and asset allocation periodically to identify any areas for adjustment or optimization.

- Utilize Analytical Tools Effectively: Take advantage of the analytical tools and features offered by the software to gain insights into your investment performance, risk exposure, and market trends. Use performance metrics, charts, and reports to assess your portfolio’s performance and make informed decisions.

- Stay Informed About Market Trends: Stay abreast of market trends, economic indicators, and geopolitical events that may impact your investments. Use the research and analysis tools provided by the software to monitor market developments and adjust your investment strategy accordingly.

- Set and Monitor Investment Goals: Define clear investment goals and objectives, such as retirement planning, wealth accumulation, or risk management. Use the goal-setting features of the software to track your progress towards these goals and adjust your investment strategy as needed.

- Diversify Your Portfolio: Implement a diversified investment strategy to spread risk across different asset classes, sectors, and geographic regions. Use the portfolio analysis tools provided by the software to assess your portfolio’s diversification and make adjustments to optimize risk-adjusted returns.

- Automate Routine Tasks: Take advantage of automation features offered by the software to streamline routine tasks such as data aggregation, portfolio rebalancing, and report generation. Automating these tasks can save you time and reduce the likelihood of errors.

- Stay Disciplined and Patient: Stick to your investment strategy and resist the temptation to make impulsive decisions based on short-term market fluctuations. Use the software’s performance tracking and reporting tools to stay disciplined and focused on your long-term investment goals.

- Monitor Fees and Expenses: Keep a close eye on the fees and expenses associated with your investments, including management fees, transaction costs, and taxes. Use the software’s fee analysis tools to assess the impact of fees on your investment returns and consider cost-effective alternatives.

- Seek Professional Advice When Needed: While investment management software can provide valuable insights and tools for self-directed investors, there may be times when professional advice is warranted. Consult with a financial advisor or investment professional for personalized guidance and recommendations.

By following these tips, you can leverage the full potential of investment management software to enhance your investment outcomes, achieve your financial goals, and build long-term wealth.

Conclusion

Choosing the right investment management software and tools can significantly impact your financial success. By leveraging these technologies, you gain access to powerful features that streamline portfolio tracking, enhance performance analysis, and mitigate risks. Whether you’re an individual investor or managing a portfolio for a business, finding the right software can make the difference between achieving your financial goals and falling short. Therefore, take the time to evaluate your needs, consider the key features discussed in this guide, and select a solution that aligns with your objectives and preferences.

Remember, investment management is not just about making money; it’s also about preserving wealth, managing risks, and achieving long-term financial security. The top investment management software and tools highlighted in this guide offer a range of benefits, from automation and customization to insightful analytics and compliance features. By harnessing the power of these tools, you can optimize your investment strategy, make informed decisions, and navigate the complexities of the financial markets with confidence.

