- What is Billing and Invoicing Software?

- Researching and Evaluating Billing and Invoicing Software

- Top Billing and Invoicing Software Solutions

- How to Choose a Billing and Invoicing Software?

- How to Implement Billing and Invoicing Software?

- Best Practices for Using Billing and Invoicing Software

- Conclusion

Are you looking for a hassle-free way to manage your business’s finances and ensure timely payments from clients? In today’s fast-paced business landscape, having efficient billing and invoicing software can make all the difference. From creating professional invoices to tracking payments and managing accounts receivable, the right software solution can streamline your financial processes and enhance your bottom line.

In this guide, we’ll explore the top billing and invoicing software options available in the market, along with key factors to consider when making your selection. Whether you’re a freelancer, small business owner, or enterprise-level organization, finding the perfect billing and invoicing software can simplify your operations, improve cash flow management, and pave the way for long-term success.

What is Billing and Invoicing Software?

Billing and invoicing software are digital tools designed to automate the process of generating invoices, tracking payments, and managing accounts receivable. These software solutions streamline financial transactions between businesses and their clients or customers. The primary purpose of billing and invoicing software is to simplify and expedite the invoicing process, ensuring accurate and timely payments while maintaining professional communication with clients.

Importance for Businesses

Billing and invoicing software play a pivotal role in the financial health and operational efficiency of businesses across various industries. Here’s why it’s essential:

- Time Efficiency: Automating the invoicing process saves time by eliminating manual data entry and repetitive tasks associated with creating and sending invoices.

- Accuracy: Billing and invoicing software reduces the risk of errors in calculations, billing amounts, and payment tracking, ensuring accurate financial records.

- Cash Flow Management: By expediting the invoicing and payment collection process, businesses can improve cash flow management and ensure a steady stream of revenue.

- Professionalism: Branded invoices and professional communication instill confidence in clients and reinforce the credibility and professionalism of the business.

- Streamlined Processes: Efficient invoicing processes facilitated by billing software allow businesses to focus on core activities and strategic initiatives rather than administrative tasks.

- Client Satisfaction: Prompt and accurate invoicing enhances the overall client experience, leading to increased satisfaction, repeat business, and positive word-of-mouth referrals.

Implementing billing and invoicing software is not just a matter of convenience; it’s a strategic investment that yields tangible benefits in terms of time savings, accuracy, cash flow optimization, and client satisfaction.

Researching and Evaluating Billing and Invoicing Software

When it comes to selecting billing and invoicing software for your business, thorough research and evaluation are key. Let’s dive into each step of the process to ensure you make the right choice.

1. Identify Your Business Needs

Before you start exploring software options, take the time to assess your business’s unique requirements. Consider factors such as the volume of invoices you generate, the complexity of your invoicing processes, and any specific features you need to streamline your billing operations. For example:

- Volume of Invoices: Do you generate a high volume of invoices on a monthly basis, or do you have a smaller number of high-value invoices?

- Complexity of Invoicing: Are your invoices straightforward, or do they require customization, recurring billing, or multi-currency support?

- Integration Requirements: Do you need the software to integrate with other tools or systems you currently use, such as accounting software or customer relationship management (CRM) platforms?

By understanding your business needs upfront, you can narrow down your options and focus on software solutions that align with your requirements.

2. Research Available Options

Once you have a clear understanding of your business needs, it’s time to research available billing and invoicing software options. Start by exploring reputable software providers in the market and take note of the features they offer. Consider factors such as:

- Cloud-Based vs. On-Premises: Decide whether you prefer a cloud-based solution, which offers flexibility and accessibility from anywhere with an internet connection, or an on-premises solution, which may offer greater control over your data but requires hosting on your own servers.

- Industry-Specific Solutions: Some software providers offer industry-specific solutions tailored to the needs of businesses in particular sectors, such as professional services, retail, or healthcare.

- Scalability: Consider whether the software can scale with your business as it grows. Look for solutions that offer flexible pricing plans and additional features or modules to support your evolving needs.

3. Compare Features and Pricing

Once you’ve identified a shortlist of software options, it’s time to compare their features and pricing. Create a spreadsheet or comparison chart to evaluate key factors such as:

- Core Features: Assess the core invoicing features offered by each software solution, such as invoice customization, recurring billing, and payment processing.

