Are you a small business owner looking for the right accounting software to streamline your financial processes and improve efficiency? In today’s digital age, choosing the best accounting software can make a significant difference in managing your business’s finances effectively.

From tracking expenses and generating invoices to analyzing financial reports and ensuring compliance, the right accounting software can empower you to make informed decisions and drive business growth. In this guide, we’ll explore everything you need to know about selecting the best accounting software for your small business, including key features to consider, benefits, and top options available in the market.

What is Accounting Software?

Accounting software refers to computer programs or applications designed to automate, streamline, and manage financial tasks and processes within a business or organization. These software solutions are specifically tailored to handle accounting-related functions, such as recording financial transactions, tracking expenses and income, generating financial reports, and facilitating compliance with tax and regulatory requirements.

Key Features of Accounting Software

- General Ledger: A central repository for all financial transactions, providing a comprehensive overview of a business’s financial position.

- Invoicing and Billing: Allows businesses to create, send, and track invoices to customers for products or services rendered.

- Expense Tracking: Enables businesses to record and categorize expenses incurred in the course of operations, facilitating budgeting and cost control.

- Financial Reporting: Generates a variety of financial reports, such as profit and loss statements, balance sheets, and cash flow statements, to assess financial performance and make informed decisions.

- Bank Reconciliation: Matches transactions recorded in the accounting system with those reflected in bank statements to ensure accuracy and identify discrepancies.

- Payroll Processing: Calculates employee wages, taxes, and deductions, and generates paychecks or direct deposits.

- Inventory Management: Tracks inventory levels, sales, and purchases, helping businesses optimize stock levels and reduce carrying costs.

- Tax Compliance: Assists with tax preparation and compliance by organizing financial data and generating reports required for tax filing.

Accounting software comes in various forms, including desktop-based applications, cloud-based solutions, and hybrid systems that combine both approaches. Businesses can choose the type of accounting software that best suits their needs, budget, and technical requirements.

Benefits of Using Accounting Software

The adoption of accounting software offers numerous benefits to businesses of all sizes, ranging from increased efficiency and accuracy to improved financial management and decision-making.

- Time Savings: Automates repetitive and time-consuming accounting tasks, such as data entry, invoicing, and reconciliation, allowing employees to focus on more strategic activities.

- Accuracy: Reduces the risk of errors associated with manual data entry and calculations, leading to more accurate financial records and reports.

- Cost Efficiency: Helps businesses save money by minimizing the need for manual labor, paper-based processes, and costly accounting errors.

- Improved Financial Management: Provides real-time visibility into a business’s financial performance, allowing owners and managers to make informed decisions and strategic adjustments as needed.

- Compliance: Facilitates compliance with tax laws, regulatory requirements, and financial reporting standards by automating data collection, organization, and reporting.

- Scalability: Scales with business growth and complexity, allowing businesses to easily add new users, features, and functionalities as needed.

- Accessibility: Provides anytime, anywhere access to financial data and reports via the cloud, enabling remote work and collaboration among team members.

- Integration: Integrates seamlessly with other business tools and software, such as CRM systems, project management tools, and payment processors, streamlining workflows and data sharing.

Importance of Accounting Software for Small Businesses

Accounting software plays a vital role in the success and sustainability of small businesses by providing essential tools and capabilities to manage finances effectively.

- Financial Visibility: Provides small business owners with real-time insights into their financial performance, allowing them to monitor cash flow, track expenses, and identify areas for improvement.

- Decision-Making: Empowers small business owners to make informed decisions based on accurate financial data and reports, enabling them to allocate resources strategically and pursue growth opportunities.

- Compliance: Helps small businesses stay compliant with tax laws, regulations, and reporting requirements, reducing the risk of penalties, fines, and legal consequences.

- Efficiency: Streamlines accounting processes and workflows, saving time and effort associated with manual data entry, reconciliation, and reporting.

- Professionalism: Enhances the professional image of small businesses by providing professional-looking invoices, financial reports, and documentation to clients, vendors, and stakeholders.

- Growth: Facilitates business growth and expansion by providing scalable solutions that can adapt to changing needs and requirements as the business evolves.

- Competitive Advantage: Gives small businesses a competitive edge by enabling them to operate more efficiently, make better-informed decisions, and focus on delivering value to customers.

- Financial Planning: Supports small businesses in creating and executing financial plans, budgets, and forecasts to achieve their short-term and long-term goals.

Understanding Small Business Accounting Needs

Running a small business involves managing various financial transactions and staying compliant with regulatory requirements. Understanding the common types of transactions, essential financial reports, and compliance obligations is crucial for effective financial management.

Types of Transactions Commonly Encountered

Small businesses engage in various transactions on a day-to-day basis, each of which impacts their financial records and overall performance. Some of the most common transactions include:

- Sales: Recording revenue generated from the sale of products or services to customers.

- Purchases: Tracking expenses incurred when purchasing goods or services necessary for business operations.

- Invoices: Issuing invoices to customers for products or services rendered, including terms of payment and due dates.

- Payments: Receiving payments from customers and making payments to suppliers, employees, or lenders.

- Payroll Transactions: Managing payroll expenses, including salaries, wages, bonuses, and payroll taxes.

- Bank Transactions: Monitoring cash inflows and outflows, including deposits, withdrawals, and transfers between accounts.

- Inventory Transactions: Tracking inventory levels, purchases, sales, and adjustments to ensure accurate inventory management.

Understanding these transaction types and accurately recording them in your accounting system is essential for maintaining accurate financial records and making informed business decisions.

