Are you struggling to recover outstanding debts owed by customers or clients? In today’s fast-paced business environment, efficient debt collection is crucial for maintaining healthy cash flow and sustaining business operations. However, manually managing debt collection processes can be time-consuming, error-prone, and resource-intensive. This comprehensive guide to the top debt collection software solutions is your roadmap to streamlining and optimizing your debt recovery efforts. From automating communication and tracking payments to ensuring compliance with legal regulations, debt collection software offers a range of features and functionalities to simplify the debt collection process and improve recovery rates. Whether you’re a creditor, collection agency, or financial institution, this guide will help you navigate the landscape of debt collection software and make informed decisions to drive better results for your business.

What is Debt Collection Software?

Debt collection software serves as a technological solution designed to streamline and optimize the process of recovering outstanding debts owed by individuals or organizations. Its primary purpose is to automate various tasks involved in the debt collection process, from contacting debtors to tracking payments and managing accounts receivable. By centralizing data, automating communication, and providing actionable insights, debt collection software empowers businesses to recover debts more efficiently while minimizing costs and resources.

Importance in Debt Recovery Process

- Efficiency: Debt collection software improves the efficiency of debt recovery processes by automating repetitive tasks such as sending reminders, tracking payments, and generating reports. This automation reduces manual effort and allows collection agents to focus on more strategic activities.

- Accuracy: By maintaining accurate and up-to-date records of debtor information, payment histories, and communication logs, debt collection software minimizes errors and discrepancies. This accuracy ensures that collection efforts are targeted and effective, leading to higher recovery rates.

- Compliance: Debt collection software helps businesses maintain compliance with legal regulations and industry standards governing debt collection practices. Features such as audit trails, regulatory compliance checks, and data security measures ensure adherence to laws such as the Fair Debt Collection Practices Act (FDCPA) and the General Data Protection Regulation (GDPR).

- Insights: Debt collection software provides valuable insights and analytics that enable businesses to make informed decisions and optimize their collection strategies. By analyzing trends, identifying patterns, and tracking key performance indicators (KPIs), businesses can refine their approaches and maximize recovery efforts.

- Customer Relationships: Effective debt collection software facilitates better communication and relationship management with debtors. By automating communication processes and offering self-service options for debt resolution, businesses can maintain positive relationships with debtors while still pursuing timely payments.

- Cost Savings: Ultimately, debt collection software helps businesses save time, resources, and costs associated with manual debt recovery processes. By streamlining operations, reducing administrative overhead, and improving recovery rates, businesses can achieve a higher return on investment (ROI) from their debt collection efforts.

Evolution and Adoption

The evolution of debt collection software has been driven by advancements in technology, changes in consumer behavior, and the need for more efficient and compliant debt recovery solutions. Initially, debt collection processes were largely manual, involving paper-based records, phone calls, and manual follow-ups. However, as businesses sought to streamline operations and improve efficiency, the need for automated solutions became apparent.

Over time, debt collection software has evolved to incorporate advanced features such as artificial intelligence (AI), machine learning, and predictive analytics. These technologies enable more accurate debtor profiling, personalized communication, and predictive modeling to optimize collection strategies and outcomes.

In addition to technological advancements, changes in consumer behavior and preferences have also influenced the evolution of debt collection software. With the rise of digital communication channels such as email, SMS, and online portals, debt collection software has adapted to meet the needs of modern consumers who prefer digital interactions and self-service options.

As a result of these advancements and changing market dynamics, the adoption of debt collection software has become increasingly widespread across industries and organizations of all sizes. Businesses recognize the value of these solutions in improving efficiency, compliance, and recovery rates, leading to increased investment and adoption in the debt collection software market.

Debt Collection Software Features

Debt collection software is equipped with a plethora of features aimed at simplifying the debt recovery process and enhancing operational efficiency. Let’s explore some of the key features in more detail:

Client Management

Effective client management lies at the core of successful debt collection operations. Debt collection software streamlines client management by centralizing all pertinent information in one accessible location. Here’s a deeper look into client management features:

- Centralized Database: A comprehensive database enables you to store and manage all client information, including contact details, payment history, and communication logs. This centralized repository facilitates easy access to relevant client data, empowering your team to make informed decisions and take appropriate actions.