- Additional Features: Look for any additional features or modules that may be beneficial to your business, such as expense tracking, time tracking, or project management capabilities.

- Pricing Plans: Compare the pricing plans offered by each software provider, taking into account factors such as the number of users, invoicing volume, and additional fees for extra features or support.

- Trial Periods and Demos: Take advantage of free trials or demos offered by software providers to test the platform’s functionality and usability before making a commitment.

4. Read Reviews and Seeking Recommendations

Finally, don’t underestimate the power of user reviews and recommendations when evaluating billing and invoicing software. Look for reviews on independent review sites, business software directories, and social media platforms. Additionally, reach out to your professional network for recommendations and ask for referrals from businesses similar to yours. Pay attention to factors such as:

- User Satisfaction: Look for patterns in user feedback to gauge overall satisfaction with the software’s performance, reliability, and customer support.

- Ease of Use: Consider whether users find the software intuitive and easy to navigate, especially if you have team members who will be using the software regularly.

- Customer Support: Assess the responsiveness and helpfulness of the software provider’s customer support team, especially when it comes to resolving technical issues or answering questions about billing and invoicing processes.

By taking the time to thoroughly research and evaluate billing and invoicing software options, you can make an informed decision that meets the needs of your business now and in the future.

Top Billing and Invoicing Software Solutions

Selecting the ideal billing and invoicing software is a pivotal decision for businesses seeking to optimize their financial operations. We’ll explore a diverse range of top-tier billing and invoicing software solutions renowned for their robust features, user-friendly interfaces, and seamless integration capabilities.

Sage Intacct

Sage Intacct stands out as a comprehensive cloud-based accounting solution tailored to the needs of midsize and enterprise businesses. Recognized for its advanced invoicing features, including multi-entity billing, revenue recognition, and subscription billing management, Sage Intacct empowers businesses to automate complex billing processes and gain actionable insights into their financial performance. With its scalable platform and robust integration capabilities, Sage Intacct offers businesses a sophisticated solution for managing their billing and invoicing needs as they grow and evolve.

Xero

Xero has garnered widespread acclaim for its robust invoicing capabilities and seamless integration with third-party applications. From customizable invoice templates to automated recurring invoicing, Xero provides businesses with the tools they need to streamline their invoicing processes and maintain financial clarity. With its extensive app marketplace, users can seamlessly integrate Xero with a myriad of business tools, enhancing efficiency and productivity across their operations.

Wave

Wave has earned acclaim for its commitment to providing free, user-friendly accounting and invoicing software tailored to the needs of small businesses and freelancers. Offering professional invoice templates, automatic payment reminders, and seamless online payment processing, Wave simplifies the invoicing process without imposing hefty subscription fees. Additionally, Wave’s suite of financial tools, including accounting and receipt scanning features, provides businesses with a holistic solution for managing their finances.

PandaDoc

PandaDoc is a versatile document automation platform that includes powerful invoicing features alongside contract management, eSignature, and proposal creation tools. With its intuitive interface and customizable invoice templates, PandaDoc simplifies the invoicing process for businesses of all sizes. Moreover, PandaDoc’s integration capabilities with CRM systems and accounting software provide users with a seamless solution for managing their invoicing and document workflows from start to finish.

SumUp

SumUp, previously Debitoor, is a simple yet powerful invoicing and accounting software solution designed for freelancers, sole traders, and small businesses. With its intuitive interface and customizable invoice templates, Debitoor enables users to create professional invoices quickly and easily. Additionally, SumUp offers features such as expense tracking, VAT calculations, and financial reporting, providing users with comprehensive tools for managing their finances. With its mobile app and cloud-based platform, Debitoor offers flexibility and accessibility, allowing users to manage their invoicing and accounting tasks on the go.