Key Financial Reports Necessary for Small Business Management

Financial reports provide valuable insights into a business’s financial performance, helping owners and stakeholders assess profitability, liquidity, and overall financial health. Some of the key financial reports necessary for small business management include:

- Profit and Loss Statement (P&L): Also known as an income statement, the P&L summarizes revenues, expenses, and net income over a specific period, such as a month, quarter, or year. It helps owners understand whether the business is generating profits or incurring losses.

Formula: Net Income = Total Revenue – Total Expenses - Balance Sheet: The balance sheet provides a snapshot of a business’s financial position at a specific point in time, showing its assets, liabilities, and equity. It helps owners assess solvency, liquidity, and overall financial stability.

Formula: Assets = Liabilities + Equity - Cash Flow Statement: The cash flow statement tracks the flow of cash in and out of a business over a specific period, categorizing cash inflows and outflows into operating, investing, and financing activities. It helps owners understand how cash is being generated and used within the business.

Formula: Net Cash Flow = Cash Inflows – Cash Outflows - Accounts Receivable Aging Report: This report provides a detailed analysis of outstanding customer invoices, categorizing them by age to identify overdue payments. It helps businesses manage cash flow and collections effectively.

- Accounts Payable Aging Report: Similar to the accounts receivable aging report, the accounts payable aging report categorizes outstanding vendor invoices by age, helping businesses prioritize payments and manage vendor relationships.

By regularly reviewing these financial reports, small business owners can gain insights into their business’s performance, identify areas for improvement, and make informed decisions to drive growth and profitability.

Compliance Requirements for Small Businesses

Small businesses are subject to various regulatory requirements, including tax obligations, financial reporting standards, and industry-specific regulations. Staying compliant with these requirements is essential to avoid penalties, fines, or legal consequences. Compliance obligations for small businesses may include:

- Tax Compliance: Small businesses must comply with federal, state, and local tax laws, including income taxes, payroll taxes, sales taxes, and any industry-specific taxes. Maintaining accurate financial records and filing tax returns on time is essential to meet these obligations.

- Financial Reporting: Depending on the legal structure of the business and its size, small businesses may be required to prepare and submit financial statements in accordance with generally accepted accounting principles (GAAP) or other regulatory standards. These financial statements provide transparency and accountability to stakeholders, including investors, lenders, and regulatory agencies.

- Record-Keeping: Small businesses are required to maintain accurate and organized financial records, including invoices, receipts, bank statements, and accounting ledgers. These records serve as evidence of financial transactions and support compliance with tax and regulatory requirements.

- Licenses and Permits: Depending on the nature of the business and its location, small businesses may need to obtain licenses, permits, or certifications to operate legally. These requirements vary by industry and jurisdiction and may include business licenses, health permits, zoning permits, and professional licenses.

By understanding and fulfilling these compliance requirements, small business owners can minimize legal risks, maintain good standing with regulatory authorities, and build trust with customers, suppliers, and other stakeholders. It’s essential to stay informed about changes in tax laws, accounting standards, and industry regulations to ensure ongoing compliance and mitigate potential risks.

What to Consider When Choosing Accounting Software?

Selecting the right accounting software for your small business is a critical decision that can significantly impact your financial management processes. Several factors should be taken into account to ensure that the software you choose aligns with your business needs and objectives.

Cost Considerations

When evaluating accounting software options, cost considerations play a significant role in the decision-making process. It’s essential to understand the pricing structure of each software solution and assess whether it fits within your budget. Some key cost considerations include:

- Subscription Fees: Many accounting software providers offer subscription-based pricing models, where you pay a monthly or annual fee for access to the software. Consider the cost of the subscription and whether it’s affordable for your business.

- Tiered Pricing Plans: Some software providers offer tiered pricing plans with different levels of features and functionality at varying price points. Assess your business’s needs and determine which pricing tier offers the best value for your money.

- Add-on Costs: In addition to the base subscription fee, consider any additional costs associated with the software, such as fees for additional users, payroll processing, or integrations with third-party apps.

- Free Trials and Discounts: Take advantage of free trials or discounts offered by software providers to test the software before committing to a subscription. This allows you to evaluate the software’s suitability for your business without incurring any upfront costs.

By carefully considering the cost implications of each accounting software option, you can make an informed decision that meets your budgetary constraints while providing the features and functionality you need.

Ease of Use and User Interface

The usability of accounting software is another critical factor to consider, as it directly impacts how efficiently you and your team can navigate the software and perform essential tasks. Look for software with an intuitive user interface and user-friendly features that simplify the accounting process. Some factors to consider include:

- Intuitive Navigation: The software should have a clear and organized layout, with easy-to-navigate menus and options that are logically grouped together.

- Customization Options: The ability to customize the software to suit your preferences and workflow can enhance usability and improve productivity. Look for software that allows you to personalize settings, templates, and reports.

- Training and Support Resources: Assess the availability of training materials, tutorials, and customer support options provided by the software vendor. Adequate training and support can help you and your team quickly learn how to use the software effectively.

- Mobile Accessibility: If you or your team members need to access the accounting software while on the go, consider whether the software offers mobile apps or a responsive web interface that allows for easy access from smartphones or tablets.

By prioritizing ease of use and user interface design, you can minimize the learning curve associated with adopting new accounting software and maximize productivity within your business.

Features and Functionality Required for Your Business

Every small business has unique accounting needs, so it’s essential to assess the features and functionality offered by each accounting software option and determine which ones are essential for your business. Consider the following factors when evaluating software features:

- Invoicing and Billing: Does the software allow you to create and send professional invoices to customers, track payment status, and manage billing cycles effectively?

- Expense Tracking: Can you easily record and categorize business expenses, track receipts, and reconcile transactions with bank statements?

- Financial Reporting: Does the software offer robust reporting capabilities, allowing you to generate customizable reports such as profit and loss statements, balance sheets, and cash flow statements?

