Have you ever wondered how traders, investors, and financial analysts access real-time market data, analyze stock prices, and make informed investment decisions? The answer lies in financial data APIs – powerful tools that provide seamless access to a wealth of financial information through programmable interfaces. In today’s digital age, where data drives decision-making across industries, financial data APIs play a crucial role in democratizing access to market data, empowering individuals and organizations with the insights they need to navigate the complexities of the financial markets.

From real-time stock quotes and historical market data to company fundamentals and economic indicators, these APIs offer a treasure trove of data that fuels innovation, drives efficiency, and facilitates informed decision-making within the finance industry and beyond. In this guide, we’ll explore the best financial data APIs available, their features, use cases, and how you can leverage them to gain a competitive edge in today’s dynamic and interconnected financial landscape. Whether you’re a seasoned trader, financial analyst, or developer, understanding the capabilities and potential of financial data APIs is essential for success in today’s data-driven economy.

What is a Financial API?

Financial APIs serve as essential tools in the realm of finance, enabling seamless access to a wide array of financial information through programmable interfaces. These APIs are designed to facilitate the retrieval of real-time and historical data related to various financial instruments, market indices, economic indicators, and more. The purpose of financial data APIs is to empower individuals, organizations, and developers with the ability to harness the power of data-driven insights to inform decision-making processes, conduct research, develop trading strategies, and build innovative financial applications.

Importance of Financial APIs in the Financial Industry

Financial data APIs play a pivotal role in the modern financial landscape, offering a multitude of benefits and opportunities across different sectors and functions within the industry. Here’s why they are indispensable:

- Accessibility: Financial data APIs democratize access to financial information, making it readily available to a diverse range of stakeholders, including individual investors, financial institutions, researchers, and developers.

- Efficiency: By providing real-time and on-demand access to financial data, APIs streamline the process of data retrieval and analysis, enabling faster decision-making and execution of financial transactions.

- Innovation: APIs fuel innovation by enabling developers to create new financial products, services, and applications that leverage the wealth of data available in the financial markets. From robo-advisors and trading algorithms to budgeting apps and portfolio management tools, the possibilities are endless.

- Competitive Advantage: Organizations that leverage financial data APIs gain a competitive edge by gaining insights into market trends, identifying investment opportunities, and optimizing their operations. Access to timely and accurate data can help them stay ahead of the curve and adapt to changing market conditions.

- Risk Management: Financial data APIs facilitate risk management by providing access to a diverse range of risk metrics, including market volatility, credit spreads, and liquidity indicators. This enables organizations to identify and mitigate risks proactively, protecting their assets and preserving shareholder value.

- Compliance: APIs play a crucial role in regulatory compliance by providing access to data needed for reporting, disclosure, and regulatory filings. They enable organizations to adhere to regulatory requirements such as MiFID II, GDPR, and SEC reporting standards while minimizing manual effort and errors.

Financial APIs are integral to the functioning of the financial industry, driving innovation, efficiency, and informed decision-making across various domains and stakeholders. Their importance will only continue to grow as the demand for real-time data and analytics continues to rise in an increasingly digital and interconnected world.

Understanding Financial Data APIs

Financial data APIs serve as the backbone for accessing a plethora of financial information programmatically. Let’s dive deeper into how these APIs operate, the various types of financial data they offer, and the key features that make them indispensable tools in the finance industry.

How Financial Data APIs Work

Financial data APIs function as intermediaries between data providers and users, facilitating the seamless exchange of financial information. When you send a request to a financial data API, it communicates with the provider’s servers to retrieve the requested data. This data is then formatted and delivered back to you in a structured format, such as JSON or XML, making it easy to integrate into your applications or trading systems.

One of the primary mechanisms used by financial data APIs is HTTP requests. By leveraging standard HTTP methods such as GET and POST, users can specify the data they need and retrieve it in real-time or asynchronously. Additionally, many APIs offer authentication mechanisms, such as API keys or OAuth tokens, to ensure secure access to sensitive data.

Types of Financial Data Available

Financial data APIs offer a diverse array of data types to cater to the myriad needs of users in the finance industry. Some of the most common types of financial data available through these APIs include:

- Stock Prices: Real-time and historical prices for individual stocks, ETFs, and other securities.

- Market Indices: Performance metrics for major market indices, such as the S&P 500, NASDAQ, and Dow Jones Industrial Average.

- Company Fundamentals: Fundamental financial metrics, including revenue, earnings, dividends, and balance sheet data, for publicly traded companies.