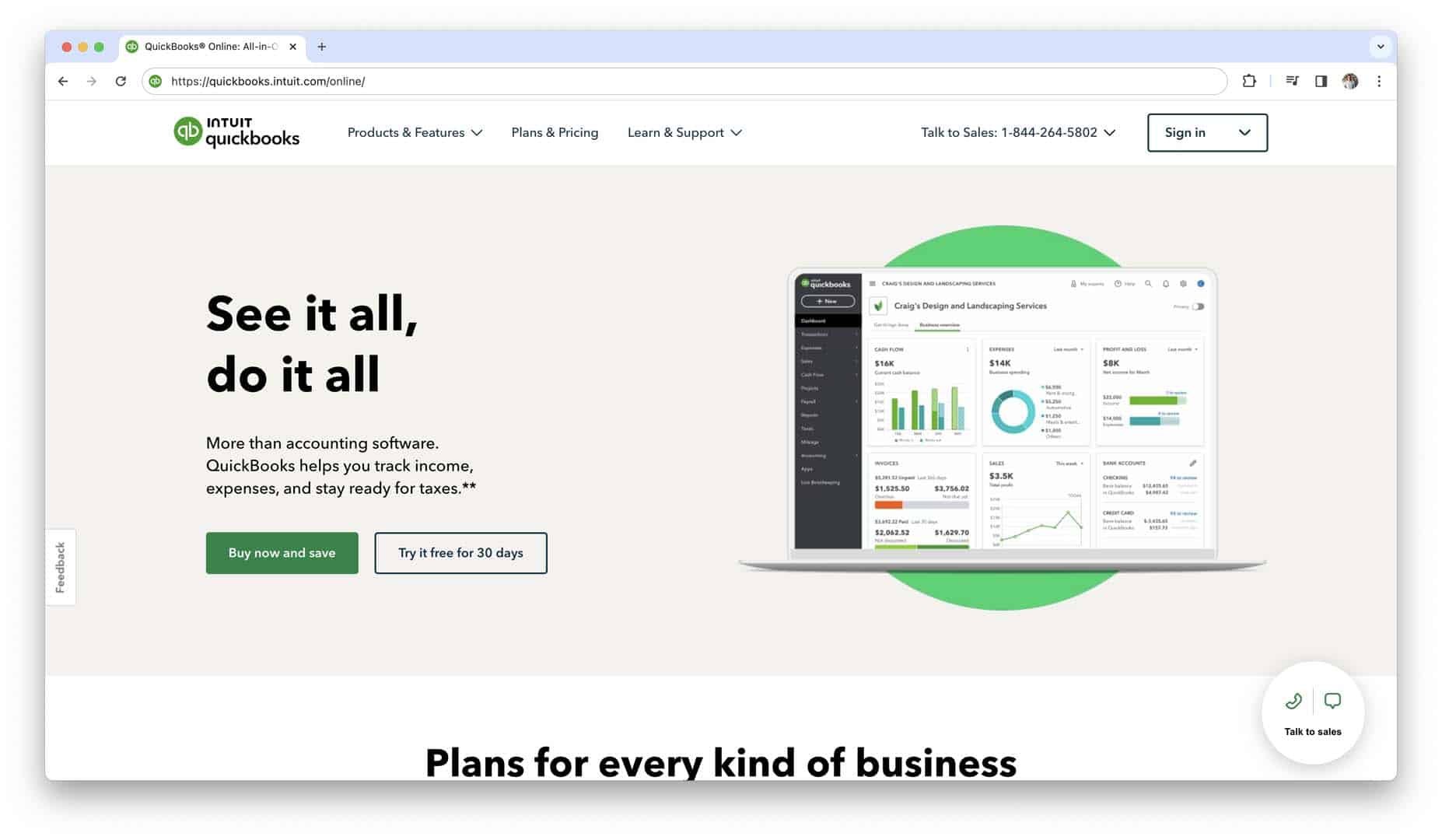

Intuit QuickBooks Online

Intuit QuickBooks Online stands as a cornerstone in the realm of accounting software, catering to the needs of businesses ranging from freelancers to large enterprises. Renowned for its versatility and comprehensive invoicing features, QuickBooks Online empowers users to create professional invoices, automate recurring billing, and effortlessly track payments. With its cloud-based platform, users can access their financial data anytime, anywhere, ensuring flexibility and convenience in managing invoicing tasks.