- Payroll Processing: If you have employees, does the software provide payroll processing functionality, including calculating wages, deductions, and tax withholdings?

- Inventory Management: If you sell products, does the software offer inventory management features to track stock levels, monitor sales, and manage reordering?

- Tax Preparation: Does the software simplify tax preparation by organizing income, expenses, and deductions, and generating reports to assist with tax filing?

By identifying the specific features and functionality your business requires, you can narrow down your options and choose software that meets your needs effectively.

Integration with Other Business Tools and Software

In today’s interconnected business environment, integration capabilities are crucial for maximizing efficiency and streamlining workflows. Look for accounting software that integrates seamlessly with other business tools and software your company uses, such as:

- Customer Relationship Management (CRM) Software: Integration with CRM software allows you to sync customer information, sales data, and invoices between your accounting system and CRM platform, providing a unified view of customer interactions and financial transactions.

- E-commerce Platforms: If you sell products online, integration with e-commerce platforms such as Shopify, WooCommerce, or BigCommerce enables automated syncing of sales data, inventory levels, and customer orders, reducing manual data entry and errors.

- Payment Processors: Integration with payment processors such as PayPal, Stripe, or Square facilitates seamless payment acceptance, reconciliation, and tracking within your accounting system.

- Project Management Tools: Integration with project management software such as Asana, Trello, or Basecamp allows you to link project-related expenses, time tracking data, and invoices to specific projects or clients, providing transparency and accountability.

By leveraging integration capabilities, you can create a connected ecosystem of business tools that work together seamlessly, improving collaboration, data accuracy, and productivity.

Customer Support and Training Options

Finally, consider the level of customer support and training options provided by the accounting software vendor, as ongoing support and guidance are essential for successful software implementation and usage. Evaluate the following factors when assessing customer support and training options:

- Support Channels: Does the vendor offer multiple support channels, such as phone support, email support, live chat, or a help center? Consider your preferred method of communication and the availability of support during business hours.

- Response Times: Assess the vendor’s average response times for customer inquiries and support requests, as well as their track record for resolving issues promptly and satisfactorily.

- Training Resources: Look for software vendors that provide comprehensive training resources, including user manuals, video tutorials, webinars, and knowledge base articles, to help you and your team learn how to use the software effectively.

- Dedicated Account Manager: Some software providers offer dedicated account managers or customer success representatives who serve as a single point of contact for assistance, guidance, and account management.

By choosing accounting software with robust customer support and training options, you can ensure that you receive the assistance and guidance you need to maximize the value of the software and overcome any challenges that may arise during implementation and usage.

Top Accounting Software for Small Businesses

Choosing the right accounting software for your small business can be overwhelming given the multitude of options available in the market. To help you make an informed decision, we’ve curated a list of some of the top accounting software options tailored to meet the needs of small businesses. Each software solution offers unique features, pricing plans, and benefits, so it’s essential to evaluate them based on your specific requirements and preferences.

Sage Intacct

Sage Intacct or Sage Business Cloud Accounting, formerly known as Sage One, is an accounting software solution designed for small businesses and startups. It offers features such as invoicing, expense tracking, bank reconciliation, and financial reporting. Sage Intracct is known for its robust functionality and scalability, allowing you to grow your business without outgrowing the software. It also offers integration with other Sage products, such as payroll and HR software, for a complete business management solution.

Xero

Xero is another popular accounting software option that caters to small businesses and freelancers. It offers a cloud-based platform with features such as invoicing, expense tracking, bank reconciliation, and payroll processing. Xero‘s intuitive interface and user-friendly design make it easy for non-accountants to navigate and use effectively. Additionally, Xero offers a marketplace of add-ons and integrations, allowing you to tailor the software to your specific business requirements.

Wave

Wave is a free accounting software option that offers a range of features tailored to small businesses and self-employed individuals. It includes invoicing, expense tracking, receipt scanning, and financial reporting capabilities. While Wave lacks some of the advanced features found in paid accounting software solutions, it provides a cost-effective option for businesses with basic accounting needs. Wave also offers paid add-ons for payroll processing and payment processing, allowing you to customize the software to your requirements.

Intuit QuickBooks Online

Intuit QuickBooks is one of the most widely used accounting software solutions for small businesses. It offers a comprehensive suite of features to help you manage your finances efficiently, including invoicing, expense tracking, bank reconciliation, and financial reporting. With its user-friendly interface and robust functionality, QuickBooks Online is suitable for businesses of all sizes and industries. It also offers integrations with hundreds of third-party apps, allowing you to customize and expand its capabilities to suit your needs.