- Economic Indicators: Key macroeconomic indicators, such as GDP growth rates, inflation figures, unemployment rates, and consumer confidence indices.

- Alternative Data: Non-traditional datasets, such as social media sentiment, satellite imagery, and web traffic statistics, used for investment research and analysis.

These data types provide valuable insights into various aspects of the financial markets, enabling users to conduct in-depth analysis, develop trading strategies, and make informed investment decisions.

Key Features and Functionality

Financial data APIs offer a host of features and functionality designed to streamline the process of accessing and integrating financial data. Some of the key features to look out for include:

- Real-Time Data: The ability to access up-to-the-minute market data, ensuring that you have the latest information at your fingertips.

- Historical Data: Access to extensive historical datasets, allowing you to conduct backtesting, trend analysis, and performance evaluation.

- Customizable Requests: Flexibility in specifying data parameters and filters, enabling you to tailor requests to your specific requirements.

- Streaming Data: Support for streaming data feeds, which deliver real-time updates and alerts directly to your applications.

- Data Quality: Assurance mechanisms to ensure the accuracy, reliability, and integrity of the data being provided.

- Developer Tools: Comprehensive documentation, code samples, and SDKs to facilitate integration and development.

- Scalability: Robust infrastructure capable of handling large volumes of data and high request rates, ensuring optimal performance under varying load conditions.

By leveraging these features, users can unlock the full potential of financial data APIs and harness the power of data-driven insights to drive their financial endeavors.

Top Financial Data APIs

When it comes to accessing financial data programmatically, several APIs stand out for their comprehensive coverage, reliability, and ease of integration. Let’s explore some of the top financial data APIs in more detail:

1. Financial Modeling Prep

Financial Modeling Prep is a comprehensive financial data provider, offering an extensive range of tools and resources for developers, traders, and financial analysts. Known for its high accuracy and reliability, Financial Modeling Prep provides historical prices, fundamental data, and insider transactions going back 30 years, making it a go-to choice for detailed financial analysis and integration.

Features:

- Access to historical and real-time stock prices, fundamental data, and financial indicators.

- Detailed company information, including financial statements, key metrics, and market capitalization.

- Market news, press releases, and expert articles to keep users informed.

- Over 70,000 stocks covered with extensive data sets available.

Pros:

- User-friendly API documentation and an interactive API viewer for hands-on exploration.

- Data collected from trusted sources like the U.S. SEC and the Federal Reserve, ensuring high quality and reliability.

- Flexible data formats with support for JSON and CSV, and custom endpoints available for enterprise plans.

- Fast, accurate, and developer-friendly API with over 100 endpoints and continuous updates.

Financial Modeling Prep offers a robust and reliable platform for accessing a wide array of financial data, making it an invaluable resource for anyone involved in financial analysis, investment research, or application development.

Ready to get started? You can explore Financial Modeling Prep for free. Plus, as a special offer for 10XSheets readers, sign up for a paid plan using our link and enjoy an additional 15% off on all plans. Don’t miss this opportunity to elevate your financial data integration!

2. Alpha Vantage

Alpha Vantage offers a robust suite of APIs that provide access to a wide range of financial data, including real-time and historical stock prices, technical indicators, sector performance metrics, and cryptocurrency data. With its user-friendly interface and extensive coverage of global markets, Alpha Vantage has become a popular choice among developers, traders, and financial analysts.

Features:

- Real-time and historical data for equities, forex, cryptocurrencies, and more.

- Support for technical indicators such as moving averages, RSI, MACD, and Bollinger Bands.

- Flexible API endpoints with support for JSON and CSV formats.

- Free tier with generous usage limits and premium tiers for additional features and data.

Pros:

- Easy-to-use API with comprehensive documentation and code samples.

- Free access to basic data sets suitable for personal and small-scale projects.

- Support for multiple programming languages, including Python, JavaScript, and R.

Cons:

- Limited historical data available in the free tier.

- Rate limits and usage restrictions apply to free accounts, potentially limiting scalability for larger projects.

3. Intrinio

Intrinio is a leading provider of high-quality financial data feeds, offering a wide range of data sets covering equities, ETFs, mutual funds, indices, and more. With its emphasis on data quality and reliability, Intrinio is trusted by financial professionals, researchers, and developers for a variety of use cases, including investment analysis, algorithmic trading, and financial reporting.

Features:

- Real-time and historical stock prices, fundamentals, and market indices.

- Coverage of global markets, including exchanges in North America, Europe, and Asia.