- Segmentation: Segmentation allows you to categorize clients based on various criteria such as payment status, account balance, and priority level. By segmenting clients, you can tailor your debt collection strategies to suit the specific needs and circumstances of each group, thereby maximizing effectiveness.

- Notes and Comments: Adding notes and comments to client profiles facilitates internal communication and collaboration among team members. Whether it’s recording important details from client interactions or sharing insights for future reference, these notes serve as valuable resources for improving overall collection efforts.

Account Management

Efficient account management is essential for tracking and managing debts effectively. Debt collection software provides robust tools for organizing and monitoring accounts, ensuring nothing falls through the cracks. Here’s a closer look at account management features:

- Debtor Profiles: Creating and maintaining profiles for individual debtors enables you to track pertinent details such as personal information, debt status, and payment arrangements. These profiles serve as comprehensive records that facilitate personalized communication and targeted follow-up actions.

- Payment Tracking: Accurate payment tracking capabilities allow you to monitor payments received, outstanding balances, and payment histories for each account. By maintaining up-to-date records of financial transactions, you can identify trends, anticipate cash flow, and prioritize collection efforts accordingly.

- Automated Reminders: Setting up automated reminders for payment due dates, follow-ups, and overdue notices helps streamline communication and improve debtor responsiveness. By automating routine tasks, you can free up valuable time and resources to focus on more strategic aspects of debt collection.

Automated Communication

Timely and effective communication is critical for engaging debtors and facilitating prompt resolution of outstanding debts. Debt collection software offers automation features that streamline communication processes and enhance engagement. Here’s a closer look at automated communication features:

- Email Templates: Pre-designed email templates enable you to send customized communications to debtors with minimal effort. Whether it’s sending payment reminders, settlement offers, or legal notices, these templates ensure consistency and professionalism in your communications.

- SMS Integration: Integrating SMS capabilities allows you to send automated text messages to debtors, providing an additional channel for communication. SMS messages are often more immediate and accessible, making them ideal for urgent notifications or reminders.

- Call Logging: Logging and tracking phone calls made to debtors helps maintain a comprehensive record of communication activities. By documenting call details such as duration, outcome, and follow-up actions, you can track progress, identify patterns, and optimize your approach for future interactions.

Reporting and Analytics

Data-driven insights are instrumental in guiding strategic decision-making and optimizing debt collection processes. Debt collection software offers robust reporting and analytics features that provide valuable insights into performance metrics and trends. Here’s a closer look at reporting and analytics features:

- Custom Reports: Generating custom reports allows you to tailor insights to your specific needs and objectives. Whether it’s tracking recovery rates, aging receivables, or collection efficiency, custom reports provide actionable data that empowers you to measure progress and identify areas for improvement.

- Visual Dashboards: Interactive dashboards offer real-time visibility into key performance indicators, presenting data in a visual format for easy interpretation. These dashboards provide at-a-glance insights into debt collection activities, enabling you to monitor trends, spot anomalies, and make informed decisions on the fly.

- Trend Analysis: Analyzing trends and patterns in debtor behavior and payment trends helps anticipate future outcomes and adapt collection strategies accordingly. By leveraging trend analysis capabilities, you can identify recurring issues, forecast cash flow, and proactively address potential challenges before they escalate.

Compliance Management

Maintaining compliance with regulatory requirements and industry standards is paramount in the debt collection industry. Debt collection software includes features designed to ensure adherence to relevant laws and regulations, minimizing the risk of legal issues or compliance violations. Here’s a closer look at compliance management features:

- Regulatory Compliance: Debt collection software incorporates built-in checks and safeguards to ensure compliance with applicable regulations such as the Fair Debt Collection Practices Act (FDCPA) in the United States. These features help safeguard against non-compliant practices and mitigate legal risks associated with debt collection activities.

- Audit Trails: Maintaining detailed audit trails of all debt collection activities ensures transparency and accountability throughout the process. Audit trails capture essential information such as communication logs, payment transactions, and legal actions taken, providing a comprehensive record that can be used for internal review or external audit purposes.

- Data Security: Robust data security measures protect sensitive client information from unauthorized access, breaches, or cyber threats. Encryption, access controls, and secure storage protocols safeguard data integrity and confidentiality, instilling trust and confidence in clients and stakeholders alike.