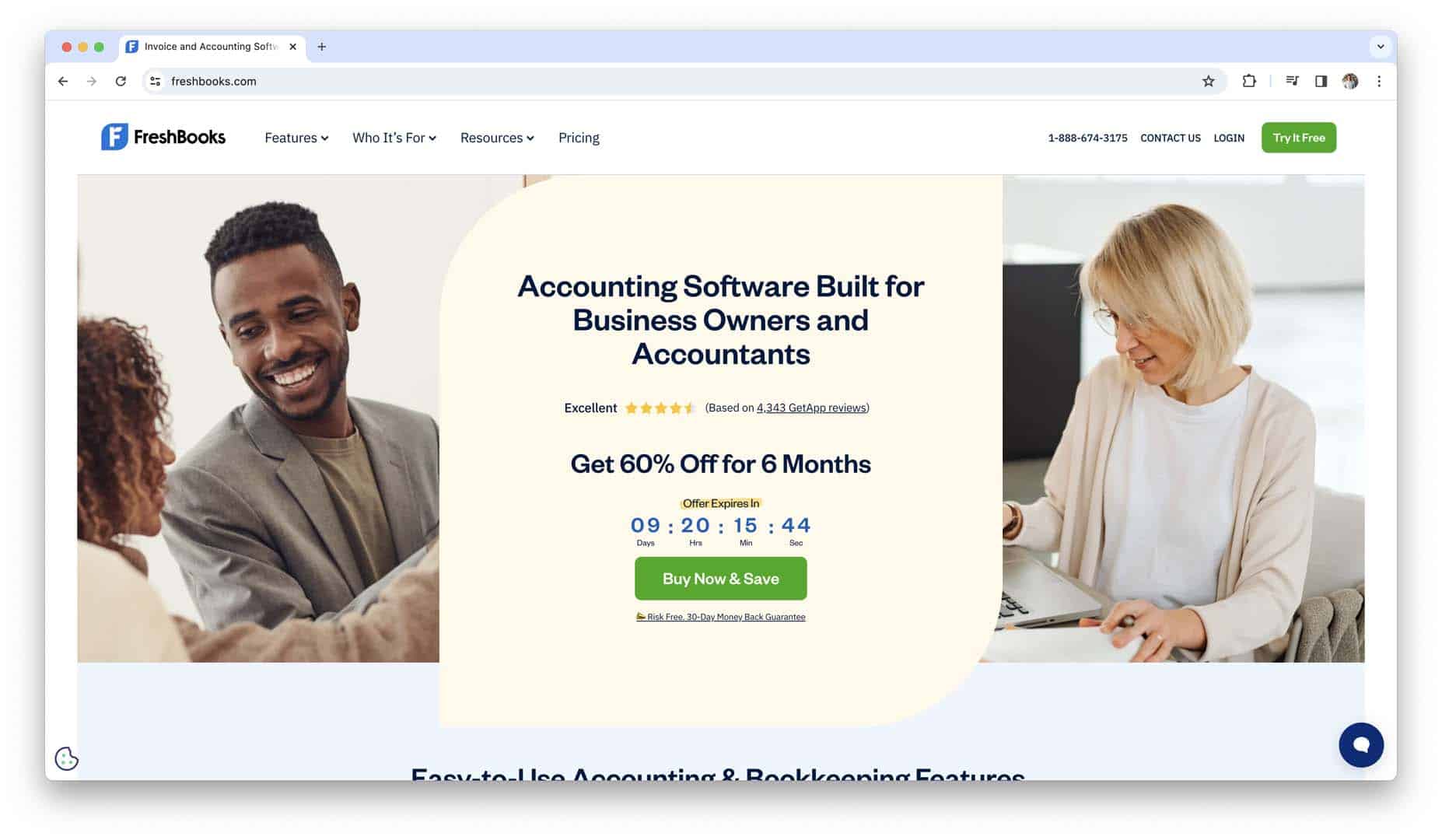

FreshBooks

FreshBooks is a cloud-based accounting software solution designed for small service-based businesses and freelancers. It offers features such as time tracking, project management, invoicing, expense tracking, and reporting. FreshBooks’ user-friendly interface and automation capabilities streamline administrative tasks, allowing you to focus on growing your business. It also integrates with popular business tools and payment processors, making it easy to manage all aspects of your business finances in one place.