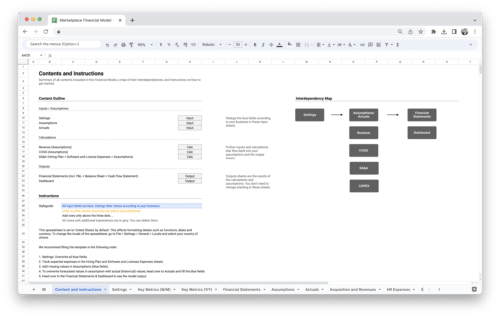

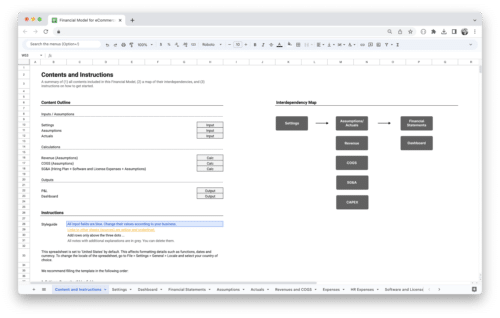

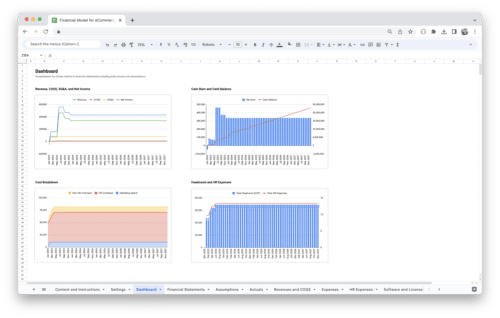

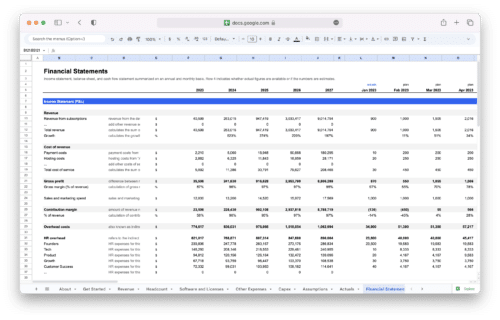

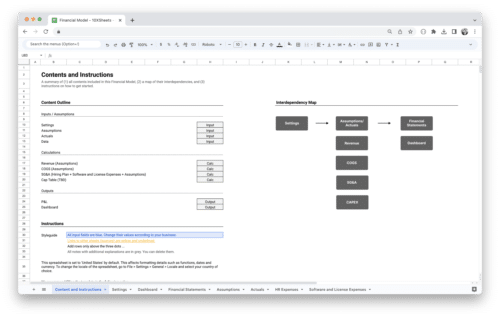

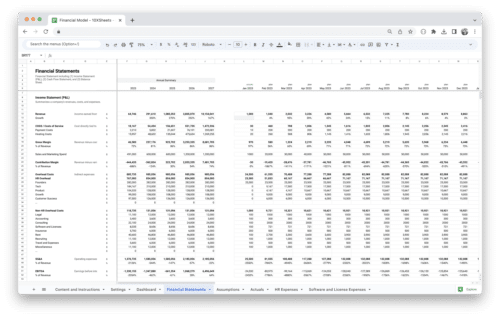

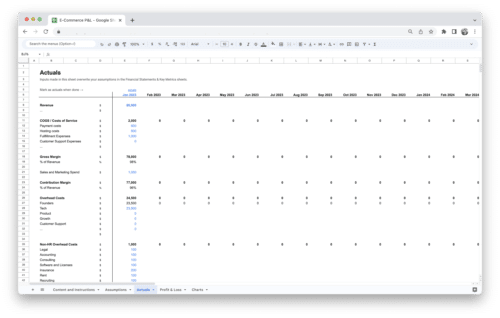

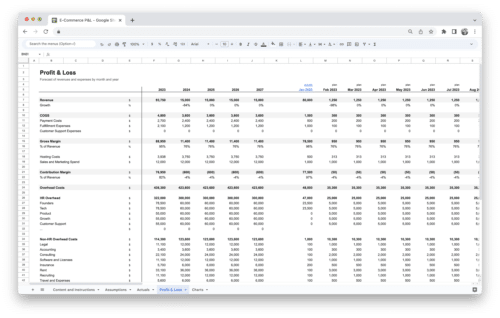

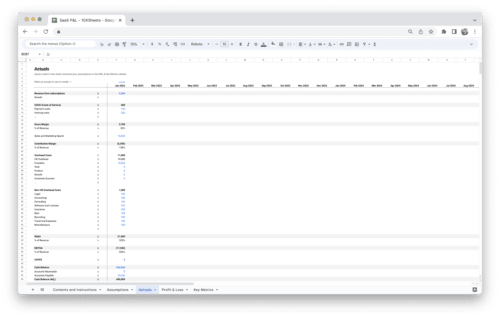