Top Debt Collection Software Solutions

When it comes to choosing the right debt collection software for your business, several top solutions stand out for their comprehensive features, user-friendly interfaces, and proven track records. Here are some of the top debt collection software solutions available in the market:

Accountgram

Accountgram is a cutting-edge B2B debt collection service designed for tech-native companies and SaaS businesses that need fast, effective, and data-driven debt recovery. Unlike traditional dunning methods, Accountgram goes beyond simple reminders by leveraging smart escalation strategies to maximize collection success rates—quickly and efficiently.

With a high recovery rate and an intelligent, data-powered approach, Accountgram ensures that unpaid invoices don’t disrupt your cash flow. The platform analyzes debtor behavior, determining the best escalation path to secure payments faster than industry standards. Whether it’s strategic follow-ups, legal steps, or alternative resolutions, Accountgram finds the most effective way to recover funds without damaging business relationships.

For SaaS and tech-native companies, where speed and precision matter, Accountgram is the go-to solution for streamlining collections and getting paid without any of the stress.

Experian

Experian Debt Management and Collection System is a leading debt collection software solution known for its robust features and comprehensive capabilities. It offers end-to-end debt collection functionalities, including client management, account tracking, automated communication, and compliance management. With advanced analytics and reporting tools, Experian Collections empowers businesses to optimize their collection strategies and improve recovery rates.

Cogent

Cogent Collections is a cloud-based debt collection software solution designed for scalability, flexibility, and ease of use. It offers customizable workflows, automated communication options, and integration capabilities with third-party systems. Cogent Collections also provides real-time dashboards and analytics to monitor performance metrics and track key indicators, enabling businesses to make data-driven decisions and drive results.