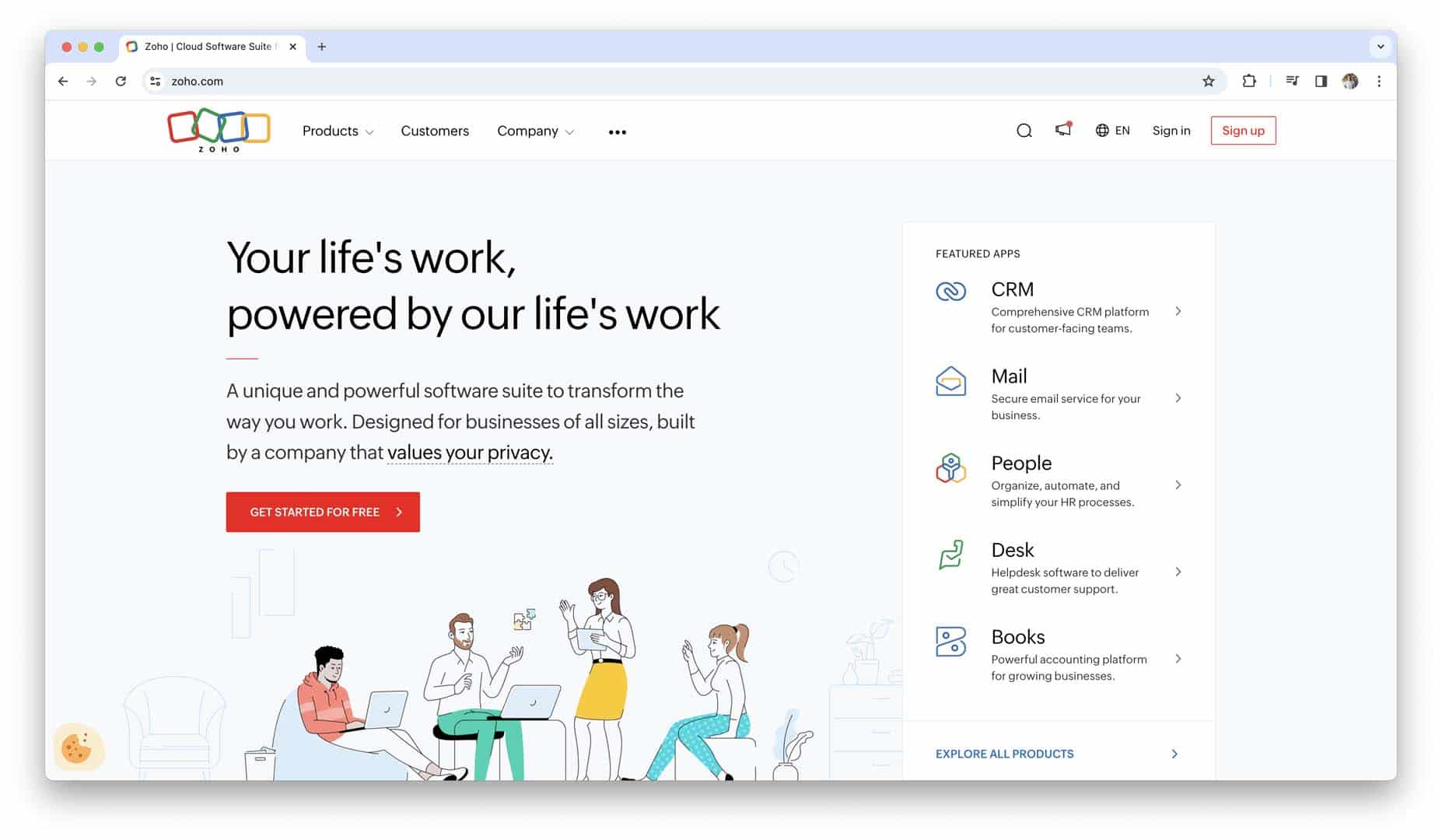

Zoho Books

Zoho Books is an accounting software solution designed for small businesses and freelancers. It offers features such as invoicing, expense tracking, bank reconciliation, and financial reporting. Zoho Books integrates seamlessly with other Zoho products, such as CRM and project management software, providing a comprehensive business management solution. With its user-friendly interface and affordable pricing plans, Zoho Books is an excellent option for small businesses looking for an all-in-one accounting solution.

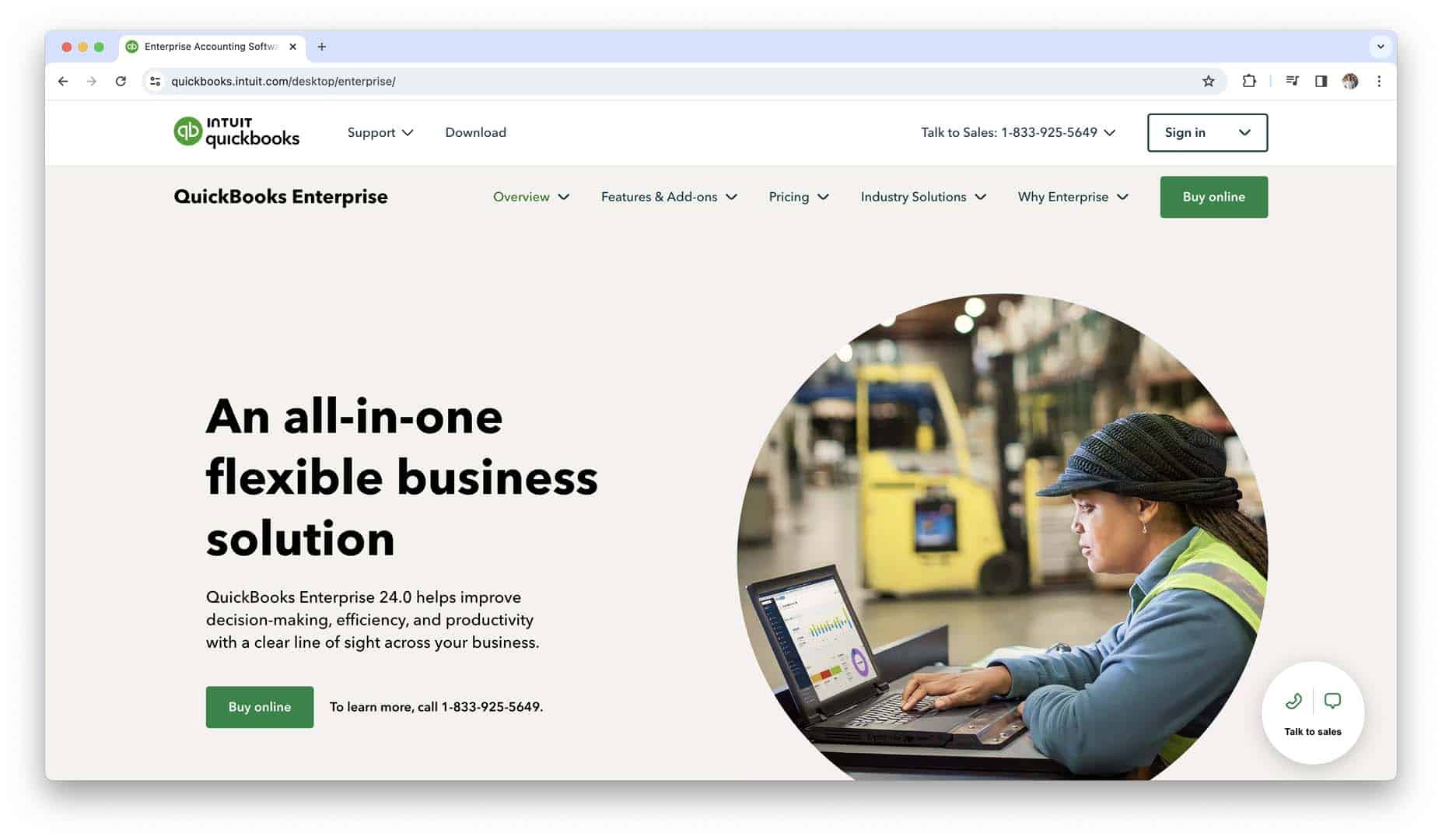

Intuit QuickBooks Enterprise (Desktop)

While QuickBooks Online is the cloud-based version of QuickBooks, Intuit QuickBooks Desktop Enterprise remains a popular choice for small businesses that prefer traditional desktop accounting software. It offers a wide range of features, including invoicing, expense tracking, inventory management, and reporting. QuickBooks Enterprise is known for its robust functionality and customization options, making it suitable for businesses with complex accounting needs. However, it requires installation on a local computer and may not offer the same level of mobility and accessibility as cloud-based solutions.