- RESTful API architecture with support for JSON and CSV formats.

- Flexible pricing plans tailored to individual and enterprise users.

Pros:

- High-quality, institutional-grade data sourced from reliable providers.

- Comprehensive documentation and developer support resources.

- Flexible pricing options to suit varying budget and usage needs.

Cons:

- Higher pricing compared to some competitors, especially for enterprise users.

- Limited free trial period for testing the API, which may be restrictive for evaluating its suitability for long-term use.

4. Quandl

Nasdaq Data Link’s Quandl is renowned for its vast repository of alternative and economic data sets, offering access to thousands of datasets from hundreds of sources. From demographic and environmental data to financial and economic indicators, Quandl provides a treasure trove of data for researchers, analysts, and developers seeking unique insights into various aspects of the global economy.

Features:

- Diverse range of alternative data sets not available elsewhere.

- High-quality data curated from reputable sources and providers.

- RESTful API with support for multiple data formats, including JSON, CSV, and XML.

- Customizable data requests with filtering options based on time period, frequency, and data type.

Pros:

- Extensive coverage of alternative and niche data sets for specialized research and analysis.

- Robust data sourcing and quality assurance processes ensure accuracy and reliability.

- Seamless integration with popular programming languages and data analysis tools.

Cons:

- Pricing may be higher compared to APIs offering more mainstream financial data.

- Limited support for real-time data feeds, with a focus on historical and static data sets.

5. Xignite

Xignite is a leading provider of cloud-based market data solutions, offering a comprehensive suite of APIs for accessing real-time and historical financial data. With its scalable and reliable data infrastructure, Xignite serves a wide range of clients, including financial institutions, fintech startups, and retail investors, seeking to leverage market data for investment research, trading, and financial application development.

Features:

- Real-time and historical data for equities, forex, fixed income, and commodities.

- Coverage of global markets, including exchanges in North America, Europe, and Asia-Pacific.

- SOAP and RESTful API endpoints with support for JSON, XML, and CSV formats.

- Enterprise-grade data security and compliance features, including encryption and access controls.

Pros:

- Reliable and scalable infrastructure capable of handling large volumes of data and high request rates.

- Comprehensive data coverage across multiple asset classes and markets.

- Robust documentation and developer support resources, including SDKs and code samples.

Cons:

- Higher pricing compared to some competitors, particularly for enterprise-level data access.

- Complexity may be a barrier for novice developers or smaller organizations seeking simple data solutions.

6. Bloomberg Open API

Bloomberg, a global leader in financial data and analytics, offers an open API that provides access to a comprehensive suite of financial data, analytics, and market insights. Designed for institutional clients, the Bloomberg API Library enables developers to build custom applications and integrations that leverage Bloomberg’s extensive data infrastructure and analytical tools.

Features:

- Extensive coverage of financial markets, including equities, fixed income, commodities, and derivatives.

- Real-time market data, news, and research from Bloomberg’s global network of journalists and analysts.

- RESTful API endpoints with support for various programming languages, including Python, Java, and C++.

- Integration with Bloomberg Terminal, Bloomberg Professional service, and Bloomberg Enterprise Access Point.

Pros:

- Unparalleled depth and breadth of financial data and analytics from a trusted industry leader.

- Seamless integration with Bloomberg’s suite of desktop and enterprise solutions.

- Comprehensive documentation and dedicated support for API users.

Cons:

- Limited accessibility for individual developers and smaller organizations due to high entry costs.

- Complex licensing and usage terms may be restrictive for certain use cases or applications.

7. Polygon.io

Polygon.io provides real-time and historical market data APIs for stocks, forex, cryptocurrencies, and more. With its scalable and reliable infrastructure, Polygon.io offers low-latency data feeds and support for advanced data analysis and visualization.

Features:

- Real-time and historical data for equities, forex, and cryptocurrencies.

- WebSocket and RESTful API endpoints for streaming and on-demand data access.

- Support for technical indicators, news sentiment analysis, and event data.

- Flexible pricing plans with options for free and paid subscriptions.

8. Tiingo

Tiingo Stock & Financial Markets API offers a comprehensive suite of financial data APIs, including real-time and historical stock prices, fundamentals, and news. With its focus on data quality and reliability, Tiingo serves a diverse range of clients, including investors, traders, and developers.

Features:

- Real-time and historical stock prices, dividends, and splits.

- Fundamental data for company financials, earnings, and dividends.

- RESTful API endpoints with support for JSON and CSV formats.