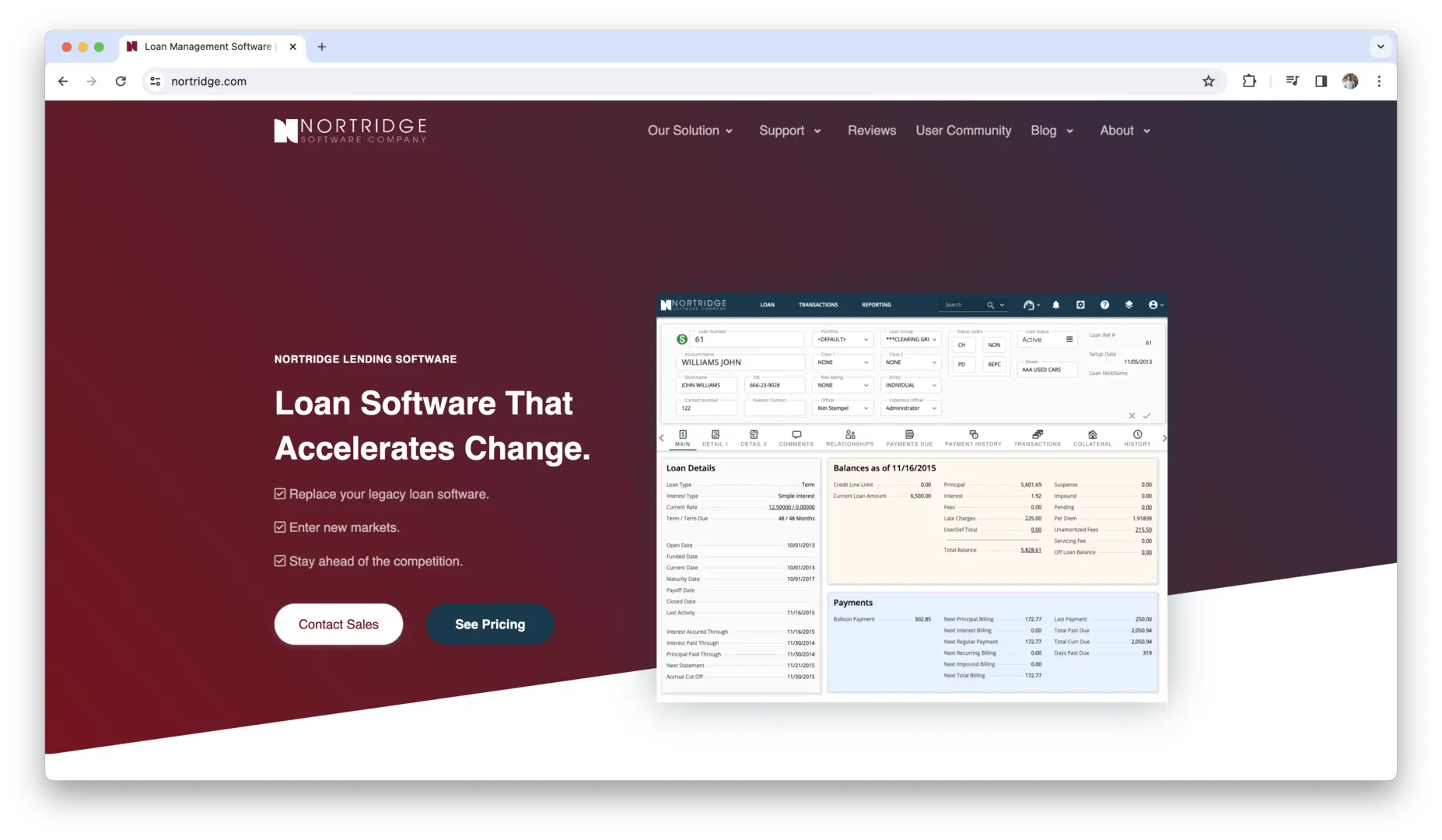

Nortridge

Nortridge Software is a comprehensive debt collection software solution tailored for the lending industry. It offers robust account management features, customizable payment plans, and compliance tools to ensure adherence to regulatory requirements. Nortridge Software also provides workflow automation, customer self-service portals, and advanced reporting capabilities for enhanced efficiency and customer satisfaction.

Quantrax

Quantrax Corporation offers a powerful debt collection software solution that combines automation, analytics, and compliance management features. Its predictive dialer, skip tracing tools, and decisioning engine help streamline collection processes and maximize recovery efforts. Quantrax Corporation also provides flexible deployment options, including on-premises and cloud-based solutions, to accommodate diverse business needs.

CollectMax

JST CollectMax is a user-friendly debt collection software solution designed for small to mid-sized businesses. It offers customizable workflows, automated letter generation, and payment processing capabilities to simplify debt collection operations. CollectMax also provides built-in compliance checks, audit trails, and data security measures to ensure regulatory compliance and data protection.

DAKCS

DAKCS Software Systems offers a comprehensive debt collection software solution that caters to the needs of collection agencies, healthcare providers, and financial institutions. Its features include client management, automated workflows, compliance tools, and performance analytics. DAKCS Software Systems also provides customizable reporting and integration capabilities for seamless data exchange with other systems.

Finvi

Finvi (formerly Ontario Systems) provides debt collection software solutions designed to streamline accounts receivable management and debt recovery processes. Its offerings include account segmentation, automated communication, payment processing, and compliance management features. Finvi also offers industry-specific solutions for healthcare, government, and utilities sectors, tailored to their unique requirements and regulations.

Debtmaster

Comtronic Systems Debtmaster 360 specializes in debt collection software solutions for the legal and accounts receivable industries. Its offerings include case management, court calendaring, document automation, and compliance tools. Comtronic Systems also offers integrations with legal research databases and e-filing systems to streamline legal processes and improve efficiency.

InterProse

InterProse Corporation offers debt collection software solutions designed to automate and optimize the debt recovery process for businesses of all sizes. Its features include predictive analytics, portfolio management, compliance management, and client reporting tools. InterProse Corporation also provides customizable dashboards and workflow automation to improve productivity and decision-making.

Debtrak

Debtrak offers debt collection software solutions tailored for the financial services industry, including banks, credit unions, and lending institutions. Its features include loan servicing, delinquency tracking, payment processing, and regulatory compliance tools. Debtrak also provides mobile accessibility and self-service options for borrowers to manage their accounts conveniently.

Collect!

Collect! by Comtech Systems provides debt collection software solutions with customizable features and flexible deployment options. Its offerings include account management, payment processing, skip tracing, and legal case management capabilities. Collect! Software Systems also offers API integration and data import/export functionalities for seamless data exchange with external systems.

Simplicity Collect

Simplicity Collect by Finvi offers cloud-based debt collection software solutions with intuitive interfaces and customizable features. Its offerings include account management, automated workflows, payment processing, and reporting tools. Simplicity Collect also provides role-based access controls and audit trails for data security and compliance assurance.

These top debt collection software solutions offer a range of features and functionalities to meet the diverse needs of businesses across industries. Whether you’re looking for scalability, automation, compliance management, or analytics capabilities, these solutions provide the tools and resources you need to optimize your debt collection processes and drive results.