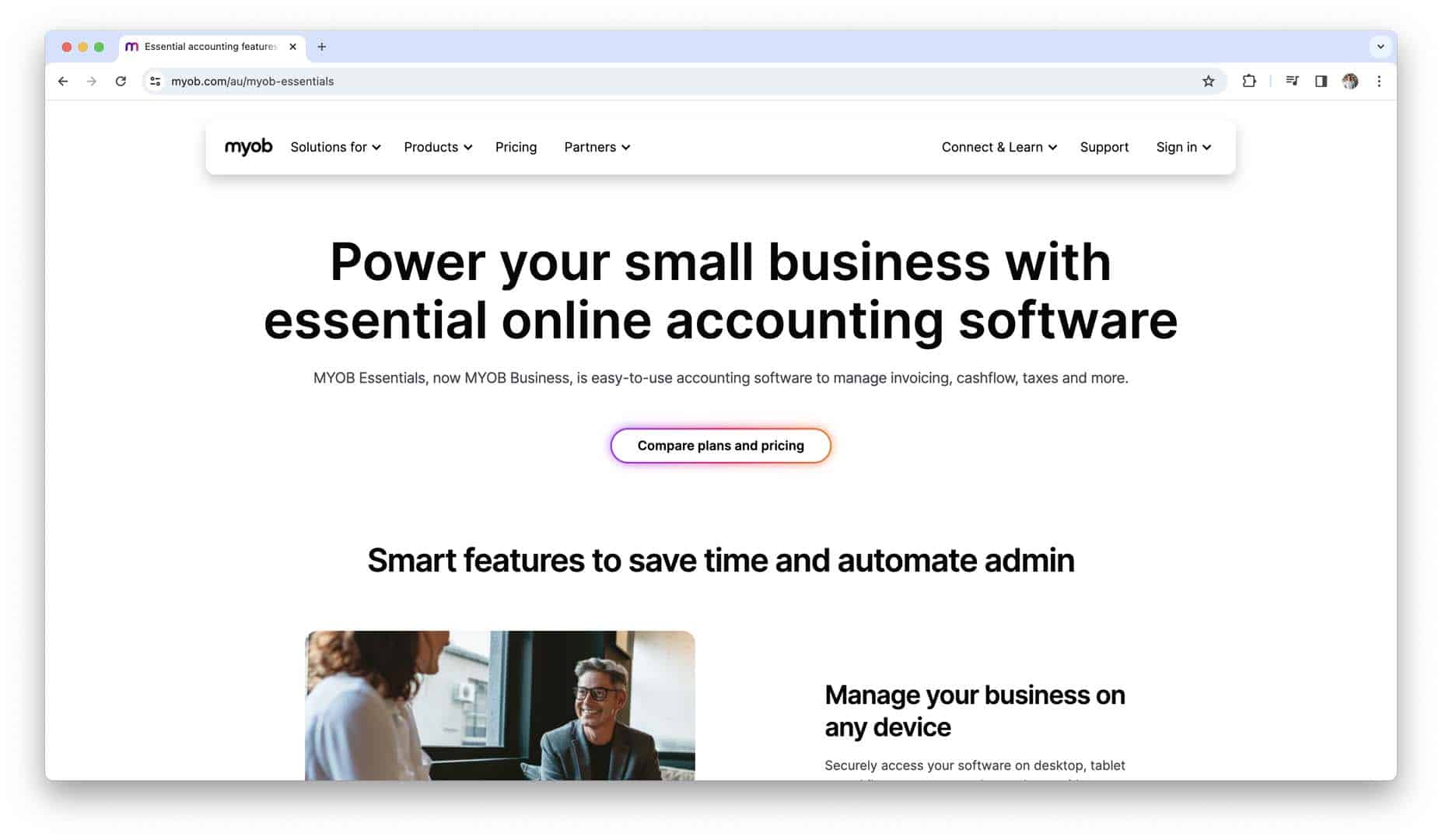

MYOB Essentials

MYOB Essentials is an accounting software solution designed for small businesses and sole traders in Australia and New Zealand. It offers features such as invoicing, expense tracking, payroll processing, and financial reporting. MYOB Essentials is known for its user-friendly interface and comprehensive functionality, making it suitable for businesses in various industries. It also integrates with other MYOB products, such as payroll and HR software, for a complete business management solution tailored to the needs of Australian and New Zealand businesses.

Kashoo

Kashoo is a cloud-based accounting software solution designed for small businesses and freelancers. It offers features such as invoicing, expense tracking, bank reconciliation, and financial reporting. Kashoo’s simple and intuitive interface makes it easy for users to manage their finances without prior accounting knowledge. It also integrates with popular business tools and payment processors, allowing you to streamline your business processes and improve efficiency.

FreeAgent

FreeAgent is an accounting software solution designed for small businesses and freelancers in the UK. It offers features such as invoicing, expense tracking, bank reconciliation, and financial reporting. FreeAgent is known for its user-friendly interface and automation capabilities, making it easy for users to manage their finances efficiently. It also integrates with other business tools and payment processors, providing a complete business management solution tailored to the needs of UK businesses.

These are just a few of the top accounting software options available for small businesses. It’s essential to thoroughly research and evaluate each option based on your specific needs, budget, and long-term business goals. By choosing the right accounting software, you can streamline your financial processes, save time and effort, and focus on growing your business.