- Flexible pricing options tailored to individual and enterprise users.

9. IEX Cloud

IEX Cloud provides financial data APIs for accessing real-time and historical stock prices, market data, and corporate actions. With its developer-friendly platform and extensive data coverage, IEX Cloud is a popular choice among fintech startups, trading platforms, and financial analysts.

Features:

- Real-time and historical stock prices, market quotes, and volume data.

- Corporate actions such as dividends, stock splits, and earnings releases.

- RESTful API endpoints with support for JSON and CSV formats.

- Free tier with limited access and premium tiers for additional features and data.

10. Tradier

Tradier offers a brokerage API that provides access to real-time market data, trading functionality, and account management features. With its focus on developer experience and flexibility, Tradier is ideal for building custom trading platforms and algorithmic trading systems.

Features:

- Real-time stock quotes, options chains, and market news.

- Trading functionality for executing orders, managing positions, and accessing account information.

- WebSocket and RESTful API endpoints with support for JSON and XML formats.

- Competitive pricing plans with options for per-trade or subscription-based pricing.

11. Yahoo Finance API

Yahoo Finance offers a suite of financial data APIs for accessing stock prices, market data, and company information. With its user-friendly interface and extensive data coverage, Yahoo Finance is a popular choice for individual investors and retail traders.

Features:

- Real-time and historical stock prices, market indices, and exchange rates.

- Company fundamentals, financial statements, and analyst estimates.

- RESTful API endpoints with support for JSON and CSV formats.

- Free access with limited usage and premium options for additional features.

12. marketstack

marketstack provides real-time and historical stock market data APIs for global equities, ETFs, and indices. With its easy-to-use platform and flexible pricing plans, marketstack caters to a wide range of users, from individual investors to institutional clients.

Features:

- Real-time and historical stock prices, trading volumes, and market indices.

- Coverage of global equities exchanges, including NYSE, NASDAQ, and major international markets.

- RESTful API endpoints with support for JSON and CSV formats.

- Free tier with limited access and premium tiers for additional data and features.

13. EOD Historical Data

EOD Historical Data (EODHD APIs) offers historical stock market data APIs for equities, ETFs, and indices. With its extensive historical database and affordable pricing plans, EOD Historical Data is a popular choice for backtesting trading strategies and conducting historical research.

Features:

- Daily, weekly, and monthly historical stock prices and trading volumes.

- Adjusted and unadjusted price data for dividends, splits, and other corporate actions.

- RESTful API endpoints with support for JSON and CSV formats.

- Subscription-based pricing with options for individual stocks or bulk data access.

14. Intrinio Options Data API

Intrinio’s Options Data API provides access to real-time options pricing and analytics for US equities. With its comprehensive coverage of options data and advanced analytics features, Intrinio is a trusted resource for options traders and derivatives analysts.

Features:

- Real-time options quotes, chains, and Greeks calculations.

- Historical options data for backtesting and analysis.

- RESTful API endpoints with support for JSON and CSV formats.

- Flexible pricing plans tailored to individual and enterprise users.

15. AlphaSense

AlphaSense offers a financial search engine API that provides access to real-time and historical market intelligence. With its advanced natural language processing (NLP) technology and extensive document database, AlphaSense is a valuable tool for research analysts and financial professionals.

Features:

- Real-time search results for news articles, SEC filings, and research reports.

- Advanced NLP algorithms for sentiment analysis and entity recognition.

- RESTful API endpoints with support for JSON and XML formats.

- Subscription-based pricing with options for individual and enterprise access.

16. Morningstar Direct API

Morningstar Direct API offers access to Morningstar’s comprehensive database of investment research, fund data, and portfolio analytics. With its suite of APIs, Morningstar Direct is a valuable resource for financial advisors, asset managers, and institutional investors.

Features:

- Fundamentals data for stocks, mutual funds, ETFs, and fixed income securities.

- Portfolio analysis tools, including risk metrics, performance attribution, and style analysis.

- RESTful API endpoints with support for JSON and XML formats.

- Subscription-based pricing with options for individual and enterprise access.

In summary, these top financial data APIs offer a wealth of opportunities for accessing, analyzing, and leveraging financial data to support various functions and applications within the finance industry. Whether you’re a seasoned trader, financial analyst, or developer, these APIs provide the tools and resources you need to stay ahead of the curve and make informed decisions in today’s dynamic and interconnected financial markets.

How to Select the Best Financial Data APIs?