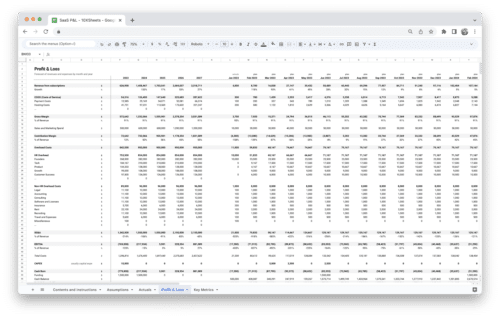

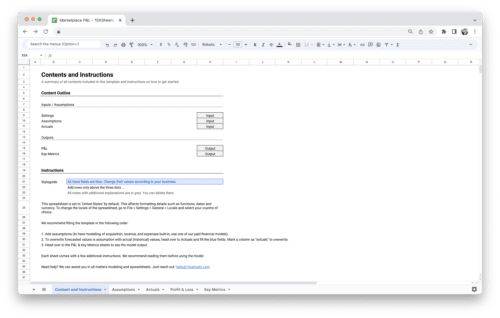

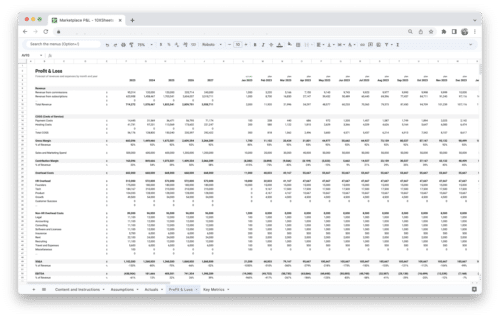

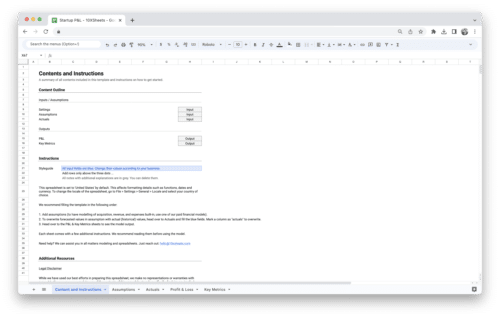

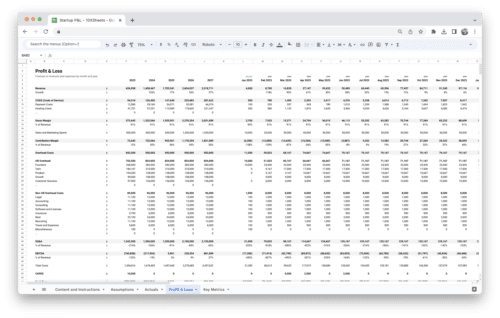

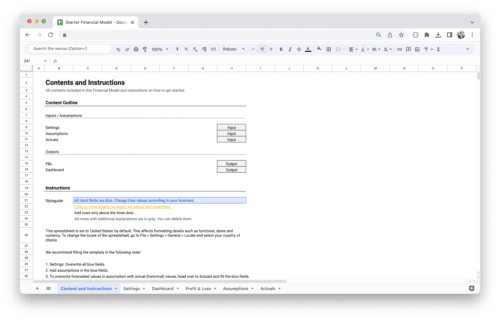

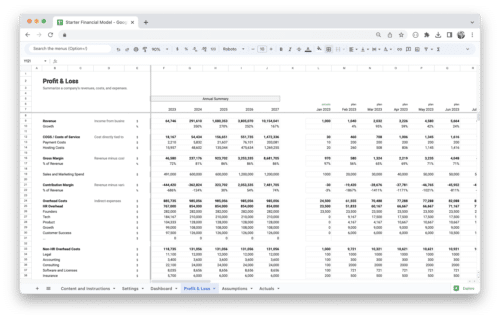

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.