Using Accounting Software for Daily Operations

Once you’ve chosen the right accounting software for your small business, it’s essential to understand how to leverage its features effectively to streamline your daily operations. Accounting software can automate many financial tasks, saving you time and effort while providing valuable insights into your business’s financial health.

Recording Transactions

Recording transactions accurately is the foundation of sound financial management. With accounting software, you can streamline the process of entering and categorizing transactions, ensuring that your books are always up-to-date. Here’s how you can effectively record transactions using accounting software:

- Enter Transactions Promptly: Make it a habit to record transactions as soon as they occur to prevent errors and ensure accuracy.

- Categorize Transactions Correctly: Assign appropriate categories to each transaction to track income and expenses accurately and facilitate financial reporting.

- Reconcile Bank Statements: Regularly reconcile your bank statements with your accounting records to identify discrepancies and ensure that all transactions are accounted for.

- Use Bank Feeds: Take advantage of bank feeds or automatic transaction imports to streamline the process of reconciling bank transactions and ensure accuracy.

By recording transactions promptly and accurately, you can maintain a clear and accurate picture of your business’s financial position and make informed decisions based on up-to-date information.

Generating and Analyzing Financial Reports

Financial reports provide valuable insights into your business’s financial performance, allowing you to track key metrics, identify trends, and make data-driven decisions. Most accounting software solutions offer a range of pre-built reports that you can generate with the click of a button. Here are some essential financial reports to generate and analyze using accounting software:

- Profit and Loss Statement (P&L): The P&L statement summarizes your business’s revenues, expenses, and net income over a specific period, providing insight into profitability.

- Balance Sheet: The balance sheet provides a snapshot of your business’s financial position at a specific point in time, including assets, liabilities, and equity.

- Cash Flow Statement: The cash flow statement tracks the flow of cash in and out of your business, helping you understand your cash position and liquidity.

- Aging Reports: Accounts receivable aging and accounts payable aging reports help you track overdue payments from customers and outstanding bills to vendors, respectively.

By regularly generating and analyzing these financial reports, you can gain a deeper understanding of your business’s financial performance, identify areas for improvement, and make informed decisions to drive growth and profitability.

Managing Invoices and Payments

Managing invoices and payments efficiently is essential for maintaining cash flow and ensuring timely payment from customers. Accounting software simplifies the invoicing and payment process, allowing you to create and send invoices, track payment status, and reconcile transactions seamlessly. Here’s how you can effectively manage invoices and payments using accounting software:

- Create Professional Invoices: Customize invoice templates with your branding and include detailed information about products or services provided, payment terms, and due dates.

- Send Invoices Electronically: Use email or online invoicing features to send invoices to customers electronically, speeding up the payment process and reducing the risk of errors.

- Track Payment Status: Monitor the status of invoices and payments in real-time, allowing you to follow up on overdue invoices and take appropriate action to ensure prompt payment.

- Automate Payment Reminders: Set up automated payment reminders to notify customers of overdue invoices and encourage timely payment, reducing the need for manual follow-up.

By streamlining the invoicing and payment process, accounting software helps you maintain a steady cash flow and improve your business’s financial health.

Tracking Expenses and Receipts

Tracking business expenses accurately is essential for managing costs, monitoring profitability, and maximizing tax deductions. Accounting software simplifies expense tracking by allowing you to categorize expenses, capture receipts electronically, and reconcile transactions with bank statements. Here’s how you can effectively track expenses and receipts using accounting software:

- Categorize Expenses: Assign appropriate categories to each expense to track spending and allocate costs accurately.

- Capture Receipts Digitally: Use mobile apps or integrations with receipt scanning services to capture and store receipts electronically, reducing paper clutter and ensuring compliance with record-keeping requirements.

- Reconcile Transactions: Regularly reconcile your business bank accounts with your accounting records to ensure that all expenses are accounted for and properly categorized.

- Track Mileage: If your business involves travel, use mileage tracking features to record and categorize business-related mileage for reimbursement or tax purposes.

By tracking expenses and receipts diligently, you can gain insights into your business’s spending patterns, identify opportunities to reduce costs, and maximize tax deductions.

Automating Recurring Tasks

Accounting software can automate many repetitive and time-consuming tasks, allowing you to focus on growing your business rather than getting bogged down in administrative work. Here are some recurring tasks that you can automate using accounting software:

- Recurring Invoices: Set up recurring invoices for regular customers to automate billing and ensure timely payment.

- Expense Management: Use automation features to categorize recurring expenses automatically and allocate them to the appropriate accounts.

- Bank Reconciliation: Automate bank reconciliation processes by syncing bank feeds or importing transactions, reducing manual data entry and errors.

- Payment Reminders: Set up automated payment reminders to notify customers of upcoming due dates and encourage prompt payment, reducing the need for manual follow-up.

By automating recurring tasks, you can streamline your daily operations, improve efficiency, and free up time to focus on strategic business initiatives and growth opportunities

Advanced Features and Tips for Optimization

As you become more familiar with your chosen accounting software, you can explore advanced features and strategies to further optimize your financial management processes. From budgeting and forecasting tools to advanced reporting options and integration capabilities, leveraging these advanced features can help you streamline operations and gain deeper insights into your business’s financial performance.

Budgeting and Forecasting Tools

Budgeting and forecasting are essential components of financial planning and management for small businesses. Many accounting software solutions offer built-in budgeting and forecasting tools that allow you to set financial goals, create budgets, and project future financial performance based on historical data and assumptions. Here’s how you can leverage these tools effectively:

- Set Realistic Financial Goals: Define clear and achievable financial goals for your business, such as revenue targets, expense reduction goals, or profitability benchmarks.