Selecting the right financial data API is crucial for ensuring that you have access to accurate, reliable, and comprehensive data to support your financial analysis and decision-making processes. Let’s explore the key criteria you should consider when evaluating different APIs.

Accuracy and Reliability

Accuracy and reliability are paramount when it comes to financial data. You need to be confident that the data provided by the API is up-to-date, precise, and sourced from reputable sources. Look for APIs that have robust quality assurance processes in place, including data validation checks and error monitoring mechanisms. Additionally, consider the track record and reputation of the API provider within the financial industry to gauge the reliability of their data.

Data Coverage and Variety

The breadth and depth of data coverage offered by an API can significantly impact its usefulness for your specific needs. Evaluate the types of data provided by the API, such as stock prices, market indices, company fundamentals, economic indicators, and alternative datasets. Consider whether the API offers coverage of global markets or is focused on specific regions or asset classes. Ideally, you want an API that provides access to a diverse range of data sources to support comprehensive financial analysis and research.

Pricing Structure and Cost

Pricing is another crucial factor to consider when selecting a financial data API. Assess the various pricing plans offered by the API provider and determine which option best aligns with your budget and usage requirements. Some APIs offer subscription-based models with tiered pricing based on the volume of data accessed or the frequency of requests, while others may charge on a pay-per-use basis. Take into account any additional fees, such as data licensing fees or API access fees, to ensure that there are no hidden costs that could impact your overall expenses.

API Documentation and Support

Comprehensive documentation and responsive support are essential for successful integration and troubleshooting when using a financial data API. Prioritize APIs that provide clear and detailed documentation, including API endpoints, request parameters, authentication methods, and code samples in various programming languages. Additionally, assess the availability and responsiveness of the API provider’s support team, including channels for seeking assistance, such as email, chat, or forums. A supportive and knowledgeable support team can be invaluable when encountering technical challenges or seeking guidance on API usage.

Security and Compliance

Given the sensitive nature of financial data, security and compliance should be top priorities when selecting an API. Ensure that the API provider implements robust security measures to protect data confidentiality, integrity, and availability. Look for APIs that offer encryption protocols, access controls, and audit trails to safeguard sensitive information from unauthorized access or breaches. Additionally, verify that the API provider complies with relevant regulatory requirements, such as GDPR, HIPAA, or industry-specific regulations governing financial data. A commitment to security and compliance demonstrates the API provider’s dedication to maintaining the highest standards of data protection and privacy.

Financial APIs Use Cases and Applications

Financial data APIs are versatile tools that find applications across various domains within the finance industry. Let’s explore some of the most common use cases and applications where these APIs can add significant value.

Investment Analysis and Research

Financial data APIs are invaluable for conducting investment analysis and research, providing access to a wealth of data to inform investment decisions. Analysts and portfolio managers can leverage real-time and historical market data, company fundamentals, and economic indicators to assess investment opportunities, identify trends, and evaluate risk-return profiles. By integrating financial data APIs into their research workflows, investors can gain deeper insights into market dynamics, sector performance, and individual securities, enabling them to make informed investment decisions with confidence.

Algorithmic Trading

Algorithmic trading, also known as algo trading or automated trading, relies heavily on real-time market data and sophisticated trading algorithms to execute trades automatically. Financial data APIs play a crucial role in algorithmic trading by providing access to timely and accurate market data, including stock prices, order book data, and trade execution metrics. Traders can use this data to develop and backtest trading strategies, optimize trade execution algorithms, and execute trades across various asset classes and markets. By leveraging financial data APIs, traders can capitalize on market inefficiencies, minimize latency, and enhance trading performance in highly competitive markets.

Risk Management

Effective risk management is paramount in the finance industry, where uncertainty and volatility are inherent features of the market environment. Financial data APIs enable risk managers and risk analysts to monitor and assess various types of risk, including market risk, credit risk, liquidity risk, and operational risk. By accessing real-time and historical market data, volatility indices, credit spreads, and other risk indicators, risk professionals can quantify risk exposures, stress-test portfolios, and implement hedging strategies to mitigate potential losses. Additionally, financial data APIs facilitate the integration of risk management tools and systems into existing workflows, enabling proactive risk management and compliance with regulatory requirements.