FreshBooks

FreshBooks is synonymous with simplicity and efficiency, making it a favored choice among small businesses and self-employed professionals. Its intuitive interface and streamlined invoicing tools enable users to create polished invoices, track billable hours, and manage expenses with ease. FreshBooks also offers advanced features such as client retainer billing and project-based invoicing, catering to the diverse needs of service-based businesses.

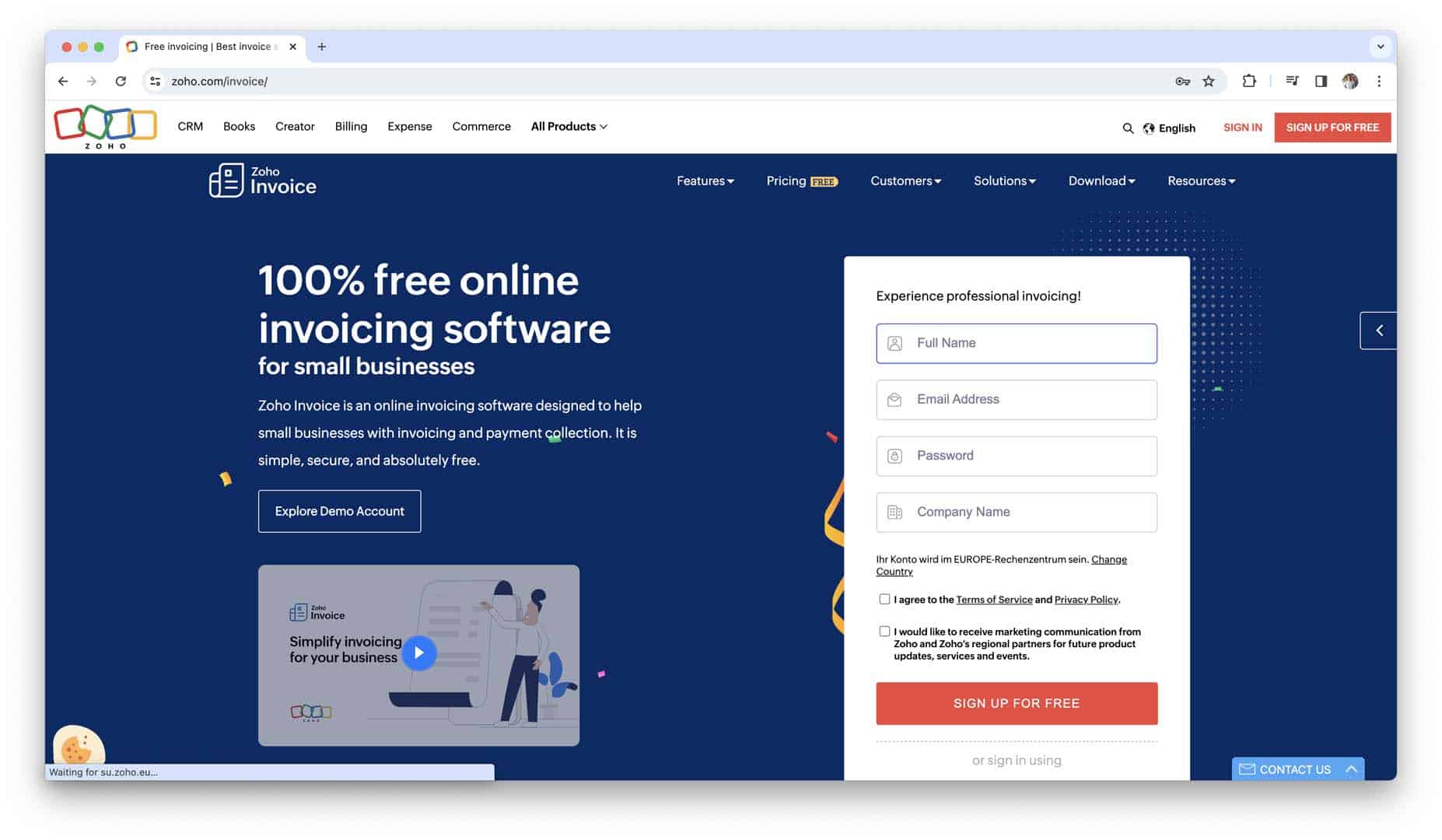

Zoho Invoice

Zoho Invoice stands out for its user-friendly interface and extensive feature set designed to meet the invoicing needs of businesses of all sizes. With Zoho Invoice, users can customize invoice templates, set up recurring invoices, and automate payment reminders to ensure timely payments from clients. Moreover, its integration with other Zoho applications offers businesses a comprehensive suite of tools for managing finances, customer relationships, and more.