- Create Detailed Budgets: Develop detailed budgets for different aspects of your business, including sales, marketing, operations, and capital expenditures. Consider historical performance, industry trends, and future growth projections when creating budgets.

- Monitor Performance Against Budgets: Regularly compare actual financial performance against budgeted targets to identify variances and take corrective action as needed. Use variance analysis to understand the reasons for deviations from the budget and adjust your financial plans accordingly.

- Adjust Forecasts as Needed: Continuously update your financial forecasts based on changing market conditions, business trends, and performance data. Use forecasting tools to model different scenarios and assess the potential impact of strategic decisions on your business’s financial health.

By incorporating budgeting and forecasting tools into your financial management processes, you can set clear financial targets, track progress towards goals, and make informed decisions to drive business growth and profitability.

Inventory Management Capabilities

For businesses that sell products, effective inventory management is critical for maintaining optimal stock levels, reducing carrying costs, and meeting customer demand. Many accounting software solutions offer built-in inventory management capabilities that allow you to track inventory levels, monitor sales trends, and manage stock replenishment efficiently. Here’s how you can leverage these capabilities:

- Track Inventory Levels: Use inventory tracking features to monitor stock levels in real-time and identify when to reorder products to prevent stockouts or overstocking.

- Manage Multiple Locations: If your business has multiple warehouses or retail locations, utilize inventory management tools to track stock across locations and transfer inventory as needed to optimize distribution.

- Forecast Demand: Analyze historical sales data and market trends to forecast future demand for products accurately. Use forecasting tools to anticipate spikes in demand and ensure adequate stock availability.

- Optimize Inventory Turnover: Aim to optimize inventory turnover by minimizing excess inventory and carrying costs while ensuring that you have enough stock to fulfill customer orders promptly.

By effectively managing your inventory using accounting software, you can improve cash flow, reduce carrying costs, and enhance customer satisfaction by ensuring product availability.

Advanced Reporting Options

In addition to standard financial reports such as profit and loss statements and balance sheets, many accounting software solutions offer advanced reporting options that allow you to customize and analyze data in more detail. Leveraging advanced reporting capabilities can provide deeper insights into your business’s financial performance and help you make more informed decisions. Here are some advanced reporting options to consider:

- Customizable Reports: Customize financial reports to include specific metrics, KPIs, and visualizations that are relevant to your business’s goals and objectives.

- Comparative Analysis: Conduct comparative analysis by comparing current financial performance against historical data, industry benchmarks, or competitor metrics to identify trends and opportunities.

- Segmentation and Filtering: Use segmentation and filtering options to analyze financial data by different dimensions, such as product lines, customer segments, geographic regions, or sales channels.

- Drill-Down Capabilities: Drill down into detailed transaction-level data to investigate variances, identify root causes, and gain a deeper understanding of your business’s financial performance.

By leveraging advanced reporting options, you can gain deeper insights into your business’s financial performance, identify trends and patterns, and make data-driven decisions to drive growth and profitability.

Integrating with CRM or Project Management Software

Integration with customer relationship management (CRM) or project management software can further enhance the capabilities of your accounting software by enabling seamless data sharing and collaboration between different business functions. Here’s how you can leverage integration capabilities effectively:

- Sync Customer Data: Integrate your accounting software with CRM software to sync customer data, sales orders, and invoices, providing a unified view of customer interactions and financial transactions.

- Streamline Project Billing: If your business engages in project-based work, integrate your accounting software with project management software to streamline project billing, track project costs, and invoice clients accurately.

- Automate Data Entry: Take advantage of integration features to automate data entry and eliminate manual tasks such as re-entering customer information or project details into multiple systems.

- Improve Collaboration: Facilitate collaboration between sales, finance, and project teams by enabling seamless data sharing and real-time access to financial and customer information.

By integrating your accounting software with CRM or project management software, you can improve efficiency, enhance collaboration, and gain a more comprehensive understanding of your business’s operations and performance.

Tips for Maximizing Efficiency and Accuracy

In addition to leveraging advanced features, there are several tips and best practices you can follow to maximize efficiency and accuracy when using accounting software:

- Regularly Update Software: Keep your accounting software up-to-date with the latest patches, updates, and feature releases to ensure optimal performance and security.

- Backup Data Regularly: Implement regular data backups to protect against data loss due to hardware failure, software glitches, or security breaches.

- Train Employees: Provide comprehensive training and support to employees who will be using the accounting software to ensure that they understand its features and functionality.

- Monitor User Access: Control access to sensitive financial data by assigning appropriate user roles and permissions to employees and limiting access to authorized users only.

By following these tips and best practices, you can maximize the efficiency, accuracy, and effectiveness of your accounting software, allowing you to focus on growing your business and achieving your financial goals.

Conclusion

Choosing the best accounting software for your small business is a crucial step towards streamlining your financial processes and driving success. By carefully considering factors such as cost, features, usability, and scalability, you can select a solution that meets your business needs and objectives. Whether you opt for QuickBooks Online, Xero, FreshBooks, or another software option, implementing accounting software will save you time, improve accuracy, and provide valuable insights into your business’s financial health.

In today’s competitive business landscape, leveraging the right tools and technologies is essential for staying ahead. Accounting software not only simplifies day-to-day financial tasks but also empowers you to make informed decisions, comply with regulations, and plan for the future. With this guide, you now have the knowledge and resources to choose the best accounting software for your small business and unlock its full potential for growth and success.

Get Started With a Prebuilt Template!

Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

- Save time with no need to create a financial model from scratch.

- Reduce errors with prebuilt formulas and calculations.

- Customize to your needs by adding/deleting sections and adjusting formulas.

- Automatically calculate key metrics for valuable insights.

- Make informed decisions about your strategy and goals with a clear picture of your business performance and financial health.