Financial Reporting and Visualization

Financial data APIs are instrumental in generating dynamic and interactive financial reports and visualizations that provide insights into key performance metrics and trends. By accessing company fundamentals, financial statements, and market data, financial analysts and reporting teams can create customizable dashboards, charts, and graphs to communicate financial information effectively. These reports and visualizations enable stakeholders to gain a deeper understanding of business performance, track KPIs, and make data-driven decisions. Furthermore, financial data APIs support seamless integration with reporting tools, business intelligence platforms, and data visualization libraries, enhancing the accessibility and usability of financial information across organizations.

Financial APIs offer a wide range of applications and use cases, from investment analysis and algorithmic trading to risk management and financial reporting. By harnessing the power of real-time and historical financial data, organizations can unlock actionable insights, optimize decision-making processes, and gain a competitive edge in the dynamic and evolving finance industry.

How to Integrate Financial Data APIs?

Implementing and integrating financial data APIs into your systems and applications requires careful planning and execution. Let’s explore the process of API integration, best practices for implementation, and common challenges faced along the way.

API Integration Process

The API integration process typically involves several key steps:

- Requirements Gathering: Begin by defining your requirements and identifying the specific financial data you need access to. Determine the use cases and functionalities that the API will support within your organization.

- API Selection: Research and evaluate different financial data APIs based on criteria such as data coverage, reliability, pricing, and support. Choose an API that aligns with your requirements and budget.

- Registration and Authentication: Sign up for an API key or authentication token from the API provider. Follow the registration process and obtain the necessary credentials to authenticate your requests.

- Development and Testing: Develop code to interact with the API using your preferred programming language or development environment. Test the API integration thoroughly to ensure that it functions as expected and handles various scenarios gracefully.

- Deployment: Deploy the integrated API within your production environment, taking into account factors such as scalability, performance, and security. Monitor the API’s usage and performance to identify any issues or optimization opportunities.

- Documentation and Training: Document the API integration process and provide training to relevant stakeholders within your organization. Ensure that developers and end-users understand how to interact with the API effectively.

Best Practices for Implementation

To ensure a successful API integration:

- Start Small: Begin with a small-scale integration project to familiarize yourself with the API and its capabilities. Gradually expand the scope as you gain confidence and experience.

- Follow API Guidelines: Adhere to the API provider’s documentation and guidelines when making requests and handling responses. Use the appropriate endpoints, request parameters, and authentication methods as specified by the API documentation.

- Handle Errors Gracefully: Implement error handling mechanisms to gracefully handle API errors and exceptions. Provide informative error messages to users and log detailed error information for troubleshooting purposes.

- Optimize Performance: Optimize API requests and responses for performance and efficiency. Minimize unnecessary data transfers, use caching mechanisms where appropriate, and leverage asynchronous processing to improve responsiveness.

- Secure Data Transmission: Ensure that sensitive data transmitted between your systems and the API provider’s servers is encrypted using secure protocols such as HTTPS. Implement access controls and authentication mechanisms to prevent unauthorized access to sensitive information.

Common Challenges and Solutions

Despite careful planning and execution, API integration projects may encounter various challenges along the way. Some common challenges include:

- Rate Limiting: APIs may impose rate limits on the number of requests allowed within a certain time period. To address this challenge, implement rate limiting strategies such as request batching, caching, or adjusting request frequency.

- Data Quality Issues: Inconsistent or inaccurate data from the API can impact the reliability of your applications and analysis. To mitigate this risk, implement data validation checks, error handling mechanisms, and data cleansing processes.

- Dependency Management: Your applications may become dependent on external APIs, making them vulnerable to changes or disruptions in the API’s availability or functionality. To mitigate this risk, maintain clear documentation of API dependencies and have contingency plans in place for fallback options or alternative APIs.

By following best practices and proactively addressing common challenges, you can streamline the implementation and integration of financial data APIs within your organization, unlocking the full potential of data-driven insights and decision-making capabilities.

Conclusion

Financial data APIs offer a gateway to the world of finance, providing access to a wealth of information that powers decision-making processes across industries. From individual investors seeking to optimize their portfolios to financial institutions executing complex trading strategies, these APIs serve as indispensable tools for accessing, analyzing, and leveraging financial data in real-time. By harnessing the power of financial data APIs, individuals and organizations can unlock new opportunities, mitigate risks, and stay ahead of the curve in today’s fast-paced and competitive financial landscape.

In a world where data is king, financial data APIs democratize access to critical market information, empowering users with the insights they need to make informed decisions and drive success. As technology continues to evolve and data becomes increasingly central to business operations, the importance of financial data APIs will only continue to grow. Whether you’re a novice investor exploring the world of finance or a seasoned professional seeking to optimize your strategies, embracing the capabilities of financial data APIs is essential for staying agile, informed, and competitive in today’s digital age.