BILL

BILL serves as a cornerstone in automating accounts payable and accounts receivable processes, offering businesses unparalleled efficiency and control over their billing workflows. With features such as electronic invoice delivery, customizable approval workflows, and seamless integration with accounting software, BILL streamlines invoicing tasks and accelerates payment processing. Its intuitive platform empowers businesses to optimize cash flow management and gain greater visibility into their financial operations.

Invoicera

Invoicera is a comprehensive billing and invoicing software solution designed to cater to businesses of all sizes, from freelancers to large enterprises. With its extensive range of features, including customizable invoice templates, recurring invoicing, and expense tracking, Invoicera offers users the tools they need to streamline their invoicing processes and improve cash flow management. Additionally, Invoicera’s integration capabilities with popular payment gateways and accounting software make it a versatile choice for businesses seeking to optimize their financial operations.

Hiveage

Hiveage is a user-friendly invoicing and billing platform that empowers businesses to create professional invoices, manage subscriptions, and track expenses effortlessly. With its intuitive interface and customizable invoice templates, Hiveage makes it easy for users to generate polished invoices that reflect their brand identity. Moreover, Hiveage’s built-in time tracking and project management features offer added flexibility for service-based businesses seeking to streamline their invoicing and project management workflows.

PaySimple

PaySimple is a versatile billing and payment processing platform designed to simplify invoicing and payment collection for businesses across various industries. With its comprehensive suite of features, including recurring billing, online payment acceptance, and customer management tools, PaySimple enables businesses to automate their invoicing processes and improve cash flow management. Additionally, PaySimple’s integration capabilities with accounting software and CRM platforms provide businesses with a seamless solution for managing their finances and customer relationships.

Moon Invoice

Moon Invoice is a feature-rich invoicing software solution tailored to the needs of small businesses, freelancers, and entrepreneurs. With its intuitive interface and customizable invoice templates, Moon Invoice empowers users to create professional invoices quickly and efficiently. Additionally, Moon Invoice offers advanced features such as multi-currency invoicing, expense tracking, and real-time reporting, making it a comprehensive solution for businesses seeking to streamline their invoicing processes and improve financial visibility.

Scoro

Scoro is an all-in-one business management software solution that includes robust invoicing features alongside project management, CRM, and financial reporting tools. With its customizable invoice templates, automated billing workflows, and real-time financial insights, Scoro offers businesses a comprehensive platform for managing their invoicing and financial operations. Additionally, Scoro’s integration capabilities with third-party apps and services make it a flexible solution for businesses seeking to streamline their workflows and improve productivity.

Odoo

Odoo is a comprehensive business management software suite that offers a wide range of modules, including invoicing, accounting, CRM, and inventory management. With its modular architecture, Odoo allows businesses to customize their invoicing workflows to suit their specific needs. Whether creating professional invoices, managing customer relationships, or tracking inventory levels, Odoo provides businesses with the tools they need to streamline their operations and drive growth.

Invoiced

Invoiced is a cloud-based invoicing and accounts receivable platform designed to streamline billing processes for businesses of all sizes. With features such as customizable invoice templates, automated payment reminders, and online payment processing, Invoiced simplifies invoicing tasks and accelerates cash flow. Additionally, Invoiced offers advanced analytics and reporting tools to provide businesses with insights into their financial performance and customer payment behavior, enabling them to make informed decisions and optimize their invoicing strategies.