How to Choose the Best Debt Collection Software?

Selecting the right debt collection software is a critical decision that can significantly impact your organization’s efficiency, effectiveness, and bottom line. To make an informed choice, it’s essential to consider various factors that align with your specific needs and priorities. Let’s explore these factors in detail:

Scalability

Scalability refers to the software’s ability to accommodate your organization’s growth and evolving requirements over time. When evaluating scalability, consider the following:

- Business Growth: Assess whether the software can scale alongside your business as it expands geographically, acquires new clients, or diversifies its services. Scalable software ensures that you can seamlessly adapt to changing demands without outgrowing your system.

- Volume Handling: Evaluate the software’s capacity to handle increasing volumes of accounts, transactions, and users without compromising performance or efficiency. Scalable solutions should be capable of processing large datasets and supporting concurrent users without experiencing slowdowns or bottlenecks.

- Feature Expansion: Consider whether the software offers additional features or modules that can be added as your needs evolve. Scalable solutions provide flexibility to incorporate new functionalities or integrations without requiring a complete overhaul of your existing infrastructure.

User-Friendliness

User-friendliness plays a crucial role in the adoption and utilization of debt collection software across your organization. Here’s what to consider:

- Intuitive Interface: Evaluate the software’s interface for ease of navigation, intuitiveness, and user-friendliness. A well-designed interface minimizes the learning curve for new users and enhances overall productivity by making common tasks easily accessible.

- Training and Support: Assess the availability of training resources, documentation, and customer support options provided by the software vendor. Comprehensive training programs and responsive support channels can empower your team to maximize the software’s capabilities and troubleshoot issues effectively.

- Feedback Mechanisms: Look for software that incorporates user feedback mechanisms or user-driven design principles to continuously improve usability and address user pain points. Regular updates based on user input ensure that the software remains user-friendly and responsive to changing needs.

Customization Options

Every organization has unique workflows, preferences, and requirements when it comes to debt collection processes. Customization options allow you to tailor the software to fit your specific needs. Here’s what to consider:

- Workflow Flexibility: Evaluate the software’s flexibility in adapting to your organization’s existing workflows and processes. Customizable workflows enable you to configure the software to mirror your preferred methods of operation, minimizing disruptions and maximizing efficiency.

- Field Customization: Assess the extent to which you can customize fields, forms, and data entry screens to capture relevant information specific to your business requirements. Customizable fields ensure that you can track and report on data points that are meaningful to your organization.

- Rules and Automation: Look for software that offers rule-based automation capabilities, allowing you to define and automate tasks, triggers, and actions based on predefined criteria. Customizable automation rules streamline repetitive tasks and enforce consistency across your debt collection processes.

Integration Capabilities

Integration capabilities are essential for seamless data exchange and interoperability with other systems and tools used in your organization. Here’s what to consider:

- API Access: Assess whether the software provides robust application programming interface (API) access for integrating with third-party systems, such as accounting software, CRM platforms, or payment gateways. Open APIs enable smooth data flow and real-time synchronization between systems.

- Pre-built Integrations: Look for pre-built integrations with commonly used business applications or platforms, as they can expedite the integration process and reduce development efforts. Pre-built integrations streamline implementation and ensure compatibility with existing systems.

- Custom Integration Options: Evaluate the flexibility to develop custom integrations or connectors tailored to your organization’s specific needs. Custom integration options enable you to bridge gaps between disparate systems and leverage data from multiple sources for comprehensive insights and decision-making.

Security Measures

Security is paramount when dealing with sensitive financial and personal data in debt collection operations. Here’s what to consider:

- Data Encryption: Ensure that the software employs robust encryption protocols to protect data both in transit and at rest. Encryption safeguards sensitive information from unauthorized access or interception, maintaining confidentiality and integrity.

- Access Controls: Evaluate the software’s access control mechanisms for restricting user permissions and privileges based on roles and responsibilities. Granular access controls minimize the risk of data breaches by limiting access to sensitive functionalities and information.

- Compliance Certifications: Look for software vendors that adhere to industry standards and regulations governing data security and privacy, such as SOC 2 compliance or GDPR compliance. Compliance certifications demonstrate a commitment to maintaining high security standards and safeguarding client data.