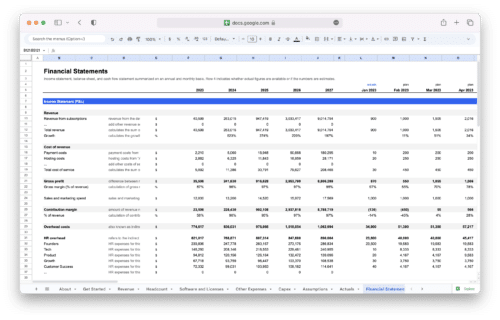

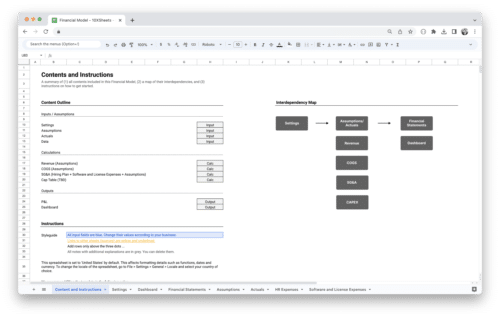

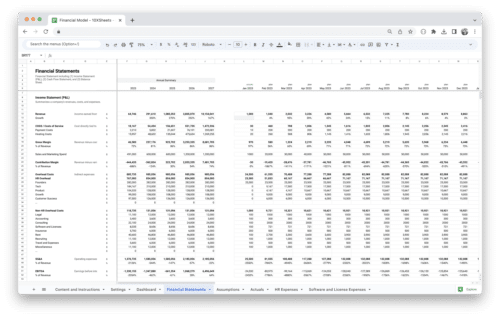

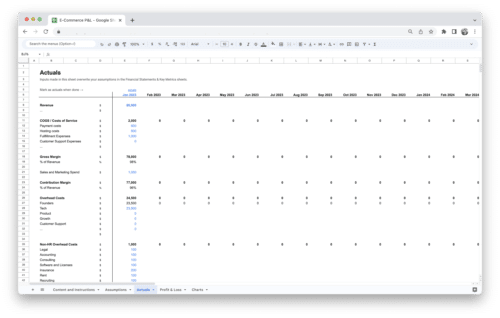

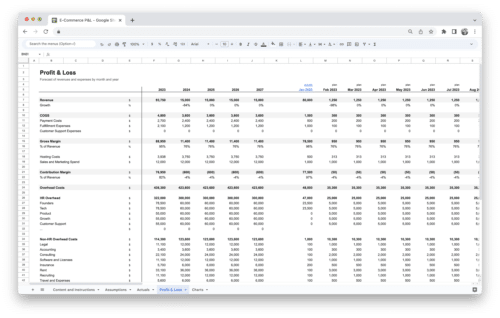

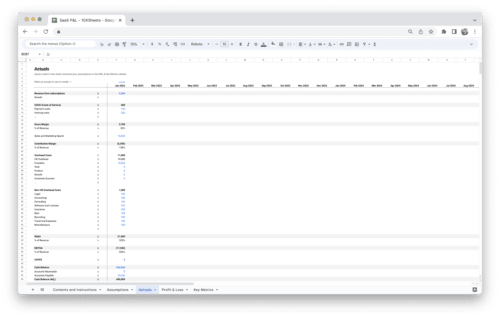

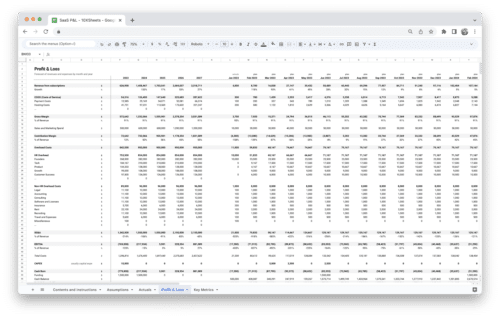

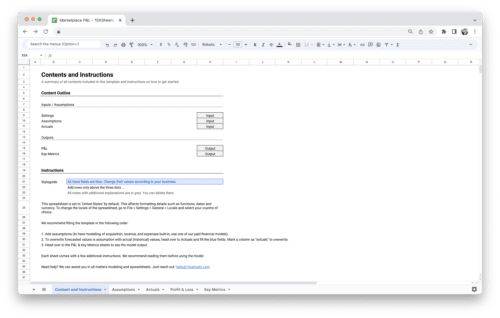

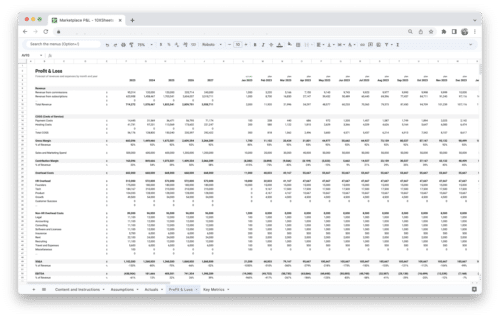