EasyBooks

EasyBooks is a comprehensive accounting and invoicing software solution designed for small businesses and self-employed individuals. With its intuitive interface and customizable invoice templates, EasyBooks makes it easy for users to create professional invoices and track payments. Moreover, EasyBooks offers features such as expense tracking, inventory management, and tax calculations, providing users with all the tools they need to manage their finances effectively. With its affordable pricing plans and cross-platform compatibility, EasyBooks is an ideal choice for businesses looking to streamline their invoicing and accounting processes.

Billdu

Billdu is a versatile invoicing and business management platform that caters to the needs of freelancers, small businesses, and entrepreneurs. With its user-friendly interface and customizable invoice templates, Billdu enables users to create professional invoices and track payments effortlessly. Moreover, Billdu offers features such as expense tracking, time tracking, and inventory management, providing users with comprehensive tools for managing their finances and operations. With its mobile app and cloud-based platform, Billdu offers flexibility and accessibility, allowing users to manage their invoicing and business tasks anytime, anywhere.

In selecting the right billing and invoicing software for your business, it’s essential to consider factors such as your business size, industry-specific requirements, integration needs, and budget constraints. By leveraging these top billing and invoicing software solutions, businesses can streamline their financial processes, enhance efficiency, and pave the way for sustained growth and success.

How to Choose a Billing and Invoicing Software?

Selecting the right billing and invoicing software is a critical decision for your business, and several key factors should guide your choice. Let’s delve into these factors to ensure you make an informed decision that aligns with your business needs.

Scalability

Scalability refers to the software’s ability to adapt and grow alongside your business.

- Future Growth: Evaluate whether the software can accommodate your business’s growth trajectory. Will it support an increase in the volume of invoices, clients, or transactions?

- Additional Features: Look for software that offers additional features or modules that you may need as your business expands, such as multi-currency support, advanced reporting capabilities, or integrations with other business tools.

- Cost Considerations: Consider the scalability of the software in relation to pricing. Will you incur additional costs as you scale up your usage, or does the pricing scale proportionally with your business growth?

Choosing a scalable billing and invoicing solution ensures that you won’t outgrow the software prematurely and minimizes the need for disruptive transitions to new systems as your business evolves.

Customization Options

Customization options allow you to tailor the software to meet your specific business requirements and branding preferences.

- Invoice Templates: Look for software that offers customizable invoice templates, allowing you to incorporate your company logo, color scheme, and branding elements for a professional look.

- Invoice Fields: Consider whether you can add custom fields to your invoices to capture additional information relevant to your business or industry.

- Automation Rules: Assess the software’s ability to automate invoicing processes based on predefined rules or triggers, such as sending recurring invoices or applying discounts automatically.

Customization options empower you to create personalized invoices that reflect your brand identity and streamline your billing processes to suit your unique business needs.

Integration Capabilities

Integration capabilities are crucial for seamless connectivity between your billing and invoicing software and other essential business tools or systems.

- Accounting Software: Evaluate whether the software integrates with your accounting software, such as QuickBooks, Xero, or Sage, to streamline financial reporting and reconciliation processes.

- CRM Platforms: Consider integration with customer relationship management (CRM) platforms like Salesforce or HubSpot to synchronize customer data and streamline client communication.

- Payment Gateways: Ensure the software integrates with popular payment gateways like PayPal, Stripe, or Square to accept online payments securely and efficiently.

Integrations eliminate manual data entry, reduce errors, and enhance efficiency by syncing information across your business ecosystem.

Security Measures

Security is paramount when handling sensitive financial data, and robust security measures are non-negotiable when selecting billing and invoicing software. Look for the following security features:

- Data Encryption: Ensure that the software encrypts sensitive data, such as client information and payment details, both in transit and at rest, to protect against unauthorized access.

- Compliance Certifications: Verify that the software provider adheres to industry-standard security certifications and compliance regulations, such as PCI DSS (Payment Card Industry Data Security Standard) for handling credit card information.

- Access Controls: Assess the software’s access control features, such as user permissions and authentication mechanisms, to prevent unauthorized users from accessing sensitive financial data.

Prioritizing security measures safeguards your business and client data from potential breaches, fraud, and cyberattacks, instilling trust and confidence in your billing processes.

User-Friendliness

User-friendliness is essential for ensuring smooth adoption and usage of the billing and invoicing software by you and your team.