Cost and Pricing Models

Cost considerations are integral to selecting debt collection software that aligns with your budget and provides value for money. Here’s what to consider:

- Upfront Costs: Assess any upfront costs associated with purchasing or licensing the software, including installation fees, setup costs, or one-time license fees. Understanding upfront costs helps you budget effectively and avoid unexpected expenses.

- Subscription Fees: Evaluate the software’s subscription-based pricing model, including recurring subscription fees, tiered pricing structures, and contract terms. Subscription fees should be transparent, predictable, and scalable based on your usage and requirements.

- Additional Charges: Consider any additional charges or hidden costs associated with the software, such as customization fees, maintenance fees, or support fees. Clarify pricing details upfront to avoid surprises and ensure that the total cost of ownership remains within your budget constraints.

How to Implement Debt Collection Software?

Implementing debt collection software requires careful planning, execution, and adherence to best practices to maximize its effectiveness and ensure a smooth transition. Here are some key implementation steps and best practices to consider:

- Needs Assessment: Begin by conducting a thorough needs assessment to identify your organization’s specific requirements, challenges, and objectives related to debt collection. This assessment should involve key stakeholders from various departments to gain insights into workflow processes, data management needs, and compliance requirements.

- Vendor Evaluation: Research and evaluate different debt collection software vendors based on factors such as functionality, scalability, user-friendliness, integration capabilities, and cost. Request demos, trial periods, and references from existing clients to assess the software’s suitability for your organization.

- Data Migration: Plan and execute a data migration strategy to transfer existing client information, account data, and historical records to the new software platform. Ensure data accuracy, integrity, and consistency throughout the migration process to avoid disruptions or data loss.

- Training and Onboarding: Provide comprehensive training and onboarding sessions for users to familiarize them with the software’s features, functionalities, and best practices. Tailor training sessions to different user roles and skill levels, offering hands-on practice and ongoing support to ensure proficiency and adoption.

- Customization and Configuration: Customize and configure the software to align with your organization’s specific workflows, preferences, and compliance requirements. Leverage built-in customization options to tailor fields, forms, workflows, and automation rules to match your business processes.

- Integration with Existing Systems: Integrate the debt collection software with other existing systems and tools used in your organization, such as accounting software, CRM platforms, and communication channels. Seamless integration facilitates data exchange, workflow automation, and collaboration across systems.

- Compliance and Legal Considerations: Ensure compliance with relevant regulations and legal requirements governing debt collection practices, such as the Fair Debt Collection Practices Act (FDCPA) in the United States or the General Data Protection Regulation (GDPR) in Europe. Implement policies, procedures, and safeguards to protect consumer rights and maintain regulatory compliance.

- Testing and Quality Assurance: Conduct thorough testing and quality assurance checks to verify the software’s functionality, performance, and usability before full deployment. Test various scenarios, workflows, and edge cases to identify and address any issues or discrepancies proactively.

- Pilot Rollout: Conduct a pilot rollout or phased implementation of the debt collection software to a smaller group of users or departments before full deployment. Gather feedback, evaluate performance metrics, and make necessary adjustments to optimize the software’s effectiveness and user satisfaction.

- Continuous Improvement: Establish a process for continuous improvement and optimization of debt collection processes and software usage. Solicit feedback from users, monitor key performance indicators (KPIs), and leverage analytics insights to identify areas for improvement and innovation.

By following these implementation steps and best practices, you can ensure a successful deployment of debt collection software that enhances efficiency, effectiveness, and compliance across your organization’s debt collection operations.

Conclusion

Selecting the right debt collection software is a critical decision that can have a significant impact on your organization’s efficiency, effectiveness, and bottom line. By leveraging the features and capabilities of top debt collection software solutions, businesses can streamline processes, improve communication with debtors, ensure compliance with regulatory requirements, and ultimately enhance their ability to recover outstanding debts. Whether you’re a small business or a large enterprise, investing in debt collection software is a proactive step towards optimizing your debt recovery efforts and achieving better financial outcomes.

In today’s digital age, debt collection software has become an indispensable tool for businesses looking to navigate the complexities of debt recovery with ease and efficiency. With a wide range of options available in the market, it’s essential to carefully evaluate your organization’s needs, consider key factors such as scalability, user-friendliness, customization options, integration capabilities, security measures, and cost considerations. By choosing the right debt collection software solution that aligns with your specific requirements and objectives, you can streamline operations, improve collection rates, and ultimately drive better results for your business.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.