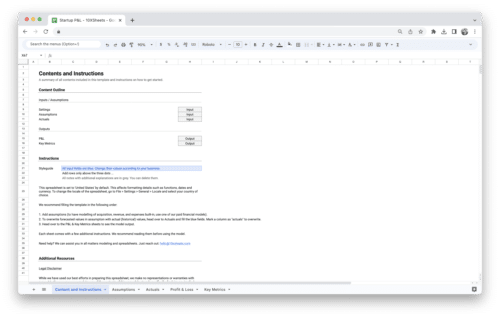

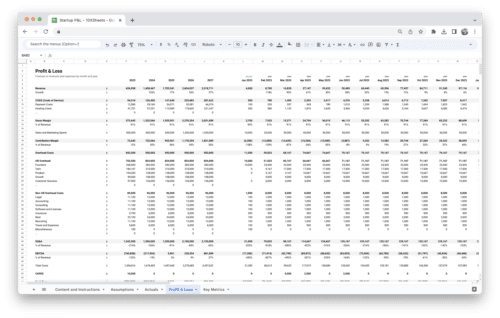

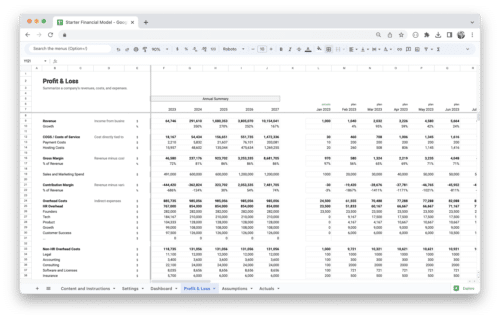

Get Started With a Prebuilt Template!

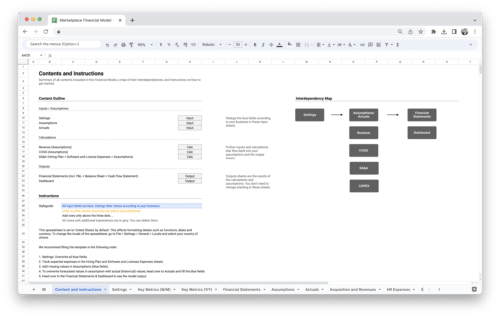

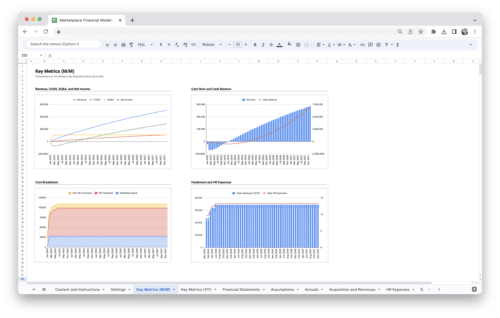

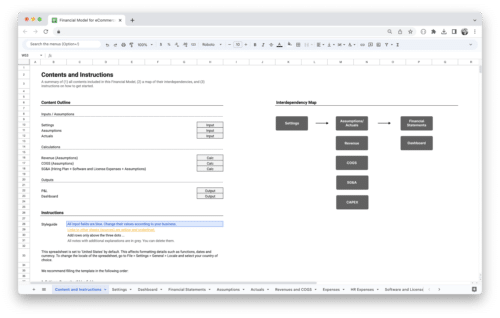

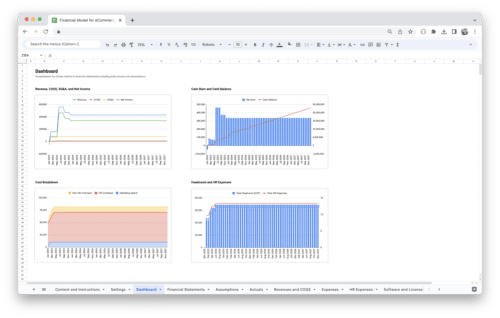

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.