- Intuitive Interface: Look for software with an intuitive, user-friendly interface that minimizes the learning curve for users, even those with limited technical expertise.

- Onboarding Process: Assess the availability of training resources, tutorials, and onboarding support provided by the software provider to help users get up to speed quickly.

- Customer Feedback: Pay attention to user reviews and testimonials regarding the software’s ease of use and overall user experience to gauge its suitability for your team.

Choosing user-friendly software enhances productivity, reduces errors, and promotes user adoption across your organization.

Customer Support and Training

Responsive customer support and comprehensive training resources are vital for resolving issues promptly and maximizing the software’s effectiveness.

- Support Channels: Evaluate the availability of customer support channels, such as phone, email, live chat, or helpdesk ticketing systems, and their responsiveness to inquiries and technical issues.

- Documentation and Tutorials: Look for comprehensive documentation, tutorials, and knowledge bases provided by the software provider to assist users in troubleshooting common issues and mastering advanced features.

- Training Programs: Assess whether the software provider offers training programs, webinars, or workshops to educate users on best practices for using the software effectively and optimizing its features.

Investing in software with robust customer support and training ensures that you have the assistance you need to overcome challenges and maximize the value of your billing and invoicing solution.

How to Implement Billing and Invoicing Software?

Now that you’ve selected the ideal billing and invoicing software for your business needs, it’s time to implement it effectively. We will guide you through the process of setting up the software, migrating data if necessary, training your team, and integrating the new system with existing tools and systems.

Setting Up the Software

Setting up your billing and invoicing software is the first step towards streamlining your financial processes. Here’s how to do it effectively:

- Account Creation: Begin by creating an account with the software provider and subscribing to the appropriate pricing plan based on your business requirements.

- Configuration: Customize the software settings to align with your business preferences, such as invoice templates, payment terms, and tax rates.

- User Permissions: Define user roles and permissions within the software to control access to sensitive financial data and ensure compliance with data security policies.

- Bank Integration: If the software offers bank integration features, link your bank accounts to facilitate seamless payment reconciliation and financial reporting.

By configuring the software to suit your specific needs, you lay the foundation for efficient invoicing and billing processes.

Data Migration (if applicable)

If you’re transitioning from an existing billing system or spreadsheet-based invoicing to the new software, data migration may be necessary. Follow these steps to ensure a smooth transition:

- Data Assessment: Begin by assessing the data you need to migrate, including client information, invoice history, payment records, and any other relevant financial data.

- Data Cleansing: Cleanse and organize your data to ensure accuracy and consistency before importing it into the new software. Remove duplicates, correct errors, and standardize formatting where necessary.

- Data Import: Utilize the import tools provided by the software to transfer your data from the existing system or spreadsheets into the new software. Follow the instructions carefully to map data fields accurately and avoid data loss or corruption.

- Verification: After importing the data, verify its integrity by cross-referencing it with your original records and conducting thorough testing to ensure that all data has been transferred correctly.

Effective data migration is crucial for preserving historical financial records and ensuring continuity in your billing processes.

Training Your Team

Training your team on the new billing and invoicing software is essential for successful adoption and utilization. Here’s how to approach the training process:

- Training Materials: Utilize the training materials provided by the software provider, such as tutorials, user guides, and video demonstrations, to familiarize your team with the software’s features and functionality.

- Hands-on Practice: Schedule hands-on training sessions where users can interact with the software in a simulated environment and practice common tasks such as creating invoices, sending reminders, and recording payments.

- Role-Specific Training: Tailor training sessions to address the specific needs of different user roles within your organization, such as administrators, accountants, and sales representatives.

- Ongoing Support: Encourage open communication and provide ongoing support to address any questions, concerns, or challenges that arise during the training process. Consider appointing power users or champions within your team who can provide assistance and support to their colleagues.

By investing in comprehensive training, you empower your team to leverage the full potential of the billing and invoicing software and maximize productivity.

Integration with Existing Systems

Integrating your new billing and invoicing software with existing tools and systems streamlines workflows and enhances efficiency. Follow these steps to ensure seamless integration:

- Compatibility Assessment: Assess the compatibility of the new software with your existing systems, such as accounting software, CRM platforms, and payment gateways.

- API Integration: Explore the software’s application programming interface (API) capabilities to facilitate integration with third-party systems. Work with your IT team or software developers to develop custom integrations if necessary.

- Data Synchronization: Configure the integrations to synchronize data seamlessly between the billing and invoicing software and other systems, ensuring consistency and accuracy across all platforms.

- Testing: Conduct thorough testing of the integrations to verify data flow, identify any potential issues or bottlenecks, and ensure that all systems function harmoniously together.

- Documentation: Document the integration processes, including configuration settings, API endpoints, and data mappings, to facilitate troubleshooting and future maintenance.

By integrating your billing and invoicing software with existing systems, you eliminate duplicate data entry, reduce errors, and create a unified ecosystem that enhances productivity and collaboration across your organization.

Best Practices for Using Billing and Invoicing Software

Optimizing your use of billing and invoicing software is essential for maximizing efficiency, accuracy, and client satisfaction. Follow these best practices to make the most of your software investment:

- Establish Efficient Invoicing Processes: Streamline your invoicing workflows by setting clear procedures for generating, reviewing, and sending invoices promptly. Use automation features to schedule recurring invoices and minimize manual data entry.

- Set Up Automated Reminders and Alerts: Reduce late payments and improve cash flow by configuring automated reminders for outstanding invoices. Set up alerts to notify you when invoices are overdue or payments are received, allowing you to take timely action.

- Ensure Data Accuracy and Consistency: Maintain accurate and consistent records by regularly reconciling invoices with payments received and updating client information as needed. Double-check invoice details, such as billing amounts and due dates, to prevent errors that could impact your financial records.

- Monitor and Analyze Financial Data: Leverage reporting and analytics tools provided by your billing and invoicing software to gain insights into your financial performance. Track key metrics such as revenue, accounts receivable aging, and client payment trends to identify opportunities for improvement and inform strategic decision-making.

- Customize Invoices for Professionalism: Customize your invoice templates with your company logo, branding elements, and personalized messaging to create a professional and memorable impression on your clients. Clearly communicate payment terms, accepted payment methods, and contact information to facilitate prompt payment processing.

- Implement a Clear Payment Policy: Establish a transparent payment policy outlining your expectations regarding payment terms, late fees, and dispute resolution processes. Communicate this policy to your clients upfront and include it on your invoices to minimize misunderstandings and disputes.

- Regularly Update Software and Security Measures: Stay up-to-date with software updates and security patches provided by your billing and invoicing software provider to ensure optimal performance and protect against security vulnerabilities. Implement strong password policies and multi-factor authentication to safeguard sensitive financial data.

- Provide Ongoing Training and Support: Invest in ongoing training and support for your team to ensure they are proficient in using the billing and invoicing software effectively. Offer refresher courses, user guides, and access to customer support resources to address any questions or concerns that may arise.

- Seek Feedback and Continuously Improve: Solicit feedback from your team members and clients on their experience with the billing and invoicing process. Use this feedback to identify areas for improvement and implement changes to enhance efficiency, usability, and client satisfaction over time.

By following these best practices, you can optimize your use of billing and invoicing software to streamline your financial processes, improve cash flow management, and strengthen client relationships.

Conclusion

Selecting the best billing and invoicing software for your business is a crucial step towards optimizing your financial processes and enhancing efficiency. By leveraging the features and capabilities of top-tier software solutions such as QuickBooks Online, FreshBooks, and Xero, you can streamline your invoicing workflows, improve cash flow management, and maintain professional communication with your clients. Additionally, considering key factors such as scalability, customization options, integration capabilities, security measures, user-friendliness, and customer support ensures that you make an informed decision that aligns with your business needs and goals.

In today’s digital age, the importance of adopting the right billing and invoicing software cannot be overstated. From saving time and reducing errors to enhancing client satisfaction and improving financial visibility, investing in the right software solution can yield significant benefits for your business. Whether you’re a freelancer managing invoices for multiple clients or a large corporation processing thousands of transactions, finding the perfect billing and invoicing software empowers you to streamline your operations, drive growth, and achieve long-term success in the competitive business landscape.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.